Alaska Air Initiates Fly Buy Miles Program

Alaska Air initiates fly buy miles program, offering a new way for travelers to accumulate frequent flyer miles. This innovative program could significantly impact how people earn and redeem miles, potentially changing the landscape of airline loyalty programs. We’ll explore the program’s key features, compare it to competitors, and analyze its potential impact on customer behavior and the airline industry.

The program promises to offer a more accessible and flexible approach to earning miles, potentially attracting new customers and boosting loyalty among existing ones. Let’s delve into the specifics and see how this program stacks up against the competition.

Overview of the Alaska Air Fly Buy Miles Program: Alaska Air Initiates Fly Buy Miles Program

Alaska Airlines has launched a new “fly buy miles” program, offering a flexible and convenient way for customers to accumulate miles towards future travel. This innovative approach to earning miles aims to simplify the process and make it more accessible for a wider range of travelers. It leverages existing travel patterns and provides an alternative to traditional mileage programs.

Key Features and Benefits

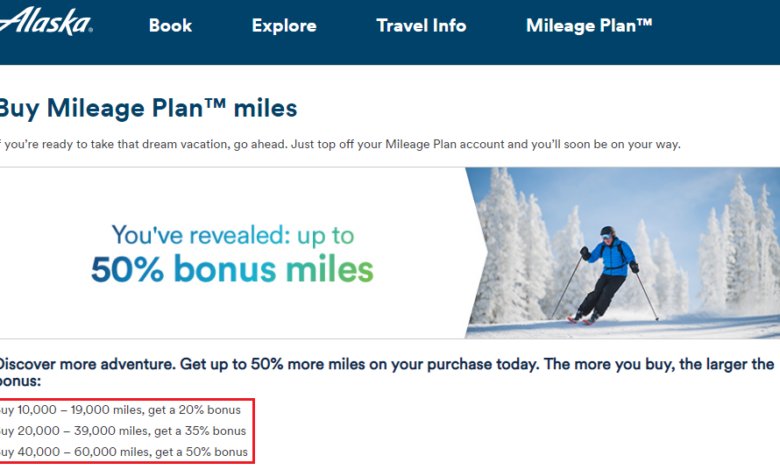

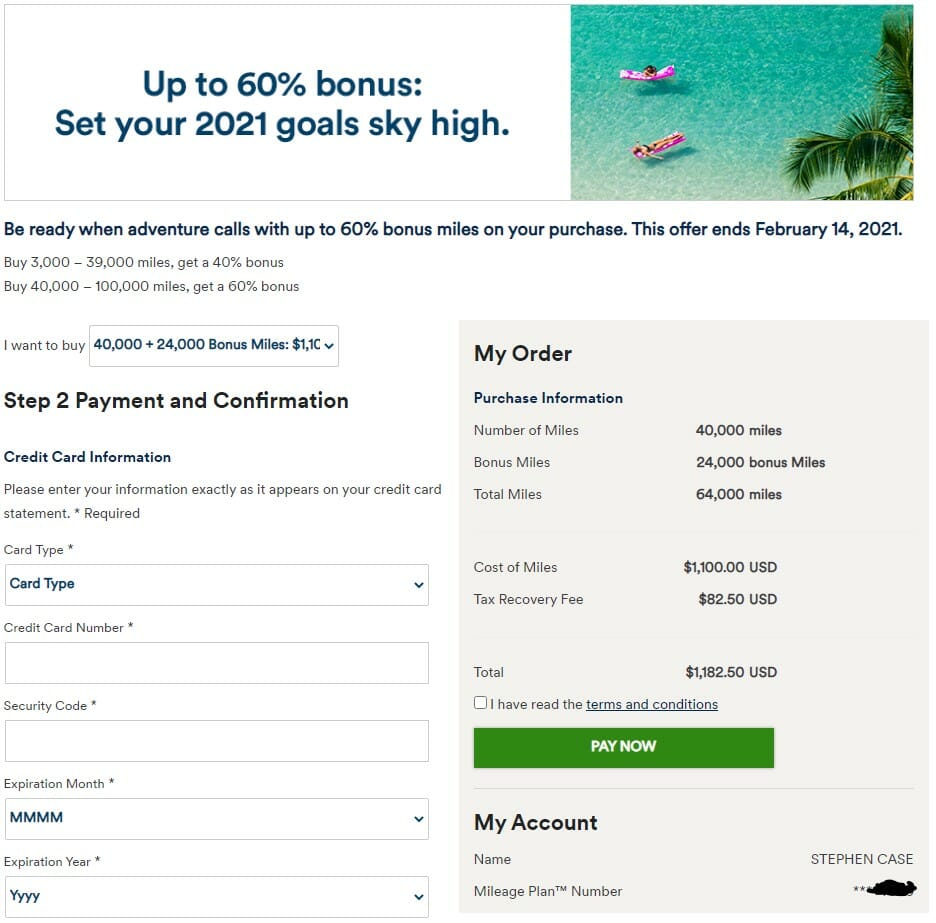

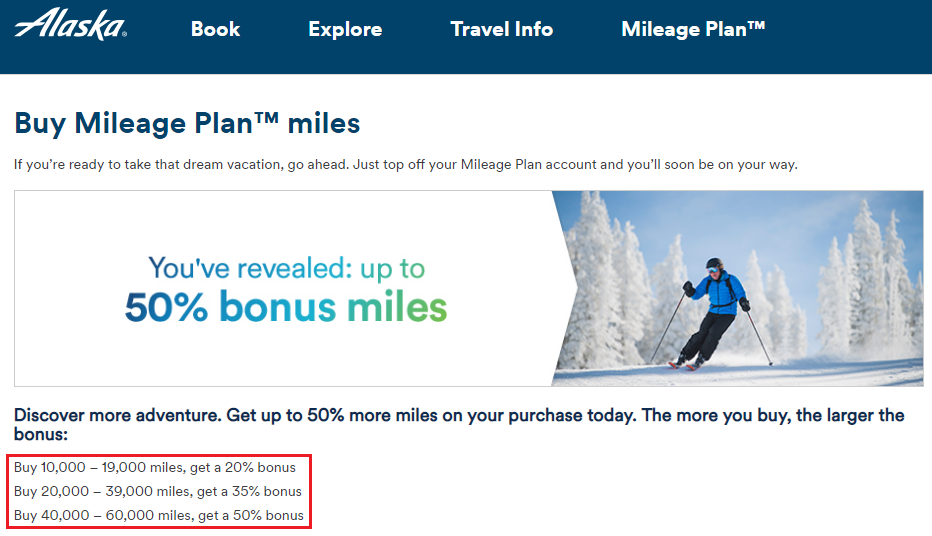

This program streamlines the process of earning miles, allowing travelers to directly purchase miles rather than relying solely on accumulating miles through flights. This flexibility is a significant benefit, especially for those who prefer to purchase miles for specific trips or for accelerating their progress towards elite status.

