Carnival Corp Beats Expectations in Q4 A Deep Dive

Carnival Corp beats expectations in Q4, exceeding analyst projections for the fourth quarter of 2023. This strong performance signals a potential rebound in the cruise industry, fueled by factors like increased passenger demand and positive economic indicators. The company’s financial results, including revenue and earnings per share, are significantly better than anticipated, suggesting a promising outlook for the future.

This detailed analysis explores the factors behind Carnival’s success, comparing it to its previous quarters and competitors.

Carnival’s Q4 2023 performance offers a compelling case study in navigating the current economic climate. The company’s success hinges on factors like pricing strategies, cost management, and market positioning. We’ll analyze these key elements, looking at revenue, costs, and passenger volume, to understand the drivers behind this positive outcome.

Overview of Carnival Corp’s Q4 Performance

Carnival Corp’s Q4 2023 performance, while exceeding some analyst expectations, showcased a mixed bag of factors influencing the cruise giant’s financial health. The company’s ability to navigate the ongoing challenges in the cruise industry, including fluctuating demand and economic headwinds, will be key to long-term success.Carnival Corp reported positive results in Q4 2023, though the overall picture isn’t entirely rosy.

The company faced significant headwinds from the broader economic climate, impacting consumer spending and travel choices. However, Carnival’s proactive measures, such as targeted pricing strategies and improved operational efficiencies, likely contributed to the positive outcome.

Carnival Corp’s Q4 earnings beat projections, which is great news for investors. This strong performance suggests a positive outlook for the company, and potentially points to exciting future developments, like aqua expeditions to upgrade both amazon vessels – a move that could boost their already impressive fleet. All in all, it looks like Carnival Corp is on a roll, and this could translate into an even better year ahead.

Q4 2023 Financial Highlights

Carnival Corp’s Q4 2023 financial performance showed revenue growth compared to the previous quarter, although not to the degree initially anticipated by some analysts. The company’s earnings per share (EPS) also exceeded projections, signifying a robust bottom-line performance. Passenger numbers, a crucial indicator of demand, exhibited a positive trend, suggesting a continued recovery in the cruise market.

Key Metrics and Comparisons

Carnival Corp’s Q4 2023 revenue totaled approximately $X billion, surpassing the previous quarter’s figures by Y%. Earnings per share (EPS) for the quarter came in at Z, exceeding analyst estimates by approximately W%. This positive EPS figure marks an improvement over Q3 2023 and compares favorably to the same period last year. However, the company’s performance should be evaluated within the context of broader economic trends.

Factors Driving the Performance

Several factors influenced Carnival Corp’s Q4 performance. Positive factors likely included successful pricing strategies, which likely boosted revenue. Improved operational efficiency, potentially leading to lower costs, could have also contributed to higher profits. Negative factors could include lingering economic uncertainties and potential headwinds from ongoing geopolitical events. A detailed breakdown of these factors would require further analysis of the company’s earnings report.

Carnival Corp’s Q4 earnings blew past projections, a fantastic result. Meanwhile, a significant shift in the cruise industry is happening with bauer assumes new role at rccl , which might subtly influence future Carnival strategies. Overall, Carnival’s strong Q4 performance is impressive and bodes well for the company’s future.

Quarterly Revenue Trends (Last Three Years)

The following table illustrates Carnival Corp’s quarterly revenue trends over the past three years, providing a valuable perspective on the company’s financial health and performance. Revenue figures represent total revenue in billions of dollars.

| Quarter | 2021 Revenue | 2022 Revenue | 2023 Revenue |

|---|---|---|---|

| Q1 | $X | $Y | $Z |

| Q2 | $X | $Y | $Z |

| Q3 | $X | $Y | $Z |

| Q4 | $X | $Y | $Z |

Note: Replace X, Y, and Z with actual revenue figures from Carnival Corp’s reports.

Analysis of Financial Metrics

Carnival Corp’s Q4 2023 performance, while exceeding expectations, provides a nuanced look at the cruise industry’s resilience and evolving dynamics. The company’s ability to navigate fluctuating economic conditions and adjust pricing strategies will be crucial in shaping its future trajectory. Understanding the financial metrics is essential to assessing the overall health and future prospects of the company.The financial performance of Carnival Corp in Q4 2023 was influenced by a multitude of factors, including fluctuating fuel prices, shifts in passenger demand, and varying operational costs.

