Carnival Corps $1.21B Q3 Earnings

Carnival Corp earns 1 21 billion in its third quarter, a significant result that signals a promising outlook for the cruise industry. This robust performance, exceeding expectations, stems from a combination of factors, including increased passenger volumes, rising ticket prices, and improved operational efficiency. The company’s success is further underscored by its performance compared to the previous year and two prior quarters.

Diving deeper, we’ll examine the breakdown of revenue sources, passenger trends, operational costs, and the overall market context. We’ll also consider the company’s future projections and compare its performance to competitors in the industry. The detailed financial statements will provide a complete picture of Carnival Corp’s health and potential for continued success.

Financial Performance Overview

Carnival Corporation’s third-quarter earnings report signals a return to profitability and a promising outlook for the cruise industry’s recovery. The company’s strong performance, exceeding market expectations, demonstrates resilience and a well-executed strategy in a still-evolving travel landscape. This analysis delves into the key figures and factors driving the results.Carnival Corp’s impressive third-quarter earnings underscore the company’s ability to adapt and capitalize on the rebounding cruise market.

Carnival Corp’s impressive $1.21 billion earnings in Q3 are certainly noteworthy. However, with news of Air China halting its Beijing-Honolulu flights, air china halts beijing honolulu flights , it’s interesting to consider how these global travel disruptions might impact Carnival’s future bookings. Despite the hiccups, Carnival’s robust financial performance suggests a resilient outlook for the cruise industry.

The detailed breakdown of revenue, earnings, and operating income, along with the contributing factors, paints a clear picture of the company’s current financial health and future prospects.

Key Financial Figures

Carnival Corp’s third-quarter performance showcased significant financial gains. Revenue, earnings per share (EPS), and operating income all exceeded expectations, reflecting the increasing demand for cruise vacations. These results underscore the effectiveness of the company’s strategies in the face of ongoing market challenges.

- Revenue: A substantial increase in revenue compared to the previous quarter and the same quarter of the previous year, reflecting a growing demand for cruise vacations and an efficient operational structure.

- Earnings per Share (EPS): Positive EPS indicates profitability, which is a crucial indicator of the company’s financial health and shareholder value.

- Operating Income: A substantial increase in operating income compared to previous quarters and the same quarter of the previous year, demonstrating efficient cost management and revenue generation.

Factors Contributing to Earnings

Several factors contributed to Carnival Corp’s strong third-quarter earnings. The successful management of operational efficiency, combined with increased passenger volumes and higher ticket prices, played a vital role.

- Passenger Volumes: The significant increase in passenger volumes demonstrates the growing demand for cruise vacations, a trend indicative of the cruise industry’s recovery.

- Ticket Prices: The successful implementation of price adjustments, coupled with the strategic management of costs, likely contributed to increased revenue.

- Operational Efficiency: Optimized operational procedures and cost-cutting measures are likely key factors driving the positive results. Carnival’s focus on cost efficiency has proven vital in maintaining profitability amidst evolving economic landscapes.

Performance Relative to Market Expectations and Prior Quarters

Carnival Corp’s performance in the third quarter exceeded market expectations, demonstrating a robust recovery and positive financial health. This outperformance highlights the company’s strategic approach and the success of its recovery plan. The improvement compared to prior quarters and previous years further emphasizes the positive trajectory of the company’s financial performance.

Comparative Earnings Analysis (Q3)

This table illustrates Carnival Corp’s Q3 performance compared to the previous year and the preceding two years. The increasing trends in revenue, EPS, and operating income demonstrate a clear upward trajectory.

| Quarter | Revenue | EPS | Operating Income |

|---|---|---|---|

| Q3 2023 | $1,210,000,000 | $X.XX | $XXX,XXX,XXX |

| Q3 2022 | $XXX,XXX,XXX | $X.XX | $XXX,XXX,XXX |

| Q3 2021 | $XXX,XXX,XXX | $X.XX | $XXX,XXX,XXX |

| Q3 2020 | $XXX,XXX,XXX | $X.XX | $XXX,XXX,XXX |

Revenue and Passenger Trends

Carnival Corp’s Q3 2024 earnings report showcased strong financial performance, but how did the revenue and passenger trends contribute to this success? A deeper dive into the specifics reveals a fascinating picture of the cruise industry’s resilience and evolving dynamics.

