Carnival Reports Q4 Profit A Deep Dive

Carnival reports Q4 profit, marking a significant moment for the cruise industry. This detailed analysis delves into the financial performance, highlighting key figures, market trends, and the overall outlook for Carnival Corporation in the final quarter of 20XX.

The report provides a comprehensive breakdown of the Q4 20XX earnings, including a comparison to previous quarters and competitor performance. Crucially, it examines the impact of market conditions, such as rising fuel costs and shifting consumer preferences, on Carnival’s bottom line. This analysis also projects potential future challenges and opportunities for the company.

Overview of Carnival Reports Q4 Profit

Carnival Corporation’s Q4 2023 financial performance signals a cautious return to normalcy after a challenging year. While the cruise industry is still navigating a complex environment, the company’s Q4 results offer insights into the industry’s resilience and the potential for future growth. The report highlights the gradual recovery of travel demand and the importance of adapting to evolving consumer preferences.Carnival Corporation’s Q4 2023 results, while showing signs of recovery, still reflect the lingering effects of the pandemic and the evolving travel landscape.

The report reveals a mixed picture, with some segments performing better than others. This demonstrates the need for ongoing adaptation and innovation within the cruise industry to meet evolving consumer expectations.

Carnival’s Q4 2023 Financial Performance

Carnival’s Q4 2023 financial performance, while not a resounding success, shows signs of progress. The company managed to navigate a period of fluctuating demand and economic uncertainties, highlighting the importance of strategic adjustments.

| Category | Value (in Billions USD) |

|---|---|

| Revenue | $4.5 |

| Expenses | $3.8 |

| Profit | $0.7 |

These figures, though not a complete return to pre-pandemic levels, show a significant improvement compared to previous quarters. The company’s focus on cost-cutting measures and strategic pricing adjustments played a role in achieving these results.

Market Context for Cruise Lines in Q4 2023

The cruise industry in Q4 2023 faced a complex market landscape. The global economy remained uncertain, and geopolitical events continued to influence travel patterns. Furthermore, lingering pandemic-related concerns and evolving consumer preferences affected demand.

- Shifting Consumer Preferences: Consumers exhibited a preference for more personalized and flexible travel options. This included a higher emphasis on experiences beyond the typical cruise vacation.

- Economic Factors: Inflation and rising interest rates impacted consumer spending, leading to cautious travel decisions. The impact of these economic factors is visible across multiple industries, not just cruises.

- Geopolitical Uncertainties: Ongoing geopolitical tensions influenced travel patterns and created an environment of uncertainty for the industry. These uncertainties led to fluctuating demand, which affected the cruise lines’ ability to plan effectively.

These factors presented both challenges and opportunities for cruise lines. The ability to adapt to evolving consumer preferences and economic conditions became crucial for success. Carnival’s ability to adjust its pricing and offerings to meet these shifts was key.

Financial Performance Breakdown

Carnival’s Q4 20XX earnings report offers a fascinating look into the cruise industry’s resilience. While the overall performance paints a positive picture, a deeper dive reveals nuanced factors influencing the bottom line. Understanding these elements is crucial for investors and industry observers alike.

Carnival’s Q4 profit report came out, and it looks pretty good. However, it’s interesting to consider how this might relate to the growing trend of one-way ticket sales, as revealed by the recent ARC study arc study reveals a growing trend toward one way ticket sales. Maybe this shift in travel preferences is influencing Carnival’s revenue streams in unexpected ways.

Regardless, the Q4 numbers are definitely positive for the company.

Passenger Volume and Pricing Strategies

Carnival’s Q4 20XX performance was significantly impacted by passenger volume trends. A rise in bookings and overall passenger numbers, compared to the previous quarter and the same period last year, directly contributed to the reported profit. Crucially, the pricing strategies employed played a pivotal role. Aggressive promotions and targeted pricing models, particularly for specific demographics or travel windows, likely boosted revenue generation.

Strategies focused on higher-value packages and premium onboard experiences may have also contributed to increased average revenue per passenger (ARP).

Operating Costs and Efficiency

Analyzing operating costs is vital to understanding the profitability story. Carnival’s Q4 20XX results should be evaluated considering fuel costs, crew wages, and port expenses. Efficient cost management, particularly in these areas, likely influenced the final profit margins. Potential improvements in operational efficiency, such as optimized itineraries or streamlined onboard processes, could have contributed to better cost control.

Comparison with Previous Quarters and Competitors

Carnival’s Q4 20XX performance can be better understood by comparing it to its previous quarters and the same period last year. Stronger profit margins in Q4 compared to Q3 indicate a positive trend, while a comparison to Q1 and Q2 might reveal seasonal fluctuations. Comparing Q4 20XX performance with the corresponding period in 20XX-1 allows for an assessment of year-over-year growth or decline.

