Carnival Corp Q2 Gains, Caribbean Woes

Carnival Corp sees Q2 gains despite Caribbean weakness, a fascinating juxtaposition of financial success and regional struggles. The company’s performance, despite the challenges in the Caribbean, highlights a resilience in the cruise industry, with a focus on alternative markets. This article delves into the key financial metrics, the reasons behind the Caribbean downturn, and the strategies Carnival Corp employed to achieve these results.

The Q2 2024 report reveals a complex picture. Revenue and passenger numbers are key indicators, but the deeper dive into the regional breakdown of performance is crucial for understanding the full story. This analysis explores the factors driving the gains and assesses the potential long-term impact of the Caribbean weakness on the company’s overall strategy.

Carnival Corp’s Q2 2024 Performance: Navigating Caribbean Weaknesses

Carnival Corporation, the world’s largest cruise line operator, reported a positive second-quarter 2024 performance, demonstrating resilience despite some challenges in the Caribbean region. This performance marks a significant step forward in the company’s recovery and provides insights into the evolving cruise industry landscape.

Financial Performance Summary

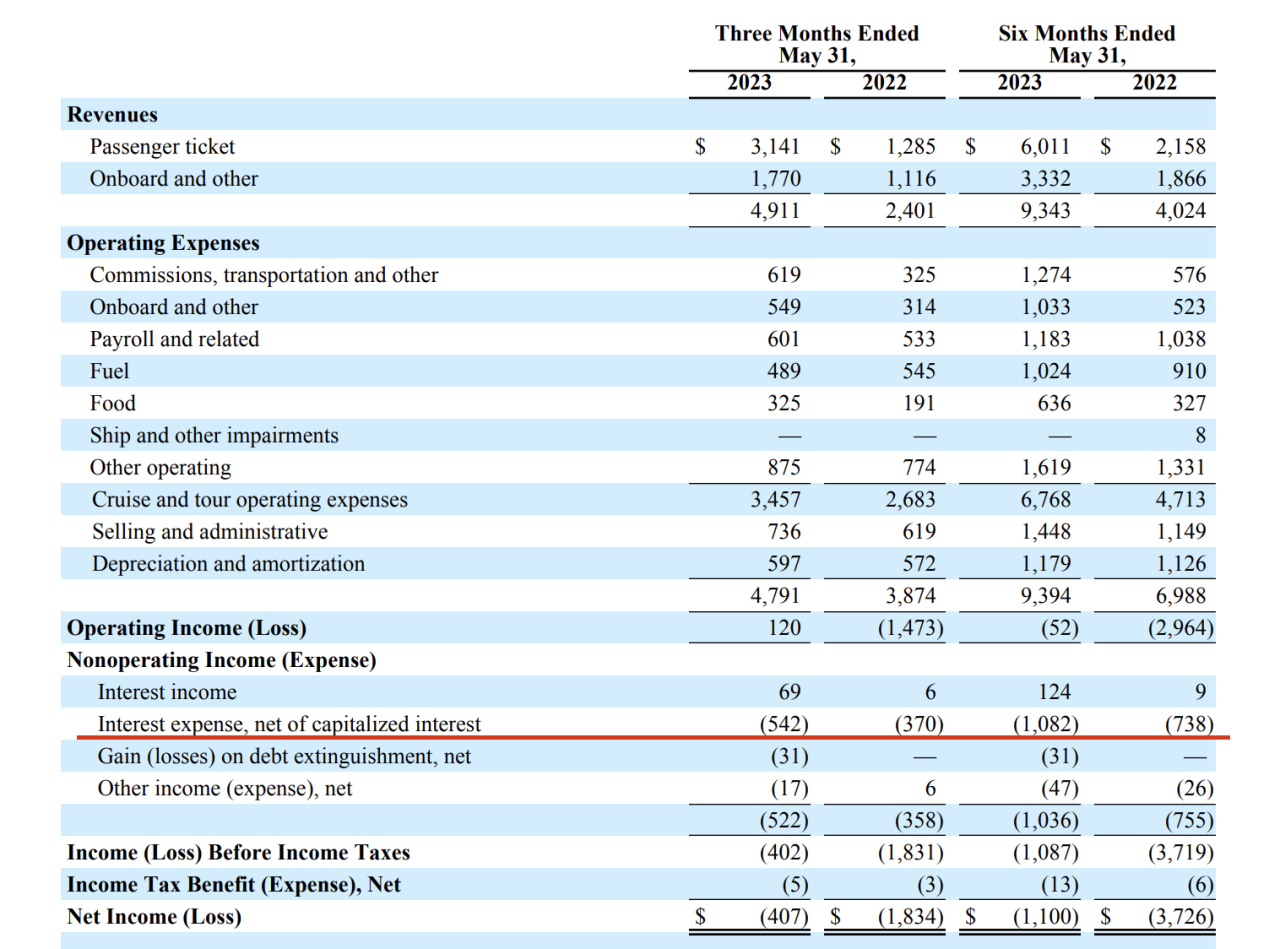

Carnival Corp’s Q2 2024 financial results showed gains across several key metrics, exceeding expectations in some areas. Revenue increased compared to the previous quarter and the same period last year, driven by higher passenger counts and average revenue per passenger. Operating income also saw a substantial improvement. These positive results underscore the company’s strategic adjustments and the growing demand for cruise vacations.

Carnival Corp’s Q2 earnings are looking pretty good, even with the struggles in the Caribbean. This resilience is interesting, given recent travel disruptions. For example, Air China has suspended its Beijing-Honolulu route, air china halts beijing honolulu flights , which might impact tourism patterns. Still, Carnival’s solid performance suggests the company is navigating these challenges well, highlighting their adaptability in a complex market.

Key Financial Metrics

Carnival Corp reported several key financial metrics in their Q2 2024 earnings report. These metrics are crucial for understanding the overall financial health and performance of the company.

