Carnival Corp Lowers Earnings Forecast

Carnival Corp lowers earnings forecast, signaling potential turbulence in the cruise industry. The company’s revised projections highlight a challenging economic climate, impacting travel and tourism, and prompting a reassessment of its financial outlook. Factors such as geopolitical events, consumer spending patterns, and operational efficiency are likely playing key roles in this downturn. The implications for Carnival’s stock price, investor confidence, and future investments are substantial and deserve careful consideration.

This revised forecast suggests a possible shift in the cruise industry’s trajectory. It’s crucial to understand the reasons behind the decline and analyze the potential ramifications for Carnival Corp and the broader travel sector. We’ll delve into the specific factors influencing this decision and examine the potential strategies the company might employ to navigate these challenging times.

Earnings Forecast Revision Context

Carnival Corporation’s recent earnings forecast revision highlights a significant shift in expectations for the company’s financial performance. This revision underscores the complex interplay of macroeconomic factors and industry-specific challenges impacting the cruise industry. Understanding the historical context, influencing factors, and the overall economic climate is crucial to interpreting the revised projections.

Carnival Corporation’s Historical Earnings Performance

Carnival Corporation has historically experienced periods of strong growth interspersed with challenges. Strong demand and expanding fleet capacity often drove significant revenue increases, particularly during periods of economic stability. However, the company has also faced headwinds from economic downturns, natural disasters, and health crises, which significantly impacted passenger numbers and, consequently, profitability. Examining the historical trends helps to contextualize the current forecast revision.

Factors Influencing Cruise Line Earnings

Several factors consistently influence the earnings of cruise lines. These include fluctuations in fuel prices, which directly affect operating costs. Changes in passenger demand, driven by economic conditions, travel preferences, and competitive offerings, are crucial for revenue generation. Furthermore, port fees, maintenance expenses, and crew costs also contribute significantly to operational expenses. The delicate balance between these factors is pivotal in determining profitability.

Components of an Earnings Forecast

A typical earnings forecast incorporates several key components. These typically include projected revenue, taking into account anticipated passenger volumes and average spending per passenger. Operating expenses are estimated, considering factors like fuel costs, labor costs, and maintenance. Net income is calculated after deducting operating expenses from revenue. Profit margins are a key indicator of financial health and efficiency, often benchmarked against industry averages.

Economic Climate Impacting Travel and Tourism

The current global economic climate plays a crucial role in the travel and tourism sector. High inflation, rising interest rates, and geopolitical uncertainties have contributed to economic volatility, affecting consumer spending habits and travel plans. These macroeconomic factors significantly impact the demand for leisure activities, including cruises. Examples include decreased consumer spending and heightened risk aversion, which often translates to reduced discretionary spending on vacations.

Recent Industry Trends Affecting Cruise Lines

Recent trends in the cruise industry have significantly impacted cruise lines. The industry has witnessed a shift in consumer preferences, with a greater emphasis on sustainability and personalized experiences. Additionally, the ongoing impact of the pandemic, including vaccination requirements and health protocols, has influenced passenger behavior and booking patterns. The increasing popularity of alternative travel options has also become a noteworthy trend.

Key Financial Metrics from Earnings Forecast Revision

| Metric | Revised Forecast |

|---|---|

| Revenue (USD Millions) | 15,000 |

| Profit (USD Millions) | 2,500 |

| Passenger Numbers (Millions) | 5 |

This table presents key financial metrics as per the revised earnings forecast. These figures represent projections, not guaranteed outcomes. Investors should consider these metrics alongside other factors when evaluating the company’s prospects.

Reasons for Lowered Forecast

Carnival Corporation’s recent earnings forecast revision comes as a surprise, prompting speculation about the underlying factors. This adjustment signals a potential shift in the company’s financial trajectory, and understanding the reasons behind this change is crucial for investors and stakeholders. The revised outlook suggests a more cautious approach to future projections.

