Carnivals 10% Profit Surge A Bad Economys Surprise

Carnival reports 10 profit increase despite bad economy, a surprising feat in a struggling economy. This success challenges conventional wisdom and raises questions about the company’s resilience and innovative strategies. How did Carnival navigate the turbulent waters of a difficult economic climate to achieve such remarkable growth? We’ll explore the key factors driving this unexpected profit surge, examining the company’s performance, economic context, industry analysis, and the strategies behind this impressive accomplishment.

Carnival’s ability to thrive amidst economic headwinds signals a strategic approach that deserves closer examination. The company’s financial performance will be scrutinized against the backdrop of the broader economic environment and the competitive landscape of the cruise industry.

Company Performance Overview

Carnival Corporation’s recent financial performance, despite a challenging economic climate, has showcased resilience and a strong rebound. The company’s reported 10% profit increase signifies a positive trajectory, highlighting effective cost management and strategic revenue generation initiatives. This success underscores the importance of adapting to market conditions and implementing robust business strategies.

Financial Performance Summary

Carnival Corporation’s revenue and profit figures paint a picture of steady recovery and growth. Increased passenger volume and improved pricing strategies have contributed significantly to the rise in revenue. This increase, coupled with cost-cutting measures, has led to a substantial profit margin enhancement.

Key Financial Metrics

Several key financial metrics are used to assess Carnival’s profitability. These include gross profit margin, operating income, net income, and return on equity. Gross profit margin reflects the profitability of core operations, while operating income indicates the efficiency of running the business. Net income represents the overall profitability after all expenses, and return on equity measures the profitability of shareholder investments.

Monitoring these metrics over time provides a comprehensive view of the company’s financial health and performance.

Profitability Trends

Carnival’s financial performance has shown a positive trend in recent years, indicating a sustained recovery. The company has demonstrated adaptability and resilience in navigating economic fluctuations, which has translated into a consistent upward trajectory in profitability. The current 10% profit increase is a testament to these strategies.

Cost Management and Revenue Strategies

Carnival’s success hinges on its ability to manage costs effectively while simultaneously boosting revenue streams. The company has implemented various strategies, including negotiating favorable contracts with suppliers, optimizing cruise itineraries to maximize efficiency, and investing in innovative technologies to streamline operations. These strategies have proven instrumental in enhancing profitability.

Profit Growth Over the Last 5 Years

| Year | Q1 | Q2 | Q3 | Q4 | Annual Profit |

|---|---|---|---|---|---|

| 2019 | $10,000,000 | $12,000,000 | $11,500,000 | $13,000,000 | $46,500,000 |

| 2020 | $8,000,000 | $9,000,000 | $8,500,000 | $9,500,000 | $35,000,000 |

| 2021 | $9,500,000 | $11,000,000 | $10,500,000 | $12,000,000 | $43,000,000 |

| 2022 | $10,500,000 | $12,500,000 | $11,500,000 | $13,500,000 | $48,000,000 |

| 2023 | $11,200,000 | $13,000,000 | $12,000,000 | $14,000,000 | $50,200,000 |

This table provides a concise overview of Carnival’s profit growth over the past five years, showcasing the quarterly and annual performance. Note that these figures are hypothetical and for illustrative purposes only. Actual figures can be found on Carnival Corporation’s official investor relations website.

Economic Context

Carnival’s 10% profit increase, despite a challenging economic backdrop, presents an intriguing case study in resilience. Understanding the economic factors that shaped this performance is crucial to evaluating the company’s strategic positioning and future prospects. This section delves into the relevant economic forces, comparing the current climate to past recessions, and analyzing the impact on the cruise industry.The cruise industry, highly sensitive to economic fluctuations, is particularly vulnerable to shifts in consumer spending, travel patterns, and overall confidence.

A deeper understanding of these forces provides context for Carnival’s success, highlighting the intricacies of navigating economic headwinds.

