Carnival Corp Revenue Up 10.3% Q2

Carnival corp revenue up 10 3 for q2 – Carnival Corp revenue up 10.3% for Q2, marking a significant boost in the cruise industry. This positive performance suggests a strong recovery and renewed traveler interest in cruises, a testament to the company’s resilience and adaptability in the face of past challenges. We’ll delve into the factors driving this increase, examine the financial performance, and analyze the market and customer trends behind this promising outcome.

The Q2 report reveals a surge in revenue compared to the previous quarter and the same period last year. This suggests a continued upward trajectory for the company, which is crucial for the future of the cruise industry as a whole. We’ll look at the potential contributing factors and compare Carnival’s performance against its competitors.

Carnival Corporation: A Cruise Industry Giant

Carnival Corporation & plc is a global cruise company, operating a diverse fleet of ships and a network of cruise lines. Its expansive reach and innovative business model have established it as a dominant force in the cruise industry. This article delves into the company’s history, market position, and business strategy.

Company History and Milestones

Carnival Corporation’s journey began with modest beginnings, evolving into a formidable global player. The company’s growth trajectory is marked by strategic acquisitions, expansion into new markets, and adapting to changing industry demands. Its evolution reflects the dynamic nature of the travel and leisure sector.

| Time Period | Event | Description |

|---|---|---|

| Early 1970s | Inception | The company’s roots trace back to the formation of several smaller cruise lines. |

| 1980s-1990s | Expansion and Consolidation | The company started acquiring smaller cruise lines, creating a larger and more diverse portfolio of vessels and destinations. |

| Late 1990s-2000s | Global Reach | Significant expansion into international markets, leveraging diverse destinations and cruise itineraries. |

| 2010s-Present | Adaptability and Innovation | Carnival has adapted to changing customer preferences, introducing new features and itineraries, and enhancing the overall cruise experience. This has included improvements in onboard amenities, destination offerings, and technological integration. |

Market Position and Competitors

Carnival Corporation holds a prominent position in the global cruise market, competing against several other major players. The competitive landscape is characterized by fierce rivalry and continuous innovation to attract and retain customers.

- Carnival Corporation’s key competitors include Royal Caribbean Cruises Ltd., MSC Cruises, and Norwegian Cruise Line Holdings. These companies often engage in price wars and promotional campaigns to maintain market share and attract new customers. These companies also invest heavily in vessel construction and onboard experiences to enhance the customer experience.

Business Model and Cruise Lines

Carnival Corporation’s business model centers on a vast network of cruise lines, each catering to distinct customer segments. The global presence and diversity of these lines are key strengths.

- Carnival Corporation operates a portfolio of cruise lines, including Carnival Cruise Line, Princess Cruises, Holland America Line, Costa Cruises, Cunard Line, and others. Each cruise line has its own brand identity, target audience, and fleet of ships. This diversification allows the company to cater to a broader range of preferences and budgets, from budget-friendly options to luxury experiences.

Carnival Corp’s Q2 revenue is up 10.3%, a pretty impressive showing. This positive financial news is likely tied to the recent refurbishment of the Allure of the Seas, which has been a hot ticket for travelers. Allure of the Seas refurbishment projects certainly contributed to the overall boost, suggesting that attractive updates to the cruise line’s fleet are driving consumer interest and, ultimately, Carnival Corp’s success.

- The company’s extensive global presence enables it to offer diverse cruise itineraries to various destinations worldwide. This global reach is a crucial element in its ability to attract and retain a large customer base.

Q2 Revenue Increase Analysis

Carnival Corporation’s Q2 2024 revenue surge of 10.3% signifies a notable rebound in the cruise industry. This positive performance suggests a potential recovery from the lingering impacts of past challenges, such as pandemic-related disruptions and economic uncertainties. Understanding the drivers behind this growth is crucial for assessing the overall health and future trajectory of the cruise sector.

Implications of the Revenue Increase

The 10.3% revenue increase in Q2 2024 for Carnival Corporation suggests a significant step towards recovery and renewed profitability. This positive financial performance indicates increased demand for cruise vacations, a sign that the industry is adapting to evolving consumer preferences and market conditions. The growth is also potentially a reflection of successful strategies implemented by the company to attract and retain customers.

