Carnival Corp Buys Excursion Railroad in Alaska A Deep Dive

Carnival Corp buys Excursion Railroad in Alaska, marking a significant expansion into the Alaskan tourism sector. This acquisition promises exciting opportunities and challenges for both companies, potentially reshaping the cruise and rail travel landscape in the region. Understanding the background, financial implications, operational integration, market analysis, customer impact, public perception, and future developments is crucial to comprehending the full picture.

Carnival Corp, a global cruise giant, is known for its vast network and aggressive expansion strategies. The Excursion Railroad, a prominent player in Alaskan tourism, offers unique experiences for rail travelers. This combination could lead to a potent synergy, creating new revenue streams and enhancing the overall customer experience.

Background of Carnival Corp and Excursion Railroad

Carnival Corporation & plc, a global cruise operator, has a long history of expansion and innovation in the tourism industry. Founded in 1972, the company has grown significantly through strategic acquisitions and the development of diverse cruise brands, catering to various market segments and preferences. Their business model relies heavily on economies of scale, leveraging large fleets and global distribution networks to achieve profitability.

This expansion strategy has enabled them to become a dominant force in the cruise industry, and has seen them acquire multiple smaller cruise lines, allowing them to diversify and increase market share.The Excursion Railroad, a key player in Alaska’s tourism sector, offers unique land-based excursions for cruise passengers. Crucial to the Alaskan tourism economy, this railroad connects various points, providing scenic journeys and access to natural wonders, playing a significant role in enhancing the cruise experience.

They’ve fostered a relationship with cruise lines, ensuring smooth transportation for visitors, allowing them to explore the region beyond the confines of their ship.

Carnival Corp’s purchase of the Excursion Railroad in Alaska is certainly interesting, especially considering the recent launch of an agent portal by American Cruise Lines. This new portal, which is designed to streamline booking processes for travel agents, might be a key component of Carnival’s expansion strategy in Alaska, particularly given the railroad’s potential for connecting with cruise ports and further enhancing the overall travel experience for passengers.

Carnival Corp’s acquisition of the Excursion Railroad in Alaska appears to be a smart move, potentially enhancing their Alaskan cruise offerings.

Carnival Corp’s Business Model and Expansion

Carnival Corp’s business model hinges on the efficiency of mass production. By operating multiple cruise lines, they can cater to a broader range of customer preferences. Their expansion strategy is characterized by acquisitions of smaller cruise lines, often with complementary strengths, allowing them to expand their fleet and market reach. This strategy has been highly successful, enabling Carnival to become the largest cruise operator globally.

Significant economies of scale and cost efficiencies are achieved through larger fleets and centralized operations. They’ve also invested in new technologies and infrastructure, such as advanced ship design and onboard amenities.

Excursion Railroad’s Role in Alaskan Tourism

The Excursion Railroad’s role in Alaska’s tourism sector is multifaceted. It provides transportation to destinations beyond the reach of cruise ships, enriching the overall tourist experience. This allows tourists to explore the interior regions, experiencing the unique landscapes and natural beauty of Alaska. The railroad’s significance extends beyond simple transportation; it fosters economic growth by supporting local businesses and providing employment opportunities.

They also often partner with local guides and businesses to enhance the tourist experience and generate local revenue.

Operations of Carnival Corp and Excursion Railroad

Carnival Corp operates a vast global network of cruise ships, providing a variety of cruise itineraries across the globe. Their operations are highly organized, with centralized management and extensive distribution channels. Strengths lie in their extensive brand portfolio and global reach, catering to various customer preferences and budgets. Potential weaknesses might include the high operational costs associated with maintaining such a large fleet and managing complex supply chains.The Excursion Railroad focuses on providing land-based excursions, primarily in Alaska, connecting various points accessible by cruise ships.