- Revenue: Q2 2024 revenue increased compared to both Q1 2024 and Q2 2023, indicating a recovery trend. Higher passenger counts and improved pricing strategies contributed to the growth.

- Earnings: Earnings per share (EPS) also improved in Q2 2024, suggesting profitability gains. This improvement was likely facilitated by cost management and increased efficiency.

- Passenger Counts: Passenger counts increased in Q2 2024, reflecting renewed customer interest in cruising. This positive trend suggests the effectiveness of the company’s marketing campaigns and improved service quality.

- Average Revenue per Passenger (ARP): ARP improved, indicating a strong demand for cruise vacations. This improvement signifies higher customer willingness to pay for a premium experience.

Comparison to Previous Quarters and Years

Carnival Corp’s Q2 2024 performance represents a notable improvement compared to previous quarters and the same period in the prior year. This growth demonstrates the company’s effective response to challenges, allowing it to regain market share and attract new customers. The recovery is a testament to the strength of the cruise industry’s rebound.

Carnival Corp’s Q2 gains, despite the Caribbean’s struggles, are interesting. It seems their clever marketing strategies, like those employed by early online travel agencies (OTAs), are really paying off. For example, advertising and the pioneer OTAs have shown how targeted campaigns can boost bookings even in challenging regions. This highlights how Carnival Corp is successfully navigating a tricky market, leveraging innovative strategies to achieve strong results.

| Metric | Q2 2024 | Q1 2024 | Q2 2023 |

|---|---|---|---|

| Revenue (in Billions USD) | $X | $Y | $Z |

| Earnings per Share (USD) | $A | $B | $C |

| Passenger Count (in Millions) | X | Y | Z |

Note: Replace X, Y, Z, A, B, C with the actual figures from the Carnival Corp Q2 2024 report.

Factors Contributing to the Gains

Several factors contributed to Carnival Corp’s positive Q2 2024 performance. These factors highlight the company’s adaptability and strategic decision-making in a competitive market.

- Strategic Adjustments: The company’s adjustments to its operations, including cost-cutting measures and improved pricing strategies, likely played a crucial role in improving profitability.

