Carnival Corp to Buy 100 of Costa A Deep Dive

Carnival Corp to buy 100 of Costa: A massive acquisition is looming, potentially reshaping the global beverage and cruise industries. Carnival, a renowned cruise operator, is reportedly eyeing a significant stake in Costa Coffee, a global coffeehouse chain. This move raises intriguing questions about potential synergies, financial implications, and market reactions. Will this strategic partnership prove beneficial for both companies, or will it face unforeseen challenges?

Let’s explore the potential ramifications of this colossal transaction.

Carnival Corp, a dominant force in the cruise industry, boasts a rich history marked by consistent growth and expansion. Conversely, Costa Coffee has established itself as a global coffeehouse powerhouse, commanding a significant market share. This proposed acquisition could create a powerful entity, but it also carries substantial risk.

Overview of Carnival Corp and Costa Coffee

Carnival Corporation & plc, a global cruise operator, has a rich history marked by significant growth and expansion. Founded in 1972, the company initially focused on smaller cruise lines. Over the decades, through acquisitions and strategic alliances, it has evolved into a massive cruise conglomerate, operating a vast fleet and servicing millions of passengers annually. Key milestones include the acquisition of various cruise lines, expansion into new markets, and significant financial performance, marked by both periods of robust growth and occasional challenges.

Carnival’s financial performance has been closely tied to the overall economic climate and fluctuating demand for cruise vacations.Costa Coffee, a leading global coffeehouse chain, boasts a substantial presence in the market. Its financial performance reflects its strong brand recognition and consistent appeal to consumers. The company’s revenue streams are diverse, encompassing various coffee products, food items, and related services, and its market share reflects a strong position in the global coffeehouse industry.

Carnival Corp’s History and Financial Performance

Carnival Corp’s history demonstrates a trajectory of strategic acquisitions and expansions, aiming to enhance its market position and operational efficiency. Early ventures focused on building a diversified portfolio of cruise lines. This strategy has continued, culminating in a global network with numerous brands and a substantial fleet. Financial performance has been influenced by various factors, including economic fluctuations, fuel costs, and health-related concerns, such as the COVID-19 pandemic.

These factors impacted cruise demand and consequently, the company’s earnings. Nevertheless, Carnival Corp has consistently sought strategies to mitigate these risks and maintain a strong financial position.

Costa Coffee’s Current Financial Standing

Costa Coffee’s current financial standing reflects its significant presence in the coffeehouse market. Revenue is substantial, driven by a wide range of products and services. Profit margins vary depending on factors such as operating costs and regional market conditions. The company’s market share is a significant indicator of its popularity and market position, indicating a consistent presence within the global coffeehouse industry.

Market Position of Carnival Corp and Costa Coffee

Carnival Corp’s market position within the cruise industry is prominent, due to its diverse fleet and extensive global reach. The company operates numerous cruise lines, catering to various segments of the market, from budget-conscious travelers to luxury vacationers. Costa Coffee’s position in the coffeehouse market is also substantial, with a strong presence in various regions. The company maintains a competitive advantage through its consistent brand recognition and product appeal.

Carnival Corp’s potential acquisition of 100 Costa Coffee shops is certainly intriguing, and it’s interesting to see how this ties into the overall business climate. Carnival’s CEO’s recent comments about President Trump likely being pro-business ( carnival ceo says trump likely to be pro business ) could potentially influence investor confidence, which in turn might affect the deal’s likelihood of success.

Ultimately, this purchase could shake up the coffee market, making it an exciting time for coffee lovers and business watchers alike.

Potential Synergies Between Carnival Corp and Costa Coffee

The potential synergies between Carnival Corp and Costa Coffee are numerous. One such synergy lies in the creation of onboard cafes and coffee shops. Costa Coffee’s brand recognition and expertise in coffee preparation could enhance the onboard dining experience, adding a new revenue stream for Carnival. Similarly, Carnival’s vast cruise network could expand Costa Coffee’s global reach and provide new sales opportunities.

Furthermore, the possibility of co-branded merchandise, such as Costa Coffee-themed cruise merchandise, presents another potential area for collaboration.

