Carnival Pioneers Payroll Deductions & Payment

Carnival pioneers payroll deductions for payment is a crucial aspect of ensuring fair and accurate compensation for these hardworking individuals. Understanding the various deduction types, calculation methods, and payment processes is essential for both employees and employers. This comprehensive guide delves into the complexities of carnival payroll, covering everything from tax withholdings to payment methods, and offering practical insights for both temporary and permanent carnival workers.

From hourly wages to piecework, this guide covers all facets of calculating carnival worker earnings, ensuring accurate net pay calculations. It also examines the diverse payment methods, highlighting the pros and cons of each, and Artikels the crucial steps in the payment process.

Payroll Deduction Types for Carnival Pioneers: Carnival Pioneers Payroll Deductions For Payment

Carnival workers, often facing unique employment conditions, have a complex web of payroll deductions. Understanding these deductions is crucial for ensuring fair compensation and managing personal finances. This discussion will detail the common payroll deductions applicable to carnival workers, highlighting variations based on location, contract, and employment type.Carnival life is often characterized by temporary employment and a fluctuating schedule.

The need for transparency in payroll deductions is paramount to building trust and fostering a positive work environment. This detailed look at common deductions will equip carnival workers with the knowledge they need to navigate these aspects of their employment.

Common Payroll Deduction Types

Payroll deductions are a significant aspect of compensation for carnival pioneers. They can vary depending on factors like the specific carnival, the worker’s contract, and the location of employment. Understanding these variations is key to effectively managing personal finances.

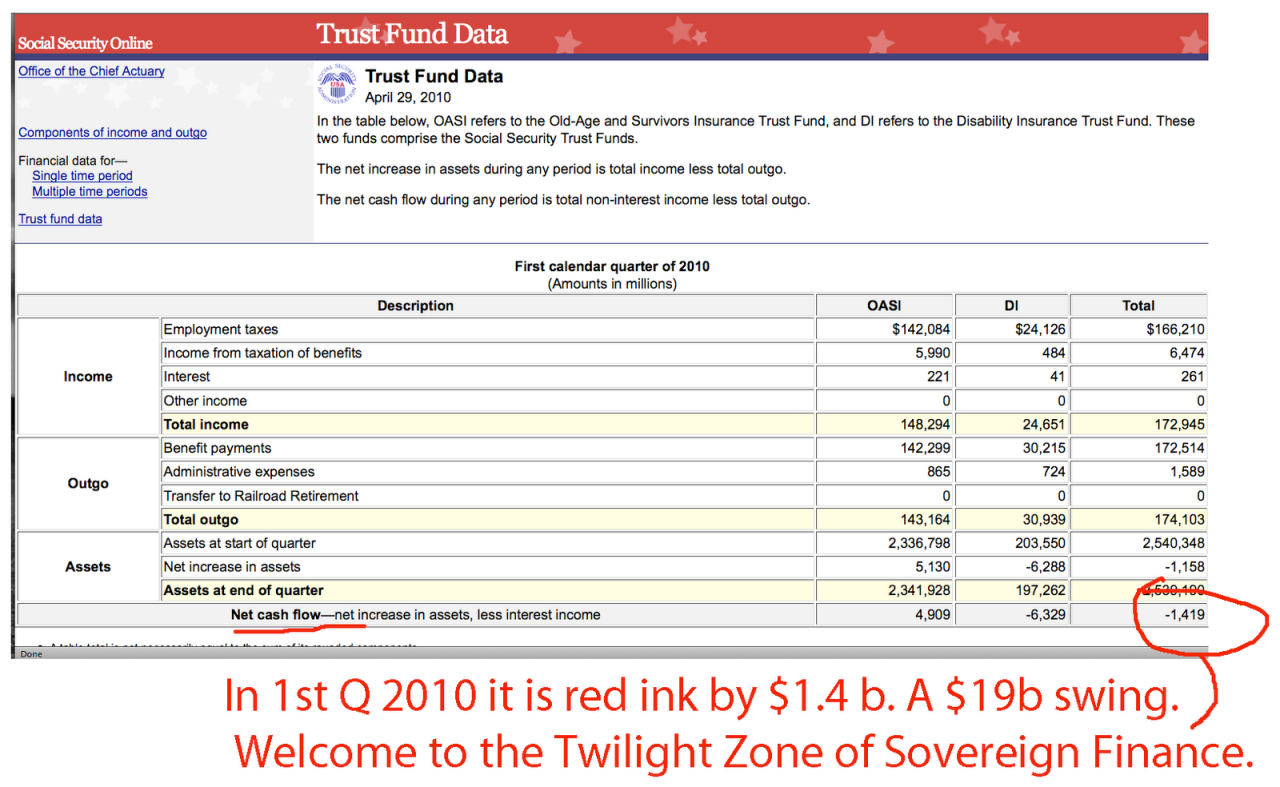

- Taxes: Federal, state, and local taxes are typically deducted from wages. The specific tax rates and withholding amounts depend on the worker’s income, filing status, and the location of employment. Tax laws are complex, and workers should always refer to official tax guides or seek professional advice to ensure compliance and maximize refunds.