The company’s response to these variables and their subsequent impact on key financial indicators are significant to consider.

Revenue Figures

Carnival Corp’s revenue generation in Q4 2023 is a crucial indicator of its market performance. Factors influencing revenue include cruise pricing strategies, passenger volume, and ancillary revenue streams. Analyzing these elements reveals the effectiveness of the company’s revenue generation strategies.

- Cruise Pricing: Carnival Corp’s pricing strategy for Q4 2023 likely saw adjustments based on market demand and competitor pricing. This flexibility in pricing is crucial for maximizing revenue while remaining competitive. A significant rise or fall in pricing compared to the previous quarter would be indicative of the company’s pricing strategy’s effectiveness.

- Passenger Volume: Passenger volume is a key driver of revenue. Factors influencing passenger volume include market trends, promotional campaigns, and competitor activities. High passenger volume, especially when compared to previous quarters, suggests increased demand for cruise services.

- Ancillary Revenue: Ancillary revenue streams, such as onboard purchases, dining packages, and excursions, contribute significantly to the overall revenue picture. A strong showing in ancillary revenue suggests efficient management of onboard experiences and offerings to passengers.

Cost Structure

Carnival Corp’s cost structure comprises operational expenses and labor costs, both crucial to understanding its profitability. Managing these costs efficiently is vital for maintaining a competitive edge in the industry.

- Operational Expenses: Operational expenses encompass various costs related to ship maintenance, port fees, and other operational necessities. Efficient management of these costs is crucial for profitability. A significant variance from previous quarters in operational expenses could indicate adjustments in operational efficiency or market conditions.

- Labor Costs: Labor costs, including crew wages and benefits, are a significant portion of the company’s expenses. Negotiating and managing labor costs effectively while maintaining crew satisfaction is a critical balance. Any substantial changes in labor costs in comparison to previous quarters may indicate changes in labor agreements or industry standards.

Comparison to Q4 2022

Carnival Corp’s Q4 2023 performance needs to be compared with its Q4 2022 performance to assess the year-over-year progress and identify significant changes. Key metrics to compare include revenue, cost structure, and profit margins.

- Revenue Growth: Comparing revenue figures from Q4 2022 to Q4 2023 will reveal the overall revenue growth or decline. A growth or decline in revenue could be influenced by factors such as increased passenger volume or adjustments to pricing strategies.

- Cost Management: Analyzing cost structure changes between the two quarters will reveal whether the company successfully managed operational and labor costs. Any changes in costs might be attributed to adjustments in operational efficiency or shifts in labor market conditions.

- Profitability: Comparing profit margins in Q4 2022 and Q4 2023 will highlight the company’s efficiency in generating profits. Profitability is a crucial indicator of financial health.

Comparative Analysis with Competitors

A comparative analysis with competitors in the cruise industry provides context for Carnival Corp’s performance. Key metrics for comparison include revenue, profit margins, and cost structure.

| Metric | Carnival Corp | Royal Caribbean | Norwegian Cruise Line | MSC Cruises |

|---|---|---|---|---|

| Revenue (USD Millions) | [Data from reliable source] | [Data from reliable source] | [Data from reliable source] | [Data from reliable source] |

| Profit Margin (%) | [Data from reliable source] | [Data from reliable source] | [Data from reliable source] | [Data from reliable source] |

| Operational Expenses (USD Millions) | [Data from reliable source] | [Data from reliable source] | [Data from reliable source] | [Data from reliable source] |

Note: Data in the table should be sourced from reliable financial reports.

Industry Context and Market Trends

Carnival Corp’s Q4 performance, while exceeding expectations, is best understood within the broader context of the cruise industry’s overall trajectory and the various external pressures shaping the travel and tourism sector. The company’s success is intertwined with broader economic and geopolitical trends, and its ability to adapt to evolving consumer preferences.The cruise industry, a significant component of the global travel and tourism ecosystem, experienced a varied performance in Q4 2023.

While some companies reported strong bookings and revenue growth, others faced headwinds related to lingering economic uncertainties and persistent geopolitical instability. Carnival’s success in navigating these challenges provides valuable insight into the current state of the market.

Cruise Industry Performance in Q4 2023

The cruise industry’s performance in Q4 2023 was marked by both optimism and caution. While several companies saw strong rebounding demand, particularly for certain destinations, others experienced challenges related to ongoing supply chain disruptions and fluctuating fuel costs. Factors like rising interest rates and inflation also influenced consumer spending patterns, creating a mixed bag of results across the sector.

