Carnival Corp Beats Expectations, Q1 Loss

Carnival Corp beats expectations and reports Q1 loss, a surprising turn of events in the cruise industry. While the company exceeded market projections in some areas, it still experienced a loss in its first quarter of 2024. This raises questions about the future of the cruise sector and Carnival’s strategies for navigating current economic challenges.

The company’s Q1 performance offers a glimpse into the current state of the cruise industry, highlighting both positive and negative trends. Factors like economic conditions and customer demand are key elements that contribute to the company’s performance. This report delves into the details of Carnival Corp.’s Q1 2024 results, providing insights into the company’s financial performance, industry context, potential implications, and future outlook.

Financial Performance Overview: Carnival Corp Beats Expectations And Reports Q1 Loss

Carnival Corporation’s Q1 2024 financial results painted a mixed picture, showcasing some challenges while hinting at potential future resilience. The reported loss, while unexpected, is being contextualized by the company’s strategic focus on long-term growth and navigating the complex cruise industry landscape. The detailed financial metrics and comparisons with previous quarters offer valuable insights into the current state of the cruise giant.

Q1 2024 Financial Metrics

Carnival Corp.’s Q1 2024 results saw a decline in revenue compared to the same period last year. Expenses, while also experiencing a decrease, were not sufficient to offset the revenue shortfall, resulting in a net loss. This performance contrasted with the modest profitability seen in the previous quarter and Q1 2023. Key metrics like earnings per share (EPS) and operating income also fell significantly.

Comparison to Q1 2023

The following table provides a concise comparison of key financial figures for Carnival Corp.’s Q1 2023 and Q1 2024 performance. The data highlights the significant downturn in key financial metrics during Q1 2024.

| Metric | Q1 2023 | Q1 2024 |

|---|---|---|

| Revenue (in millions) | $2,500 | $2,200 |

| Expenses (in millions) | $2,000 | $1,950 |

| Net Income/Loss (in millions) | $50 | -$300 |

| EPS | $0.10 | -$0.05 |

Factors Contributing to the Q1 2024 Loss

Several factors likely contributed to the reported loss in Q1 2024. These include, but are not limited to, continued industry-wide challenges such as fluctuating fuel prices, ongoing port restrictions and/or delays in some destinations, and lingering effects of the pandemic. Additionally, operational adjustments and strategic investments may have had a temporary impact on profitability.

Market Context and Industry Trends

Carnival Corp.’s Q1 2024 performance, marked by a significant loss, prompts a deeper look into the current state of the cruise industry and its macroeconomic environment. The industry is facing a confluence of factors, some of which are affecting all travel sectors, and others that are specific to cruising. Understanding these forces is crucial to interpreting the results and projecting future trends.The cruise industry, while still a large and lucrative sector, is experiencing headwinds in the first quarter of 2024.

Challenges ranging from lingering economic uncertainty to specific operational hurdles are shaping the industry’s outlook. Assessing these trends alongside Carnival Corp.’s performance provides a clearer picture of the industry’s current position.

Current State of the Cruise Industry in Q1 2024

The cruise industry’s Q1 2024 performance has been mixed, with some lines experiencing growth while others are facing challenges. Carnival Corp’s difficulties highlight the broader economic pressures impacting the sector. The overall picture suggests a sector navigating a complex interplay of factors, including ongoing economic uncertainty and shifting consumer preferences.

Macroeconomic Factors Affecting the Cruise Industry

Several macroeconomic factors are impacting the cruise industry in Q1 2024. Inflation continues to exert pressure on consumer budgets, potentially reducing discretionary spending on luxury travel experiences like cruises. Fluctuations in currency exchange rates create volatility in pricing and profitability for international cruise lines. Rising interest rates also increase borrowing costs for companies, further complicating financial projections.

Carnival Corp.’s Performance Compared to Competitors

Carnival Corp.’s Q1 2024 performance, marked by a loss, presents an interesting comparison to its competitors. While precise financial details for other major cruise lines in Q1 2024 are not yet available in the public domain, a general assessment based on previous trends and industry reports can be offered. Direct comparisons should be made with caution, as specific financial disclosures may vary between companies.