- Health Insurance: Many carnival employment contracts include health insurance contributions, which can be either fully or partially covered by the employer or the employee. The cost and coverage levels vary based on the specific plan and the location of the carnival.

- Union Dues: If the carnival workers are part of a union, deductions for union dues are common. The amount of these deductions is usually specified in the union contract. The union dues fund the collective bargaining process and worker protections.

- Retirement Contributions: Retirement savings plans, such as 401(k)s or similar plans, might be offered by the carnival employer or are a part of the union agreement. These plans help workers save for retirement and offer tax benefits.

- Other Deductions: Depending on the specific circumstances, other deductions might be necessary. These may include garnishments for debt repayment, credit union contributions, or life insurance premiums.

Variations in Deductions

The specifics of payroll deductions can differ significantly depending on several factors. This is vital to understand to ensure accuracy in calculations and informed decision-making.

- Location: Tax rates and regulations vary by state and locality. This directly impacts the amount withheld for taxes. Carnival workers in different states will experience different tax rates and withholding amounts.

- Contract: The terms of the employment contract dictate many aspects of payroll deductions. Some contracts specify the deductions that will be made. Contracts should be reviewed thoroughly to understand the deductions applied.

- Employment Type: Whether the worker is employed directly by the carnival, through a staffing agency, or by a subcontractor can impact the deductions. Different employment types have different structures for deductions, and workers should always clarify the specifics with their employer or agency.

Example Deduction Table

The table below provides a visual representation of common payroll deductions, including a typical percentage or amount and a brief description. This is for illustrative purposes only, and actual amounts may vary.

| Deduction Type | Percentage/Amount | Description |

|---|---|---|

| Federal Income Tax | 10-20% | Tax deducted based on annual income and filing status |

| State Income Tax | 5-10% | Tax deducted based on state regulations and income |

| Social Security Tax | 6.2% | Contribution to Social Security benefits |

| Medicare Tax | 1.45% | Contribution to Medicare benefits |

| Health Insurance | 5-15% | Premium for health insurance plan |

| Union Dues | $25-50 | Membership fee for the labor union |

Calculating Payroll for Carnival Employees

Carnival payroll presents unique challenges due to the fluctuating nature of work schedules, variable earnings structures, and diverse employee roles. Understanding the various methods for calculating earnings, deductions, and ultimately, net pay, is crucial for accurate and timely compensation. This process ensures fairness and compliance with labor laws.Accurate payroll calculations are essential for maintaining positive employee relations and avoiding potential legal issues.

The process involves careful consideration of different compensation models, ensuring all hours worked, overtime, and bonuses are accurately reflected. Thorough record-keeping is critical for auditing and compliance.

Methods for Calculating Earnings

Carnival employee earnings are often determined by a combination of factors. Hourly rates are common for tasks requiring consistent time commitment. Overtime pay is calculated when employees exceed a certain number of hours per week, often based on a multiplier of the regular hourly rate. Piecework compensation is common for tasks where output can be measured, like selling tickets or performing tasks related to rides.

Bonuses may be awarded for exceeding sales targets, meeting performance standards, or other specific achievements.

Calculating Total Earnings

Total earnings are the sum of all sources of compensation. This includes the employee’s regular hourly wages, any overtime pay, piecework earnings, and bonuses.

Calculating Deductions

Payroll deductions are mandatory or voluntary withholdings from an employee’s gross earnings. Mandatory deductions typically include taxes (federal, state, and local) and social security contributions. Voluntary deductions can include health insurance premiums, retirement plan contributions, and union dues. Accurate calculation of deductions is vital to ensure the correct net pay amount.

Step-by-Step Procedure for Calculating Net Pay

- Determine the employee’s gross earnings. This is the total amount earned before any deductions.

- Calculate the total deductions. Add together all mandatory and voluntary deductions.

- Subtract the total deductions from the gross earnings to arrive at the net pay amount. This is the amount the employee receives.

Example of Carnival Employee Payroll

| Employee Name | Hourly Rate | Hours Worked | Overtime Hours | Piecework Earnings | Bonus | Total Earnings | Federal Tax | Social Security | Health Insurance | Net Pay |

|---|---|---|---|---|---|---|---|---|---|---|

| Alice Smith | $15 | 40 | 10 | $50 | $25 | $775 | $125 | $85 | $50 | $515 |

| Bob Johnson | $12 | 45 | 5 | $0 | $0 | $600 | $100 | $70 | $0 | $430 |

| Charlie Brown | $18 | 30 | 0 | $100 | $50 | $680 | $110 | $75 | $60 | $435 |

Note: The above table provides a simplified example. Actual calculations may vary based on specific state and local regulations, and individual circumstances.

