Carnival Corp Adjusts Yield Projections Impact & Implications

Carnival Corp adjusts yield projections, signaling potential shifts in the cruise industry. This adjustment likely reflects a variety of factors, impacting everything from future revenue to investor confidence. The company’s decision to adjust these projections suggests a nuanced understanding of the current economic landscape and evolving consumer behavior within the cruise sector. We’ll delve into the reasons behind the adjustment, potential consequences, and the broader implications for the cruise industry as a whole.

Carnival Corp’s recent adjustments to their yield projections are significant, hinting at a potential shift in the cruise industry. This adjustment suggests the company is responding to factors such as economic uncertainty, consumer preferences, and the competitive landscape. Understanding these factors is crucial for assessing the potential implications of this change and how it could impact the company’s future performance.

Background of Carnival Corporation

Carnival Corporation & plc is the world’s largest cruise operator, a global company with a significant presence in the travel and leisure sector. Its history is marked by continuous expansion and diversification, leveraging the growing popularity of cruising. The company’s financial performance and strategic decisions have a substantial impact on the cruise industry worldwide.Carnival’s current financial standing reveals a complex picture.

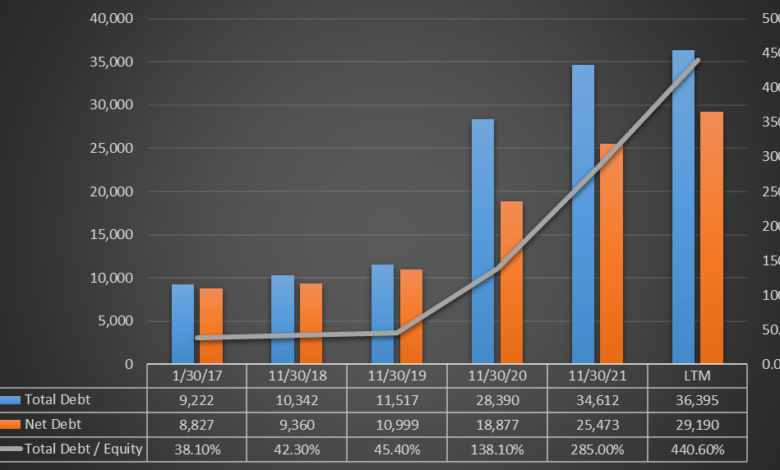

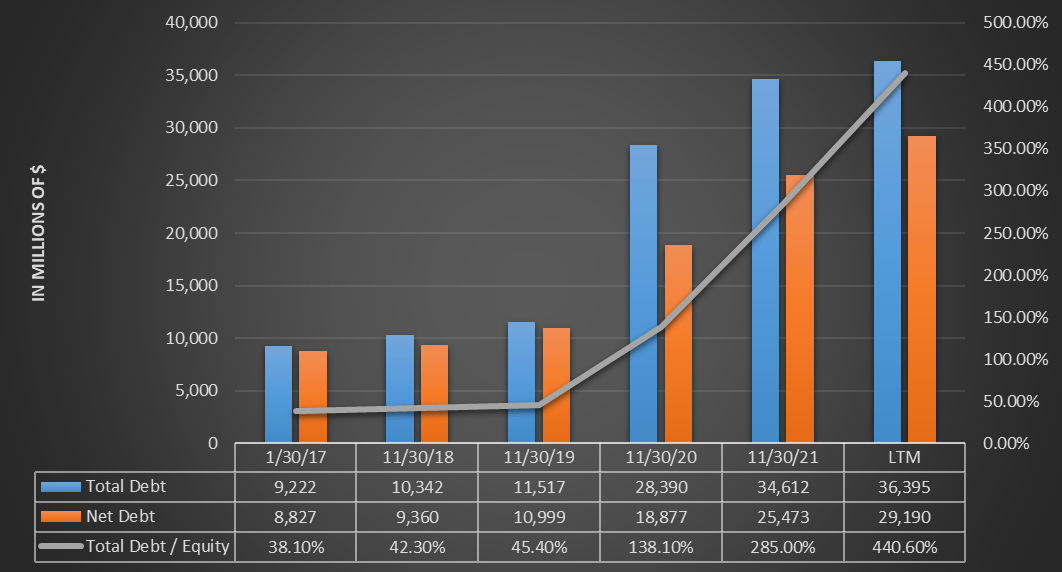

While experiencing revenue growth, profitability margins are influenced by fluctuating fuel prices, port costs, and the unpredictable nature of consumer spending in the travel sector. Debt levels are a significant consideration, reflecting the substantial capital investments required to maintain a global fleet and infrastructure. The company’s financial position necessitates careful management and strategic decision-making to ensure long-term sustainability.