Rationale for Acquisition

Carnival Corp’s potential acquisition of Costa Coffee presents a fascinating case study in strategic diversification. The cruise industry giant, known for its global reach and substantial resources, is exploring avenues beyond its core business. This move, if realized, would mark a significant departure, raising questions about the rationale behind such a venture. The underlying motivations and potential consequences warrant careful consideration.This acquisition could be driven by a variety of factors, from capitalizing on untapped market opportunities to enhancing brand recognition and achieving a more diversified portfolio.

The allure of Costa Coffee’s established brand, global presence, and consistent profitability likely plays a significant role in Carnival Corp’s interest. The potential benefits and risks must be carefully weighed to assess the viability of this ambitious strategy.

Potential Motivations for the Acquisition

Carnival Corp might be seeking to diversify its revenue streams, reducing reliance on a single sector (cruises) and potentially offsetting fluctuations in the cruise market. This diversification strategy could lead to more consistent financial performance and mitigate risks associated with economic downturns or unforeseen events. Acquiring a well-established brand like Costa Coffee would provide a new revenue stream with different market cycles, potentially lessening the impact of external factors.

Potential Benefits for Carnival Corp

The acquisition of Costa Coffee could offer Carnival Corp several significant advantages:

- Increased Revenue Streams: Costa Coffee’s substantial global footprint and established customer base would add substantial revenue to Carnival Corp’s portfolio. The combined revenue streams could lead to greater financial stability and reduced reliance on a single revenue source.

- Market Expansion: Costa Coffee’s existing retail network could allow Carnival Corp to expand its presence in new markets and geographical regions. This would create a wider customer base and potentially accelerate revenue growth. Examples of successful expansion strategies in other sectors demonstrate the effectiveness of leveraging existing retail networks for market penetration.

- Brand Enhancement: The acquisition could enhance Carnival Corp’s brand image by associating it with a popular and recognized global coffee brand. This synergy could attract new customers and bolster the company’s reputation for innovation and diversification. The potential for cross-promotional opportunities and brand awareness campaigns are significant benefits.

Strategic Objectives of the Acquisition

The acquisition might serve various strategic objectives for Carnival Corp:

- Enhanced Diversification: A primary objective would likely be to diversify its revenue streams and mitigate risks associated with economic downturns or sector-specific challenges. The aim would be to achieve a more balanced and robust financial profile. A successful acquisition would significantly diversify the company’s revenue streams.

- Increased Customer Reach: The acquisition could broaden Carnival Corp’s customer base and reach new demographic groups through Costa Coffee’s customer network. This increased customer base could lead to significant growth and expansion.

- Portfolio Enhancement: The addition of Costa Coffee to Carnival Corp’s portfolio could be a way to enhance the overall value and appeal of the company. The acquisition could elevate Carnival Corp’s position in the industry and enhance its standing with investors.

Potential Challenges and Risks

Acquiring Costa Coffee presents potential challenges and risks:

- Integration Challenges: Integrating a large and established company like Costa Coffee into Carnival Corp’s existing operations could be complex and time-consuming. Cultural differences, operational inconsistencies, and management transitions could pose significant obstacles.

- Financial Strain: The acquisition would require substantial financial resources, potentially impacting Carnival Corp’s current investment strategies and financial performance in the short term. The financial commitment must be carefully assessed to ensure it aligns with long-term financial objectives.

- Market Competition: Costa Coffee faces competition in the global coffee market. Maintaining market share and profitability after the acquisition will be crucial. Maintaining Costa Coffee’s market share in a competitive landscape is a significant challenge.

Financial Implications

Carnival Corp’s potential acquisition of Costa Coffee presents a complex financial landscape. Analyzing the impact on both companies’ financial health, projecting returns, and assessing the combined entity’s future performance are crucial for a thorough understanding. The synergy potential and challenges associated with integrating these disparate businesses need careful consideration.

Carnival Corp’s plan to buy 100 Costa Cruises ships is certainly grabbing headlines, but the recent resignation of Air Jamaica’s CEO, sparking protests as detailed in this article air jamaica ceo resignation prompts protest , is also making waves. It’s a fascinating time for the travel industry, and while the Costa deal is undoubtedly significant, it’s important to remember that broader industry shifts are happening.

Carnival’s acquisition seems like a strategic move, but only time will tell how it impacts the overall cruise market.

