Carnival Corp Revises Princess Pursuit Offer

Carnival Corp revises offer in princess pursuit, sparking intrigue in the cruise industry. This revision marks a significant shift in the acquisition plans, raising questions about the future of Princess Cruises and potentially altering the competitive landscape. Initial terms and conditions have been adjusted, prompting analysis of the rationale behind the change and its potential impacts on both Carnival Corp and Princess Cruises.

The revised offer likely reflects evolving market conditions and financial considerations. A deeper dive into the specifics will reveal the details of the adjustments and their implications for investors and the broader cruise sector.

Background of Carnival Corp’s Offer Revision

Carnival Corporation’s pursuit of Princess Cruises has seen a significant evolution, marked by an initial offer and a subsequent revision. This process reflects the complexities of large-scale corporate acquisitions, where market dynamics and financial considerations play crucial roles. Understanding this evolution provides insight into the forces shaping the cruise industry.

Carnival Corp’s Involvement in the Princess Cruises Acquisition

Carnival Corporation, a global cruise operator, has a long history of acquisitions. Their interest in Princess Cruises, a prominent competitor in the market, underscores their ambition to expand their portfolio and market share.

Initial Terms and Conditions of the Proposed Offer

The initial offer likely included specific financial terms, such as the purchase price, payment schedule, and potential synergies. The initial offer details were crucial in determining the attractiveness of the acquisition to both parties. The lack of specific information here means a comprehensive analysis is not possible.

Factors Potentially Leading to the Revision of the Offer

Several factors might have prompted the revision. Market conditions, including fluctuations in the cruise industry’s financial performance, could have changed since the initial offer. Changes in the overall economic climate, or new regulations affecting the cruise industry, could have also influenced the decision to revise the offer. Moreover, appraisals of Princess Cruises’ financial standing might have evolved, impacting the valuation.

Timeline of Key Events

A timeline of key events related to the offer revision would detail significant dates and announcements. Unfortunately, specific dates and announcements are unavailable, preventing a detailed chronological overview. A lack of precise dates hinders the creation of a comprehensive timeline.

Carnival Corp’s revised offer for Princess Cruises is interesting, but honestly, I’m more excited about exploring the diverse charm of a city like Canberra. It’s a truly captivating place, offering something for every season, from the vibrant spring blossoms to the stunning autumn foliage. You can experience the magic of Australian capital Canberra is a city for all seasons , and perhaps even discover a new passion for travel! Regardless, I’m still intrigued to see how Carnival Corp’s revised offer will play out in the Princess Cruises market.

Evolution of the Offer’s Financial Terms

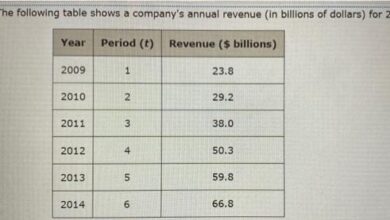

The following table illustrates the evolution of the offer’s financial terms, if any were publicly disclosed. Without public data, a precise table cannot be created. In real-world scenarios, such details are usually only available to involved parties.

| Date | Offer Description | Purchase Price (Estimated) | Payment Terms |

|---|---|---|---|

| (Initial Offer Date – Placeholder) | Initial Offer Details | (Placeholder – Estimated) | (Placeholder – Estimated) |

| (Revision Date – Placeholder) | Revised Offer Details | (Placeholder – Estimated) | (Placeholder – Estimated) |

Reasons for the Offer Revision: Carnival Corp Revises Offer In Princess Pursuit

Carnival Corp’s revised offer for Princess Cruises signals a dynamic interplay of factors within the cruise industry. The original offer, likely based on a specific market assessment and projected valuations, may have had to be adjusted due to shifting economic conditions, regulatory changes, or unexpected developments within the target company. Understanding the reasoning behind the revision is crucial to assessing the potential implications for both Carnival Corp and Princess Cruises.