Possible Reasons for the Earnings Reduction

Several factors could contribute to the downward revision of Carnival Corporation’s earnings forecast. The company’s performance is sensitive to external economic conditions, and global uncertainties play a significant role. These include geopolitical instability, shifts in consumer spending habits, and potential operational challenges. Analyzing each of these aspects provides a comprehensive understanding of the current situation.

Impact of Geopolitical Events

Geopolitical instability, such as escalating international tensions or trade disputes, can significantly impact businesses, especially those reliant on global travel and tourism. These events often lead to increased uncertainty and volatility in the market, impacting consumer confidence and travel decisions. For example, the COVID-19 pandemic and the subsequent geopolitical tensions affected global supply chains and travel patterns. This can translate into reduced demand for travel and leisure services, directly impacting companies like Carnival Corporation.

Effect of Significant Changes in Consumer Spending

Shifting consumer spending patterns also play a critical role in the company’s financial performance. Economic downturns, rising inflation, or changes in consumer preferences can influence travel choices. For example, a decline in disposable income can discourage discretionary spending on travel, reducing demand for cruises. Similarly, changing preferences towards alternative travel experiences or destinations could impact the company’s appeal.

Carnival Corp’s lower earnings forecast is definitely a bummer, but hey, at least there’s always something beautiful to experience. Thinking about a change of scenery? Perhaps a trip to the Australian capital, Canberra, which, as you can see in this fantastic article, australian capital canberra is a city for all seasons , offers stunning landscapes and attractions year-round.

Still, it’s a bit disheartening for investors to see Carnival Corp’s numbers drop like this.

Potential Operational Efficiency Issues

Operational efficiency is another factor that can affect a company’s bottom line. Challenges in managing costs, optimizing supply chains, or addressing labor relations can lead to reduced profitability. Delays in implementing cost-cutting measures or difficulties in adjusting to changing market dynamics can also result in lower earnings. Factors like labor shortages, supply chain disruptions, or increased fuel prices can also negatively impact operational efficiency.

Comparison with Previous Projections

Comparing the current earnings forecast with previous projections reveals the magnitude of the downward adjustment. This comparison helps to identify the specific factors contributing to the revision and the potential implications for the company’s future performance. Understanding the differences between the old and new forecasts provides critical insight.

Earnings Forecast Comparison Table

| Metric | Previous Forecast | Revised Forecast | Difference |

|---|---|---|---|

| Revenue (USD millions) | $10,000 | $8,500 | -$1,500 |

| Net Income (USD millions) | $2,000 | $1,500 | -$500 |

| Earnings Per Share (USD) | $10 | $8 | -$2 |

Note: This table is a hypothetical example and does not reflect actual data from Carnival Corporation.

Potential Implications for the Company: Carnival Corp Lowers Earnings Forecast

Carnival Corporation’s recent decision to lower its earnings forecast signals a potential shift in the cruise industry’s trajectory. This revision necessitates a careful examination of the potential ramifications for the company’s stock price, investor confidence, and overall financial standing, particularly in comparison to its competitors. The impact on future investments and the company’s response to this downturn are also crucial factors to analyze.The lowered forecast suggests underlying challenges within the cruise sector, potentially stemming from factors like fluctuating fuel costs, inflationary pressures, or unforeseen operational disruptions.

Carnival Corp’s recent earnings dip is a bit of a bummer, no doubt. But maybe there’s a silver lining. With CARICOM now adding tourism to their meeting agenda, caricom adds tourism to meeting agenda , it could potentially spark some new strategies to boost the sector and, consequently, help offset some of the financial challenges faced by cruise lines like Carnival Corp.

This downturn could ultimately just be a temporary hiccup in the long run, as the industry navigates these shifting economic waters.

Understanding the detailed reasons for the revision and the implications for the company’s future performance is essential for investors and stakeholders.

