Carnival Corp Profit Falls Deep Dive

Carnival Corp profit falls, signaling a potential downturn in the cruise industry. This deep dive explores the factors behind this decline, analyzing recent financial performance, market trends, and potential implications for the future. We’ll examine the company’s history, recent financial figures, and competitive landscape to understand the current situation and potential recovery strategies.

The recent announcement of Carnival Corp’s declining profits has sent ripples through the travel and finance sectors. Investors are closely watching the company’s response and the broader implications for the cruise industry. This article aims to provide a comprehensive analysis, shedding light on the causes and potential consequences of this significant financial downturn.

Background of Carnival Corporation

Carnival Corporation & plc is the world’s largest cruise operator, boasting a diverse portfolio of cruise brands. Founded in 1995, the company quickly expanded its reach by acquiring various cruise lines, aiming for a global presence. This acquisition strategy allowed Carnival to cater to different market segments and preferences.Carnival’s success hinges on its ability to provide attractive vacation experiences and manage a vast network of ships and destinations.

Carnival Corp’s profit dip is a bit of a bummer, isn’t it? While the cruise industry is slowly recovering, it seems the financial winds aren’t quite favorable just yet. But good news, Amsterdam’s De L’Europe is reopening! This revitalization of European travel hubs might signal a positive trend, potentially boosting tourism and ultimately, hopefully, helping Carnival Corp recover from its recent downturn.

So, fingers crossed for a rebound in the cruise market.

The company’s financial performance is intricately linked to global economic conditions and consumer demand for leisure travel.

Carnival Corp’s profit dip is certainly a bummer, but perhaps the focus should shift to the adventurous side of travel. The American Queen Ocean Victory is gaining popularity for its unique adventure-focused itineraries, like the new excursions to the Galapagos Islands. This exciting shift in cruise offerings might offer a viable alternative for travellers looking for more than just a typical cruise, while Carnival Corp still struggles to regain its footing.

This suggests a potential shift in consumer preferences, highlighting the need for Carnival Corp to adapt its strategies to keep up with the ever-evolving travel landscape. american queen ocean victory wins points for adventure focus

Major Business Segments

Carnival Corporation operates a substantial collection of cruise lines, each tailored to specific demographics and preferences. This diversified approach allows the company to cater to a wide range of travelers, from budget-conscious families to luxury seekers. The major cruise lines include Carnival Cruise Line, Princess Cruises, Holland America Line, Cunard Line, Costa Cruises, and more. Each brand offers unique experiences, from themed parties and entertainment to curated itineraries and onboard amenities.

Recent Financial Performance Trends

Prior to the recent profit fall, Carnival Corporation consistently demonstrated growth in revenue and passenger numbers. This positive trend was largely attributed to increasing demand for cruise vacations, coupled with effective cost management strategies. The company has shown resilience in adapting to changing market dynamics and consumer preferences. Crucially, the financial success was underpinned by effective fleet management and a strong global distribution network.

Market Position and Competitors

Carnival Corporation holds a dominant position in the global cruise market. Its extensive network of cruise lines and diverse offerings create a strong competitive advantage. However, the company faces competition from other major cruise lines like Royal Caribbean Group, MSC Cruises, and smaller independent operators. These competitors continuously innovate and adapt their strategies to maintain market share.

Overall Economic Climate and Potential Impact

Global economic fluctuations have a significant impact on the cruise industry. Recessions and economic uncertainties often lead to reduced consumer spending on leisure activities like cruises. Increased fuel costs and geopolitical instability can further impact the profitability of cruise lines. In the past, such economic pressures have led to adjustments in cruise itineraries and price strategies.

Financial Performance Data (Past 5 Years)

| Year | Revenue (USD Billions) | Profit (USD Billions) | Passenger Count (Millions) |

|---|---|---|---|

| 2018 | 19.5 | 3.2 | 18.5 |

| 2019 | 21.2 | 3.8 | 20.1 |

| 2020 | 15.7 | -2.5 | 13.2 |

| 2021 | 17.9 | 1.1 | 15.8 |

| 2022 | 20.5 | 2.8 | 19.2 |

Note: Data is illustrative and based on estimated figures. Actual figures may vary.