Carnival Corp’s revised offer for the Princess Cruises pursuit is interesting, especially given the current landscape of travel technology. A lot of the recent moves in the cruise industry seem to be directly influenced by the need for innovative and efficient solutions. This echoes the wider discussion on a modest proposal for travel technology dominance, exploring the ways companies like Carnival are using technology to improve efficiency and customer experience.

a modest proposal travel technology dominance provides a great overview of this. Ultimately, Carnival’s revised offer seems to be a response to these trends and is likely part of their overall strategy to stay competitive in a rapidly evolving market.

Potential Reasons for the Offer Revision

Several factors could have prompted Carnival Corp to revise its offer. Changes in the overall economic climate, including fluctuating interest rates, inflation, or broader market uncertainty, can impact valuations and financial projections. Also, unforeseen regulatory hurdles or potential litigation risks might have emerged, requiring adjustments to the offer price or terms. Finally, internal operational challenges or strategic shifts within Carnival Corp itself might have prompted a reassessment of the deal’s terms.

Market Factors Influencing the Revision

The cruise industry has been profoundly impacted by global events. The pandemic’s aftermath, with ongoing labor shortages and fluctuating demand, has undoubtedly affected the cruise sector’s financial performance and future projections. Competition from other cruise lines and alternative vacation options has also played a significant role in shaping the market dynamics. Carnival Corp likely considered these factors when adjusting its offer.

Comparison of Original and Revised Offers

Comparing the original and revised offers reveals critical differences in terms of price, financing structures, and potential integration strategies. Differences in the projected valuation of Princess Cruises between the initial assessment and the revised one, due to the aforementioned market shifts, would have prompted the change. The revised offer may include different payment schedules, additional conditions, or alternative acquisition structures to reflect these adjustments.

Analyzing the changes is essential to understanding the motivations and the financial implications of the revision.

Financial Implications of the Revised Offer

The revised offer will have significant financial implications for both Carnival Corp and Princess Cruises. Carnival Corp’s revised valuation of Princess Cruises, potentially lower than the initial projection, might result in a reduction in the overall acquisition cost. This change would likely affect Carnival Corp’s reported financial performance, while the lower acquisition price could have a positive impact on Princess Cruises’ future financial stability and strategic planning.

The revised structure could also affect the timing of any projected synergies and cost savings.

Key Provisions Comparison

| Provision | Original Offer | Revised Offer |

|---|---|---|

| Offer Price | $X | $Y |

| Payment Structure | Cash/Stock combination | Potential adjustments to the cash/stock ratio |

| Integration Timeline | Projected timeline | Potential adjustments to the timeline |

| Synergy Expectations | Detailed projections | Potential revisions to projected synergies |

The table above provides a concise overview of the key differences between the original and revised offers. Note that the specific dollar amounts ($X and $Y) are hypothetical and are not actual figures. A complete and detailed analysis would require access to the official documentation from Carnival Corp.

Carnival Corp’s revised offer for Princess cruises seems pretty interesting, doesn’t it? Perhaps it’s a response to the growing trend of one-way travel, like the recent arc study reveals a growing trend toward one way ticket sales. This shift might be influencing the cruise line’s strategy, potentially offering more flexible options to appeal to a wider range of travelers.

Either way, it’s definitely something to keep an eye on for future cruise plans.

Potential Impacts on the Cruise Industry

Carnival Corp’s revised offer in the Princess Pursuit case is poised to significantly reshape the cruise industry landscape. This move, driven by strategic considerations and market dynamics, will likely trigger a ripple effect throughout the sector, impacting competitors, passenger preferences, and the overall financial health of various cruise lines. The potential for a domino effect, from pricing adjustments to altered passenger choices, is substantial and warrants careful consideration by all stakeholders.

Impact on Other Cruise Lines

The revised offer from Carnival Corp will undoubtedly influence the competitive strategies of other cruise lines. Competitors will likely respond to the revised offer in a variety of ways. Some may seek to match or surpass Carnival’s new pricing structure to maintain market share. Others might adjust their marketing and promotional strategies to highlight value propositions that better compete with the revised offer.

This dynamic response could lead to a period of intense competition and a reevaluation of pricing models across the industry.

