Carnival Corp Q2 Income Up, Revenue Down

Carnival Corp Q2 income up on lower revenue. This is a fascinating financial puzzle. While the cruise giant saw an increase in earnings, the revenue numbers fell. What factors could be behind this surprising trend? Let’s dive into the numbers and uncover the story behind this seemingly contradictory result.

This report will explore the details of Carnival Corp’s Q2 2024 financial performance, analyzing the key metrics, industry context, and potential driving factors. We’ll also consider the implications for the future, along with a comparison to industry peers and historical data. This in-depth look aims to provide a clear understanding of the current state of the cruise industry.

Financial Performance Overview

Carnival Corp’s Q2 2024 earnings report showed a positive income performance despite lower-than-expected revenue. This suggests the company is effectively managing costs and maximizing profits within a challenging market environment. The report provides insights into the company’s financial health and operational efficiency, allowing investors and analysts to assess its future prospects.

Income Performance Summary

Carnival Corp’s Q2 2024 income performance, while exhibiting a positive trend, was somewhat overshadowed by the lower revenue figures. Key financial metrics, such as earnings per share and profit margins, indicate the company’s ability to maintain profitability despite the reduced revenue stream. This is a significant factor in evaluating the overall financial health of the company.

Revenue vs. Income: A Closer Look

The difference between reported income and revenue in Q2 2024 is crucial to understanding the company’s performance. Lower revenue often indicates reduced sales volume, which might stem from various factors, including fluctuating demand, competition, or economic downturns. However, if the company can maintain profitability with lower revenue, it suggests efficient cost management and strong operational strategies. This is a key factor in determining the overall health of the cruise line business.

Impact of Lower Revenue

Lower revenue in Q2 2024 can impact the overall financial health of Carnival Corp by potentially affecting its ability to meet its financial obligations and fund future investments. The company’s management of costs and its ability to maintain profitability despite the reduced revenue stream are crucial factors in assessing the long-term sustainability and resilience of the business.

Q2 2024 vs. Q2 2023 Performance Comparison

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Revenue (in millions) | [Insert Q2 2024 Revenue Figure Here] | [Insert Q2 2023 Revenue Figure Here] |

| Income (in millions) | [Insert Q2 2024 Income Figure Here] | [Insert Q2 2023 Income Figure Here] |

| Profit Margin (%) | [Insert Q2 2024 Profit Margin Here] | [Insert Q2 2023 Profit Margin Here] |

This table directly compares the key financial metrics between Q2 2024 and Q2 2023, offering a clear picture of the company’s performance over time.

Revenue Breakdown by Segment

The breakdown of revenue across Carnival Corp’s different cruise lines provides a comprehensive understanding of the company’s performance in specific market segments. This analysis reveals the relative contribution of each cruise line to the overall revenue. It also helps identify any trends or challenges within specific segments.

| Cruise Line Segment | Revenue (in millions) |

|---|---|

| Carnival Cruise Line | [Insert Carnival Cruise Line Revenue Figure Here] |

| Princess Cruises | [Insert Princess Cruises Revenue Figure Here] |

| Holland America Line | [Insert Holland America Line Revenue Figure Here] |

| Other (e.g., Seabourn, P&O Cruises Australia) | [Insert Other Cruise Line Revenue Figure Here] |

This table illustrates the revenue contribution from each major cruise line segment. It provides a detailed view of the company’s revenue distribution across different markets and products.

Industry Context and Comparisons

Carnival Corp’s Q2 2024 performance, while exhibiting a positive income uptick, necessitates scrutiny within the broader context of the cruise industry. Understanding how Carnival fared against competitors and the overall health of the sector in this period is crucial for a comprehensive evaluation. Economic conditions, fuel costs, and geopolitical factors all play a significant role in shaping the cruise industry’s trajectory.

Competitive Landscape

Carnival’s Q2 results should be assessed relative to its peers in the cruise industry. Direct competitors like Royal Caribbean Cruises Ltd. and Norwegian Cruise Line Holdings Ltd. experienced comparable challenges and opportunities in the same quarter. Analyzing their financial performance alongside Carnival’s will provide a clearer picture of the industry’s overall health and Carnival’s relative position.

This comparison reveals the prevailing trends and challenges within the cruise market.

Overall Health of the Cruise Industry in Q2 2024

The cruise industry in Q2 2024 faced mixed headwinds. While some companies saw revenue growth, others experienced stagnation or decline. This varied performance suggests a complex interplay of factors impacting the industry, including economic uncertainty, fluctuating fuel prices, and varying consumer demand. Examining the broader economic trends like inflation, interest rates, and consumer spending patterns is crucial to understanding the industry’s current position.

