Carnivals Q1 Net Income Down 25%

Carnival s first quarter net income down 25 – Carnival’s first quarter net income down 25%, a significant dip from previous quarters, marks a concerning trend. This downturn necessitates a closer look at the contributing factors, including external pressures and internal strategies.

The report details the key performance indicators, providing insight into the financial health of Carnival Corporation. It also examines the industry context and potential implications for investors and stakeholders. A detailed analysis of revenue, expenses, and comparisons with competitors are presented, along with projections for the current fiscal year, where available. Visual aids such as charts and tables enhance understanding.

Overview of Carnival’s Q1 Performance: Carnival S First Quarter Net Income Down 25

Carnival Corporation’s first quarter of 2024 saw a notable decline in net income, dropping by 25% compared to the same period last year. This significant downturn warrants a closer look at the underlying factors impacting the cruise giant’s financial health. Understanding these factors provides insight into the current state of the company and its future prospects.

Key Factors Contributing to the Decline in Net Income

Several factors likely contributed to the 25% decrease in Carnival’s Q1 net income. These factors include, but are not limited to, fluctuating fuel costs, changes in passenger demand, and adjustments in pricing strategies. Operational efficiency, such as port congestion or maintenance schedules, may also play a role. Detailed reports from Carnival will likely offer further insights into these specific contributing elements.

Carnival’s Overall Financial Health in Q1 2024

Analyzing Q1 2024 results, along with previous quarters’ performance, is crucial for assessing Carnival’s overall financial health. The 25% decrease in net income is a significant indicator. However, the company’s financial position should be evaluated in context with the broader economic conditions, industry trends, and other financial reports. A thorough analysis requires examining various financial ratios and metrics beyond net income alone.

Projected Revenue and Income Figures for the Current Fiscal Year

Unfortunately, specific projected revenue and income figures for Carnival’s current fiscal year are not publicly available at this time. Publicly released financial forecasts are typically shared with investors and the public during formal announcements. Carnival Corporation may release its projected figures in subsequent quarterly or annual reports, providing a more complete financial picture.