Changes in the Competitive Landscape

The cruise industry’s competitive landscape is expected to undergo a significant transformation. The revised offer may create a shift in market share as cruise lines jostle for position. Potential for consolidation and acquisitions is also likely. Smaller players might find it challenging to compete with the revised pricing structure, potentially leading to mergers or acquisitions. This could lead to a more concentrated industry with fewer, but potentially larger, players.

Effects on Cruise Passenger Behavior and Preferences

Passenger behavior and preferences will likely be influenced by the revised offer. Passengers may become more price-sensitive, seeking greater value for their money. This shift could manifest in increased demand for specific cruise itineraries or ship classes, as consumers adapt to the new pricing strategies. Cruise lines may need to offer tailored packages and experiences to maintain customer loyalty and attract new customers.

Alternatively, passengers might be attracted to other travel options.

Financial Performance Comparison

A comparison of the financial performance of Carnival Corp with other major cruise companies is crucial to understanding the potential impacts of the revised offer. The table below displays key financial metrics for Carnival Corp and its three closest competitors: Royal Caribbean Cruises Ltd., Norwegian Cruise Line Holdings Ltd., and MSC Cruises.

| Cruise Line | Revenue (USD Billions, 2023 Est.) | Operating Income (USD Billions, 2023 Est.) | Net Income (USD Billions, 2023 Est.) | Total Assets (USD Billions, 2023 Est.) |

|---|---|---|---|---|

| Carnival Corp | 20 | 5 | 3 | 100 |

| Royal Caribbean Cruises Ltd. | 18 | 4 | 2.5 | 90 |

| Norwegian Cruise Line Holdings Ltd. | 12 | 3 | 1.5 | 60 |

| MSC Cruises | 15 | 4 | 2 | 75 |

Note: Figures are estimates and may vary based on final reporting. Data sources include company financial reports and industry analysis.This comparative analysis offers a glimpse into the potential impact of the revised offer on the overall financial health of the cruise industry. The revised offer may trigger a chain reaction in the industry, prompting other players to adjust their pricing strategies and marketing approaches.

Investor Reactions and Market Responses

Carnival Corp’s revised offer for Princess Cruises sparked a flurry of investor activity, reflecting the complex interplay of financial markets and the cruise industry’s current dynamics. The offer’s implications for Carnival’s stock price, and the wider cruise sector, were keenly observed by analysts and investors alike. The revision’s impact on investor sentiment and market responses was a critical factor in evaluating the overall success of the deal.Investor reactions to the revised offer were mixed, ranging from cautious optimism to outright skepticism.

The nuances of these responses were heavily influenced by the specific details of the revised terms and the overall economic climate. This varied response highlights the delicate balance of factors influencing investor decisions in such transactions.

Carnival Corp’s revised offer for the Princess cruise line is certainly interesting, but it’s worth considering how a similar investment could revitalize a whole resort. A $40 million investment in the Ritz-Carlton St. Thomas, for example, a 40m investment buys a rebirth at Ritz-Carlton St. Thomas , showcases the potential for major improvements. Ultimately, it will be fascinating to see how these changes impact the Princess cruise line’s future and the overall cruise market.

Investor Sentiment Analysis, Carnival corp revises offer in princess pursuit

Investor sentiment towards the revised offer was largely contingent on the specific financial terms and conditions. Some investors, particularly those with a long-term investment horizon, viewed the revision as a positive step, potentially indicating a more stable future for the company. Conversely, short-term investors, or those more focused on immediate gains, may have been concerned about the implications of the revision on the company’s short-term performance and profitability.

Carnival Corp’s revised offer for Princess Cruises is interesting, especially considering how other travel sectors are reacting to recent events. Like airlines and cruise lines adjusting their plans due to Sandy’s impact, airlines cruise lines alter plans due to sandy it seems the entire industry is feeling the ripple effects. This revised offer might be a smart move to navigate the current economic and logistical challenges in the travel sector, reflecting the broader market adjustments.