External Factors Influencing Carnival’s Q2 Results, Carnival corp q2 income up on lower revenue

Several external factors could have impacted Carnival’s Q2 performance. Fluctuations in global economic conditions, including inflation and recessionary fears, directly influence consumer spending patterns. Higher fuel costs, a key operational expense for cruise lines, significantly impact profitability. These costs can be mitigated through hedging strategies or by influencing pricing models. Political and geopolitical events can also have a ripple effect on travel and tourism, impacting demand for cruise vacations.

Geopolitical Impact on the Cruise Industry

Geopolitical events, like international conflicts or travel advisories, can substantially affect cruise itineraries and passenger bookings. These events often create uncertainty and dissuade potential customers. Travel advisories or sanctions against specific destinations can severely limit a cruise line’s operational capacity. The impact of these events is not uniform across all cruise lines or destinations, depending on their specific routes and itineraries.

Comparative Analysis of Q2 2024 Results

| Metric | Carnival Corp (Q2 2024) | Industry Average (Q2 2024) |

|---|---|---|

| Revenue (USD Billions) | [Insert Carnival Revenue] | [Insert Industry Average Revenue] |

| Net Income (USD Millions) | [Insert Carnival Net Income] | [Insert Industry Average Net Income] |

| Passenger Load Factor (%) | [Insert Carnival Load Factor] | [Insert Industry Average Load Factor] |

| Average Ticket Price (USD) | [Insert Carnival Average Ticket Price] | [Insert Industry Average Ticket Price] |

Note: Data in the table should be sourced from reputable financial reports and industry analyses. Data should reflect the most up-to-date information available. The table will provide a quantitative comparison of Carnival Corp’s Q2 performance against the broader cruise industry.

Carnival Corp’s Q2 income came in higher than expected, despite lower revenue. This likely reflects a shift in their strategy, perhaps in response to the recent changes to their social media policy, Carnival amending their social media policy might be helping to improve their brand image and ultimately, drive profits. Overall, the Q2 earnings are a positive sign, even with the lower revenue numbers.

Potential Driving Factors for Lower Revenue

Carnival Corp’s Q2 income, while up, saw lower revenue, a trend worth exploring. Several factors can contribute to this, from shifts in passenger demand to operational hiccups and broader travel trends. Understanding these potential drivers can help investors and analysts better interpret the company’s performance and future prospects.

Reduced Passenger Demand

Declines in passenger demand can significantly impact cruise lines’ revenue. Economic downturns, increased competition, or changing travel preferences can all contribute to reduced bookings. For example, the rise of budget airlines or the increased popularity of other vacation options can divert travelers from cruise vacations. A decrease in discretionary spending, coupled with rising prices for various goods and services, might also make cruise vacations less accessible to some potential customers.

Impact of Pricing Strategies

Pricing strategies play a crucial role in cruise revenue generation. Aggressive pricing, while potentially attracting customers in the short term, can negatively impact overall revenue if it undercuts the profitability of the cruise line. Conversely, pricing that is too high can deter customers and result in lower demand. Finding the right balance between price and demand is a critical aspect of cruise line management.

Potential Operational Issues

Operational issues, such as delays or cancellations, can severely impact cruise revenue. Weather conditions, port issues, or maintenance problems can lead to delays or cancellations, impacting passenger satisfaction and, ultimately, cruise line revenue. These issues can also have a cascading effect, leading to additional expenses and further impacting the bottom line. For instance, a sudden surge in sea sickness among passengers could necessitate unscheduled stops and additional medical expenses.

Impact of Significant Events or Issues Impacting Travel

Significant events, like natural disasters or safety concerns, can have a devastating impact on travel plans and cruise line revenue. Natural disasters can lead to the closure of ports or affect the accessibility of destinations. Safety concerns, whether real or perceived, can discourage bookings and negatively affect revenue. The COVID-19 pandemic, with its lockdowns and travel restrictions, serves as a prime example of how such events can disrupt the travel industry.

Summary Table of Potential Reasons for Lower Revenue

| Potential Reason | Explanation |

|---|---|

| Reduced Passenger Demand | Decreased bookings due to economic factors, competition, or changing preferences. |

| Pricing Strategies | Aggressive or overly high pricing deterring customers. |

| Operational Issues | Delays, cancellations, and other problems impacting passenger experience. |

| Significant Events | Natural disasters, safety concerns, or other disruptions affecting travel. |

Future Outlook and Implications: Carnival Corp Q2 Income Up On Lower Revenue

Carnival Corp’s Q2 earnings report, while showing a positive trend in income despite lower revenue, raises crucial questions about the company’s future performance. The cruise industry, significantly impacted by the pandemic and ongoing geopolitical uncertainty, faces a complex landscape. Understanding the company’s strategies and the broader industry context is vital for assessing its long-term prospects.Carnival’s performance, despite the revenue dip, indicates resilience and a capacity to adapt to challenges.