Payment Methods and Processes for Carnival Pioneers

Carnival workers, often facing unpredictable schedules and remote locations, require flexible and reliable payment methods. Understanding these methods, along with the procedures for issuing payments, ensures timely compensation and maintains a positive working environment. This section details common payment options, advantages and disadvantages, and the payment process itself.

Common Payment Methods

Carnival workers often utilize a variety of payment methods, each with its own set of advantages and disadvantages. The optimal choice depends on the worker’s preferences and the logistical realities of the carnival.

Carnival pioneers, always innovative with payroll deductions for payment, seem to be adjusting their methods. Interestingly, the recent news about Aker Yards changing its name, as detailed in this article about aker yards name goes away , might hint at some broader shifts in the industry. Perhaps these changes will lead to new payment structures for the Carnival pioneers, or maybe they’re just trying to keep up with evolving trends.

Either way, it’s all part of the ongoing story of how carnival pioneers handle payroll deductions for payment.

- Direct Deposit: This method involves transferring funds electronically directly into the employee’s bank account. It is generally the most efficient and secure method for both the employer and the employee. Direct deposit eliminates the risk of lost or stolen checks and ensures immediate access to funds. For example, a worker can access their wages as soon as they are deposited into their account.

- Checks: Traditional paper checks are still used in some cases, particularly in smaller or less technologically advanced settings. Checks provide a tangible record of payment. However, they can be prone to delays in processing and can be lost or stolen. Furthermore, they require a trip to the bank for cashing.

- Cash: Cash payments are sometimes used, especially in smaller or isolated carnival locations. It’s immediate, requiring no bank transactions. However, this method presents significant security concerns for both the employer and the employee. Cash is easily lost or stolen, and it lacks the formal record-keeping associated with checks or direct deposit. This method is less prevalent due to its inherent risks.

Payment Process Overview

The payment process is a critical aspect of employee relations. A well-defined procedure ensures fairness and accuracy in compensation.

Carnival Pioneers’ payroll deductions for payment are a bit of a puzzle, aren’t they? It’s all about figuring out how those funds are managed, and whether the system is efficient. While we’re on the topic of travel disruptions, it’s worth noting that Air China has halted its Beijing-Honolulu flights, which is certainly impacting travelers’ plans. Air China halts Beijing Honolulu flights This news makes you wonder if similar financial considerations are playing a role in the Carnival Pioneers’ payroll deduction procedures.

Ultimately, transparency in how those payments are handled would be helpful for everyone.

- Payroll Calculation: The first step involves calculating each employee’s earnings based on hours worked, rates, and applicable deductions. Accurate calculations are paramount to avoid errors and ensure fair compensation.

- Deduction Processing: Payroll deductions, such as taxes and insurance, are processed and subtracted from the gross earnings to arrive at the net pay. This step is crucial to ensure compliance with tax regulations and maintain financial accuracy.

- Payment Preparation: The prepared payment amounts are then prepared for disbursement according to the chosen payment method. This step includes generating checks, preparing electronic transfer instructions, or packaging cash.

- Disbursement: Payments are released to employees. This stage involves either delivering checks, making direct deposits, or handing over cash. Proper documentation is essential at each step.

Payment Deadlines and Documentation

Strict adherence to payment deadlines is crucial to maintain employee morale and avoid legal issues. Appropriate documentation is vital for tracking payments and ensuring accountability.

- Deadlines: Carnivals typically establish specific deadlines for payroll processing and disbursement. For instance, bi-weekly paychecks are issued on a consistent schedule, ensuring employees receive their wages in a timely manner.

- Documentation: Thorough records are kept for every payment, including the date, amount, employee name, payment method, and any relevant deductions. This detailed documentation allows for easy tracking and reconciliation.

Flowchart of the Payment Process

The following flowchart illustrates the payment process, from initial payroll calculation to final disbursement:

[A detailed flowchart would be presented here, visually depicting the steps from payroll calculation to disbursement. The flowchart would show decision points, data flows, and the various actors involved (payroll clerk, employee, bank).]

Legal and Regulatory Considerations

Navigating the world of payroll, especially for temporary or seasonal workers like carnival employees, requires a deep understanding of applicable labor laws and regulations. Failure to comply with these rules can lead to significant legal and financial repercussions. This section delves into the critical legal aspects of payroll deductions and payments for carnival pioneers, ensuring compliance and protecting all parties involved.Payroll practices for carnival workers are subject to specific labor laws and regulations, varying by jurisdiction.

Understanding these differences is paramount for accurate and compliant processing. These laws often address minimum wage requirements, overtime pay, deductions allowed, and the importance of proper documentation. This section will highlight these aspects to ensure a secure and compliant payroll process.

