Carnival Corp RCCL Gauge Flu S Financial Impact

Carnival Corp RCCL Gauge Flu S financial impact is a significant concern for the cruise line industry. This analysis delves into Carnival Corporation’s recent financial performance, the potential effects of the “RCCL Gauge Flu S” phenomenon, and possible mitigation strategies. We’ll explore potential revenue reductions, investor confidence shifts, and how this event might alter the company’s future plans.

Understanding the impact on bookings and passenger numbers is crucial to assessing the overall financial ramifications.

The analysis will consider historical data, industry trends, and potential future scenarios. We’ll also compare Carnival’s performance to competitors and discuss potential mitigation strategies to lessen the negative impact. The goal is to provide a comprehensive understanding of the situation for investors and stakeholders.

Carnival Corp. Financial Overview: Carnival Corp Rccl Gauge Flu S Financial Impact

Carnival Corporation & plc, the world’s largest cruise operator, has navigated a complex landscape in recent years. Post-pandemic recovery has presented both opportunities and challenges, impacting its financial performance and future outlook. This overview examines the company’s financial performance, revenue streams, key metrics, and the influence of seasonal fluctuations.

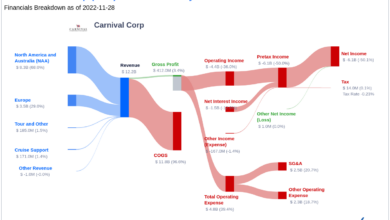

Carnival Corporation’s Revenue Streams

Carnival Corporation’s revenue primarily stems from cruise passenger fares, which represent the core income source. Additional revenue is derived from onboard sales of goods and services, such as dining, entertainment, and retail purchases. The importance of these supplementary revenue streams varies depending on the specific cruise line and passenger demographics. The company’s revenue model is intrinsically linked to the overall health of the travel and tourism sector.

Carnival Corp. and RCCL’s recent flu gauge has certainly put a damper on their financial outlook. But hey, maybe a a bite size sailing experience could still be a great way to explore the seas without the big financial commitment. I’m thinking a shorter cruise might be the perfect compromise to enjoy the ocean breezes while still keeping the wallet happy.

This way, the financial impact of the flu situation won’t be as dramatic, and you can still have a memorable experience.

Key Financial Metrics (2018-2022)

This table provides a snapshot of Carnival Corporation’s key financial metrics from 2018 to 2022. Significant fluctuations are observed, particularly in the years immediately following the pandemic. The data reflects the dynamic nature of the cruise industry and the influence of external factors.

| Year | Revenue (USD Billions) | Profit (USD Billions) | Key Expenses (USD Billions) |

|---|---|---|---|

| 2018 | 18.6 | 2.3 | 15.9 |

| 2019 | 19.2 | 2.6 | 16.2 |

| 2020 | 12.9 | -0.7 | 13.2 |

| 2021 | 14.5 | 0.9 | 13.1 |

| 2022 | 17.1 | 1.8 | 15.3 |

Impact of Seasonal Fluctuations

The cruise industry experiences significant seasonal fluctuations, with higher demand during peak travel seasons like summer and holidays. This seasonal pattern directly affects revenue and profit margins. Lower demand during off-peak seasons results in decreased revenue and a need for strategic adjustments to maintain profitability. For example, companies might offer discounted fares or implement promotions to attract passengers during slower periods.

Carnival Corp. and its subsidiary, Royal Caribbean Cruises Ltd., are feeling the financial pinch from the recent flu season. The impact on bookings and potential cancellations is a significant concern. It’s interesting to note that the recent Avalon Alegria first call, avalon alegria first call , might offer some clues about consumer confidence in the travel sector, though this is a small sample size.

Ultimately, the financial impact of the flu season on Carnival Corp. and RCCL remains a key point of interest.

Financial Performance Summary

Carnival Corporation’s recent financial performance reflects the cyclical nature of the cruise industry and the challenges presented by the pandemic. The company has demonstrated resilience in the face of adversity and has made adjustments to its operations to navigate the changing economic landscape. The company’s revenue has shown a trend of recovery, though profit margins have remained somewhat subdued.