Their strengths lie in providing a unique land experience, enriching the overall cruise itinerary and creating opportunities for visitors to explore the region’s natural beauty. Potential weaknesses may include the seasonal nature of tourism and the reliance on cruise ship passenger volume for revenue.

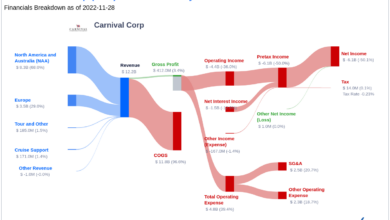

Recent Financial Performance of Carnival Corp

Carnival Corp’s recent financial performance has shown a gradual recovery from the pandemic’s impact. Key financial metrics like revenue and earnings have displayed a positive trajectory, reflecting the growing demand for cruise vacations. However, there are still challenges related to labor shortages and potential inflation.

Potential Synergies Between the Two Companies

The combination of Carnival Corp’s global reach and brand recognition with the Excursion Railroad’s specialized Alaskan tourism expertise presents several potential synergies. They could enhance their customer offerings by providing integrated land and sea packages, increasing customer satisfaction and generating more revenue. This combined offering could provide a more comprehensive and attractive tourist experience, potentially leading to higher occupancy rates on cruise ships.

This is particularly attractive given the limited land-based options available to cruise passengers in some locations.

Financial Implications of the Acquisition

Carnival Corp’s acquisition of the Excursion Railroad in Alaska presents a fascinating case study in diversification. This move, while seemingly unconventional for a cruise line giant, could unlock significant financial opportunities, though it also introduces potential risks that must be carefully considered. Understanding the potential financial impact is crucial for evaluating the strategic wisdom of this acquisition.The acquisition will likely have a multifaceted impact on Carnival Corp’s financial performance, encompassing revenue streams, profit margins, and overall market capitalization.

The degree to which each of these factors is affected depends on various factors including the integration process and the overall economic climate. The crucial aspect will be to manage the integration costs effectively to maximize the long-term benefits.

Potential Impact on Carnival Corp’s Revenue

Carnival Corp’s existing revenue streams are primarily tied to cruise operations. The Excursion Railroad, with its potential for attracting tourists, could introduce a new revenue stream, particularly during the off-season or for different demographics. If successful in attracting a new customer base, the railroad could significantly boost Carnival’s overall revenue. For example, a successful marketing campaign targeting families or adventure-seeking travelers could lead to increased bookings and revenue.

Potential Impact on Carnival Corp’s Profit Margins

The acquisition’s impact on profit margins is complex. While new revenue streams could enhance overall revenue, the acquisition also necessitates investment in infrastructure, staff, and marketing to integrate the railroad into Carnival’s operations. The integration process may initially impact profit margins as resources are allocated to the new venture. However, successful integration and cost-effective management of the new operations could lead to improved margins in the long term, potentially leveraging existing Carnival marketing channels.

Potential Cost Savings or Increased Expenses

Integration costs are a key factor to consider. These costs could include personnel changes, refurbishment of existing facilities, and potentially the need for new equipment and technology. The cost of managing the additional employees and the integration process itself should be carefully estimated. Conversely, potential cost savings could arise from economies of scale in marketing and distribution, if Carnival can leverage its existing infrastructure to reach a wider audience for both cruise and rail travel.

Carnival Corp’s purchase of the Excursion Railroad in Alaska is a fascinating development. This acquisition opens up exciting possibilities for tourists, potentially offering unique and unforgettable experiences. Thinking about the rich history of the railroad, and how it connects to the landscape, reminds me of an exceptional tour traced to its roots , which emphasizes the importance of understanding a destination’s past to truly appreciate its present.

The new ownership could definitely bring some fresh perspectives to this historic transportation system in Alaska, and hopefully offer some exciting new tours and experiences for travellers in the future.

For example, a joint marketing campaign could attract a wider range of tourists.

