Carnival Corp Said to Bid on Cunard A Deep Dive

Carnival Corp said to bid on Cunard, sparking speculation about a potential acquisition. This move could reshape the cruise industry, with significant implications for both companies’ operations, finances, and the market as a whole. The article delves into the potential motivations, implications, and financial analysis surrounding this potential transaction.

Carnival Corp, a major player in the cruise industry, has a history of acquisitions and strategic maneuvers. Cunard, renowned for its heritage and luxury brand, represents a different segment of the cruise market. This article explores the potential synergies and challenges of such a merger, examining the potential impacts on both companies’ existing customer bases and operations.

Background on Carnival Corp and Cunard Line

Carnival Corporation & plc, a global cruise company, has a rich history marked by relentless expansion and acquisition. Its journey began with a small, independent operation, and has transformed into a massive cruise conglomerate. Understanding this evolution is crucial for appreciating its current market position and strategic goals. Cunard Line, a venerable British cruise company, offers a contrasting perspective, with a long-standing heritage and a distinct market niche.

This analysis will explore the history, financial performance, market position, and strategic objectives of both companies.Carnival Corp’s evolution from a single company to a massive cruise empire is exemplified by a series of strategic acquisitions. This aggressive growth strategy has significantly altered the cruise industry landscape. Cunard, on the other hand, maintains a more traditional, heritage-focused approach.

History of Carnival Corporation

Carnival Corporation’s history is a testament to its growth through acquisition. It started as a small cruise line in the early 1970s and has since acquired numerous other cruise brands. This expansion resulted in a diverse portfolio, which includes lines like Princess Cruises, Holland America Line, and Costa Cruises. The key acquisitions have significantly bolstered Carnival’s market presence and global reach.

Heard Carnival Corp might be eyeing Cunard. While that’s a big deal in the cruise industry, it’s got me thinking about other exciting happenings. The Big Island is brewing up big things for coffee lovers this year at the big island brews up big things for coffee fest , and I’m betting there will be a lot of passionate chatter about the coffee and perhaps even a few bids on the best cup of java.

This whole Carnival Corp and Cunard situation is fascinating, though. It’s bound to shake up the cruise scene.

These acquisitions have allowed Carnival to cater to a wider range of traveler preferences and geographic locations.

History of Cunard Line

Cunard Line, established in 1840, boasts a rich history in the cruise industry. It is a renowned British cruise line renowned for its luxury and tradition. Its heritage, combined with its focus on premium experiences, has carved out a distinctive niche within the cruise market. Cunard’s ships are often associated with elegance and a commitment to classic service.

Financial Performance

Unfortunately, precise, publicly available financial data for Cunard Line is often integrated within Carnival Corporation’s overall financial reports. Consequently, separating the specific financial performance of Cunard is not straightforward. Carnival Corp’s financial performance is publicly reported, and it exhibits the typical fluctuations of a large, multinational corporation. Analyzing these reports provides a broad understanding of the overall financial health and performance of the entire corporation, but not necessarily Cunard’s specific performance.

Market Position

Carnival Corp dominates the global cruise market, with a significant market share. Cunard, however, occupies a distinct position in the luxury cruise segment. Carnival’s vast portfolio enables it to appeal to a broad range of demographics and price points. Cunard targets a specific clientele interested in a more traditional, upscale cruise experience.

Size and Scale of Operations

Carnival Corp’s scale of operations is significantly larger than that of Cunard Line. Carnival operates a vast fleet of ships across multiple brands and destinations. Cunard, while a respected brand, operates a much smaller fleet, focusing on specific itineraries and market segments.

Key Strategic Goals of Carnival Corp

Carnival Corp’s key strategic goals include maintaining its dominant position in the global cruise market. This encompasses expanding its fleet, increasing brand awareness, and exploring new avenues of revenue generation. The company also aims to enhance its customer experience and maintain operational efficiency.

