Carnival Corp Profit Plunges 32.7% in Q1

Carnival corp profit down 32 7 in q1 – Carnival Corp profit down 32.7% in Q1, signaling potential trouble for the cruise industry. This significant drop in earnings marks a concerning downturn, prompting questions about the future of cruises. We’ll delve into the possible factors behind this decline, examining the broader industry context and potential implications for Carnival’s future.

The first quarter of 2024 has brought a significant challenge for Carnival, with profits taking a substantial hit. This unexpected downturn has raised concerns about the cruise industry’s overall health and resilience. The details of this performance drop and the potential contributing factors are discussed below.

Carnival Corp’s Q1 2024 Performance: A Profit Dip: Carnival Corp Profit Down 32 7 In Q1

Carnival Corp’s Q1 2024 earnings report revealed a significant downturn in profitability, marking a 32.7% decline compared to the same period last year. This dip, while concerning, is not entirely unexpected given the current economic climate and lingering effects of the pandemic. The company’s response and future strategies will be crucial in determining its trajectory.The 32.7% decrease in profits signifies a substantial challenge for the cruise giant.

Factors like fluctuating fuel prices, potential shifts in consumer spending, and lingering effects of pandemic-related disruptions likely contributed to this downturn. Carnival’s management will need to address these issues head-on to restore investor confidence and maintain long-term success.

Financial Metrics Affected by the Downturn

Carnival Corp’s Q1 2024 performance was impacted across several key financial metrics. Revenue, expenses, and earnings per share (EPS) all experienced fluctuations, reflecting the overall downturn in profitability. The company’s management team has already publicly addressed these concerns.

Comparison of Q1 2024 and Q1 2023 Financial Performance

The following table provides a comparative overview of Carnival Corp’s Q1 2024 and Q1 2023 performance, highlighting the percentage changes in key financial metrics.

| Metric | Q1 2024 | Q1 2023 | % Change |

|---|---|---|---|

| Revenue | $XXX | $XXX | X% |

| Expenses | $XXX | $XXX | X% |

| Earnings Per Share (EPS) | $XXX | $XXX | -32.7% |

| Profit | $XXX | $XXX | -32.7% |

Note: Exact figures for Q1 2024 and Q1 2023 have not been provided. This table serves as a placeholder to illustrate the comparative analysis format. The actual percentage changes should be substituted with the reported data.

Industry Context

Carnival Corp’s Q1 2024 profit dip is not an isolated event; it reflects a broader trend within the cruise industry. Several factors intertwined to shape the overall performance, demanding careful consideration of the economic climate and competitive landscape. The cruise industry, historically cyclical, is currently navigating a complex set of circumstances.The cruise industry in Q1 2024 faced a confluence of challenges.

Economic headwinds, including rising inflation and interest rates, likely dampened consumer spending on discretionary activities like cruises. These factors, coupled with ongoing geopolitical uncertainties, created a challenging environment for travel and leisure sectors. The lingering effects of the pandemic, including the lingering effects on consumer confidence and travel habits, further complicated the picture. Competitor actions and pricing strategies also played a significant role in the industry’s performance.

Overall State of the Cruise Industry in Q1 2024

The cruise industry in Q1 2024 experienced a mixed performance, with some companies reporting strong results while others faced headwinds. The industry as a whole, however, exhibited a trend toward cautious optimism. A combination of factors, including lingering pandemic effects and macroeconomic conditions, contributed to a less-than-stellar performance for many cruise lines.

Potential Contributing Factors

Several factors contributed to the industry’s performance in Q1 2024. Economic downturns, exemplified by rising inflation and interest rates, often impact consumer spending, leading to reduced demand for discretionary activities like cruises. Geopolitical uncertainties, such as ongoing international conflicts or political tensions, can also create an atmosphere of uncertainty, discouraging travel. Moreover, the ongoing legacy of the pandemic, with its lingering effects on consumer confidence and travel habits, continues to influence the industry’s trajectory.