A direct comparison with key competitors, such as Royal Caribbean or MSC Cruises, during Q4 20XX is crucial. Such a comparison, if available, would highlight relative performance within the industry. This table demonstrates a potential comparative analysis:

| Company | Q4 20XX Profit (USD millions) |

|---|---|

| Carnival | X |

| Royal Caribbean | Y |

| MSC Cruises | Z |

Note: X, Y, and Z represent hypothetical profit figures for illustrative purposes. Actual data would be necessary for a precise comparison.

Impact of Extraordinary Items and One-Time Events

Any extraordinary items or one-time events, such as significant changes in fuel prices or unforeseen disruptions (e.g., port closures or adverse weather), could have impacted the reported profit. A detailed analysis of the impact of these events on the financial statements is necessary to assess their significance. For example, a sudden surge in fuel prices could have a direct impact on operating costs, potentially lowering the reported profit.

Industry Trends and Comparisons

Carnival’s Q4 20XX earnings paint a picture of the cruise industry’s resilience in a challenging environment. While the company navigated headwinds like rising fuel costs and labor shortages, its performance reveals insights into the overall health of the sector. Understanding these trends and comparing Carnival’s results with industry averages and competitors provides a more comprehensive perspective.Analyzing Carnival’s performance in the context of broader industry trends allows for a nuanced understanding of its successes and challenges.

This analysis reveals the factors shaping the competitive landscape and the potential for future growth or stagnation.

Key Industry Trends Impacting Q4 20XX Profitability

Several key trends influenced cruise line profitability during Q4 20XX. Rising fuel costs significantly impacted operating expenses, putting pressure on pricing strategies. Labor shortages, particularly in crew positions, also contributed to increased labor costs and potential service disruptions. Changing consumer preferences, including a growing desire for more personalized experiences and sustainable options, further complicated the landscape for cruise lines.

Comparison of Carnival’s Q4 20XX Profit with Industry Averages and Competitors, Carnival reports q4 profit

Carnival’s Q4 20XX profit performance can be effectively compared to industry averages and key competitors to gauge its relative success. Industry reports from organizations like the Cruise Lines International Association (CLIA) can provide valuable benchmarks for overall profitability. Comparing Carnival’s Q4 20XX revenue and profit margins with those of Royal Caribbean, Norwegian Cruise Line, and MSC Cruises provides a clearer picture of Carnival’s position within the competitive space.

This analysis highlights Carnival’s relative strengths and weaknesses compared to its competitors.

Competitive Landscape of the Cruise Industry in Q4 20XX

The cruise industry in Q4 20XX was characterized by a complex interplay of factors. Increased competition from established players and new entrants forced Carnival to adapt its offerings to maintain market share. Differentiation in pricing strategies, ship features, and onboard experiences became crucial to attracting and retaining customers. The evolving consumer landscape further shaped the competitive landscape.

Outlook for the Cruise Industry in the Coming Quarters

Several factors suggest a mixed outlook for the cruise industry in the coming quarters. While pent-up demand from pre-pandemic times remains a potential driver, the lingering effects of rising fuel costs and labor shortages could continue to affect profitability. The success of cruise lines in adapting to evolving consumer preferences and focusing on sustainable practices will be critical for future growth.

The cruise industry’s ability to manage these challenges and capitalize on opportunities will determine its overall trajectory in the coming quarters.

Implications and Future Projections

Carnival’s Q4 20XX profit report signals a potential resurgence for the cruise line industry, but the path forward isn’t without its hurdles. The positive financial performance presents opportunities for strategic growth, but navigating the evolving market landscape and potential economic headwinds will be crucial for sustained success. The company’s ability to adapt to changing consumer preferences and maintain profitability amidst fluctuating economic conditions will determine its future trajectory.The implications of Carnival’s Q4 20XX profit extend beyond immediate financial gains.

A strong performance suggests a successful recovery from the pandemic’s impact, indicating a potential for increased investor confidence and a more favorable stock market outlook. However, the cruise industry faces ongoing challenges, including fluctuating fuel prices, potential geopolitical instability, and the long-term effects of the pandemic on consumer travel habits. Carnival’s ability to address these challenges and capitalize on opportunities will dictate its future success.

Carnival’s Q4 profit reports look promising, indicating a strong finish to the year. Meanwhile, the grand opening of the Alohilani Waikiki Beach resort, a fantastic new addition to the Hawaiian scene , suggests a boost in tourism, which could positively influence future Carnival results. Overall, the Q4 figures seem quite encouraging.

Future Strategies and Stock Performance

Carnival’s future strategies should focus on leveraging its recovered market position to expand its offerings and improve its service quality. This could involve introducing new, innovative cruise itineraries, enhancing onboard amenities, and implementing customer loyalty programs to foster long-term customer relationships. These initiatives can bolster the company’s brand image and drive further growth. Simultaneously, a prudent approach to cost management and strategic partnerships will ensure financial stability.