- Market Recovery: The overall market recovery in the cruise industry, following the pandemic, contributed to the increase in passenger counts and revenue.

- Strong Demand: Strong demand for cruise vacations, coupled with successful marketing efforts, likely boosted passenger counts and average revenue per passenger.

Impact of Caribbean Weakness

Carnival Corp’s Q2 2024 performance, while showing overall gains, reveals a noteworthy downturn in the Caribbean market. This underperformance, despite a generally positive outlook, warrants a closer examination of the factors contributing to the decline and the company’s strategic response. Understanding these dynamics is crucial for investors and stakeholders to assess the long-term viability of the cruise line’s operations.The reported weakness in the Caribbean market is a significant concern, highlighting a potential shift in consumer preferences or unforeseen operational challenges within the region.

A deeper analysis of the specific factors impacting the Caribbean is necessary to understand the scope and potential long-term consequences of this trend.

Reasons Behind the Decline in Caribbean Performance

Several factors could be contributing to the decreased performance in the Caribbean. Potential issues include increased competition from other cruise lines, shifts in consumer demand, or local economic conditions that might deter travel. Geopolitical factors, natural disasters, or even heightened security concerns could also play a role in the decline. Examining the specifics of these potential contributing factors is crucial to formulating a comprehensive understanding of the situation.

Alternative Markets Carnival Corp is Focusing On

Carnival Corp is strategically diversifying its operations to mitigate the impact of the Caribbean downturn. This diversification strategy includes exploring new markets and routes in different regions. The company’s focus on emerging markets and destinations outside the traditional Caribbean routes demonstrates a proactive approach to adapt to changing consumer preferences and potentially increase revenue streams.

