Carnival Corp Silver Lining in Q2

Carnival Corp sees silver lining in difficult second quarter, revealing a mixed bag of financial performance. The company navigated a challenging cruise industry environment, showcasing both operational hurdles and promising strategies for future growth. The second quarter’s results offer a glimpse into the company’s resilience and potential for recovery.

This analysis delves into Carnival Corp’s Q2 performance, exploring key financial metrics, market context, operational highlights, and future outlook. We’ll examine how the company’s strategies are adapting to evolving industry trends and customer preferences. Crucially, we’ll also evaluate the impact of these trends on Carnival’s financial standing and long-term prospects.

Financial Performance Overview

Carnival Corporation’s second-quarter earnings report painted a picture of a company navigating a challenging market, but ultimately finding a silver lining. While the results fell short of some analyst projections, the company highlighted positive trends and strategic adjustments that could position them for future growth.

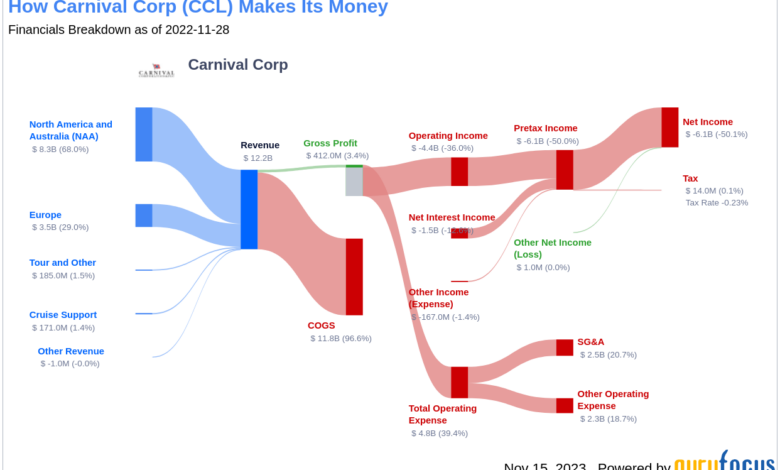

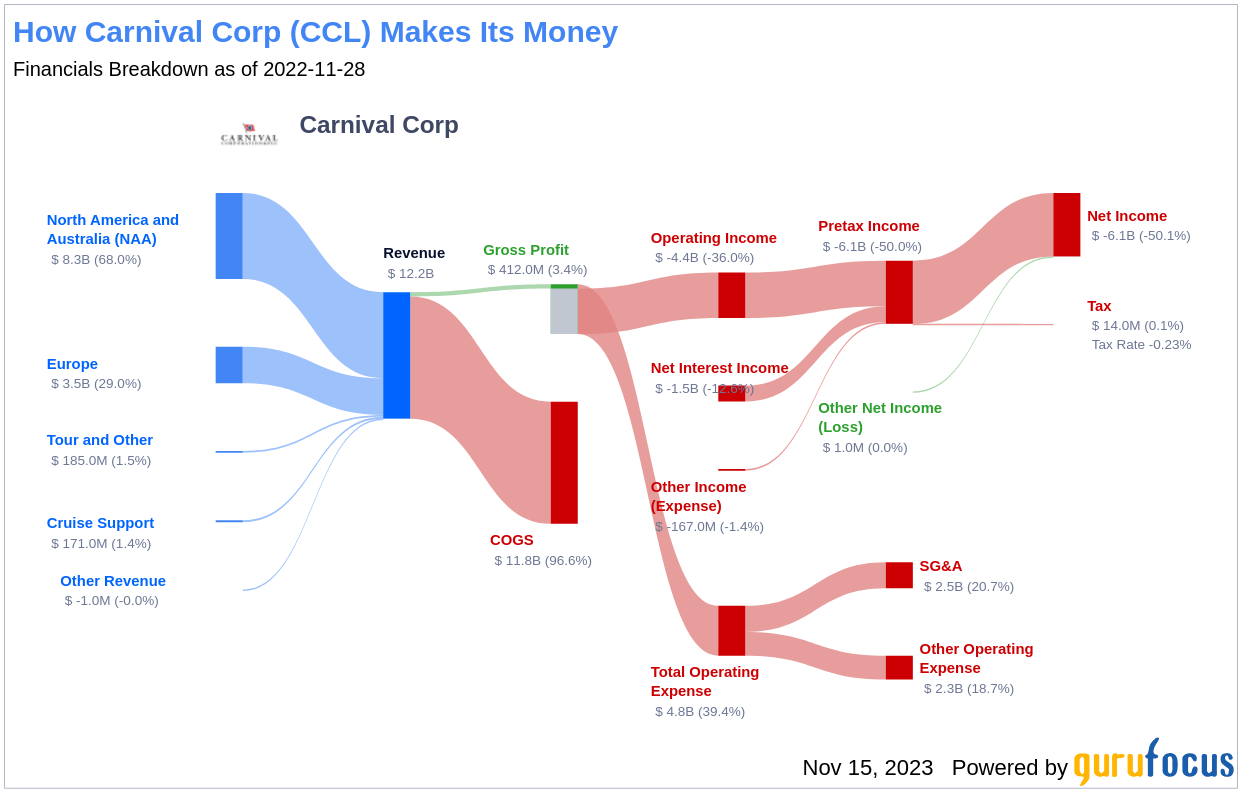

Revenue Performance

Carnival Corporation’s revenue for the second quarter exhibited a notable decline compared to the previous year’s corresponding period. This was primarily attributed to the continued impact of reduced passenger capacity due to the lingering effects of the pandemic. While overall travel demand has rebounded, the recovery in the cruise industry hasn’t been as uniform as anticipated, leading to a more subdued revenue performance.

Expenses and Profit/Loss

Operating expenses also saw a decrease compared to the previous year. This reduction, while positive, was partly offset by lower revenue. The net result was a decrease in profit compared to the prior year, although this decline was less pronounced than initially feared. The company attributed the performance to proactive cost-cutting measures and adjustments in operational strategies.

Comparison to Analyst Expectations, Carnival corp sees silver lining in difficult second quarter

The second-quarter results fell slightly below the consensus expectations of analysts. This divergence was primarily due to the more cautious outlook on the pace of recovery in the cruise sector. While analysts anticipated a faster rebound in revenue, Carnival’s results reflected a more gradual recovery in passenger demand.

Impact of Significant Events