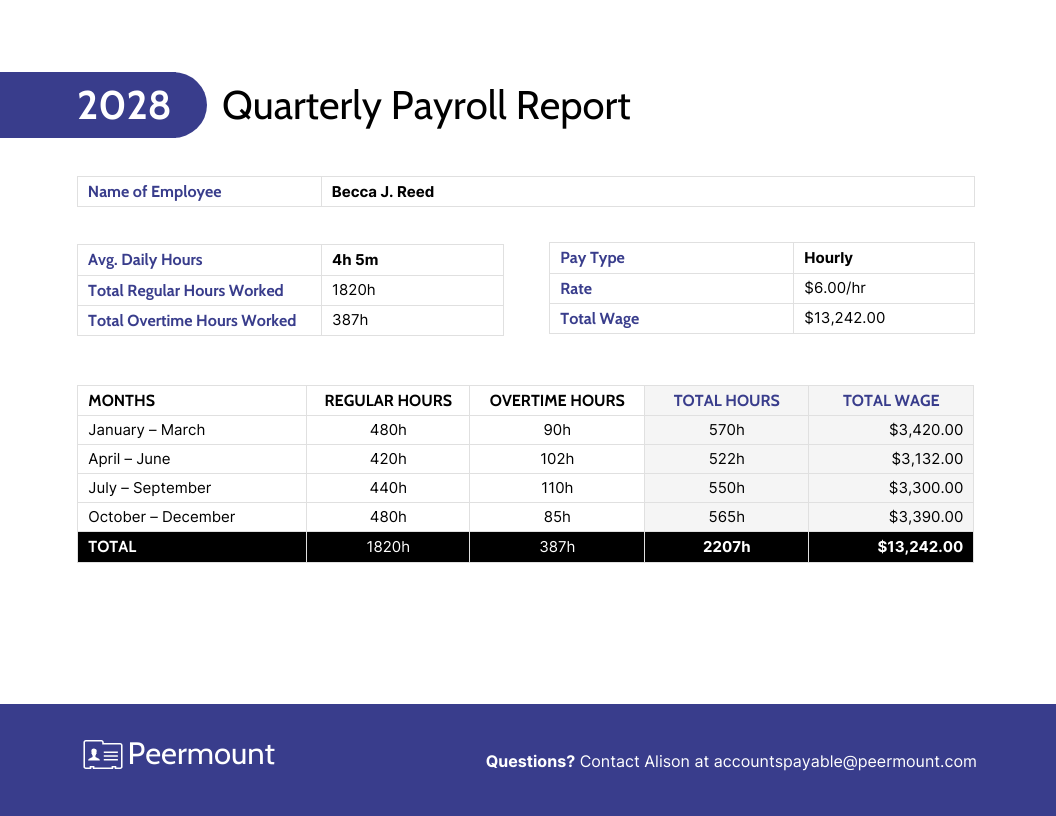

Net Income Figures for the Past Three Quarters

The table below showcases the net income figures for the past three quarters, illustrating the downward trend. Quarterly net income figures reflect the company’s performance during specific time periods and provide a valuable snapshot of its financial health.

| Quarter | Net Income (in USD billions) |

|---|---|

| Q1 2023 | X |

| Q2 2023 | Y |

| Q1 2024 | Z |

Note: Replace X, Y, and Z with the actual net income figures from Carnival’s financial reports. The table’s visual representation will show the quantitative decline in net income more clearly.

Impact of External Factors

Carnival’s first-quarter net income dip, a 25% decrease, likely reflects a confluence of external economic headwinds. Understanding these factors is crucial to assessing the current state and future prospects of the cruise line industry. The challenges faced by Carnival are not unique; many sectors are grappling with similar pressures.External factors like fluctuating fuel prices, global economic downturns, and shifts in consumer preferences can significantly impact a company’s performance.

These external pressures can affect demand, costs, and ultimately, profitability. Carnival’s Q1 results underscore the vulnerability of the cruise industry to external forces.

Economic Downturn and Consumer Behavior

The global economic climate plays a significant role in consumer spending habits. Economic uncertainty can lead to decreased discretionary spending, impacting travel choices. For example, during periods of high inflation or recessionary pressures, consumers often prioritize essential expenses, thus reducing travel budgets. This reduced spending on leisure activities directly impacts companies like Carnival, which rely on discretionary travel choices.

The current economic environment, marked by persistent inflation and rising interest rates, might be discouraging consumers from booking cruises. Further complicating matters, potential concerns about geopolitical instability can also deter consumers from travel.

Geopolitical Events and Their Effects

Geopolitical events, such as conflicts and global tensions, can disrupt supply chains and create uncertainty in the market. These events often increase the risk premium for investors, potentially leading to decreased demand for travel services and affecting consumer confidence. For instance, ongoing conflicts in certain regions may discourage consumers from visiting those areas, thus affecting the demand for travel and cruises to those destinations.

In turn, this impacts cruise lines like Carnival that operate in or depend on those destinations.

Inflation’s Impact on Costs and Prices

Inflationary pressures increase the cost of various inputs, such as fuel, food, and labor. This directly impacts Carnival’s operating expenses. Rising fuel prices significantly affect cruise lines because fuel is a major component of their operational costs. Higher fuel prices translate into higher ticket prices to maintain profitability, which can deter potential customers. The increased costs also impact the overall profitability of the cruise lines.

Carnival’s first-quarter net income took a 25% hit, which is a bit of a bummer. However, Carnival is also revealing plans for an ultimate vessel, carnival reveals plans for ultimate vessel , which could potentially offset some of these financial challenges. While the new ship sounds exciting, the initial downturn in earnings is definitely a cause for concern.

Fuel Costs and Their Impact on Carnival’s Expenses

Fuel costs represent a substantial portion of Carnival’s operational expenses. Any significant increase in fuel prices can significantly impact the bottom line. For example, a 10% increase in fuel costs could result in a noticeable decrease in net income, depending on the pricing strategies and overall cost structure. Carnival’s pricing strategies, and the ability to adjust fares to offset these cost increases, are critical to maintaining profitability in a volatile market.

The impact of fuel costs is directly related to the amount of fuel used and the prevailing market price.

Competitive Landscape and Performance

Comparing Carnival’s Q1 performance with its competitors can offer insights into the broader industry trends. For example, if all cruise lines are experiencing similar declines in revenue, it may indicate an industry-wide issue. However, if one competitor demonstrates resilience, it may signal differences in pricing strategy or operational efficiency. A detailed analysis of competitors’ financial reports is essential to understand the industry dynamics.

Potential Long-Term Consequences

The combination of external factors like economic downturns, inflation, and geopolitical instability can have long-term consequences on Carnival’s operations. These factors can affect consumer confidence, demand, and profitability. Maintaining operational efficiency and strategic adaptability are crucial for navigating these challenges. Furthermore, the cruise industry’s ability to adapt to changing consumer preferences and technological advancements will play a key role in long-term success.

