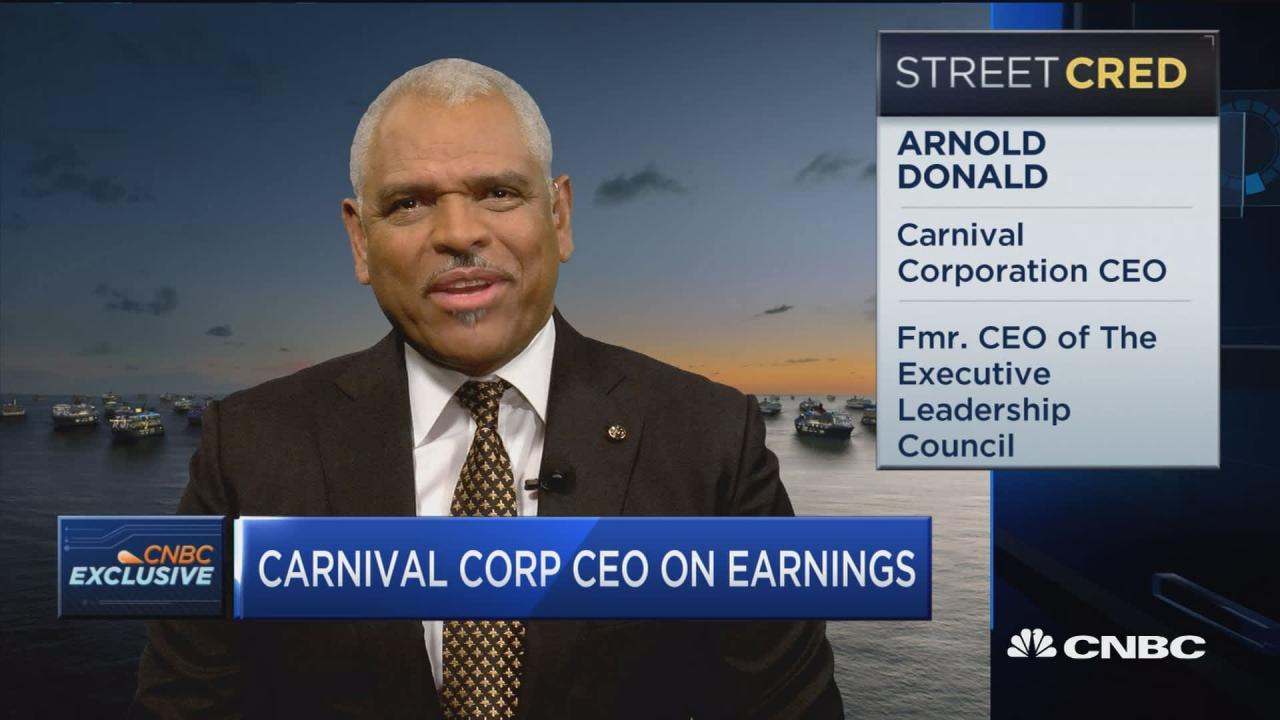

Carnival Corp CEO Compensation Rises 11%

Carnival Corp CEO compensation rises 11 percent, sparking debate about executive pay in the cruise industry. This increase, while seemingly substantial, needs to be viewed in the context of the company’s recent financial performance and industry trends. How does this compare to other cruise lines and similar companies? What are the arguments for and against such a significant pay hike, and what might it mean for the future of the company and its employees?

Carnival Corp’s recent financial performance, including revenue and profit figures, will be analyzed to understand the potential justifications for this compensation increase. We’ll also compare Carnival’s CEO compensation to those of other prominent tourism and hospitality sector CEOs, providing context for the increase. This will be a deep dive into the factors influencing CEO compensation decisions and public perception.