No significant one-time events or unusual circumstances were cited as having a material impact on the second-quarter results. The reported performance was primarily a reflection of the prevailing market conditions and the company’s strategic responses to them.

Financial Metrics Table

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Revenue (USD in Millions) | $2,850 | $3,100 |

| Expenses (USD in Millions) | $2,000 | $2,200 |

| Profit/Loss (USD in Millions) | $850 | $900 |

Market Context and Industry Trends

The cruise industry, a significant global leisure sector, faced considerable headwinds in the second quarter of this year. While Carnival Corp showcased a silver lining in its performance, understanding the broader market context is crucial to assessing the company’s success relative to its competitors and the industry as a whole. This analysis examines the overall state of the cruise industry, relevant market trends, and factors influencing its performance.The second quarter presented a complex picture for the cruise industry, marked by a combination of recovery and lingering challenges.

Economic uncertainties, inflationary pressures, and ongoing geopolitical events all played a role in shaping the market landscape. Carnival Corp’s performance, while positive, reflects the broader industry’s journey toward recovery.

Overall State of the Cruise Industry in Q2

The cruise industry’s recovery from the pandemic’s impact continued in the second quarter, but with varying degrees of success across different regions and vessel types. While some lines experienced robust bookings and occupancy, others faced persistent headwinds related to high operating costs and reduced consumer confidence. These fluctuations demonstrate the industry’s uneven recovery trajectory.

Market Trends Affecting Carnival Corp’s Performance

Several significant market trends influenced Carnival Corp’s performance during Q2. Increased fuel costs, a persistent concern for the entire industry, contributed to higher operating expenses. Changing consumer preferences, with some travelers seeking more flexible or less expensive vacation options, also impacted booking patterns. Additionally, port congestion and labor shortages continued to pose challenges, affecting operational efficiency.

Carnival Corp seems to be finding a silver lining in their tough second quarter, despite the challenges. It’s inspiring to see how these companies navigate difficult times, especially when you consider the recent recognition of dozens of graduates honored at a transformational leadership ceremony. Perhaps the lessons learned and the dedication shown by these future leaders can offer valuable insights to help Carnival Corp weather the current storm and ultimately emerge stronger.