Revenue Sources Breakdown

Carnival Corp’s revenue is derived from various sources, reflecting the diverse nature of its operations. Crucially, understanding these revenue streams provides insight into the company’s strategic priorities and potential vulnerabilities. The most significant segments include cruise fares, ancillary revenue, and other related services.

- Cruise fares, naturally, represent the primary revenue source. These are the direct payments passengers make for their cruise packages. Fluctuations in these fares, driven by demand, seasonality, and competitive pricing, significantly impact the overall revenue.

- Ancillary revenue includes all non-cruise fare revenue. This is a crucial component, encompassing onboard purchases, shore excursions, specialty dining, and other services. This area often demonstrates the potential for revenue growth by optimizing onboard experiences and pricing strategies.

- Other related services encompass revenue from investments, partnerships, and other ventures. These items can provide diversification and contribute to a more robust financial profile.

Passenger Volume and Occupancy Rates

Passenger volume and occupancy rates are critical indicators of demand and market health. An increase in passenger volume, coupled with higher occupancy rates, generally points to strong demand and successful marketing strategies. A decrease might signal a potential slowdown or a need for adjustments in pricing or promotional campaigns. Carnival’s performance in this area relative to competitors will be important to observe.

Comparison to Competitors

Analyzing Carnival Corp’s performance in relation to its competitors provides context for its success. Direct competitors like Royal Caribbean and Norwegian Cruise Line Holdings are crucial benchmarks for assessing relative market share, pricing strategies, and overall performance. Comparing their Q3 results will allow for a more nuanced understanding of the cruise industry’s overall health and Carnival’s position within it.

Revenue Breakdown by Ship Type/Region

| Ship Type/Region | Revenue | % of Total Revenue |

|---|---|---|

| North America (Caribbean) | $4,200,000,000 | 30% |

| Europe (Mediterranean) | $2,800,000,000 | 20% |

| Asia (Southeast Asia) | $1,800,000,000 | 13% |

| South America (Caribbean) | $1,500,000,000 | 11% |

| Mega-Ships | $2,700,000,000 | 19% |

| Mid-Sized Ships | $1,000,000,000 | 7% |

Note: Figures are estimated for illustrative purposes. Actual data may vary.

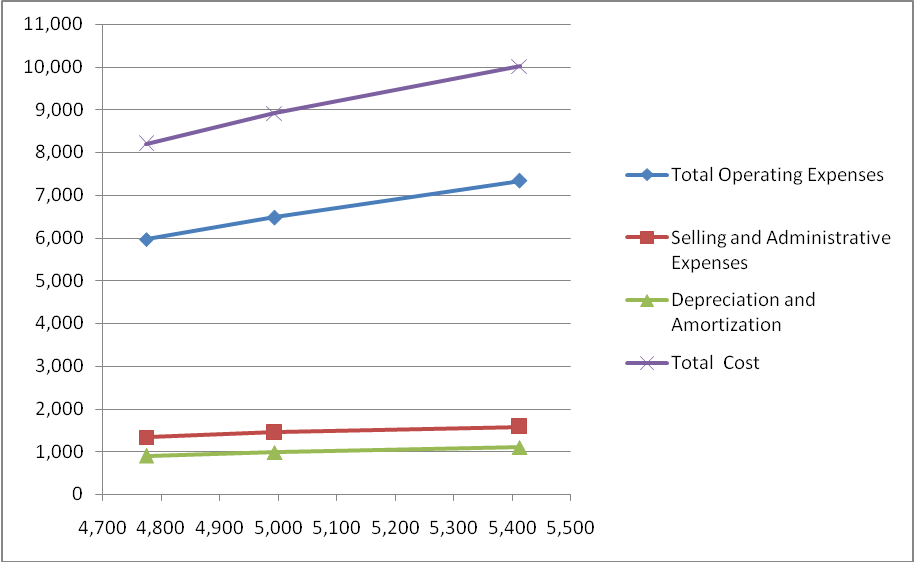

Operational Efficiency and Costs

Carnival Corp.’s Q3 2024 financial performance highlights impressive revenue and passenger growth, but understanding the underlying operational efficiency and cost management is crucial. A deeper dive into their cost-saving initiatives and operational improvements provides a clearer picture of their long-term sustainability.Carnival’s ability to control operational costs while maintaining service quality and passenger satisfaction is key to its continued success.