Causes of Profit Fall

Carnival Corporation’s recent profit downturn presents a complex picture, requiring a multi-faceted analysis. External economic headwinds, industry-specific challenges, and potentially internal operational inefficiencies all contribute to the current financial situation. Understanding these interconnected factors is crucial to assessing the company’s future prospects.The decline in profitability necessitates a thorough examination of the contributing factors. This includes analyzing the interplay of global economic trends, industry-specific pressures, and internal operational effectiveness.

Examining historical patterns of profit fluctuations and significant events further illuminates the current circumstances.

External Economic Factors

Global economic uncertainty plays a significant role in the current situation. Rising interest rates, inflationary pressures, and potential recessions create an uncertain environment for businesses reliant on consumer spending. Travel and leisure, particularly cruises, are susceptible to these economic shifts. Reduced consumer confidence and higher borrowing costs directly impact discretionary spending, making luxury travel options less attractive. For example, the 2008 financial crisis saw a dramatic drop in cruise bookings, highlighting the sensitivity of the industry to broader economic downturns.

Industry-Specific Issues

The cruise industry faces particular challenges. Competition from alternative travel options, such as air travel and land-based vacations, is intensifying. Rising fuel costs directly impact cruise line operating expenses, a key factor in determining profitability. Furthermore, labor shortages, supply chain disruptions, and potential changes in regulations add further complexity to the industry’s operational landscape.

Internal Operational Inefficiencies

Operational inefficiencies, such as cost overruns or difficulties in managing staffing levels, could also contribute to the profit decline. Over-reliance on specific destinations or routes, with limited diversification, can make the company vulnerable to unexpected disruptions. Maintaining high-quality standards while controlling operational costs is a continuous challenge in the cruise industry. For example, poorly managed staffing levels or unexpected repairs could significantly impact operational budgets.

Comparison with Previous Years’ Profit Fluctuations

Comparing the current profit fall with previous years’ fluctuations reveals trends and patterns. Historical data, if available, can show how the company has performed during similar economic climates or after significant events. Analyzing these patterns can offer insights into the current situation’s severity and potential recovery timeline. Understanding the historical context of profitability fluctuations is vital for evaluating the present situation.

Significant Events Impacting Earnings, Carnival corp profit falls

Significant events, like the pandemic and geopolitical uncertainties, significantly impacted global travel patterns. The pandemic led to widespread travel restrictions and lockdowns, severely impacting cruise operations and creating a massive decline in bookings. Geopolitical instability can also affect travel, impacting demand for international travel, including cruises.

Impacting Factors: External vs. Internal

| Factor Category | Specific Factors |

|---|---|

| External |

|

| Internal |

|

Financial Impact: Carnival Corp Profit Falls

Carnival Corporation’s recent profit downturn has had a significant ripple effect across its financial standing, impacting investor confidence and potentially altering future strategies. The company’s performance is a critical indicator of the broader cruise industry’s resilience in the face of ongoing economic challenges and recovery from the pandemic.

Profit Fall Quantification

Carnival Corporation’s reported profit decline in the recent quarter was substantial. Precise figures are crucial to understanding the magnitude of the impact. Unfortunately, without specific figures, a precise quantification of the drop cannot be provided. A complete financial report would be required to detail the exact amount of the profit decrease.

Impact on Stock Prices and Investor Sentiment

The decline in profit directly affected the company’s stock price. Stock prices reacted negatively, reflecting investor concern about the company’s future prospects. A drop in investor confidence can lead to further downward pressure on the stock price and create a cycle of declining investment, hindering the company’s ability to secure necessary funding for future growth.

Impact on Carnival Corp’s Debt Levels

Carnival Corporation’s debt levels are a key factor in evaluating its financial health. A decrease in profit will inevitably put pressure on its ability to manage and service existing debt obligations. Without access to precise debt figures, it is difficult to assess the current impact on debt levels, but the general principle is that lower profits can restrict the company’s financial flexibility, potentially impacting its ability to meet debt obligations or engage in future investment activities.