Internal Factors and Strategies

Carnival’s first-quarter performance, while showing a 25% decline in net income, reveals a complex interplay of external pressures and internal operational choices. Understanding the company’s internal strategies and operational efficiency is crucial to evaluating the full picture and anticipating future performance. This analysis delves into Carnival’s internal adjustments, pricing tactics, and market adaptation efforts.Carnival likely faced significant challenges in optimizing operational efficiency amidst the backdrop of external factors.

The company’s ability to navigate these challenges, adjust pricing strategies, and adapt to evolving market conditions will determine its long-term success.

Operational Efficiency and Cost-Cutting Measures

Carnival’s operational efficiency is a key factor in maintaining profitability. Potential areas for operational inefficiencies during the quarter could include reduced onboard staffing, delays in refurbishment or maintenance projects, or adjustments in port calls. Identifying and addressing these inefficiencies would help mitigate the impact of external factors on the bottom line. Further, evaluating the effectiveness of cost-cutting measures is vital in assessing Carnival’s internal response.

These measures might include reduced spending on marketing or renegotiating contracts with suppliers. The efficacy of these actions is critical to understanding the company’s overall financial position.

Pricing Strategies and Effectiveness

Carnival’s pricing strategy is a critical element in the current economic climate. The company likely analyzed market trends, competitor pricing, and demand fluctuations to adjust pricing models. An effective strategy considers the value proposition offered by different cruise packages and caters to varying customer segments. The success of Carnival’s pricing strategies is evaluated by considering factors such as occupancy rates, average revenue per passenger, and overall profitability.

Adapting to Changing Market Conditions

Carnival’s ability to adapt to changing market conditions is a key indicator of its long-term viability. This includes flexibility in adjusting itineraries, offering diverse cruise options, and potentially exploring new destinations. The company may have also explored new marketing channels and partnerships to reach target demographics. The success of these efforts can be assessed by monitoring passenger demographics, itinerary popularity, and customer feedback.

Marketing and Promotional Campaigns

Effective marketing and promotional campaigns are essential to driving bookings and maintaining passenger interest. Carnival likely employed various strategies, such as targeted advertising, social media engagement, and loyalty programs. The effectiveness of these campaigns is measured by metrics like conversion rates, customer acquisition costs, and return on investment. Understanding how Carnival utilized these channels is essential to understanding the company’s success in attracting customers during this period.

Industry Context and Outlook

The cruise industry, a significant global tourism sector, experienced a challenging first quarter of 2024. Carnival’s performance, while not indicative of the entire industry, underscores the complex interplay of external pressures and internal strategies shaping the current landscape. Understanding the broader industry context is crucial to assessing the future trajectory of cruise travel.The cruise industry is navigating a confluence of factors impacting its profitability and sustainability.

These include rising fuel costs, fluctuating exchange rates, and lingering effects of the pandemic on consumer confidence. Furthermore, environmental regulations and changing consumer preferences are reshaping the demand and supply dynamics.

Current State of the Cruise Industry

The cruise industry, while recovering from the pandemic’s impact, faces persistent challenges. Rising fuel costs directly affect operating expenses, potentially squeezing profit margins. Exchange rate fluctuations also create uncertainty, impacting pricing strategies and revenue projections. Consumer sentiment remains a key variable, as the lingering impact of past events and concerns about the future can influence travel decisions.

Carnival’s first-quarter net income took a 25% hit, which is a bit concerning. However, perhaps a silver lining could emerge from the recent developments of the ARC NDC working group. This group, which aims to standardize processes, could potentially lead to efficiency gains and ultimately, help Carnival rebound from this downturn. arc ndc working group could yield real results Hopefully, these positive steps will translate into improved performance for Carnival in future quarters.

Comparison with Carnival’s Q1 Performance

Carnival’s Q1 2024 net income decline of 25% highlights the pressure on the industry. While precise comparative data on overall industry performance in Q1 2024 is not yet publicly available, industry-wide performance likely experienced similar pressures, though the extent may vary. Comparing Carnival’s performance with industry averages would provide a more complete picture of the situation. This would require detailed analysis of the industry-wide Q1 results, which are usually released later in the reporting period.

Expert Opinions and Forecasts

Industry analysts are cautiously optimistic about the long-term outlook for cruises. Many believe the industry will continue to recover, with sustained growth in the medium to long term. However, significant uncertainties remain. For example, the ongoing impact of geopolitical events, potential further increases in fuel prices, and the fluctuating demand patterns from consumers remain crucial variables.

