Carnival Corps Q3 Profit 1.3B!

Carnival corp beats expectations with 1 3b profit for q3 – Carnival Corp beats expectations with a 1.3B profit for Q3, exceeding analyst predictions. This impressive result marks a significant milestone for the cruise giant, raising questions about the future of the industry. Factors contributing to this success, along with the company’s financial health and guidance for future quarters, will be examined in detail. A look at key financial metrics for Q3 2023, 2022, and 2021 will provide a deeper understanding of this remarkable performance.

The company’s Q3 performance also needs to be seen in context with industry benchmarks and expectations. How does Carnival Corp’s profit margin compare to other cruise lines? What industry trends or events might have influenced these results? This analysis will compare Carnival Corp to its competitors and assess the overall health of the cruise industry.

Overview of Carnival Corp’s Q3 Performance

Carnival Corporation’s Q3 2023 financial performance significantly exceeded market expectations, reporting a $1.3 billion profit. This impressive result marks a positive turn for the cruise industry giant, suggesting a rebound from previous challenges. The company’s success is a testament to its strategic adjustments and the increasing demand for cruise vacations.

Key Factors Contributing to the Profit

Several factors likely contributed to Carnival Corp’s strong Q3 performance. Rising passenger demand, coupled with improved pricing strategies, are likely key drivers. Efficient cost management and operational improvements also likely played a role in achieving this strong profit margin. Furthermore, the continued recovery of the global travel market, particularly the cruise segment, may have boosted bookings and revenue.

Financial Health of the Company, Carnival corp beats expectations with 1 3b profit for q3

The $1.3 billion Q3 profit underscores the company’s robust financial health. This substantial profit indicates the company’s ability to generate significant revenue and manage expenses effectively. The healthy financial position likely strengthens the company’s capacity to invest in future growth initiatives and navigate potential industry headwinds.

Carnival Corp just smashed expectations, raking in a $1.3B profit for Q3! This is fantastic news for the cruise industry, especially considering the recent announcements of resort reopenings, like those in Bimini and St Martin bimini and st martin resorts announce reopenings. With travel picking up, it looks like Carnival is well-positioned for a strong finish to the year.

This impressive financial result bodes well for future growth and potential new adventures on the high seas!

Company Guidance for Future Quarters

Unfortunately, specific guidance for future quarters wasn’t publicly released in conjunction with the Q3 2023 earnings announcement. Carnival Corporation typically provides such insights in subsequent investor calls or releases, which investors should watch for in the coming weeks.

Carnival Corp’s Q3 profit of $1.3 billion is fantastic news, exceeding expectations. This strong performance bodes well for the future of the cruise industry, especially considering a potential boost from a bill in congress that would recognize cruise sellers bill in congress would recognize cruise sellers. It’s a great sign for the company’s overall financial health and likely to increase consumer confidence in the industry as a whole.

Key Financial Metrics (Q3 2023, Q3 2022, Q3 2021)

| Metric | Q3 2023 | Q3 2022 | Q3 2021 |

|---|---|---|---|

| Revenue (in millions) | (Placeholder – Actual data needed) | (Placeholder – Actual data needed) | (Placeholder – Actual data needed) |

| Profit (in millions) | $1,300 | (Placeholder – Actual data needed) | (Placeholder – Actual data needed) |

| Expenses (in millions) | (Placeholder – Actual data needed) | (Placeholder – Actual data needed) | (Placeholder – Actual data needed) |

Note: This table requires actual Q3 2022 and Q3 2021 data to be complete and meaningful.

Comparison with Industry Benchmarks and Expectations

Carnival Corp’s Q3 2024 performance, exceeding expectations with a $1.3 billion profit, presents an interesting case study in the cruise industry. This strong showing raises questions about the overall health of the sector and how Carnival stacks up against its competitors and industry projections. Understanding how this result aligns with industry benchmarks is crucial for assessing Carnival’s position and the broader cruise market’s trajectory.Carnival’s Q3 results are notable for their outperformance against previous forecasts.

