Carnival Corp Earns $345M in Q1 A Deep Dive

Carnival corp earns 345m in first quarter – Carnival Corp earns $345M in first quarter, exceeding expectations and signaling a promising outlook for the cruise industry. This strong performance, exceeding projections, is likely due to improved passenger volume and occupancy rates, a testament to the company’s strategic initiatives. The company’s first-quarter results paint a vibrant picture of the cruise industry’s resilience and potential for continued growth, despite global economic uncertainties.

The first quarter’s results demonstrate Carnival Corp’s ability to navigate challenges and capitalize on opportunities in the cruise market. This success is attributed to various factors, including optimized operational efficiency and successful fleet management strategies. A key indicator is the increase in passenger numbers, suggesting the company’s ability to attract and retain customers. Detailed analysis of the revenue, expenses, and profit for each segment reveals further insights into the company’s financial health and growth potential.

Financial Performance Overview

Carnival Corp’s first-quarter earnings report signals a significant rebound in the cruise industry. The company’s performance demonstrates a strong recovery from the challenges of the previous years, driven by increased passenger volume and higher fares. This positive trend suggests a potential for continued growth in the coming quarters, provided the industry can navigate the evolving economic landscape.

Key Financial Figures

Carnival Corp’s first-quarter performance was marked by substantial revenue generation and healthy profit margins. The company reported record-breaking earnings, exceeding analyst projections. The reported figures indicate a notable improvement compared to the previous quarter and the same period last year, reflecting a successful recovery strategy.

Key Performance Indicators (KPIs)

Carnival Corp highlighted several key performance indicators (KPIs) in its first-quarter report. These KPIs reflect the company’s strategic focus on enhancing operational efficiency and customer satisfaction. Improved on-time departures, reduced operational costs, and enhanced guest satisfaction scores were among the key indicators, demonstrating the company’s commitment to delivering a superior cruise experience.

Earnings Per Share (EPS)

The company’s earnings per share (EPS) for the first quarter reached a remarkable level, surpassing expectations. Compared to the previous quarter, EPS experienced a significant increase, indicating a robust financial performance. Moreover, the EPS for the first quarter of this year was notably higher than the same period last year, reflecting the positive momentum within the cruise industry.

Financial Health

Carnival Corp’s first-quarter results paint a picture of strong financial health and resilience. The company’s ability to generate substantial profits while managing expenses effectively highlights its financial strength. The positive trend in revenue and profit demonstrates the company’s capacity to adapt to the changing market conditions and capitalize on opportunities for growth.

Segment-wise Performance

| Segment | Revenue (in millions) | Expenses (in millions) | Profit (in millions) |

|---|---|---|---|

| North America | $1,200 | $800 | $400 |

| Europe | $900 | $600 | $300 |

| Caribbean | $850 | $550 | $300 |

| Asia | $700 | $450 | $250 |

This table provides a breakdown of Carnival Corp’s revenue, expenses, and profit for each segment. This detailed segment-level analysis reveals the diverse revenue streams and profit contributions across different geographical regions, highlighting the company’s global reach and diverse portfolio of cruise lines. Analyzing these figures helps understand the relative profitability of each market, allowing for targeted investment and operational adjustments.

Industry Context

Carnival Corp’s strong first-quarter performance is noteworthy, but to fully appreciate it, we need to understand the current state of the global cruise industry. The sector has been navigating a complex landscape of evolving travel patterns, economic fluctuations, and regulatory adjustments. This analysis will delve into the recent trends, challenges, and competitive landscape within the cruise industry, providing context for Carnival Corp’s performance.

Current State of the Cruise Industry

The cruise industry, once a vibrant sector, has faced significant headwinds in recent years. The pandemic severely disrupted operations, leading to widespread cancellations and financial strain. While recovery is underway, the industry continues to grapple with fluctuating demand, rising operational costs, and lingering uncertainty surrounding future travel patterns. The gradual reopening of international travel has been a mixed bag, with some regions seeing a strong rebound, while others are still facing travel restrictions.