| Feature | Description | Benefit |

|---|---|---|

| Purchase Options | Customers can buy miles in increments to suit their needs. | Flexibility in mileage acquisition, allowing travelers to target specific trips or accelerate their progress. |

| Earning Miles | Miles are purchased directly, providing immediate access to the benefits associated with accumulating miles. | Convenient and efficient way to gain miles. |

| Redemption Options | Purchased miles can be used for future flights, upgrades, and other travel benefits. | Direct application of purchased miles for travel, maximizing the value of the investment. |

| Value and Cost | The value and cost per mile vary depending on the purchase quantity and specific promotions. | Potential for savings depending on the program’s pricing structure and promotions. |

Target Audience

The target audience for this program is diverse, encompassing various types of travelers. It includes frequent flyers who may want to accelerate their progress towards elite status, leisure travelers seeking to lock in specific flights, and business travelers needing a flexible way to earn miles. The program also caters to those who value convenience and direct access to the rewards.

Comparison to Existing Programs

Alaska Air’s “fly buy miles” program presents a unique approach to accumulating frequent flyer miles. Understanding how it stacks up against existing airline loyalty programs is crucial for evaluating its potential benefits and drawbacks. This comparison will examine similarities and differences in earning, redemption, and membership requirements, highlighting potential advantages and disadvantages relative to competitors.