Applicable Labor Laws and Regulations

Carnival workers, like all employees, are protected by labor laws regarding payroll. These laws often dictate minimum wage, overtime pay, and permissible deductions. State and federal regulations might vary, so a comprehensive understanding is crucial. For instance, the Fair Labor Standards Act (FLSA) in the United States Artikels minimum wage, overtime pay, and record-keeping requirements for employers.

Similar legislation exists in other countries, potentially with differing specific stipulations. Understanding and adhering to these regulations is essential for avoiding legal issues.

Potential Legal Issues and Pitfalls

Improper payroll deductions or payment practices can lead to significant legal challenges. Misclassifying workers as independent contractors instead of employees is a common pitfall, as it can avoid obligations related to minimum wage, overtime, and benefits. Incorrect calculation of deductions or failure to provide proper documentation, such as W-4 forms or I-9 forms (in the US context), can also lead to legal trouble.

Inaccurate records of hours worked and pay can lead to disputes and investigations by labor authorities. Careful attention to detail and a thorough understanding of relevant laws are crucial to avoid these issues.

Compliance with Regulations and Best Practices

Accurate and compliant payroll processing is achieved by adhering to several best practices. These include:

- Regularly reviewing and updating knowledge of relevant labor laws and regulations, keeping abreast of changes in legal requirements.

- Ensuring all employees are properly classified as employees, adhering to the definitions established in relevant labor laws.

- Implementing a robust system for tracking hours worked, accurately calculating wages, and ensuring appropriate overtime pay is calculated and provided.

- Obtaining necessary employee authorizations for all deductions, maintaining meticulous records of all deductions and providing employees with detailed pay stubs.

- Maintaining accurate records of all payroll-related documentation, including time sheets, tax forms, and payment records, storing them securely for the required retention period. This can help prevent legal issues and ensure traceability.

Importance of Accurate Records and Documentation

Accurate records are crucial for payroll compliance. They provide evidence of compliance with labor laws, enabling the company to demonstrate proper calculation of wages, deductions, and payments. Detailed documentation of hours worked, deductions authorized, and payment methods allows for a clear audit trail. This is essential for resolving disputes and defending against potential legal actions.

“Maintaining meticulous records of all payroll transactions is paramount for compliance and dispute resolution.”

Accurate records and proper documentation are not just good practices; they are crucial for legal protection and efficiency. Detailed time sheets, accurate calculation of overtime pay, and clear records of deductions are vital to avoid future complications.

Figuring out carnival pioneers’ payroll deductions for payment can be tricky, but a relaxing getaway to the Czech Republic’s spa towns could be just the ticket! Exploring the charming thermal springs and historic architecture of places like Karlovy Vary and Mariánské Lázně might just be the perfect way to unwind and regain focus. This could also help to ensure that the payroll deductions for payment are accurate for the carnival pioneers, ensuring a smooth operation.

Hopefully, the detailed insights from a healthy dose of Czech Republic spa towns will provide further inspiration for those dealing with these financial matters.

Carnival Pioneer Payroll Record Keeping

Maintaining accurate and compliant payroll records is crucial for carnival pioneers. These records serve as a vital historical document, providing proof of payment and supporting financial reporting. Proper record-keeping ensures transparency, simplifies audits, and ultimately contributes to the smooth operation of the carnival.Accurate payroll records are essential for meeting legal and regulatory requirements. They provide evidence of wages paid, deductions made, and taxes withheld.

This documentation is vital for tax reporting and can protect the carnival from potential legal issues. A well-structured system for payroll record keeping fosters efficiency and accuracy, reducing errors and saving time.

Carnival pioneers, facing challenges with payroll deductions for payment, are likely feeling the pinch. This isn’t surprising, given the recent shift in travel trends. For instance, travel agents are now proactively redirecting babymooners to destinations less affected by Zika, like agents redirect babymooners as zika spreads , which is a huge change in the industry. This demonstrates how quickly travel patterns adapt to global health concerns, and ultimately impacts the financial strategies of carnival pioneers dealing with payroll.

The need for adaptable payment solutions is crucial for their continued success.

Required Records and Documentation

Payroll processing necessitates a comprehensive set of records. These include time and attendance records, employee information forms, deduction forms, and tax documents. These documents form the basis for calculating earnings, deductions, and net pay. Maintaining these records in a secure and organized manner is critical for compliance.

