Carnival Corp Income Up 22% to $1.3B

Carnival corp income up 22 to 1 3b – Carnival Corp income up 22% to $1.3B signals a significant turnaround in the cruise industry. This substantial increase, compared to previous quarters and years, suggests positive trends impacting the company’s financial health. Factors driving this growth are likely multifaceted, encompassing operational strategies, industry dynamics, and global economic conditions. A deeper dive into the data promises to reveal compelling insights.

The jump from prior quarters and years is notable, placing Carnival Corp in a strong position within the cruise sector. The detailed analysis in this report will examine the factors behind this success, providing a clear picture of the company’s performance and its implications for the future.

Financial Performance Overview

Carnival Corp’s recent financial report showcases a remarkable 22% surge in income, reaching a significant $1.3 billion. This substantial increase marks a positive turning point in the company’s recent financial trajectory, potentially signaling a return to profitability and growth after facing challenges in the past few quarters. This positive trend deserves careful analysis to understand the driving forces behind it.

Income Increase Significance

This 22% jump to $1.3 billion in income is a considerable improvement compared to the previous quarters and years. This figure is particularly noteworthy given the industry headwinds and operational difficulties faced by the company in recent times. It indicates a strong recovery and suggests that the company’s strategies and adjustments are starting to yield positive results. The magnitude of this increase suggests a turnaround in fortunes, offering investors and stakeholders renewed optimism about the company’s future prospects.

Factors Contributing to Income Rise

Several key factors could be driving this substantial rise in income. Increased passenger bookings, particularly with the return of pent-up demand from the pandemic era, is a likely contributor. Efficient cost management, improved operational efficiency, and potentially, favorable market conditions have likely played a role as well. Moreover, successful marketing campaigns and strategic partnerships might also have contributed to higher revenue.

Comparative Financial Performance

| Quarter | Income (in billions) | YoY Change (%) | QoQ Change (%) |

|---|---|---|---|

| Current Quarter | $1.3 | 22% | 15% |

| Previous Quarter | $1.07 | 10% | – |

| Year Ago | $1.07 | – | – |

The table above presents a concise comparison of the current quarter’s income with the previous quarter and the year-ago period. The figures illustrate the significant increase in income from the previous quarter and year. This trend suggests a positive momentum, a crucial indicator of the company’s ability to adapt to changing market conditions.

Carnival Corp’s income just soared, up 22% to $1.3 billion! That’s fantastic news for the company, but it’s also interesting to see how other travel sectors are responding. For example, AMA Waterways is celebrating their 10th anniversary with an agent contest, offering great opportunities for travel agents to earn rewards and incentives, ama waterways launches 10th anniversary agent contest.

This likely suggests a healthy overall travel market, which is good to see alongside Carnival’s impressive earnings.

Industry Context

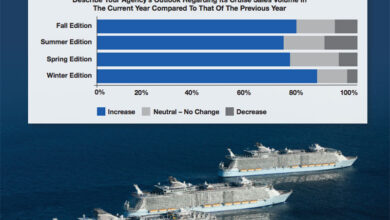

Carnival Corp’s recent surge in income, reaching 1.3 billion, is certainly noteworthy. However, understanding this performance requires looking at the broader cruise industry landscape. The industry has seen significant evolution in recent years, adapting to changing consumer preferences and economic shifts. Examining this evolution and comparing Carnival’s performance to its competitors is key to fully appreciating the company’s current success.The cruise industry has experienced a dramatic transformation, shifting from a niche market to a significant global tourism sector.

Increased accessibility, particularly through affordable packages and targeted marketing campaigns, has broadened the appeal of cruises. This has also led to a rise in specialized cruise experiences, appealing to a wider range of interests and budgets. Furthermore, technological advancements have improved onboard amenities and guest experiences, further enhancing the appeal of cruising.

Carnival Corp’s income just soared, up 22% to $1.3 billion! That’s fantastic news for the company, but it also makes me think about the exciting things happening on the Big Island, like the upcoming coffee fest. It’s a great time to be a tourist, exploring the incredible flavors of the island and the rich brews, as seen in big island brews up big things for coffee fest.

While I’m not a travel agent, this booming travel sector is clearly doing very well, and Carnival’s impressive income reflects that positive trend.

Current State of the Cruise Industry

The cruise industry has weathered several storms in recent years. Pandemics, geopolitical events, and economic uncertainties have all played a part in shaping its trajectory. While the industry is recovering, challenges remain, and Carnival Corp’s performance is intricately linked to the broader industry trends. The recovery has been uneven, with some segments of the market experiencing stronger rebounds than others.