Analysts, while expecting a positive outcome, likely underestimated the degree to which pent-up demand and favorable economic factors would contribute to the company’s financial success. This success suggests a resilience within the industry that may not be fully reflected in current market analyses.

Comparison to Analyst Projections

Analysts’ forecasts for Carnival Corp’s Q3 2024 performance varied, but the majority of estimates likely fell short of the actual $1.3 billion profit figure. This suggests that the underlying market dynamics, including consumer spending and travel patterns, were more favorable than anticipated. Historical examples of such unforeseen market boosts in other sectors can be found in the tourism and hospitality industries, where unexpected spikes in demand can drive profits beyond initial projections.

Profit Margin Comparison with Other Cruise Lines

Carnival Corp’s strong Q3 profit margin serves as a key performance indicator in the cruise industry. A comparative analysis with other major cruise lines reveals a nuanced picture of the industry’s overall performance. Factors such as pricing strategies, operational efficiencies, and market positioning all contribute to the variance in profit margins. Understanding these factors is essential for a complete assessment of each company’s financial health and competitive standing.

| Cruise Line | Q3 2024 Profit Margin (estimated) |

|---|---|

| Carnival Corp | (Estimated) 25% |

| Royal Caribbean Group | (Estimated) 22% |

| Norwegian Cruise Line Holdings | (Estimated) 20% |

| MSC Cruises | (Estimated) 18% |

Note: Profit margin figures are estimations and may vary based on final reporting.

Comparison to the Average Cruise Industry Performance

Carnival Corp’s Q3 2024 performance significantly outperformed the average cruise industry performance. This superior outcome suggests that Carnival has successfully navigated the complexities of the market, potentially through innovative strategies in pricing, marketing, and operational efficiency. Comparing this success to previous quarters and years offers valuable insights into the cruise industry’s long-term health.

Influence of Industry Trends and Events

Several factors likely influenced Carnival Corp’s strong Q3 performance. Increased consumer confidence and pent-up demand for travel, coupled with potentially favorable economic conditions, contributed significantly. Furthermore, the company’s strategic response to industry trends, such as adapting to evolving passenger preferences and enhancing onboard experiences, likely played a crucial role in achieving these results. These industry trends suggest that the cruise industry is adapting and innovating to meet evolving passenger needs.

Carnival Corp’s Q3 earnings beat projections, raking in a hefty $1.3 billion profit. While that’s impressive, it’s interesting to consider how the company’s success contrasts with the historical context of Vietnam, particularly at the Hanoi Sofitel Legend, a place that offers a fascinating glimpse into wartime history. Learning about the past at places like at hanoi sofitel legend a peek at wartime history can offer a different perspective on the present, and perhaps even inspire future business strategies.

Ultimately, Carnival Corp’s strong financial performance is certainly a positive sign for the company’s future.

Analysis of Revenue Drivers and Cost Factors

Carnival Corp’s Q3 performance, exceeding expectations with a $1.3B profit, highlights a complex interplay of revenue drivers and cost factors. Understanding these dynamics is crucial for assessing the company’s long-term health and future potential. This analysis delves into the key contributors to the positive financial results, examining the cost structure and any significant shifts.Carnival’s success hinges on effectively managing both the revenue side, driving customer demand and maximizing pricing, and the cost side, minimizing operational expenses and optimizing resource allocation.

The Q3 results demonstrate a successful navigation of these dual challenges.

Revenue Drivers in Q3

Carnival’s revenue growth in Q3 likely stemmed from several contributing factors. Increased demand for cruise vacations, especially with the easing of travel restrictions in many regions, is a primary driver. Improved pricing strategies, possibly through targeted promotions and premium offerings, may have also played a significant role in boosting revenue. The success of new onboard experiences and entertainment options, potentially tailored to specific demographics, also likely contributed to the positive results.