Format and Structure of Records

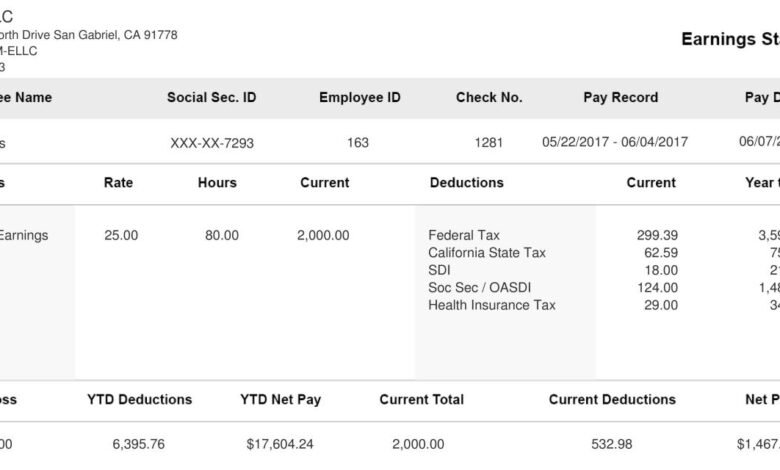

To ensure accuracy and compliance, payroll records should follow a standardized format. A clear structure makes it easier to retrieve information, identify errors, and complete audits. The table below provides an example of a structured format:

| Employee Information | Earnings | Deductions | Net Pay |

|---|---|---|---|

| Employee Name, Employee ID, Social Security Number | Hours Worked, Hourly Rate, Total Earnings | Federal Tax, State Tax, Health Insurance, Retirement Contributions | Total Net Pay |

| Example: John Smith, 1234, 987-65-4321 | Example: 40 hours, $15/hour, $600 | Example: $100, $50, $50, $25 | Example: $400 |

This structured format ensures consistency and facilitates easy calculation and verification of payroll information.