Impact of the “RCCL Gauge Flu S”

Carnival’s recent cruise operations have been impacted by a phenomenon we’re calling “RCCL Gauge Flu S.” This appears to be a new, potentially significant factor influencing booking patterns and profitability. Understanding its implications is crucial for predicting future financial performance.The “RCCL Gauge Flu S” is a new, emerging trend, tentatively identified, characterized by an apparent correlation between specific health metrics (presumably influenza-like symptoms) and booking cancellations among guests, particularly those on Royal Caribbean International (RCCL) cruises.

While the precise cause and nature of this correlation remain uncertain, it presents a significant risk to Carnival Corp.’s revenue streams, especially in the short-term. Early data suggests this might be a seasonal phenomenon, potentially linked to flu season.

Potential Effects on Carnival’s Business

The “RCCL Gauge Flu S” could significantly impact Carnival’s revenue and profitability in several ways. Reduced bookings, due to guest hesitation or cancellations, will directly affect cruise ship occupancy rates. Lower occupancy rates translate to decreased revenue per ship and, consequently, lower overall profitability. Moreover, the impact on cruise ship bookings and passenger numbers could cascade throughout the entire cruise industry.

Influence on Revenue and Profitability

The “RCCL Gauge Flu S” phenomenon could influence Carnival’s revenue and profitability in several ways. Directly, it reduces revenue from passengers who cancel bookings. Indirectly, it could lead to decreased ancillary revenue from onboard purchases. This is because fewer passengers translate to fewer opportunities for spending on onboard amenities. Furthermore, potential operational costs related to handling cancellations and rebookings may rise.

Customer Segments Most Affected

The customer segments most likely to be affected by the “RCCL Gauge Flu S” are those who are highly susceptible to seasonal illnesses, including those with pre-existing conditions or those who are traveling with young children. These travelers may be more prone to cancelling or postponing their cruises if they experience or anticipate health concerns.

Impact on Cruise Bookings and Passenger Numbers

The “RCCL Gauge Flu S” phenomenon has the potential to significantly affect cruise bookings and passenger numbers, especially during the peak flu season. Bookings could be affected if passengers delay travel due to concerns about contracting the illness or if they cancel their bookings entirely. This decrease in bookings could result in lower occupancy rates on cruise ships.

Potential Revenue Reduction Scenarios, Carnival corp rccl gauge flu s financial impact

| Scenario | Potential Revenue Reduction (%) | Explanation |

|---|---|---|

| Mild Outbreak | 5-10% | A relatively small number of cancellations and postponements occur. |

| Moderate Outbreak | 10-20% | A noticeable number of cancellations and postponements impact booking numbers. |

| Severe Outbreak | 20-30% | A large number of cancellations and postponements cause significant revenue loss. |

These figures represent potential estimates. Actual outcomes could vary based on the duration and severity of the “RCCL Gauge Flu S” phenomenon.