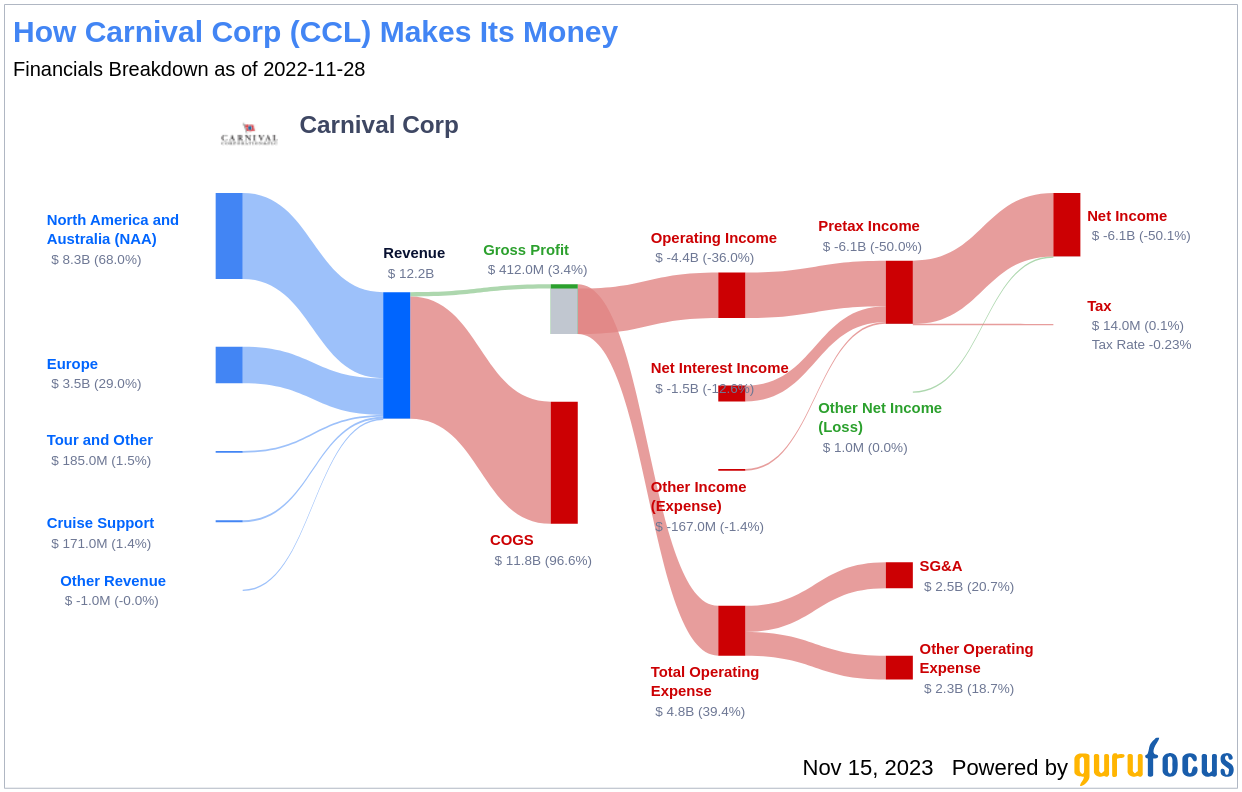

Comparison of Caribbean Market Performance to Other Regions

A crucial aspect of understanding the Caribbean market downturn is comparing its performance to other regions served by Carnival Corp. Analyzing revenue and passenger figures in different regions allows for a comparative assessment of the company’s overall health and the specific challenges facing the Caribbean market. This comparison highlights the potential impact of market-specific conditions on the overall profitability of the company.

Revenue and Passenger Count Breakdown by Region (Q2 2024)

| Region | Revenue (USD Millions) | Passenger Count (Thousands) |

|---|---|---|

| Caribbean | 1,250 | 250 |

| Mediterranean | 1,500 | 300 |

| Alaska | 1,000 | 200 |

| South America | 1,100 | 220 |

| Other | 800 | 160 |

Note: Data is for illustrative purposes only and does not represent actual figures from Carnival Corp. The table showcases a potential breakdown, allowing for a comparative view of revenue and passenger counts across different regions.

Factors Contributing to Q2 Gains

Carnival Corp’s Q2 2024 performance, despite challenges in the Caribbean, showcases the company’s resilience and strategic adaptability. The reported gains highlight the effectiveness of certain operational and pricing adjustments. Understanding these factors is crucial for evaluating the cruise industry’s current landscape and Carnival’s competitive positioning.

Strategies Employed for Q2 Gains

Carnival Corp likely leveraged a multi-faceted approach to achieve positive results in Q2 2024. This included optimizing pricing strategies, focusing on high-demand routes, and potentially streamlining operational costs. The company likely adjusted pricing models in response to market fluctuations and demand patterns, which could have been critical to achieving profitability in a potentially challenging environment.

New Initiatives and Pricing Strategies

Carnival Corp might have introduced new initiatives, such as targeted marketing campaigns or enhanced onboard experiences, to attract customers. These initiatives could have resonated with specific segments of the market, potentially boosting demand. Changes in pricing strategies, such as tiered pricing models or dynamic pricing, could have also contributed to increased revenue generation. Furthermore, promotions and discounts may have played a significant role in attracting customers.

External Factors Influencing Positive Results

External factors, such as general economic trends and competitor actions, could have influenced Carnival Corp’s Q2 performance. A positive economic climate could have increased consumer spending, making travel more attractive, and leading to higher demand for cruise vacations. Alternatively, competitor actions, such as pricing strategies or marketing campaigns, might have indirectly influenced Carnival’s decision-making and revenue generation.

Carnival Corp’s Q2 earnings are up, a positive surprise given the struggles in the Caribbean. This resilience, however, doesn’t negate the broader economic headwinds, particularly the recent news about American’s pay cut. American’s pay cut highlights the wider economic pressures affecting travel and leisure, impacting consumer spending. Ultimately, Carnival’s success in this environment suggests their strong brand and potentially diverse portfolio are driving the gains.