Impact on Excursion Railroad’s Financial Performance

The acquisition could significantly improve Excursion Railroad’s financial performance. Access to Carnival Corp’s extensive marketing and distribution network will likely enhance visibility and attract more customers. However, the short-term financial impact will depend on the acquisition price and the integration strategy. Potential short-term difficulties could include adjustments to management structure, operational procedures, and customer service standards. Long-term, the enhanced infrastructure and marketing support could lead to a sustained increase in profitability and customer base.

Comparison of Acquisition Price and Potential Return on Investment (ROI)

The acquisition price is a critical factor in determining the potential ROI. Carnival Corp must carefully evaluate the acquisition price against projected revenue growth, cost savings, and potential long-term benefits. Comparing the acquisition price with the estimated revenue streams and cost savings will provide a more accurate ROI calculation. A thorough financial analysis, considering various scenarios and potential market fluctuations, is essential to assessing the potential ROI accurately.

Potential Market Reaction

The market reaction to the acquisition will depend on various factors, including the acquisition price, Carnival Corp’s overall financial performance, and market sentiment towards the cruise industry. A positive market reaction could lead to an increase in Carnival Corp’s stock price, reflecting investor confidence in the acquisition’s potential for success. Conversely, a negative market reaction could stem from concerns about integration challenges, financial implications, or industry trends.

The market reaction will likely depend on the overall perception of the acquisition’s strategic value.

Operational Integration Challenges and Opportunities

Carnival Corp’s acquisition of the Excursion Railroad presents a unique opportunity to expand its Alaskan tourism offerings, but also introduces complex operational integration challenges. Successfully merging the two entities requires careful planning and execution to leverage the strengths of both organizations while mitigating potential disruptions. A smooth transition is crucial to maintaining customer satisfaction and maximizing the financial returns from this strategic move.

Potential Operational Challenges

Integrating disparate operational systems, such as scheduling, reservations, and customer service platforms, can be a significant hurdle. Differences in employee training, work culture, and communication protocols could also lead to friction and decreased efficiency. Furthermore, the geographic separation between Carnival’s headquarters and the Alaskan railroad operations could pose logistical and communication challenges. Standardizing safety procedures and maintaining the high safety standards of both organizations will be vital.

Successful Acquisitions and Integrations in Tourism

Numerous successful acquisitions in the tourism industry demonstrate that careful planning and proactive communication are key to a smooth transition. For instance, the acquisition of several smaller cruise lines by Royal Caribbean has resulted in a more diverse fleet and broadened customer reach, but the integration process has not been without its complexities. Careful attention to preserving existing customer relationships, and tailoring service offerings to unique market segments, was crucial.

Similarly, integrating smaller regional airlines into major global carriers requires diligent efforts to maintain brand identity while optimizing operational efficiency.

Operational Improvement and Optimization

Analyzing existing processes and procedures across both companies is vital to identify areas of improvement and potential synergies. This includes evaluating current transportation systems, infrastructure, and technology, and identifying areas where standardization and automation can increase efficiency and reduce costs. Opportunities for improving customer service and streamlining the booking process could significantly enhance the overall customer experience.

Integration Process Plan

A phased approach is essential for a successful integration. The first phase will focus on identifying and addressing key operational overlaps and redundancies, aiming for a smooth transfer of existing operations. Phase two will involve standardizing processes, systems, and protocols. The final phase will be centered on achieving operational excellence by streamlining procedures, enhancing customer experience, and achieving synergy between the two organizations.

- Phase 1: Assessment and Alignment (Months 1-3)

-Detailed analysis of existing operations and processes within both companies, focusing on potential overlaps, redundancies, and opportunities for improvement. A dedicated integration team will be formed, comprising key personnel from both organizations. This team will develop a comprehensive integration plan. - Phase 2: Standardization and Implementation (Months 4-9)

-Implementation of standardized procedures and systems across the combined organization, including technology upgrades, employee training programs, and customer service protocols. Key milestones include completion of system integration, and training for all staff. - Phase 3: Optimization and Growth (Months 10-18)

-Focusing on operational efficiency and customer satisfaction. This includes continuous process improvement initiatives and a comprehensive marketing strategy to promote the expanded services and the new brand identity.