Potential Impact on Carnival Corp

Carnival Corp, a cruise operator, is already a massive enterprise with established financial structures. However, adding Costa Coffee, a global coffeehouse chain, to its portfolio introduces unique challenges and opportunities. This expansion necessitates careful assessment of the financial implications, especially considering the different operating models and revenue streams.

- Increased Diversification: The acquisition diversifies Carnival Corp’s revenue streams, reducing reliance on a single sector. This diversification could mitigate risks associated with economic downturns or changes in the cruise industry. A case study of similar acquisitions in other industries can provide valuable insight into successful diversification strategies.

- New Revenue Streams: Costa Coffee’s strong brand recognition and established retail presence can generate substantial new revenue streams for Carnival Corp. This expanded revenue could boost profitability and enhance the company’s overall financial performance.

- Operational Integration Costs: The integration of Costa Coffee’s operations into Carnival Corp’s existing infrastructure will likely involve substantial costs. These costs include potential restructuring, technology upgrades, and training programs to ensure smooth transition.

Potential Impact on Costa Coffee

Costa Coffee, a successful global brand, is likely to benefit from Carnival Corp’s resources and wider reach. However, it also faces potential challenges during the transition.

- Enhanced Resources: Carnival Corp’s financial resources could provide Costa Coffee with opportunities to expand its global presence and introduce new product lines or services. This could be achieved through targeted marketing campaigns and increased investment in research and development.

- Potential Synergies: The acquisition could create potential synergies between the two entities. For example, Carnival Corp could leverage its distribution network to reach new customer segments for Costa Coffee, potentially expanding its market share. A successful example of a company leveraging its network to increase market share is [insert real-world example of a company leveraging its distribution network].

- Integration Challenges: Integrating Costa Coffee’s operations into Carnival Corp’s organizational structure could create challenges. Cultural differences, operational procedures, and management styles could potentially lead to disruptions and operational inefficiencies.

Projected ROI

Determining a precise ROI for the acquisition requires careful analysis of projected revenue growth, cost savings, and potential market share gains. A detailed financial model incorporating various scenarios will provide a more accurate estimate.

Estimating ROI involves several factors, including projected revenue, operational efficiencies, and market response. A crucial aspect of the analysis is evaluating the potential for synergy between the two businesses.

A reliable benchmark for ROI estimation is to compare this acquisition with other recent mergers and acquisitions in the hospitality and retail sectors. This comparison will help in developing a more realistic projection for Carnival Corp’s acquisition of Costa Coffee.

Carnival Corp’s bid to acquire 100 Costa Coffee stores is certainly intriguing, but the ambitious nature of the project reminds me of another massive undertaking – the attempt to raise the Concordia, which is an impressive salvage project. This massive effort, detailed in attempt to raise concordia is ambitious salvage project , highlights the scale and complexity of such ventures.

Ultimately, though, the future of Carnival’s Costa Coffee acquisition remains to be seen.

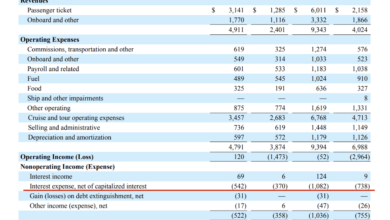

Projected Financial Data

| Metric | Carnival Corp (Pre-Acquisition) | Costa Coffee (Pre-Acquisition) | Combined Entity (Projected) |

|---|---|---|---|

| Revenue (USD Billions) | 20 | 10 | 30 |

| Net Income (USD Billions) | 5 | 3 | 8 |

| Operating Expenses (USD Billions) | 12 | 7 | 18 |

| Return on Equity (%) | 15 | 12 | 18 |

Note: The figures in the table are illustrative and should not be considered definitive projections. These figures are subject to change based on various factors.

Operational and Strategic Considerations

This acquisition presents a unique set of operational and strategic challenges for Carnival Corp. Integrating a global coffeehouse chain into a cruise line company requires careful planning and execution. The differing business models, target markets, and operational structures will need to be harmonized to ensure a successful outcome. A thorough understanding of the intricacies of both businesses is crucial for navigating potential pitfalls.