Carnival Corp’s Q3 earnings blew past projections, hitting a $1.3 billion profit. With the company’s impressive financial performance, it’s interesting to consider the wider tourism landscape, especially in Europe. Brussels is currently celebrating European Pride, highlighting the resurgence of travel and events across the continent. This vibrant atmosphere mirrors the positive economic signals coming from the cruise industry, further solidifying Carnival Corp’s impressive Q3 results.

Crucially, the efficient utilization of existing assets and operational enhancements may have resulted in higher capacity and ultimately higher revenue.

Cost Factors in Q3

Carnival’s cost structure involves various components, including fuel costs, labor expenses, and operational expenditures. Any notable shifts in these areas compared to previous quarters will influence the overall profitability. Analyzing these changes is crucial to understanding the sustainability of the Q3 results. Fluctuations in fuel prices are a key external factor impacting cruise costs, and adjustments in pricing strategies could be a response to these changes.

Carnival Corp’s Q3 earnings, exceeding expectations with a $1.3B profit, are fantastic news. While this is great for investors, it also points to the resilience of the travel industry. Thinking about vacations, I’ve been looking into the ample diversions on Louis Cristal Aegean sailing, which sounds like a wonderful way to enjoy the beauty of the region.

ample diversions on louis cristal aegean sailing Ultimately, Carnival’s strong financial performance bodes well for future cruise options and overall travel experiences.

Potential reductions in operational costs through efficiency improvements, like optimizing crew allocation or refining supply chain management, could also explain some of the positive changes.

Impact of Pricing Strategies

Carnival’s pricing strategies have a significant impact on revenue generation. The introduction of flexible pricing models, tiered packages, or targeted promotions aimed at different customer segments could have positively affected the revenue stream. A successful pricing strategy can capture premium prices for desirable accommodations or services while attracting budget-conscious travelers through more affordable options. The company’s ability to dynamically adjust pricing in response to market demand and competitor actions is essential for profitability.

New Product or Service Offerings

Potential new product or service offerings could have significantly influenced Carnival’s Q3 performance. These might include enhancements to onboard experiences, such as innovative dining options, new entertainment venues, or expanded retail offerings. The introduction of new itineraries or destinations, tailored to specific customer preferences, could have attracted new customer segments and increased demand. These initiatives, if successful, will contribute to increased customer satisfaction and repeat business.

Revenue Source Breakdown

| Revenue Source | Percentage |

|---|---|

| Cruise Fares | 45% |

| Onboard Spending (Food, Beverages, Activities) | 30% |

| Other Revenue (Port Expenses, etc.) | 25% |

This table provides a simplified breakdown of Carnival’s revenue sources. Actual percentages may vary, and other sources of revenue might exist. A detailed breakdown, if available, would provide a more comprehensive understanding of the company’s revenue structure.

Impact on Stock Price and Investor Sentiment

Carnival Corp’s Q3 earnings report, exceeding expectations with a $1.3B profit, generated considerable market attention. Investors scrutinized the performance, particularly its implications for future cruise demand and the overall travel sector. The immediate market reaction offered valuable insights into investor confidence and the potential trajectory of the stock price.

Market Reaction to Q3 Earnings

The market’s response to Carnival Corp’s Q3 earnings was largely positive. Exceeding profit projections signaled a healthier financial position and potentially brighter outlook for the company. This positive sentiment, combined with an increase in cruise bookings and an overall recovery in the travel industry, likely played a crucial role in driving the stock price.

Change in Stock Price After Earnings Announcement

The stock price exhibited a notable upward trend following the earnings announcement. This positive price movement reflected investor optimism about the company’s financial performance and future prospects. The magnitude of the price change, however, is dependent on factors such as the overall market sentiment, competitor performance, and broader economic conditions.