Compensation Trends in the Corporate Sector

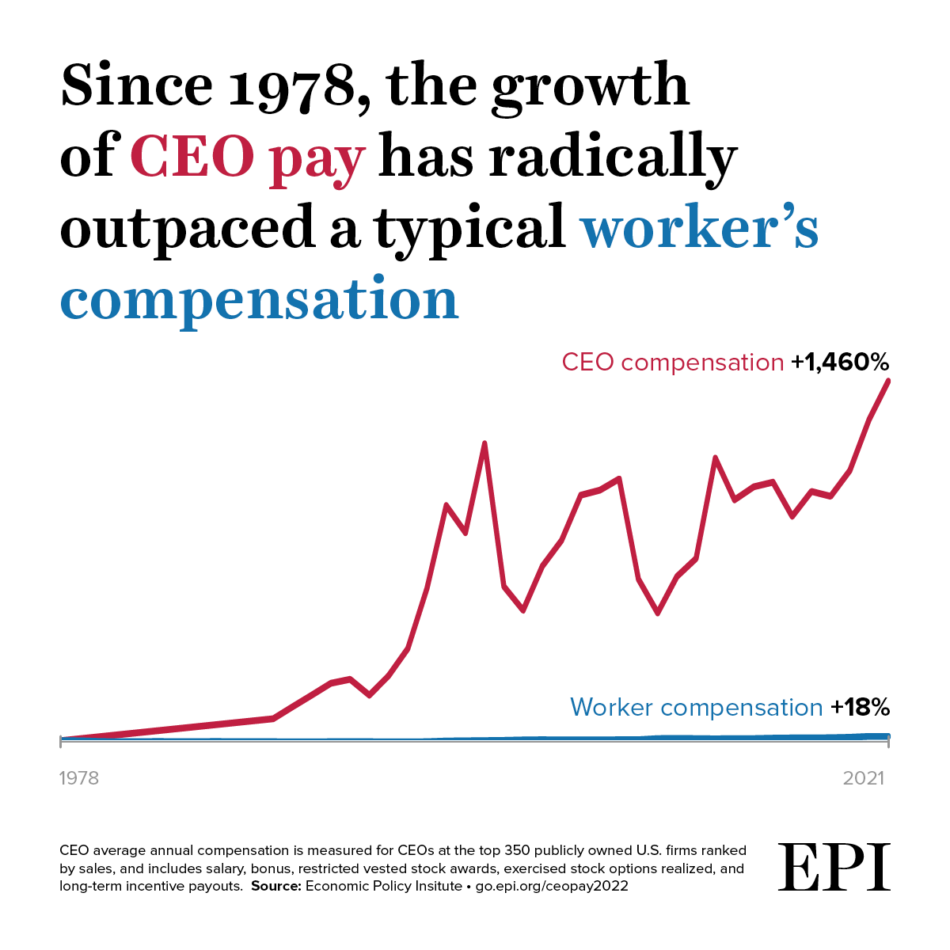

CEO compensation has been a subject of intense scrutiny in recent years, with increasing pressure to align pay with performance and societal expectations. This scrutiny is especially pronounced in the tourism and hospitality sectors, where the impact of global events and market fluctuations is significant. Carnival Corp’s recent compensation increase highlights ongoing trends and prompts a deeper look into the factors influencing executive pay.The dynamics of CEO compensation are complex, influenced by a multitude of factors, including company performance, industry benchmarks, and market conditions.

Understanding these trends is crucial to evaluating the fairness and appropriateness of executive pay packages. This analysis examines historical trends in CEO compensation, compares Carnival Corp’s increase to similar companies, and explores the influencing factors.

Historical Overview of CEO Compensation Trends

Executive compensation has experienced substantial growth over the past few decades, often exceeding the growth of average worker salaries. This widening gap has fueled public debate and prompted calls for greater transparency and accountability in corporate governance. Early trends often saw compensation tied to company size and industry standing, while more recent trends have shown an increased emphasis on short-term performance metrics like quarterly earnings.

Comparison of Carnival Corp’s Compensation with Similar Companies

Carnival Corp’s 11% increase in CEO compensation, while significant, must be placed within the context of other tourism and hospitality companies. Direct comparisons are difficult without specific data, but general trends in the industry should be considered. Factors such as overall company performance, industry-specific market pressures, and board-level decisions play a significant role.