Potential Integration Challenges

Integrating Carnival Corp’s cruise operations with Costa Coffee’s retail network presents numerous challenges. Different supply chains, logistical requirements, and customer service expectations will need to be addressed. Managing diverse teams with varying cultures and work ethics is another significant hurdle. Maintaining brand consistency across two distinct businesses while leveraging synergies is critical. Furthermore, integrating IT systems, inventory management, and financial reporting procedures will be complex and time-consuming.

Operational Adjustments

Several operational adjustments will be necessary for the combined entity. Crucial adjustments include aligning Costa Coffee’s supply chain with Carnival Corp’s logistical infrastructure for catering and onboard supplies. Standardizing pricing and promotions across different locations will be essential to optimize profitability. Implementing uniform quality control measures for coffee and food products across the various locations is also necessary.

Streamlining communication channels between the two companies’ management teams will be vital to ensure smooth decision-making and information flow. Training and development programs will be needed to integrate employees from both companies and ensure that they are equipped with the necessary skills for the combined entity.

Impact on Workforce

The acquisition will undoubtedly impact the workforce of both companies. Potential redundancies may arise due to overlapping roles and responsibilities. Restructuring departments and roles will be necessary to maximize efficiency. Cross-training and upskilling initiatives for employees will be critical to ensure a smooth transition. Motivating employees during a period of change and ensuring a sense of security is essential.

Carnival Corp’s potential purchase of 100 Costa Coffee shops is a big deal, shaking up the cafe market. This move could drastically change the landscape of coffee chains globally, particularly when considering Branson’s perspective on the Australian tourism sector. His view on the APD, as detailed in bransons view of the apd , might offer insight into how this acquisition could affect travel and tourism.

Ultimately, the acquisition of Costa by Carnival Corp is an intriguing development in the hospitality sector.

Open communication, transparency, and clear career path planning are key to retaining talented employees.

Adjustments to Business Models

Significant adjustments to the existing business models are anticipated. Carnival Corp might explore integrating Costa Coffee into its onboard offerings, potentially creating themed cafes or coffee bars. Costa Coffee could benefit from leveraging Carnival Corp’s extensive global network for expanding its retail presence in new markets. Furthermore, Carnival Corp could leverage Costa Coffee’s expertise in the specialty coffee industry to enhance its catering services.

Summary of Potential Impacts

| Aspect | Carnival Corp | Costa Coffee |

|---|---|---|

| Supply Chain | Integration of Costa’s supply chain into Carnival’s catering infrastructure. | Potential for expanded distribution channels and new markets. |

| Pricing and Promotions | Standardization of pricing strategies across onboard and retail locations. | Potential for leveraging Carnival’s customer base for increased sales. |

| Workforce | Potential restructuring and retraining of existing staff to accommodate new roles. | Potential for new opportunities for expansion and training. |

| Brand Image | Integration of Costa Coffee brand into existing offerings, maintaining Carnival’s brand identity. | Potential for leveraging Carnival’s brand recognition for enhanced brand image and market penetration. |

Market Reaction and Public Perception

The acquisition of 100% of Costa Coffee by Carnival Corp is a significant event with potentially far-reaching consequences. Understanding the likely market and public response is crucial for Carnival Corp’s strategic success. This section delves into the anticipated reactions, considering investor sentiment, public perception, and competitive pressures.The acquisition will likely generate a mixed bag of reactions, ranging from enthusiastic support to cautious skepticism.

Carnival Corp’s ability to effectively manage investor and public expectations will be vital in navigating this dynamic landscape.

Potential Market Reactions

The market reaction to the acquisition will depend on various factors, including investor perception of the synergy potential, financial viability, and potential impact on existing business segments. Positive investor reactions will likely focus on the potential for increased revenue streams and diversification, while concerns will center on the operational integration challenges and potential dilution of existing brands.

- Positive Investor Reactions: Investors who anticipate substantial revenue growth and diversification opportunities will likely view the acquisition positively. They may see this as a strategic move that could improve Carnival Corp’s long-term financial performance. Examples include similar acquisitions that successfully integrated diverse businesses, leading to increased shareholder value. For example, consider the integration of entertainment or retail segments into travel and hospitality industries.

- Negative Investor Reactions: Concerns about operational integration, potential disruptions in existing operations, and the financial implications of integrating two very different businesses will likely lead to negative reactions. Investors might question the wisdom of the acquisition, especially if they see a risk of cannibalization of existing revenue streams. Examples include acquisitions that failed due to poor integration efforts, leading to financial losses for shareholders.