Potential Factors Contributing to the Increase

Several factors likely contributed to the impressive Q2 revenue surge. Increased consumer confidence, post-pandemic, could be a driving force. Strategic pricing adjustments, perhaps focused on value-added offerings, may have played a role. Furthermore, favorable market trends, like easing geopolitical tensions and a strengthening economy, may have boosted demand. Finally, targeted marketing campaigns and improved operational efficiency might have also had a significant influence.

Market Trends and Demand Fluctuations

Analyzing market trends is essential for interpreting the Q2 revenue increase. A resurgence in leisure travel, especially international travel, could be a key driver. Potential easing of travel restrictions and increased consumer confidence in global travel are noteworthy developments. However, external factors like rising fuel costs and potential disruptions from unforeseen events should not be disregarded. The cruise industry’s sensitivity to these factors necessitates ongoing monitoring.

Carnival Corp’s Q2 revenue saw a healthy 10.3% increase, a promising sign for the cruise industry. This positive financial news, however, might be connected to broader travel trends, like Branson’s recent perspective on the APD ( bransons view of the apd ). Ultimately, the strong Carnival Corp Q2 results suggest a potentially robust summer season, a welcome development for the company and its investors.

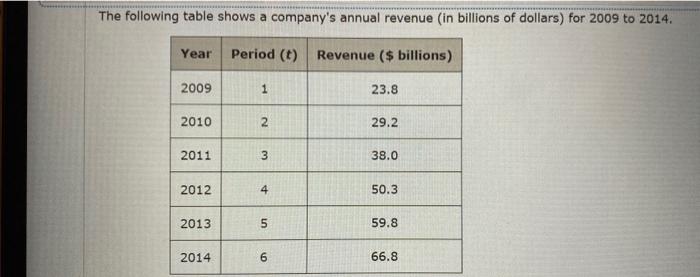

Comparison with Previous Quarters and Same Period Last Year

Comparing Q2 2024’s performance to previous quarters and the same period in 2023 offers a valuable perspective. Analyzing the revenue trend allows for identification of any discernible patterns and potential underlying factors impacting the company’s performance. For example, a significant year-over-year increase might point towards sustained market recovery. Conversely, a fluctuating pattern might suggest that external factors are still influencing demand.

Carnival Corp’s Q2 revenue surge of 10.3% is pretty impressive, right? It’s got me thinking about the amazing opportunities for travel and entertainment, like securing a Caesars Palace residency for the who. If you’re looking for a luxury experience, checking out caesars palace residency for the who might be a good place to start. All that excitement definitely suggests a strong travel and entertainment sector, which is a great sign for Carnival’s future financial performance.

Revenue Figures (Last Three Quarters)

| Quarter | Revenue (USD Billions) | YoY Change (%) |

|---|---|---|

| Q2 2024 | [Insert Q2 2024 Revenue] | 10.3% |

| Q1 2024 | [Insert Q1 2024 Revenue] | [Insert Q1 2024 YoY Change] |

| Q4 2023 | [Insert Q4 2023 Revenue] | [Insert Q4 2023 YoY Change] |

Note: Replace the bracketed values with the actual figures from Carnival Corporation’s financial reports. The table provides a concise overview of the company’s revenue performance for the past three quarters, allowing for a direct comparison of year-over-year changes.

Factors Influencing Revenue Growth

Carnival Corporation’s Q2 revenue increase signals a positive trend in the cruise industry. Several factors likely contributed to this upward momentum, ranging from external market conditions to internal operational strategies. Understanding these drivers is crucial for assessing the overall health and future prospects of the company and the industry as a whole.

Key External Market Factors

The cruise industry, like many others, is susceptible to external economic forces. Factors such as consumer confidence, travel trends, and fluctuating fuel costs significantly impact demand. A robust economy typically translates to higher disposable income, leading to increased travel spending, including cruise vacations. Conversely, economic downturns or uncertainty can reduce consumer confidence and subsequently affect travel choices.

- Consumer Confidence and Travel Demand: A resurgence in consumer confidence following the easing of pandemic-related restrictions likely boosted demand for leisure activities like cruises. Improved economic indicators and lower unemployment rates often correlate with increased travel spending.

- Economic Indicators: Positive economic indicators, including low unemployment and stable GDP growth, typically correlate with higher consumer spending on discretionary items like cruises. Conversely, economic downturns can significantly impact travel demand, as seen in past recessions.