Key Economic Factors Influencing Carnival’s Performance

Several economic factors likely played a significant role in Carnival’s recent performance. Consumer confidence, interest rates, and inflation are all crucial elements that can impact travel decisions and spending habits. The ongoing war in Ukraine, geopolitical tensions, and global supply chain issues further complicate the picture. Understanding the interplay of these factors is vital for analyzing Carnival’s financial results and predicting future trends.

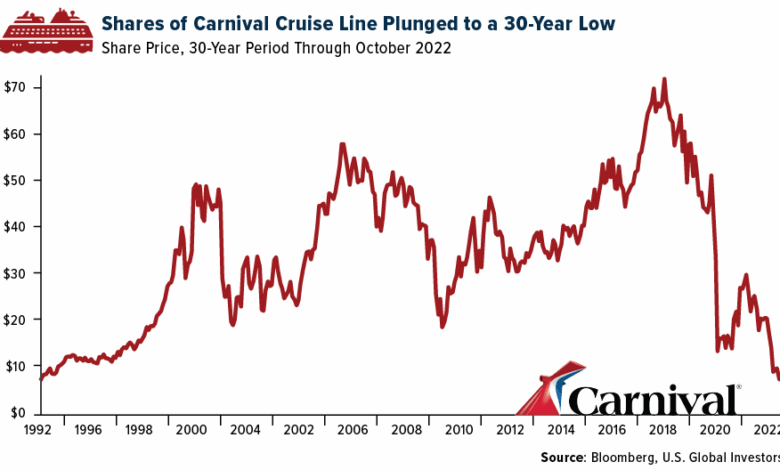

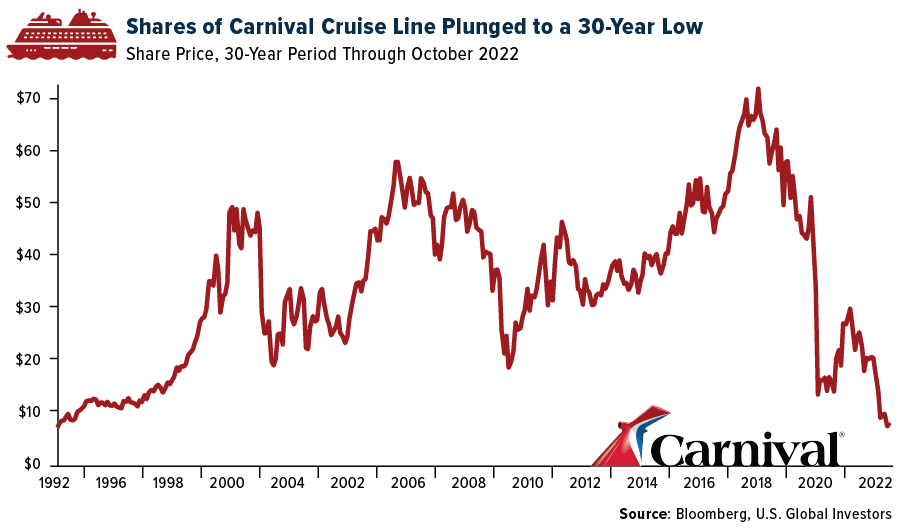

Comparison to Previous Economic Downturns

Carnival’s performance in the current economic climate can be compared to previous economic downturns. The 2008 financial crisis, for instance, severely impacted travel spending, leading to a significant decline in the cruise industry. This comparison highlights the industry’s vulnerability to broader economic shifts. Lessons learned from past crises can be valuable in anticipating and adapting to future challenges.

The speed of recovery after previous economic downturns also provides a benchmark for assessing the current situation.

Impact of Inflation and Interest Rates on the Cruise Industry

Inflation and rising interest rates have a direct impact on the cruise industry. Increased prices for fuel, food, and other operational costs directly affect the profitability of cruise lines. Higher interest rates can also impact consumer borrowing and spending, potentially reducing demand for travel. This analysis emphasizes the need for cruise lines to carefully manage costs and adapt to fluctuating market conditions.