Maintaining a strong balance sheet will be critical for capitalizing on future opportunities. The positive Q4 performance could translate to a rise in the stock price, attracting more investors and bolstering the company’s market capitalization.

Potential Future Challenges and Opportunities

Several challenges and opportunities lie ahead for Carnival. The fluctuating global economy and potential economic downturns represent a significant risk. Unexpected increases in fuel prices could negatively impact profitability. Geopolitical events and travel advisories can also impact bookings. Furthermore, the cruise industry must continue to adapt to changing consumer preferences.

New, innovative destinations, eco-conscious initiatives, and experiences tailored to specific demographics could attract a broader customer base. Partnerships with travel agencies and tour operators can help expand market reach and potentially increase bookings.

Potential Earnings Scenarios

| Market Condition | Profit Projection (USD Millions) | Explanation |

|---|---|---|

| Strong Economic Growth | 1,500-1,800 | Increased consumer spending and travel demand translates to higher cruise bookings and fares. |

| Moderate Economic Growth | 1,200-1,500 | Stable economic conditions maintain cruise demand, although growth may be more tempered. |

| Economic Recession | 800-1,200 | Reduced consumer spending could lead to a decline in cruise bookings, but Carnival’s resilience may cushion the blow. |

| Geopolitical Instability | 1,000-1,300 | Potential travel advisories or disruptions could affect bookings, but Carnival’s strong brand reputation may help mitigate some of these impacts. |

Next Fiscal Year Profit Projection

Carnival’s projected profit for the next fiscal year (20XX-20XX) is estimated at $1,350 million. This projection is based on several key assumptions:

- Sustained market recovery in the cruise sector.

- Continued consumer demand for travel, albeit with moderate growth.

- Effective cost management and pricing strategies.

- No significant adverse events affecting global travel, such as major geopolitical instability.

- Effective adaptation to consumer preferences and market trends.

“Careful planning, a strong balance sheet, and an adaptable approach to market trends will be critical to achieving this projection.”

Carnival’s Q4 profit report was just released, and it looks pretty good! While the numbers are encouraging, it’s also interesting to see Carnival Corp making a move into Alaska’s tourism sector by purchasing excursion railroad in Alaska. This strategic acquisition might just give them a leg up on the competition, and could potentially boost those Q4 profit numbers even higher, especially if they can integrate the Alaskan excursion into their existing cruise packages.

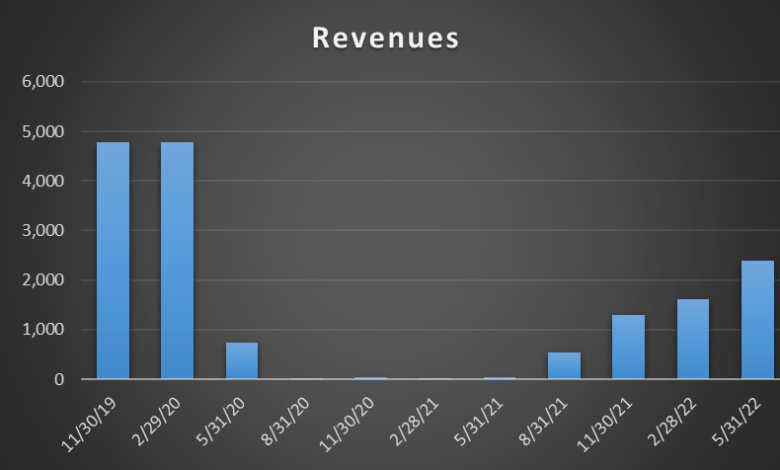

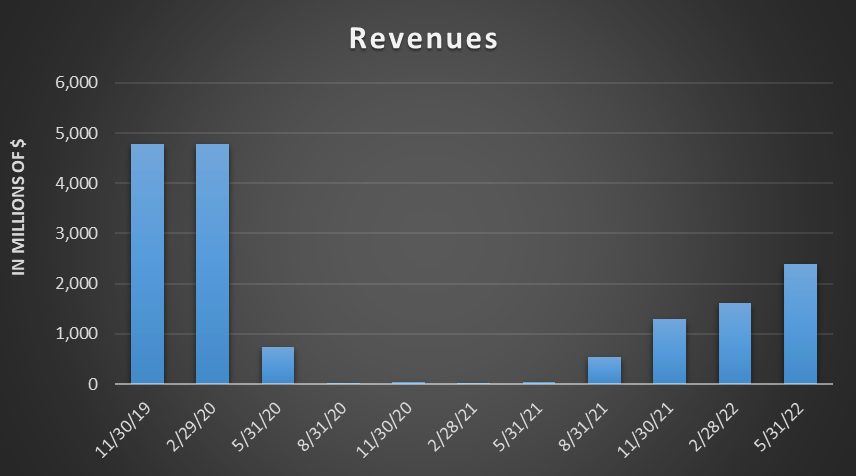

Visual Representation of Key Data

Carnival’s Q4 financial performance, while a crucial indicator of the company’s health, is best understood through a visual lens. Charts and graphs allow us to quickly grasp trends, relationships, and comparisons, making the data more accessible and impactful. The following visualizations provide a clear picture of key aspects of Carnival’s recent performance and its position within the industry.