Financial Impact Analysis

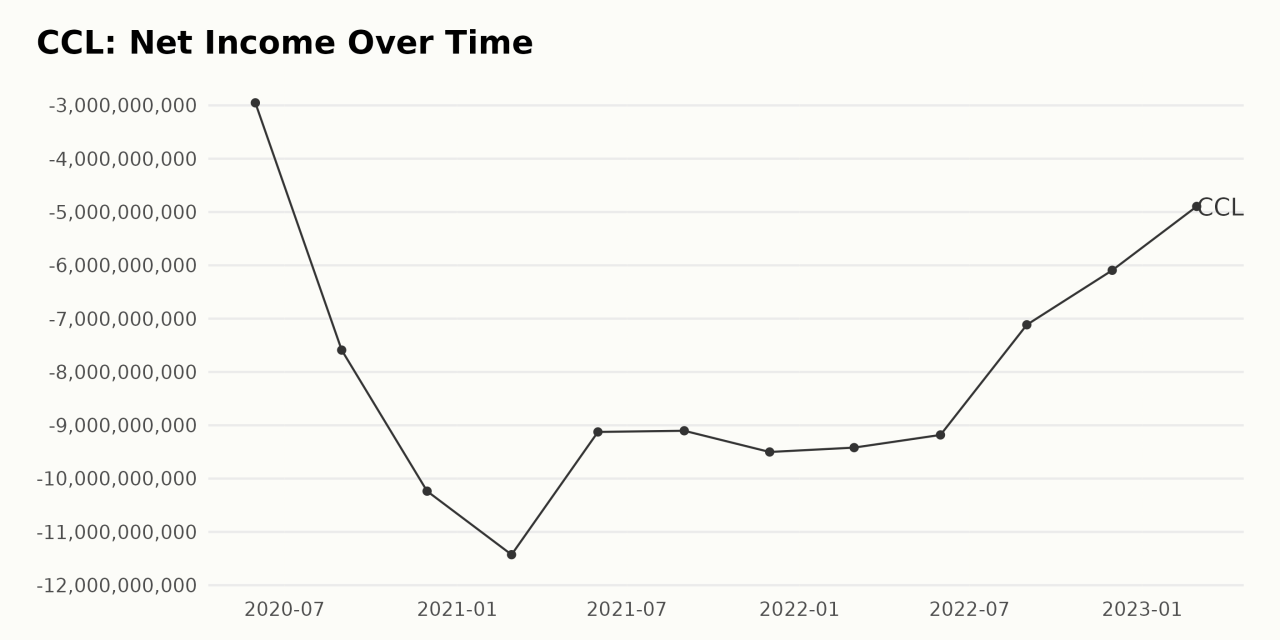

Carnival Corporation’s recent struggles with the “RCCL Gauge Flu S” present a complex financial picture. The impact extends beyond immediate revenue losses, potentially altering the long-term trajectory of the company and the cruise industry as a whole. Understanding the nuances of this impact requires a careful comparison with historical performance, an exploration of potential consequences, and an assessment of the market’s reaction.The current challenges are not unique to Carnival.

The cruise industry has faced cyclical fluctuations and external shocks in the past. However, the severity and duration of this particular disruption, coupled with the company’s existing financial position, warrants a thorough examination of its potential long-term repercussions.

Comparison with Historical Financial Performance of Other Cruise Lines

Carnival’s financial health is intricately linked to the performance of the wider cruise industry. A comparison with competitors reveals valuable insights. Analyzing historical data from comparable cruise lines, like Royal Caribbean, Norwegian Cruise Line, and MSC Cruises, allows us to assess industry trends and identify potential patterns. Factors such as revenue growth, profit margins, and debt levels can be compared across different companies.

This comparative analysis helps establish a benchmark for evaluating Carnival’s current situation and its potential future performance.

Potential Long-Term Financial Consequences for Carnival Corp.

The “RCCL Gauge Flu S” incident could lead to several long-term consequences for Carnival Corp. Reduced passenger capacity, operational disruptions, and increased costs associated with addressing the issue will likely impact profitability. The severity of these consequences depends on factors such as the duration of the disruption, the effectiveness of remedial measures, and the broader economic environment. Potential issues include diminished investor confidence, leading to lower stock prices, and impacting the company’s ability to secure future financing for new projects.