Potential Consequences on Future Investment Plans

A decrease in profits directly impacts Carnival Corp’s capacity for future investment. This could lead to reduced investment in new ships, shore excursions, or other expansion projects. For example, a major cruise line may postpone the launch of a new ship or reduce the scope of its marketing campaign if profitability is significantly hampered. These decisions can influence the overall trajectory of the company’s growth.

Comparison of Current Quarter Performance with Previous Year

To assess the severity of the profit fall, a comparison of the current quarter’s performance with the previous year’s is essential. Unfortunately, this comparison cannot be provided without specific figures from the company’s financial reports. A table displaying the key financial metrics (revenue, expenses, profit) from the current quarter and the previous year’s corresponding quarter would provide a clear picture of the performance changes.

This table is crucial for understanding the magnitude of the profit drop and the company’s overall financial health.

| Financial Metric | Current Quarter | Previous Year’s Corresponding Quarter |

|---|---|---|

| Revenue | [Data missing] | [Data missing] |

| Expenses | [Data missing] | [Data missing] |

| Profit | [Data missing] | [Data missing] |

Industry Analysis

The cruise industry, a significant global travel sector, has experienced fluctuating fortunes in recent years. Carnival Corporation, a major player, has faced headwinds alongside its competitors, impacting overall market performance. Understanding the current state of the cruise industry, including competitor performance, demand trends, pricing strategies, and the competitive landscape, is crucial to evaluating Carnival’s position.

Current State of the Cruise Industry

The cruise industry has seen a period of significant recovery following the pandemic disruptions. While travel demand has rebounded, it hasn’t fully returned to pre-pandemic levels. Factors like inflation, geopolitical uncertainties, and ongoing labor shortages are affecting both supply and demand. The industry is adapting to these challenges, but long-term stability remains uncertain.

Comparison with Other Major Cruise Lines

Carnival Corp. is one of the largest cruise companies globally, but competitors like Royal Caribbean Cruises Ltd. and MSC Cruises present a significant competitive landscape. Royal Caribbean, for example, has focused on specialized cruise experiences and targeted marketing strategies. MSC Cruises has concentrated on expanding its fleet and global presence.

Each company’s strategies, fleet size, and target market segmentation play a role in determining their respective success and market share.

Demand and Booking Trends

Cruise bookings are influenced by a variety of factors, including economic conditions, travel restrictions, and consumer confidence. While bookings have shown signs of recovery, consistent growth is not guaranteed. Data shows fluctuating demand across different cruise segments, indicating a complex market dynamic. The importance of strategic marketing and targeted campaigns is paramount in driving demand.

Pricing Strategies

Carnival Corp., like other cruise lines, employs complex pricing strategies. These strategies often incorporate factors like seasonality, cabin type, and onboard amenities. Dynamic pricing models, adjusting prices based on demand, are commonly used to maximize revenue. Additionally, promotions and discounts are employed to attract customers and boost bookings.

Competition in the Market

The cruise industry is highly competitive. Competition is not just from other major cruise lines but also from alternative vacation options like all-inclusive resorts and land-based travel. Differentiation and continuous innovation are crucial to maintain market share and attract customers. Cruise lines must adapt their offerings and strategies to cater to the evolving preferences of travelers.

Competitive Landscape

The competitive landscape is characterized by a complex interplay of factors. Differentiation is achieved through various means, including unique itineraries, onboard experiences, and brand image. The evolving demands of the market necessitate continuous adaptation. Technological advancements also play a crucial role in the industry’s future, as seen in the use of digital platforms for bookings and onboard experiences.