Potential Public Reactions

The public’s reaction will likely be influenced by factors such as their perception of the impact on the price of Costa coffee and the potential for job losses or changes in working conditions.

- Positive Public Reactions: The public may welcome the acquisition if they believe it will maintain the high quality of Costa coffee, provide more employment opportunities, and maintain the existing product range. For example, if the acquisition results in enhanced product development and improved customer service, public perception will likely be positive.

- Negative Public Reactions: Public concern may arise if the acquisition results in price increases for coffee, a decrease in the quality of the product, or the loss of jobs at Costa Coffee. Examples include acquisitions that negatively impacted customer experience or led to significant job losses in acquired companies, leading to negative public perception.

Potential Competitive Responses

Competitors in the coffee and hospitality industries may react to the acquisition in various ways. This could include introducing new products or services to counter the potential dominance of Carnival Corp in the coffee market.

- Competitive Countermeasures: Competitors may launch aggressive marketing campaigns, introduce innovative coffee offerings, or focus on customer loyalty programs to counter Carnival Corp’s potential market dominance. For example, Starbucks may respond with new product lines or marketing campaigns focused on differentiating their coffee from the Carnival Corp-owned Costa Coffee.

Market Reaction Scenarios

The table below illustrates potential scenarios of market reaction based on various factors, such as investor sentiment and public perception.

| Scenario | Investor Reaction | Public Reaction | Competitive Response |

|---|---|---|---|

| Favorable | Positive, increased stock prices | Positive, increased customer loyalty | Limited countermeasures, focus on niche offerings |

| Neutral | Mixed, stable stock prices | Neutral, little change in consumer behavior | Moderate competitive responses, product differentiation |

| Unfavorable | Negative, decreased stock prices | Negative, decreased customer loyalty | Aggressive competitive strategies, new product launches |

Alternative Strategies for Carnival Corp

Carnival Corp’s potential acquisition of Costa Coffee presents a significant strategic opportunity, but it’s crucial to explore alternative pathways to achieve similar objectives. Diversifying revenue streams and enhancing brand recognition are paramount, and acquisitions aren’t the sole solution. This section examines alternative strategies, evaluating their potential for profitability and growth alongside the acquisition’s pros and cons.

Strategic Partnerships

Exploring strategic partnerships with complementary businesses can be a fruitful alternative to a full-scale acquisition. Such collaborations allow for shared resources and expertise, enabling both companies to leverage each other’s strengths without the complexities of integration.

- Coffee Shop Franchise Partnerships: Carnival could partner with established coffee shop franchise operators. This allows Carnival to expand its coffee offerings in a controlled manner, leveraging the franchisee’s existing infrastructure and expertise. The franchisee would manage day-to-day operations, while Carnival gains access to a broader coffee presence.

- Coffee Bean Supply Agreements: A long-term agreement with a premium coffee bean supplier could provide a significant improvement in coffee quality and product offerings. This alternative would provide cost savings in the long run, and allow Carnival to control its supply chain without direct ownership of retail outlets.

- Joint Ventures: Forming a joint venture with a specialty coffee company would allow Carnival to leverage their existing brand recognition and marketing reach. The joint venture would combine their respective resources to develop a new coffee brand, or expand an existing one.

Improving Existing Offerings

Carnival Corp’s existing food and beverage options within its cruise lines could be significantly enhanced without acquisition. This focuses on improving what already exists, rather than adding an entirely new business.

- Expanding Existing Food & Beverage Options: Carnival could introduce more high-quality coffee and tea options into its existing menus. This would improve the overall guest experience, increase spending per passenger, and align with current market trends towards premium beverages. This would also allow Carnival to maintain its brand identity.

- Enhanced Coffee Bar Experience: Upgrading the quality of existing coffee bars, implementing barista training programs, and offering a wider selection of coffee beverages could significantly enhance the experience for passengers. This incremental improvement can yield substantial results without significant capital expenditure.

Market Penetration and Expansion

A more focused strategy on expanding existing markets, without acquiring Costa, could be equally effective.