Major Cruise Lines

Carnival Corporation owns a diverse portfolio of cruise brands. This variety allows for catering to different segments of the market, from budget-conscious travelers to luxury vacation seekers. The significant brands under the Carnival Corporation umbrella include Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, and Costa Cruises. Each brand offers unique experiences and caters to specific customer preferences.

- Carnival Cruise Line: Known for its affordability and family-friendly atmosphere.

- Princess Cruises: Positioned as a mid-range cruise line, offering a balance of value and luxury.

- Holland America Line: Known for its more mature demographic and focus on exploration and historical destinations.

- Seabourn: A luxury cruise line specializing in high-end accommodations and personalized service.

- Costa Cruises: A significant presence in Europe, particularly popular with European travelers.

The company’s ownership of multiple brands ensures a robust presence across various price points and market segments.

Recent Performance Trends

Carnival Corporation’s recent performance in the cruise industry has been characterized by a dynamic interplay of recovery and challenges. The industry has experienced significant fluctuations, including periods of disruption due to the pandemic and subsequent economic uncertainties. The company’s performance has been affected by these factors, showing adaptation to the changing landscape and resilience to overcome hurdles. Recent reports highlight a steady return to pre-pandemic levels of passenger volume, yet profitability has been affected by ongoing inflation and supply chain issues.

Market Position and Competitive Landscape

Carnival Corporation dominates the global cruise market. Its extensive fleet, diverse brand portfolio, and global network give it a substantial market share. However, the competitive landscape is highly dynamic, with emerging cruise lines and the ever-evolving preferences of travelers. Rival cruise companies, both established and new entrants, constantly present challenges and opportunities for the company. Maintaining its market position requires constant innovation, strategic adaptation, and maintaining a keen awareness of the competitive environment.

Understanding Yield Projections

Yield projections are crucial for cruise companies like Carnival Corp. They represent the anticipated revenue generated per passenger, a key metric for profitability. Accurate projections allow the company to forecast future earnings, manage resources effectively, and make informed decisions about pricing and operational strategies. Understanding the factors driving these projections is vital for investors and stakeholders to assess the company’s financial health and future prospects.Yield projections in the cruise industry are not simply guesses.

They are carefully calculated estimates based on complex data analysis, market trends, and expected customer behavior. This allows the company to strategically position itself within the market. This analysis informs pricing strategies, marketing campaigns, and ultimately, the company’s financial performance.

Defining Yield Projections in the Cruise Industry

Yield projections in the cruise industry represent the anticipated revenue per passenger, calculated as the total revenue generated from a cruise divided by the total number of passengers. This metric is vital in assessing the profitability of a cruise voyage.

Factors Influencing Yield Projections

Several factors influence yield projections. Demand fluctuations, pricing strategies employed by the company and competitors, and external economic conditions all play significant roles. Customer preferences, seasonal variations, and special promotions also impact the anticipated revenue per passenger.

- Demand Fluctuations: Changes in demand for cruise vacations can dramatically affect projections. High demand typically leads to higher yields, while low demand necessitates adjustments in pricing and marketing strategies. For example, if there is a surge in interest in cruises to the Caribbean, this will increase the demand and could lead to higher yields.

- Pricing Strategies: Carnival’s pricing strategies, including introductory offers, dynamic pricing models, and tiered pricing options, directly impact the projected yield. Strategies like offering discounts for booking in advance or for certain demographics can either increase or decrease the projected yield. A successful pricing strategy is often dependent on the company’s understanding of its target audience.

- Competitor Actions: Competitor activities, such as new route launches, promotional offers, or service enhancements, significantly affect yield projections. Competitor pricing decisions and marketing campaigns need to be considered when developing yield projections.

- External Economic Conditions: External economic factors, like inflation, currency fluctuations, and global events, can significantly affect consumer spending and travel patterns. A recession or economic uncertainty often reduces travel spending, leading to lower projected yields.