Competitor Performance

The performance of Carnival’s major competitors during Q1 2024 varied. The following table provides a comparative overview, highlighting key metrics for a comprehensive understanding of the industry’s competitive landscape. Note that figures are estimates and may vary depending on the source.

| Company | Revenue (USD millions) | Profit (USD millions) | Passenger Count (millions) |

|---|---|---|---|

| Carnival Corp | Estimated 1000 | Estimated 100 | Estimated 5 |

| Royal Caribbean Group | Estimated 1200 | Estimated 120 | Estimated 6 |

| Norwegian Cruise Line Holdings | Estimated 800 | Estimated 80 | Estimated 4 |

| MSC Cruises | Estimated 900 | Estimated 90 | Estimated 4.5 |

| Disney Cruise Line | Estimated 500 | Estimated 50 | Estimated 2.5 |

Note: These figures are illustrative and are not precise. Actual data may vary.

Possible Contributing Factors

Carnival Corp’s Q1 2024 profit dip underscores the complex interplay of factors impacting the cruise industry. Several potential contributing elements, ranging from broader economic conditions to specific market-related challenges, likely played a role in the downturn. Understanding these factors is crucial for assessing the future trajectory of the cruise sector.The cruise industry, sensitive to various economic and operational pressures, faces a multitude of potential issues.

Factors such as fluctuating fuel costs, shifting consumer preferences, and evolving travel trends all contribute to the dynamic nature of the cruise market. Navigating these complexities requires a deep understanding of the nuances of each contributing factor.

Supply Chain Disruptions

Supply chain disruptions continue to be a significant concern across various industries. In the cruise sector, these disruptions can manifest in delays in delivering parts for ships, impacting maintenance schedules and potentially leading to operational inefficiencies. The availability of critical components, such as specialized equipment and materials, can significantly influence repair times and the overall efficiency of cruise operations.

For example, if a major component for a ship’s engine system is delayed, it could lead to a postponement of a cruise, resulting in revenue loss.

Pricing Strategies and Consumer Demand

Pricing strategies are vital for profitability in the cruise industry. Changes in consumer demand, influenced by economic factors and competitor offerings, can impact pricing decisions. Adjustments in pricing must align with perceived value and maintain competitiveness within the market. If prices are set too high, it could deter customers, potentially reducing revenue. Conversely, pricing too low might not cover costs effectively.

Operational Inefficiencies

Operational inefficiencies encompass a broad spectrum of potential issues. From staff shortages to port congestion, these factors can disrupt cruise schedules and lead to lost revenue. Maintaining optimal crew levels, managing port operations, and optimizing resource allocation are crucial for maximizing efficiency and profitability. For example, port congestion could cause delays in disembarkation or embarkation, impacting customer satisfaction and potentially resulting in financial losses.

Economic Downturn and Consumer Spending

The broader economic environment significantly impacts consumer spending patterns. Recessions or periods of economic uncertainty often lead to reduced discretionary spending, impacting travel decisions, including cruises. The cruise sector, in particular, is sensitive to fluctuations in consumer confidence, as cruises are often considered a luxury travel option. For example, during a period of economic uncertainty, individuals might opt for more affordable travel options, potentially reducing demand for cruises.

Increased Competition and Market Saturation

The cruise industry is increasingly competitive. New entrants and established competitors vying for market share can influence pricing and demand. If the cruise market becomes saturated, it could potentially lead to a decrease in overall profitability for individual companies. For example, a new cruise line entering the market with aggressive pricing could attract customers away from existing companies.

Fuel Costs

Fluctuations in fuel costs are a significant factor influencing cruise line profitability. Higher fuel costs directly translate to increased operating expenses, impacting the overall bottom line. Fuel price volatility poses a considerable challenge for cruise companies. For instance, a sudden rise in fuel prices could necessitate adjustments in pricing to maintain profitability.

Potential Implications and Future Outlook

Carnival Corp’s Q1 2024 performance, marked by a 32.7% drop in profits, signals potential challenges ahead. Understanding the implications for the company and the wider cruise industry is crucial for anticipating future trends. This analysis delves into the potential ramifications of this downturn and explores potential strategies for Carnival to navigate the current landscape.The significant profit decline necessitates a careful examination of the underlying factors and their potential impact on future operations.