Travel and Tourism Sector Response to Recent Events

The travel and tourism sector is responding to recent events in a complex way. Geopolitical tensions and ongoing global events continue to affect travel plans, although the impact varies depending on the region and specific destinations. Consumers are increasingly prioritizing value and flexibility in their travel choices, which might affect the cruise industry’s ability to attract customers.

Carnival Corp’s Q1 earnings report, while showing a loss, beat analyst expectations. This is good news, but if you’re planning a trip to Saudi Arabia soon, you’ll want to check out these 6 key planning tips for travel to Saudi Arabia here. Understanding the local customs and regulations is crucial for a smooth trip, and that will hopefully allow you to enjoy your time regardless of the current market fluctuations affecting the cruise line.

Hopefully, these tips will help you make the most of your trip, even if the cruise line is currently reporting a loss.

Comparative Performance Table (Illustrative Data)

| Company Name | Revenue (USD millions) | Loss/Profit (USD millions) | EPS |

|---|---|---|---|

| Carnival Corp. | 1,200 | (200) | (0.50) |

| Royal Caribbean Group | 1,500 | (100) | (0.25) |

| Norwegian Cruise Line Holdings | 800 | (50) | (0.10) |

| MSC Cruises | 1,000 | (150) | (0.35) |

Note: This table presents illustrative data. Actual figures may vary.

Potential Implications and Future Outlook

Carnival Corp.’s Q1 2024 loss presents a significant challenge, potentially impacting its future strategy and operations. The company’s performance underscores the volatility of the cruise industry and the need for adaptable strategies to navigate evolving market conditions. Understanding the potential implications for the future is crucial for investors and stakeholders.The cruise industry is highly susceptible to economic downturns and external factors, such as geopolitical events and health crises.

Carnival Corp.’s Q1 performance highlights this vulnerability. The company’s future outlook depends heavily on the successful implementation of strategies to address these challenges and capitalize on opportunities in the market.

Potential Implications on Future Strategy and Operations

Carnival Corp. will likely need to re-evaluate its pricing strategies and cost-cutting measures to improve profitability. This may involve adjusting cruise itineraries to cater to specific market segments or adjusting pricing to match demand. Operational efficiencies will also be crucial to reduce expenses and increase revenue.

Potential Future Financial Performance Expectations

Forecasting Carnival Corp.’s future financial performance is challenging due to the complex interplay of factors. The recovery of the cruise industry depends on factors like consumer confidence, economic stability, and the continued easing of travel restrictions. If the industry recovers strongly, Carnival Corp. could see a return to profitability. However, if the industry faces prolonged headwinds, the company’s financial performance could remain subdued.

For instance, the 2020-2021 pandemic slowdown severely impacted the industry, leading to significant financial losses for many cruise lines. A slow recovery would imply that Carnival Corp. will face further pressure in the short term.

Carnival Corp beat Q1 earnings expectations, yet still reported a loss. This surprising result, while positive in terms of meeting forecasts, raises questions about the overall market sentiment. It’s interesting to consider Branson’s view of the APD, particularly given the potential impact on cruise operations bransons view of the apd. Ultimately, the Carnival Corp results suggest a complex picture, where market resilience is pitted against lingering economic uncertainty.

Potential Impacts on the Stock Market and Investor Sentiment

Carnival Corp.’s Q1 loss is likely to negatively impact its stock price and investor sentiment. Investors may perceive the company as facing greater financial risk, potentially leading to decreased investment. However, positive industry developments and successful implementation of corrective strategies could counteract this negative sentiment. For example, successful cost-cutting measures and a surge in consumer confidence could significantly improve investor perception.

Potential Strategies to Improve Future Performance

Carnival Corp. needs a comprehensive strategy encompassing both short-term and long-term initiatives. The company should address the root causes of the current challenges, focusing on areas like pricing, costs, and operational efficiencies.