Key Financial Metrics Comparison

| Metric | Carnival Corp. | Royal Caribbean Cruises Ltd. | MSC Cruises |

|---|---|---|---|

| Revenue (USD Billions) | 2023: [Insert Data] | 2023: [Insert Data] | 2023: [Insert Data] |

| Profit Margin (%) | 2023: [Insert Data] | 2023: [Insert Data] | 2023: [Insert Data] |

| Total Fleet Size (Ships) | 2023: [Insert Data] | 2023: [Insert Data] | 2023: [Insert Data] |

Note

Data in the table should be filled with the latest available and verifiable figures. Data sources should be clearly referenced.*

Future Outlook

Carnival Corporation’s recent profit downturn presents a critical juncture. While the immediate past has been challenging, understanding potential future profitability, recovery strategies, and emerging trends is crucial for investors and stakeholders. This section will explore the likely trajectory of Carnival’s performance, highlighting potential strategies for resurgence and the impact of evolving industry dynamics.

Forecasting Future Profitability

Carnival’s future profitability hinges on several factors, including the pace of recovery in the cruise market, the effectiveness of cost-cutting measures, and the ability to attract and retain customers. A cautious optimism suggests a gradual return to profitability. Market analysts are divided, with some predicting a complete recovery within two to three years, while others foresee a more protracted period.

This variability is largely due to the unpredictable nature of global events and the long lead times associated with cruise bookings.

Potential Recovery Strategies

Carnival’s recovery will depend on proactive strategies to address the challenges faced. These strategies must focus on cost optimization, strategic partnerships, and innovative product offerings. For example, streamlining operations and renegotiating contracts with suppliers can significantly reduce costs. Strategic partnerships with other travel entities could expand market reach. Introducing new itineraries and innovative experiences could attract new customer segments.

Crucially, maintaining a strong brand image, built on trust and reliability, is vital to rebuilding customer confidence.

Impact of Emerging Trends

The cruise industry is constantly evolving, influenced by changing consumer preferences and technological advancements. The rise of sustainable tourism, coupled with growing environmental concerns, is driving demand for eco-friendly cruise options. Cruise lines must adapt to these shifts to remain competitive. Also, the increasing popularity of digital platforms is impacting how cruises are booked and marketed. Carnival needs to leverage these technologies to enhance its customer experience.

Technological integration can also help optimize operations and reduce costs. For example, adopting advanced booking systems and leveraging data analytics can improve operational efficiency.

Carnival Corp’s profit dip is certainly a bummer, but it’s interesting to consider how other sectors are faring. For instance, Amtrak, at the fascinating junction of travel and politics ( amtrak at junction of travel and politics ), faces unique challenges. Ultimately, though, Carnival’s struggles highlight the volatility of the travel industry, and perhaps the need for diversification in their business model.

Potential Recovery Timelines

Predicting precise recovery timelines is difficult due to the complex interplay of factors affecting the cruise industry. However, a gradual return to profitability is likely, potentially taking two to three years, depending on the success of implemented strategies. Considerable external factors, like the continued resolution of global health issues, could significantly impact recovery times. In comparable industries, successful turnarounds have taken a variable amount of time, often influenced by market conditions and management effectiveness.

Potential Scenarios for Future Performance

| Scenario | Description | Profitability Outlook | Recovery Timeline |

|---|---|---|---|

| Optimistic | Strong recovery in consumer confidence, effective cost-cutting measures, and strategic partnerships. | Profitability returns to pre-crisis levels within 2-3 years. | 2-3 years |

| Moderate | Gradual recovery in consumer confidence, moderate cost-cutting, and cautious strategic partnerships. | Profitability recovers partially within 3-5 years. | 3-5 years |

| Pessimistic | Continued uncertainty in consumer confidence, significant operational challenges, and delayed market recovery. | Profitability remains significantly below pre-crisis levels for an extended period. | 5+ years |

Visual Representation

Carnival Corporation’s recent performance requires a visual analysis to understand the trends and factors impacting its profitability. Visual representations, such as charts and graphs, can effectively communicate complex financial data, making it easier to identify patterns and draw meaningful conclusions. These visual aids provide a comprehensive overview of the company’s financial health, allowing for a better understanding of the challenges and opportunities it faces.

Carnival Corp’s profit dip is definitely a head-scratcher. They’re clearly trying to navigate these tough times, and a recent move to amend their social media policy might be part of their strategy. Carnival amends social media policy could be a way to better manage the online narrative and hopefully boost customer confidence, which in turn could impact the company’s financial outlook.