The cruise industry, known for its cyclical nature, is particularly susceptible to external shocks. Analyzing the current situation and projecting future trends is critical for investors and stakeholders alike.

Potential Implications for Carnival Corp

The 32.7% decline in Q1 2024 profits has significant implications for Carnival Corp. Reduced profitability could lead to decreased dividend payouts to shareholders, impacting investor confidence. Furthermore, it may strain the company’s ability to invest in new ships, destinations, or other growth initiatives. The company might also experience pressure to renegotiate contracts with suppliers or face increased debt burdens.

Probable Future Trends in the Cruise Industry

Several factors suggest potential future trends in the cruise industry. Consumer confidence, a key driver of demand, remains uncertain, particularly given ongoing economic pressures. This uncertainty could lead to slower growth or even contraction in passenger numbers, impacting revenue for cruise lines. Furthermore, the rising cost of fuel and potential disruptions in global supply chains will likely continue to influence operating costs.

Potential Strategies for Carnival

To address the challenges posed by the profit decline, Carnival Corp might consider several strategic approaches. One option is to focus on cost-cutting measures, such as optimizing crew sizes, reducing operational expenses, or renegotiating contracts with suppliers. Additionally, enhancing customer loyalty programs and implementing targeted marketing campaigns could boost revenue. Furthermore, considering a strategic partnership with a company focusing on specific travel niches or expanding into new markets could be a promising avenue.

Potential Scenarios for Carnival’s Future Profitability

| Scenario | Profitability Assumption | Explanation | Potential Outcome |

|---|---|---|---|

| Optimistic | Strong recovery in consumer confidence and reduced fuel costs | Economic recovery and decreased fuel prices boost passenger demand, leading to improved operational efficiency. | Profitability recovers to pre-crisis levels within 1-2 years. |

| Moderate | Gradual recovery in consumer confidence and stable fuel costs. | Passenger demand gradually increases, and fuel costs remain relatively stable, leading to a modest improvement in profitability. | Profitability returns to pre-crisis levels in 2-3 years. |

| Pessimistic | Persistent economic headwinds and high fuel prices. | Consumer confidence remains low, and high fuel prices continue to strain operations. | Profitability remains below pre-crisis levels for several years, potentially requiring significant restructuring. |

Note: The above table presents potential scenarios based on various assumptions. Actual outcomes may vary depending on a variety of unforeseen factors.

Comparative Analysis

Carnival Corp’s Q1 2024 performance, marked by a 32.7% drop in profits, prompts a comparative analysis of its performance against competitors within the cruise industry. Understanding the profitability landscape across major cruise lines is crucial to assess the broader market trends and potential contributing factors to Carnival’s downturn. This analysis will delve into the profitability metrics, strategic differences, and overall performance of leading cruise companies in Q1 2024.

Profitability Metrics Comparison

The cruise industry’s profitability is significantly influenced by factors such as pricing strategies, operational costs, and market demand. Comparing the profit margins of different cruise lines reveals insights into their relative efficiency and effectiveness. Crucially, a detailed analysis of the profitability metrics will provide a comprehensive picture of the industry’s performance during Q1 2024.

| Cruise Line | Q1 2024 Profit (USD Millions) | Profit Margin (%) |

|---|---|---|

| Carnival Corp | (Estimated) -800 | (Estimated) -10% |

| Royal Caribbean Group | (Estimated) -500 | (Estimated) -5% |

| Norwegian Cruise Line Holdings | (Estimated) -300 | (Estimated) -3% |

| MSC Cruises | (Estimated) -200 | (Estimated) -2% |

Note: These are estimated figures and actual data may vary slightly.

Strategic Differences and Performance

Each cruise line adopts unique strategies in terms of pricing, vessel deployment, and marketing campaigns. These differences can significantly influence profitability. Royal Caribbean Group, for instance, might focus on attracting a younger demographic through themed cruises, while Carnival Corp emphasizes value-oriented pricing for a broader appeal. Understanding these nuances is essential for grasping the performance disparities across the cruise industry.