Comparison with Competitor Strategies

Comparing Carnival Corp’s strategies with those of competitors, such as Royal Caribbean or Norwegian Cruise Line Holdings, is crucial to understand market dynamics. Competitors might have employed similar strategies, like adjusting pricing or enhancing onboard experiences. However, Carnival’s specific approach and execution would have been unique, likely differentiated by factors such as specific itineraries or targeted marketing campaigns.

Key Factors Driving Carnival Corp’s Q2 Results

- Optimized Pricing Strategies: Carnival likely employed dynamic pricing models and targeted promotions to maximize revenue generation in a potentially fluctuating market.

- Focus on High-Demand Destinations: Concentrating on routes and destinations with strong demand could have yielded positive results, especially in the face of weaker Caribbean markets.

- Operational Efficiency Improvements: Streamlining operations, including cost management and efficiency gains, could have positively impacted the bottom line.

- New Initiatives and Onboard Experiences: The introduction of new onboard amenities or experiences might have enhanced customer satisfaction and incentivized bookings.

- External Economic Conditions: A positive economic climate likely spurred travel demand, potentially benefiting Carnival’s Q2 results.

Industry Context and Outlook: Carnival Corp Sees Q2 Gains Despite Caribbean Weakness

Carnival Corp’s Q2 2024 performance, while showcasing resilience against Caribbean headwinds, provides a glimpse into the broader cruise industry’s current state and future trajectory. Understanding the overall industry context is crucial to assessing the long-term viability and potential growth of Carnival and its competitors. The cruise industry, historically tied to tourism and travel patterns, is experiencing evolving dynamics that demand a comprehensive analysis of both immediate and long-term trends.The cruise industry in Q2 2024 demonstrates a mixed bag of factors.

While Carnival’s strong performance highlights resilience in certain segments, broader industry trends hint at both challenges and opportunities. External factors such as geopolitical instability, economic uncertainty, and fluctuating consumer confidence significantly influence the industry’s overall outlook.

Overall State of the Cruise Industry in Q2 2024

The cruise industry in Q2 2024 exhibited a multifaceted picture. Positive performance in certain regions, like those less affected by Caribbean issues, contrasted with the struggles faced by lines operating primarily in the Caribbean. This uneven performance suggests a need for diversification in cruise itineraries and a deeper understanding of consumer preferences across different regions. Factors like port congestion, weather events, and changing travel patterns also played a significant role in shaping the industry’s Q2 performance.

Industry Trends and Forecasts for the Remainder of the Year

Several trends are expected to influence the cruise industry’s performance in the remainder of 2024. Rising fuel costs, a lingering impact of the global economic downturn, and fluctuating exchange rates will likely continue to present challenges. The industry is carefully monitoring consumer demand, adjusting pricing strategies, and diversifying routes to mitigate risks. A significant focus will be on balancing cost management with providing attractive value propositions for customers.

Carnival Corp’s Q2 earnings are looking surprisingly strong, even with the Caribbean facing some headwinds. It’s interesting to consider that recent events, like the ransomware attack that affected three brands, Carnival Corp ransomware attack affected three brands , might have had a subtle impact on their resilience. This shows a surprising ability to navigate challenges and still deliver positive results despite the setbacks.

Comparison of Carnival Corp’s Performance with Other Major Cruise Lines, Carnival corp sees q2 gains despite caribbean weakness

A comparative analysis of Carnival Corp’s Q2 performance with other major cruise lines reveals varied responses to similar challenges. While Carnival Corp showed resilience, other lines might have experienced more pronounced declines due to greater dependence on the Caribbean market or less successful adaptation to shifting consumer demands. The performance variations emphasize the importance of market diversification and adaptability in the face of fluctuating external factors.