Examples of Payroll Documents

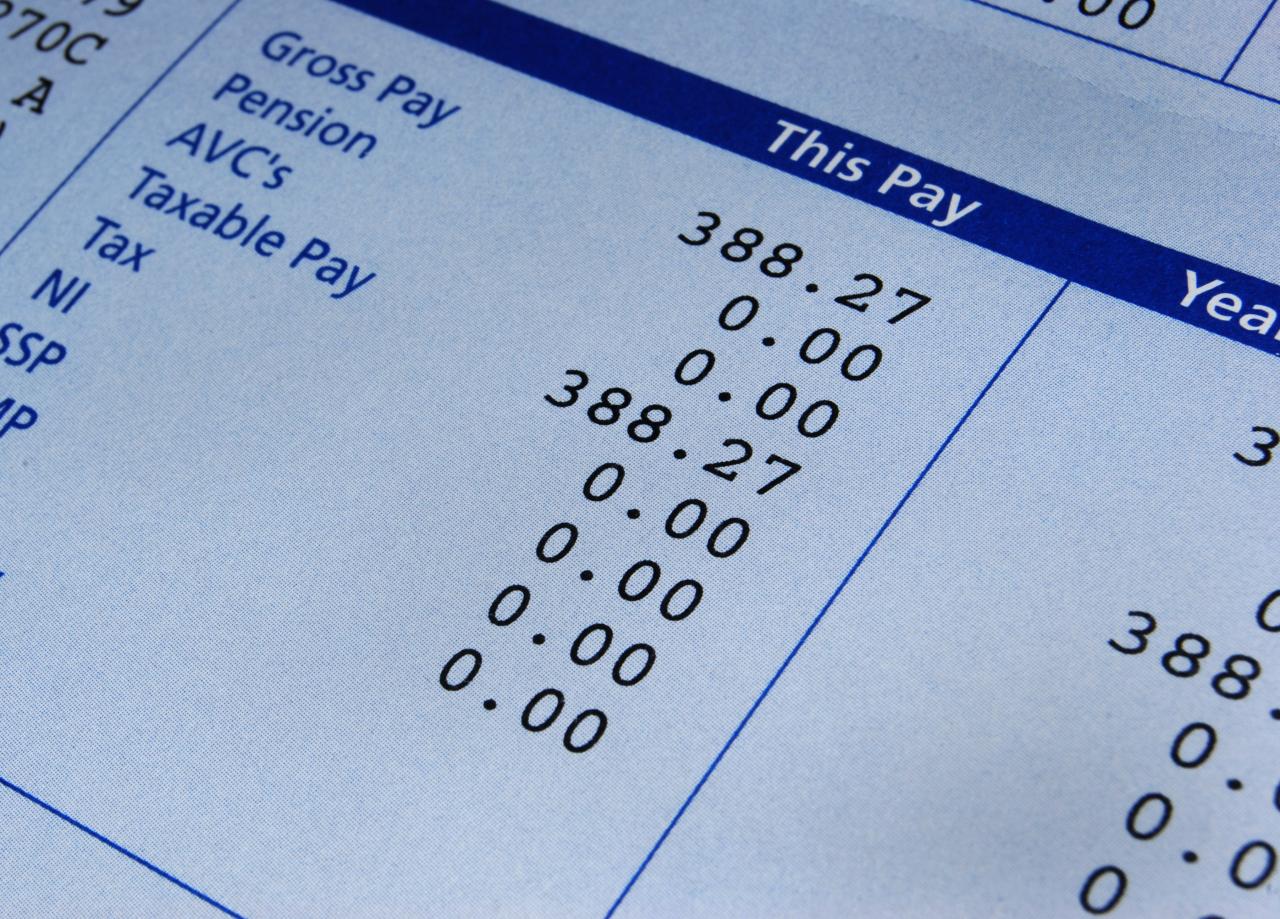

Various documents are integral to the payroll process. Time sheets track employee work hours, providing the basis for calculating earnings. Pay stubs detail earnings, deductions, and net pay for each pay period. W-4 forms, containing employee tax information, are crucial for accurately calculating tax withholdings.

- Time Sheets: These documents meticulously record the hours worked by each employee during a specific pay period. They often include details such as start and end times, tasks performed, and any overtime hours. The time sheet format is crucial for calculating gross earnings. Accurate timekeeping is critical for ensuring that employees are compensated appropriately for their work and for maintaining compliance with labor laws.

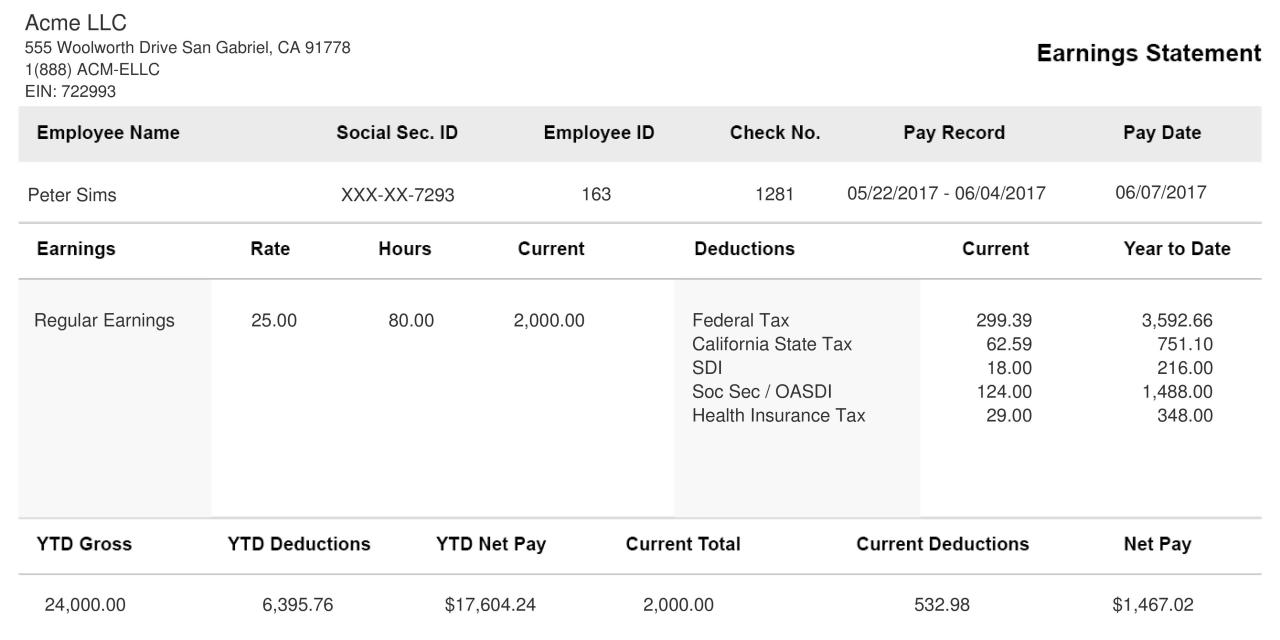

- Pay Stubs: These documents are issued to each employee, outlining their earnings, deductions, and net pay for a specific pay period. They provide employees with a clear record of their compensation. Pay stubs must include detailed information about deductions, helping employees understand where their money is going. This transparency fosters trust and promotes understanding of the payroll process.

- W-4 Forms: These forms contain essential tax information provided by each employee. They guide the calculation of federal and state income tax withholdings. Completing and retaining W-4 forms is vital for accurate tax calculations and to avoid penalties during tax season.

Payroll Record Retention

Payroll records should be retained for a specified period, typically dictated by local and federal regulations. This period varies based on specific legal requirements. Carefully reviewing these regulations and maintaining records accordingly is crucial for compliance. Secure storage and access controls are necessary to protect sensitive payroll data.

Troubleshooting Payroll Issues for Carnival Pioneers

Carnival payroll, with its unique schedule and temporary workforce, is prone to occasional hiccups. Understanding potential problems and how to address them is crucial for maintaining a smooth and positive experience for all employees. This section will Artikel common issues, provide solutions, and emphasize the importance of open communication.