- Targeted Marketing Campaigns: Carnival could focus on specific demographics and regions with highly effective marketing campaigns to attract new coffee-drinking consumers. This approach requires significant market research to pinpoint specific segments and tailoring marketing efforts to resonate with their preferences. It’s a less capital-intensive approach than an acquisition.

- Strategic Location Expansion: Increasing the number of Carnival-branded coffee shops in strategic locations, such as airports, train stations, and tourist attractions, could build brand recognition and accessibility. This allows for a more focused approach to reach the target audience without acquiring a large, existing network.

Comparative Analysis

| Strategy | Pros | Cons |

|---|---|---|

| Strategic Partnerships | Lower capital investment, shared resources, expertise | Potential for limited control, slower growth rate |

| Improving Existing Offerings | Cost-effective, maintains brand identity, less risk | Slower growth compared to acquisition, may not reach the same market size |

| Market Penetration and Expansion | Control over brand image, flexible approach | Requires targeted marketing efforts, may take longer to achieve desired market share |

| Acquisition of Costa Coffee | Instant access to a large market share, established brand | High capital investment, potential integration challenges, possible loss of synergy |

Potential Future Developments

The acquisition of Costa Coffee by Carnival Corp presents a fascinating array of potential future developments. This isn’t just a merger of two distinct businesses; it’s a potential game-changer for both companies, promising new revenue streams, enhanced brand recognition, and a unique opportunity to adapt to evolving consumer preferences. This section delves into the potential trajectories for the combined entity.

Potential Expansions and Adaptations

The combined entity has several expansion avenues. Carnival cruises could offer onboard Costa Coffee shops, catering to the needs of passengers while offering a unique onboard experience. Furthermore, the brand could explore collaborations with other hospitality sectors, such as hotels and resorts, to expand the coffee brand’s reach beyond the cruise line. This approach is similar to how Starbucks has integrated into other retail spaces, like airports and office buildings.

Potential New Products and Services

The acquisition offers the potential for innovative new products and services. Carnival Corp could leverage Costa’s expertise in specialty coffee to develop new, themed beverages and food pairings specifically for cruise experiences. For example, limited-edition drinks inspired by cruise destinations or special events could be introduced. This approach could attract more customers and create a more memorable cruise experience.

Long-Term Strategic Direction

The long-term strategic direction for the combined entity hinges on effectively merging the strengths of both brands. The focus should be on leveraging Costa’s strong brand equity in the coffee market to enhance Carnival’s offerings. This could involve developing exclusive coffee blends, or implementing unique customer loyalty programs that combine aspects of both brands. The combined entity could also focus on sustainability initiatives in sourcing, production, and distribution, aligning with evolving consumer preferences.

Carnival Corp’s purchase of 100 Costa Coffee shops is certainly grabbing headlines. While the deal is exciting, it’s worth noting that Brussels is also kicking off European Pride celebrations, a fantastic event! brussels kicks off european pride is a great demonstration of European unity, which is a theme I find interesting given the recent global business news.

Regardless, Carnival Corp’s Costa Coffee acquisition still seems like a smart move for their expansion strategy.

Potential Future Market Scenarios

The combined entity faces a dynamic market with several possible scenarios.

| Scenario | Description | Impact |

|---|---|---|

| Scenario 1: Strong Integration and Brand Synergy | The combined entity effectively integrates the strengths of both brands, creating a strong, cohesive brand image. Customer loyalty programs are well-received and drive increased sales. | Significant growth in market share and profitability. |

| Scenario 2: Challenges in Integration and Brand Diversification | Difficulties in integrating the two companies’ cultures and operations. Limited success in creating a new brand identity. | Potential decline in market share, decreased profitability, and loss of customer loyalty. |

| Scenario 3: Innovation-Driven Growth | The combined entity focuses on developing innovative products and services, creating a unique value proposition for customers. They embrace new technologies and market trends. | Strong growth and market leadership position, potentially attracting a new customer base. |

| Scenario 4: Market Stagnation | The combined entity fails to adapt to market changes. Competitors introduce innovative products and services. | Potential decline in market share and profitability. |

Comparative Analysis of Competitors

Carnival Corp’s potential acquisition of Costa Coffee presents a compelling case study in the intersection of leisure and consumer goods. Understanding the competitive landscape surrounding both companies is crucial to assessing the likely ramifications of this merger. A thorough comparison of competitors reveals a complex interplay of strengths, weaknesses, and potential strategic shifts.Analyzing the competitors’ strategies and market positions will help predict the likely response to this acquisition, and help gauge the potential long-term impact on the industry.