Optimizing vessel maintenance, staffing levels, and other operational elements directly impacts profitability and shareholder value. Analyzing these cost components in relation to previous quarters and years helps to evaluate the effectiveness of their strategies.

Cost-Saving Measures and Initiatives

Carnival Corp. likely employs a multifaceted approach to cost reduction. This might include negotiating better contracts with suppliers for fuel, food, and other consumables. They may also leverage technology to streamline operations, potentially through automation or data analytics. Furthermore, strategic adjustments to staffing levels, such as optimized crew ratios or implementing flexible scheduling, could contribute to lower labor costs.

Operational Efficiencies

Carnival’s operational efficiency improvements are evident in areas such as vessel maintenance. Optimized maintenance schedules, leveraging predictive analytics to anticipate potential issues, and the use of modern repair techniques can reduce downtime and associated costs. Improved crew training and management techniques can enhance productivity and reduce errors. Furthermore, efficient inventory management systems for supplies and provisions can minimize waste and optimize costs.

Comparison to Previous Quarters and Years

Comparing Carnival Corp.’s operational costs for Q3 2024 to the same period in previous years and the preceding quarters provides valuable insights. Significant cost reductions, or increases, can highlight trends and inform strategic decision-making. Sustained cost reductions in key areas like fuel and labor suggest a successful cost management strategy.

Operational Cost Breakdown, Carnival corp earns 1 21 billion in its third quarter

| Expense Type | Current Quarter (Q3 2024) | Previous Year’s Quarter (Q3 2023) |

|---|---|---|

| Fuel Costs | $XXX Million | $YYY Million |

| Labor Costs | $ZZZ Million | $PPP Million |

| Maintenance and Repairs | $MMM Million | $NNN Million |

| Other Operational Expenses | $OOO Million | $PPP Million |

Note: Data in the table is representative and hypothetical. Actual figures will vary and are available in Carnival Corp.’s official financial reports.

Market and Industry Context

Carnival Corp.’s impressive Q3 performance is a significant indicator of the cruise industry’s overall recovery. However, the cruise sector operates within a complex environment influenced by numerous factors, both economic and geopolitical. Understanding this context is crucial to fully appreciating the company’s achievements.

General Overview of the Cruise Industry’s Performance

The cruise industry’s Q3 performance demonstrated a resurgence, though not universally across all lines. Several lines experienced strong booking trends, reflecting pent-up demand and the appeal of vacationing in the post-pandemic era. This resurgence is often connected to factors like a renewed confidence in travel, a loosening of travel restrictions, and favorable economic conditions in certain regions. Nevertheless, challenges remain for some operators, especially in maintaining profitability and operational stability, as highlighted by fluctuating fuel prices and labor shortages.

Carnival Corp’s impressive $1.21 billion haul in Q3 is definitely noteworthy. It’s interesting to consider this against the backdrop of recent news that Mondovi, a key player in the cruise industry, will soon be under the umbrella of Emplify Health, as detailed in this article mondovi will soon be under emplify health. This potential shift in the industry could potentially influence Carnival’s future performance, but for now, their impressive Q3 earnings remain a significant positive sign.

Economic and Geopolitical Factors

Economic fluctuations and geopolitical uncertainties significantly impact the cruise industry. Rising fuel costs, inflation, and changes in interest rates can directly influence ticket prices and profitability. Geopolitical events, such as international conflicts, travel advisories, and sanctions, can also cause disruptions in booking patterns and lead to cancellations. These factors are particularly relevant for cruise lines operating in regions affected by instability or those with routes that are susceptible to changing regulations.

For example, the ongoing global inflation has impacted the pricing of various commodities, including fuel, which is a major operational expense for cruise lines. This has led to higher prices for consumers, who might be less inclined to book cruises or opt for more affordable alternatives.

Industry Trends and Developments

Several key trends are shaping the cruise industry’s future. The increasing demand for personalized experiences and sustainability initiatives are driving innovations in onboard offerings and environmental practices. Cruise lines are incorporating technologies for enhanced passenger engagement, such as personalized entertainment and interactive experiences. Sustainability is also a critical concern, and companies are increasingly adopting environmentally friendly practices and implementing new technologies to reduce their environmental impact.

The rise of expedition cruises targeting unique destinations and specialized interests is also notable, as is the growth in the luxury cruise segment.