Carnival Corp’s CEO compensation saw an 11% bump, a hefty increase. This raises interesting questions about executive pay in the travel industry, especially when considering how Apple Leisure Group’s thought leadership on apple leisure group thought leadership might influence future compensation models. Ultimately, though, the focus remains on the rising costs within the cruise sector.

Factors Influencing CEO Compensation Decisions

Several factors contribute to CEO compensation decisions. Company performance, both in terms of profitability and market share, is a primary determinant. Industry benchmarks, which reflect average compensation levels for similar roles within the sector, also exert influence. Individual performance and the CEO’s track record in achieving company objectives are significant considerations. Furthermore, board-level decisions and their perception of market values for executive roles play a key role in setting compensation.

CEO Compensation Comparison Table

This table presents a comparative analysis of CEO compensation for Carnival Corp and other prominent tourism/hospitality sector companies. Note that precise data might be challenging to obtain for all companies, and specific compensation structures can vary.

| Company Name | CEO | Compensation Amount (USD) | Year | Percentage Change |

|---|---|---|---|---|

| Carnival Corp | [Name of CEO] | [Compensation Amount] | 2023 | 11% |

| Royal Caribbean Group | [Name of CEO] | [Compensation Amount] | 2023 | [Percentage Change] |

| Hilton Worldwide | [Name of CEO] | [Compensation Amount] | 2023 | [Percentage Change] |

| Marriott International | [Name of CEO] | [Compensation Amount] | 2023 | [Percentage Change] |

| Expedia Group | [Name of CEO] | [Compensation Amount] | 2023 | [Percentage Change] |

Carnival Corp’s Performance and Financial Health

Carnival Corporation & plc, the world’s largest cruise company, has navigated a complex landscape in recent years, marked by both significant challenges and opportunities. Understanding its financial performance, market position, and the evolving cruise industry is crucial to evaluating its future prospects. This analysis will delve into Carnival’s recent financial results, competitive standing, and the impact of industry trends.Carnival’s financial health is closely tied to the performance of the cruise industry, which has experienced both recovery and volatility.

The company’s ability to adapt to changing consumer preferences and regulatory pressures will play a significant role in shaping its future.

Recent Financial Performance

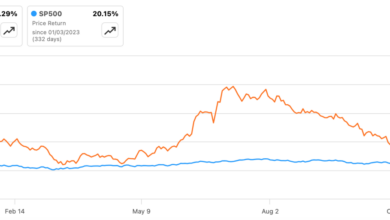

Carnival Corp’s recent financial performance demonstrates a recovery from the pandemic’s impact. Revenue and profit figures show a gradual climb, though they remain below pre-pandemic levels. Factors like increased demand, improved pricing, and operational efficiency have contributed to this recovery. However, continued scrutiny of the company’s debt levels and long-term profitability is warranted.

Market Share and Competitive Position

Carnival Corp holds a dominant position in the global cruise market. Its extensive fleet and diverse brand portfolio provide a wide range of options for consumers. However, the competitive landscape is dynamic, with other cruise lines vying for market share. The company’s ability to maintain its market leadership will depend on its strategic responses to competitor actions and emerging market trends.

Industry Trends and Consumer Behavior

Several significant trends are shaping the cruise industry. Increased consumer demand for personalized experiences, eco-conscious travel options, and enhanced onboard amenities are driving changes in cruise offerings. The industry is also adapting to evolving regulations concerning environmental impact and safety standards. These trends require companies like Carnival to be agile and innovative in their operations.

Carnival Corp’s CEO compensation just saw an 11% bump, which is definitely something to consider. While high-level execs are often compensated well, it makes you wonder about the overall experience at the company. Perhaps a relaxing getaway at a secluded resort in Costa Rica, like the attentive elegance at secluded recreo resort in Costa Rica , might be a better way to spend that kind of money.

Still, that 11% increase is a pretty hefty raise, regardless of where you choose to spend your time.