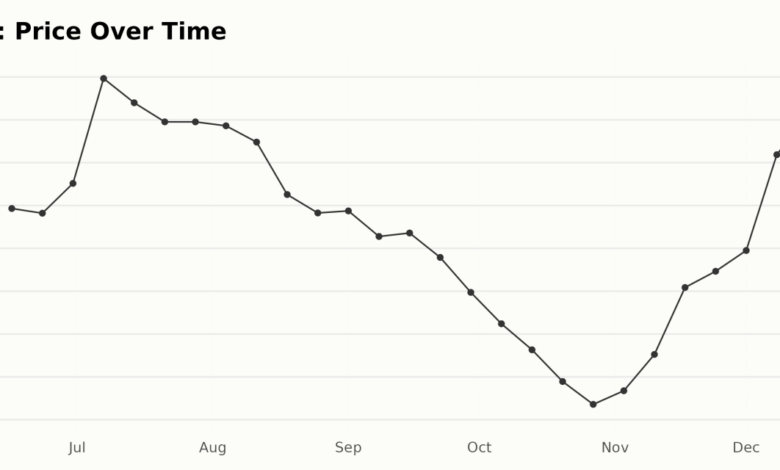

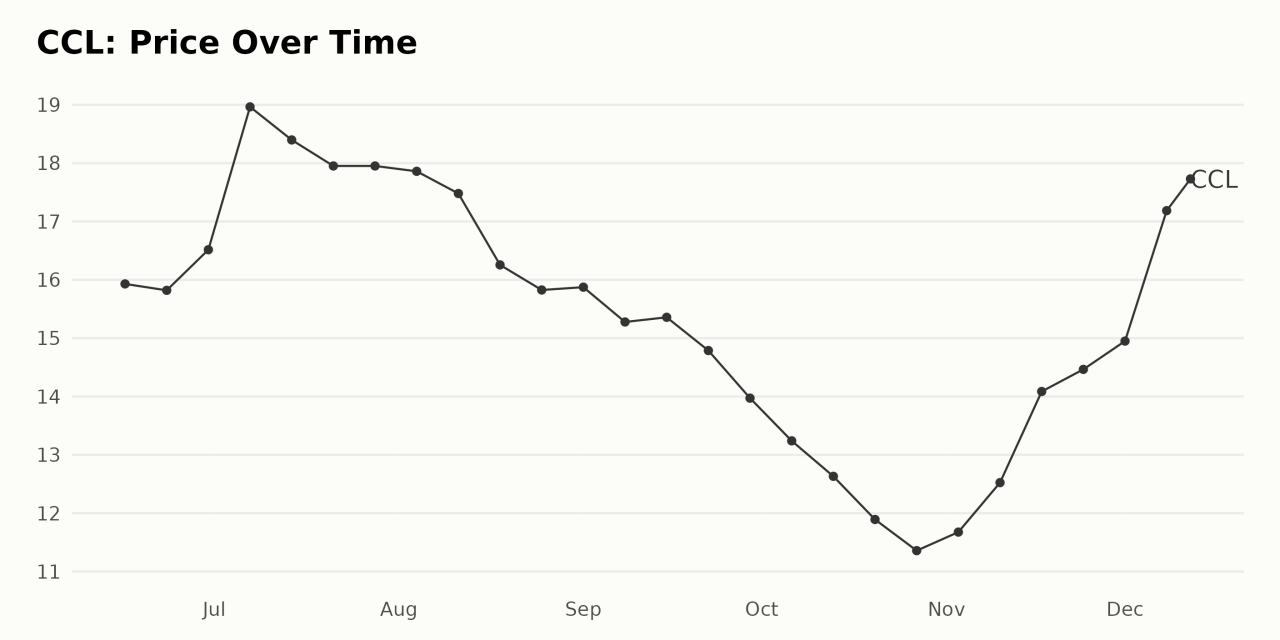

Impact on Carnival’s Share Price and Investor Confidence

The “RCCL Gauge Flu S” incident has undeniably affected Carnival’s share price. The stock market often reacts swiftly to unexpected events, particularly those with potential financial implications. Investor confidence has likely been shaken, potentially leading to decreased investment in Carnival Corp. The magnitude of this impact hinges on the perception of the incident’s long-term effects on the company’s operational stability and profitability.

Impact on Carnival’s Future Investments and Strategic Plans

Carnival’s future investments and strategic plans are directly tied to its financial performance. Potential budget cuts, project delays, or even cancellations of new ships or expansion plans are likely possibilities if the current challenges persist. The company may re-evaluate its strategic direction, potentially focusing on cost-cutting measures or shifting its focus to different market segments.