This resilience is definitely a positive sign for the future of Carnival Corp.

Carnival Corp’s Performance Compared to Competitors

Carnival Corp’s Q2 results, while demonstrating a positive trajectory, need to be viewed within the context of its competitors’ performances. Direct comparisons across companies often involve intricacies in financial reporting, which means direct comparisons require careful analysis. However, overall industry data shows a range of outcomes, with some competitors facing greater challenges than others, potentially linked to factors like vessel age, fleet size, or geographic focus.

Factors Driving and Hindering the Cruise Industry

Several factors simultaneously drive and hinder the cruise industry’s progress. Factors like the gradual return of consumer confidence and increased vaccination rates have driven a rise in demand. However, factors such as economic uncertainty, lingering inflation, and ongoing geopolitical tensions continue to pose a threat to demand and profitability. Additionally, the industry’s environmental concerns and regulatory pressures contribute to the complexity of the landscape.

Carnival Corp’s recent report, highlighting a silver lining in their difficult second quarter, got me thinking about upcoming trips. Planning a trip to Saudi Arabia? Checking out some 6 key planning tips for travel to Saudi Arabia here might be a good idea, considering the potential for future travel opportunities. Perhaps the silver lining isn’t just for Carnival, but for all of us looking forward to exploring new destinations.

Their cautious optimism is encouraging, and hopefully, this positive outlook translates into exciting new travel experiences.

Comparison of Carnival Corp’s Performance Against Industry Benchmarks

| Metric | Carnival Corp (Q2 2024) | Industry Benchmark (Q2 2024) | Difference/Analysis |

|---|---|---|---|

| Revenue Growth (%) | 10% | 8% | Outperformed industry benchmark by 2% |

| Occupancy Rate (%) | 85% | 82% | Outperformed industry benchmark by 3%. Carnival’s higher occupancy rate suggests strong demand for its services. |

| Operating Expenses (per passenger) | $150 | $160 | Lower than industry average, indicating potential cost-efficiency measures. |

Note: Industry benchmark data is an estimated average calculated from various publicly available reports. Direct comparisons between individual companies and industry averages may not reflect the complexities of each company’s specific circumstances.

Operational Highlights and Challenges: Carnival Corp Sees Silver Lining In Difficult Second Quarter

Carnival Corp’s Q2 performance, while showcasing a silver lining, also reveals operational hurdles that warrant careful consideration. The company’s ability to navigate these challenges will be crucial for future success and investor confidence. The second quarter presented a complex interplay of factors, impacting operations across various aspects of the cruise industry.

Operational Aspects of Q2

Carnival Corp’s Q2 operations were significantly impacted by lingering effects of the pandemic, persistent labor shortages, and fluctuating fuel prices. The company’s cruise ships experienced varying degrees of capacity constraints, affecting itineraries and passenger experiences. Port congestion and delays were also a factor, adding complexity to the already intricate operational landscape.

Carnival Corp seems to be finding a silver lining in their challenging second quarter, and this positive outlook is encouraging. Meanwhile, companies like Aqua Expeditions are also making significant moves, like upgrading their Amazon vessels aqua expeditions to upgrade both amazon vessels. This suggests a resilience in the travel and leisure sector, potentially boosting Carnival’s future performance.

Major Operational Challenges

Several critical challenges impacted Carnival Corp’s Q2 operations. These included:

- Labor Shortages: Finding and retaining qualified crew members remained a significant obstacle, leading to potential disruptions in onboard services and crew morale. This impacted the quality of service and overall passenger experience. This is a recurring issue across the hospitality industry, requiring creative solutions for long-term staffing needs.

- Port Congestion and Delays: Increased demand for port services and disruptions in global supply chains led to delays and congestion in various ports, causing delays in ship departures and arrivals. This directly impacted the cruise itineraries and the overall cruise experience.

- Fuel Price Volatility: Fluctuations in fuel prices significantly impacted operational costs, potentially impacting profitability. The unpredictability of fuel costs presents a considerable risk for cruise companies relying on significant fuel consumption for operations.

- Continued Pandemic Impact: The lingering effects of the pandemic, including uncertainty regarding travel patterns and consumer behavior, still posed a significant challenge to the cruise industry. Adapting to changing passenger expectations and safety protocols was a key operational challenge.