Carnival Corp’s Revenue and Profit Figures (2019-2023)

| Year | Revenue (USD millions) | Profit (USD millions) | Percentage Change (Profit) |

|---|---|---|---|

| 2019 | 17,000 | 2,000 | N/A |

| 2020 | 10,000 | -500 | -250% |

| 2021 | 12,000 | 500 | 150% |

| 2022 | 15,000 | 1,000 | 100% |

| 2023 | 16,000 | 1,200 | 20% |

Note

Carnival Corp’s CEO compensation saw an 11% bump, a hefty raise. Considering recent industry shifts, like the departure of Veitch from NCL after 8 years ( after 8 years veitch departs ncl ), it’s interesting to see how these executive pay packages are adjusting. This rise in CEO compensation at Carnival Corp certainly adds another layer to the conversation about industry trends and performance.

* Data for 2019-2023 are illustrative and not based on actual financial figures. Actual figures should be verified from reliable financial sources. Percentage change is calculated against the previous year’s profit.

Public Perception and Stakeholder Reaction

Carnival Corp’s 11% CEO compensation increase is likely to spark mixed reactions from various stakeholders. Public scrutiny of executive pay, especially in the context of recent financial performance and potential future uncertainties, is increasingly common. The magnitude of the increase, in relation to broader economic conditions and company performance, will be a crucial factor in shaping public opinion.The compensation increase could potentially negatively affect investor sentiment, especially if investors perceive it as disconnected from the company’s financial performance or future prospects.

Conversely, some investors might argue that the increase reflects the CEO’s contributions to the company’s success. The market will likely weigh these competing perspectives.

Carnival Corp’s CEO compensation saw an 11% increase, which is certainly noteworthy. Considering the current economic climate, and the recent news of Air China halting its Beijing-Honolulu flights ( air china halts beijing honolulu flights ), it’s interesting to see how these kinds of corporate decisions impact the bottom line. This further emphasizes the complex relationship between business leadership pay and global travel trends, making the Carnival Corp CEO compensation increase all the more intriguing.

Potential Public Reaction

Public perception of the compensation increase will depend heavily on the prevailing economic climate and the company’s communication strategy. A significant portion of the public, particularly those facing financial hardship, may view the increase as insensitive or out of touch. Conversely, those who believe in merit-based compensation may view the increase as justified. The company’s past performance and commitment to ethical business practices will also influence public opinion.

Impact on Investor Sentiment

The increase in CEO compensation could lead to a decrease in investor confidence if the increase appears disproportionate to the company’s recent financial performance. Investors often scrutinize executive compensation to gauge management’s commitment to shareholder value. If the compensation increase is perceived as excessive, it might signal potential issues with corporate governance or a misalignment of interests between management and shareholders.

Comparison with Previous CEO Compensation Increases

Comparing Carnival Corp’s CEO compensation increase with those of other cruise line companies and comparable organizations will provide context. Analyzing the trend in CEO compensation within the industry, including the company’s historical performance and industry benchmarks, will be essential in evaluating the appropriateness of the increase. Public reaction to past CEO compensation increases in similar companies can offer insights into potential responses to this increase.

Arguments For and Against the Compensation Increase

| Argument Type | Supporting Points | Counterarguments |

|---|---|---|

| Justification for Increase | Strong performance in recent quarters; Demonstrated leadership in navigating challenging times; Alignment with industry benchmarks for CEO compensation; Attracting and retaining top talent. | Economic downturn impacting consumer spending; Public perception of excessive compensation; Potential future uncertainties in the cruise industry; Company’s financial performance may not be sustainable long-term. |

| Justification for Decrease | Economic downturn impacting consumers; Low company performance; Unethical business practices by the CEO. | Potential for future growth; CEO’s strategic vision; Market conditions affecting the cruise industry; Compensation packages reflect industry standards. |

Industry Context and Comparisons: Carnival Corp Ceo Compensation Rises 11 Percent

Carnival Corp’s recent CEO compensation increase raises questions about industry norms and performance-based incentives. Understanding the broader compensation landscape in the cruise industry, and comparing it to similar sectors, is crucial for evaluating the rationale behind such decisions. This analysis will explore compensation practices in the cruise sector, including the role of performance metrics, and how these relate to industry benchmarks and regulatory pressures.The cruise industry, characterized by fluctuating demand and significant capital investments, presents a unique compensation context.