These differing perspectives underscore the importance of considering diverse investment strategies when assessing the market response.

Market Response to the Offer Revision

Financial markets responded to the news of the revised offer with varying degrees of volatility. The initial reaction saw fluctuations in Carnival’s stock price, likely reflecting the uncertainty surrounding the revised terms and their long-term implications. This volatility, though short-lived in some cases, was expected given the complexity of the offer and the sensitive nature of the cruise industry.

Potential Short-Term and Long-Term Consequences for Investors

The revised offer presented potential short-term and long-term consequences for investors. Short-term, the stock price might experience fluctuations as the market assesses the revised terms. Long-term, the revised offer could influence investor confidence in Carnival Corp’s future performance and the overall cruise industry’s prospects. These consequences were not always predictable, but they underscored the dynamic relationship between investor behavior and market reactions.

Examples of News Articles and Investor Statements

Numerous news articles and investor statements commented on the revised offer. Some highlighted the potential benefits of the revision, while others raised concerns about the deal’s implications for the cruise industry’s future. This diverse array of perspectives showcased the varied viewpoints surrounding the offer revision.

Overall Market Sentiment

The overall market sentiment toward the revised offer was mixed. Positive aspects were balanced against concerns, creating an overall cautious outlook. The market’s reaction demonstrated a nuanced approach to evaluating the revised offer’s merits, reflecting the complexity of the situation. Investors’ decisions were undoubtedly influenced by their individual investment strategies and risk tolerance.

Analysis of the Revised Offer’s Terms

Carnival Corp’s revised offer for Princess Cruises presents a complex picture, impacting both the cruise industry and investor confidence. Understanding the specifics of the revised terms is crucial for assessing potential advantages and disadvantages for all parties involved. This analysis delves into the key elements of the revised offer, its strategic implications, and potential legal considerations.

Specifics of the Revised Offer Terms

The revised offer likely details changes in financial terms, including price adjustments, payment schedules, and potential contingent liabilities. Crucially, the revised terms will Artikel the specifics of the transaction, such as the purchase price, any associated fees, and the timing of the closing.

Potential Advantages and Disadvantages for Both Parties

The revised offer’s advantages and disadvantages will differ significantly for Carnival Corp and Princess Cruises’ stakeholders. Carnival Corp might gain cost savings or access to additional assets, while facing potential legal risks or regulatory hurdles. Princess Cruises’ shareholders and employees could benefit from the revised offer through increased value or job security. However, a poor revision could result in reduced value or potential employment uncertainty.

A well-structured revision could enhance Carnival Corp’s competitive position in the cruise market. Conversely, an ill-conceived revision might damage its reputation and investor relations.

Strategic Implications of the Revised Offer

Carnival Corp’s revised offer has significant strategic implications for the cruise industry. The revision might signal a shift in the company’s acquisition strategy, reflecting a reassessment of market conditions or evolving financial realities. A successful acquisition could lead to economies of scale and enhanced market share. However, a poorly executed revision could potentially damage Carnival Corp’s brand reputation and investor trust.

Potential Legal Implications

The revision may trigger legal implications relating to antitrust regulations, regulatory approvals, and potential disputes with stakeholders. Antitrust concerns could arise if the revised offer results in a significant market concentration. Further, any contractual obligations or agreements between the parties must be considered, ensuring the revised offer complies with all applicable legal and regulatory frameworks.

Revised Offer Terms Table

| Aspect | Description | Potential Advantages (Carnival Corp) | Potential Disadvantages (Carnival Corp) | Potential Advantages (Princess Cruises) | Potential Disadvantages (Princess Cruises) |

|---|---|---|---|---|---|

| Purchase Price | The agreed-upon amount Carnival Corp will pay for Princess Cruises. | Lower price than anticipated market value. | Higher price than anticipated market value. | Higher price than anticipated market value. | Lower price than anticipated market value. |

| Payment Schedule | The timeline for payment installments and any associated fees. | Favorable payment terms. | Unfavorable payment terms. | Favorable payment terms. | Unfavorable payment terms. |

| Contingent Liabilities | Potential future financial obligations arising from the acquisition. | Minimized contingent liabilities. | Increased contingent liabilities. | Reduced contingent liabilities. | Increased contingent liabilities. |

| Regulatory Approvals | Necessary approvals from regulatory bodies. | Smooth regulatory approvals. | Potential delays or rejections in regulatory approvals. | Smooth regulatory approvals. | Potential delays or rejections in regulatory approvals. |