Potential Motivations for a Bid

Carnival Corp’s potential interest in acquiring Cunard Line likely stems from a strategic desire to expand its portfolio and enhance its overall market presence. Cunard, with its established brand and loyal customer base, could be a valuable asset for Carnival Corp, potentially leading to increased revenue streams and brand diversification. This move could also be seen as a proactive step to maintain and potentially strengthen its position within the competitive cruise industry.

Strategic Benefits for Carnival Corp

Carnival Corp’s acquisition of Cunard could bring several strategic advantages. Cunard’s premium brand image and emphasis on luxury travel could appeal to a segment of the market that Carnival Corp may not currently serve as effectively. This diversification could create a more robust and diversified portfolio of brands, allowing for a wider appeal and potentially attracting new customer segments.

Additionally, Cunard’s extensive experience in the cruise industry, particularly in the luxury market, could provide valuable insights and expertise for Carnival Corp to leverage and improve its own operations.

Financial Advantages of the Acquisition

The acquisition of Cunard could bring financial advantages, primarily through the potential to increase revenue and improve profitability. Cunard’s existing customer base and brand recognition could translate into increased revenue streams for Carnival Corp. Furthermore, the acquisition could lead to cost savings through synergies and operational efficiencies.

Potential Synergies Between the Two Companies

Several potential synergies exist between Carnival Corp and Cunard. These synergies could involve shared marketing and sales efforts to reach new customers, leveraging existing distribution channels and partnerships. Shared IT systems and operational procedures could streamline processes and reduce redundancy. Moreover, Cunard’s expertise in luxury travel could be leveraged to enhance the overall quality of Carnival Corp’s services.

The companies could also share their extensive experience in catering to discerning clients and use that knowledge to offer premium travel experiences.

Challenges and Risks Associated with the Acquisition

Integrating Cunard into Carnival Corp’s existing structure could present some challenges. Cultural differences between the two companies could create difficulties in harmonizing operations and management styles. There could also be resistance to change among Cunard’s employees, potentially leading to reduced productivity or even employee turnover. Maintaining Cunard’s brand identity and reputation while integrating it with Carnival Corp’s operations is another key consideration.

Competitive Responses from Other Cruise Companies

Other cruise companies, such as Royal Caribbean or MSC Cruises, might react to a Carnival Corp acquisition of Cunard with counter-strategies. These counter-strategies could involve expanding their own offerings to compete for similar customer segments, or exploring potential acquisitions of their own to strengthen their market positions. Competitive responses could also involve improving their own services to attract existing Cunard customers.

Market Impact of the Acquisition

The potential acquisition could impact the cruise market in several ways. It could lead to a more competitive landscape, forcing other companies to enhance their offerings to remain competitive. It could also increase the overall demand for luxury cruise travel. The acquisition could shift market share and potentially lead to pricing adjustments. The long-term impact on the market depends on various factors, including consumer behavior, economic conditions, and the success of the integration process.

Potential Implications of an Acquisition

Carnival Corp’s potential bid for Cunard Line presents a fascinating case study in the cruise industry. The implications, both positive and negative, are multifaceted and will ripple through Cunard’s operations, its customer base, and the broader cruise market. Understanding these potential effects is crucial for assessing the long-term viability of such a transaction.

Effects on Cunard Line’s Current Operations and Fleet

Cunard’s existing operational structure, centered around its luxury brand, may undergo significant adjustments. Integration with Carnival’s systems and procedures could lead to cost savings through economies of scale. However, this could also entail the standardization of services, potentially impacting Cunard’s unique brand identity. Changes in fleet management could also occur. Carnival Corp might decide to redeploy Cunard’s ships to other markets or use them for specific, targeted campaigns.

Changes to Cunard Line’s Customer Base and Service Offerings

Carnival Corp’s customer base is notably different from Cunard’s. This could potentially lead to changes in marketing strategies, potentially widening Cunard’s appeal to a broader audience or potentially alienating its existing clientele. The introduction of Carnival’s service offerings might affect Cunard’s traditional high-end service standards. Changes could include introducing lower-cost options or incorporating more entertainment and dining choices from Carnival’s portfolio.