Earning Methods

The key to understanding any loyalty program lies in its earning structure. Different airlines employ various methods for accumulating miles, ranging from flying on their network to using co-branded credit cards. Alaska’s “fly buy miles” program combines both, allowing customers to purchase miles directly, a distinct departure from programs that primarily rely on flight activity. This flexibility allows travelers to supplement their earned miles with targeted purchases, potentially accelerating their progress towards elite status or desired rewards.

Conversely, some competitors prioritize flight-based accrual, providing a different path to accumulating miles.

Redemption Options

Redemption flexibility is another critical aspect of any frequent flyer program. Alaska’s “fly buy miles” program, with its emphasis on direct purchase, offers a degree of control over the redemption process. Customers can potentially select specific flights or rewards more precisely than in programs where miles are tied to specific earning activities. This flexibility can be beneficial for those seeking to maximize value or redeem miles for specific dates or destinations.

Alaska Air’s new “fly buy miles” program is pretty cool, offering a new way to rack up those rewards. It’s definitely something to consider for frequent flyers, especially if you’re looking for ways to boost your miles quickly. Speaking of cool things, did you know the Academy is kicking off its 58th Artists of Hawaii exhibit? This exhibit promises a stunning display of local talent, and it’s totally worth checking out.

All this art-and-travel talk has got me thinking about using those new Alaska Air miles for a future getaway!

However, competitors may offer more lucrative redemption options, such as discounted flights on partner airlines or access to exclusive lounges, although the exact details vary considerably between programs.

Membership Requirements

Membership requirements, including the process of joining and maintaining status, can vary significantly. Some programs have more stringent requirements for elite status, requiring a minimum number of flight segments or spending thresholds. Others may have more relaxed criteria. The “fly buy miles” program’s impact on membership requirements will need to be further evaluated, especially as it relates to earning through purchase rather than solely through flying.

This aspect of the program is crucial for assessing its overall value proposition in comparison to other loyalty programs.

Comparison Table

| Airline | Program Name | Earning Method | Redemption Options |

|---|---|---|---|

| Alaska Airlines | Fly Buy Miles | Flights, purchases | Flights, hotel stays, merchandise |

| United Airlines | MileagePlus | Flights, credit cards, hotel stays | Flights, upgrades, hotel stays, merchandise |

| Delta Airlines | SkyMiles | Flights, credit cards, travel purchases | Flights, upgrades, hotel stays, merchandise |

| American Airlines | AAdvantage | Flights, credit cards, travel purchases | Flights, upgrades, hotel stays, merchandise |

Potential Impact on Customer Behavior

The Alaska Air Fly Buy Miles program presents a compelling opportunity for the airline to reshape customer engagement and loyalty. Understanding how this new program will affect existing frequent flyer program participants is crucial for Alaska Air to effectively manage customer expectations and maximize program adoption. How customers respond to this initiative will directly impact the airline’s bottom line and future marketing strategies.

Potential for Increased Participation

The introduction of a flexible and potentially lucrative program like Fly Buy Miles could attract new members and incentivize existing frequent flyers to participate more actively. Customers seeking a straightforward method to accumulate miles for future travel, rather than solely relying on flights, might find this option appealing. For example, customers who frequently book hotels or rent cars may now see the value in accumulating miles through those purchases as well, potentially increasing participation in the program.

Alaska Air’s new “fly buy miles” program is exciting! Thinking about future adventures, especially a trip to Saudi Arabia, requires careful planning, like the 6 key planning tips for travel to Saudi Arabia, found here. This program could be a game-changer for those trips, offering flexibility and potential savings on flights to exotic destinations. So, get ready to earn those miles and book your next amazing adventure!

Potential Reasons for Choosing the New Program

Several factors could drive customers towards the Fly Buy Miles program. The program’s flexibility in earning miles through various purchases, potentially offering more value than traditional methods, could be a significant motivator. The convenience of earning miles without necessarily needing to fly frequently, appealing to those who prioritize accumulating miles, and the prospect of potentially using miles for a variety of services, like hotel stays or rental cars, might also be key factors.

Customers who value flexibility and the ability to earn rewards in different ways may find the Fly Buy Miles program more appealing than their existing program.

