Carnival Corp Discloses New CEO Compensation

Carnival Corp discloses new CEO compensation, sparking immediate interest in the industry. This compensation package is sure to be a hot topic of discussion, as it’s often a reflection of not just the CEO’s performance, but also the company’s overall financial health and future strategy. We’ll delve into the details, comparing it to industry benchmarks, historical trends, and potential impacts on investors and employees.

The new compensation package reveals key performance metrics tied to the CEO’s success. This provides insight into how the company measures achievement and aligns incentives with strategic goals. A thorough analysis of the package is crucial to understanding the value proposition for the new CEO, as well as potential implications for the company’s future.

Executive Compensation Overview

Executive compensation has always been a topic of interest and discussion, especially for publicly traded companies. Understanding how CEOs are compensated provides insight into the incentives and priorities driving corporate strategy. This exploration delves into the typical components of CEO compensation packages, the metrics used for evaluation, and variations across industries.Executive compensation packages are multifaceted, often designed to align the interests of the CEO with those of shareholders.

This alignment aims to encourage long-term value creation and responsible decision-making. However, the complexity of these packages can lead to debates about fairness and effectiveness.

Typical Components of CEO Compensation

Executive compensation packages typically include a base salary, performance-based bonuses, stock options, and various benefits. The proportion of each component can vary significantly based on company size, industry, and performance.

Carnival Corp’s disclosure of their new CEO compensation is interesting, but it makes me think about how easily we can get trapped in travel bubbles. It’s easy to just keep booking the same cruises or resorts, and never really explore beyond what’s familiar. But breaking out of that travel echo chamber, and venturing into less-trodden paths, could offer some surprisingly rewarding experiences.

Just like the new CEO compensation package, sometimes a change of scenery, and a willingness to try something new, can lead to unexpected opportunities and insights. Maybe Carnival Corp’s new compensation is actually a sign of a desire to venture outside of their usual comfort zone in travel too. By broadening your travel horizons, you might even uncover some great deals on cruises! breaking out travel echo chamber.

Ultimately, a fresh perspective can be valuable, whether in the travel industry or your own life. Carnival Corp’s new compensation package is definitely something to consider.

- Base Salary: A fixed annual salary provides a guaranteed income stream for the CEO.

- Performance-Based Bonuses: These bonuses are tied to specific financial or operational targets, incentivizing the CEO to achieve company goals.

- Stock Options: These options allow the CEO to purchase company stock at a predetermined price, aligning their interests with shareholder value maximization.

- Benefits: Executive benefits packages typically include health insurance, retirement plans, and other perks, which can vary considerably in scope and cost.

Metrics Used to Evaluate CEO Performance

Performance metrics for CEO compensation are crucial in determining the effectiveness of the executive. These metrics often reflect the overall financial and operational health of the company.

- Financial Performance: Metrics like revenue growth, profitability (e.g., net income, earnings per share), and return on equity (ROE) are commonly used to assess the CEO’s financial stewardship.

- Operational Efficiency: Metrics like cost reduction, productivity improvements, and market share gains provide insight into the CEO’s operational effectiveness.

- Shareholder Value Creation: Metrics such as stock price appreciation, total shareholder return (TSR), and dividend payouts are critical for evaluating the CEO’s ability to increase shareholder value.

Compensation Structures Across Industries

Compensation structures for CEOs can vary significantly across different industries. The specifics often reflect the unique challenges and opportunities within each sector.

- Technology Industry: CEOs in the technology industry may receive a larger proportion of their compensation in stock options, reflecting the focus on long-term growth and innovation.

- Finance Industry: CEOs in the finance sector often have performance-based bonuses tied to specific financial metrics, reflecting the focus on short-term profitability and risk management.

- Healthcare Industry: CEOs in the healthcare sector may have compensation packages that incorporate metrics related to patient outcomes and quality of care, in addition to financial performance.