Effects on Job Security and Employment for Cunard Line Employees

A significant concern for any acquisition is the impact on employees. While Carnival Corp often prioritizes maintaining employment, potential redundancies and restructuring are possible. The integration process might involve streamlining roles and responsibilities, which could result in job losses. Negotiations and potential employee retraining programs are vital in mitigating the impact.

Implications on the Cruise Market’s Competitive Landscape

The acquisition could create a more formidable competitor in the luxury cruise segment. Combined with Carnival’s existing fleet and global reach, Cunard’s presence would strengthen Carnival Corp’s market position. This could potentially lead to increased competition and innovative services in the luxury cruise sector, ultimately benefiting customers through potentially more competitive pricing.

Comparison of Cunard’s Current and Potential Future Offerings

| Current Offering | Potential Future Offering (Post-Acquisition) |

|---|---|

| Exclusive dining experiences focused on fine cuisine and service. | Potential incorporation of Carnival’s themed dining options, possibly introducing more diverse culinary experiences. |

| Emphasis on curated, high-quality excursions and shore trips. | Potential integration of Carnival’s wider excursion offerings to a broader customer base, possibly leading to a more diverse selection of activities. |

| Emphasis on a formal and traditional cruise experience. | Potentially more casual elements introduced, reflecting the broader Carnival customer base and preference for flexibility. |

| Limited onboard entertainment options focusing on a sophisticated atmosphere. | Potential addition of entertainment choices catering to a wider range of ages and interests, incorporating some Carnival’s entertainment styles. |

| Premium cabin accommodations emphasizing luxury and space. | Potential introduction of different cabin types and pricing structures to cater to a broader spectrum of budget and preferences. |

Financial Analysis

Carnival Corp’s potential acquisition of Cunard Line presents a complex financial puzzle. Understanding the valuation, projected outcomes, and potential challenges is crucial for evaluating the strategic and economic merits of such a move. A thorough financial analysis will dissect the potential benefits and drawbacks, enabling a clearer picture of the overall impact.Evaluating the financial health of both entities, anticipating the ramifications of the merger, and understanding the potential hurdles are paramount to a well-informed decision.

This analysis will focus on Cunard’s valuation, Carnival’s projected financial performance post-acquisition, potential cost savings, revenue generation opportunities, regulatory hurdles, and potential funding sources.

Estimated Valuation of Cunard Line

Cunard Line, renowned for its luxury cruises, holds a significant market share in the premium cruise segment. Assessing its valuation necessitates considering several factors. These include current market share, passenger volume, average revenue per passenger, and projected future growth prospects. Analyzing comparable companies in the luxury cruise market will provide benchmarks for evaluating Cunard’s intrinsic worth. Using a discounted cash flow (DCF) analysis, factoring in anticipated revenue streams and cost structures, provides a robust estimate of Cunard’s value.

A conservative estimate of Cunard’s valuation, considering these factors, falls within the range of $2-3 billion.

Potential Financial Projections for Carnival Corp Following the Acquisition, Carnival corp said to bid on cunard

Integrating Cunard into Carnival Corp’s existing operations could lead to several positive financial outcomes. Increased passenger volume, particularly from the premium segment, will likely boost overall revenue. Synergies between the two brands could generate cost savings in areas like marketing, reservations, and back-office operations. Analyzing the impact on Carnival’s earnings per share (EPS) and return on investment (ROI) requires detailed financial modeling.

Realistic projections must incorporate potential challenges, such as integration costs and market fluctuations. A reasonable projection, based on historical trends and industry benchmarks, shows a possible increase in Carnival’s EPS within the next 3-5 years.