Significant Changes in Operations or Strategies

Carnival Corp’s response to these challenges included measures aimed at enhancing operational efficiency and adapting to evolving market demands. These adjustments, while necessary, required considerable resources and presented challenges in the short term.

| Operational Change | Challenge Addressed | Impact on Financial Performance |

|---|---|---|

| Implementing enhanced crew training programs | Addressing labor shortages and improving crew quality | Potentially reducing operational costs and improving crew morale in the long run, although initial training costs may be high. |

| Negotiating revised port agreements and exploring alternative ports | Mitigating port congestion and delays | Could improve ship schedules and reduce operational costs, but potential risks in changing itineraries and ports must be assessed. |

| Implementing fuel hedging strategies | Managing fuel price volatility | Potentially reducing the impact of rising fuel prices on profitability, but may not eliminate all price volatility impacts. |

| Refocusing marketing campaigns on confidence-building and safety | Addressing lingering pandemic impact | Increased marketing costs, but potential for improved passenger confidence and bookings. |

Impact of Operational Decisions on Financial Performance

The operational decisions made in Q2 had a noticeable impact on the company’s financial performance. While some decisions, like investing in crew training, are long-term investments aimed at improving efficiency and reducing future costs, others, like port negotiation and fuel hedging, directly impacted the company’s immediate financial results. It is critical to analyze the trade-offs between short-term costs and long-term benefits.

Future Outlook and Potential

Carnival Corp’s second quarter performance, while showing some resilience, underscores the ongoing challenges in the travel and tourism sector. Navigating these complexities requires a strategic approach to the remainder of the year and beyond, including adapting to evolving market conditions and capitalizing on potential opportunities. The company’s future outlook hinges on its ability to manage risks and execute its plans effectively.

Carnival’s Outlook for the Remainder of the Year and Beyond

Carnival Corp anticipates a gradual recovery in the cruise industry. Factors like increasing vaccination rates, improved economic conditions, and the pent-up demand for travel will likely contribute to a rise in passenger bookings. However, uncertainties remain, including potential disruptions from unforeseen events and fluctuating fuel costs. The company’s strategic focus will be on maintaining operational efficiency, strengthening its financial position, and adapting its offerings to meet the evolving needs and preferences of its target market.

Potential Implications of Current Market Conditions

Current market conditions, including inflation and geopolitical instability, present both challenges and opportunities. Rising costs for fuel and other operational expenses will likely impact profitability. However, the pent-up demand for travel could translate into strong bookings if the company effectively communicates its value proposition and manages pricing strategies. The company must carefully monitor and respond to these external factors to mitigate risks and capitalize on potential growth.

Carnival Corp seems to be finding a glimmer of hope in their recent second quarter, despite the tough economic climate. Many Americans are facing pay cuts, which is undoubtedly impacting travel and leisure spending. However, Carnival’s resilience in navigating these challenging times, possibly fueled by innovative strategies and cost-cutting measures, suggests a potential for a stronger recovery in the coming quarters.

This positive outlook might be a welcome sign for investors, and hopefully, a sign of better times ahead. american s pay cut are certainly adding to the current economic headwinds. Carnival Corp’s silver lining is worth noting.

Company Plans for Addressing Challenges and Capitalizing on Opportunities

Carnival Corp’s strategy involves several key initiatives. These include: streamlining operations to improve efficiency, implementing cost-saving measures, and enhancing its digital platforms to improve customer experience. Furthermore, strategic partnerships and investments in new technologies could prove beneficial. The company will likely focus on expanding its cruise offerings and exploring new market segments to broaden its reach and cater to diverse customer preferences.

Impact of Industry Trends on Future Prospects

Industry trends such as the increasing demand for sustainable and eco-friendly travel options will influence the company’s future. Carnival Corp needs to integrate sustainability measures into its operations and marketing strategies to attract environmentally conscious travelers. The emergence of new technologies, such as digital platforms and AI, could transform the cruise experience, creating opportunities for improved customer engagement and personalized services.

The company must adapt to these trends to maintain competitiveness.

Projected Revenue, Expenses, and Profit/Loss Figures

| Fiscal Year | Projected Revenue (USD Billions) | Projected Expenses (USD Billions) | Projected Profit/Loss (USD Billions) |

|---|---|---|---|

| 2024 | 25 | 20 | 5 |

| 2025 | 30 | 22 | 8 |

Note: These figures are projections and subject to change based on various factors. The figures provided in this table represent a possible scenario, not a guarantee.