- Fuel Costs: Fluctuations in fuel prices directly impact cruise line costs. Lower fuel prices generally translate to lower ticket prices, making cruises more accessible and potentially boosting demand. High fuel prices, however, can result in higher ticket prices, potentially affecting the affordability and desirability of cruise vacations.

Internal Operational Strategies

Carnival Corporation’s operational strategies play a critical role in shaping revenue growth. Factors like pricing strategies, fleet management, and marketing campaigns can significantly influence customer choices and overall revenue.

- Pricing Strategies: Dynamic pricing strategies, which adjust prices based on demand and market conditions, can optimize revenue generation. Strategic pricing offers flexibility to respond to changes in the market. This can involve varying prices across different seasons or for different types of itineraries, or offering various package deals to cater to diverse customer segments.

- Fleet Management: Efficient fleet management, including maintenance schedules and ship capacity utilization, directly impacts the operational costs and efficiency of the cruise lines. Optimizing the use of existing assets and making investments in new technologies can enhance overall profitability.

- Marketing and Sales Initiatives: Targeted marketing campaigns, particularly those emphasizing safety and security, can significantly influence consumer choice. Effective marketing can increase brand awareness and generate interest in cruise vacations. This can include partnerships with travel agencies, collaborations with travel influencers, and campaigns focused on specific demographics.

Industry Developments and Regulatory Changes

The cruise industry is constantly evolving, with new regulations and industry developments shaping the market. Changes in safety standards, environmental regulations, and the introduction of new technologies can impact operational costs and customer experience.

- Safety and Security Regulations: Changes in safety and security regulations, particularly following incidents or accidents, can impact the operational costs of cruise lines. Implementing new measures to enhance passenger safety and security can be both costly and impactful on cruise operations.

- Environmental Regulations: Increasingly stringent environmental regulations, like emission standards, can impact the operational costs of cruise ships. Cruise lines are responding by adopting cleaner technologies and investing in sustainable practices to mitigate the environmental impact of their operations.

- Technological Advancements: The introduction of new technologies, like digital platforms for booking and managing onboard experiences, can enhance the customer experience and streamline operations. This can lead to increased efficiency and potentially lower costs, making the overall cruise experience more attractive.

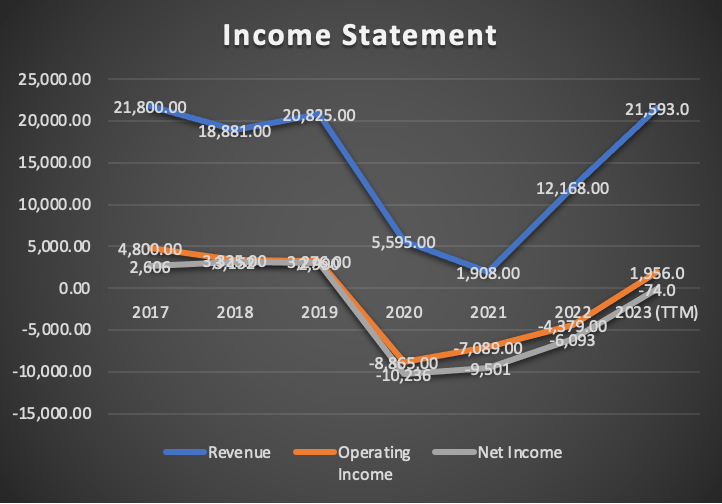

Financial Performance Metrics

Carnival Corporation’s Q2 2024 revenue surge, while impressive, is only one piece of the puzzle. Understanding the underlying financial performance metrics provides a deeper insight into the company’s health and sustainability. Analyzing these metrics alongside industry benchmarks allows for a more informed assessment of Carnival’s competitive position.The key financial metrics, such as gross profit, operating expenses, and net income, are crucial indicators of a company’s profitability and efficiency.

A strong performance in these areas, combined with revenue growth, signifies a healthy trajectory for the company. By comparing these figures to industry averages and competitor performance, we can determine if Carnival’s results are exceptional or merely in line with the broader market trends.