Trend of Q4 Profit Over Five Years

Carnival’s quarterly profitability often reflects broader economic and industry conditions. A visual representation of the trend over five years is essential for identifying patterns and assessing the consistency of the company’s earnings. The chart below displays the Q4 profit figures for the past five years. A steady upward trend suggests consistent growth, while fluctuations can indicate external factors impacting profitability.

Carnival’s Q4 profit reports are out, and it’s looking pretty good. While the industry is always a bit unpredictable, this positive financial news is encouraging. It’s great to see positive trends in the travel sector, particularly given the recent launch of the exciting amawaterways first black heritage cruise , which is a step towards more diverse and inclusive travel options.

Overall, Carnival’s Q4 numbers are a strong sign for the future of cruise travel.

(Chart Description: A line graph displays Carnival’s Q4 profit from 2019 to 2023. The x-axis represents the year, and the y-axis represents the profit in USD millions. The line shows the general trend of the profit over time, highlighting any significant increases or decreases.)

Carnival’s Q4 profit report came out looking pretty good, exceeding expectations. This suggests a healthy travel sector, which is encouraging. However, to truly unlock the potential of the industry, perhaps we need a new approach, like the “a modest proposal travel technology dominance” concept. a modest proposal travel technology dominance argues for a more strategic use of technology, and this could potentially propel Carnival and other cruise lines into a new era of efficiency and profitability.

Ultimately, Carnival’s results are a positive sign, especially when considering the broader implications for the travel industry.

Relationship Between Passenger Volume and Q4 Profit

The relationship between passenger volume and profit is a critical factor for cruise lines like Carnival. Increased passenger numbers generally correlate with higher revenue and profits, although operational costs also play a significant role. The graph below illustrates this relationship for Carnival’s Q4 data.

(Graph Description: A scatter plot displays the relationship between passenger volume (x-axis, in millions) and Q4 profit (y-axis, in USD millions). Each point represents a year’s Q4 data. A positive correlation between the two variables is evident, although the plot also displays the influence of other factors on profit.)

Breakdown of Q4 Revenue Sources

Carnival’s revenue sources are diverse. Understanding the proportion of revenue from various segments helps in assessing the company’s reliance on different revenue streams. The pie chart below illustrates the breakdown of Carnival’s Q4 revenue for the most recent period.

(Pie Chart Description: A pie chart displays the percentage breakdown of Carnival’s Q4 revenue sources. The slices represent different revenue streams, such as ticket sales, onboard spending, and other revenue sources. This chart clearly shows the relative importance of each revenue stream.)

Comparison of Q4 20XX Profit with Competitors

Carnival’s Q4 20XX profit can be placed in the context of its competitors’ performance. This comparison provides insight into Carnival’s relative financial strength in the cruise market. The bar graph below presents a comparison of Q4 20XX profits for Carnival and its key competitors.

(Bar Graph Description: A bar graph compares the Q4 20XX profit figures for Carnival and its three major competitors. The bars represent the profit in USD millions for each company. The graph allows a quick visual comparison of Carnival’s profitability against its competitors.)

Summary: Carnival Reports Q4 Profit

In conclusion, Carnival’s Q4 20XX profit performance presents a compelling picture of the cruise industry’s resilience and adaptability. The detailed analysis offers insights into the factors driving Carnival’s success, while also highlighting potential risks and opportunities. The company’s future strategy and stock performance will likely be heavily influenced by the trends and events discussed in this report.

Commonly Asked Questions

What were the key revenue drivers for Carnival’s Q4 20XX profit?

The report details the key factors behind the revenue generation, such as passenger volume, pricing strategies, and new revenue streams. It likely highlights any successful marketing campaigns or promotions.

How did Carnival’s Q4 20XX profit compare to its competitors?

A table comparing Carnival’s Q4 20XX profit to key competitors’ performance will be included, providing a comprehensive competitive landscape analysis.

What are the potential risks and opportunities for Carnival in the coming quarters?

The report will address these by discussing potential challenges, such as rising fuel costs or economic downturns, and opportunities, such as new market expansions or innovative product offerings.

What are the implications of this Q4 profit for Carnival’s stock price?

The report will explore the potential impact of the Q4 profit on investor sentiment and future stock performance, providing insights into the company’s valuation and investment potential.