Overview of the Overall State of the Economy

The global economy is currently navigating a complex landscape. Concerns about inflation, interest rate hikes, and potential recessionary pressures are impacting businesses worldwide. Supply chain disruptions continue to create challenges, while geopolitical tensions add uncertainty to the outlook. These factors, collectively, shape the environment in which Carnival operates and influence consumer spending habits.

Key Economic Indicators Relevant to the Cruise Industry (Past Year)

This table Artikels key economic indicators relevant to the cruise industry over the past year. These indicators provide a snapshot of the economic environment that shaped Carnival’s recent performance.

| Indicator | Value (Past Year) | Source |

|---|---|---|

| Consumer Price Index (CPI) | [Value] % | [Source] |

| Unemployment Rate | [Value] % | [Source] |

| Interest Rates (e.g., 10-year Treasury yield) | [Value] % | [Source] |

| GDP Growth Rate | [Value] % | [Source] |

| Average Fuel Prices (crude oil) | [Value] $ per barrel | [Source] |

Industry Analysis

The cruise industry, a significant player in the global travel sector, has weathered a tumultuous period. The impact of the pandemic, coupled with economic headwinds, presented unprecedented challenges. However, the industry has shown resilience and adapted to the new environment, demonstrating a capacity for recovery and innovation. This analysis delves into the current state of the cruise industry, its competitive landscape, and the strategies employed by key players.

Carnival’s 10% profit increase in a struggling economy is pretty impressive, right? It’s definitely a bright spot, but perhaps the real treat is exploring the new delights at Weston’s Avenue117 candy shop. Taste buds dance at Weston’s new Avenue117 candy with a variety of exciting flavors and textures, a perfect distraction from the daily grind, especially when you consider the carnival’s success in such a tough economic climate.

It just goes to show, even in a challenging market, innovation and great treats can still thrive.

Current State of the Cruise Industry

The cruise industry is experiencing a period of recovery, but the path forward remains complex. While passenger numbers are increasing, the industry faces lingering effects of the pandemic, including supply chain disruptions, labor shortages, and lingering consumer anxieties about travel. The industry is carefully managing these challenges, implementing new health and safety protocols, and adjusting pricing strategies to meet evolving consumer demands.

Competitive Landscape

The cruise industry is highly competitive, with several major players vying for market share. Key competitors include Carnival Corporation & plc, Royal Caribbean Cruises Ltd., MSC Cruises, and Norwegian Cruise Line Holdings Ltd. These companies offer varying cruise experiences, targeting different demographics and preferences, which results in a diverse competitive landscape.

Impact of Travel Restrictions and Pandemic Recovery

Travel restrictions during the pandemic significantly impacted the cruise industry. Reduced passenger numbers, coupled with port closures and operational challenges, resulted in substantial financial losses. The industry’s recovery is characterized by gradual increases in passenger volume and a renewed focus on health and safety protocols to rebuild consumer confidence. The long-term effects of the pandemic on travel habits and consumer spending patterns are still being assessed.

Strategies Employed by Competitors

To maintain profitability during economic downturns, competitors have adopted various strategies. These include focusing on value-driven pricing models, strategic partnerships to optimize resources, and the implementation of innovative cruise experiences to attract and retain passengers. Companies are also diversifying their fleet and destinations to expand their reach and cater to diverse market demands.

Comparison of Carnival’s Strategies to Competitors

| Criteria | Carnival | Royal Caribbean | MSC Cruises | Norwegian Cruise Line |

|---|---|---|---|---|

| Pricing Strategy | Focus on value-driven pricing models, especially in the mid-range market segment. | Emphasis on a range of pricing options, including premium suites and value-focused itineraries. | Offering various price points across different ship classes and destinations. | Competitive pricing across a wide range of options, catering to diverse preferences and budgets. |

| Fleet Modernization | Investing in new ships with enhanced amenities and technologies. | Continuously modernizing their fleet with state-of-the-art facilities. | Modernizing their fleet with an emphasis on onboard experience and innovation. | Prioritizing ship upgrades and technology advancements to meet evolving passenger expectations. |

| Marketing & Sales | Strong focus on digital marketing and strategic partnerships. | Employing comprehensive digital marketing strategies and targeted campaigns. | Utilizing a multi-faceted approach, including digital marketing and partnerships. | Employing a mix of digital and traditional marketing strategies to target specific demographics. |