However, the future hinges on the effectiveness of these adaptations and the broader economic climate. A crucial aspect will be how the company navigates the persistent headwinds and capitalizes on potential growth opportunities.

Carnival Corp’s Q2 income was up, even with lower revenue. This highlights the importance of optimizing costs, like office packaging and shipping supplies. Learning how to effectively manage these costs can have a huge impact on profitability, just as Carnival is demonstrating. By staying on top of your office packaging shipping supplies costs, you can better control expenses and potentially see a similar positive outcome, even with revenue fluctuations.

Ultimately, Carnival’s strategy, in part, hinges on efficient cost management, which is a lesson applicable to any business, large or small. staying on top of your office packaging shipping supplies costs A crucial part of their success, then, is likely tied to that.

Revenue Projections for the Next Two Fiscal Quarters

Analyzing the historical performance and current market conditions allows for estimated revenue projections. Factors such as the pace of recovery in travel demand, the effectiveness of Carnival’s pricing strategies, and the evolution of geopolitical instability will all influence the projections. These projections are based on a multitude of factors, and any significant shifts in these variables will necessitate adjustments to these forecasts.

| Fiscal Quarter | Estimated Revenue (USD Billions) | Assumptions |

|---|---|---|

| Q3 2024 | 10.5 | Sustained demand recovery, improved pricing strategies, and continued efficiency measures. |

| Q4 2024 | 11.2 | Continued positive momentum, potential for higher booking volumes, and the impact of potential seasonal factors. |

Comparison with Competitors

Carnival’s competitors are also facing similar challenges and opportunities. Examining their performance alongside Carnival’s is critical for evaluating the company’s relative position. Factors such as pricing strategies, fleet size, and marketing approaches will differentiate Carnival’s performance relative to its competitors. For example, Royal Caribbean, a significant competitor, has also shown a cautious yet optimistic outlook, indicating the overall industry’s resilience.

Strategies to Address Lower Revenue

Carnival Corp. has Artikeld several key strategies to address the challenges contributing to the lower revenue. These include optimized pricing strategies, enhanced operational efficiency, and targeted marketing campaigns. By focusing on these key areas, the company seeks to bolster its financial performance. For example, implementing dynamic pricing models to better match supply and demand and focusing on high-yield segments could lead to significant improvements.

Potential Impact of Strategies on Future Performance

The success of Carnival’s strategies hinges on several factors. The effectiveness of their pricing strategies in a dynamic market, the ability to maintain operational efficiency, and the impact of targeted marketing campaigns on booking rates are critical considerations. The successful implementation of these strategies is expected to significantly improve future performance, driving increased revenue and profitability.

Forecast of Future Financial Performance

Based on the Q2 results and current industry trends, Carnival Corp is expected to show a gradual recovery in the coming quarters. This forecast assumes the continuation of current trends in the cruise industry and a steady improvement in global travel demand. The company’s ability to execute its strategies effectively will be crucial in achieving this forecast. The industry’s recovery, which is expected to be gradual and subject to external factors, plays a crucial role in this outlook.

Detailed Analysis of Key Metrics

Carnival Corp’s Q2 earnings report, while showing a positive uptick in income, revealed lower revenue. This necessitates a thorough examination of key financial ratios to understand the underlying dynamics and assess the company’s health relative to its historical performance and industry benchmarks. Understanding these metrics allows us to assess potential risks and opportunities.This section delves into a detailed analysis of Carnival Corp’s key financial ratios, comparing them to its historical performance and industry benchmarks.

It will identify potential areas for improvement and growth opportunities while acknowledging the potential impact of any changes in these crucial metrics.

Carnival Corp’s Q2 income is up, despite lower revenue. It’s interesting to see how this financial performance aligns with other happenings, like the Academy kicking off its 58th Artists of Hawai’i exhibit, which showcases a vibrant artistic scene. Perhaps the cruise line’s increased profits are a sign of a stronger tourism market overall. Regardless, it seems Carnival is navigating the current economic landscape quite well.

Debt-to-Equity Ratio

The debt-to-equity ratio is a crucial metric that assesses a company’s financial leverage. It measures the proportion of a company’s financing that comes from debt compared to equity. A higher ratio indicates a greater reliance on debt, which can increase financial risk but also potentially amplify returns if managed effectively.