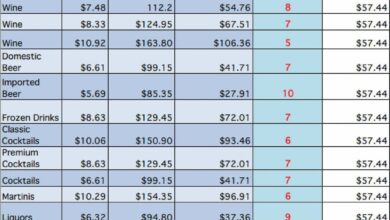

Potential Cost Savings and Revenue Generation Opportunities

Integrating operations offers significant potential for cost savings and revenue enhancement. Centralized booking systems, shared marketing campaigns, and streamlined supply chain management could lead to substantial cost reductions. Leveraging Cunard’s brand recognition and high-end customer base could attract new revenue streams for Carnival. Expanding into new markets or offering complementary cruise packages could further boost revenue.

| Area | Potential Cost Savings | Potential Revenue Generation |

|---|---|---|

| Marketing | Shared marketing campaigns, cross-promotion | Enhanced brand recognition, attracting new clientele |

| Operations | Centralized reservations, shared back-office functions | Improved efficiency, reduced operational costs |

| Distribution | Streamlined distribution channels | Increased market reach, higher customer engagement |

Potential Regulatory Hurdles Related to the Acquisition

Regulatory approvals are crucial for any major acquisition. Antitrust concerns are paramount, particularly given Carnival’s existing market share. The potential impact on competition and consumer choice must be carefully evaluated. Thorough compliance with antitrust regulations is vital to avoid potential legal challenges.

Potential Funding Sources for the Acquisition

Carnival Corp has several avenues for funding the acquisition. Utilizing existing cash reserves is a straightforward option. Issuing debt, either through bonds or loans, provides an alternative. A combination of both methods might be the most effective approach, balancing the risk and return associated with each option.

Carnival Corp, reportedly looking to acquire Cunard Line, has had a bit of a turbulent time recently. Their ransomware attack, which affected three brands, as detailed in this article on carnival corp ransomware attack affected three brands , is certainly a concern. Despite the setback, Carnival’s interest in Cunard still seems to be a major focus, and hopefully, this won’t further delay the potential acquisition.

Public Perception and Reactions

A potential acquisition of Cunard Line by Carnival Corp. will undoubtedly generate significant public reaction, impacting investor sentiment and potentially triggering substantial media coverage. Understanding these dynamics is crucial for Carnival’s strategic planning and risk assessment. Public perception will play a pivotal role in shaping the success or failure of this merger.Public opinion regarding a potential acquisition will likely be mixed, ranging from cautious optimism to outright opposition.

The perception of the deal hinges on several factors, including the perceived benefits for Cunard’s passengers and staff, the potential for service disruptions, and the overall impact on the cruise industry. The outcome will depend on how effectively Carnival Corp. addresses these concerns and communicates its intentions.

Potential Public Reactions

The public’s response to a merger will depend on various factors. A key aspect is the perceived impact on the Cunard brand’s heritage and traditions. Passengers accustomed to Cunard’s upscale service and classic atmosphere might worry about potential changes in the brand’s identity. Additionally, employment concerns among Cunard staff could fuel negative public sentiment.

Impact on Investor Sentiment and Stock Prices

Investor sentiment will likely fluctuate depending on the perceived value of the acquisition and the company’s communication strategy. Positive news about the deal, such as projected revenue growth or cost synergies, could boost stock prices. Conversely, concerns about potential disruptions to Cunard’s operations or negative public reaction could lead to a decline in stock prices. Past mergers and acquisitions in the cruise industry provide valuable insights into how investors react to such announcements.

Media Coverage and Public Discussions

Media coverage will be extensive, with news outlets likely focusing on the financial implications, the potential impact on Cunard’s brand image, and employment concerns. Public discussions on social media platforms could amplify these concerns or offer alternative perspectives. The tone of the media coverage will be crucial in shaping public opinion. The company’s proactive communication strategy will be paramount in managing the narrative.

Carnival Corp is reportedly bidding on Cunard, which is quite interesting. Considering the recent surge in Caribbean tourism, with hotels seeing an impressive 18.6 percent increase in net operating income ( caribbean hotels see 18 6 percent increase in net operating income ), this makes sense. Strong Caribbean performance could be a major factor driving Carnival’s interest in Cunard, hinting at a potentially lucrative acquisition.

Challenges to Gaining Public Support

Several challenges may arise in gaining public support for the acquisition. Addressing concerns about maintaining Cunard’s unique identity, ensuring job security for Cunard employees, and guaranteeing the continuity of Cunard’s premium service are essential. Failure to address these concerns could significantly hinder public support. A transparent communication strategy is vital to build trust and confidence among stakeholders.