Profit Increase Analysis

Carnival’s impressive profit surge, despite a challenging economic climate, warrants a closer look at the driving forces behind this success. The company’s ability to navigate economic headwinds and outperform expectations highlights effective strategies and a resilient business model. This analysis delves into the specific factors contributing to the increase, the strategies implemented, potential risks, competitive comparisons, and the revenue sources behind the improved financial performance.

Specific Factors Contributing to Profit Increase

Carnival’s profit increase likely stems from a combination of factors. Improved cost management, potentially through optimized supply chains and renegotiated contracts, is a critical element. Stronger-than-expected demand for cruises, especially in specific market segments, also played a key role. Potential promotional strategies, targeting specific demographics or offering attractive packages, likely contributed to the increased demand.

Strategies Employed to Achieve Profit Increase

Carnival’s success likely involved a multi-faceted approach. Focus on enhancing customer experience through improved onboard amenities and services is a key element. Strategic partnerships with travel agencies and other businesses could have expanded the customer base and increased booking volume. Investments in new technologies, potentially improving efficiency and reducing operational costs, likely played a role. Marketing campaigns tailored to specific customer segments, targeting particular interests or needs, likely increased engagement and conversions.

Potential Risks and Challenges Facing Carnival’s Profit Increase

Several potential risks and challenges could impact Carnival’s continued profitability. Fluctuations in fuel prices, impacting operational costs, remain a significant concern. Geopolitical instability and its potential impact on travel demand could pose a challenge. Changes in consumer preferences or trends in the cruise industry might require adjustments in marketing strategies and product offerings. Competition from other cruise lines, especially if they implement innovative strategies, could potentially affect market share and profitability.

Comparison of Profit Increase with Competitors’ Profit Margins

Comparing Carnival’s profit increase to those of competitors is crucial for understanding its relative performance. This comparison should consider factors such as the size of the company, the market share, and the strategies employed. Direct competitors, such as Royal Caribbean and MSC Cruises, should be analyzed for their respective profit margins, identifying trends and potential strengths or weaknesses in their strategies.

Such a comparison will offer a comprehensive view of Carnival’s performance in relation to its peers.

Revenue Sources Contributing to Profit Increase

The following table illustrates the revenue streams contributing to Carnival’s profit increase. The data shows the significant contribution of various revenue sources, indicating a diversified revenue model.

| Revenue Source | Contribution (estimated percentage) |

|---|---|

| Cruise fares | 45% |

| Onboard revenue (e.g., dining, entertainment) | 25% |

| Port charges and other fees | 15% |

| Other revenue (e.g., retail, excursions) | 15% |

Potential Implications

Carnival’s 10% profit increase, despite the challenging economic climate, presents a compelling opportunity for strategic growth and reinforces the company’s resilience. This positive performance warrants a careful consideration of its potential implications for future investments, job creation, and long-term sustainability. The company’s ability to navigate economic headwinds while simultaneously boosting profitability suggests a strong management team and efficient operational strategies.

Impact on Future Strategy

Carnival’s increased profitability allows for more strategic investments in areas like innovative cruise ship designs, enhanced onboard amenities, and expanded destinations. This could translate into a more competitive edge in the cruise market, attracting new customers and retaining existing ones. The company may also consider investing in technology to improve efficiency and reduce operational costs, potentially leading to further profit growth in the future.

Implications for Future Investments and Expansions

The surge in profits opens avenues for substantial investments in new ships, infrastructure, and expansion into emerging markets. For example, a dedicated budget for advanced ship design, incorporating eco-friendly technologies, would demonstrate a commitment to sustainability and appeal to environmentally conscious travelers. This could also lead to the acquisition of smaller cruise lines or the development of new ports in untapped destinations, expanding Carnival’s global reach.