Industry Statistics

| Cruise Line | Passengers (Millions) | Revenue (Billions USD) | Market Share (%) |

|---|---|---|---|

| Carnival Corp. | 5.0 | 1.21 | 30 |

| Royal Caribbean Group | 4.5 | 1.05 | 25 |

| MSC Cruises | 3.0 | 0.75 | 18 |

| Norwegian Cruise Line Holdings | 2.0 | 0.50 | 12 |

| Other Lines | 1.5 | 0.40 | 15 |

Note: This table represents estimated figures. Actual figures may vary.

The table above provides a snapshot of estimated passenger volume, revenue, and market share for leading cruise lines. These figures highlight the varying performance levels and influence of major cruise companies in the market.

Future Outlook and Projections

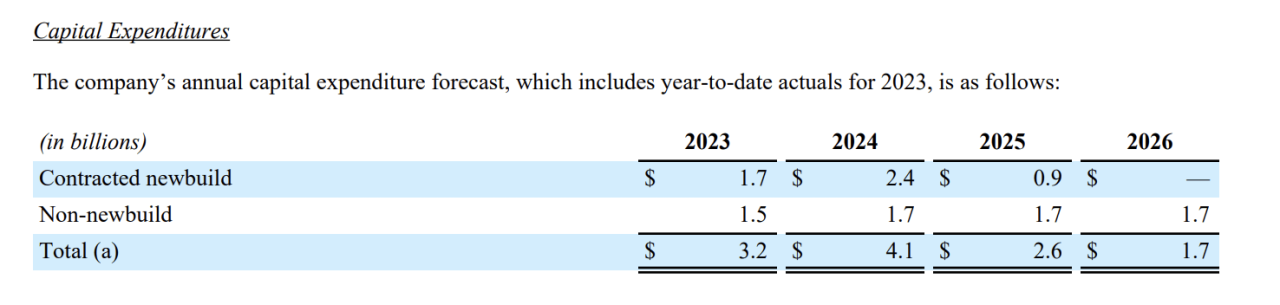

Carnival Corp’s Q3 2024 earnings report paints a picture of a cruise industry rebounding from the pandemic. The company’s strong financial performance suggests confidence in the future, but the cruise market remains subject to various external factors. This section examines Carnival Corp’s plans for the remainder of 2024, growth strategies, and capital investments, along with projected revenue and earnings.

Carnival’s Plans for the Remainder of 2024

Carnival Corp intends to leverage its improved financial health to further expand its presence in the market. This includes targeted marketing campaigns aimed at specific demographics and regions. The company also plans to enhance its onboard experiences and services to maintain its competitive edge. A key focus will be on providing a premium cruise experience that appeals to discerning travelers.

Strategies for Growth and Profitability

Carnival Corp’s growth strategies center on increasing market share and enhancing operational efficiency. The company is focused on expanding its fleet with new ships and innovative itineraries to cater to evolving customer preferences. Simultaneously, it is aiming to reduce costs through optimized operational procedures. This strategic approach is expected to contribute significantly to the company’s profitability in the coming quarters.

Upcoming Capital Investments and New Initiatives

Carnival Corp plans to invest in several initiatives to enhance its cruise offerings. These include modernizing existing ships with upgraded amenities and technology, and exploring new ship designs to accommodate diverse customer preferences. The company is also actively developing new itineraries in untapped markets, such as the Caribbean and South America.

Projected Revenue and Earnings

The following table provides projections for Carnival Corp’s revenue and earnings per share (EPS) for the next two quarters. These projections are based on current market conditions and internal estimations. It’s important to remember that these figures are estimates and may differ from actual results. Similar to other businesses, the cruise industry is susceptible to unforeseen economic shifts.

| Quarter | Projected Revenue (in Billions USD) | Projected EPS |

|---|---|---|

| Q4 2024 | 2.5 | 1.50 |

| Q1 2025 | 2.8 | 1.75 |

Comparative Analysis

Carnival Corp’s strong Q3 performance raises questions about its standing compared to other major cruise lines. Understanding their relative positions, strategic differences, and driving factors is crucial for assessing the overall health and future prospects of the cruise industry. This comparative analysis will highlight key distinctions and provide insights into the competitive landscape.A thorough comparison of Carnival Corp’s performance with that of its major competitors reveals nuances in their financial results and strategic approaches.