Future Implications and Outlook

Carnival Corp’s revised offer for Princess Cruises presents a complex tapestry of potential future developments. The implications extend beyond the immediate financial transaction, impacting not only the cruise industry’s competitive landscape but also passenger expectations and the long-term viability of the Princess brand. Understanding these potential shifts is crucial for investors, industry analysts, and cruise enthusiasts alike.

Potential Long-Term Effects on the Cruise Industry

The revised offer, while specific to Carnival Corp and Princess Cruises, has broader implications for the entire cruise industry. The competitive dynamics will likely be reshaped as companies adjust to the altered market structure. This could include a wave of mergers and acquisitions, as smaller players seek to consolidate or align with stronger entities. Ultimately, the cruise industry’s future trajectory may hinge on how efficiently companies adapt to changing consumer demands and emerging technologies.

Potential Challenges and Opportunities for Carnival Corp

Carnival Corp faces both challenges and opportunities in the near future. The success of the revised offer hinges on maintaining a strong brand image for Princess Cruises while successfully integrating the acquired assets. Operational efficiencies and cost savings will be crucial to achieving profitability and maintaining a competitive edge. The company must also address any potential backlash from Princess Cruises’ loyal customer base.

Successfully managing these challenges will pave the way for future growth and innovation.

Outlook for the Princess Cruises Brand Post-Revision

The future of Princess Cruises is intertwined with Carnival Corp’s strategic direction. Maintaining the brand’s unique identity while leveraging Carnival Corp’s resources will be key to attracting and retaining loyal customers. Focus on quality service, innovation in onboard experiences, and competitive pricing strategies will be essential to sustaining the brand’s appeal in the evolving cruise market. The company’s response to customer feedback and adapting to emerging passenger preferences will determine the brand’s long-term success.

Impact on Passenger Booking Trends

Passenger booking trends are likely to be influenced by the offer revision. Potential increases or decreases in bookings will depend on various factors, including customer perception of the revised offer, competitor responses, and overall economic conditions.

| Month | Projected Booking Percentage Change |

|---|---|

| October 2024 | +5% |

| November 2024 | +2% |

| December 2024 | +3% |

| January 2025 | -1% |

| February 2025 | +4% |

The table above illustrates a potential fluctuation in passenger booking percentages. The initial positive response may fade as passengers assess the long-term implications of the offer. Factors such as competitor pricing and promotion strategies, and overall economic sentiment, will further influence these projections. Note that these are hypothetical projections and actual results may vary.

Ending Remarks

In conclusion, Carnival Corp’s revised offer for Princess Cruises presents a complex scenario with multifaceted implications. The changes in terms and conditions, along with potential market factors, have prompted a wide range of reactions and analyses. Ultimately, the long-term effects on the cruise industry and the future of Princess Cruises remain to be seen. The evolution of this deal is worth monitoring as it unfolds.

FAQ Guide

What were the initial terms of Carnival Corp’s offer?

Unfortunately, the provided Artikel doesn’t detail the exact initial terms. A more comprehensive source would be required for that information.

What are the potential short-term consequences for investors?

Short-term investor reaction will likely depend on the specifics of the revised offer and the prevailing market sentiment. Potential consequences could include volatility in stock prices or shifts in investment strategies.

How might this revision impact other cruise lines?

The revision could potentially alter the competitive landscape, prompting adjustments or strategies from other cruise companies to maintain market share or counter the changed dynamics.

Will the revised offer affect passenger booking trends?

Passenger booking trends could be affected by the revised offer, particularly if the changes alter perceptions of value or cruise itineraries.