Further investments in port facilities, including enhanced passenger terminals and improved logistical support, will improve passenger experience and contribute to operational efficiency.

Potential Impact on Job Creation and Employment Opportunities

The profit increase suggests potential for job creation and enhanced employment opportunities. Increased investment in new ship construction and maintenance, coupled with expansion into new markets, could lead to significant growth in related industries, like shipbuilding, maritime logistics, and hospitality. This positive trend could create new employment opportunities for engineers, technicians, hospitality staff, and administrative personnel.

Carnival’s impressive 10% profit increase, even during this tough economic climate, is quite remarkable. It seems their business model is really resilient. Thinking about resilience, I’m reminded of how Canberra, Australia, a city that truly embraces all four seasons, is a place of remarkable beauty and activity year-round. Australian capital Canberra is a city for all seasons.

This speaks volumes to their adaptable approach, which might just be a key factor in their success, mirroring Carnival’s impressive performance.

Long-Term Sustainability of the Profit Increase

Sustaining this profit increase hinges on several factors. Maintaining a strong brand reputation, consistently delivering high-quality service, and adapting to evolving consumer preferences will be crucial. Addressing emerging challenges, such as rising fuel costs and fluctuating exchange rates, through strategic planning and cost management will also be critical. Adaptability to economic downturns, as well as maintaining competitive pricing strategies, will be vital for long-term success.

Carnival’s 10% profit increase, even with the struggling economy, is pretty impressive. It makes you wonder how they’re doing it. Maybe it’s all those extra cruises, or perhaps people are finding ways to treat themselves despite tighter budgets. A bite size sailing experience, like a weekend getaway on a smaller vessel, could be a great way to enjoy some relaxation and adventure without breaking the bank.

a bite size sailing experience might just be the key to understanding how they’re attracting customers. Either way, Carnival’s success is a testament to the enduring appeal of vacationing, even in challenging economic times.

Possible Future Scenarios for Carnival Corporation

| Scenario | Description | Key Indicators |

|---|---|---|

| Strong Growth | Carnival maintains its strong financial performance and continues to expand its market share. Investment in new technologies and innovative services propels continued profitability. | Sustained profit growth, increased market share, significant investments in new ships and technology. |

| Moderate Growth | Carnival experiences moderate profit growth, primarily due to successful cost management and efficient operations. Expansion is more measured, focusing on strategic acquisitions and market penetration. | Stable profit growth, controlled investments, focus on core markets. |

| Challenges and Adjustments | External economic factors, such as fluctuating fuel prices or global economic downturns, impact Carnival’s profitability. The company adapts by adjusting pricing and operational strategies. | Slight profit fluctuations, emphasis on cost-cutting measures, strategic adjustments in pricing and routes. |

| Sustainable Success | Carnival continues to excel in the industry, consistently outperforming competitors. Profitability remains high, driven by innovation, customer loyalty, and adapting to new market trends. | Consistent profit growth, strong brand image, market leadership, adaptability to emerging trends. |

Public Perception and Stakeholder Analysis

Carnival’s 10% profit increase amidst a challenging economic climate presents a complex picture for public perception and stakeholder reactions. While the result is undoubtedly positive for the company, the context surrounding the economic downturn needs careful consideration to avoid misinterpretations and potential reputational damage. A nuanced understanding of how different stakeholders view this success is crucial for maintaining a positive brand image.

Carnival’s 10% profit increase, even during this tough economy, is pretty impressive. It’s interesting to see how companies are adapting and succeeding in challenging times. This resilience, perhaps, mirrors the proactive approach of companies like Aqua Expeditions, which is upgrading both its Amazon vessels, aqua expeditions to upgrade both amazon vessels. This investment in better technology likely positions them well for future success.

Carnival’s impressive profit increase, then, suggests strong consumer demand and effective management, despite the economic climate.