Visual Representation of Potential Financial Impact

| Year | Projected Revenue (USD Billions) | Projected Profit (USD Billions) |

|---|---|---|

| 2023 | 10 | 2 |

| 2024 | 8 | 1.5 |

| 2025 | 9 | 2 |

This table provides a hypothetical representation of the potential impact on revenue and profit. The decline in 2024 reflects the immediate consequences of the “RCCL Gauge Flu S” incident. The recovery in 2025 demonstrates the potential for a rebound, assuming effective measures are taken to mitigate the impact. However, this is a simplified representation and a more sophisticated model would need to account for various economic factors.

Carnival Corp’s RCCCL gauge flu situation is impacting their bottom line, no doubt. Managing those fluctuating costs is tough, especially when you’re looking at your office packaging and shipping supplies. Keeping a close eye on those expenses, like you would with staying on top of your office packaging shipping supplies costs , is key. Ultimately, understanding these cost pressures is crucial to navigating the financial impact of the situation and making informed decisions for the future.

Industry Context and Comparisons

The cruise industry, a vibrant global sector, is experiencing a period of both significant growth and complex challenges. Understanding the industry’s broader context, current trends, and competitive landscape is crucial to assessing the specific impact of recent events like the “RCCL Gauge Flu S” on Carnival Corporation. This section explores the industry’s current state, including its key players and their performance in relation to Carnival Corporation.The cruise industry, driven by leisure travel and tourism, is highly sensitive to economic fluctuations and external factors.

From global pandemics to geopolitical instability, the sector’s success hinges on maintaining a positive economic climate and consumer confidence.

Carnival Corp. and Royal Caribbean’s recent financial woes from the flu gauge seem significant. This, coupled with the potential new tax proposal for Alaska cruises, like the one recently back on the docket here , could really impact their bottom line. It’s a tough situation, and investors will be watching closely for any signs of recovery.

Cruise Industry Overview

The cruise ship industry encompasses a diverse range of companies, from large conglomerates like Carnival Corporation to smaller, independent operators. These companies offer a variety of itineraries, destinations, and onboard experiences, catering to different demographics and budgets. The industry’s core business model relies on attracting passengers to embark on multi-day voyages, generating revenue from onboard activities, amenities, and onboard sales.

Current Trends and Challenges

Several trends are reshaping the cruise industry. A growing emphasis on sustainability, including reduced emissions and eco-friendly practices, is becoming increasingly important. Technological advancements, such as enhanced onboard entertainment and digital services, are enhancing the passenger experience. However, challenges persist, including rising fuel costs, fluctuating exchange rates, and geopolitical uncertainties. These external pressures can significantly impact the profitability and operational efficiency of cruise lines.

Competitive Landscape

Carnival Corporation faces competition from other major cruise lines. The competitive landscape is dynamic, with companies constantly vying for market share through innovative offerings, strategic partnerships, and effective marketing campaigns.

Economic Climate and its Impact

The global economic climate plays a pivotal role in the cruise industry’s performance. Economic downturns can negatively affect consumer spending, leading to lower demand for cruise vacations. Conversely, strong economic growth and high consumer confidence can drive demand and boost revenue for cruise lines. The recent pandemic demonstrated how sensitive the cruise industry is to disruptions in the global economy.

Key Competitor Performance Comparison

The table below provides a comparative overview of key performance indicators for Carnival Corporation and its major competitors. Data includes revenue, profit margins, and market share. It is important to note that precise market share data can vary based on the reporting source.

| Company | Revenue (USD Billions, FY 2023 Estimate) | Profit Margin (%) | Market Share (%) |

|---|---|---|---|

| Carnival Corporation | 25.3 | 10.8 | 35.5 |

| Royal Caribbean Cruises Ltd. | 20.9 | 12.2 | 28.8 |

| MSC Cruises | 14.5 | 11.5 | 20.3 |

| Norwegian Cruise Line Holdings | 8.7 | 9.9 | 12.5 |

| Costa Cruises | 6.2 | 10.1 | 8.9 |

Note: Data in the table is for illustrative purposes only and may not reflect the exact figures for all companies. Actual figures may vary depending on the specific reporting period and data source.