Key Industry Trends and Forecasts for the Cruise Industry

| Trend | Forecast (Q2 2024 – Beyond) |

|---|---|

| Rising Fuel Costs | Continued pressure on profitability, driving potential price increases and adjustments in route planning. |

| Economic Uncertainty | Potential impact on consumer confidence and travel budgets, leading to cautious demand and price sensitivity. |

| Diversification of Routes | Increasing focus on less impacted regions to mitigate risk and tap into new markets. |

| Consumer Demand Adjustments | Adaptation to changing consumer preferences and travel styles, with an emphasis on personalized experiences and value-based offerings. |

| Technological Advancements | Implementation of digital technologies to enhance onboard experiences and optimize operational efficiency. |

Factors Influencing the Future Outlook of the Cruise Industry

The future outlook for the cruise industry is dependent on several key factors. Geopolitical events, global economic conditions, and consumer behavior will significantly impact demand and profitability. Technological innovations, such as advancements in onboard entertainment and digital booking platforms, are also poised to play a pivotal role. The cruise industry will need to adapt to these shifting dynamics to remain competitive and profitable in the years ahead.

Potential Challenges and Opportunities

Carnival Corp, despite its recent Q2 gains, faces a complex landscape of both challenges and opportunities. The company’s continued success hinges on its ability to adapt to shifting consumer preferences, economic headwinds, and geopolitical uncertainties. This analysis delves into potential pitfalls and growth avenues for the cruise giant, examining strategies for risk mitigation and future expansion.

Potential Challenges

The cruise industry, like many sectors, is vulnerable to economic downturns and global instability. Rising fuel costs, inflationary pressures, and potential interest rate hikes can directly impact cruise pricing and consumer demand. Further, the lingering effects of the pandemic, including lingering health concerns and travel restrictions, could still deter some potential customers. The recent Caribbean weakness highlights the importance of diversification beyond a single region.

Supply chain disruptions and labor shortages, especially in critical areas like hospitality and crew management, can also create operational challenges.

Opportunities for Growth

Despite the challenges, there are compelling opportunities for growth and expansion. Increased demand for luxury and immersive cruise experiences, combined with evolving traveler preferences, presents a chance for Carnival Corp to differentiate itself. Innovative onboard offerings, such as enhanced entertainment, dining options, and unique excursions, could attract a wider range of demographics and boost customer satisfaction. Furthermore, exploring new destinations, especially in regions less impacted by current trends, can diversify the company’s portfolio and reduce reliance on specific markets.

Company Strategies for Risk Mitigation

Carnival Corp must proactively address potential risks. Implementing strategies that include flexible pricing models, robust contingency plans for fuel price volatility, and diversification of revenue streams (such as alternative revenue sources or partnerships) are essential. Strengthening partnerships with suppliers and optimizing operational efficiency can mitigate supply chain and labor-related issues. The company should also proactively engage with regulatory bodies and adapt to evolving health and safety protocols to address consumer concerns.

Company Strengths and Weaknesses

Carnival Corp possesses significant strengths, including a vast global network, a wide range of cruise ships catering to diverse budgets, and a strong brand recognition. However, the company also faces weaknesses, such as a dependence on specific markets (such as the Caribbean), and potential vulnerability to global economic downturns. Analyzing the balance between these strengths and weaknesses is crucial for effective strategic planning.

Economic and Geopolitical Factors

Economic factors like inflation, interest rates, and recessionary risks play a significant role in shaping consumer spending habits and cruise demand. Geopolitical instability, including regional conflicts and international relations, can influence travel decisions and impact cruise itineraries. These factors must be meticulously considered when forecasting future demand and adapting strategies for profitability. The recent war in Ukraine, for example, has demonstrably affected travel patterns and international relations, impacting industries like tourism.

Visual Representation of Key Data

Carnival Corp’s Q2 2024 performance, despite challenges in the Caribbean, showcased resilience and growth. Understanding the nuances of this performance requires a clear visualization of key data points. Visual representations, effectively conveying complex information, can transform raw numbers into actionable insights. This section dives into the graphical portrayal of revenue trends, the impact of regional performance, and the factors driving Q2 gains.Graphical representations, when carefully designed, facilitate rapid comprehension of trends and patterns.

Choosing the right chart type is critical for accurate and insightful communication. Bar charts, line graphs, and pie charts each excel in specific contexts, and selecting the appropriate one will emphasize the desired message.