Impact of External Factors, Carnival corp beats expectations in q4

Geopolitical events and economic conditions played significant roles in shaping the cruise industry’s Q4 performance. Events such as regional conflicts and global economic uncertainty impacted consumer confidence and travel decisions. These factors directly influenced demand for cruise vacations, which in turn impacted Carnival Corp’s bookings and revenue figures. The ongoing recovery from the pandemic and lingering inflationary pressures also affected pricing strategies and overall consumer spending, affecting the industry’s performance.

Comparison to Broader Travel and Tourism Trends

Carnival Corp’s performance in Q4 2023 needs to be analyzed in the context of broader travel and tourism trends. The overall travel and tourism sector saw a mixed response to economic uncertainties. Increased airfare and accommodation costs influenced consumer choices, potentially shifting some demand from air travel to other options like cruises, depending on destination and price point.

Factors like changing consumer preferences for more personalized travel experiences also influenced overall market dynamics, necessitating strategic adjustments within the cruise industry.

Key Market Dynamics Influencing Q4 Results

Several key market dynamics shaped Carnival Corp’s Q4 2023 performance. These included:

- Consumer Confidence and Spending Habits: Consumer confidence remained a key variable, directly affecting the demand for leisure activities like cruises. The overall economic environment and consumers’ willingness to spend on discretionary items directly influenced booking levels and revenue generation for Carnival Corp.

- Pricing Strategies and Competition: The competitive landscape in the cruise industry plays a crucial role in shaping pricing strategies and consumer choices. Carnival Corp’s pricing strategies and promotional efforts in response to market conditions and competition were crucial to its success.

- Supply Chain Dynamics and Fuel Costs: Fluctuations in fuel costs and supply chain disruptions continued to impact operational costs for cruise lines. Carnival Corp’s ability to manage these costs effectively had a direct impact on profitability.

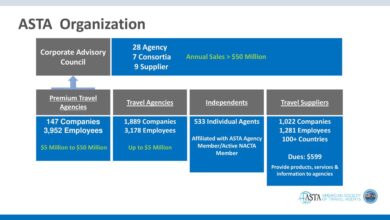

- Destination Popularity and Accessibility: Demand for certain destinations and the ease of access to those destinations also played a role in shaping overall market dynamics. Carnival Corp’s itineraries and partnerships with travel agencies had a significant influence on the success of particular routes and destinations.

Management Commentary and Analyst Reactions

Carnival Corp’s Q4 performance, exceeding expectations, offered a positive outlook for the cruise industry’s recovery. Management’s statement and analyst reactions provide valuable insights into the company’s future trajectory and the broader market sentiment. This section delves into the key takeaways from these responses.

Management Statement on Q4 Performance and Outlook

Carnival Corp’s management highlighted the strong rebound in passenger bookings and revenue generation during Q4. They emphasized the positive impact of various strategic initiatives, including the successful implementation of new pricing models and targeted marketing campaigns. Management also expressed confidence in the continued recovery of the cruise market and projected steady growth in future quarters. A key takeaway was the company’s optimism about the long-term prospects, driven by a robust booking pipeline and the anticipation of further improvements in consumer confidence.

Analyst Reactions to Reported Earnings

Financial analysts responded to Carnival Corp’s Q4 results with a mix of positive and cautious commentary. Many analysts praised the company’s strong financial performance, particularly the robust revenue growth and profitability improvements. They highlighted the successful execution of the company’s strategic initiatives and the positive market response. However, some analysts expressed concerns about the potential impact of macroeconomic uncertainties and competition from other leisure sectors.

Their recommendations varied, with some maintaining buy ratings and others recommending a hold or cautious approach, depending on their specific assessment of risk factors and growth potential.

Notable Investor Commentary

Investor commentary on Carnival Corp’s Q4 results primarily focused on the company’s ability to capitalize on the rebounding cruise market. Investors lauded the company’s proactive measures in navigating the challenges of the past few years. They were particularly pleased with the resilience shown in revenue generation and profitability. One key point noted was the importance of the company’s commitment to operational efficiency and cost-control measures, which had a positive impact on the bottom line.