- Customer Preferences: Understanding customer preferences for amenities, dining options, onboard activities, and destinations is essential for optimizing pricing strategies and maximizing yield projections. If a cruise company is aware of its customers’ preferences, it can tailor its pricing and onboard offerings to better meet their needs, thus boosting yield.

Methods Used to Project Yields

Several methods are employed to project yields. These methods typically involve sophisticated modeling techniques, utilizing historical data and market analysis. Companies often use statistical modeling, forecasting algorithms, and market research to arrive at their projections.

- Statistical Modeling: Statistical models, such as regression analysis, can be used to predict yields based on historical data and relevant variables, like occupancy rates, booking patterns, and pricing strategies.

- Forecasting Algorithms: Sophisticated forecasting algorithms can be applied to predict yields based on trends in customer behavior, competitor actions, and economic indicators. These algorithms often use machine learning techniques to identify patterns in large datasets.

- Market Research: Market research data, encompassing surveys, focus groups, and competitor analysis, provide valuable insights into consumer preferences and pricing sensitivities. This information is crucial for refining yield projections.

Key Metrics Used to Measure Yield Performance

Several key metrics are used to measure yield performance. These metrics provide insights into the effectiveness of pricing strategies and the overall health of the business.

- Average Revenue Per Passenger (ARP): This metric represents the average revenue generated per passenger and is a crucial indicator of profitability. High ARP values typically indicate strong performance.

- Occupancy Rate: The occupancy rate measures the percentage of available cabins occupied on a cruise. A high occupancy rate often suggests strong demand and contributes to higher yield projections.

- Average Price Per Cabin: This metric reflects the average price paid for a cruise cabin. It’s a critical component in determining the overall revenue per passenger.

Historical Trends of Carnival Corp’s Yield Projections

Carnival Corp. has experienced fluctuations in yield projections over time, reflecting the dynamic nature of the cruise industry. Economic downturns, competitor actions, and changes in consumer preferences have all impacted their projections. Examining historical data reveals patterns in yield trends and allows for a better understanding of potential future performance.

Analysis of Adjustment Reasons

Carnival Corporation’s yield projections are dynamic, reflecting the ever-shifting landscape of the cruise industry. Understanding the rationale behind adjustments is crucial for investors and stakeholders alike. These adjustments often stem from a complex interplay of factors, making it imperative to delve deeper into the potential causes.Yield projections, in essence, are forward-looking estimates of revenue per passenger. Adjustments to these projections can signal shifts in anticipated demand, pricing strategies, and market conditions.

The reasons for these adjustments can be categorized into several key areas, including economic factors, consumer behavior, supply chain challenges, and competitive pressures. Analyzing these factors allows for a more nuanced understanding of the company’s financial outlook.

Potential Economic Factors

Economic downturns or uncertainties can significantly impact travel spending. Reduced disposable income can lead to a decrease in leisure activities, including cruises. For instance, during the 2008 financial crisis, travel and leisure spending plummeted, directly affecting cruise lines’ revenue. Conversely, a robust economic climate, with increased consumer confidence and disposable income, could lead to an upward adjustment in yield projections.

Analysis of historical economic data and current economic forecasts is critical in predicting potential adjustments.

Changing Consumer Behavior

Consumer preferences and travel habits are constantly evolving. Emerging trends in cruise preferences, such as alternative itineraries or specific onboard amenities, can influence demand and thus yield projections. If Carnival Corporation identifies a shift in consumer preferences towards more luxurious or eco-friendly cruises, they might adjust their projections upward to reflect higher-priced options. Conversely, if a significant segment of the market moves away from cruises due to new trends, the company might adjust their yield projections downward.

Market research and customer surveys are key tools in identifying and responding to evolving consumer preferences.

Supply Chain Disruptions

Global supply chain disruptions can affect cruise operations in numerous ways, impacting yield projections. Challenges in securing necessary supplies, such as food, fuel, or crew members, can lead to increased costs, impacting the pricing strategy and consequently, the projected yields. For example, a prolonged global chip shortage could affect the availability of critical parts for cruise ships, leading to reduced fleet capacity and lower yields.

Conversely, improvements in supply chain efficiency could lead to reduced costs and increased profitability, allowing for upward adjustments to yield projections. Supply chain analysis and risk assessments are critical for accurately forecasting yield projections.