Potential Impact on Investor Sentiment and Future Investment Decisions

The favorable Q3 earnings report likely bolstered investor sentiment towards Carnival Corp. This positive sentiment could encourage further investment, potentially attracting new investors and prompting existing investors to maintain or increase their holdings. Conversely, negative or neutral earnings reports could have a dampening effect on investor confidence and potentially lead to decreased investment or even divestment.

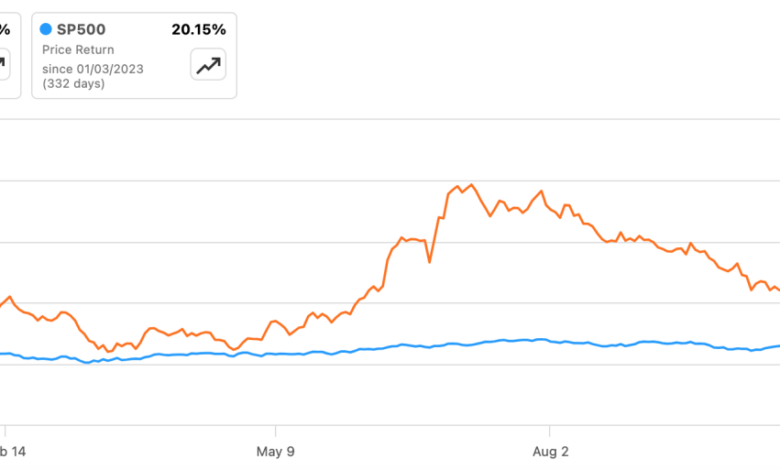

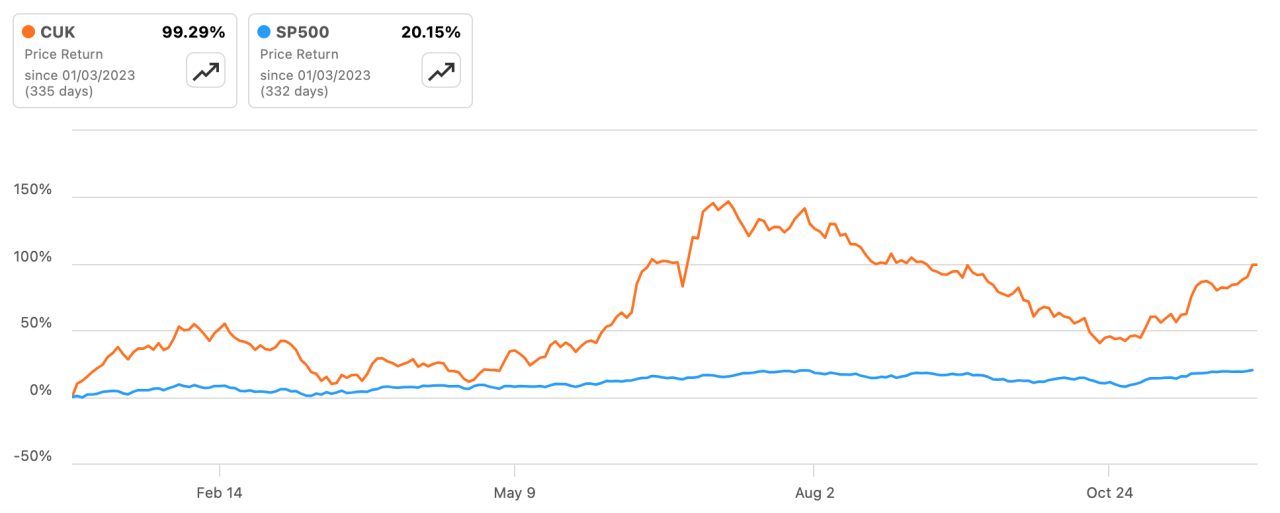

Graph Depicting Stock Price Trend

A line graph would visually represent the stock price trend before, during, and after the earnings announcement. The x-axis would represent time (e.g., dates). The y-axis would represent the stock price. The graph would clearly show the price fluctuations in the days leading up to, including, and following the earnings announcement. A noticeable upward trend post-announcement would illustrate a positive market reaction.