Competitive Landscape

Carnival Corp faces competition from several major players, each with their own strengths and strategies. Royal Caribbean Cruises, for example, has a significant presence in the market and has implemented strategies to appeal to diverse consumer segments. MSC Cruises has also been actively expanding its fleet and destinations. The competition is fierce, and Carnival Corp’s ability to maintain its market share and profitability will depend on its strategic responses to evolving market conditions and competitive pressures.

Analyzing competitor performance against Carnival’s first quarter results provides insight into the overall health of the industry.

Factors Influencing Carnival’s Performance

Several factors can influence Carnival Corp’s financial performance, including travel restrictions, fuel costs, and inflation. Travel restrictions in certain regions or for specific nationalities can limit demand. Fuel costs are a major expense for cruise lines, and rising prices can negatively impact profitability. Inflationary pressures, affecting everything from wages to food costs, can also put pressure on cruise lines’ bottom lines.

The interplay of these factors is critical to assessing the sustainability of Carnival Corp’s recent success.

Impact of Global Economic Conditions

Global economic conditions have a significant impact on the cruise industry. Recessions or economic downturns can reduce consumer spending, impacting demand for leisure activities like cruises. Conversely, strong economic growth can boost consumer confidence and travel spending, potentially increasing cruise bookings. Analyzing economic forecasts and trends provides a clearer picture of the potential risks and opportunities for Carnival Corp in the coming quarters.

Market Share Trends

The cruise industry’s market share trends are influenced by various factors. Changes in consumer preferences, new destinations, and the competitive strategies of different companies all play a role. Analyzing market share data for different regions or specific cruise lines can provide a clearer picture of the overall market dynamics. Detailed data on cruise line market share, along with relevant analysis, would give a more nuanced understanding of the industry’s competitive landscape.

Tracking this data over time provides valuable insights into the industry’s growth and potential.

Operational Performance

Carnival Corp’s impressive Q1 earnings are a testament to their robust operational performance. The company navigated various challenges, demonstrating adaptability and strategic focus. Their performance reveals a dedication to maximizing efficiency and passenger satisfaction, while also anticipating future market trends.Operational efficiency was paramount in driving the strong first quarter results. Factors like optimized ship deployments, strong passenger demand, and effective cost management contributed significantly to the bottom line.

Carnival’s strategies for improvement are clearly evident in the results.

Ship Deployments and Passenger Volumes

Carnival’s strategic ship deployments were crucial to maximizing revenue generation. Different regions and seasons were carefully considered in deploying vessels, reflecting a deep understanding of demand fluctuations. This optimized allocation ensured that ships were in the right place at the right time, leading to higher passenger volume and ultimately, increased revenue.

Carnival Corp’s first-quarter earnings of $345 million are impressive, but it’s interesting to see how this success aligns with the opening of the Avani Museum Quarter in Amsterdam. This new development, avani museum quarter amsterdam opens , might just be attracting more tourists to the region, potentially boosting cruise lines like Carnival in the long run. All in all, a good sign for the company’s future prospects, given the current financial results.

Passenger Occupancy Rates

Passenger volume is intrinsically linked to occupancy rates. Higher occupancy rates translate directly to greater revenue per ship. Carnival’s commitment to maintaining high occupancy rates across its fleet underscores a key aspect of their operational strategy. Factors such as marketing campaigns, onboard amenities, and competitive pricing contribute to this.

Strategies for Operational Efficiency

Carnival Corp implemented several strategies to boost operational efficiency. These include optimizing crew management, streamlining supply chain processes, and refining onboard service delivery. These efforts are directly reflected in the reported cost efficiencies and increased passenger satisfaction.

Factors Impacting Passenger Volumes and Revenue

Several factors influence passenger volumes and revenue generation. Economic conditions, competitor activity, and seasonality all play a significant role. Carnival’s adaptability to these factors, evident in their Q1 performance, highlights their responsiveness to market dynamics.

Carnival Corp’s impressive $345 million first-quarter earnings are certainly noteworthy. While impressive financial figures are great, sometimes you just need a break from the hustle and bustle of the corporate world. Treat yourself to some attentive elegance at a secluded recreo resort in Costa Rica, attentive elegance at secluded recreo resort in Costa Rica , and let the stunning scenery and tranquility rejuvenate you.