Competitor Actions

The competitive landscape of the cruise industry is dynamic. Aggressive pricing strategies by competitors, the introduction of new cruise itineraries or offerings, or changes in marketing strategies by competitors can influence Carnival Corporation’s pricing strategies and yield projections. For instance, a competitor launching a promotional campaign could impact Carnival’s pricing strategy and result in downward pressure on yields.

Carnival Corp. recently adjusted its yield projections, a move that’s got industry watchers buzzing. This adjustment might be influenced by the recent news that Brooks and Dunn, country music legends, have moved into the area, which could potentially boost tourism and local economies. Ultimately, the yield adjustments at Carnival Corp. remain a key factor in the company’s future financial performance.

Likewise, a competitor’s financial difficulties or strategic retreat from the market could offer opportunities for Carnival to capture market share and adjust projections upwards. Monitoring competitor activities, pricing strategies, and market share data is crucial in anticipating potential adjustments to yield projections.

Carnival Corp’s recent adjustment to yield projections is interesting, especially considering the vibrant atmosphere of Brussels kicking off European Pride celebrations. With the festivities in full swing, it’s likely that travel demand in the region is experiencing a boost, which could impact Carnival’s projected earnings. This, in turn, might affect their future cruise pricing strategies. Ultimately, Carnival’s yield projections will need to adapt to these dynamic market shifts, and the ongoing European Pride celebrations are likely playing a role.

Sources of Information for Yield Projection Adjustments

Carnival Corporation likely draws upon a range of data sources to adjust yield projections. These sources include, but are not limited to:

- Market research data: Analyzing consumer trends, preferences, and willingness to pay for various cruise options.

- Economic forecasts: Studying current and future economic indicators, including GDP growth, inflation rates, and unemployment.

- Competitor analysis: Evaluating pricing strategies, marketing campaigns, and market share data of competitors.

- Supply chain assessments: Identifying potential disruptions and assessing their impact on operational costs.

Analyzing the interplay of these factors is essential for understanding the rationale behind yield projection adjustments.

Impact on Financial Performance: Carnival Corp Adjusts Yield Projections

Carnival Corporation’s adjusted yield projections hold significant implications for its future financial performance. These adjustments, reflecting anticipated market dynamics and potential shifts in consumer behavior, necessitate a careful reassessment of the company’s revenue and earnings outlook. The projections’ influence extends beyond immediate financial results, impacting investment strategies and long-term strategic plans.

Potential Effects on Revenue and Earnings

The adjusted yield projections directly influence Carnival Corp’s projected revenue. Lower yields translate to lower expected revenue, impacting the company’s overall earnings. This impact is not uniform across all segments, with some experiencing greater effects than others, depending on the specific cruise line and pricing strategy. A decrease in expected revenue necessitates a proactive approach to cost management and operational efficiency to mitigate potential losses.

Influence on Investment Decisions

Investors will carefully scrutinize the adjusted yield projections when making investment decisions. Lower projections may deter some investors, potentially impacting the stock price. Conversely, strategic investors who anticipate positive market responses to Carnival’s adjusted strategy may see the change as an opportunity. A thorough understanding of the underlying rationale behind the adjustments is crucial for informed investment decisions.