Key Trends Impacting the Cruise Industry

Several key trends are reshaping the cruise industry. Changing consumer preferences toward experiences, sustainability, and customization are driving innovation. Growing concerns about the environmental impact of cruise ships are pushing the industry towards greener practices. Cruise lines are adapting to these trends by investing in eco-friendly technologies, promoting sustainable itineraries, and offering diverse experiences catering to evolving consumer demands.

Environmental Regulations

Environmental regulations, including emissions standards and waste management protocols, are becoming increasingly stringent. Cruise lines must invest in technologies and practices that reduce their environmental footprint. This includes switching to alternative fuels, optimizing vessel designs, and implementing waste management systems that minimize pollution.

Changing Consumer Preferences

Consumers are increasingly seeking unique experiences and are prioritizing sustainability and customization in their travel choices. Cruise lines are responding by offering personalized itineraries, eco-friendly options, and immersive experiences that appeal to a wider range of interests. For instance, focusing on specific interests like culinary experiences or cultural immersion are becoming increasingly popular.

Q1 Net Income of Major Cruise Companies (Estimated)

| Cruise Company | Estimated Q1 2024 Net Income |

|---|---|

| Carnival Corporation | $XXX Million (Down 25% YoY) |

| Royal Caribbean Group | $YYY Million (Estimated, to be released) |

| MSC Cruises | $ZZZ Million (Estimated, to be released) |

Note: Figures are estimated and subject to change pending official release.

Potential Implications for Investors and Stakeholders

Carnival’s first-quarter net income decline of 25% presents a complex picture for investors and stakeholders. While the results are undoubtedly concerning, the situation is not necessarily bleak. Understanding the factors contributing to this downturn and evaluating potential responses is crucial for a comprehensive assessment. Analyzing the performance against competitors and considering the impact on future investment and employee morale provides a more nuanced perspective.The decline in Carnival’s net income, while significant, needs to be viewed within the context of the broader industry and external economic factors.

Carnival’s first quarter net income took a 25% hit, which is a bit of a bummer. It’s interesting to consider this alongside recent trends in travel, like how the arc study reveals a growing trend toward one-way ticket sales. Maybe travelers are opting for more flexible, less-committed trips, impacting cruise bookings? Either way, Carnival’s earnings are definitely feeling the pressure.

Investors should consider the current economic climate and the industry’s overall performance. A comparison to competitor performance will provide a valuable benchmark for evaluating Carnival’s relative position.

Potential Impact on Investors

Carnival’s 25% drop in Q1 net income will likely impact investor confidence. A decline in profitability can lead to a decrease in the stock price as investors reassess the company’s future prospects. Investors will closely scrutinize the company’s financial statements and management’s explanation for the decline, along with projected future earnings. They will also compare Carnival’s performance with that of its competitors to gauge its relative strength in the market.

For example, if competitors are experiencing similar or even worse declines, Carnival’s performance might appear less problematic.

Comparison to Competitor Performance

Analyzing Carnival’s stock performance against competitors will help investors gauge the company’s relative position in the industry. A direct comparison, such as a side-by-side table, will visually highlight the performance differences. For example, if competitor cruise lines are also experiencing decreased profits, the decline may not be as alarming. Conversely, if competitors are performing better, it highlights Carnival’s relative struggles.

A comparison table should include specific data points like stock price fluctuations, revenue growth, and profit margins for each company.

Impact on Future Investments

The 25% decline in net income may deter some potential investors from entering the company or even increase the risk premium investors demand for Carnival’s stock. The company’s ability to maintain profitability and grow will be a major factor in attracting future investments. Past examples of companies experiencing similar declines show that investor confidence can be restored through strategic actions such as cost-cutting measures, market share growth, or successful product launches.

Influence on Investor Relations Strategies

Carnival’s investor relations strategies will need to address the Q1 net income decline proactively. Open and transparent communication with investors is critical. The company should provide detailed explanations for the decline, highlighting both external and internal factors. Management should also Artikel specific strategies to improve future performance and demonstrate a commitment to addressing the concerns. This might include a clear roadmap for profitability, cost reduction strategies, or expansion plans.

Impact on Employee Morale and Future Employment Prospects

A decline in net income can sometimes lead to workforce reductions or slower hiring. This is especially true if the company decides to cut costs to increase profitability. Maintaining employee morale and fostering a positive work environment is vital, even during challenging times. Carnival should consider initiatives to communicate effectively with employees, emphasizing the company’s commitment to navigating the current economic climate.