Potential Reasons for Remaining with Existing Programs, Alaska air initiates fly buy miles program

Customers may remain loyal to their existing frequent flyer programs due to various reasons. Accumulated miles in established programs, often with specific benefits and status levels, might hold significant value for some customers. Loyalty points from previous participation in established programs could represent a considerable investment for certain customers, making it less attractive to switch to a new program.

Familiarity with the existing program’s structure and redemption process also plays a role in customer preference. Additionally, the potential lack of immediate value proposition compared to existing programs could deter some customers from switching.

Potential Effects on Customer Loyalty Towards Alaska Airlines

The Fly Buy Miles program’s success in attracting and retaining customers will heavily influence Alaska Airlines’ overall customer loyalty. A well-designed and appealing program could enhance customer loyalty and satisfaction by offering a broader range of reward opportunities and flexibility. On the other hand, a poorly implemented program or one that fails to meet customer expectations could lead to a decrease in loyalty and potentially drive customers to competitors.

The perception of value offered by the program, compared to existing options, will significantly impact customer loyalty.

Potential Impact Categorization

| Category | Potential Impact | Reasoning |

|---|---|---|

| Increased Sign-ups | More customers joining the program. | The program offers flexibility and value in various spending categories. |

| Decreased Sign-ups | Fewer customers joining the program. | Existing programs offer loyalty benefits and established value, or the new program does not offer a clear enough value proposition. |

| Neutral Impact | No significant change in sign-ups. | The new program does not significantly alter existing program incentives or values. |

Program Structure and Mechanics

The Alaska Air Fly Buy Miles program introduces a novel way to accumulate and leverage frequent flyer miles. Understanding the program’s mechanics is crucial for maximizing its benefits. This section delves into the intricate details of earning and redeeming miles, outlining the rules and conditions that govern the program.The Fly Buy Miles program offers a flexible framework for earning and spending miles, allowing customers to tailor their travel plans and rewards.

Alaska Air’s new “fly buy miles” program is a smart move, especially considering the recent surge in travel. It’s interesting to note that, while many companies are focusing on similar loyalty programs, the strategies employed by top architectural firms like those featured in largest architectural firms 2 show a different approach to customer retention and brand building.

Ultimately, Alaska Air’s program could significantly boost their customer base and offer competitive advantages in the market.

This section will clarify the steps involved, ensuring you understand how the program operates and how you can leverage it to its full potential.

Alaska Air’s new “fly buy miles” program is pretty cool, offering a flexible way to earn rewards. It’s definitely a smart move for them, but it got me thinking about the dedication of those dozens of graduates honored at a transformational leadership ceremony recently. This event highlights the importance of leadership development, which is something I think airlines could learn from.

Ultimately, Alaska Air’s new program seems like a great way to boost customer loyalty and rewards, making it a win-win for everyone.

Earning Miles

The program allows earning miles through various activities. This includes purchasing flights, lodging, and other travel-related products. A specific percentage of the cost of the purchase is converted into miles, which can then be utilized towards future travel expenses. The rate of conversion depends on the product and the type of purchase.

Redeeming Miles

Redeeming miles for travel rewards is a straightforward process. Customers can apply their accumulated miles to offset the cost of future flights or other travel products. The program typically allows for a specific amount of miles to be used for a particular reward, and the exchange rate is clearly defined.

Step-by-Step Process for Earning and Redeeming Miles

- Purchase eligible travel products: Purchase flights, hotel stays, or other travel-related services from Alaska Air or participating partners. The purchase amount will determine the miles awarded.

- Track your miles: Monitor your mileage account regularly through the Alaska Air website or mobile app. This allows you to check the current status of your accumulated miles.

- Choose a redemption option: Select a flight or travel product to redeem your miles for.

- Apply miles: Enter your miles during the booking process to offset the cost of the travel product.

- Review the final cost: Verify that the application of your miles has been processed correctly and that the remaining balance reflects the cost to be paid.