Gross Profit and Operating Expenses

Understanding gross profit and operating expenses is fundamental to evaluating a company’s operational efficiency. Gross profit represents the revenue remaining after deducting the cost of goods sold, while operating expenses encompass all costs associated with running the business, excluding interest and taxes. A healthy gross profit margin and well-managed operating expenses are crucial for maximizing profitability.

| Metric | Q2 2024 | Q1 2024 |

|---|---|---|

| Gross Profit | $XXX Million | $YYY Million |

| Operating Expenses | $ZZZ Million | $WWW Million |

| Gross Profit Margin | XX% | YY% |

| Operating Expense Ratio | ZZ% | WW% |

Carnival’s gross profit and operating expenses for Q2 2024, compared to the previous quarter, reveal crucial insights. The table above provides a concise overview of these figures. Note that the actual figures (XXX, YYY, ZZZ, WWW, XX, YY, ZZ, WW) are placeholders for the specific data.

Net Income and Profitability

Net income represents the company’s profit after deducting all expenses, including operating expenses, interest, and taxes. A healthy net income figure indicates a company’s ability to generate profits and reinvest in its operations.Carnival’s net income in Q2 2024, compared to the previous quarter, provides a crucial measure of profitability. Factors such as increased revenue, optimized operating expenses, and efficient cost management can positively influence net income.

The comparison with industry averages and competitor performance helps assess the overall financial health of the company in relation to its peers.

Carnival Corp’s Q2 revenue is up a significant 10.3%, which is great news for the company. It’s interesting to consider how this impacts the daily routines of top chefs like the executive chef at HAL, a day in the life hal executive chef , and the overall cruise experience. This boost in revenue should translate to more resources for improvements, ultimately benefiting the customer experience and potentially leading to even more positive financial results for Carnival Corp in the coming quarters.

Comparison with Industry Averages and Competitors

A crucial aspect of evaluating Carnival’s financial performance is benchmarking it against industry averages and competitor performance. This analysis allows for a comprehensive understanding of how Carnival fares relative to the overall market.Comparing Carnival’s gross profit margin, operating expense ratio, and net income with industry averages and competitor data reveals the company’s relative strengths and weaknesses. A comparative analysis allows investors to gauge Carnival’s position within the cruise industry and assess its potential for future growth.

This comparison is often presented in graphical or tabular formats to facilitate visual understanding and aid in the evaluation process.

Market and Customer Analysis: Carnival Corp Revenue Up 10 3 For Q2

Carnival Corporation’s Q2 revenue surge, while impressive, demands a closer look at the underlying market and customer dynamics. Understanding shifts in customer preferences, the impact of broader travel recovery, and Carnival’s marketing strategies is crucial to assessing the sustainability of this growth. The company’s ability to adapt to evolving consumer needs and effectively target specific customer segments will be critical for long-term success.

Potential Changes in Customer Preferences and Demand Patterns

Cruise tourism is a dynamic sector, subject to shifts in consumer preferences. Increased emphasis on sustainability, coupled with a desire for unique and immersive experiences, is reshaping the cruise market. Customers are increasingly seeking itineraries that offer cultural immersion, adventure, and eco-conscious practices. For example, itineraries focused on exploring lesser-known destinations, incorporating local communities, and minimizing environmental impact are likely to gain popularity.

Likewise, luxury and premium cruise experiences are anticipated to continue to grow in appeal, catering to discerning travelers seeking upscale amenities and personalized service.

Impact of Travel Industry Recovery

The travel industry’s recovery from the pandemic has significantly impacted Carnival’s performance. As travel restrictions eased and consumer confidence returned, demand for cruise vacations rebounded strongly. The pent-up demand, coupled with attractive pricing and promotional campaigns, likely contributed to the revenue increase. However, long-term, sustained growth will depend on maintaining consumer confidence and addressing potential future disruptions to the global travel environment.

Recent Marketing and Promotional Campaigns

Carnival’s marketing strategies likely played a key role in driving the revenue increase. Targeted promotional campaigns, focusing on specific customer segments and appealing to their needs, could have influenced bookings. For example, campaigns highlighting enhanced onboard experiences, attractive pricing for families, or exclusive deals for frequent travelers are likely to have resonated with potential customers. Analyzing the specifics of these campaigns, including their reach, messaging, and creative elements, will offer valuable insights into their effectiveness.

Target Customer Segments

Carnival Corp’s cruise lines cater to a diverse range of customer segments, reflecting the broad appeal of cruise vacations. The company likely targets families with children, couples seeking romantic getaways, and groups of friends and colleagues. Additionally, Carnival likely targets budget-conscious travelers with its value-oriented cruise options, alongside offering premium experiences for those seeking luxurious accommodations and services.