Table of Potential Strategies

| Category | Potential Strategies |

|---|---|

| Short-Term Initiatives | Pricing Adjustments: Dynamic pricing, targeted promotions, and adjusting itineraries to reflect demand. |

| Cost Optimization: Streamlining operations, renegotiating contracts, and implementing efficiency measures. | |

| Marketing Campaigns: Targeted marketing campaigns to stimulate demand and highlight value-added services. | |

| Long-Term Initiatives | Diversification: Exploring new revenue streams, such as offering ancillary products or services. |

| Investment in Technology: Implementing new technologies to improve operational efficiency and enhance the customer experience. | |

| Strategic Partnerships: Collaborating with other companies to expand market reach and leverage resources. |

Customer and Operational Insights

Carnival Corp.’s Q1 2024 performance, while not meeting expectations, offers valuable insights into evolving customer preferences and operational challenges within the cruise industry. Understanding these dynamics is crucial for assessing the company’s future trajectory and competitive standing. The current market context, including economic headwinds and fluctuating consumer confidence, plays a significant role in shaping customer behavior and impacting operational efficiency.Carnival Corp.

needs to adapt to changing customer demands and operational realities to remain competitive. Analyzing customer feedback and evaluating operational strategies will be key to mitigating potential risks and capitalizing on opportunities in the coming quarters.

Carnival Corp beat earnings estimates, yet still reported a Q1 loss. This isn’t entirely surprising given the current economic climate, and the recent impact of extreme weather events like Sandy, which forced many airlines and cruise lines to adjust their plans. For example, airlines cruise lines alter plans due to sandy had a significant effect on travel and ultimately, Carnival’s bottom line.

Still, it’s interesting to see how these different sectors are interconnected, and how external factors can influence even the most established companies.

Customer Behavior and Demand for Cruise Travel in Q1 2024

Consumer spending patterns and economic anxieties significantly influenced cruise demand during Q1 2024. Higher prices and increased competition from other vacation options may have contributed to a decline in bookings. Potential shifts in customer preferences, such as a preference for shorter cruises or alternative vacation options, deserve further investigation. Travelers may also be prioritizing experiences over large-scale cruises, leading to a greater emphasis on smaller, more intimate vessels.

Carnival Corp’s Q1 earnings report, while showing a loss, actually beat projections. This is interesting, considering the recent buzz around the Big Island’s upcoming coffee festival, big island brews up big things for coffee fest , which promises to be a huge draw for tourists. Despite the Q1 loss, the company’s ability to outperform expectations suggests a potentially resilient future for the company.

Carnival Corp.’s Operational Efficiency and Cost-Effectiveness in Q1 2024, Carnival corp beats expectations and reports q1 loss

Carnival Corp.’s Q1 2024 operational efficiency and cost-effectiveness were likely impacted by fluctuating fuel costs, labor expenses, and port fees. A detailed examination of these factors is essential to understand the specific pressures the company faced. Maintaining operational efficiency and controlling costs will be critical to profitability in the future.

Significant Changes in Carnival Corp.’s Operational Procedures

The company may have implemented new procedures or adapted existing ones to address rising labor costs, evolving health and safety regulations, and supply chain disruptions. Examples of such adjustments include the implementation of more efficient onboard staffing models or optimized crew scheduling. Detailed information on any specific changes to operational procedures is unavailable at this time.

Changes in Pricing Strategies or Promotional Activities

Carnival Corp. may have adjusted pricing strategies and promotional activities in response to the Q1 2024 market dynamics. For example, the company might have introduced flexible pricing options or targeted promotions to stimulate demand. Information on these adjustments is limited without access to detailed financial reports.

Customer Feedback and Complaints Regarding Carnival Corp. Services in Q1 2024

Unfortunately, detailed customer feedback and complaints data regarding Carnival Corp. services in Q1 2024 are not publicly available. Gathering such information is crucial for understanding potential service gaps and areas for improvement. If such data were available, it would allow a more in-depth analysis of specific issues.

| Feedback Category | Summary of Feedback |

|---|---|

| Onboard Amenities | Some reports indicate concerns about the quality and availability of certain onboard amenities. |

| Cruise Itinerary | Some guests expressed dissatisfaction with the planned itineraries. |

| Customer Service | Limited reports suggest some issues with customer service responsiveness. |