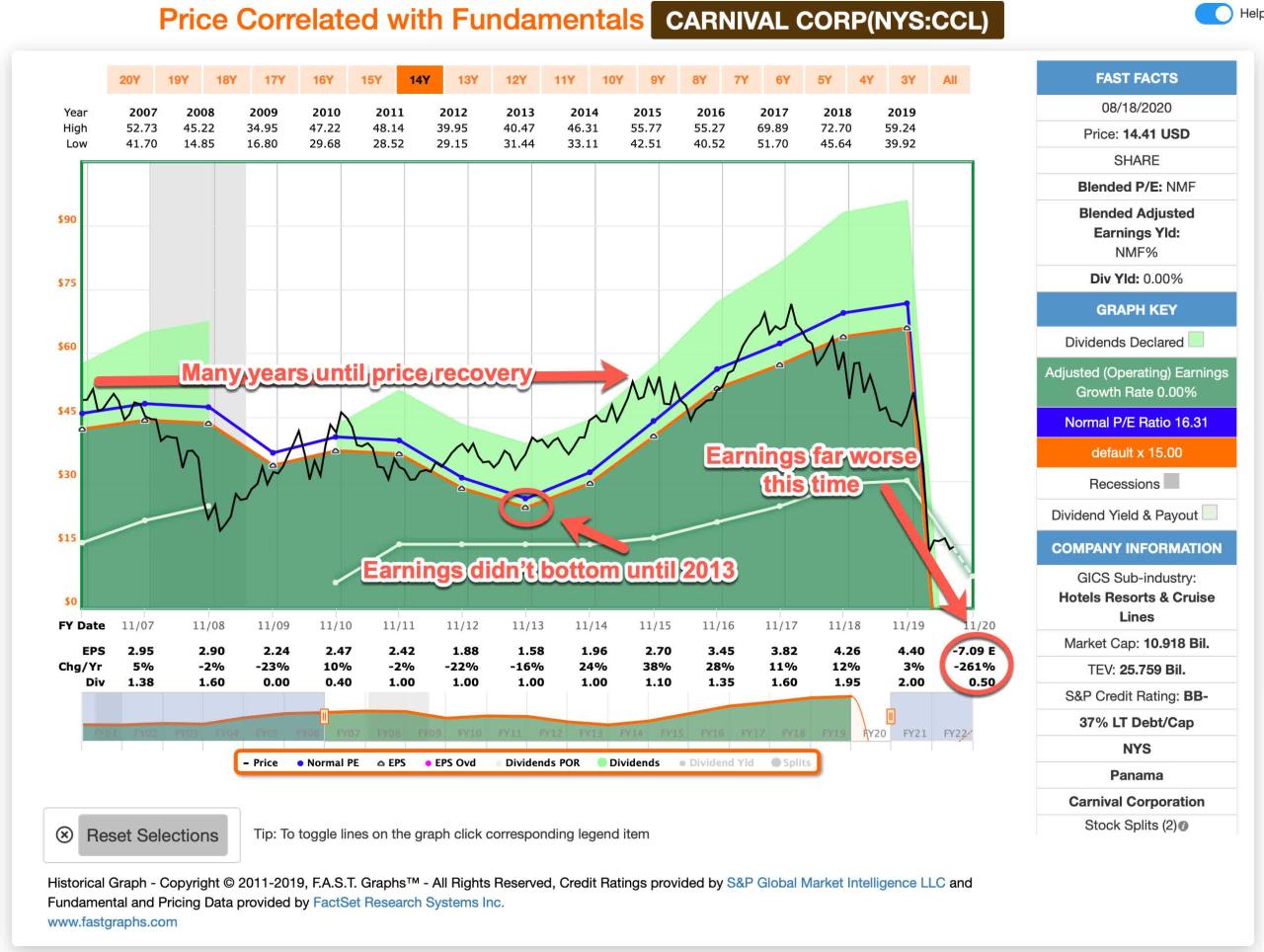

Impact on Stock Price

A significant downward revision to yield projections can negatively impact Carnival Corp’s stock price. Investors often react to negative news with immediate price adjustments. The degree of impact depends on several factors, including the magnitude of the projection change, the overall market sentiment, and investor confidence in the company’s management and future strategies.

Impact on Strategic Plans

Carnival Corp’s strategic plans are intrinsically linked to its yield projections. The adjustments will require a review and potential recalibration of existing plans, potentially leading to shifts in marketing strategies, pricing models, or even vessel deployment. Management may need to explore new market segments or adjust pricing strategies to compensate for lower-than-expected yields. This adaptation may involve a reassessment of current vessel capacities, routes, or investment strategies.

Comparative Analysis of Projected Revenue

The table below demonstrates how different yield scenarios affect projected revenue. These figures are hypothetical and do not represent specific financial projections from Carnival Corp. They are illustrative examples, highlighting the impact of various yield assumptions.

| Yield Scenario | Projected Revenue (USD Billions) | Difference from Baseline (USD Billions) |

|---|---|---|

| Baseline Yield | $25.0 | 0 |

| Low Yield (Scenario 1) | $22.5 | -$2.5 |

| High Yield (Scenario 2) | $27.5 | +$2.5 |

Note: Baseline Yield represents the original yield projection. Low Yield (Scenario 1) assumes a 10% decrease in yields, while High Yield (Scenario 2) assumes a 10% increase. These are illustrative examples only.