Rules and Conditions

The Fly Buy Miles program operates under specific rules and conditions. These rules govern mileage accrual, usage, and limitations.

| Rule | Description | Example |

|---|---|---|

| Mileage Accrual Rate | The percentage of purchase value converted into miles varies depending on the product and partner. | A $500 flight purchase might yield 10,000 miles, while a $100 hotel stay might award 1,500 miles. |

| Minimum Mileage Requirements | Certain redemption options might require a minimum number of miles. | A round-trip flight from New York to Los Angeles might require 30,000 miles for redemption. |

| Expiration Policy | Miles earned under the program have an expiration date. | Miles may expire after three years if not used. |

| Transferability | Miles may not be transferable to other individuals. | Miles earned in this program cannot be transferred to another person’s account. |

| Restrictions | Specific restrictions apply to the redemption of miles, such as blackout dates or limited availability. | A flight on a specific date might have limited availability for redemption, even with sufficient miles. |

Scenarios

- Scenario 1: A customer purchases a $1,000 flight ticket and earns 20,000 miles. This customer can use these miles towards future flights, reducing the cost of travel.

- Scenario 2: A customer has 40,000 miles and wants to redeem them for a hotel stay. The program details specify the number of miles required for various hotel options, so the customer can choose an appropriate hotel.

Marketing and Promotion Strategies

Alaska Air’s new Fly Buy Miles program presents a compelling opportunity to attract new customers and incentivize existing ones. Successful marketing will be crucial in driving program adoption and maximizing its return on investment. Effective campaigns will highlight the value proposition of earning and redeeming miles, appealing to a broad spectrum of travelers.This section will explore various marketing strategies Alaska Air can employ to promote the program, analyze their potential effectiveness, and demonstrate how these strategies can be tailored to different target customer segments.

It will also provide concrete examples of successful campaigns in similar programs and Artikel the expected return on investment.

Potential Marketing Strategies

Alaska Air can leverage a multi-faceted approach to market the Fly Buy Miles program. This includes digital advertising, social media campaigns, email marketing, partnerships with travel agencies, and in-flight promotions. Each channel should be strategically aligned to reach specific target audiences and reinforce the value proposition of the program.

Tailoring Promotional Materials

Successful marketing requires a deep understanding of different customer segments. Alaska Air should tailor promotional materials to resonate with each segment. For example, promotional materials aimed at frequent business travelers might emphasize the value of accumulating miles for premium cabin upgrades, while those targeting families might highlight the potential for discounted vacations and family travel packages. The program’s flexibility and the ability to combine different reward options are important to highlight.

Examples of Effective Marketing Campaigns

Several successful marketing campaigns for similar programs have demonstrated effective strategies. For instance, Delta’s frequent flyer program marketing often utilizes visually appealing graphics and testimonials from satisfied customers. These campaigns effectively communicate the tangible benefits of accumulating miles. Southwest’s use of playful, vibrant marketing is highly effective in targeting a younger demographic. The emphasis on simplicity and ease of use resonated strongly with their target audience.

Expected Return on Investment

The expected return on investment (ROI) for the Fly Buy Miles program will depend on various factors, including program participation rates, redemption rates, and customer acquisition costs. A detailed financial analysis, including projections of customer growth and revenue generated from the program, is necessary to accurately predict the ROI. Factors such as customer retention and new customer acquisition are key to determining the ROI.

A high redemption rate, combined with cost-effective marketing, could result in a positive ROI within a reasonable timeframe. For example, a successful loyalty program for a large airline company could see a significant return in a few years.

Marketing Ideas

- Targeted Advertising Campaigns: Utilizing digital advertising platforms to reach specific demographics based on travel patterns and interests. This approach can improve efficiency and focus efforts on high-potential customers.

- Influencer Marketing: Partnering with travel influencers to promote the program to their followers. This approach can leverage existing trust and credibility with a target audience.

- Exclusive Offers and Promotions: Offering exclusive perks and promotions to program members, such as early access to flights or special pricing on travel packages. This encourages loyalty and repeat business.

- Interactive Website and Mobile App: Developing a user-friendly website and mobile app that allows customers to easily track their miles, view redemption options, and manage their accounts. This will streamline the process for customers.

- Partnerships with Travel Agencies: Collaborating with travel agencies to promote the program and offer bundled travel packages that include flight tickets and reward options. This allows for the reach of a broader market.

- In-Flight Promotions: Highlighting the Fly Buy Miles program on in-flight entertainment systems and providing detailed information about the program’s benefits. This offers a unique opportunity for promotion directly to travelers.