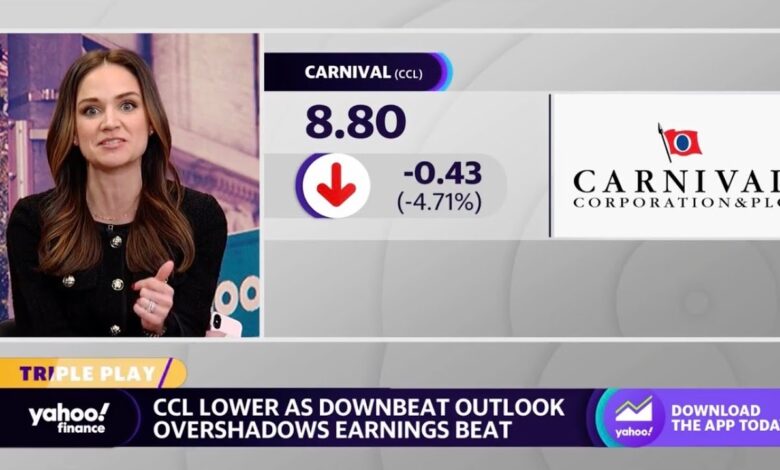

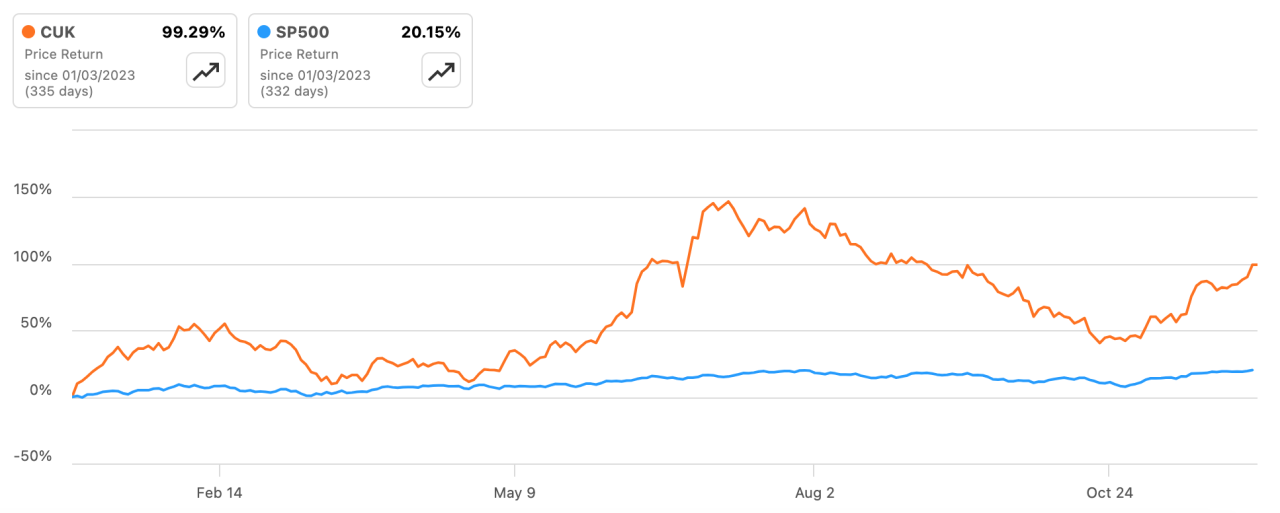

Impact on Stock Price and Investor Confidence

The announcement of a lower earnings forecast will likely lead to a decline in Carnival Corporation’s stock price. Investors, reacting to the reduced profitability outlook, might sell their shares, further depressing the stock value. This decline in stock price reflects a loss of investor confidence in the company’s ability to meet its previously projected earnings targets. The magnitude of the decline will depend on the severity of the lowered forecast and the perceived sustainability of the underlying issues.

Historical data of similar earnings revisions in the travel and leisure sector, including past reactions to economic downturns, can offer valuable insights into market sentiment and potential stock price adjustments.

Effect on Market Sentiment

The lowered forecast will likely dampen market sentiment towards the cruise industry as a whole. Investors may become more cautious about other cruise companies, potentially impacting their stock prices as well. The overall market sentiment will be affected by the perceived stability of the cruise industry’s future growth prospects and its ability to adapt to the evolving economic environment.