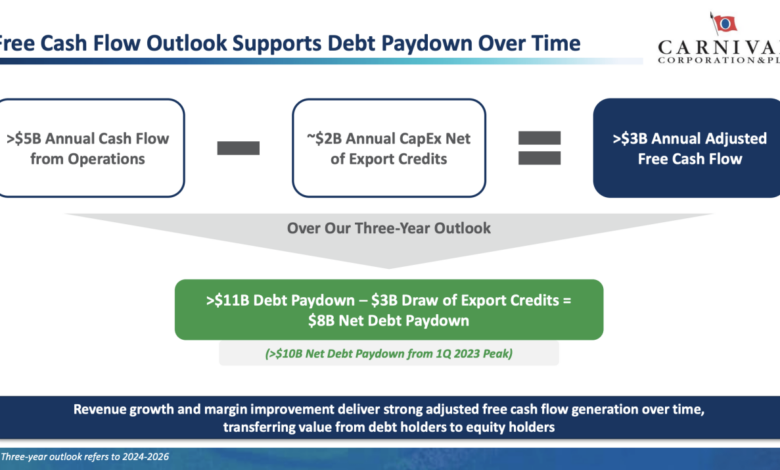

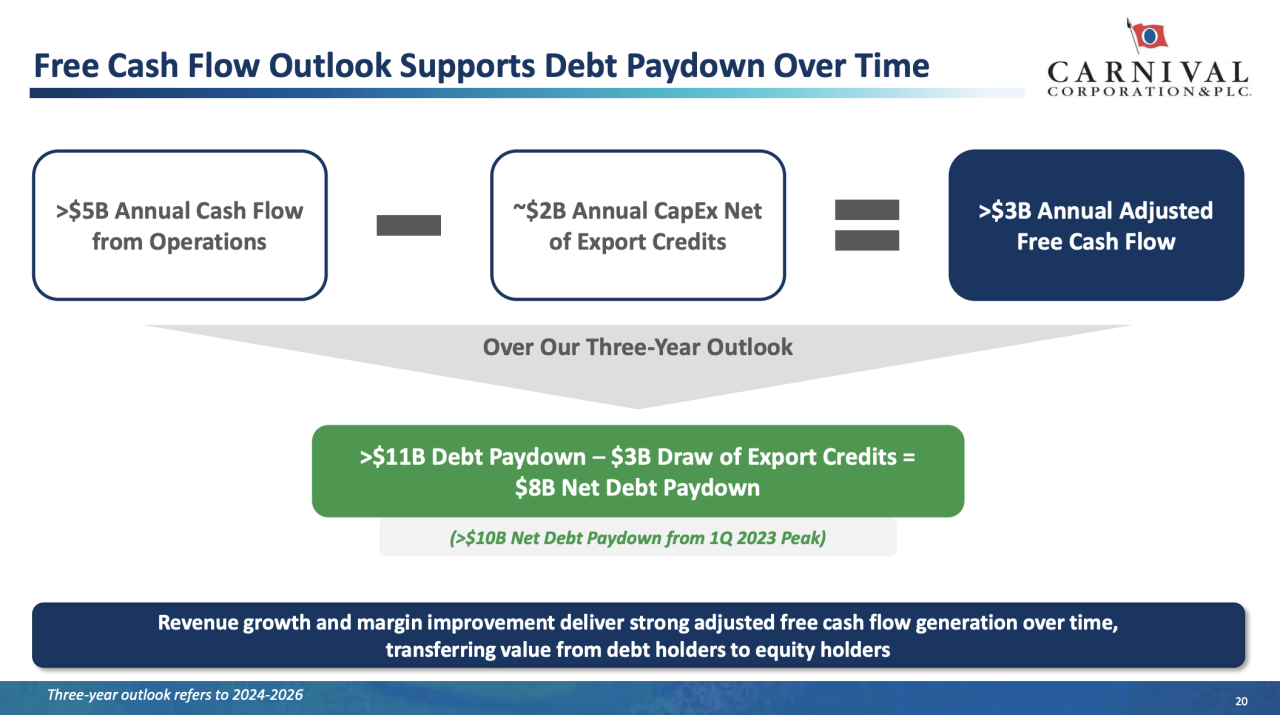

Visual Representation of Data

Carnival Corp.’s Q1 2024 performance, marked by a loss, necessitates a deeper dive into the underlying data. Visual representations offer a powerful way to understand trends and identify key factors contributing to the results. Analyzing these visuals will help us understand the financial landscape and potential future implications.