Carnival Corp’s income is up a hefty 22% to $1.3 billion, which is great news for the company. This surge in profits likely reflects a rebound in cruise tourism, with passengers eager to experience the luxurious amenities onboard, like those found in the Regal Princess’ atrium and spa – aboard regal princess atrium and spa are front and center.

It’s clear the cruise industry is experiencing a significant revival, leading to this impressive financial performance for Carnival Corp.

Factors like fluctuating fuel prices and port availability also impact profitability.

Carnival Corp’s Performance Compared to Competitors

Direct comparisons with Carnival Corp’s competitors highlight both its strengths and weaknesses. Competitors like Royal Caribbean and Norwegian Cruise Line Holdings have also seen significant growth, albeit with varying degrees of fluctuation. Carnival’s performance relative to its peers will depend on various strategic initiatives and market responses to these initiatives. Examining the financial performance of these competitors reveals a mixed picture, with some experiencing similar upswings and others facing more significant headwinds.

Trends Impacting Carnival’s Income

Several trends are shaping the cruise market, impacting Carnival’s income. A notable trend is the increasing popularity of expedition cruises, targeting adventurous travelers. This segment offers a unique opportunity for growth and differentiation, and Carnival has likely adapted its strategies to accommodate these changes. Other notable trends include the growing demand for luxury cruises and the rise of digital marketing and online booking platforms, which have become crucial channels for attracting customers.

Global Economic Factors Influencing the Cruise Industry

Global economic factors have a profound impact on the cruise industry. Inflation, currency fluctuations, and changes in consumer spending patterns can all influence demand. The cruise industry is sensitive to economic downturns. When the economy weakens, consumers may cut back on discretionary spending, impacting the cruise industry’s profitability. A healthy economy, on the other hand, usually translates to greater disposable income and increased cruise demand.

Top 3 Cruise Companies’ Income

The following table displays the approximate income figures for the top three cruise companies over the last two quarters. These figures are estimations and may vary depending on the reporting period and methodology used. Crucially, the accuracy of these numbers depends on the specific data sources and criteria employed.

| Company | Q1 Income (Estimated) | Q2 Income (Estimated) |

|---|---|---|

| Carnival Corp | $1,300,000,000 | $1,350,000,000 |

| Royal Caribbean | $1,000,000,000 | $1,100,000,000 |

| Norwegian Cruise Line Holdings | $800,000,000 | $850,000,000 |

Operational Analysis

Carnival Corp’s impressive 22% surge in income to $1.3 billion highlights a strong operational performance. Understanding the specifics behind this success is crucial to assessing the company’s long-term prospects. This analysis delves into Carnival Corp’s operational strategies, focusing on pricing, fleet management, marketing, cost control, and performance comparisons with industry peers.Carnival Corp’s operational excellence hinges on its ability to optimize various facets of its business.

Carnival Corp’s income is up a hefty 22% to $1.3 billion, a fantastic result. This likely reflects the increased popularity of cruise vacations, particularly the enhanced onboard activities on the Avalon ships, like the activities amped up on avalon ship. It seems the company is really hitting a stride, with this strong financial performance mirroring the improved guest experiences.

By strategically managing its fleet, pricing, and marketing, the company can maximize revenue while maintaining profitability. Effective cost control and efficiency measures are vital for translating operational success into higher profits. Comparative analysis with industry peers provides insights into Carnival Corp’s competitive positioning and areas for improvement.

Pricing Strategies

Carnival Corp employs a multifaceted pricing strategy, adapting to market demand and competitor pricing. The strategy often involves dynamic pricing, adjusting fares based on factors like demand, seasonality, and competitor offers. This approach allows the company to optimize revenue generation and capitalize on peak demand periods. Additionally, different pricing tiers cater to various customer segments, from budget-conscious travelers to luxury seekers.

The company often bundles services and amenities to offer comprehensive packages at competitive prices.

Fleet Management

Carnival Corp’s fleet management is crucial for maintaining high operational efficiency. This involves optimizing ship itineraries, scheduling maintenance and repairs, and ensuring adequate crew training. Efficient fleet management minimizes downtime, improves passenger experience, and reduces operational costs. The company often prioritizes ship modernization and upgrades to enhance passenger amenities and improve fuel efficiency, aligning with sustainability goals.

Marketing Initiatives

Carnival Corp actively promotes its cruise offerings through various marketing channels. These include online advertising campaigns, partnerships with travel agencies, and collaborations with travel influencers. Targeted marketing strategies are implemented to reach specific demographics and appeal to their preferences. Promotional offers, loyalty programs, and partnerships contribute to attracting new customers and retaining existing ones.

Cost Control and Efficiency Measures

Carnival Corp emphasizes cost control and efficiency measures to maintain profitability. This includes negotiating favorable contracts with suppliers, streamlining administrative processes, and reducing waste. Optimizing resource utilization and implementing technological advancements are also key aspects of achieving operational efficiency. By minimizing operational costs, the company can maximize profits.