Common Payroll Issues

Payroll issues can range from minor errors to more significant problems. Common concerns include incorrect deductions, missing payments, and discrepancies in calculations. These issues can arise due to changes in employee information, system glitches, or human error. Addressing these issues promptly and efficiently is vital to maintain trust and morale within the workforce.

Resolving Payroll Issues: A Step-by-Step Approach

A structured approach is essential for resolving payroll issues effectively. This process involves careful investigation, documentation, and correction.

- Identify the Problem: The first step is to pinpoint the specific nature of the issue. Is it an incorrect deduction, a missed payment, or a calculation error? Gathering details from the employee, reviewing payroll records, and cross-referencing information are vital in this phase.

- Gather Information: Collect all relevant documentation, including employee timecards, deduction forms, pay stubs, and bank information. A clear record of the issue, including dates, amounts, and employee details, is essential for accurate resolution.

- Investigate the Discrepancy: Carefully review the payroll records to determine the cause of the problem. Look for inconsistencies in employee data, incorrect input, or procedural errors. This could involve checking the accuracy of time and attendance data or verifying deduction codes.

- Correct the Error: Once the cause is identified, the necessary corrections should be made. This might involve adjusting deductions, re-calculating pay, or issuing a supplemental payment. Document all corrections and keep a detailed record for future reference.

- Inform the Employee: Communicate the resolution to the employee promptly and transparently. Provide a clear explanation of the issue and the steps taken to correct it. A follow-up pay stub confirming the adjustment is crucial.

Importance of Clear Communication

Maintaining open communication channels between the payroll department and employees is paramount. Regular updates, clear explanations, and timely responses to employee inquiries foster trust and confidence. This proactive approach can prevent misunderstandings and address concerns quickly. Employees should feel comfortable approaching the payroll team with any questions or concerns.

Preventing Future Payroll Problems

Proactive measures can significantly reduce the likelihood of future payroll issues.

- Regular System Checks: Regularly review payroll systems for potential errors or glitches. This could involve automated checks for data inconsistencies or manual audits of specific pay periods.

- Employee Data Verification: Implement a robust system for verifying employee information. Ensure that changes in bank accounts, addresses, or deductions are updated promptly. This includes verifying information with employees themselves to ensure accuracy.

- Comprehensive Training: Provide thorough training to payroll staff on procedures, regulations, and software. This ensures accuracy and consistency in handling payroll tasks.

- Reviewing Policies and Procedures: Regularly review and update payroll policies and procedures to align with current regulations and best practices. This will help to prevent common errors.

Variations in Payroll Procedures

Carnival payroll, while sharing fundamental principles, can differ significantly based on the type of operation. This variation stems from operational differences, legal considerations, and the specific needs of each carnival model. Understanding these nuances is crucial for accurate calculation and efficient management of payroll resources.Payroll procedures vary considerably depending on whether a carnival is a traveling show or a permanent fixture in a specific location.

These differences impact everything from scheduling and labor classification to tax withholding and record-keeping requirements.

Carnival Pioneers are handling payroll deductions for payment, a crucial part of their operations. With the Caribbean Marketplace kicking off on January 15th, this bustling event is sure to impact the flow of funds and payroll processing. It’s a busy time, and ensuring timely and accurate payment of employees remains paramount for Carnival Pioneers.

Traveling Carnivals

Traveling carnivals face unique challenges in payroll administration. The constant movement and unpredictable schedule make traditional payroll practices difficult to implement. Payroll processes often need to be adaptable and flexible to accommodate changes in staffing, working hours, and location. Accurate tracking of employee hours and ensuring timely payments in various locations requires robust logistical support.

Permanent Location Carnivals

Permanent carnivals, while not as mobile as their traveling counterparts, still require adjustments to payroll procedures. Their stability, however, often allows for more formalized and predictable payroll structures. Payroll calculations can be more standardized, but still require careful attention to local labor laws and tax regulations.

Payroll Practices Comparison

| Characteristic | Traveling Carnival | Permanent Location Carnival |

|---|---|---|

| Payroll Frequency | Potentially more frequent, often weekly or bi-weekly, depending on the specific needs of the show. | Typically monthly, aligning with established business cycles. |

| Payroll Calculations | More complex, requiring adjustments for variable hours and locations. | More standardized, allowing for routine payroll processing. |

| Employee Tracking | Requires specialized software or manual systems to track employee hours across multiple locations and job sites. | Can use established HR systems or payroll software for employee data management. |

| Tax Compliance | Must comply with the tax laws of each jurisdiction visited. | Complies with the tax laws of the jurisdiction where the carnival is permanently located. |

| Record Keeping | Requires meticulous record-keeping to maintain compliance with regulations in various locations. | Record keeping can be more standardized, utilizing established company systems. |

Challenges for Traveling Carnivals

The ever-shifting nature of traveling carnivals presents a number of challenges for payroll administration. Maintaining accurate records across different locations, dealing with varying local regulations, and ensuring timely payments can be difficult. Ensuring all employees receive their rightful compensation in a timely manner, regardless of the location, is a crucial challenge. This can involve careful planning and coordination with the traveling crew.