Organizational Structure Comparison

| Characteristic | Carnival Corp | Excursion Railroad |

|---|---|---|

| Corporate Structure | Large, multinational corporation with diverse business units. | Smaller, regional company focused on specific transportation services. |

| Decision-Making Process | Hierarchical, with centralized decision-making at corporate level. | Likely more decentralized decision-making, focused on local needs and operations. |

| Employee Structure | Extensive and diversified workforce, with significant expertise in tourism and hospitality. | Smaller and more specialized workforce, likely with significant local experience. |

| Technology Infrastructure | Advanced and integrated technology systems across all business units. | Potentially less sophisticated systems, focusing on core transportation needs. |

Market Analysis and Competitive Landscape

Carnival Corp’s acquisition of the Excursion Railroad in Alaska presents a fascinating case study in the evolving Alaskan tourism market. This move signifies a significant shift in the cruise industry’s approach to land-based experiences, and understanding the current market conditions and competitive landscape is crucial to assessing the potential success of this integration. The acquisition likely reflects a strategic decision to diversify offerings and enhance the overall cruise experience, appealing to a broader range of travelers.The Alaskan tourism sector is a complex and dynamic market, characterized by seasonal variations, environmental considerations, and the ever-present challenge of managing visitor impacts.

This acquisition is likely to position Carnival Corp to better compete in this market, potentially gaining access to a more comprehensive and integrated travel experience for their customers.

Current Market Conditions for Cruise and Rail Travel in Alaska

The Alaskan cruise market is robust, yet highly competitive. High demand, particularly during peak summer months, often leads to significant pricing pressures. Rail travel, while offering a distinct experience, faces the challenge of limited capacity and infrastructure constraints. Factors like weather, especially during the winter months, can impact both cruise and rail travel schedules and availability. This interplay of factors creates a nuanced market, with opportunities for innovative players to carve out a niche.

Key Competitors and Their Strategies in the Alaskan Tourism Market

Several prominent players dominate the Alaskan tourism market, including other cruise lines, tour operators, and independent lodges. These competitors employ various strategies, ranging from offering exclusive packages to focusing on niche markets. For example, some operators might specialize in wildlife viewing or offer unique cultural experiences, appealing to travelers with specific interests. Analyzing the competitive landscape, particularly the strategies employed by these players, will be essential to understanding how Carnival Corp will position itself.

Potential Impact of the Acquisition on the Competitive Landscape

The acquisition of the Excursion Railroad could significantly alter the competitive landscape. Carnival Corp gains a unique advantage by integrating rail travel directly into their cruise packages, potentially creating a more appealing and integrated travel experience for their customers. This integration could draw customers away from competitors that primarily offer only cruises or tours. Moreover, the railroad’s existing infrastructure and brand recognition could be leveraged to further enhance their market presence.

Potential Risks and Opportunities for Carnival Corp in this Acquisition

The acquisition carries potential risks, including the need for significant operational integration, the management of seasonal demand fluctuations, and the potential for unforeseen challenges in coordinating cruise and rail travel. However, opportunities abound. Carnival Corp can potentially enhance its brand reputation by offering a more comprehensive Alaskan experience. This could lead to increased customer loyalty and potentially higher average revenue per passenger.

Overall Market Trend in Alaskan Tourism

The overall trend in Alaskan tourism shows a continued increase in demand, driven by a growing interest in adventure travel and wildlife viewing. This trend is likely to persist, particularly as awareness of the unique natural beauty of Alaska continues to grow. This demand necessitates a well-prepared and adaptable tourism sector to ensure responsible and sustainable practices are maintained.