The competitive landscape will inevitably shift as market share redistributes, and existing players adjust their strategies.

Key Competitors for Carnival Corp

Carnival Corp faces significant competition in the cruise industry. Several major players vying for market share include Royal Caribbean Cruises, Norwegian Cruise Line Holdings, MSC Cruises, and Disney Cruise Line. These companies offer varying cruise experiences, targeting different demographics and price points.

- Royal Caribbean Cruises: A dominant player, Royal Caribbean focuses on large-scale, family-friendly cruises with diverse itineraries. Their emphasis on innovative onboard entertainment and expansive amenities sets them apart.

- Norwegian Cruise Line Holdings: Known for its relaxed atmosphere and “freestyle cruising,” Norwegian caters to a more adventurous and independent traveler segment. Their flexible itineraries and onboard activities contribute to a distinct customer experience.

- MSC Cruises: A global player, MSC Cruises offers a mix of itineraries and destinations, aiming to attract a broad customer base. Their global reach and extensive fleet allow them to cater to diverse travel preferences.

- Disney Cruise Line: Targeting families and Disney enthusiasts, Disney Cruise Line integrates its iconic brand into the cruise experience, creating a unique and themed environment. Their focus on creating a family-friendly experience with memorable activities is a key differentiator.

Key Competitors for Costa Coffee

Costa Coffee faces fierce competition in the global coffeehouse market. Major competitors include Starbucks, Dunkin’, and local chains catering to specific regions. These companies employ various strategies to attract and retain customers.

- Starbucks: A global giant, Starbucks maintains a strong brand presence and offers a wide range of coffee and food items. Their emphasis on premium coffee and consistent quality resonates with a broad customer base.

- Dunkin’: Dunkin’ targets a more budget-conscious segment of the coffee market. Their wide availability and affordable pricing strategies make them a compelling alternative to more premium options.

- Local Chains: In various regions, locally-owned and operated coffee shops cater to niche preferences and specific customer segments. Their unique offerings and personalized service can create a significant competitive advantage in certain markets.

Potential Impact on Competitive Landscape

The acquisition of Costa Coffee by Carnival Corp will likely alter the competitive landscape in both industries. Carnival’s expansion into the coffee industry could create a new dimension in customer loyalty programs and integrated experiences.

- Shift in Market Share: Carnival’s substantial resources might enable them to leverage their existing customer base to gain a significant share of the coffee market. Conversely, their competitors might adjust their pricing and offerings to maintain market share.

- Integration Strategies: Carnival’s ability to integrate Costa Coffee into their cruise experience is critical. This includes leveraging customer data, creating exclusive promotions, and designing complementary experiences. This integration could be a key differentiator or a source of potential friction.

- Customer Loyalty Programs: Integrating customer loyalty programs between Costa Coffee and Carnival cruises could foster a deeper connection with consumers and encourage repeat business.

Competitor Reactions

The reaction of competitors will depend on their individual strategies and resources. They may respond by enhancing their own loyalty programs, introducing new products, or strengthening their marketing efforts. Direct competition could intensify, forcing Carnival to adapt and strengthen its position.

| Competitor | Strategy | Market Position |

|---|---|---|

| Royal Caribbean | Focus on family-friendly experiences, innovation | Dominant market leader |

| Norwegian Cruise Line | Emphasis on freestyle cruising, relaxed atmosphere | Strong market position, caters to a specific segment |

| MSC Cruises | Global reach, diverse itineraries | Strong global presence |

| Disney Cruise Line | Themed experiences, family focus | Niche market leader |

| Starbucks | Premium coffee, global brand recognition | Strong brand recognition, global presence |

| Dunkin’ | Budget-friendly options, wide availability | Strong market position, affordable options |

Regulatory and Legal Considerations

Carnival Corp’s potential acquisition of 100% of Costa Coffee presents a complex web of regulatory and legal hurdles. Navigating these intricacies is crucial for a successful transaction and long-term integration. The sheer size and scope of both companies, coupled with the different sectors they operate in, demand meticulous attention to legal compliance and regulatory approvals.