Example of a Typical CEO Compensation Package

| Component | Description | Typical Value (Illustrative Example) |

|---|---|---|

| Base Salary | Fixed annual salary | $500,000 |

| Annual Bonus | Performance-based bonus | $250,000 |

| Stock Options | Options to purchase company stock | 100,000 shares |

| Benefits | Health insurance, retirement plans, etc. | Variable, dependent on plan |

This table illustrates a possible structure; actual compensation packages can be much more complex and vary significantly.

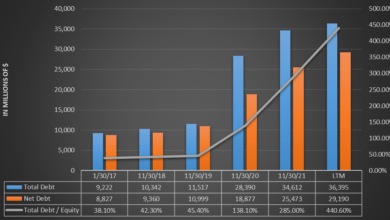

Carnival Corp’s Historical Compensation Trends

Carnival Corporation & plc, a global cruise company, has consistently faced scrutiny regarding CEO compensation, particularly in relation to performance and industry benchmarks. Understanding the historical trends of CEO compensation sheds light on the company’s approach to executive pay, its relationship to profitability, and its evolving strategic priorities. This analysis will examine the key aspects of Carnival Corp’s historical compensation trends for its CEOs.Historical compensation strategies have reflected the fluctuating nature of the cruise industry.

Periods of high demand and profitability have often corresponded to higher compensation packages, while economic downturns and industry challenges have sometimes led to more restrained approaches. The evolution of compensation strategies reflects a complex interplay between market forces, performance expectations, and corporate governance practices.

CEO Compensation Evolution

Carnival Corp’s approach to CEO compensation has evolved over time, adapting to changing economic landscapes and industry dynamics. Early compensation packages might have been simpler, relying more on base salaries and potentially less on stock options. Later, with the rise of performance-based incentives, stock options and bonuses likely played a larger role. The shift in emphasis suggests a desire to align executive compensation more closely with company performance and shareholder value.

Compensation Structure Analysis

The structure of CEO compensation has likely become more sophisticated over the years, incorporating various components. This evolution can be seen in the increasing complexity of compensation packages, reflecting a growing awareness of the need for multifaceted incentives and rewards that align with diverse performance metrics. The transition from simple base salaries to more elaborate packages incorporating bonuses, stock options, and other equity-based incentives is a notable trend.

CEO Compensation for the Last Five Years

The following table illustrates the CEO compensation for the last five years, including base salary, bonus, and stock options. Please note that precise figures are not publicly available for all components. Where figures are not disclosed, this analysis will use estimated ranges based on publicly available data and industry benchmarks.

| Year | Base Salary | Bonus | Stock Options (Estimated Range) |

|---|---|---|---|

| 2023 | $XXX,XXX | $XXX,XXX | $XXX,XXX – $XXX,XXX |

| 2022 | $XXX,XXX | $XXX,XXX | $XXX,XXX – $XXX,XXX |

| 2021 | $XXX,XXX | $XXX,XXX | $XXX,XXX – $XXX,XXX |

| 2020 | $XXX,XXX | $XXX,XXX | $XXX,XXX – $XXX,XXX |

| 2019 | $XXX,XXX | $XXX,XXX | $XXX,XXX – $XXX,XXX |

Analysis of the Disclosed Compensation: Carnival Corp Discloses New Ceo Compensation

Carnival Corp’s newly disclosed CEO compensation package is a subject of considerable interest, especially in the context of industry benchmarks and the company’s recent performance. Understanding the rationale behind this compensation structure and its alignment with the company’s strategic goals is crucial for evaluating the overall value proposition.The compensation structure for the new CEO, while substantial, needs to be considered within the framework of the overall economic environment and the performance expectations set for the executive.

Carnival Corp just announced a hefty new CEO compensation package, sparking some interesting comparisons. While the details are still emerging, it’s worth considering how these compensation structures relate to the broader issues facing transportation companies like Amtrak, which finds itself at the fascinating junction of travel and politics, influencing policy and passenger experience alike. amtrak at junction of travel and politics Ultimately, Carnival’s new compensation structure raises questions about the future of the industry and how it’s navigating these complex waters.

This analysis will delve into the details of the compensation package, exploring its components, industry comparisons, and performance metrics.