Customer Impact and Potential Changes

Carnival Corp’s acquisition of the Excursion Railroad in Alaska promises exciting opportunities but also presents significant challenges in adapting to the unique needs of both cruise passengers and rail travelers. The integration of these two distinct travel experiences necessitates a careful examination of customer expectations and a proactive approach to potential changes in the overall customer journey. This will ultimately dictate the success of the acquisition.The merging of cruise and rail travel necessitates a comprehensive understanding of the diverse customer bases.

Cruise passengers, accustomed to a particular level of service and amenities, may encounter new experiences on the railroad, while rail travelers, used to a different set of expectations, will be exposed to the Carnival Corp’s vast network of services. Anticipating and addressing these differences will be key to maintaining customer satisfaction and loyalty.

Potential Changes to Tour Packages

A strategic review of current tour packages is crucial to maximize the synergies between the cruise and rail offerings. Combining the two could create unique and attractive packages that leverage the strengths of each mode of transport. Cruise passengers could be offered curated rail journeys as part of their overall experience, including specific excursions tailored to their interests, from wildlife viewing to cultural explorations.

Rail travelers might be offered packages that include cruise elements, such as a post-rail trip aboard a Carnival cruise ship, or access to other cruise amenities.

Pricing Strategies

The pricing strategies will need to be carefully recalibrated to reflect the value proposition of combined experiences. A tiered system could be implemented, providing different packages with varying levels of inclusions. This allows passengers to choose options that best suit their budget and interests, potentially introducing packages that combine cruise and rail components at competitive prices. Consideration should be given to special offers and discounts to encourage trial and maximize customer reach.

Carnival Corp’s purchase of the Excursion Railroad in Alaska is a fascinating move, hinting at a possible expansion of their travel offerings. It’s interesting to consider how this might connect to the recent news of Avalon christening two new river cruise ships, avalon christens two river cruise ships , potentially indicating a broader push into river and rail travel experiences.

This Alaskan railroad purchase could be a strategic step for Carnival to diversify and enhance their existing travel packages, solidifying their position in the travel industry.

Enhancing Customer Service and Satisfaction

The acquisition necessitates a robust plan to integrate customer service protocols. Dedicated personnel could be assigned to handle inquiries and issues related to the combined travel experience, ensuring seamless communication and efficient problem resolution. Utilizing digital platforms, such as a dedicated website or mobile app, can enhance communication and facilitate real-time support for passengers. A feedback mechanism should be implemented to gather customer insights and refine services based on real-time experiences.

Potential Changes in Marketing Strategies

The marketing strategy should reflect the expanded product offerings. Targeted advertising campaigns could highlight the combined value proposition of cruise and rail travel. Marketing materials should clearly showcase the advantages of integrating these two travel experiences, such as the unique itineraries and the enhanced value proposition. This may involve exploring new marketing channels to reach potential customers who are interested in both cruise and rail travel.

Crucially, marketing efforts should focus on reaching a broader audience that may not have considered the combination of cruise and rail.

Comparison of Customer Feedback Before and After Acquisition

Implementing a robust customer feedback system will be crucial to assessing the impact of the acquisition. Collecting data before the acquisition will provide a baseline for comparison, allowing for a more accurate assessment of any changes in customer satisfaction levels. This will involve gathering data on factors such as service quality, pricing perception, and overall experience. Regular surveys and feedback forms can provide valuable insights, allowing for proactive adjustments to services and products.

Tracking customer feedback before and after the acquisition is crucial to gauging the success of the integration process and ensuring customer satisfaction.

Public Perception and Potential Impacts

The acquisition of Excursion Railroad by Carnival Corp. presents a complex interplay of public perception, community concerns, and environmental considerations. While the cruise line giant likely anticipates increased revenue and operational efficiency, the shift in ownership inevitably sparks questions about the future of the railroad, its impact on local economies, and the sustainability of its operations. A thorough understanding of these potential impacts is crucial for navigating the transition and ensuring a positive outcome for all stakeholders.