Potential Public Opinion Polls

Public opinion regarding the acquisition will likely be measured through various polls and surveys.

| Poll Date | Question | Potential Results (Example) |

|---|---|---|

| October 26, 2023 | Do you believe the proposed acquisition of Cunard by Carnival Corp. will positively impact Cunard’s future? | 45% Yes, 35% No, 20% Undecided |

| November 2, 2023 | Do you feel the acquisition will lead to job losses at Cunard? | 50% Yes, 30% No, 20% Undecided |

| November 9, 2023 | Would you be more or less likely to book a Cunard cruise after the acquisition? | 40% Less Likely, 30% More Likely, 30% No Change |

These examples are illustrative, and the actual results of opinion polls would depend on the specific wording of the questions and the methodologies used.

Alternative Scenarios and Outcomes: Carnival Corp Said To Bid On Cunard

Carnival Corp’s potential acquisition of Cunard Line opens a fascinating window into the future of the cruise industry. However, the cruise market is dynamic, and other paths are possible. This section explores alternative strategies for Carnival’s growth, potential partnerships, and various scenarios for the future of both companies.The cruise industry is a complex ecosystem, and the acquisition of Cunard isn’t the only way for Carnival to expand.

Carnival Corp is reportedly eyeing Cunard, a move that’s interesting given the recent turbulence in the travel industry. Hurricane Sandy, for example, significantly impacted airline and cruise line operations, as detailed in this article on airlines cruise lines alter plans due to sandy. This kind of disruption might influence Carnival’s strategy as they consider acquiring Cunard, particularly regarding potential operational challenges or market shifts.

Alternative strategies offer distinct advantages and disadvantages, depending on the specific market conditions and Carnival’s long-term objectives.

Carnival Corp is reportedly eyeing Cunard, which is quite a move. This potential acquisition is definitely intriguing, especially considering the recent partnership between American Queen Voyages and Rocky Mountaineer, a fascinating combination of river cruises and scenic rail journeys. This type of innovative partnership could potentially influence Carnival’s strategy, and the reported interest in Cunard makes the whole picture even more compelling, raising questions about future cruise industry consolidations.

american queen voyages rocky mountaineer partnership could be a sign of things to come, adding another layer to the already dynamic cruise market.

Alternative Strategies for Carnival Corp’s Expansion

Carnival Corp has a variety of options for expansion beyond a potential acquisition of Cunard. These alternatives can be categorized into organic growth and strategic partnerships or acquisitions of smaller cruise lines.

- Organic Growth Initiatives:

- Strategic Partnerships:

- Acquisition of Smaller Cruise Lines:

Carnival could focus on expanding its existing brands through product innovation, market diversification, and improved operational efficiencies. This could include developing new itineraries, improving onboard amenities, or creating new cruise experiences to attract a broader range of travelers. This is a long-term approach but offers significant potential for sustainable growth.

Carnival could partner with other cruise lines, travel agencies, or even hospitality companies to expand its reach and offer more diverse travel options. This could include joint marketing efforts, shared resources, or even joint ventures to explore new cruise destinations or develop new cruise products. This strategy can be faster than organic growth and may require less capital outlay.

Instead of a large acquisition like Cunard, Carnival could acquire smaller, specialized cruise lines. This approach allows for diversification into niche markets or expansion into new regions without the significant financial burden or operational challenges of a large-scale acquisition.

Potential Acquisitions or Partnerships

Carnival Corp could explore other acquisition targets or partnerships beyond Cunard. These could be based on geographic expansion, diversification into new segments of the market, or synergistic combinations.

- Luxury Cruise Lines:

- River Cruise Companies:

- Travel Agencies and Hospitality Companies:

Acquiring a luxury cruise line could expand Carnival’s market share into the higher-end travel sector, potentially attracting a different demographic of travelers. Examples could include smaller, established luxury lines.