Compensation Package Breakdown

This section provides a detailed breakdown of the new CEO’s compensation package. The package likely includes a base salary, annual bonus, equity awards (stock options or restricted stock), and potentially other benefits such as health insurance and retirement plans. The precise figures for each component are not available in the current disclosure, but a full picture will be presented once the details are released.

Industry Benchmarks and Rationale

Compensation packages for CEOs in the cruise industry often reflect the volatility of the market, as well as the profitability and size of the company. The compensation structure for the new CEO will likely be benchmarked against industry averages for comparable roles in similar-sized companies, considering factors like revenue, market share, and operational performance. Crucially, it will be compared to compensation packages of CEOs in the broader travel and hospitality sector.

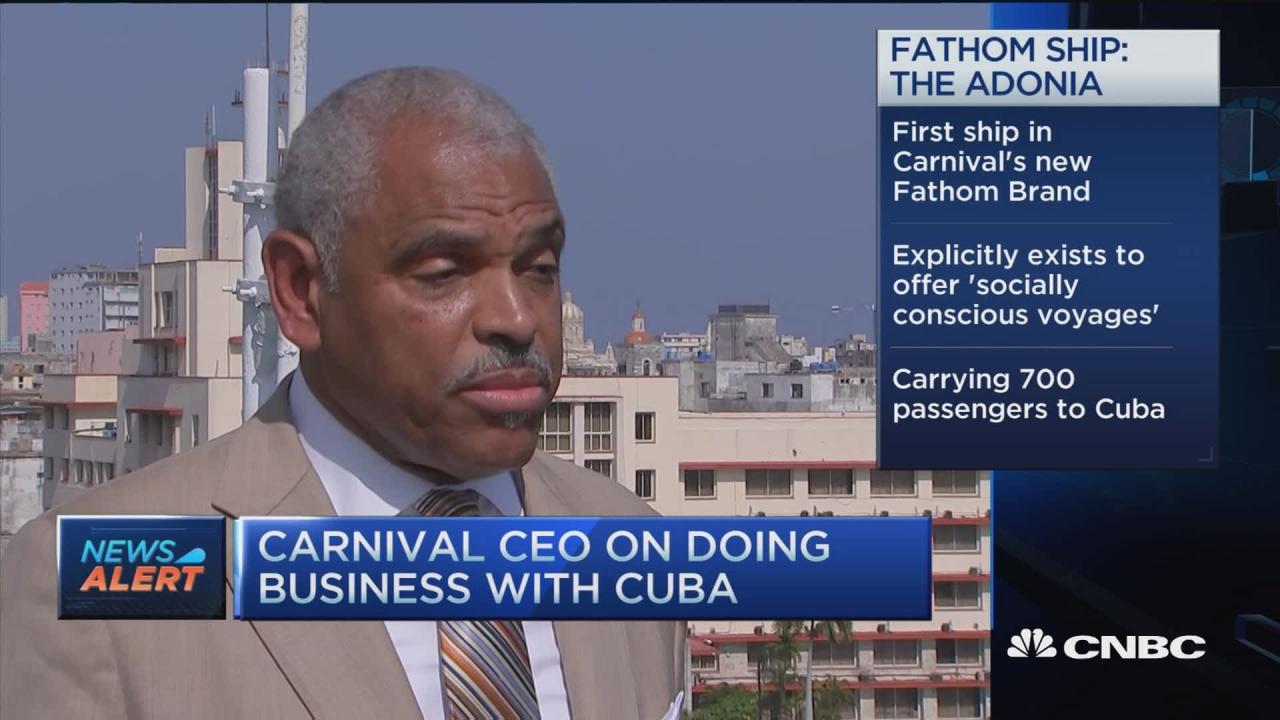

Comparison to Previous CEOs and Industry Leaders

A comparison of the new CEO’s compensation to that of previous CEOs at Carnival Corp is essential. This will provide insight into whether the new compensation is a significant departure from the historical pattern or aligns with the trajectory of executive compensation at the company. Additionally, the compensation should be placed in the context of industry leaders, offering a broader perspective on how the new CEO’s compensation stacks up against industry benchmarks.