Potential Public Concerns and Controversies

Public perception regarding the acquisition will depend heavily on how the transition is managed. Concerns about potential job losses, changes in service quality, and increased environmental impact are likely to arise. Moreover, questions about the long-term vision for the railroad, its role in the Alaskan tourism landscape, and the extent of Carnival’s influence on its operations are important considerations.

Impact on Local Communities and Employment

The acquisition’s effect on local communities and employment is a significant factor. Maintaining existing jobs and potentially creating new opportunities within the tourism sector is vital. Transparency regarding job security and potential retraining programs will be critical to assuage concerns and foster trust among employees and the wider community. Examples of successful acquisitions that have fostered community engagement include [insert example here, e.g., a specific company that acquired a local business and maintained or improved its operations and employment levels].

Environmental Impacts and Sustainability Concerns

Environmental considerations are paramount. The acquisition needs to address potential increases in carbon emissions, waste management challenges, and the preservation of natural habitats. Carnival Corp. has a history of initiatives in sustainability, but the specifics of how these initiatives will be implemented within the Excursion Railroad context need to be clearly Artikeld. Sustainable practices, including responsible waste disposal, minimizing energy consumption, and promoting eco-tourism, will be crucial for long-term success.

Examples of successful environmental initiatives in the tourism sector include [insert example here, e.g., specific programs that promote sustainability in a similar context].

Examples of Successful Acquisitions with Positive Public Perception

Several acquisitions have maintained a positive public image by focusing on community engagement, preserving jobs, and demonstrating a clear commitment to the business’s long-term success. These acquisitions often involve active communication with stakeholders, transparent reporting on performance, and a demonstrated commitment to the region’s well-being. For example, [insert example here, e.g., a specific acquisition that has garnered positive community feedback and maintained employment].

These examples underscore the importance of proactive stakeholder engagement in ensuring a positive public response.

Government Regulations and Approvals Required

The acquisition may necessitate various government regulations and approvals, particularly if there are changes to the railroad’s operations or environmental impact. Navigating the regulatory landscape is crucial, and this process must be transparent and address potential concerns. The exact requirements will depend on the specific laws and regulations in Alaska. Furthermore, the process will likely involve consultation with local authorities and environmental agencies to ensure the acquisition complies with environmental regulations and the preservation of natural resources.

This includes, but is not limited to, permits for environmental impact assessments, transportation regulations, and labor standards.

Potential Future Developments

Carnival Corp’s acquisition of the Excursion Railroad in Alaska marks a significant step into the region’s tourism sector. This move opens exciting possibilities for expansion and innovation, potentially transforming the Alaskan experience for both tourists and locals. The acquisition presents a unique opportunity for Carnival to leverage its extensive experience in cruise tourism to create integrated land-based excursions that enhance the overall value proposition for passengers.

Carnival Corp’s purchase of the Excursion Railroad in Alaska is exciting news! Imagine the possibilities for a unique, land-based adventure, perhaps combined with a a bite size sailing experience along the Alaskan coastline. This could open up a whole new dimension of tourism in the region, offering guests a taste of both the wilderness and the comforts of a cruise-style vacation.

The railroad acquisition promises to add a new layer to the overall Alaskan experience for Carnival Corp.

Potential Expansion Plans in Alaska, Carnival corp buys excursion railroad in alaska

Carnival Corp’s expansion plans in Alaska are likely to focus on extending its reach beyond the current offerings of the Excursion Railroad. This could involve developing new rail routes to connect with other destinations within Alaska, potentially offering more diverse and immersive experiences. Further integration with existing Carnival cruise itineraries, allowing seamless transition between sea and land, is another probable strategy.

A significant component of this expansion will likely include the enhancement of existing facilities and infrastructure to improve the passenger experience. This might involve upgrading train cars, stations, and creating new amenities like themed restaurants or shops.