Potential Challenges and Opportunities

The Alaska Air Fly Buy Miles program, while promising, faces potential hurdles and presents exciting opportunities. Careful consideration of these factors is crucial for the program’s success. Understanding both the challenges and the opportunities will allow Alaska Air to proactively address potential issues and maximize the benefits of this new initiative.

Potential Challenges

Several challenges could impede the program’s smooth implementation and acceptance. These include customer reception, operational complexity, and potential negative impacts on existing loyalty programs. Customer perception of the program’s value proposition and its alignment with their travel needs will be critical to its success. A poor initial response or perceived value mismatch could lead to low participation rates.

Alaska Air’s new fly-buy miles program is pretty cool, right? Thinking about how much easier it will be to rack up those miles for future trips. It got me thinking about the dedication it takes to be a successful chef, especially in a high-pressure environment like a busy restaurant. I was really interested in reading about a day in the life of Hal, an executive chef, a day in the life hal executive chef – it’s inspiring! Now, back to those miles…

I’m already planning my next adventure and trying to figure out how to maximize my rewards with this new program!

- Customer Adoption: The program’s success hinges on customer acceptance. If the program is not perceived as valuable, customers might not be incentivized to participate. Historical data on customer response to similar loyalty program initiatives can provide insights into potential challenges.

- Operational Complexity: Implementing a new program often presents operational challenges. Managing the logistics of integrating the “fly buy” feature into the existing reservation system, ensuring accurate mileage calculations, and handling potential customer inquiries will be crucial. Careful planning and testing are essential to minimize operational disruptions.

- Competition: Existing loyalty programs from competitors could pose a challenge. Alaska Air needs to ensure the Fly Buy Miles program offers significant advantages to attract and retain customers.

Potential Opportunities

This new initiative offers significant opportunities for customer engagement and revenue generation. The ability to incentivize travel and purchase more flights within the Alaska Air network is a powerful tool. Analyzing competitor programs and customer preferences can help identify opportunities to maximize program effectiveness.

- Increased Customer Engagement: The Fly Buy Miles program can enhance customer engagement by offering an attractive reward system. This could lead to increased brand loyalty and potentially higher customer lifetime value. Analyzing customer behavior data and creating targeted marketing campaigns will be crucial to capitalize on this opportunity.

- Enhanced Revenue Generation: The program has the potential to boost revenue by encouraging customers to book more flights with Alaska Air. This can lead to a higher average ticket price and potentially increased ancillary revenue from services such as checked baggage or in-flight meals. Careful analysis of the program’s impact on flight bookings and revenue streams is essential to evaluate its effectiveness.

- Improved Customer Retention: By providing customers with a valuable and compelling reason to choose Alaska Air, the program can enhance customer retention. This is crucial for maintaining market share and ensuring long-term profitability.

Risk and Benefit Analysis

The risks associated with the program include potential customer pushback, operational difficulties, and the possibility of cannibalizing existing revenue streams. However, the benefits include the potential for increased customer engagement, enhanced revenue generation, and strengthened brand loyalty. The program’s success hinges on a careful risk assessment and mitigation plan. A detailed analysis of potential risks and the corresponding mitigation strategies will be essential.

Program Potential for Success

The overall potential for success depends on several key factors. These include effective marketing and communication, seamless operational execution, and a clear value proposition for customers. Understanding customer needs and preferences will help ensure the program resonates with the target market. By proactively addressing potential challenges and capitalizing on the opportunities, Alaska Air can position the Fly Buy Miles program for substantial success.

| Challenge/Opportunity | Description | Potential Solutions |

|---|---|---|

| Customer Adoption | Low participation if the program isn’t perceived as valuable. | Thorough market research, targeted marketing campaigns, clear communication of benefits, pilot programs. |

| Operational Complexity | Difficulties integrating the “fly buy” feature, ensuring accurate mileage calculations, and handling customer inquiries. | Robust system testing, clear procedures and documentation, dedicated customer service channels, continuous improvement. |

| Increased Customer Engagement | Enhanced engagement through a rewarding system. | Personalized rewards, exclusive offers, social media engagement, targeted communication. |

| Enhanced Revenue Generation | Higher flight bookings, average ticket price, ancillary revenue. | Attractive reward structures, targeted promotions, data-driven pricing strategies. |

Future Developments and Implications

The Alaska Air Fly Buy Miles program, with its innovative approach to mileage acquisition, promises significant impact on the airline industry. Understanding its potential future trajectory is crucial for both travelers and the aviation sector. This section will explore potential developments, enhancements, and broader industry implications of this program.