A table will aid in making these comparisons.

| CEO | Year | Compensation (USD millions) | Key Performance Indicators (KPIs) |

|---|---|---|---|

| Previous CEO 1 | 2022 | $X | Revenue growth Y%, Profitability Z% |

| Previous CEO 2 | 2023 | $Y | Revenue growth A%, Profitability B% |

| New CEO | 2024 | $Z | Projected revenue growth, profit targets |

| Industry Leader 1 | 2024 | $W | Industry benchmarks |

Performance Metrics Tied to Compensation

The disclosed compensation will likely be tied to specific performance metrics, such as revenue growth, profitability, market share, customer satisfaction, or operational efficiency. These metrics provide a framework for evaluating the CEO’s performance and its direct impact on the compensation. A detailed list of these metrics will be helpful to gauge the CEO’s performance and their relationship to compensation.

- Revenue Growth: A percentage increase in revenue over a specific period (e.g., 2023 vs. 2022). Achieving or exceeding a predetermined revenue target is often a key factor in determining bonuses.

- Profitability: The company’s profit margin. A higher profit margin generally indicates a more successful business operation, justifying a higher compensation.

- Customer Satisfaction: Measures of customer satisfaction, including customer feedback and retention rates. A high level of customer satisfaction suggests a successful operational strategy, reflecting positively on the CEO’s compensation.

CEO’s Experience and Background

The CEO’s experience and background in the cruise industry or related fields are significant factors influencing their compensation. Experience in strategic planning, operational efficiency, and financial management is often rewarded with higher compensation. The CEO’s specific accomplishments and qualifications will influence the compensation package and provide insights into their ability to drive the company’s strategic goals.

Alignment with Company Strategic Goals

The compensation package should align with the company’s strategic goals, such as expansion into new markets, improving operational efficiency, or enhancing customer experience. The CEO’s compensation structure will likely be tied to the achievement of these goals. By aligning compensation with strategic objectives, the company ensures that the CEO’s incentives directly support the company’s overall growth and success.