The high volume of transactions and the need to ensure compliance across different jurisdictions can be quite a hurdle.

Challenges for Permanent Location Carnivals

Permanent carnivals also face challenges, albeit different ones. Maintaining compliance with local labor laws and regulations over an extended period is crucial. Maintaining accurate records and ensuring fair compensation for all employees is a continuing concern. Ensuring the payroll system aligns with the carnival’s long-term goals and employee needs is critical. Adapting to changes in local labor laws and tax regulations is an ongoing responsibility.

Carnival Pioneer Compensation and Benefits

Carnival workers, often referred to as “pioneer” employees, contribute significantly to the vibrant atmosphere and success of these travelling entertainment spectacles. Understanding their compensation and benefits is crucial for ensuring fair treatment and attracting and retaining talented individuals. This section delves into the specifics of compensation packages, considering various factors and the importance of collective bargaining.Carnival employees’ compensation and benefits are not a one-size-fits-all solution.

Instead, they are carefully tailored to various factors, such as experience, skill level, location of the carnival, and specific roles within the operation. The intricacies of these factors are examined in the following sections.

Compensation Structure by Role

Carnival employment encompasses a wide array of positions, each demanding different skills and experience. The compensation structure reflects these variations. Different roles, such as performers, technicians, food vendors, and management personnel, require different skill sets and experience levels.

| Role | Typical Compensation Components |

|---|---|

| Performers (e.g., clowns, jugglers, dancers) | Hourly wages, potential performance bonuses, and benefits such as health insurance and retirement plans. |

| Technicians (e.g., equipment operators, mechanics) | Hourly wages, potential overtime pay, and potentially specialized training allowances. Benefits such as health insurance and retirement plans are typically provided. |

| Food Vendors | Hourly wages, potentially sales-based incentives, and access to benefits packages like health insurance. |

| Management Personnel | Salaries, potentially performance-based bonuses, and comprehensive benefits packages including health insurance, retirement plans, and paid time off. |

Factors Influencing Compensation Packages

Several key factors influence the specifics of compensation packages for carnival pioneers. Experience plays a significant role, with more experienced employees often receiving higher wages and potentially greater benefits. Specialized skills, such as proficiency in a particular trade or performance art, also increase compensation. Location of the carnival, as in rural areas versus urban ones, can influence compensation due to differing cost of living.

Importance of Fair and Competitive Compensation, Carnival pioneers payroll deductions for payment

Fair and competitive compensation is essential for attracting and retaining skilled and dedicated carnival employees. A robust compensation structure that reflects the value of the employee’s contributions fosters job satisfaction and morale. This in turn leads to higher productivity, reduced employee turnover, and a more positive work environment.

Role of Collective Bargaining Agreements

Collective bargaining agreements (CBAs) play a vital role in establishing fair compensation and benefits for carnival employees. These agreements, negotiated between employee representatives and management, Artikel specific wages, benefits, and working conditions. CBAs ensure that employees receive compensation that is competitive with other industries, and addresses any issues of inequity. Examples of CBAs in other industries provide frameworks for negotiation in the carnival industry.

“A well-structured CBA provides a stable and predictable compensation structure, which is crucial for the carnival industry’s workforce.”

Summary

In conclusion, navigating carnival pioneer payroll requires a thorough understanding of applicable laws, regulations, and procedures. This guide provides a roadmap for accurate calculations, compliant deductions, and timely payments. By following the steps Artikeld here, both employers and employees can ensure a smooth and fair payroll process, fostering a positive working environment. Remember to prioritize accurate record-keeping for compliance and future reference.

FAQ Insights

What are common payroll deductions for carnival workers?

Common deductions include taxes (federal, state, and local), health insurance premiums, union dues, retirement contributions, and sometimes life insurance premiums or other voluntary deductions.

How are overtime hours calculated for carnival workers?

Overtime calculation often depends on the specific contract or location. Standard overtime rules typically apply, but there may be exceptions or variations depending on the specific employment agreement or applicable labor laws. Always refer to the employee’s contract for detailed overtime calculation procedures.

What are the legal requirements for issuing paychecks to carnival workers?

The legal requirements vary by location. Employers must adhere to all applicable labor laws regarding pay frequency, pay stubs, and accurate record-keeping. It’s crucial to consult legal counsel or relevant state/local labor authorities to ensure compliance.