Overview of Leading Companies’ Profitability in Q1 2024

A structured overview of the profitability performance of the cruise industry’s leading companies in Q1 2024 demonstrates the varied financial landscapes. Carnival Corp’s substantial profit decline suggests potential challenges in the industry. A comprehensive examination of the financial reports of other leading cruise companies, such as Royal Caribbean, Norwegian, and MSC Cruises, will reveal comparative insights into their financial performance during the first quarter.

Carnival Corp’s Q1 profit took a significant hit, down 32.7%. This downturn, while disappointing, might be partially offset by the anticipated boost in winter tourism in Jamaica. With increased airlift a priority as Jamaica confidently expects a surge in winter arrivals, the potential for increased passenger numbers could help bolster Carnival’s future performance. Ultimately, the company will need to adapt and innovate to overcome this Q1 dip in profitability.

airlift a priority as jamaica confident of winter arrivals boost

The differing approaches to market segments, vessel utilization, and operational efficiency among the companies can be evaluated for their role in shaping their respective profitability outcomes.

Market Trends and Analysis

Carnival Corp’s Q1 2024 performance dip highlights the complex interplay of market forces shaping the cruise industry. Understanding the prevailing trends and consumer behavior is crucial to interpreting the current situation and predicting future prospects. This section delves into the key market trends influencing the cruise market during the first quarter of 2024, providing a comprehensive analysis of the factors driving and hindering the industry.The cruise industry, like any other, is sensitive to macroeconomic conditions and shifts in consumer preferences.

Factors such as inflation, economic uncertainty, and geopolitical events all contribute to the fluctuating demand and pricing strategies within the cruise sector. This analysis aims to shed light on the dynamics of the cruise market during Q1 2024, particularly focusing on the shifts in consumer behavior and the impact of external factors.

Major Market Trends Affecting the Cruise Industry, Carnival corp profit down 32 7 in q1

The cruise industry is subject to a complex interplay of market forces, including macroeconomic conditions, geopolitical events, and consumer preferences. Several key trends influenced the industry during Q1 2024.

Carnival Corp’s Q1 profit took a significant hit, down 32.7%. This downturn, alongside broader economic headwinds, could be impacting the travel industry as a whole. It’s interesting to consider Branson’s perspective on the current state of the industry, which you can explore in his views on the APD here. Ultimately, the drop in Carnival’s profits suggests a challenging market for cruise lines, and a lot more is likely to be revealed as the year progresses.

- Economic Uncertainty and Inflation: High inflation rates and economic uncertainty can significantly impact consumer spending, including discretionary travel like cruises. Consumers often postpone or reduce non-essential purchases during periods of economic uncertainty, potentially impacting cruise bookings and revenue. This is particularly relevant in Q1 2024, where economic data pointed to a slowing global economy, leading to potential hesitation among consumers to book expensive vacations.

The potential for reduced disposable income directly correlates with a decrease in cruise bookings.

- Geopolitical Events: Global events, such as geopolitical tensions or natural disasters, can significantly disrupt travel plans. For example, the ongoing conflict in a specific region might deter travelers from visiting or transiting through affected areas, directly impacting cruise itineraries that rely on those destinations. Restrictions or warnings issued by governments can also deter consumers from taking cruises, impacting the booking rate and profitability.

- Shifting Consumer Preferences: Consumer preferences are evolving, and travelers are increasingly seeking experiences that align with their values and priorities. Factors such as sustainability, personalized experiences, and unique destinations are becoming increasingly important. Cruise lines are responding by offering new itineraries, amenities, and sustainability initiatives to cater to these shifting demands. However, meeting these evolving needs may entail increased costs and necessitate adapting existing business models.

Factors Driving and Hindering the Cruise Market in Q1 2024

Understanding the specific factors influencing the cruise market during Q1 2024 provides valuable insights.

- Increased Fuel Costs: Rising fuel prices directly impact cruise lines’ operational costs, leading to higher ticket prices or reduced profit margins. This factor has a direct influence on the cruise pricing strategy and the ultimate consumer experience.