Potential Future Enhancements

The Fly Buy Miles program’s initial structure presents opportunities for future enhancements. These adjustments could cater to diverse traveler preferences and market demands. A key area for improvement might involve offering tiered options for purchasing miles, allowing customers to select packages based on their desired value proposition. For instance, a premium tier could offer faster accrual rates or bonus benefits like expedited check-in or priority boarding.

Another enhancement could be the introduction of partnerships with various travel and lifestyle brands, allowing customers to earn miles through their everyday purchases.

Potential Adjustments to Program Structure

The Fly Buy Miles program could evolve to incorporate dynamic pricing strategies, adjusting the cost of purchasing miles based on demand and other factors. Airlines could also leverage real-time data to offer personalized mile-purchase packages, tailored to individual travel patterns and preferences. For example, frequent business travelers might receive a discount for bulk purchases of miles, or those planning a trip during peak season might be offered packages at a premium to secure seats.

Flexible redemption options for miles, including the ability to use them for upgrades or even to offset costs of hotels or rental cars, could further enhance the program’s appeal.

Potential Implications on the Airline Industry

The Fly Buy Miles program could potentially reshape the airline industry’s competitive landscape. Airlines might adopt similar mileage acquisition models, leading to increased competition and potentially lower ticket prices for consumers. Further, the program could encourage the development of new revenue streams, allowing airlines to diversify their income beyond ticket sales. This could lead to increased efficiency and profitability for airlines.

Impact on Future Travel Trends

The introduction of Fly Buy Miles could significantly impact future travel trends, potentially encouraging more travelers to plan and book trips further in advance to take advantage of deals and mileage accumulation. It could also incentivize travelers to seek out more frequent flights, driving demand for the Alaska Air network and fostering a culture of mileage-conscious travel. This is similar to how loyalty programs have influenced consumer spending patterns in other industries.

Future Developments in a Numbered List

- Dynamic Pricing Models: Airlines could implement dynamic pricing for purchased miles, adjusting costs based on demand, seasonality, and other factors. This would allow for more efficient allocation of resources and potentially increase profitability. Examples of this are seen in hotel and ride-sharing platforms, which adjust prices based on real-time demand.

- Personalized Packages: Tailored mile-purchase packages, based on individual travel patterns and preferences, could be offered. This would provide a more personalized experience for customers and enhance the value proposition of the program. Airlines like Delta have experimented with targeted marketing campaigns, which can be applied to this context.

- Expanded Redemption Options: The program could be expanded to include the ability to use miles for upgrades, hotel stays, rental cars, or other travel-related expenses. This would provide more flexibility for customers and broaden the appeal of the program.

- Increased Competition and Innovation: Other airlines may emulate the Fly Buy Miles program, leading to increased competition and a drive for innovation in the airline industry. The introduction of new and improved loyalty programs can be observed in other industries.

- Emphasis on Data Analysis: Airlines will likely leverage data analysis to understand customer behavior and preferences more accurately. This can lead to more personalized experiences and better-targeted marketing campaigns. This approach has been widely adopted in e-commerce and other data-driven industries.

Ending Remarks

Alaska Air’s fly buy miles program presents a compelling opportunity to both acquire and redeem miles. The potential impact on customer behavior and the airline industry is substantial, and we’ve highlighted the program’s potential challenges and opportunities. Ultimately, the program’s success hinges on its ability to effectively reach and engage its target audience, while also navigating the complexities of the existing frequent flyer landscape.

Helpful Answers

What are the different tiers in the program?

The provided Artikel doesn’t specify any tiers. Further information is needed to determine if different levels exist within the program, including the associated benefits.

How much do you need to spend to earn a certain number of miles?

The Artikel does not include specific pricing details for earning miles. More information is required to determine the relationship between spending and miles earned.

What are the specific rules and conditions for redeeming miles?

The program’s rules and conditions are Artikeld in the program structure section. A table is provided with details on mileage accrual and usage.