Examples of Similar Acquisitions and Their Outcomes

Several companies have successfully integrated land-based operations with their cruise businesses. Royal Caribbean, for example, has a well-established presence in various destinations, offering excursions and activities that complement their cruises. In these cases, the outcomes have varied. Some acquisitions have led to a significant increase in passenger engagement and revenue, while others have faced challenges in integrating operations smoothly.

Factors such as local regulations, operational complexities, and market reception have influenced the success of these integrations. The successful acquisitions often demonstrate a clear strategic vision that aligns the land-based excursions with the cruise experience. This allows for seamless transition between the different elements of the vacation, providing a more comprehensive and valuable package.

Potential Collaborations and Partnerships

Collaborations with other companies in the Alaskan tourism industry, including tour operators, lodges, and local businesses, could be mutually beneficial. Such partnerships could offer a wider range of activities and experiences for cruise passengers. Shared marketing efforts and resource allocation could increase the reach and impact of the integrated packages. For instance, joint ventures with local businesses could provide valuable insights into the region’s cultural nuances, resulting in curated excursions that cater to specific interests.

Such collaborations can enhance the overall experience for travelers, ensuring that they can fully immerse themselves in the local culture and environment.

Carnival Corp’s purchase of the Excursion Railroad in Alaska is a fascinating development, highlighting the company’s ongoing expansion. It’s interesting to consider how this acquisition might intertwine with their existing cruise operations, and it begs the question of future destinations. Perhaps a deeper understanding of the railroad’s role in Alaskan tourism can be found in similar travel experiences, like those explored in at hanoi sofitel legend a peek at wartime history.

Ultimately, the acquisition could boost tourism in the area, mirroring the potential for increased foot traffic to Alaska following the purchase.

Potential Innovative Services and Products

The acquisition opens opportunities to develop innovative services and products tailored to Alaskan experiences. For example, customized train tours based on specific interests, like wildlife viewing or historical explorations, could be introduced. Integration of technology, such as interactive maps and virtual reality experiences, could enhance the learning aspect of the excursions. Additionally, the integration of sustainable practices into the excursions, such as eco-friendly transportation and accommodations, could attract environmentally conscious travelers.

Potential Long-Term Implications

The long-term implications of this acquisition extend beyond the immediate financial gains. It could potentially reshape the Alaskan tourism landscape by creating a more comprehensive and integrated travel experience for cruise passengers. This increased competition in the Alaskan tourism market might lead to better services and more diverse offerings for tourists, potentially driving economic growth in the region.

It might also encourage further investments in Alaskan infrastructure and transportation, which could benefit the local community in the long run.

Ending Remarks

The acquisition of Excursion Railroad by Carnival Corp in Alaska presents a complex interplay of potential benefits and challenges. The integration process will require careful planning and execution to avoid disruptions and maximize synergies. The impact on customer experience, local communities, and the overall Alaskan tourism market will be substantial, warranting ongoing monitoring and adaptation. While the future holds much promise, navigating potential hurdles and maximizing the long-term benefits will be crucial for both companies.

Answers to Common Questions: Carnival Corp Buys Excursion Railroad In Alaska

What are the potential cost savings associated with the acquisition?

Potential cost savings could arise from shared resources, streamlined operations, and optimized marketing strategies. However, integrating two distinct operations might also introduce unforeseen costs.

How might this acquisition impact local employment in Alaska?

The acquisition could potentially lead to job creation in areas like maintenance, customer service, and marketing. However, it’s important to consider the potential for job displacement within the Excursion Railroad if roles become redundant.

What are the potential environmental impacts of this acquisition?

The environmental impact will depend on how the combined companies manage their operations, including transportation, waste management, and energy use. Sustainability practices will be critical to minimizing any negative environmental consequences.

What is the estimated timeline for the integration process?

No exact timeline is available in the provided Artikel. A detailed integration plan will be crucial in outlining milestones and timelines.