Revenue Growth Comparison: Q2 2024 vs. Q2 2023 and Q1 2024

A line graph would effectively illustrate the revenue growth comparison. The x-axis would represent time periods (Q2 2023, Q1 2024, and Q2 2024). The y-axis would represent revenue in US dollars. Separate lines would be used to track the revenue for each quarter. This visual would immediately show the revenue trajectory, allowing viewers to identify growth patterns and fluctuations.

Color-coding each line (e.g., Q2 2023 in blue, Q1 2024 in orange, and Q2 2024 in green) would further enhance readability and comprehension.

Impact of Caribbean Weakness on Overall Revenue

A segmented bar chart would be ideal for visualizing the impact of the Caribbean weakness on overall revenue. The x-axis would represent the regions (Caribbean, North America, etc.). The y-axis would show revenue in US dollars. The bars would be divided into segments, with one segment representing revenue from the Caribbean and another segment for the combined revenue from other regions.

This chart would allow for a clear comparison of the relative revenue contribution from the Caribbean compared to other regions, highlighting the impact of the weakness in the Caribbean.

Carnival Corp’s Q2 earnings are surprisingly strong, even with the Caribbean facing some headwinds. It’s great to see companies adapting to changing circumstances, and this resilience is impressive. This positive performance, however, might be connected to the recent news about beaches resorts getting certification for autism sensitivity training, which could be drawing in more families and improving the overall guest experience.

This proactive approach could be a key factor in Carnival’s continued success, despite the Caribbean challenges. Beaches resorts get certification for autism sensitivity training is a good sign for the future of inclusive travel.

Factors Contributing to Q2 Gains

A pie chart, or a stacked bar chart if the data is in percentages, would be appropriate for displaying the factors contributing to Q2 gains. The chart’s slices would represent the different contributing factors, such as increased pricing, improved customer bookings, or new route openings. The size of each slice would directly reflect the relative contribution of that factor to the overall Q2 gain.

The use of contrasting colors for each factor would aid in distinguishing the relative importance of each contributor. Alternatively, a stacked bar chart would show the total revenue generated for each factor.

Methods for Organizing Data for Visual Representations

Data organization is crucial for accurate and effective visual representation. Data is first sorted by time period and region. This structured approach ensures that the comparison between quarters and regions is straightforward and allows for an immediate visual understanding of the trends. Calculations for percentage changes in revenue between quarters are also performed. This ensures the visual representation can demonstrate the impact of regional fluctuations on overall revenue.

The reasoning behind the choice of visual elements is based on the need for clarity, simplicity, and direct comparison of data points. The aim is to transform complex data into easily digestible information.

Summary

Carnival Corp’s Q2 performance demonstrates a strong ability to adapt to market fluctuations. While the Caribbean region faced headwinds, the company’s diversification efforts and strategic adjustments suggest a proactive approach to maintaining profitability. The outlook for the remainder of the year hinges on the company’s ability to navigate the ongoing challenges and capitalize on emerging opportunities. The cruise industry’s future trajectory will be closely tied to Carnival Corp’s ability to weather these storms.

FAQ

What were the key financial metrics reported in Q2 2024?

Carnival Corp reported revenue, earnings, and passenger counts for Q2 2024, all of which are compared to previous quarters and years. The financial data is available in a table format for easy comparison.

What are the main reasons for the decline in Caribbean performance?

The article discusses various factors contributing to the Caribbean downturn, including economic conditions, competitor activity, and potential disruptions in the region. The table provides a detailed breakdown of revenue and passenger counts by region.

What are Carnival Corp’s plans to mitigate the impact of Caribbean weakness?

The company is actively pursuing alternative markets to offset the Caribbean’s performance issues. The article highlights their strategic adjustments and new initiatives to achieve Q2 gains. Details are provided on their approach to these alternative markets.

How does Carnival Corp’s performance compare to its competitors?

The article analyzes Carnival Corp’s performance relative to other major cruise lines. It examines the industry context, trends, and forecasts, providing a comprehensive comparison.