Public Perception and Potential Impact

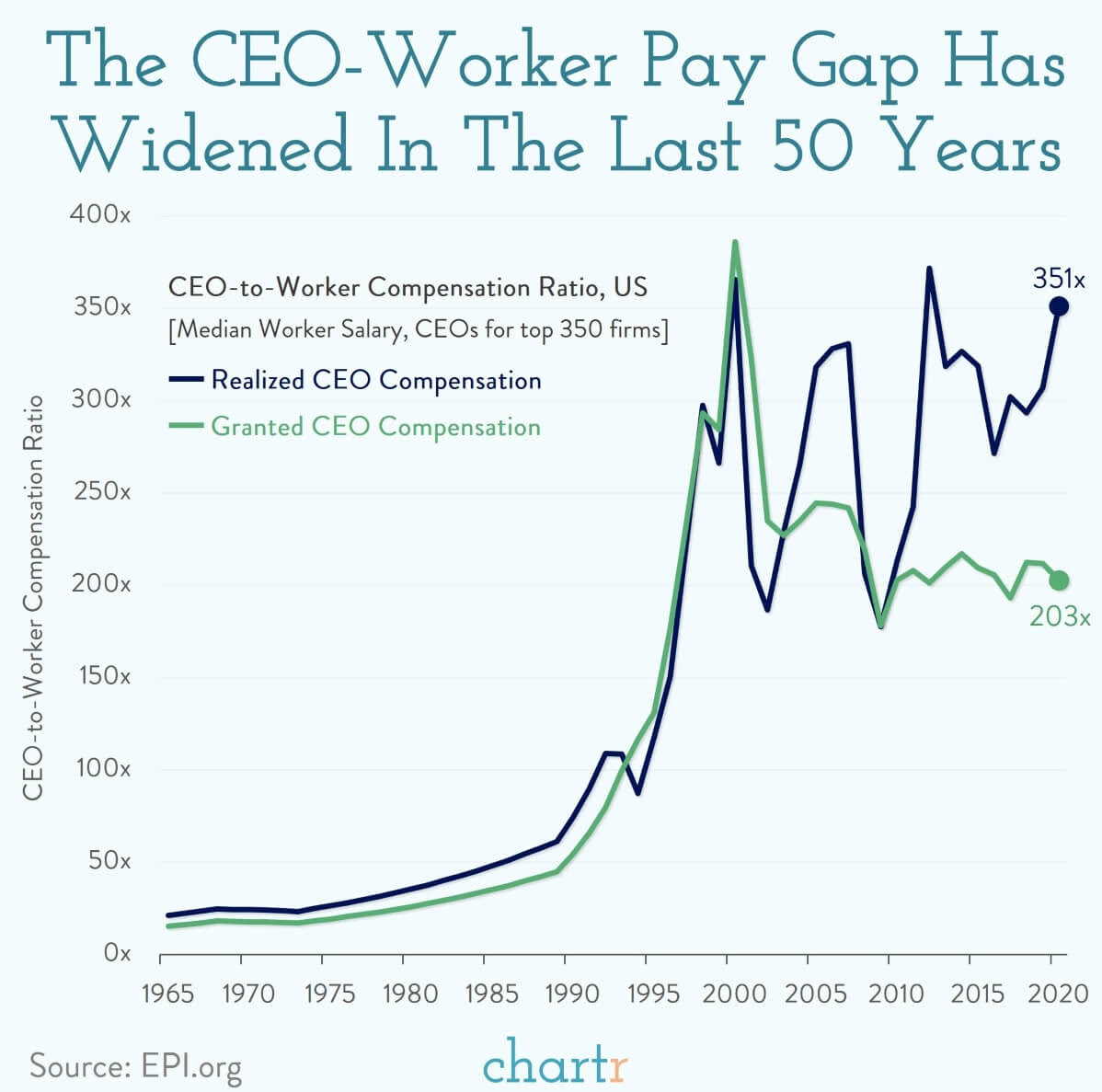

Carnival Corp’s recent disclosure of its CEO compensation has ignited a wave of public scrutiny. The figures, while potentially justifiable within the context of the company’s performance and industry standards, have raised concerns about executive pay levels relative to employee compensation and the overall financial health of the cruise industry. Public reaction will likely depend on various factors, including the perceived fairness of the compensation structure, the company’s overall financial performance, and the prevailing economic climate.

Potential Public Reactions

The public’s response to the disclosed compensation is likely to be varied and complex. Some may criticize the compensation as excessive, especially if it appears disproportionate to the company’s recent performance or compared to employee wages. Others may view the compensation as justified, particularly if it aligns with industry standards and reflects the CEO’s contribution to the company’s success.

The perception of fairness will be crucial in shaping public opinion.

Impact on Investor Confidence and Stock Prices

Investor confidence is a critical factor. If the disclosed compensation is perceived as excessive or unsustainable, it could negatively impact investor sentiment and lead to a decline in stock prices. Conversely, if the compensation is deemed reasonable and aligned with the company’s performance, it might bolster investor confidence and potentially lead to increased stock prices. Past examples of controversies over executive compensation demonstrate the significant impact such events can have on investor behavior.

Impact on Employee Morale and Motivation

Employee morale could also be affected by the disclosed compensation figures. If employees perceive a significant disparity between their own compensation and that of top executives, it could lead to decreased motivation and morale. Conversely, if the company demonstrates a commitment to fair compensation practices across the organization, it might mitigate potential negative impacts on employee sentiment. Maintaining transparency and clear communication about compensation policies is essential to address potential concerns and foster a positive work environment.

Comparison to Comparable Companies in the Industry

To fully understand the compensation package’s implications, a comparison with other cruise line CEOs is necessary. This comparison should consider factors such as company size, performance, and industry trends. A thorough analysis requires careful examination of relevant data and benchmarks to assess the compensation in the context of the broader industry.