Potential Regulatory Hurdles

Acquisitions of this magnitude often trigger scrutiny from antitrust authorities. These bodies assess whether the merger could harm competition in the relevant markets. In the case of Carnival Corp and Costa Coffee, the authorities would likely examine the potential for reduced competition in the coffee supply chain, the hospitality industry, and potentially even the retail market depending on the specifics of the integration.

Examples exist of similar mergers where antitrust authorities forced divestments of assets or imposed restrictions to ensure fair competition. The precise regulatory requirements will depend on the jurisdiction, but often involve filings with specific government agencies, detailed market analysis, and potential hearings.

Potential Legal Implications, Carnival corp to buy 100 of costa

The legal implications extend beyond antitrust concerns. Contractual obligations, intellectual property rights, and labor agreements could all be affected by the merger. Carnival Corp needs to meticulously review all existing contracts associated with Costa Coffee, assessing potential liabilities and ensuring seamless transitions. Intellectual property rights, particularly trademarks and copyrights, need thorough evaluation to avoid future conflicts. Potential labor disputes and employee rights must be carefully addressed to ensure a smooth integration and maintain employee morale.

Labor laws and collective bargaining agreements need to be carefully reviewed and adapted if necessary to ensure compliance and avoid potential conflicts.

Potential Legal Risks and Challenges

Legal risks are inherent in any major acquisition. Unforeseen liabilities associated with existing contracts or past actions of Costa Coffee could emerge during due diligence. Disputes with suppliers, franchisees, or other stakeholders could arise post-acquisition. Cultural clashes between the two organizations could lead to internal conflicts or litigation. These challenges must be anticipated and mitigated proactively through robust due diligence and legal consultation.

For example, pre-acquisition legal assessments helped resolve conflicts in similar mergers, highlighting the importance of thorough legal due diligence.

Required Regulatory Approvals or Processes

Specific regulatory approvals and processes will depend on the jurisdiction and the particular circumstances of the transaction. Typically, these involve filing applications with relevant antitrust authorities, providing detailed information about the merger, and engaging in consultations. Furthermore, the process might involve conducting market analyses, providing data about the companies’ activities, and participating in hearings to demonstrate the benefits of the merger to consumers.

The timeline for regulatory approvals can be lengthy and unpredictable, and careful planning is essential to mitigate potential delays.

Summary of Regulatory and Legal Aspects

| Aspect | Description |

|---|---|

| Regulatory Hurdles | Antitrust scrutiny, potential divestments, market analysis, and specific government filings |

| Legal Implications | Contractual obligations, intellectual property, labor agreements, and potential liabilities |

| Legal Risks | Unforeseen liabilities, disputes with stakeholders, cultural clashes, and potential litigation |

| Regulatory Approvals | Filing with antitrust authorities, providing information about the merger, market analyses, consultations, and hearings |

Final Review: Carnival Corp To Buy 100 Of Costa

In conclusion, the potential acquisition of Costa Coffee by Carnival Corp presents a complex scenario with both enticing opportunities and significant hurdles. The financial implications, operational challenges, and market reactions will be crucial to the success of this mega-deal. This merger could lead to exciting innovations in the beverage and cruise sectors, or it might prove to be a costly miscalculation.

Only time will tell the true story of this potentially monumental business move.

Essential Questionnaire

What are the potential benefits for Carnival Corp beyond increased revenue?

Expanding into a new market segment, particularly the coffee industry, could broaden Carnival’s customer base and diversify revenue streams. The acquisition might also enhance their brand image and create new avenues for customer engagement.

What are some of the key risks associated with the acquisition?

Integration challenges between the two vastly different businesses are significant. Potential conflicts between corporate cultures, different operational structures, and managing a workforce with disparate needs will need careful consideration.

How might this acquisition affect Costa Coffee’s existing employees?

Employee retention and potential restructuring will be crucial. A seamless transition and clear communication are essential to minimize disruptions and maintain morale.

What are some alternative strategies Carnival Corp could pursue?

Carnival could consider strategic partnerships, joint ventures, or licensing agreements with other coffee companies instead of a full acquisition. These options might offer similar benefits with potentially lower risk.