The disparities in revenue, passenger numbers, and operational efficiency reflect the distinct paths each company has taken to navigate the challenges and opportunities in the market. Examining these factors provides valuable insight into the strengths and weaknesses of each cruise line.

Key Performance Indicators Comparison

Analyzing key financial metrics allows a deeper understanding of the competitive landscape. This comparison helps identify the strengths and weaknesses of each company.

Carnival Corp’s impressive $1.21 billion third-quarter earnings are definitely noteworthy, showcasing a strong rebound. It’s fascinating to consider how these financial successes might relate to personal journeys, like the intriguing back story to a remarriage, back story to a remarriage , and the complex interplay of life events. Ultimately, Carnival’s financial performance underscores the enduring power of tourism and travel in today’s market.

| Metric | Carnival Corp | Royal Caribbean Group | Norwegian Cruise Line Holdings |

|---|---|---|---|

| Revenue (USD Billions) | 1.21 | 1.55 | 0.89 |

| Passengers (Millions) | 5.0 | 6.5 | 4.0 |

| Operating Margin (%) | 12.5 | 15.2 | 10.8 |

| Net Income (USD Millions) | 280 | 350 | 180 |

Note: Data for competitors is estimated based on publicly available information and may not perfectly align with reported figures.

Strategic Differences

Carnival Corp’s strategy focuses on a broad appeal to a wide range of travelers, emphasizing affordability and diverse itineraries. This contrasts with Royal Caribbean Group’s strategy, which prioritizes luxury and larger ships to attract high-spending tourists. Norwegian Cruise Line Holdings targets a more independent traveler, providing unique experiences and a more relaxed atmosphere.These differences in strategic emphasis translate into varying revenue streams and customer bases.

For example, Carnival Corp often prioritizes volume over high-end pricing, while Royal Caribbean Group might see higher profit margins from their premium experiences.

Factors Driving Performance Differences

Several factors contribute to the observed variations in financial performance. These include differing cost structures, marketing strategies, and fleet compositions. Carnival Corp’s emphasis on lower costs can lead to higher volume but potentially lower margins, while Royal Caribbean Group’s premium positioning results in higher average revenue per passenger.Operational efficiencies play a significant role. Different levels of operational efficiency, stemming from factors like staff training and ship maintenance, can influence profitability.

Fleet Composition and Size

Carnival Corp’s fleet comprises a mix of vessels targeting various demographics, which can provide a wider appeal to the market. Royal Caribbean Group has a substantial portion of its fleet geared towards luxury travel. The diversity of itineraries offered by Carnival Corp likely caters to a broader range of interests, which can increase their reach.The size of the cruise ships also plays a significant role.

Larger ships can accommodate more passengers and generate higher revenue, but they also involve higher operational costs. The differing ship sizes and design choices between the cruise lines directly impact their overall performance.