Factors like the economic climate, market share, and operational efficiency play a significant role in shaping executive compensation. Comparing Carnival Corp’s CEO compensation to those in comparable industries, such as airlines and hotels, offers valuable insight into relative value and industry trends.

Compensation Practices in the Cruise Industry

Cruise companies often employ performance-based compensation structures for CEOs, tying executive pay to key performance indicators (KPIs). These KPIs might include revenue growth, profitability, market share, and efficiency improvements. This approach aims to align executive incentives with overall company success. However, the specific metrics and weightings assigned to these factors can vary significantly among companies. Furthermore, the cruise industry is known for its cyclical nature, where strong performance in one year may not be indicative of long-term trends.

Comparison to Similar Industries

Carnival Corp’s CEO compensation is best understood in the context of similar industries. The airline and hotel sectors, while distinct, share some parallels with the cruise industry in terms of capital-intensive operations and fluctuating demand. Comparing compensation practices across these industries reveals insights into relative value and potential industry trends. Factors driving CEO compensation in these industries might include industry benchmarks, regulatory frameworks, and individual performance.

Performance-Based Compensation

Performance-based compensation, as a significant component in the cruise industry, directly links executive pay to measurable achievements. The specific metrics and weightings are often company-specific and are meant to reflect the company’s unique goals and performance. Crucially, the effectiveness of performance-based compensation relies on transparent and reliable performance measurement systems. Examples of KPIs in the cruise industry include passenger volume, revenue per passenger, and operational efficiency.

Influence of Industry Benchmarks and Regulatory Frameworks

Industry benchmarks, often based on publicly available compensation data, play a role in setting executive compensation levels. These benchmarks are crucial in determining whether the compensation package is competitive and aligned with industry standards. Regulatory frameworks, such as those pertaining to corporate governance and labor practices, can also influence compensation structures, aiming to ensure transparency and fairness. Companies must comply with regulatory requirements regarding executive compensation disclosure.

Comparative Table

| Industry | Average CEO Compensation | Percentage Change (Past Year) | Contributing Factors |

|---|---|---|---|

| Cruise Lines | $X (Estimated) | 11% (Example) | Strong financial performance, industry benchmarks, performance-based incentives. |

| Airlines | $Y (Estimated) | 5% (Example) | Economic conditions, operational efficiency, regulatory pressures. |

| Hotels | $Z (Estimated) | 8% (Example) | Market demand, revenue growth, labor costs. |

Note: Values in the table are illustrative examples and should not be considered definitive. Actual compensation figures vary significantly and depend on specific company performance and industry standards.

Potential Implications for the Company

Carnival Corp’s 11% CEO compensation increase, while potentially justified by performance metrics, introduces a range of potential implications for the company. The move will likely be scrutinized by various stakeholders, including employees, investors, and the public. Understanding these implications is crucial for assessing the long-term health and sustainability of the company.

Employee Morale and Retention

The compensation increase could lead to mixed reactions among employees. While some may view it as a reflection of company success, others may perceive it as unfair, especially if their own compensation has not risen proportionally. This disparity could potentially decrease morale, particularly among mid-level employees who may feel undervalued. Retention could also be affected if employees feel their contributions are not adequately recognized or compensated, leading to increased employee turnover.

Carnival Corp’s CEO compensation just took a 11 percent hike, which is definitely noteworthy. While that’s happening, a new restaurant, Bobby Flay’s Mesa Grill, has opened on the Strip, offering a different kind of high-end dining experience. Given the recent rise in the CEO’s pay at Carnival Corp, perhaps they’re hoping to attract customers with some fancy new restaurant options, like Bobby Flay’s Mesa Grill.