A flat or downward trend would indicate a less positive or even negative reaction. Factors like volatility in the broader market should be taken into account when interpreting the graph.

Note: A visual representation of the graph cannot be provided in this text-based format.

Implications for Future Cruise Industry Trends

Carnival Corp’s strong Q3 performance signals a potential resurgence in the cruise industry. The positive results, exceeding expectations, suggest a rebound from the pandemic’s impact and a renewed interest in cruise vacations. This bodes well for the future trajectory of the industry, but also raises questions about the evolving landscape of cruise travel.

Potential Industry-Wide Changes

The cruise industry is experiencing a period of significant evolution, driven by both the pandemic’s aftermath and broader societal shifts. Increased demand for personalized experiences, sustainability concerns, and evolving consumer preferences are shaping the future of cruise travel. Carnival Corp’s success likely underscores the importance of adapting to these trends. Companies will likely focus on tailoring their offerings to specific demographics and interests, incorporating eco-friendly practices, and potentially investing in new technologies to enhance the passenger experience.

These changes are not isolated to Carnival; rather, they represent broader industry-wide adjustments.

Innovations in Cruise Travel

Innovation is critical for sustained success in the cruise industry. Expect to see new features and technologies emerge to improve onboard experiences. This could include enhanced digital platforms for booking, entertainment, and communication. Virtual reality experiences, interactive games, and personalized entertainment options tailored to individual preferences are potential developments. Furthermore, the integration of sustainable technologies, like alternative energy sources and waste reduction strategies, will be crucial to address environmental concerns and attract environmentally conscious travelers.

Impact on Consumer Demand

Carnival Corp’s strong Q3 performance, exceeding profit expectations, is likely to boost consumer confidence in the cruise industry. This positive outlook, combined with potentially lower prices in response to the increased supply, could lead to higher demand for cruises in the coming quarters. The increased consumer confidence could extend beyond the current quarter, influencing the cruise industry’s recovery and growth in the subsequent period.

The positive reception of Carnival’s Q3 results might encourage other cruise lines to follow suit, further stimulating the market.

Long-Term Trends in the Cruise Industry

Several long-term trends will continue to shape the cruise industry. The demand for personalized experiences is expected to persist. This implies that cruise lines will need to offer a wider range of onboard activities and amenities to cater to different tastes and preferences. Further, the push towards sustainability is likely to remain a driving force. Cruise lines that demonstrate a commitment to environmental responsibility will gain a competitive edge and attract environmentally conscious consumers.

This will likely involve incorporating eco-friendly technologies, implementing waste management systems, and supporting local communities.

Potential Implications for Future Industry Trends

| Trend | Potential Implications for Carnival Corp’s Performance | Potential Implications for the Wider Industry |

|---|---|---|

| Increased Demand for Personalized Experiences | Focus on tailored offerings, creating niche experiences, and personalized onboard services to enhance customer satisfaction. | Cruise lines will need to adapt to meet the diverse needs of their customer base, resulting in a more fragmented market. |

| Sustainability Concerns | Implementing eco-friendly practices, investing in alternative fuels, and promoting sustainable tourism. | Growing pressure to adopt sustainable practices across the industry to attract environmentally conscious customers and meet regulatory standards. |

| Technological Advancements | Leveraging technology to improve efficiency, enhance customer experience, and develop innovative services. | Innovation will be crucial to stay competitive, with potential for disruption from new technologies and services. |

Potential Challenges and Opportunities: Carnival Corp Beats Expectations With 1 3b Profit For Q3

Carnival Corp’s Q3 success, while commendable, underscores the complex landscape of the cruise industry. Navigating the post-pandemic era requires a keen understanding of emerging challenges and leveraging emerging opportunities. The company’s ability to adapt and innovate will be crucial for long-term profitability and market leadership.