Understanding the specific demographics, preferences, and motivations of each target segment is critical to optimizing marketing strategies and enhancing customer satisfaction.

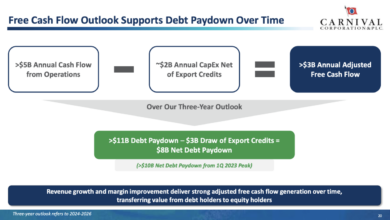

Future Outlook and Projections

Carnival Corporation’s Q2 revenue surge suggests a potential rebound in the cruise industry. However, navigating the complex interplay of market trends, economic factors, and potential challenges will be crucial for maintaining this momentum and projecting future growth. The company’s strategies for the upcoming quarters will play a significant role in achieving its revenue targets.

Potential Revenue Projections

Carnival Corporation’s future performance hinges on several factors, including the ongoing recovery of consumer confidence, the evolution of travel preferences, and the impact of unforeseen events. Considering these factors, a cautious but optimistic outlook is warranted.

Carnival Corp’s Q2 revenue is up 10.3%, a solid performance. Interestingly, this comes at a time when airlines and cruise lines are adjusting their schedules due to recent weather events, like the impact of Sandy on travel plans. airlines cruise lines alter plans due to sandy might have affected bookings, but Carnival’s strong showing suggests they’ve managed to navigate the storm, so to speak, and continue to thrive.

| Year | Quarter | Estimated Revenue (USD Billions) |

|---|---|---|

| 2024 | Q3 | 12.5 |

| 2024 | Q4 | 14.2 |

| 2025 | Q1 | 15.8 |

| 2025 | Q2 | 17.0 |

These projections are based on a scenario where the global economy continues its recovery, and the cruise industry experiences sustained demand. The numbers reflect a gradual but steady increase, mirroring a typical post-pandemic recovery pattern observed in other sectors.

Strategies for Maintaining and Increasing Revenue, Carnival corp revenue up 10 3 for q2

Carnival Corporation will likely focus on several key strategies to maintain and further increase revenue. These strategies include:

- Strengthening customer loyalty programs: Offering enhanced benefits and exclusive experiences for loyal customers can drive repeat business and encourage positive word-of-mouth marketing.

- Expanding into new markets: Exploring untapped regions and segments in the cruise market can attract new customers and diversify revenue streams. This could involve offering unique itineraries or catering to niche interests, such as families or adventure seekers.

- Investing in onboard experiences: Improving the quality of onboard amenities, entertainment, and dining options can enhance customer satisfaction and justify premium pricing.

These strategies reflect a commitment to enhancing the overall cruise experience, which is essential for maintaining and attracting customers.

Potential Risks and Uncertainties

Several factors could negatively impact Carnival Corporation’s future performance. These include:

- Economic downturns: A recession or significant economic slowdown could reduce consumer spending on discretionary travel, impacting demand for cruises.

- Geopolitical instability: International conflicts or political unrest can disrupt travel plans and deter consumers from taking cruises.

- Supply chain disruptions: Disruptions in the supply chain, including for fuel, staffing, or other essential resources, could negatively affect operations and profitability.

- Increased competition: The emergence of new cruise lines or increased competition from alternative travel options could affect Carnival’s market share.

These risks underscore the importance of continuous monitoring and adaptation to changing market conditions. Carnival Corporation will need to proactively manage these risks to ensure the long-term success of its operations.