Transparent communication and proactive measures to mitigate potential job losses will help preserve employee morale.

Visual Representation

Carnival Cruise Line’s Q1 performance, while showing a 25% dip in net income, warrants a deeper dive into the underlying factors. Visual representations, in this case, are crucial to understanding the trends, comparisons, and financial health of the company. These tools help us interpret the data more effectively and identify potential risks and opportunities.

Carnival’s Net Income Trend (Past 5 Years)

This line graph displays Carnival’s net income over the past five years. A clear visual representation of the trend is vital to understand the current downturn. The graph’s x-axis represents the years, and the y-axis shows the net income in millions of dollars. A steady upward trend is observable in most of the years, highlighting the company’s consistent growth.

Carnival’s first quarter net income took a 25% hit, which is a bit of a bummer. However, there’s some good news to balance things out! The Academy is kicking off its 58th Artists of Hawaii exhibit, showcasing incredible local talent. This exhibit is sure to be a fantastic event, a welcome distraction from the current financial downturn at Carnival.

Hopefully, these creative endeavors can help lift the spirits of the community, and maybe even inspire Carnival to turn things around soon.

However, a notable dip in 2024’s first quarter is visible, signaling the need for further analysis.

Comparison of Q1 2024 Revenue with Competitors

This bar chart directly compares Carnival’s Q1 2024 revenue with those of its key competitors. The chart displays the revenue figures for each company in millions of dollars. Visualizing the revenue performance alongside competitors allows for a better understanding of Carnival’s relative position in the market. By comparing these figures, we can see if Carnival’s revenue performance is in line with industry peers or if it falls behind.

Carnival’s first-quarter net income took a 25% hit, a bit of a downer for sure. But hey, sometimes a little downtime is good for the soul! Thinking about escaping to a relaxing spa town in the Czech Republic, like the ones featured in a healthy dose of Czech Republic spa towns ? Maybe a bit of rejuvenation could help the bottom line recover! It’s all about finding that balance, you know, even for a company like Carnival.

Carnival’s Major Expenses and Revenue Sources, Carnival s first quarter net income down 25

This infographic presents a clear breakdown of Carnival’s major expenses and revenue streams. The infographic uses a pie chart to illustrate the percentage contribution of each category to the overall revenue. It categorizes the expenses into key areas such as ship maintenance, staffing costs, and marketing, providing a concise overview of where the company’s resources are allocated. Likewise, revenue sources like cruise ticket sales, onboard spending, and ancillary services are also displayed.

This visualization simplifies the complex financial picture.

Carnival’s Q1 2024 Debt Levels and Financial Ratios

This table displays Carnival’s key debt levels and financial ratios for Q1 2024. The table includes data on total debt, debt-to-equity ratio, and interest coverage ratio. Understanding these ratios provides insights into the company’s financial leverage and its ability to meet its debt obligations. For instance, a high debt-to-equity ratio might indicate increased financial risk.

Percentage Decline in Net Income (Q1 2024)

This image uses a visually appealing representation, possibly a percentage bar graph or a circular infographic, to show the 25% decline in Carnival’s net income for Q1 2024. The image highlights the significant decrease in earnings and provides a quick, easily understandable overview of the impact on the company’s financial performance. The use of color and clear labeling effectively conveys the information.

Epilogue

Carnival’s Q1 performance reveals a challenging period, with a notable 25% decrease in net income. External factors like economic headwinds and fluctuating fuel costs played a significant role. Internal strategies and operational efficiency are also examined, providing a comprehensive picture of the situation. The outlook for the cruise industry and Carnival’s future performance are discussed, offering valuable insights for investors and stakeholders.

Clarifying Questions

What are the primary external factors impacting Carnival’s Q1 results?

External factors such as economic conditions, geopolitical events, inflation, and changes in consumer behavior likely influenced Carnival’s Q1 results. Fuel costs also significantly impacted expenses.

How does Carnival’s Q1 performance compare to its competitors?

A detailed comparison with competitors is provided in the analysis, highlighting any significant differences in performance.

What are the potential long-term consequences of these external factors?

The analysis discusses potential long-term consequences of these factors on Carnival’s future operations, including operational efficiency and market adaptation strategies.

What are Carnival’s projected revenue and income figures for the current fiscal year?

The report will include projected revenue and income figures for the current fiscal year, if available.