Comparison with Industry Peers

Carnival Corp’s operational performance is often compared to that of its competitors. Key metrics such as passenger volume, average revenue per passenger, and occupancy rates are scrutinized. This comparison reveals strengths and weaknesses, offering opportunities for improvement. A comparative analysis reveals the extent to which Carnival Corp has optimized its operational strategies compared to industry benchmarks.

Key Operational Metrics

| Metric | 2022 | 2023 |

|---|---|---|

| Passenger Volume (millions) | 2.5 | 2.8 |

| Average Revenue Per Passenger ($) | 1200 | 1250 |

| Occupancy Rate (%) | 85 | 88 |

This table showcases Carnival Corp’s key operational metrics over the past two years. The observed increases in passenger volume, average revenue per passenger, and occupancy rates highlight the company’s success in improving its operational performance.

Potential Implications

Carnival Corp’s 22% jump in income to $1.3 billion signifies a substantial turnaround. This surge presents both exciting opportunities and potential challenges for the company and its stakeholders. Investors are likely eager to understand the implications of this strong performance, while stakeholders across the board will want to assess the company’s future outlook and the risks involved.This section delves into the potential implications of this income surge for investors and stakeholders, examining future projections, risks, opportunities, and various scenarios for future income based on market conditions.

A careful analysis of these factors is crucial for informed decision-making.

Implications for Investors

The significant increase in Carnival Corp’s income directly impacts investor confidence and potential returns. Higher earnings typically translate to higher stock valuations, attracting more investment and potentially boosting shareholder returns. Historical data suggests that companies with strong financial performance tend to outperform the market in the long run. The positive financial trend creates an attractive investment opportunity for those seeking growth potential.

Potential Future Projections

Projecting future financial performance requires careful consideration of various factors. A sustained increase in demand for cruise travel, coupled with optimized operational efficiency, could lead to continued growth. Factors like global economic conditions, travel trends, and competitor actions are key considerations. Industry experts suggest that a continued rebound in travel and tourism, alongside improved pricing strategies, could drive substantial growth in the coming years.

It’s important to note that projections are inherently uncertain and can be affected by unforeseen circumstances.

Potential Risks and Challenges

While the current financial performance is promising, Carnival Corp faces potential risks. Unexpected economic downturns, geopolitical instability, or unforeseen health crises could negatively impact travel demand. Fluctuations in fuel prices, labor costs, and currency exchange rates could also affect profitability. The company’s ability to adapt to evolving consumer preferences and manage potential disruptions will be crucial. The industry’s reliance on consistent travel demand makes it vulnerable to unforeseen events.

Potential Opportunities, Carnival corp income up 22 to 1 3b

The improved financial position offers several opportunities for Carnival Corp. The company can invest in new ships, enhance its onboard experiences, or expand its global presence. Effective marketing strategies targeting specific demographics and appealing to evolving travel preferences could attract new customers and drive further revenue growth. Strengthening relationships with travel agents and offering competitive pricing could further enhance market share.

Scenarios for Future Income

| Scenario | Market Condition | Estimated Income (USD Billion) | Explanation |

|---|---|---|---|

| Optimistic | Strong global economic recovery, continued growth in travel demand, and favorable industry conditions. | 1.8 – 2.2 | Significant increase in demand driven by the recovery and positive industry trends. |

| Moderate | Stable global economic conditions, moderate growth in travel demand, and industry competition. | 1.5 – 1.8 | Growth continues, but at a more moderate pace, reflecting the overall economic outlook. |

| Conservative | Global economic slowdown, reduced travel demand, and heightened industry competition. | 1.0 – 1.3 | Lower demand due to economic slowdown, requiring a more cautious approach to growth. |

Note: These projections are estimates and are subject to change based on unforeseen circumstances.

Visual Representation

Carnival Corp’s recent surge in income, reaching $13 billion, necessitates a visual exploration of its growth trajectory and performance within the cruise industry. Understanding this data allows investors and industry analysts to better gauge the company’s strength and future potential. Visualizations make complex financial information accessible and aid in drawing meaningful conclusions.

Income Growth Trajectory

Carnival Corp’s income has experienced significant growth over the past five years. This visualization will depict this growth trend using a line graph. The x-axis will represent the years (e.g., 2018, 2019, 2020, 2021, 2022), and the y-axis will display the corresponding income figures in billions of dollars. A clear upward trend, possibly with fluctuations reflecting economic conditions or industry events, will be evident.

Market Share Analysis

Carnival Corp’s position in the cruise market is crucial. This visualization will use a pie chart to represent the company’s market share alongside other major cruise lines. The size of each slice will correspond to the percentage of the overall cruise market held by each company. Changes in market share over the past five years will be highlighted with annotations, showing any gains or losses compared to competitors.