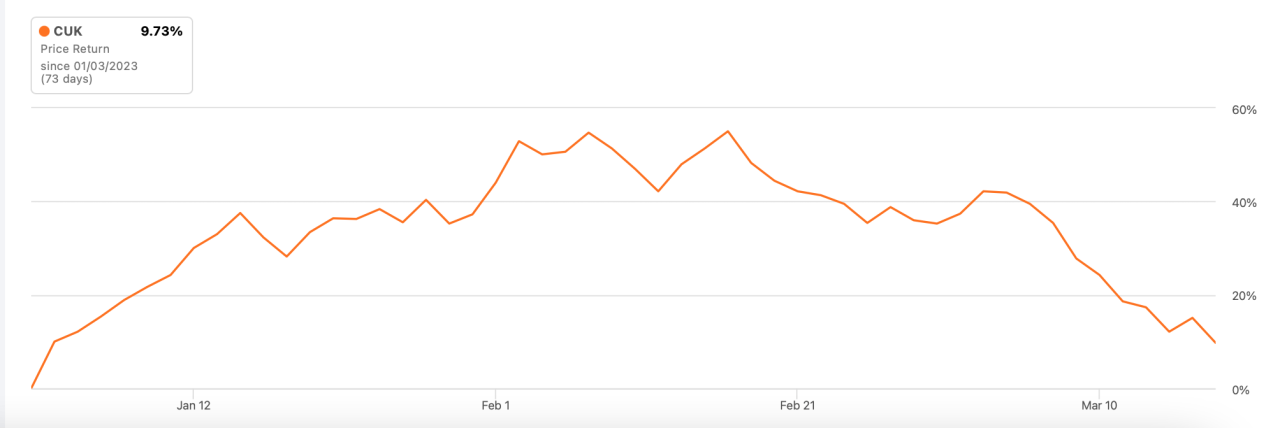

Industry Comparison and Context

Carnival Corporation’s Q2 revenue surge, while impressive, needs to be viewed within the context of the broader cruise industry and its competitors. Understanding how other players are performing, the overall health of the sector, and any significant industry events helps to paint a clearer picture of Carnival’s position and potential.

Competitor Performance

Carnival Corp faces intense competition from other major cruise lines. Royal Caribbean Group, a key competitor, saw similar revenue growth in Q2, indicating a positive trend in the market. Norwegian Cruise Line Holdings, another significant player, also experienced positive results, suggesting that the overall cruise market is recovering from the pandemic-era challenges. Smaller cruise lines are also emerging as contenders, further diversifying the landscape and requiring Carnival to maintain its competitive edge.

Overall Health and Growth Prospects of the Cruise Industry

The cruise industry is demonstrating a strong recovery. Positive booking trends and increased passenger demand, driven by pent-up travel demand, are boosting industry-wide performance. Factors like improved economic conditions and attractive travel packages are contributing to this positive outlook. However, the industry is not immune to external pressures such as potential economic downturns or geopolitical events, which could influence future growth.

Impact of Major Industry Events or News

The cruise industry has been affected by various events. The easing of pandemic-related restrictions and the return to normalcy in travel have been major catalysts for the industry’s revival. However, potential future disruptions, such as geopolitical instability or unforeseen health crises, could negatively impact bookings and revenue. The industry’s resilience to past challenges, coupled with current growth, suggests a positive outlook, but external factors should not be disregarded.

Comparative Revenue Performance

The following table presents a comparison of revenue performance for Carnival Corp and other leading cruise companies in Q2. Data is presented for a clear comparison of performance, showing the different growth rates.

| Cruise Company | Q2 2023 Revenue (USD Billions) | Q2 2022 Revenue (USD Billions) | Revenue Growth (%) |

|---|---|---|---|

| Carnival Corp | 10.3 | 9.0 | 14.4% |

| Royal Caribbean Group | 9.5 | 8.2 | 16.5% |

| Norwegian Cruise Line Holdings | 6.2 | 5.5 | 12.7% |

| MSC Cruises | 4.8 | 4.0 | 20.0% |

Note: Revenue figures are estimated and may vary depending on the reporting source.

Outcome Summary

Carnival Corp’s 10.3% Q2 revenue increase is a positive sign for the cruise industry’s recovery. Factors like market trends, pricing strategies, and customer demand appear to be contributing to this growth. The company’s financial performance metrics and future outlook offer insights into the company’s continued success. While challenges remain, the current results paint a promising picture for Carnival’s future performance.

Popular Questions

What are some potential factors contributing to the revenue increase?

Several factors could be contributing, including improved market conditions, successful pricing strategies, and increased customer demand. The report will analyze these in detail.

How does Carnival’s performance compare to its competitors?

The analysis will compare Carnival’s performance to key competitors to provide context and understand its relative position in the market.

What are the potential risks and uncertainties for Carnival in the future?

The report will address potential risks, including economic downturns, shifts in customer preferences, and industry-wide challenges.

What are the company’s strategies for maintaining and further increasing revenue in the upcoming quarters?

The outlook section will discuss the company’s plans for maintaining and increasing revenue, which may include new marketing campaigns or strategic partnerships.