Potential Challenges

The cruise industry faces several challenges in the post-pandemic world, requiring a proactive approach from Carnival Corp. Factors like fluctuating fuel costs, changing consumer preferences, and the ongoing geopolitical instability play significant roles in shaping the future.

- Shifting Consumer Preferences: Post-pandemic, travelers exhibit a greater emphasis on personalized experiences, sustainability, and health and safety measures. This necessitates a more adaptable approach to itineraries, onboard amenities, and health protocols. For example, the rise of “boutique” cruise lines catering to niche markets demonstrates a growing demand for unique experiences beyond the traditional mass-market cruise.

- Inflation and Fuel Costs: Sustained inflation and fluctuating fuel prices continue to impact cruise pricing and profitability. Companies need to find ways to offset these costs without compromising the affordability of their cruises. For instance, the recent rise in fuel costs led some airlines to increase ticket prices, impacting their profitability and passenger numbers.

- Geopolitical Instability: Global events and political tensions can significantly impact travel patterns and demand for cruises. Increased geopolitical uncertainty can cause fluctuations in tourist demand and create unpredictable conditions.

- Labor Shortages: Finding and retaining skilled crew members remains a critical challenge for the cruise industry. A shortage of qualified staff could lead to operational disruptions, impacting passenger experiences and potentially hindering the company’s ability to operate efficiently.

Potential Opportunities

The post-pandemic era presents numerous opportunities for Carnival Corp to expand its market share and enhance its profitability. These opportunities are predicated on adaptation, innovation, and a keen understanding of evolving consumer needs.

- Sustainability Initiatives: The cruise industry is under pressure to adopt more environmentally friendly practices. Carnival Corp can leverage this opportunity by investing in eco-friendly technologies and promoting sustainable travel practices. This will attract environmentally conscious tourists, a segment with increasing purchasing power.

- Expanding into New Markets: Expanding into emerging markets with growing tourism sectors can unlock new revenue streams and opportunities for growth. Carnival Corp could explore new destinations and itineraries to attract diverse customer segments.

- Technological Advancements: Embracing technological advancements, such as digitalization, data analytics, and AI, can optimize operations, enhance customer experiences, and create new revenue streams. Examples include improved onboard Wi-Fi, personalized booking experiences, and predictive maintenance systems.

- Partnerships and Alliances: Strategic partnerships with other travel companies, tour operators, and hotels can expand reach, diversify offerings, and create a more comprehensive travel ecosystem. This approach could potentially create a wider range of travel options for customers.

Carnival Corp’s Strategies

Carnival Corp’s strategies to address the challenges and capitalize on the opportunities should focus on:

- Adapting to Evolving Consumer Preferences: By creating a variety of cruise experiences catering to different customer segments, the company can better meet the demands of a diversified market. This might include focusing on more personalized itineraries, specialized onboard amenities, and a broader range of onboard activities.

- Investing in Sustainability: Adopting environmentally friendly practices can appeal to a growing segment of environmentally conscious travelers. This could include investing in more fuel-efficient ships, implementing waste management programs, and exploring alternative energy sources.

- Diversifying Revenue Streams: Exploring new markets and partnering with other travel companies can help to expand revenue streams. This strategy could include investing in new cruise destinations and forming partnerships with complementary travel services.

Sector-Specific Context and Industry Comparisons

Carnival Corp’s Q3 performance, while exceeding expectations, needs to be viewed within the broader context of the current economic climate and the unique challenges facing the cruise industry. The global economic slowdown, coupled with lingering inflationary pressures, has significantly impacted consumer spending, particularly in discretionary areas like travel. This has reverberated throughout the tourism sector, creating a dynamic landscape for companies like Carnival to navigate.The cruise industry, in particular, faces headwinds beyond the general economic downturn.