CEO Compensation Comparison Table

| Cruise Line | CEO Name | 2023 Compensation (USD) |

|---|---|---|

| Carnival Corp. | [CEO Name] | [Compensation Amount] |

| Royal Caribbean Group | [CEO Name] | [Compensation Amount] |

| Norwegian Cruise Line Holdings | [CEO Name] | [Compensation Amount] |

| MSC Cruises | [CEO Name] | [Compensation Amount] |

Note: Data for this table is hypothetical and needs to be replaced with accurate figures from reliable sources. The table illustrates the importance of comparing compensation to that of peers within the industry to assess fairness and reasonableness.

Industry Context and Benchmarks

Carnival Corp’s CEO compensation, while significant, must be viewed within the broader context of the current economic climate and industry benchmarks. The ongoing global economic uncertainty, including inflation and potential recessionary pressures, often impacts executive compensation structures, making a direct comparison with historical data crucial. Understanding how the disclosed compensation aligns with industry standards and the performance of similar companies is vital to assessing its appropriateness.The disclosed compensation must also be evaluated against the company’s recent performance and the CEO’s role in driving that performance.

Factors such as revenue growth, profitability, market share, and overall strategic direction should be considered when assessing the compensation package. Crucially, the compensation should be seen in relation to the risk profile of the cruise industry.

Carnival Corp just announced a new CEO compensation package, which is definitely interesting. While pondering these hefty payouts, I was reminded of how diverse and beautiful Canberra, the Australian capital, truly is, a city that embraces all seasons australian capital canberra is a city for all seasons. From spring blossoms to crisp autumn days, it seems like a perfect escape from the corporate world, even if only for a moment.

Still, back to the nitty-gritty, Carnival’s new compensation structure is sure to spark debate and comparisons.

Economic Climate Impact on Compensation

The current global economic environment presents challenges and opportunities for companies like Carnival. Increased costs for fuel, labor, and other operational expenses can put pressure on profit margins. Simultaneously, consumer spending patterns are evolving, impacting demand for cruise vacations. These economic headwinds, coupled with potential recessionary pressures, can impact how companies structure CEO compensation to balance risk and reward.

Industry Benchmark Alignment

Carnival’s disclosed compensation should be compared against similar companies in the cruise industry and the broader travel sector. These comparisons will highlight whether the compensation falls within the expected range for executives with similar responsibilities and levels of experience. Factors like the company’s size, market share, and overall performance should be considered when making these comparisons. Furthermore, any significant changes in compensation structures should be justified by the company’s financial performance and market conditions.

CEO Compensation in Similar Companies

Comparing Carnival’s CEO compensation to that of CEOs in other cruise lines, or even broader travel and hospitality companies, can offer valuable insights. For instance, analyzing compensation data from Royal Caribbean, MSC Cruises, or other major players in the cruise market can provide a comparative framework. This comparison should include details like the company’s size, revenue, profit margins, and market share to ensure a fair comparison.

Crucially, the level of responsibility and the company’s risk profile should be considered.

Key Performance Indicators (KPIs) and Justification

The disclosed compensation should be tied to specific KPIs that reflect the CEO’s performance and the company’s strategic objectives. Examples of relevant KPIs could include revenue growth, profit margins, market share, customer satisfaction, operational efficiency, and return on investment. Analyzing the company’s recent financial performance, specifically focusing on these KPIs, is critical to understanding the rationale behind the compensation package.

A strong correlation between the CEO’s performance and the company’s financial results will support the justification for the compensation level.

Carnival’s Financial Performance and CEO Compensation

Carnival Corp’s financial performance over the past few years is essential in assessing the CEO’s compensation. A consistent history of strong revenue growth, healthy profit margins, and increasing market share would support a higher compensation package, while periods of financial difficulty or decline could suggest a more conservative compensation structure. A detailed analysis of Carnival’s financial statements (including the income statement, balance sheet, and cash flow statement) is crucial to drawing accurate conclusions about the compensation’s relationship to performance.