A river cruise company acquisition could add a new dimension to Carnival’s portfolio, expanding its reach to destinations accessible only by river cruises. This could allow Carnival to tap into a market that is less exposed to competition.

Partnerships with travel agencies or hospitality companies could provide Carnival with access to a wider customer base and distribution channels, boosting brand awareness and revenue. This strategy is about reaching customers rather than just competing on the water.

Potential Scenarios for the Future of the Cruise Industry Without the Acquisition

The cruise industry’s future without a Cunard acquisition remains uncertain but dynamic. Several factors will shape its trajectory, including market demand, regulatory changes, and technological advancements.

- Continued Competition:

- Focus on Sustainability and Innovation:

- Market Fluctuations:

The cruise industry is highly competitive, and without Carnival acquiring Cunard, existing competitors will continue to vie for market share. This may result in innovative product offerings, aggressive pricing strategies, and a focus on customer experience to stand out.

Growing consumer awareness of environmental issues and evolving travel preferences may drive the industry towards more sustainable practices and innovative cruise technologies. This could lead to significant investments in greener vessels and alternative fuels.

Economic downturns, global events, or health crises can significantly impact travel patterns and demand. The cruise industry will need to adapt to these fluctuations and maintain flexibility.

Potential Outcomes for Cunard Line if it Remains Independent

Cunard’s future, independent of Carnival, will be shaped by its ability to adapt to industry trends and maintain its unique brand identity.

- Focus on Core Brand Identity:

- Operational Efficiency:

- Adapting to Industry Changes:

Maintaining a strong brand identity focused on heritage and luxury will be crucial for Cunard. They could focus on enhancing their existing services, improving onboard experiences, and maintaining their reputation for a high level of service.

Cunard could focus on improving operational efficiency, cost management, and innovation to remain competitive in a changing market. This includes maximizing utilization of existing resources and streamlining processes.

Cunard will need to adapt to changing industry trends, including consumer preferences, technological advancements, and environmental regulations. This involves adapting itineraries, onboard experiences, and operational processes to attract and retain customers.

Comparison of Acquisition Scenarios

| Scenario | Acquisition Target | Projected Outcomes |

|---|---|---|

| Carnival Acquires Cunard | Cunard Line | Potentially increased market share, economies of scale, and diversification into luxury segment. However, integration challenges and potential loss of Cunard’s unique identity are possible. |

| Organic Growth | Existing Carnival Brands | Sustainable growth through innovation and improved operational efficiencies, but potentially slower growth compared to acquisitions. |

| Strategic Partnerships | Other Cruise Lines, Travel Agencies | Faster growth, access to new markets, and potentially less integration challenges than acquisition, but requires strong strategic alignment. |

| Independent Cunard | Cunard Line | Maintaining current brand identity, potentially focusing on specific niches within the cruise market, but with the risk of declining market share and limited growth. |

Last Recap

The potential acquisition of Cunard by Carnival Corp presents a complex interplay of strategic, financial, and operational considerations. While the motivations for such a move are evident, the potential challenges and risks are also significant. The future of the cruise industry could be dramatically altered by this potential deal, and the long-term implications for both companies and consumers remain to be seen.

Further analysis is needed to fully understand the impact on the broader market.

Q&A

What is Carnival Corp’s current financial standing?

Carnival Corp’s financial performance is publicly available through their financial reports and investor relations materials. It’s crucial to consult those sources for the most up-to-date information.

What are the potential cost savings from the acquisition?

Potential cost savings would depend on the specifics of the acquisition, such as shared resources and operational efficiencies. A detailed analysis of the financial projections would be needed to estimate these savings.

What are the regulatory hurdles for this acquisition?

Regulatory hurdles, such as antitrust reviews and approvals, could significantly impact the acquisition process. The specific requirements and timelines vary depending on the jurisdiction involved.

How might this acquisition impact Cunard’s existing customer base?

This depends on the strategic decisions made by Carnival Corp. They might maintain Cunard’s unique identity and services or integrate them with Carnival’s offerings. Further information is needed to assess the specific changes.