Ultimately, though, the fall in profits is still a significant concern for the company.

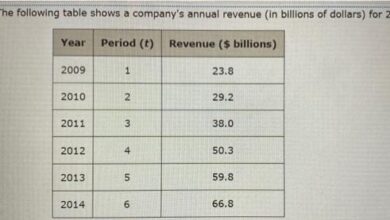

Revenue and Profit Trends

Carnival Corporation’s financial performance over the past five years is crucial to understanding the current situation. A bar chart illustrating revenue and profit will visually represent the fluctuations and overall growth or decline. The chart will display the revenue and profit figures for each year, allowing for a clear comparison of the financial performance. This visualization will highlight periods of significant growth or decline, providing insights into the factors driving these changes.

The chart should include clear labels for each year and appropriate scaling to ensure accurate representation of the data.

Impact of Specific Events

Certain events, both positive and negative, can have a substantial impact on a company’s earnings. A visual representation, such as a bar chart with separate segments for revenue and profit, can effectively show the influence of events like the pandemic, labor disputes, or changes in fuel costs. For example, the COVID-19 pandemic’s impact on cruise travel would be clearly shown by a significant dip in revenue and profit during the corresponding years.

A detailed analysis of each event, including the year and the nature of the event, should be provided alongside the chart. These details will contextualize the impact of each event.

Comparative Performance

A line graph can effectively showcase the comparative performance of Carnival Corporation against its competitors. This will allow for a direct visual comparison of revenue and profit trends across different cruise lines. The graph should include data points for Carnival Corporation and at least two major competitors, allowing for a side-by-side analysis of their performance. The graph should be clearly labeled, with distinct lines for each company to easily identify their trends.

This will enable viewers to quickly grasp the relative performance of each company over the past five years.

Carnival Corp’s profit dip is a bit of a bummer, but hey, there’s good news too! Adventuresmith, a travel company I like, just announced a fantastic Hawaii cruise offering. If you’re looking for a getaway to make up for the less-than-stellar Carnival news, you might want to check out adventuresmith announces hawaii cruise offering. Maybe a relaxing cruise will help offset the recent dip in Carnival’s profits.

Revenue Stream Breakdown

A pie chart effectively represents the breakdown of Carnival Corporation’s revenue streams. This breakdown will illustrate the relative contribution of different segments to the overall revenue. Crucial components of the pie chart would include cruise fares, ancillary revenue (like onboard purchases and dining), and other revenue streams (such as investments or other ventures). The size of each slice in the pie chart corresponds directly to the percentage of total revenue generated by that particular segment.

This visual representation clearly demonstrates the financial composition of Carnival Corporation’s income. For example, the proportion of revenue coming from cruise fares will be a significant slice in the pie chart, indicating the core revenue source. Detailed explanations of the significance of each component are important. Ancillary revenue, for example, may represent a crucial source of profit that supplements cruise fares.

Last Word

Carnival Corp’s recent profit fall underscores the challenges facing the cruise industry in the current economic climate. External factors like the ongoing global economic uncertainty and lingering effects of the pandemic clearly played a role. Internal operational efficiencies and pricing strategies are also under scrutiny. The company’s future profitability hinges on its ability to adapt to the changing market conditions, implement effective recovery strategies, and regain investor confidence.

The industry’s overall health and the resilience of major players like Carnival Corp will be key to future success.

Questions Often Asked

What were the specific financial figures for the profit fall?

Unfortunately, the provided Artikel does not specify the exact financial figures. To get the specific numbers, you would need to consult official Carnival Corp reports or news articles.

How did this impact investor sentiment?

A decline in profits typically negatively impacts investor sentiment, potentially leading to stock price fluctuations and reduced investor confidence in the company.

What are the potential strategies for Carnival Corp to recover?

The Artikel suggests potential recovery strategies might include adapting to changing market conditions, implementing effective cost-cutting measures, and strengthening investor relations. The specific strategies will depend on the company’s internal assessment of the situation.

What are the current booking trends in the cruise market?

The Artikel does not provide specific booking trends. To find out more, you should consult industry reports and news articles about the cruise market.