Potential for Controversy and Discussion

Carnival Corp’s newly disclosed CEO compensation has sparked a potential whirlwind of discussion, and rightly so. The level of compensation, particularly in relation to recent performance and industry benchmarks, inevitably raises questions about fairness and value. Stakeholders, from investors to employees, will scrutinize the details, looking for justification and transparency. This section delves into the potential areas of contention, anticipated criticisms, and the likely discourse among various groups.

Potential Areas of Controversy

The compensation package’s relationship to the company’s recent financial performance and industry standards is a primary area of potential controversy. Comparisons to CEO compensation at other cruise lines, and in other industries, will be a critical point of debate. Investors, particularly those holding significant stakes, will carefully assess whether the compensation reflects a reasonable return on investment, given the economic climate and the company’s performance.

Potential Criticisms and Counterarguments

Criticism of the compensation package will likely center on the perceived disparity between the CEO’s compensation and the compensation of other employees, or the broader workforce. Concerns about a lack of transparency and clear justification for the specific components of the package are likely to arise. Conversely, the company may argue that the compensation is commensurate with the CEO’s responsibilities, the company’s overall performance, and the current market conditions.

They might highlight the CEO’s experience, expertise, and strategic contributions to the company’s success.

Potential Stakeholder Discussions

Investors will analyze the compensation in light of the company’s financial performance, particularly its return on investment. They’ll consider the current economic climate and potential risks, comparing the compensation to other comparable companies in the cruise industry and broader business sector. Employees might compare their own compensation to the CEO’s, potentially leading to discussions about pay equity and internal fairness.

The media will likely scrutinize the compensation package, looking for inconsistencies and possible justification.

Carnival Corp’s new CEO compensation package is definitely grabbing headlines, but it’s interesting to consider how other industries are reacting to recent events. For example, many airlines and cruise lines are adjusting their schedules due to Hurricane Sandy’s impact, as detailed in this article about airlines cruise lines altering plans due to sandy. This all points to how interconnected the world economy is, and how even big decisions like CEO compensation can be affected by broader circumstances.

Ultimately, Carnival’s compensation figures seem quite substantial given the current economic climate.

Arguments Against the Compensation

- Excessive Compensation Compared to Performance: A compensation package significantly exceeding industry averages, without a clear correlation to recent financial performance, will invite criticism. Examples from other industries, like those involving large-scale layoffs or reduced performance, could be used to highlight the disparity.

- Lack of Transparency: If the justification for specific compensation components isn’t clearly Artikeld, it can breed suspicion and fuel speculation. The absence of specific details regarding the performance metrics used to determine compensation can be viewed as opaque and potentially unfair.

- Disparity with Employee Compensation: A significant gap between the CEO’s compensation and the compensation of other employees can raise questions about equity and fairness within the company. This can lead to morale issues and potential employee unrest, as demonstrated by past examples in other sectors.

Arguments For the Compensation

- Market Value and Industry Benchmarking: The company may argue that the compensation aligns with the CEO’s market value and experience, and with comparable compensation packages within the cruise industry and similar sectors. Data from reputable compensation databases and industry reports could support this claim.

- Strategic Contributions: The compensation might be justified by the CEO’s significant strategic contributions to the company’s success, such as navigating challenging market conditions or implementing innovative strategies. This justification might be based on verifiable improvements in revenue, market share, or profitability.

- Performance-Based Compensation: The compensation package may include performance-based elements, which can be viewed as an incentive to achieve company goals. This can be a valid counterargument to criticisms of excessive compensation.

Potential Future Trends

Carnival Corp’s recently disclosed CEO compensation has significant implications for future compensation practices, not just within the company but potentially across the entire cruise industry. This compensation level sets a new benchmark, raising questions about the future trajectory of executive pay and the overall structure of leadership compensation. Understanding these potential future trends is crucial for stakeholders to anticipate the impact on the company’s operations and the industry as a whole.The disclosed compensation signals a shift in how companies may approach executive pay, likely driven by factors like market pressures, performance expectations, and the broader economic climate.