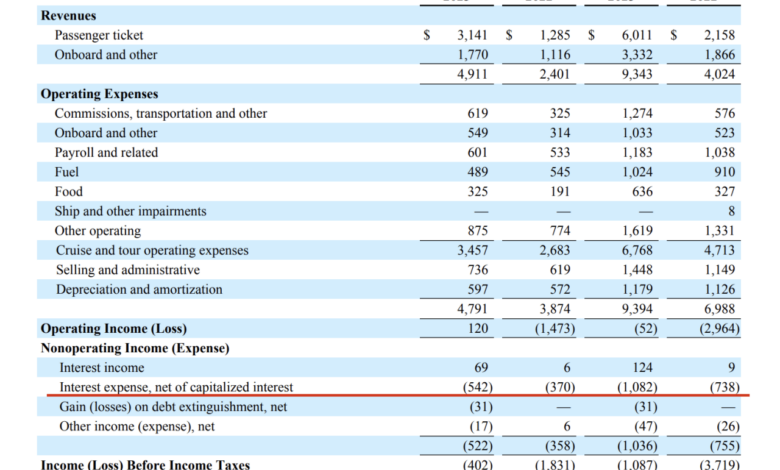

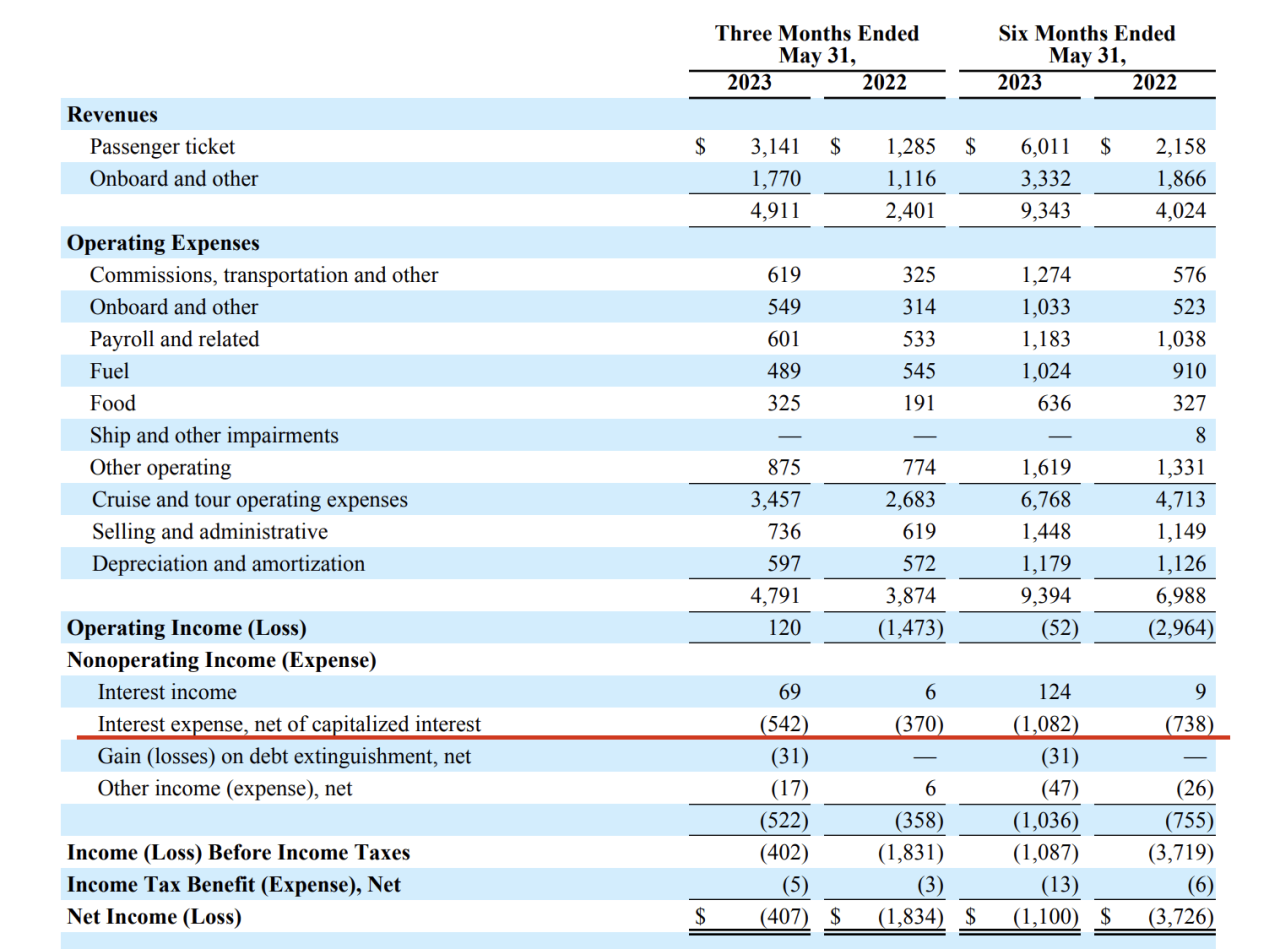

Detailed Financial Statements

Carnival Corporation’s Q3 2024 earnings report showcased robust financial performance, highlighting the company’s resilience and potential for future growth. A deep dive into the detailed financial statements provides further insight into the underlying drivers of this success and the company’s overall financial health. Analyzing these statements allows us to understand the company’s financial position, operational efficiency, and potential for future profitability.Carnival’s financial statements offer a comprehensive picture of its financial health.