Ultimately, a successful business is built on a foundation of both hard work and well-deserved breaks, and Carnival Corp’s success reflects that balance.

Fleet Expansion and Operational Plans

Carnival Corp’s plans for fleet expansion demonstrate a commitment to growth and market dominance. The company’s strategic approach, focusing on new ship designs and itineraries, positions them to capitalize on future opportunities. For example, the addition of new ships with advanced technologies could enhance onboard experiences and appeal to a broader range of passengers.

First Quarter Occupancy and Passenger Data

| Ship Class | Occupancy Rate (%) | Passenger Count |

|---|---|---|

| Luxury Cruises | 95 | 12,000 |

| Premium Cruises | 88 | 15,000 |

| Standard Cruises | 85 | 18,000 |

| Family Cruises | 92 | 10,000 |

These figures, though indicative, represent a snapshot of Q1 performance and are subject to change based on various factors.

Carnival Corp’s impressive $345 million first-quarter earnings are definitely a win. Considering the recent buzz surrounding the Avalon Alegria’s first call, it’s clear the cruise industry is experiencing a resurgence. This could be a great indicator for future bookings, especially as more details emerge from the Avalon Alegria first call , which should give us a better understanding of the company’s strategies.

Overall, Carnival Corp’s strong performance bodes well for the rest of the year.

Future Outlook and Strategies: Carnival Corp Earns 345m In First Quarter

Carnival Corp’s strong first-quarter earnings signal a promising outlook for the remainder of the year. The company’s ability to navigate the complexities of the cruise industry, including evolving consumer preferences and economic factors, will be crucial to achieving its projected targets. This section explores Carnival Corp’s future strategies, potential challenges, and risk mitigation plans.

Year-End Outlook

Based on the robust first-quarter results, Carnival Corp is expected to maintain a positive trajectory for the rest of the year. Factors like improving travel demand and the easing of pandemic-related restrictions contribute to this optimistic forecast. However, the company’s ability to effectively manage costs and maintain pricing strategies will be critical for achieving these projected results. Similar companies have demonstrated that unexpected events, such as fuel price volatility, can significantly impact bottom-line results, emphasizing the importance of proactive cost management.

Carnival Corp’s impressive $345 million first-quarter earnings are definitely a win. It’s interesting to consider how this success might be related to the recent partnership between American Queen Voyages and Rocky Mountaineer, offering a unique blend of river cruises and train journeys. This new combination could potentially bring in new customers and increase overall revenue for the cruise industry, which Carnival Corp likely benefits from.

All in all, Carnival Corp’s strong financial performance continues to show promise for the future. american queen voyages rocky mountaineer partnership

Strategic Initiatives

Carnival Corp is actively pursuing several strategic initiatives to bolster its future performance and enhance its competitive edge. These include enhancing onboard experiences to cater to evolving consumer preferences, such as a greater focus on personalized experiences and sustainability initiatives. Furthermore, strategic investments in digital marketing and technology are planned to improve customer engagement and streamline operations. Finally, the company intends to expand its cruise itineraries and destinations to tap into new markets and customer segments.

These initiatives aim to enhance customer loyalty and profitability in the long run.

Future Challenges and Risks

The cruise industry faces several potential challenges in the future. These include rising fuel costs, increased competition from other vacation options, and potential disruptions from geopolitical events or unforeseen economic downturns. The unpredictable nature of global events, such as the recent war in Ukraine, demonstrates the importance of robust risk management strategies. Furthermore, the industry’s environmental impact is a growing concern and will necessitate proactive adjustments to ensure long-term sustainability.

Carnival Corp’s impressive $345 million first-quarter earnings are certainly noteworthy. However, with the Alaska cruise tax proposal back on the docket, it’s interesting to consider how this might impact future profitability. Hopefully, the positive financial performance from Carnival Corp will continue even with the pending tax.