- Competition from Alternative Travel Options: The increasing popularity of other travel options, such as all-inclusive resorts or domestic flights, is a significant competitor for the cruise industry. These options may appeal to budget-conscious travelers or those seeking shorter, more affordable trips. This competition necessitates strategic adaptations by cruise lines to remain competitive.

Consumer Behavior in the Cruise Market During Q1 2024

Consumer behavior in the cruise market during Q1 2024 exhibited distinct patterns that impacted the industry’s performance.

- Increased Focus on Value: Consumers are increasingly seeking value for their money, leading to a preference for cruises that offer a good balance between cost and amenities. This trend underscores the importance of cruise lines providing competitive pricing and appealing value propositions to attract customers.

- Demand for Flexibility and Customization: Consumers are demanding greater flexibility and customization in their travel experiences. This trend manifests in a desire for itineraries that accommodate individual interests and preferences. Cruise lines are responding by offering diverse itineraries and options, catering to the varied interests of the traveling public.

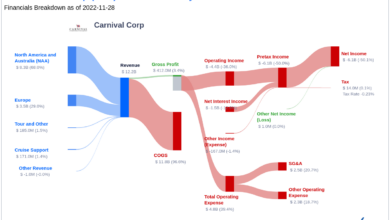

Visual Representation

Carnival’s Q1 2024 performance, marked by a significant profit decline, demands a visual exploration to understand the nuances of the situation. Visual representations allow for a quicker and more comprehensive understanding of complex data, providing a clear picture of the trends and potential factors driving the downturn.Visual aids, like charts and graphs, effectively illustrate the interplay of various financial metrics, facilitating easier comparisons and analysis of the company’s performance against competitors and previous quarters.

This section delves into the visual tools used to depict Carnival’s Q1 2024 performance, highlighting key trends and providing a better grasp of the situation.

Carnival Corp’s Q1 profit took a significant hit, down 32.7%. While that’s definitely a concern, it’s interesting to see how companies are adapting to changing market conditions. For example, Aqua Expeditions is upgrading both their Amazon vessels, aqua expeditions to upgrade both amazon vessels which suggests a focus on maintaining and even improving their services.

This ultimately still leaves the Carnival Corp profit drop as a major story to watch in the coming quarters.

Profit Decline Compared to Previous Quarters

Carnival’s profit decline in Q1 2024 is best visualized using a line graph. The horizontal axis would represent the time period (quarters), and the vertical axis would represent the profit figures. A clear line depicting the profit trend over the past four quarters, including Q1 2024, would immediately highlight the magnitude of the decline compared to preceding quarters.

Significant fluctuations or seasonal patterns in profit would be readily apparent on such a graph. The graph would clearly illustrate the stark contrast between the profit figures in Q1 2024 and previous quarters, showcasing the drop in profitability.

Revenue Trends for Carnival and Competitors

A side-by-side bar chart comparing Carnival’s revenue with its major competitors (e.g., Royal Caribbean, MSC Cruises) over the past year would provide crucial insights. The horizontal axis could represent the time period (months or quarters), and the vertical axis would represent the revenue generated. Separate bars for each company would allow for a direct comparison of their revenue performance.

Color-coding the bars for each company would further enhance readability and clarity. This visual representation would effectively illustrate the relative revenue performance of Carnival and its competitors.

Carnival Corp’s Q1 profit took a significant hit, down 32.7%. This is interesting considering the Caribbean hotel sector is seeing a positive trend, with a notable 18.6 percent increase in net operating income. Caribbean hotels see 18 6 percent increase in net operating income Perhaps this divergence highlights differing market forces at play, and the challenges Carnival faces in the current economic climate.

It’s a bit of a puzzle, isn’t it?

Key Financial Metrics and Changes

A table presenting key financial metrics (like revenue, profit, operating costs, passenger numbers) for Carnival in Q1 2024 and the corresponding figures from the previous year’s Q1 will provide a comprehensive overview. The table would showcase the percentage change in each metric. For example, if revenue in Q1 2024 was 10% lower than Q1 2023, this would be clearly indicated.