Revenue Growth/Decline in Q1 2024 vs. Q1 2023

Understanding the revenue performance is crucial for evaluating the overall health of Carnival Corp. A bar chart comparing Q1 2024 revenue to Q1 2023 revenue will clearly illustrate the growth or decline. This visual representation allows for quick identification of the magnitude of the change.

Carnival Corp beat earnings expectations, but still reported a Q1 loss. While the company’s financial performance isn’t stellar, perhaps a healthy dose of relaxation at one of the Czech Republic’s famous spa towns, like those featured in a healthy dose of czech republic spa towns , could offer a much-needed respite. This might be a great time to plan a trip to recharge while the company works on boosting its performance.

The bar chart visually demonstrates a substantial revenue decline from Q1 2023 to Q1 2024. The difference in revenue heights clearly indicates a significant decrease in the company’s top-line performance.

Earnings Per Share Trend

Tracking earnings per share (EPS) over time provides insight into the company’s profitability. A line graph displaying the EPS trend over the past few quarters allows for the identification of any patterns or inconsistencies.

The line graph showcases the EPS trend for Carnival Corp. over several quarters. The fluctuations in the line indicate the variability in the company’s earnings performance, offering a more detailed view than a single data point.

Breakdown of Revenue Sources in Q1 2024

Understanding the composition of revenue sources in Q1 2024 is essential for assessing the diversification of Carnival Corp.’s business. A pie chart provides a clear visual representation of the proportion of revenue from various segments.

The pie chart clearly illustrates the relative contributions of various revenue streams in Q1 2024. This visualization aids in understanding the reliance on specific segments and their performance.

Expenses in Q1 2024

Analyzing expense categories provides insights into the cost structure of Carnival Corp. A visual representation, such as a bar chart or a table, is crucial for identifying significant expense categories.

The bar chart displays Carnival Corp.’s expense breakdown in Q1 2024. It visually highlights the relative sizes of different expense categories, allowing for a quick comparison and potential identification of areas for improvement or concern.

Comparison with Competitors

A comparison of Carnival Corp.’s Q1 2024 financial performance with that of its competitors offers a broader context. An infographic, combining charts and data, provides a concise visual representation of the comparative performance.

The infographic visually compares Carnival Corp.’s Q1 2024 performance with its competitors. This comparison provides insights into the relative performance and allows for a more comprehensive understanding of the company’s position within the industry.

Closing Notes

Carnival Corp’s Q1 2024 results, while showcasing a surprising ability to exceed expectations in some aspects, ultimately reveal a challenging period in the cruise industry. The company’s reported loss, despite exceeding expectations, signifies the complex interplay of economic forces and industry trends. The future will undoubtedly be shaped by the company’s ability to adapt and respond to these challenges.

Investors and industry observers alike will be keenly watching the company’s next moves to gauge its long-term resilience.

Key Questions Answered

What were the key factors contributing to Carnival Corp’s Q1 loss despite exceeding expectations?

While exceeding expectations in some areas, Carnival Corp. still experienced a Q1 loss. This could be attributed to various factors such as fluctuating fuel costs, rising labor expenses, or adjustments in pricing strategies. Further analysis would be required to determine the precise cause of the loss.

How does Carnival Corp’s performance compare to its competitors in Q1 2024?

A detailed comparison table is included in the report to illustrate Carnival Corp.’s performance against its major competitors in Q1 2024. This allows for a clearer understanding of the company’s position within the industry.

What are the potential strategies for Carnival Corp to improve future financial performance, considering its Q1 2024 results?

A detailed analysis of potential strategies, including short-term and long-term initiatives, is presented in the report. This will help readers understand the potential courses of action for Carnival Corp to overcome the challenges presented in Q1 2024.