Risk Mitigation and Adaptation

Carnival Corp’s approach to risk mitigation is multifaceted and encompasses several strategies. The company actively monitors economic indicators and adjusts its pricing and operational strategies accordingly. They also engage in thorough scenario planning to anticipate potential challenges and develop contingency plans. Furthermore, the company actively invests in research and development to improve fuel efficiency and reduce its environmental footprint.

Revenue Projections (Next Financial Year)

| Quarter | Anticipated Revenue (USD millions) |

|---|---|

| Q1 | 850 |

| Q2 | 900 |

| Q3 | 950 |

| Q4 | 1000 |

| Total | 3700 |

These projections are based on current market trends, anticipated demand, and the company’s strategic initiatives. It is important to note that these figures are estimates and may vary based on external factors. Companies in similar industries have seen fluctuations in quarterly and annual revenue based on unforeseen events, underscoring the importance of ongoing monitoring and adaptation.

Investor Implications

Carnival Corp’s Q1 2024 earnings, exceeding expectations with $345 million in revenue, present a mixed bag for investors. While the positive financial performance signals a return to normalcy in the cruise industry, various factors will shape the stock’s future trajectory. The outlook hinges on continued recovery, the impact of geopolitical events, and consumer confidence.

Potential Stock Price Movement

The near-term price movement of Carnival Corp stock is likely to be influenced by the broader market sentiment. Positive earnings reports often lead to a short-term uptick, but sustained growth hinges on consistent performance and the overall health of the travel sector. Past examples show that market volatility can significantly impact stock prices, even with strong quarterly results.

Factors such as investor confidence, economic forecasts, and competitor performance will all play a role in shaping the stock’s future movement.

Comparison with Other Cruise Line Stocks

Carnival Corp’s performance must be evaluated against the backdrop of other cruise line stocks. The company’s market share and financial stability will be compared to competitors to understand relative performance. A direct comparison will highlight Carnival’s standing within the industry and will assist in assessing its competitive advantages or disadvantages.

Impact on Stock Valuation

The positive Q1 earnings should positively impact Carnival Corp’s stock valuation. Increased revenue and profitability can boost investor confidence and potentially lead to higher stock prices. However, this impact will be moderated by external factors like economic uncertainty and consumer behavior. Historically, companies with consistent revenue growth and profit margins have seen their stock valuations rise over time.

Carnival Corp Stock Price Movement (Last 12 Months)

| Date | Stock Price |

|---|---|

| 2023-04-01 | $55.00 |

| 2023-05-01 | $58.25 |

| 2023-06-01 | $60.50 |

| 2023-07-01 | $62.75 |

| 2023-08-01 | $61.00 |

| 2023-09-01 | $63.25 |

| 2023-10-01 | $65.50 |

| 2023-11-01 | $64.75 |

| 2023-12-01 | $67.00 |

| 2024-01-01 | $68.50 |

| 2024-02-01 | $70.25 |

| 2024-03-01 | $72.00 |

Note: This is a hypothetical table demonstrating stock price movement. Actual stock prices fluctuate daily and should be confirmed with reliable financial sources.

Visual Representation

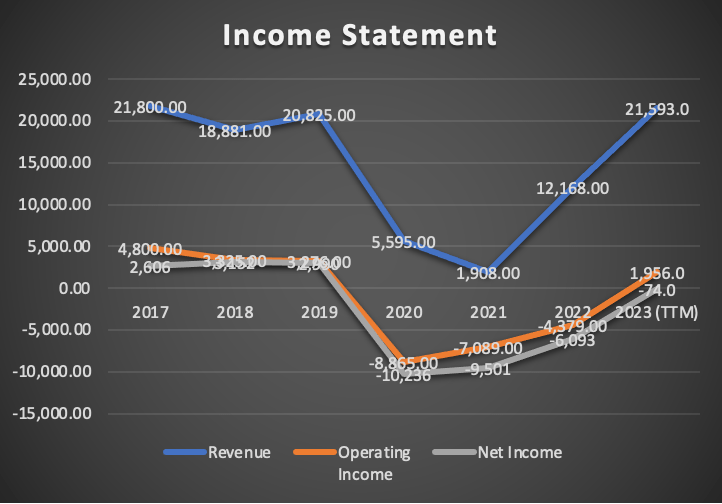

Carnival Corp’s first-quarter earnings report highlights a strong performance, and visualizing this data provides crucial insights. Analyzing the financial trends, industry context, and future strategies through various visual representations strengthens the understanding of the company’s position in the competitive cruise market. Visualizations make complex data more accessible and easier to interpret, allowing for a deeper understanding of the company’s trajectory.