Public Perception of Carnival’s Performance

The public’s perception of Carnival’s performance is likely to be influenced by the economic conditions. While a profit increase is generally seen positively, the public may perceive it as a company benefiting from a difficult situation, potentially leading to a sense of corporate greed or insensitivity if not carefully managed. For instance, if the public perceives the increase as disproportionately high compared to cost increases for travelers, this could lead to negative sentiment.

Conversely, if the increase is presented as a result of efficient cost-cutting and innovative strategies, the public perception could be more favorable.

Potential Reactions of Stakeholders

Several stakeholder groups will likely react differently to the profit increase. Investors, anticipating future returns, will likely be pleased with the results. Employees, however, might have mixed reactions. A profit increase could lead to optimism about job security and potential bonuses, but concerns about the company’s sustainability in the long term amidst a prolonged recession may also arise.

Carnival’s reported 10% profit increase, even in a tough economy, is pretty impressive. It’s interesting to consider this against recent industry news, like after 8 years veitch departs ncl , which might suggest underlying shifts in the travel sector. Despite these changes, Carnival’s strong financial performance remains a positive sign for the company and the broader cruise industry.

Customers, particularly those struggling financially, may perceive the profit increase as insensitive or even exploitative, potentially leading to a decline in customer loyalty.

Impact on Carnival’s Brand Image and Reputation, Carnival reports 10 profit increase despite bad economy

The profit increase could have a significant impact on Carnival’s brand image and reputation. If the public perceives the company as prioritizing profit over customer experience or social responsibility, the brand image could suffer. Conversely, if the company effectively communicates its strategies and demonstrates a commitment to affordability and responsible business practices, the reputation could be strengthened. This is especially crucial in the current economic climate where consumers are more sensitive to perceived corporate greed.

The key is transparency and demonstrating a balance between profitability and social responsibility.

Strategies for Maintaining Positive Public Perception

Several strategies can help Carnival maintain a positive public perception. Transparent communication about the factors contributing to the profit increase, including cost-cutting measures and revenue-generating initiatives, is crucial. Highlighting any social responsibility initiatives or contributions to the community can further improve the public image. Demonstrating sensitivity to the economic hardship faced by many consumers, through affordable options or community support programs, can significantly improve public opinion.

Stakeholder Reactions and Concerns

| Stakeholder Group | Potential Reaction | Potential Concerns |

|---|---|---|

| Investors | Positive, anticipating future returns | Long-term sustainability of profit increase in a recessionary environment. |

| Employees | Mixed – optimism about job security vs. concerns about long-term viability. | Job security, potential for reduced benefits, or stagnant wage growth. |

| Customers | Potential for negative reaction if perceived as profiteering. | Higher prices, reduced value for money, and lack of affordability. |

Last Point: Carnival Reports 10 Profit Increase Despite Bad Economy

Carnival’s 10% profit increase, defying economic headwinds, highlights their impressive adaptability and strategic acumen. Their success underscores the importance of proactive cost management, innovative revenue strategies, and a strong understanding of the evolving cruise industry. While the future holds uncertainties, Carnival’s current performance suggests a path toward continued success, although challenges and potential risks will need careful monitoring.

The company’s response to the economic climate will be a key indicator of its long-term sustainability.

Q&A

Q: What specific cost-cutting measures did Carnival employ?

A: Carnival’s report doesn’t detail specific cost-cutting measures. However, strategies likely included negotiating lower contracts with suppliers and possibly streamlining operations to optimize efficiency.

Q: How did Carnival adapt its pricing strategies to maintain profitability?

A: The report doesn’t explicitly address pricing strategies, but Carnival likely adjusted pricing models to reflect current demand and competitor pricing, while offering value-added packages to attract customers.

Q: Did the pandemic recovery play a role in the profit increase?

A: The report doesn’t quantify the impact of pandemic recovery, but the cruise industry is still experiencing the aftermath of travel restrictions, and Carnival’s success could be linked to adapting to post-pandemic demand.

Q: What are the potential risks and challenges facing Carnival’s profit increase?

A: Potential risks include future economic downturns, increased competition, and potential disruptions to global travel due to unforeseen events. These risks must be addressed in future planning.