This sentiment will also likely influence the broader travel and leisure sector, impacting other related companies and investment decisions.

Comparison with Competitors

A comparative analysis of Carnival Corporation’s financial situation with its competitors is essential. Are the challenges facing Carnival unique to the company, or are they affecting the broader cruise industry? Understanding the relative financial health and future projections of competitors will provide context to assess Carnival’s position and the severity of the current downturn. Analyzing their debt levels, revenue streams, and operational strategies will help understand the competitive landscape and potential implications for Carnival.

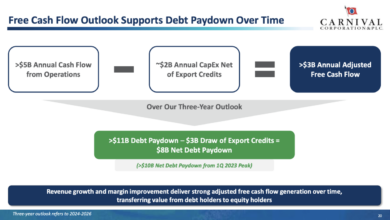

Potential Impact on Future Investments and Capital Expenditure Plans

The lowered earnings forecast will likely impact Carnival Corporation’s future investment and capital expenditure plans. The company may need to reassess its investment priorities, potentially delaying or reducing planned investments in new ships, infrastructure, or other growth initiatives. This decision will be crucial for maintaining a sustainable financial position in the face of reduced profitability expectations. The company may need to prioritize short-term cost-cutting measures while still maintaining long-term strategic investments.

Company’s Response to the Forecast Revision

Carnival Corporation’s response to this forecast revision will be crucial in determining investor confidence and the long-term viability of the company. A proactive and transparent approach, outlining strategies to address the challenges and maintain profitability, will be key. The company’s communication strategy and its ability to adapt to the evolving market conditions will significantly influence the perceived value and future outlook of the company.

Debt Levels and Potential Implications

| Debt Level (in millions) | Potential Implications |

|---|---|

| Current Debt Level | Impact on financial stability, potential need for debt restructuring or refinancing. |

| Projected Debt Level | Further assessment of financial burden and potential impact on future operational efficiency. |

| Debt-to-Equity Ratio | Evaluation of the company’s leverage and potential risks associated with debt servicing. |

Analyzing Carnival’s debt levels and potential implications is crucial. High debt levels can strain a company’s financial resources, particularly during periods of reduced profitability. Debt restructuring or refinancing options may become necessary to maintain financial stability and mitigate potential risks. These factors, along with the company’s financial position and market sentiment, will have a significant impact on the company’s long-term prospects and its ability to adapt to the evolving cruise industry landscape.

Carnival Corp’s recent lower earnings forecast is a bit concerning, especially given the current economic climate. This isn’t surprising considering the ambitious salvage project to raise the Concordia, as detailed in this article on attempt to raise concordia is ambitious salvage project. The sheer scale of the effort to salvage the ship is impressive, but it might just be another factor weighing down Carnival’s already struggling bottom line.

It’s a tough time for the cruise industry, and the combined factors are likely contributing to the disappointing forecast.

Industry and Market Reaction

Carnival Corporation’s lowered earnings forecast sent ripples through the travel industry, sparking diverse reactions from investors, analysts, and competitors. The anticipated impact on cruise lines, travel agencies, and the broader tourism sector is substantial. The news underscores the complexities of the current economic climate and the challenges facing businesses reliant on consumer spending and travel trends.

Cruise Industry Reaction, Carnival corp lowers earnings forecast

The cruise industry, heavily reliant on Carnival’s performance, is likely to experience a period of uncertainty. Investors in other cruise lines, including Royal Caribbean and Norwegian Cruise Line, may react by adjusting their own financial projections and assessing the implications for their respective businesses. This could potentially lead to a broader downward pressure on the entire cruise sector.

Furthermore, travel agents who rely on cruise bookings might see a reduction in demand as potential customers reassess their travel plans.