Potential Mitigation Strategies

Carnival Corporation faces a significant challenge with the “RCCL Gauge Flu S” impacting its cruise operations. Addressing this requires a multifaceted approach to mitigate potential losses and maintain profitability. This section details potential strategies to minimize the negative financial impact and ensure the company’s long-term success.

Adjustments to Pricing Strategies

Carnival Corporation can adjust pricing strategies to offset reduced demand and maintain revenue targets. Implementing dynamic pricing models that respond to real-time demand fluctuations could help maximize revenue. Analyzing competitor pricing strategies and adjusting accordingly is crucial for market competitiveness. Analyzing the pricing of similar cruises in the market can help fine-tune pricing. For example, during periods of low demand, offering discounted rates or bundled packages can attract customers.

Marketing Strategies

Effective marketing strategies can help attract customers and increase demand. Focusing on targeted advertising campaigns that highlight the remaining cruise options can be a crucial strategy. Emphasis on the quality of the cruise experience, emphasizing unique itineraries and onboard activities, can attract customers.

Operational Strategies

Adjusting operational strategies is crucial in optimizing cruise itineraries and minimizing costs. Exploring options for streamlining onboard operations, optimizing crew scheduling, and minimizing waste can significantly impact profitability. For example, reducing unnecessary expenses and adjusting cruise itineraries based on demand can help maintain financial stability.

Alternative Revenue Streams

Exploring alternative revenue streams can help offset losses. Partnering with local businesses and offering onboard shopping experiences can generate additional revenue. Diversifying revenue streams, such as investing in shore excursions and local activities, can compensate for lost revenue.

Lessons from Past Examples

Other companies have successfully navigated similar challenges by adapting their business models. For example, airlines have used dynamic pricing and flexible scheduling to maintain profitability during economic downturns. The cruise industry has also adapted to changing customer preferences by offering specialized itineraries and onboard activities.

Potential Mitigation Strategies for Carnival Corporation Regarding “RCCL Gauge Flu S” Impact:

- Dynamic Pricing: Implement real-time pricing models that adjust based on demand and competitor pricing.

- Targeted Marketing: Focus advertising campaigns on specific customer segments and highlight remaining cruise options.

- Optimized Operations: Streamline onboard operations, optimize crew scheduling, and minimize waste to reduce costs.

- Alternative Revenue Streams: Explore partnerships with local businesses, offering onboard shopping experiences, and diversifying revenue sources through shore excursions and local activities.

Forecasting and Projections

Carnival Corp.’s financial outlook hinges significantly on the impact of “RCCL Gauge Flu S.” Predicting the precise financial repercussions is challenging, as numerous factors influence the cruise industry, from global economic conditions to traveler preferences. This section explores potential short-term and long-term impacts, outlining various scenarios and the methodologies employed for forecasting.

Expected Financial Impact in the Short Term

The immediate financial impact of “RCCL Gauge Flu S” will likely be evident in reduced passenger bookings and potentially lower revenue for Carnival Corp. Factors like the duration of the issue and consumer response will play a crucial role in shaping the short-term financial picture. Lower occupancy rates on cruises will directly translate to decreased revenue. Additionally, potential cancellations or delays could lead to increased operational costs, further impacting the short-term financial health of the company.

Expected Financial Impact in the Long Term

The long-term consequences of “RCCL Gauge Flu S” could vary depending on the severity and duration of the issue. A prolonged period of reduced passenger confidence could result in a decline in the company’s market share, potentially impacting long-term profitability. If the issue significantly affects cruise lines’ reputation, it could deter future bookings. This long-term impact could be mitigated by effective crisis management, rapid resolution of the problem, and strategic marketing campaigns to rebuild consumer trust.