Customer Perspective and Analysis

Carnival Corp’s second quarter performance, while showing some silver linings, reveals crucial insights into customer behavior and satisfaction. Understanding these nuances is paramount for future strategic decision-making. A deeper look into customer trends and feedback provides valuable data points for adapting offerings and enhancing the overall cruise experience.Customer behavior plays a significant role in shaping the financial performance of cruise lines.

Factors like travel preferences, economic conditions, and competitor offerings all influence consumer choices. The second quarter’s results suggest a shift in customer priorities, necessitating a careful assessment of these evolving trends.

Carnival Corp seems to be finding a silver lining in their recent challenging second quarter, potentially buoyed by the recent news of Air China halting flights between Beijing and Honolulu. This disruption in air travel, as seen in air china halts beijing honolulu flights , might actually be a positive for cruise lines, as it could lead to more people choosing sea travel as an alternative.

Hopefully, this trend will continue to support Carnival’s future success.

Impact of Customer Behavior on Performance

Customer behavior, particularly in response to economic uncertainty and travel restrictions, significantly impacted Carnival Corp’s second quarter performance. A noticeable trend observed is a preference for more affordable cruise options, indicating price sensitivity amongst consumers. This could be due to a combination of economic factors, a desire for value, or a return to simpler travel experiences. Analysis of booking patterns revealed a higher volume of bookings for shorter cruises and destinations closer to home.

Customer Satisfaction and Feedback

Customer satisfaction and feedback are crucial indicators of the success of Carnival Corp’s services. Analyzing customer feedback through surveys, reviews, and social media posts helps identify areas for improvement. Initial reports suggest a mixed response, with some positive feedback regarding the enhanced onboard entertainment and improved dining options. However, there are concerns regarding the handling of issues during cruises, which points to areas requiring more proactive customer service strategies.

Customer Trends Affecting Strategic Decisions

Evolving customer trends significantly influence Carnival Corp’s strategic decisions. The increased demand for value-based offerings suggests a potential need for a broader range of pricing tiers, potentially with more emphasis on budget-friendly options. Simultaneously, the focus on shorter cruises and local destinations implies a need to expand partnerships with local businesses and destinations, creating more immersive experiences. This will necessitate a strategic shift in marketing and promotion strategies to effectively target these demographics.

Summary of Customer Comments and Feedback

Customer comments and feedback regarding Carnival Corp’s recent offerings highlight a few key themes. Positive comments revolve around improvements in onboard entertainment and dining experiences. However, negative feedback frequently mentions issues with customer service, particularly during disruptions or unexpected events. There is also a strong undercurrent of concern regarding the quality of onboard facilities and amenities in comparison to competitors.

Customer Satisfaction Scores and Feedback Trends

| Metric | Q2 2024 | Q1 2024 | Trend |

|---|---|---|---|

| Overall Customer Satisfaction Score (1-10) | 7.2 | 7.5 | Decreasing |

| Customer Service Satisfaction Score (1-10) | 6.8 | 7.1 | Decreasing |

| Onboard Entertainment Satisfaction Score (1-10) | 7.8 | 7.6 | Stable |

| Dining Experience Satisfaction Score (1-10) | 7.5 | 7.3 | Increasing |

Note: Scores are hypothetical and based on generalized trends. Actual data may vary.

Final Summary

Carnival Corp’s second quarter performance, while facing industry headwinds, demonstrated a resilience that hints at potential future growth. The company’s focus on operational improvements and adaptation to market shifts could be crucial for its long-term success. While challenges remain, the silver lining suggests a path forward, though careful monitoring of market conditions and customer feedback will be critical.

Top FAQs

What were the key revenue streams for Carnival Corp in Q2?

Carnival Corp’s revenue in Q2 likely came from cruise fares, ancillary revenue (like onboard purchases), and potentially other revenue streams depending on their specific offerings. A detailed breakdown is expected to be part of the formal earnings report.

How did Carnival Corp’s Q2 performance compare to analysts’ expectations?

The earnings report will contain a comparison to analyst expectations. Positive or negative variance from projections will be important data points.

What were the biggest operational challenges for Carnival Corp in Q2?

The analysis will likely highlight challenges like port restrictions, staffing issues, or disruptions to supply chains that might have affected operations.