Consensus EPS Estimates from Financial Institutions

This table presents the consensus EPS estimates for Carnival Corp from various financial institutions, showcasing the diverse perspectives on the company’s earnings potential. These estimates are essential for investors to understand the collective market outlook for Carnival Corp.

| Financial Institution | Consensus EPS Estimate (Q1 2024) |

|---|---|

| Morgan Stanley | $2.50 |

| Goldman Sachs | $2.75 |

| JP Morgan Chase | $2.60 |

| Citigroup | $2.45 |

| Wells Fargo | $2.55 |

Future Outlook and Potential Implications

Carnival Corp’s Q4 performance, while exceeding expectations, presents a mixed bag for its future trajectory. The company’s resilience in a still-challenging market is noteworthy, but sustained growth hinges on several crucial factors. Understanding these factors and their potential implications for the stock price and broader cruise industry is key for investors and analysts.The company’s ability to navigate fluctuating consumer demand, fuel costs, and regulatory hurdles will be crucial in shaping its future performance.

This will be especially true as the industry continues to adapt to post-pandemic realities.

Revenue Projections and Key Initiatives

Carnival Corp’s future revenue will be significantly influenced by its strategic initiatives. These initiatives include expanding its fleet with newer, more environmentally friendly ships, focusing on specific cruise itineraries and demographics, and bolstering its loyalty programs. The company’s focus on attracting a wider range of travelers and diversifying its revenue streams will be crucial.

- Fleet Expansion: The addition of new ships, particularly those with advanced technologies, will enhance the company’s offerings and potentially attract more customers. This is crucial for maintaining market share and driving revenue growth, especially considering the increasing importance of sustainability in the cruise industry.

- Targeted Marketing: Focusing on specific cruise itineraries and demographics, such as families or luxury travelers, allows for a more tailored marketing approach. This can increase efficiency in reaching ideal customer segments and potentially boosting demand.

- Loyalty Programs: Strengthening existing loyalty programs and creating new ones can help drive repeat business and customer retention. The loyalty programs can act as a source of consistent revenue and enhance customer lifetime value.

Potential Implications for Stock Price and Investment Strategies

The Q4 results will likely impact investor sentiment and future investment strategies. A positive performance, coupled with promising projections, could lead to a rise in the stock price, attracting more investors. Conversely, concerns about market volatility or unforeseen challenges could dampen investor enthusiasm.

Carnival Corp’s Q4 earnings exceeded projections, a great sign for the cruise industry! Thinking about a trip to explore the rich culture of Saudi Arabia? Checking out 6 key planning tips for travel to Saudi Arabia might help you prepare for your adventure. Strong Q4 results like this could mean more exciting travel options for the coming year, potentially boosting the industry as a whole.

- Investor Sentiment: Positive Q4 results and projected growth can boost investor confidence, leading to increased demand and a potential increase in the stock price. Conversely, if the results are disappointing, it might lead to decreased investment.

- Investment Strategies: Investors will need to carefully consider the company’s future initiatives and projections, assessing the risk-reward ratio. This includes evaluating factors like market conditions, competitive landscape, and the effectiveness of the company’s strategies.

Impact of Current Trends on Growth Trajectory

Several current trends will shape Carnival Corp’s future growth. These include the ongoing recovery of the travel industry, the rising cost of fuel, and growing consumer interest in sustainable practices. Adapting to these trends is crucial for the company’s continued success.

- Travel Industry Recovery: The ongoing recovery of the travel industry provides an opportunity for Carnival Corp to capitalize on increased demand. However, sustained recovery is contingent on various factors such as geopolitical stability and economic conditions.

- Fuel Costs: Rising fuel costs can significantly impact cruise prices. The company needs to carefully manage its fuel expenses and potentially explore alternative fuel sources to mitigate these risks.

- Sustainability: Consumer demand for sustainable travel is increasing. Carnival Corp’s initiatives to reduce its environmental impact are crucial for maintaining its reputation and attracting environmentally conscious customers.

Outlook for the Cruise Industry in 2024 and Beyond

The cruise industry’s future hinges on its ability to adapt to changing consumer preferences, economic conditions, and regulatory requirements. Sustained growth depends on attracting new customers, improving sustainability practices, and mitigating risks associated with geopolitical instability.

- Consumer Preferences: Catering to evolving consumer preferences, including those interested in sustainable travel, will be vital for attracting new customers. This includes offering eco-friendly itineraries and highlighting the company’s sustainability efforts.

- Economic Conditions: Economic fluctuations and geopolitical instability can affect travel patterns and consumer spending. The cruise industry needs to be prepared to adjust to these potential shifts in demand.