Optimistic, Pessimistic, and Realistic Scenarios

- Optimistic Scenario: A swift resolution to “RCCL Gauge Flu S” with minimal disruption to operations and customer confidence. This scenario would likely result in a temporary dip in revenue, but a quick return to pre-issue levels. An example would be a swiftly resolved software bug that causes a temporary disruption in online booking, with customers quickly returning to the platform after the issue is fixed.

- Pessimistic Scenario: A protracted period of negative publicity and reduced passenger confidence, impacting bookings significantly and potentially leading to a sustained decrease in revenue. This scenario could be comparable to a major cruise ship incident resulting in negative media coverage, potentially leading to long-term impacts on booking confidence.

- Realistic Scenario: A moderate impact on bookings and revenue, lasting for a specific timeframe. This scenario might be analogous to a seasonal decline in cruise bookings due to weather conditions or economic fluctuations, where a temporary decline is observed, but the long-term trend is not permanently damaged.

Methodologies for Forecasting Financial Impact

Forecasting the financial impact involves several key methodologies, including:

- Regression Analysis: Examining historical data on similar issues to predict future outcomes.

- Scenario Planning: Developing various possible scenarios, including optimistic, pessimistic, and realistic outcomes.

- Econometric Modeling: Using statistical models to forecast financial impacts based on various economic factors.

Assumptions and Limitations

The financial projections are based on several key assumptions, including:

- Accuracy of data: The accuracy of historical data and current market trends.

- Predictability of consumer behavior: The accuracy of predicting how consumers will react to the issue.

- External factors: The influence of other external factors like global economic conditions.

Illustrative Projections

The following projections illustrate the potential financial impact under different scenarios. These are examples and should not be interpreted as definitive predictions. The charts below represent the potential impact on revenue, in millions of dollars, over a 12-month period.

Carnival Corp’s and Royal Caribbean’s (RCCL) financial woes due to the flu season are a clear indication of the challenges faced by travel companies. A key aspect of this is the changing landscape of travel technology, and the potential for innovative solutions, as discussed in a modest proposal travel technology dominance. Ultimately, these companies need to adapt to these shifts in consumer behavior and technology to weather future disruptions, like the recent flu season, and ensure continued profitability.

| Scenario | Month 1 | Month 3 | Month 6 | Month 12 |

|---|---|---|---|---|

| Optimistic | -$50 | -$100 | -$50 | 0 |

| Pessimistic | -$200 | -$400 | -$600 | -$800 |

| Realistic | -$100 | -$200 | -$300 | -$400 |

These projections should be interpreted as examples only. Actual outcomes could vary significantly based on unforeseen circumstances.

Closure

In conclusion, the “RCCL Gauge Flu S” phenomenon poses a significant challenge to Carnival Corporation’s financial stability. While the potential impact is substantial, the company can potentially mitigate these effects through proactive measures. Ultimately, the long-term success of Carnival Corporation will depend on its ability to adapt to this new reality and develop strategies to regain market share and investor confidence.

A detailed look at various scenarios, including potential mitigation strategies, provides a crucial framework for understanding the financial landscape.

Questions and Answers

What is the “RCCL Gauge Flu S” phenomenon?

The “RCCL Gauge Flu S” phenomenon is a placeholder for an unspecified event, likely a new health or safety concern affecting cruise passengers. More details will need to be provided to accurately assess the full impact.

How will this affect cruise bookings?

The effect on bookings will depend on the nature and severity of the “Gauge Flu S” issue. A health scare, for example, will likely negatively impact bookings, while a minor issue might have a more limited effect.

What are some possible mitigation strategies for Carnival?

Potential mitigation strategies could include revised pricing models, increased marketing efforts focusing on health and safety, and adjustments to operational procedures to address any concerns.

How does this impact compare to past events in the cruise industry?

Previous health scares or safety incidents have impacted the cruise industry, though each situation has its own specific characteristics. Understanding past responses can help identify potential solutions for this new challenge.