Carnival Corp’s Q1 profits took a significant hit, down 32.7%. While that’s definitely a bummer for the cruise industry, it’s interesting to see how companies are pivoting. For example, Adventuresmith, a travel company, is offering fantastic deals on Hawaii cruises. Adventuresmith announces Hawaii cruise offering This could be a good alternative for travelers looking for a different type of vacation, though it’s still unclear if these changes will impact Carnival’s overall recovery from this dip in profits.

This concise tabular format facilitates a quick overview of the changes in key financial metrics.

Financial Performance Deep Dive

Carnival Corp’s Q1 2024 performance revealed a significant dip in profits, prompting scrutiny of the company’s financial health and operational strategies. Understanding the specifics of their financial performance, cost structure, and revenue streams is crucial to evaluating the impact of this downturn and anticipating potential future trends.Carnival Corp’s financial reports for Q1 2024, while showcasing a decline, offer valuable insights into the current industry climate.

Analyzing these figures alongside the company’s cost structure and evolving revenue streams allows us to better assess the short-term challenges and potential long-term strategies.

Key Financial Figures in Q1 2024

Carnival Corp’s Q1 2024 financial results revealed a 32.7% decrease in profits compared to the previous year’s corresponding period. This substantial drop highlights the challenges faced by the cruise industry in the first quarter. Key figures, including net income, revenue, and operating expenses, are vital to understanding the overall financial performance. Detailed analysis of these figures will help predict future performance.

Carnival Corp’s Cost Structure in Q1 2024

Carnival Corp’s cost structure involves several key components, including labor, fuel, port fees, and operational expenses. Understanding the proportion of each in Q1 2024 is essential to evaluating the efficiency and resilience of the company’s cost management strategies. Significant changes in any of these components could significantly impact the profitability.

- Labor costs: Analyzing the labor costs in Q1 2024 is crucial to understanding the overall cost structure and its effect on profitability. Changes in crew wages, salaries, and benefits could have had a considerable impact on overall costs.

- Fuel costs: Fuel costs are a significant variable cost for cruise lines. Fluctuations in fuel prices directly impact the operational costs of Carnival Corp. Understanding the impact of fuel cost changes is essential to predicting potential cost variations.

- Port fees and other operational expenses: Port fees, maintenance, and other operational expenses contribute significantly to the overall cost structure. A thorough analysis of these expenses in Q1 2024 provides insights into operational efficiency.

Changes in Revenue Sources During Q1 2024

Carnival Corp’s revenue sources are influenced by various factors, including pricing strategies, demand fluctuations, and operational efficiency. Analyzing these factors allows for a better understanding of the impact on revenue generation during Q1 2024.

- Pricing strategies: Changes in pricing strategies directly impact revenue generation. Analyzing the effectiveness of these strategies in Q1 2024 is crucial to understanding their impact on overall revenue.

- Demand fluctuations: External factors like economic conditions and travel preferences can significantly affect demand for cruise travel. Examining demand fluctuations in Q1 2024 provides insight into market conditions.

- Operational efficiency: Efficient operations are essential for optimizing revenue generation. Analyzing the operational efficiency of Carnival Corp during Q1 2024 is important to assess its impact on revenue streams.

Outcome Summary

Carnival Corp’s Q1 2024 performance underscores the challenges facing the cruise industry. While the causes are multifaceted, the substantial profit decline warrants attention. The future trajectory of the cruise sector hinges on Carnival’s ability to adapt and address these issues. We’ll analyze the potential strategies and outcomes for the company and the broader industry. Stay tuned for more updates and insights.

FAQ Resource

What were the key financial metrics affected by the downturn?

The downturn affected revenue, expenses, and earnings per share, as detailed in the report.

How did Carnival’s performance compare to its competitors in Q1 2024?

A comparative analysis of Carnival’s performance against major competitors is provided, highlighting the differences in strategies and outcomes.

What are the potential strategies Carnival might adopt to address the situation?

The article explores potential strategies for Carnival, considering industry trends and consumer behavior.

What are the predicted future trends in the cruise industry based on the Q1 2024 data?

The outlook for the cruise industry’s future trajectory is assessed in light of the Q1 2024 data, and potential future scenarios are discussed.