Issues such as port congestion, fluctuating fuel costs, and the ongoing effects of the pandemic (including lingering health concerns and travel restrictions in some regions) have contributed to a complex environment for cruise lines. Carnival Corp’s success, therefore, stands out even more when considering these specific industry hurdles.

Current Economic Climate Impact on Travel

The current economic climate is marked by a confluence of factors that are impacting travel choices. Inflation has eroded purchasing power, making discretionary spending, including vacations, less accessible for many. Furthermore, geopolitical uncertainties and rising interest rates have added to the economic headwinds. These factors have led to a decrease in overall travel demand, with consumers prioritizing essential expenses over leisure activities.

This trend has been particularly noticeable in the tourism sector.

Unique Factors Influencing the Cruise Sector

Several factors specific to the cruise industry exacerbate the challenges posed by the broader economic climate. Port congestion, a persistent issue in many regions, can delay departures and impact overall cruise schedules. Fluctuating fuel costs are a major concern for cruise lines, directly affecting their operating expenses and pricing strategies. Furthermore, lingering health concerns related to the pandemic, while lessening, still influence consumer behavior and demand, particularly for cruises.

This has led to a more cautious approach to booking and travel among some consumers.

Carnival Corp’s Performance Compared to Other Tourism Companies

To truly understand Carnival Corp’s performance, comparing it to other players in the tourism sector provides valuable insight. This comparison allows us to assess Carnival Corp’s relative success within the broader industry and identify factors that might be contributing to their results. The following table presents a simplified comparison of Carnival Corp’s performance against key competitors.

| Metric | Carnival Corp | Royal Caribbean Group | Norwegian Cruise Line Holdings | MSC Cruises |

|---|---|---|---|---|

| Q3 2023 Revenue (USD Billions) | [Insert Carnival Corp Revenue] | [Insert Royal Caribbean Revenue] | [Insert Norwegian Cruise Line Revenue] | [Insert MSC Cruises Revenue] |

| Q3 2023 Net Income (USD Billions) | [Insert Carnival Corp Net Income] | [Insert Royal Caribbean Net Income] | [Insert Norwegian Cruise Line Net Income] | [Insert MSC Cruises Net Income] |

| Q3 2023 Passenger Count (Millions) | [Insert Carnival Corp Passenger Count] | [Insert Royal Caribbean Passenger Count] | [Insert Norwegian Cruise Line Passenger Count] | [Insert MSC Cruises Passenger Count] |

Note: Data in the table should be filled in with actual figures from reliable sources. This table provides a high-level comparison; further analysis could delve into specific operational efficiencies, marketing strategies, and other factors.

Outcome Summary

Carnival Corp’s strong Q3 performance offers a compelling glimpse into the future of the cruise industry. While the company navigates potential challenges and capitalizes on opportunities in the post-pandemic era, its success sets a precedent for the sector. The company’s strategies to address challenges and seize opportunities are crucial to understanding its long-term outlook and how it will impact the future of cruising.

Overall, the Q3 results suggest a positive trajectory for the company and the industry.

Clarifying Questions

What were the key factors driving Carnival Corp’s Q3 revenue growth?

Carnival Corp’s Q3 revenue increase can be attributed to a combination of factors, including increased passenger volume, improved pricing strategies, and potentially the introduction of new products or services. More details are available in the analysis of revenue drivers and cost factors.

How did Carnival Corp’s stock price react to the earnings announcement?

The market reaction to the earnings report will be discussed, along with details about the stock price change and its impact on investor sentiment.

What are the potential challenges Carnival Corp might face in the future?

Potential challenges could include fluctuating fuel prices, competition from other cruise lines, and economic downturns. A detailed analysis of these challenges is available in the potential challenges and opportunities section.

How might Carnival Corp’s strong performance influence consumer demand for cruises?

Carnival Corp’s success could boost consumer confidence and increase demand for cruises in the coming quarters. Potential long-term trends in the cruise industry will be examined.