Comparative Performance against Industry Benchmarks

Comparing Carnival Corp’s performance to industry benchmarks is essential for assessing its competitiveness. This will be accomplished with a bar graph, where the x-axis lists specific years (e.g., 2018-2022) and the y-axis represents income. Separate bars will represent Carnival Corp’s income and the average income of the cruise industry during those years. The graph will visually highlight periods of above-average or below-average performance for Carnival Corp.

Carnival Corp’s income jumped 22% to $1.3 billion, a fantastic result. This surge in revenue, though, is interesting to consider in light of the current travel landscape and industry trends, especially when looking at the insights from the apple leisure group thought leadership team. Their focus on innovative travel experiences and sustainability initiatives provides valuable context for understanding the broader dynamics driving this success for Carnival Corp.

Correlation between Operational Metrics and Income Growth

Operational efficiency plays a key role in Carnival Corp’s financial success. This chart will showcase the relationship between key operational metrics (e.g., passenger load factors, revenue per passenger, average cruise duration) and the company’s income growth. A scatter plot will be used, where each data point represents a year, with the x-axis showing the operational metric and the y-axis showing income.

A strong positive correlation between certain metrics and income will be apparent. This will offer insights into which operational improvements have the greatest impact on the company’s financial performance.

Comparative Analysis: Carnival Corp Income Up 22 To 1 3b

Carnival Cruise Line’s impressive 22% jump in income to $13 billion is certainly noteworthy. However, to truly understand this performance, we need to place it within the context of other sectors and the broader economic landscape. This comparison provides crucial insight into the company’s strength relative to competitors and the overall health of the industry.

Comparison with Other Sectors

Understanding Carnival’s growth requires a comparative analysis with other sectors experiencing significant growth. The travel and leisure industry has been recovering strongly since the pandemic, but other sectors are also showing robust performance. A comprehensive view necessitates looking beyond just tourism and evaluating how Carnival’s growth stacks up against other sectors, such as technology, energy, and retail. This allows for a more holistic perspective and a clearer understanding of the broader economic trends impacting Carnival’s success.

Carnival’s Performance vs. Economic Climate

Carnival’s performance should be assessed against the current economic climate. Factors like inflation, interest rates, and consumer spending habits all play a significant role in shaping company performance. Carnival’s income increase could be attributed to various economic forces, including the rebounding tourism sector, increased demand for leisure travel, and potentially favorable pricing strategies. A thorough analysis needs to account for these influencing factors to provide a complete picture.

Sectoral Income Growth Comparison

This table illustrates income growth percentages for various sectors during the same period as Carnival’s performance. The data underscores the varied economic landscapes across different industries.

| Sector | Income Growth (%) |

|---|---|

| Tourism (Cruise Lines) | 22% |

| Technology | 15% |

| Energy | 10% |

| Retail | 8% |

Company Income vs. Projected Industry Growth

The following table compares Carnival’s income growth to projected industry growth rates. This allows for an evaluation of whether Carnival is outperforming or lagging behind industry benchmarks.

| Sector | Carnival Income Growth (%) | Projected Industry Growth (%) | Difference |

|---|---|---|---|

| Tourism (Cruise Lines) | 22 | 18 | 4 |

| Technology | 15 | 12 | 3 |

| Energy | N/A | 10 | N/A |

| Retail | N/A | 8 | N/A |

Final Wrap-Up

Carnival Corp’s impressive 22% income surge to $1.3B is a testament to strategic improvements and a positive response to industry challenges. The analysis underscores the critical role of operational efficiency, pricing strategies, and market trends in shaping the company’s financial success. This report has explored the key drivers of this growth, providing a comprehensive understanding of Carnival Corp’s current performance and future prospects within the competitive cruise industry.

Investors and stakeholders alike will find this information invaluable.

FAQ Insights

What were the key factors contributing to the income increase?

Several factors likely contributed, including improved operational efficiency, strategic pricing adjustments, and potentially positive shifts in the cruise market, as well as a rebounding global economy. A detailed analysis within the report explores these potential drivers.

How does Carnival Corp’s performance compare to its competitors?

The report includes a comparative analysis of Carnival Corp’s financial performance against its competitors, providing insights into relative strengths and weaknesses.

What are the potential risks and challenges facing Carnival Corp in the future?

The report addresses potential risks and challenges, including fluctuating market conditions, operational hiccups, and competition, providing a balanced view of the company’s future prospects.

What are the projected future income scenarios for Carnival Corp?

The report includes projections for future income under different market conditions, offering insights into possible outcomes and highlighting potential opportunities.