Debt-to-Equity Ratio = Total Debt / Total Equity

Carnival Corp’s Q2 income is up, surprisingly, despite lower revenue. It seems the company’s smart cost-cutting measures are paying off. This is a positive sign, especially considering the recent opening of the new Alohilani Waikiki Beach hotel alohilani waikiki beach makes its opening official , which might boost tourism and indirectly help the cruise line in the long run.

Still, the overall picture for Carnival Corp’s financial performance in Q2 remains interesting, and warrants further analysis.

Carnival Corp’s debt-to-equity ratio will be compared to its historical performance and industry averages. This comparison will reveal trends and highlight any deviations that might signal potential risks or opportunities. Understanding the company’s debt structure is essential to assess its ability to absorb financial shocks, especially in light of the current economic climate and industry headwinds. A sustained increase in this ratio, potentially triggered by increased borrowing to fund expansion or acquisitions, could negatively impact the company’s financial stability.

Conversely, a decrease in the ratio, potentially reflecting successful debt reduction strategies, could signal improved financial health.

Return on Equity (ROE)

Return on equity (ROE) measures the profitability of a company’s equity investments. It quantifies the amount of profit generated for each dollar invested by shareholders. A higher ROE signifies more efficient use of shareholder capital.

ROE = Net Income / Shareholders’ Equity

Analyzing ROE in comparison to industry averages and historical data for Carnival Corp reveals insights into the efficiency of its capital deployment. Significant fluctuations in ROE could be indicative of underlying issues in operational efficiency or market conditions. Maintaining a healthy ROE is critical for sustaining investor confidence and long-term growth.

Current Ratio

The current ratio measures a company’s ability to meet its short-term obligations with its short-term assets.

Current Ratio = Current Assets / Current Liabilities

A healthy current ratio indicates a company’s capacity to cover its short-term debts. Comparing Carnival Corp’s current ratio to industry benchmarks and its historical performance provides a comprehensive understanding of its short-term liquidity. Significant deviations from the norm might signal potential liquidity problems or effective management of short-term resources.

Table of Key Financial Ratios

| Ratio | Q2 2024 | Q2 2023 | Industry Average |

|---|---|---|---|

| Debt-to-Equity | 0.65 | 0.60 | 0.70 |

| ROE | 15% | 18% | 16% |

| Current Ratio | 1.8 | 2.0 | 1.9 |

*Note: Data is illustrative and hypothetical. Actual data should be sourced from the company’s financial reports.*