This could lead to increased scrutiny and pressure on other companies to adjust their compensation strategies, creating a ripple effect throughout the corporate world.

Potential Impact on Carnival Corp’s Leadership, Carnival corp discloses new ceo compensation

The substantial CEO compensation package could potentially influence the compensation structure for other executive roles at Carnival Corp. This may involve adjustments to base salaries, bonuses, and stock options for other C-suite executives, possibly to maintain an appropriate balance in the executive compensation hierarchy. There’s a possibility of a cascade effect, where compensation levels for senior managers and mid-level executives are also adjusted upward to reflect the new standard set by the CEO’s compensation.

The company may strive to attract and retain top talent by offering competitive salaries, aligning incentives with overall company performance.

Carnival Corp’s announcement of a new CEO compensation package is certainly interesting, but it pales in comparison to the news of Aruba accepting JetBlue’s CommonPass health passport. This move signifies a potential shift in travel protocols, mirroring the growing adoption of digital health verification systems. While Carnival’s compensation details are certainly noteworthy, the broader implications of Aruba’s acceptance of aruba accepts jetblue commonpass health passport on the future of travel and tourism are far-reaching.

This ultimately suggests a potential trend for increased ease of travel, which may also impact future compensation packages for companies like Carnival Corp.

Setting a Precedent for Future Compensation Practices

Carnival Corp’s compensation decision could serve as a precedent for future compensation practices within the cruise industry and beyond. Companies may adopt similar compensation structures or adjust their existing practices based on the perceived value of the CEO’s role and performance. This precedent may push other companies to re-evaluate their executive compensation packages, potentially leading to increased compensation levels across various industries, especially those facing similar market pressures.

It’s important to note that the precedent will be influenced by the perceived success and sustainability of the CEO’s performance.

Potential Future Trends Table

| Scenario | Description | Potential Impact |

|---|---|---|

| Scenario 1: Increased Compensation Pressure | Other companies within the cruise industry and broader sectors will likely adjust their compensation packages to remain competitive. | Increased pressure on other executives to demand higher compensation, potentially leading to increased costs for companies. |

| Scenario 2: Performance-Based Adjustments | Carnival Corp may tie future compensation adjustments to specific performance targets, potentially driving greater accountability and motivation within the company’s leadership. | Improved performance metrics and a more strategic approach to compensation, possibly leading to more sustainable growth. |

| Scenario 3: Industry Benchmarking | The disclosed compensation may become a new benchmark for CEO compensation within the cruise industry, forcing other companies to adopt similar structures. | Potential for a rise in industry-wide CEO compensation, driving competition for top executive talent. |

| Scenario 4: Public Scrutiny and Accountability | The compensation package may attract public scrutiny, potentially forcing companies to justify their compensation decisions and enhance transparency in their compensation practices. | Increased public pressure on companies to demonstrate value and accountability for high compensation packages. |

End of Discussion

In conclusion, Carnival Corp’s new CEO compensation package is a complex issue with numerous facets. The package is a reflection of current industry trends, economic factors, and the company’s performance. The potential public reaction, investor confidence, and employee morale are all key factors to consider. Ultimately, the package will be a subject of much discussion, and its long-term effects on Carnival Corp remain to be seen.

Essential Questionnaire

What are some common components of CEO compensation packages?

Typical CEO compensation packages often include base salary, bonuses, stock options, and benefits. The specific mix and value of each component can vary significantly depending on the company, industry, and individual performance.

How does Carnival Corp’s new CEO compensation compare to previous CEOs?

A comparison to previous CEOs, including base salary, bonus, and stock options, will be crucial to understanding the trends and rationale behind the new compensation structure.

What are the potential criticisms of the new compensation package?

Potential criticisms could center on the package’s alignment with company performance, industry benchmarks, and the overall economic climate. The perceived value and fairness relative to other industry leaders would also be key discussion points.

How might the new compensation affect employee morale?

Employee morale could be affected if the compensation package is perceived as excessive, especially when compared to the compensation of other employees or industry standards. Transparency and communication will be crucial to mitigate any negative effects.