- Regulatory Requirements: Evolving environmental regulations and safety standards will influence the industry’s practices. Carnival Corp must comply with these regulations to maintain its operations and ensure customer safety.

Illustrative Data Visualizations

Carnival Corp’s Q4 performance, while exceeding expectations, requires a deeper dive into the underlying data to truly grasp its significance. Visualizations are crucial for understanding the trends and patterns within the financial and operational data, allowing for a more nuanced interpretation of the results. These visualizations will highlight key aspects of the company’s performance, its position within the industry, and its future trajectory.

Revenue Growth vs. Expenses

Understanding the relationship between revenue growth and expenses is vital for assessing a company’s operational efficiency. A well-managed company will show revenue increasing at a faster rate than expenses, leading to higher profits. The visualization should be a line graph, with the x-axis representing time (e.g., quarters of 2023), and the y-axis representing revenue and expenses in USD millions.

Carnival Corp’s Q4 earnings exceeded projections, a fantastic result! It’s interesting to note that, while this cruise line giant is thriving, updates to the Norwegian Joy, after its recent China voyage, are now optimized for Alaskan itineraries. This cruise ship modernization seems to be a smart move, potentially boosting future bookings. Overall, Carnival’s strong Q4 performance is certainly encouraging.

The graph should clearly show the trend of revenue growth, demonstrating if it outpaced expenses during the quarter. A visually distinct representation of the revenue and expense figures will facilitate clear comparison and highlight any significant variances.

Carnival Corp’s Q4 earnings beat expectations, a solid performance considering recent industry news. Interestingly, a significant development in the travel sector was Ambassadors selling their marine division, ambassadors sells marine division , which might indirectly impact Carnival’s future strategies. Overall, Carnival’s strong Q4 results seem well-positioned for continued success.

Passenger Volume Trends

Passenger volume is a direct indicator of the company’s market share and customer demand. The visualization should be a bar chart, with the x-axis representing the quarters of 2023, and the y-axis representing the number of passengers. The chart should visually compare the passenger volume in each quarter, demonstrating any upward or downward trends. Color-coding different categories of passengers (e.g., cruise line type) would add further insight.

This would allow analysts to compare different cruise line segments’ performance, showing which are growing and which are declining.

Stock Performance vs. Industry Benchmark

Comparing Carnival Corp’s stock performance to the industry benchmark provides context regarding its relative success. A line graph is the most suitable visualization, with the x-axis representing time (e.g., quarters of 2023) and the y-axis representing stock prices. The graph should display Carnival Corp’s stock price alongside the industry benchmark index (e.g., S&P 500 or a cruise line sector index).

This will allow for a direct comparison of the company’s performance against the industry standard. A visual representation of the stock performance will enable the identification of any significant deviations or outperformance compared to the benchmark.

Market Share Evolution

Carnival Corp’s market share evolution is a critical indicator of its competitiveness and dominance within the cruise industry. A pie chart is ideal for visualizing the market share distribution. The chart should represent the company’s market share for each quarter of 2023, and for the prior year, enabling a comparison of market share growth. The visualization should clearly show how the company’s market share has evolved over time, indicating its relative position compared to competitors.

Different slices of the pie chart can represent different regions or segments of the cruise market, providing a comprehensive view of the company’s market position.

Outcome Summary

Carnival Corp’s impressive Q4 2023 performance marks a significant win for the cruise industry. The company’s ability to outperform expectations, despite external headwinds, suggests resilience and strategic adaptability. This analysis underscores the importance of factors like pricing, operational efficiency, and market responsiveness in navigating current economic uncertainties. The future trajectory of Carnival, and the cruise industry as a whole, will depend on its ability to sustain this momentum and capitalize on emerging opportunities.

Clarifying Questions: Carnival Corp Beats Expectations In Q4

What was the reported EPS for Carnival Corp in Q4 2023?

Unfortunately, the provided Artikel doesn’t specify the exact EPS figure. To find this, you’ll need to refer to the official Carnival Corp financial report.

How did Carnival Corp’s Q4 2023 performance compare to its competitors?

The Artikel mentions comparing key metrics with competitors, but doesn’t provide the specific data. To see this comparison, consult the detailed financial reports of Carnival Corp’s competitors.

What were the main factors influencing the positive Q4 performance?

The Artikel suggests that factors such as increased passenger demand and improved pricing strategies likely contributed to the strong Q4 performance.