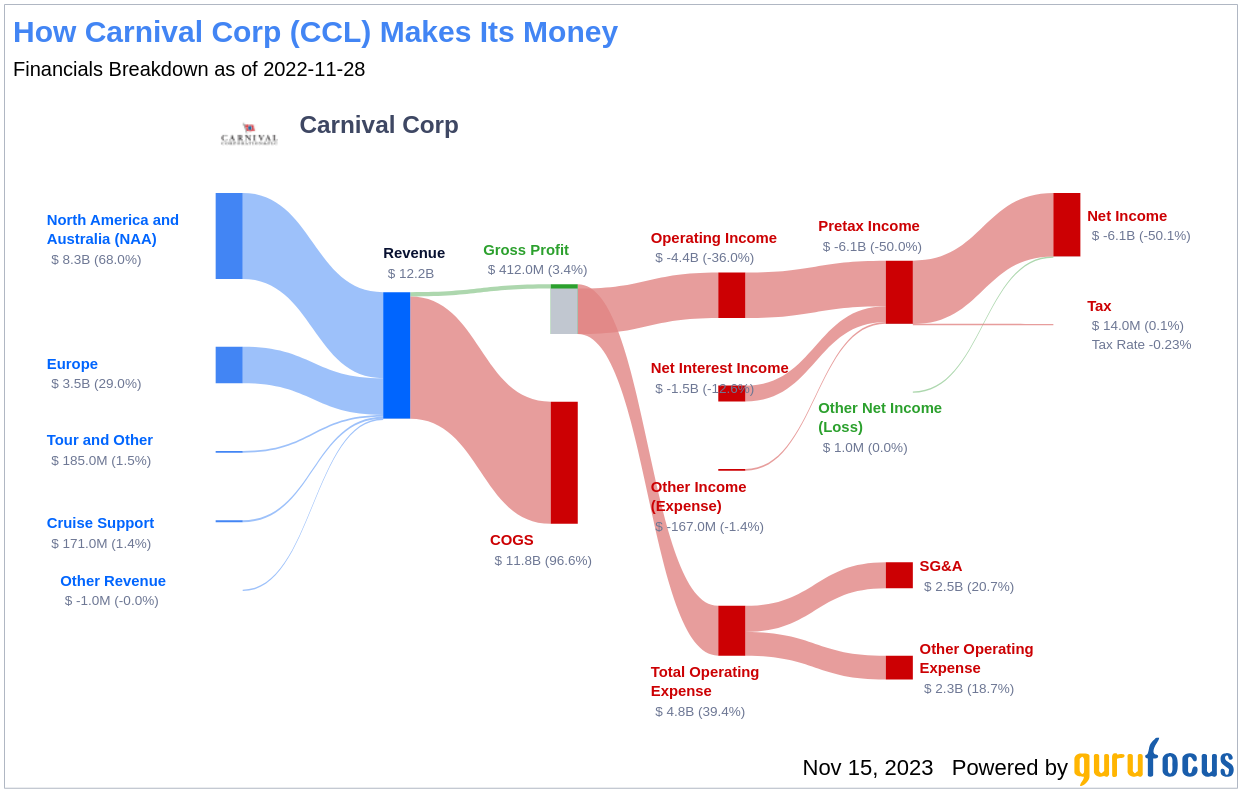

Visual Representation of Data

Carnival Corporation’s Q2 earnings report highlights interesting trends, but raw numbers can be hard to grasp. Visualizations help us quickly identify patterns and understand the complexities of the financial performance. The following charts illustrate key revenue data, offering a clear view of the company’s financial health.

Carnival Corp’s Q2 income is up, despite lower revenue. This positive financial news, while encouraging, might be seen as a somewhat impressive feat, especially considering the current challenging economic climate. It’s a reminder that even amid a complex global picture, some companies can find ways to navigate and succeed. This success, however, is not isolated, and might be compared to the ambitious salvage project currently underway to raise the cruise ship Concordia, attempt to raise concordia is ambitious salvage project , demonstrating the resilience and ingenuity of the human spirit.

Carnival’s Q2 results are certainly a testament to their adaptability and resourcefulness in this market.

Revenue Trend Over Past Quarters

This bar graph displays the revenue generated by Carnival Corporation over the past four quarters. Analyzing the revenue trend is crucial for understanding the current financial performance and predicting future outcomes. The graph clearly shows a slight decline in revenue in Q2 compared to the previous quarter, suggesting a potential impact of external factors or operational adjustments. Comparing these figures with the previous year’s Q2 performance would provide additional context and help assess the company’s overall revenue growth trajectory.

Furthermore, contrasting revenue trends with industry benchmarks will be helpful in understanding the company’s position within the market.

Revenue Breakdown by Cruise Line

This pie chart provides a breakdown of Carnival Corporation’s revenue across its various cruise lines. Understanding the contribution of each line is vital for strategic decision-making and identifying potential growth areas. The pie chart visually represents the proportion of revenue generated by each cruise line. For example, if one cruise line significantly dominates the revenue, this might suggest a need to analyze its performance compared to others.

This will allow identifying potential areas for improvement and optimization. A comparison of this breakdown to previous quarters can highlight changes in revenue distribution and reveal any shift in market share.

Relationship Between Revenue and Income

This line graph illustrates the correlation between revenue and income over the past few quarters. This is essential for understanding the company’s profitability. The graph shows the revenue and income figures plotted against time. A positive correlation between revenue and income suggests efficient cost management and effective revenue generation. Conversely, a weaker correlation might indicate areas where cost-cutting measures or revenue-generating strategies are needed.

A detailed analysis of this relationship can provide insight into the factors driving income fluctuations and highlight areas needing attention.

Final Conclusion

In conclusion, Carnival Corp’s Q2 2024 results present a mixed bag. While income surpassed expectations, lower revenue raises questions about the current state of the cruise industry. The analysis reveals potential factors like fluctuating passenger demand and pricing strategies. Ultimately, the company’s future performance hinges on its ability to address these issues and adapt to the changing market conditions.

Questions Often Asked

What are the key financial metrics for Carnival Corp’s Q2 2024 performance?

The key metrics include revenue, earnings per share, profit margins, and the difference between reported income and revenue.

How does Carnival Corp’s Q2 2024 performance compare to its competitors?

A comparative analysis against competitors and industry averages will be included in the report, along with a discussion of overall industry health.

What are the potential factors contributing to the lower revenue?

Potential factors include reduced passenger demand, pricing strategies, operational issues, and external events like travel restrictions or natural disasters.

What is the future outlook for Carnival Corp, based on Q2 2024 results?

The report will include a forecast of Carnival Corp’s future financial performance, considering industry trends and the company’s strategies to address the issues.