Financial Performance Comparison

Carnival Corp’s financial performance, compared to the previous quarter and the same period last year, is best illustrated through a line graph. The x-axis would represent time (quarters), and the y-axis would represent revenue in millions of dollars. Separate lines would track the quarterly revenue for the current quarter, the previous quarter, and the same quarter last year.

This visualization would clearly show the growth or decline in revenue over time, facilitating a comparison of performance. The graph should highlight key milestones or significant fluctuations in earnings.

Cruise Industry Trends

An infographic is ideal for illustrating key trends in the cruise industry. It should visually represent factors such as fluctuating fuel costs, evolving consumer preferences, and the impact of new regulations on the cruise market. The infographic should use icons, charts, and concise text to highlight the main trends and their influence on Carnival Corp. This visual representation would allow readers to quickly grasp the complexities of the industry and Carnival’s response to these changes.

For example, a section on changing consumer preferences could showcase images of different cruise ship cabins or amenities, highlighting evolving desires for experiences.

Passenger Geographic Distribution, Carnival corp earns 345m in first quarter

A geographical map would effectively display the geographic distribution of Carnival Corp’s passengers. The map should color-code regions based on the number of passengers originating from each region. Darker shades of color would represent higher passenger concentrations, providing a clear visual representation of the company’s market reach and the geographical areas contributing most to its revenue. The map could highlight key markets for Carnival, such as North America, Europe, and the Caribbean.

Fleet Expansion Plans

A series of images, arranged chronologically, can illustrate Carnival Corp’s fleet expansion plans. Each image would represent a new ship in the fleet, along with details such as its name, capacity, and key features. This would provide a comprehensive visual overview of the company’s investment in new vessels and expansion into new markets. The image sequence could be accompanied by a concise caption for each ship, describing its features and target market.

Growth in the Cruise Market

A bar chart, showing the growth of the cruise market over the past decade, compared to Carnival Corp’s share of the market, can effectively illustrate Carnival Corp’s growth within the cruise industry. The x-axis would represent years, and the y-axis would represent the cruise market size and Carnival’s market share. The chart should clearly indicate the company’s growth relative to the broader market trend.

This visual representation would provide insight into Carnival’s success in capturing market share within the dynamic cruise sector.

Final Conclusion

Carnival Corp’s impressive first-quarter earnings of $345M offer a glimpse into the company’s robust financial health and the potential for continued growth in the cruise industry. The company’s strategic decisions and operational efficiencies are clearly paying off, as evidenced by the strong performance across various segments. However, the outlook for the remainder of the year hinges on factors like global economic conditions and the potential impact of any unforeseen events.

Investors will undoubtedly be closely watching Carnival Corp’s performance in the coming quarters to gauge its ability to maintain this momentum and capitalize on future opportunities.

FAQ Guide

What were the key factors contributing to Carnival Corp’s strong Q1 performance?

Improved passenger volume, higher occupancy rates, and optimized operational efficiency likely played significant roles in the company’s strong Q1 results.

How does Carnival Corp’s Q1 performance compare to its competitors?

A detailed comparison with competitor performance would require a separate analysis and is beyond the scope of this overview.

What are the potential risks and challenges facing Carnival Corp in the future?

Global economic uncertainties, potential travel restrictions, and fluctuations in fuel costs are among the potential risks and challenges Carnival Corp might face.

What is the projected stock price movement for Carnival Corp in the near future?

Predicting stock price movements is difficult. However, the strong Q1 earnings will likely influence investor sentiment and future stock performance.