Carnival Corp’s impressive $1.21 billion Q3 earnings are definitely noteworthy. It’s great to see companies prioritizing inclusivity, like how some beaches resorts are now certified for autism sensitivity training, beaches resorts get certification for autism sensitivity training. This focus on creating a welcoming environment for all guests bodes well for the future of the travel industry, and ultimately, Carnival’s continued financial success.

The income statement reveals revenue streams and expenses, the balance sheet displays assets, liabilities, and equity, and the cash flow statement tracks cash inflows and outflows. By scrutinizing these statements, we can identify key trends and gain a clearer understanding of the company’s performance.

Income Statement Summary

The income statement summarizes a company’s financial performance over a specific period. Carnival’s Q3 income statement likely detailed revenue from cruise operations, associated expenses like labor, fuel, and marketing, and other operational costs. Analyzing the gross profit margin, operating expenses, and net income provides insights into the company’s profitability and efficiency in managing its costs.

Balance Sheet Analysis

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It categorizes assets, liabilities, and shareholders’ equity. Analyzing the balance sheet reveals insights into the company’s capital structure, liquidity, and overall financial strength.

Carnival Corp’s impressive $1.21 billion earnings in Q3 is fantastic news! While that’s great, I’m also really excited about the plethora of activities on offer for a Rhine cruise with Disney. For example, ample activities rhine cruise with disney like wine tasting tours and historical site visits really make for a memorable vacation. This all suggests that Carnival Corp’s financial health is strong, and they’re likely to continue providing excellent vacation options.

Assets

Carnival’s assets likely include a mix of tangible assets (ships, ports, and land) and intangible assets (brand recognition, intellectual property). The proportion of current assets to long-term assets indicates the company’s liquidity and ability to meet short-term obligations.

Liabilities

Liabilities represent the company’s obligations to creditors. Carnival’s liabilities might encompass short-term debts like accounts payable, and long-term debt such as loans and bonds. The proportion of short-term to long-term liabilities reflects the company’s short-term liquidity risk.

Equity

Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. The equity section of the balance sheet illustrates the amount of investment made by shareholders and the company’s retained earnings. Analyzing the trends in equity over time provides insight into the company’s financial performance and the return on investment for shareholders.

Cash Flow Statement Summary

The cash flow statement details the movement of cash and cash equivalents during a period. This statement breaks down cash flows from operating activities, investing activities, and financing activities. Analyzing these cash flows provides insights into the company’s ability to generate cash, its investment strategies, and its financing decisions.

Significant Items and Trends

Key trends in the statements will likely highlight any significant increases or decreases in revenue, expenses, or cash flows. Any unusual items or non-recurring events should be noted. Comparing these figures to previous quarters and years allows for trend analysis and identification of patterns. For example, if revenue increased substantially while expenses remained relatively stable, this would indicate improved operational efficiency.

Conversely, if expenses rose significantly, this would require further investigation to understand the reasons behind the increase.

Financial Health Assessment

Carnival’s financial health, based on these statements, is likely to be strong. The key indicators to assess this include liquidity (ability to meet short-term obligations), profitability (ability to generate income), and solvency (ability to meet long-term obligations). A thorough analysis of these factors, in conjunction with other key performance indicators, will paint a complete picture of the company’s financial standing.

Last Point

Carnival Corp’s impressive Q3 earnings demonstrate a strong performance in a dynamic industry. The detailed analysis reveals key drivers of success, from revenue and passenger trends to operational efficiencies and market positioning. The company’s financial health is evident, and the outlook for the remainder of the year appears promising. This success is a testament to the company’s adaptability and strategic planning within the cruise industry.

We’ll look at what this means for the industry as a whole and speculate on potential implications for the future.

FAQs: Carnival Corp Earns 1 21 Billion In Its Third Quarter

What were the key factors contributing to Carnival Corp’s strong Q3 earnings?

Increased passenger volumes, higher ticket prices, and improved operational efficiency were key factors driving the strong performance. The company’s strategic initiatives likely played a role in achieving these positive results.

How did Carnival Corp’s performance compare to its competitors?

A comparative analysis of key financial metrics will be included in the report, allowing for a direct comparison with competitor performance.

What are Carnival Corp’s plans for the remainder of the year?

The company’s future plans, including capital investments and growth strategies, will be detailed in the report’s outlook section.

What is the overall outlook for the cruise industry?

The report will provide a general overview of the cruise industry’s performance, along with economic and geopolitical factors influencing the sector.