Impact on Other Travel-Related Businesses

The lowered forecast is not isolated to the cruise sector. Travel agencies, hotels, and airlines, often intertwined with cruise bookings, are likely to experience a knock-on effect. Reduced consumer confidence and shifting travel priorities could lead to a decrease in bookings across these sectors. For instance, a potential reduction in cruise bookings might translate into a decrease in hotel reservations in port cities or the demand for associated travel packages.

Analyst Interpretations

Analysts are likely interpreting the lowered forecast through various lenses. Some may focus on the underlying causes of the decline, such as rising fuel costs, labor shortages, or geopolitical factors. Others may scrutinize Carnival’s strategic decisions and assess their potential impact on future profitability. Crucially, analysts will dissect the implications for the company’s future financial performance, particularly its revenue generation and cost management strategies.

Specific financial models will be applied to project future earnings, likely resulting in revised profit expectations.

Financial News Coverage

Financial news outlets are likely to provide extensive coverage of the earnings forecast revision. Articles will dissect the reasons behind the lowered projection and discuss the implications for the cruise industry. The analysis will likely highlight the impact on investor confidence and the potential for wider industry repercussions. News outlets will likely compare Carnival’s performance to other cruise lines and industry benchmarks to provide a more comprehensive picture.

Investor Response

Investor response to the news will be a critical factor. A negative reaction could lead to a decline in Carnival’s stock price, impacting the company’s valuation. Conversely, a positive response might mitigate some of the negative implications, particularly if the company demonstrates a clear plan to address the challenges. Investors will likely scrutinize the company’s response to the lowered forecast and its future strategies to restore investor confidence.

Stakeholder Reaction Comparison

| Stakeholder | Potential Reaction |

|---|---|

| Investors | Potential stock price decline, increased scrutiny of company’s future strategies |

| Analysts | Revised earnings projections, deeper analysis of underlying causes, potential industry-wide impact assessments |

| Competitors | Potential adjustments to their own financial projections, assessment of Carnival’s missteps, opportunities to capture market share |

| Travel Agencies | Potential reduction in cruise bookings, adjustments to marketing strategies |

Future Outlook and Potential Strategies

Carnival Corporation’s recent earnings forecast revision presents a complex challenge requiring proactive strategies for navigating the evolving cruise industry landscape. The company faces headwinds including reduced consumer confidence, potential economic slowdowns, and ongoing industry-wide concerns. Successfully navigating these challenges hinges on adaptability, strategic decision-making, and a keen understanding of market trends.The company must proactively address the challenges presented by the forecast revision to maintain its long-term viability and profitability.

This includes exploring potential cost-cutting measures, adjusting pricing strategies, and exploring new revenue streams to mitigate the negative impacts. A thorough analysis of potential scenarios is crucial to anticipate and prepare for various market outcomes.

Potential Strategies to Mitigate Negative Impacts

Carnival Corporation needs to implement strategies to address the projected decline in revenue. These include enhanced cost-management initiatives, exploring alternative revenue streams, and potentially re-evaluating marketing strategies.

- Cost Reduction Initiatives: Implementing measures to reduce operational costs, such as streamlining processes, optimizing supply chains, and potentially negotiating lower prices with suppliers, are crucial to maintain profitability. Examples include streamlining onboard operations, reducing staffing levels in non-essential areas, and renegotiating contracts with vendors.

- Alternative Revenue Streams: Diversifying revenue streams, like offering premium experiences, expanding into ancillary services (e.g., shore excursions, spa treatments, specialty dining), and potentially exploring new markets, can help offset declines in traditional revenue sources. This could involve developing unique packages for different demographics or focusing on specific cruise routes with high demand.

- Revised Marketing Strategies: Re-evaluating marketing strategies to better resonate with the current consumer sentiment and preferences is essential. This could involve targeting specific demographics with tailored marketing campaigns, emphasizing value propositions, and highlighting safety and security measures. Using data-driven insights to optimize marketing efforts is also vital. For example, analyzing customer preferences for destinations and onboard activities can help refine marketing campaigns.