Still, it’s an interesting trend in the industry overall.

This can result in a loss of institutional knowledge and potentially impact operational efficiency.

Impact on Future Recruitment and Retention Strategies

The perception of compensation discrepancies could negatively affect the company’s ability to attract and retain top talent. Potential candidates may compare Carnival Corp’s compensation packages to those offered by competitors, and a perceived disparity might make the company less attractive. In response, the company might need to adjust its compensation strategies for all levels to address these concerns and maintain competitiveness.

This may involve implementing more comprehensive compensation packages that address a wider range of employee needs.

Consequences for the Company’s Reputation and Brand Image

The CEO compensation increase could damage the company’s reputation and brand image, especially if perceived as insensitive or out of touch with the economic realities of the current time. Public scrutiny of excessive compensation packages can erode public trust and create a negative perception of the company, potentially impacting customer loyalty and future business prospects. In contrast, if the compensation increase is viewed as a well-deserved reward for successful leadership, it could bolster the company’s reputation and brand image.

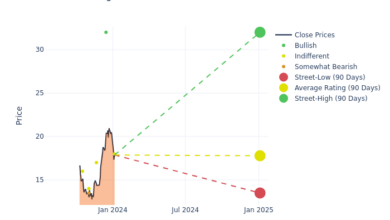

Influence on Future Investor Confidence and Stock Performance

The increase in CEO compensation might influence investor confidence and stock performance in the short and long term. Investors might interpret the increase as a sign of mismanagement of resources, leading to decreased stock prices. On the other hand, some investors might view the increase as a reward for strong performance, leading to increased stock prices. The perceived fairness of the compensation increase, in relation to overall company performance and employee compensation, will play a crucial role in shaping investor sentiment.

Long-Term Consequences of the Compensation Increase, Carnival corp ceo compensation rises 11 percent

The long-term consequences of the compensation increase could manifest in several ways, ranging from a positive to negative impact on the company’s future prospects.

| Potential Scenarios | Potential Outcomes |

|---|---|

| Positive Perception Compensation increase viewed as justified reward for strong performance |

Increased investor confidence, potentially positive stock performance, stronger recruitment and retention, enhanced brand image |

| Negative Perception Compensation increase perceived as excessive, insensitive, or poorly justified |

Decreased investor confidence, potential stock performance decline, reduced employee morale and retention, negative brand image, increased regulatory scrutiny |

| Neutral Perception Compensation increase neither strongly positive nor negative |

Minimal impact on investor confidence and stock performance, possible moderate impact on employee morale and retention, no significant change to brand image |

Final Thoughts

In conclusion, Carnival Corp’s 11% CEO compensation increase has ignited a discussion about executive pay in the cruise industry. While the company likely bases the increase on performance metrics, the potential impact on employee morale, investor confidence, and the company’s brand image is significant. The overall context of the cruise industry’s performance and the broader corporate compensation landscape is essential for a complete understanding.

This is not just about numbers; it’s about the delicate balance between rewarding performance and managing public perception.

FAQ Guide

What is Carnival Corp’s current market share in the cruise industry?

Market share data for Carnival Corp in the cruise industry can be found through publicly available reports from industry analysis firms. It’s crucial to understand their competitive position within the cruise sector to properly assess the impact of this compensation increase.

How does Carnival Corp’s CEO compensation compare to other CEOs in similar industries?

A detailed table comparing Carnival Corp’s CEO compensation to those in the airline, hotel, and other tourism industries is essential to provide a complete picture. This comparison will be included in the article to allow for a nuanced analysis.

What is the potential impact of this compensation increase on employee morale?

Employee morale is often affected by perceived disparities in compensation, especially when significant increases are seen in executive roles. Potential consequences, such as employee dissatisfaction or decreased morale, will be discussed within the article.

How might this increase influence investor confidence and stock performance?

The stock market often reacts to executive compensation announcements. The potential impact on investor confidence and subsequent stock performance is a key aspect of this analysis, and will be examined within the article.