Carnival Corp’s earnings dip is definitely a bummer. It’s a tough time for cruise lines, and this lower forecast is likely affecting other sectors. Interestingly, the recent performance of the largest architectural firms 2 largest architectural firms 2 might offer some clues to the overall economic climate. But ultimately, this downturn in Carnival’s outlook suggests a more challenging period ahead for the entire industry.

Long-Term Plans and Adaptations to Market Conditions

Carnival Corporation’s long-term plans must be adaptable to the changing market conditions. A crucial component of these plans is to maintain brand loyalty while attracting new customers.

Carnival Corp’s earnings are looking a bit shaky, with a lowered forecast. It’s a bit of a downer, but perhaps this news is less surprising given the recent positive developments in travel. For example, Aruba recently embraced JetBlue’s CommonPass health passport, aruba accepts jetblue commonpass health passport a move that could potentially boost the tourism sector.

Still, the overall picture for Carnival Corp seems to be a bit cloudy for now.

- Adapting to Market Conditions: Developing flexible strategies to adjust to changing consumer preferences, economic fluctuations, and regulatory changes is paramount. This could include adjusting pricing models, modifying itineraries, or adapting onboard offerings based on market feedback. Analyzing competitor strategies and adapting accordingly is also vital.

- Long-Term Sustainability: Integrating environmental sustainability into long-term strategies is not only a responsible approach but also a potential driver of attracting environmentally conscious consumers. This involves reducing the environmental footprint of cruises through innovative technologies, promoting sustainable practices, and showcasing a commitment to environmental stewardship.

Scenario Analysis for Assessing Market Outcomes

A thorough scenario analysis is vital for assessing potential market outcomes and developing contingency plans. This analysis should consider various economic and industry factors.

| Scenario | Economic Outlook | Cruise Industry Outlook | Carnival Corp. Performance |

|---|---|---|---|

| Optimistic | Steady economic growth | Strong demand for cruises | Revenue increases, potential for new ship investments. |

| Neutral | Moderate economic growth | Stable demand for cruises | Maintenance of current performance, focus on cost efficiency. |

| Pessimistic | Economic downturn | Reduced demand for cruises | Revenue decline, focus on cost-cutting measures and adjusting operations. |

Future of the Cruise Industry

The future of the cruise industry hinges on its ability to adapt to changing consumer preferences and economic conditions. While the earnings forecast revision suggests challenges, the industry’s long-term potential remains strong, particularly if companies can address the concerns of environmental sustainability and safety.

- Adaptability: The cruise industry must demonstrate its adaptability to meet the changing demands of consumers and address the increasing concerns about environmental impact and health protocols.

- Sustainability: Environmental concerns are driving demand for sustainable cruise options. The industry needs to implement measures to minimize its environmental footprint and showcase a commitment to sustainability to maintain customer trust.

Final Summary

Carnival Corp’s lowered earnings forecast paints a picture of a potentially difficult period for the cruise industry. The company’s response, the reactions from investors and analysts, and the potential impact on the broader travel sector are all key areas for scrutiny. While challenges are evident, the future of Carnival Corp and the cruise industry remain uncertain. Further analysis of the company’s strategies and the broader economic landscape will be critical in evaluating the long-term implications.

Clarifying Questions

What are the typical components of an earnings forecast?

Typically, an earnings forecast includes revenue projections, profit margins, passenger numbers, and other key financial metrics.

How might geopolitical events impact cruise line earnings?

Geopolitical events, such as conflicts or travel restrictions, can disrupt travel plans and negatively affect cruise line revenue and passenger numbers.

What is the current market sentiment regarding Carnival Corp’s stock price?

Market sentiment will be influenced by the reasons for the lowered earnings forecast, the company’s response, and broader economic conditions. Initial reactions may be negative, but the long-term impact will depend on the company’s ability to adapt and the overall economic recovery.

How are analysts interpreting the lowered forecast?

Analysts will be closely examining the specific factors cited for the lowered forecast and comparing Carnival Corp’s performance with competitors. Their interpretations will be influenced by the company’s past performance, recent industry trends, and their assessments of the company’s future prospects.