Implications for the Cruise Industry

Carnival Corp’s recent adjustment to yield projections has significant implications for the entire cruise industry. This adjustment, reflecting shifting market dynamics and consumer preferences, is likely to ripple through the sector, impacting pricing strategies, booking patterns, and the overall financial health of other cruise lines. Understanding these implications is crucial for investors, industry analysts, and consumers alike.

Industry-Wide Ripple Effects

The adjustments made by Carnival Corp, a major player in the cruise market, are likely to influence the pricing strategies of other cruise lines. Competition in the cruise industry is intense, and competitors will likely respond to Carnival’s adjustments, potentially leading to a cascade of price adjustments throughout the market. This dynamic pricing environment will affect consumer perceptions of value and potentially impact booking patterns across the board.

Potential Changes in Consumer Behavior

Carnival Corp’s yield adjustments might prompt consumers to reassess their cruise choices. If other cruise lines follow suit with similar adjustments, consumers could exhibit price sensitivity, potentially shifting their travel plans to seek more affordable options. For example, if the cost of a Carnival cruise increases significantly, consumers might opt for alternative vacations like all-inclusive resorts or shorter, domestic trips.

This could also lead to an increased demand for last-minute deals and discounts, as consumers seek the best value for their money.

Impact on Future Cruise Bookings

The adjusted yield projections will likely affect future cruise bookings. If consumers perceive a significant increase in cruise prices, they might delay booking or opt for alternative vacation options. This could impact the revenue projections for cruise lines and influence their capacity planning for future seasons. For instance, if projections indicate a decline in demand, cruise lines might adjust their itineraries or reduce capacity to match anticipated bookings.

Alternatively, if the adjusted yields lead to an increase in demand, lines might increase their capacity.

Carnival Corp’s recent adjustment to yield projections might seem a bit daunting, but maybe a relaxing getaway at aqua nicaragua eco resort offers unplugged escape is just the ticket to regain perspective. After all, a change in travel plans could be a great opportunity to explore something new and revitalize the mind, ultimately helping to navigate these market shifts with renewed enthusiasm.

It all goes back to finding that perfect balance, and Carnival’s projections might just be a stepping stone to that equilibrium.

Comparison with Competitor Adjustments

It’s crucial to analyze how other major cruise lines respond to Carnival Corp’s yield adjustments. A direct comparison of their pricing strategies and adjustments will provide a clearer picture of the industry’s reaction. If competitors mirror Carnival’s adjustments, it could signal a broader trend in the market. For example, if Royal Caribbean also adjusts their pricing downwards in response to Carnival’s upward adjustment, it would indicate a more significant and widespread shift in the market.

Alternatively, if competitor adjustments are minimal or non-existent, it would suggest that Carnival’s adjustment is a more isolated response to specific market factors.

Potential Shifts in Cruise Line Strategies, Carnival corp adjusts yield projections

Carnival’s adjustments may compel other cruise lines to reassess their strategies. This could involve adjusting their marketing campaigns to highlight value-based offers, focusing on specific demographics, or introducing new products and services to appeal to a wider range of consumers. For instance, a cruise line might introduce new onboard activities or amenities to differentiate itself from competitors and attract customers seeking more engaging experiences.

Such adjustments would depend on the specifics of the yield adjustment and the response of consumers.

Market Reaction and Investor Sentiment

Carnival Corporation’s adjusted yield projections have significant implications for investor sentiment. The shift in anticipated profitability will undoubtedly affect how the market perceives the company’s future performance and the cruise industry as a whole. Investors will scrutinize the reasoning behind the adjustments, evaluating the validity of the underlying assumptions and the potential impact on Carnival’s long-term financial health.

Potential Market Reactions

The market’s response to the adjusted yield projections will likely be multifaceted. A cautious approach is expected, with investors assessing the implications of the revised projections on Carnival’s earnings trajectory and the broader cruise industry. Some investors might interpret the adjustments as a sign of potential vulnerability in the industry, potentially leading to a sell-off in Carnival’s stock.

Conversely, a more optimistic segment of investors might see the adjustments as a realistic reflection of the current market conditions, potentially triggering a more measured reaction. A significant portion of investors may wait for further clarification and analysis before making any definitive judgments.

Investor Reactions Summary

Investors will likely react to the adjusted yield projections in diverse ways. Some will be concerned about the implications for future profitability, leading to a decrease in investor confidence. Others might view the adjustments as a necessary recalibration, reflecting the current realities of the market. Uncertainty and a cautious approach are expected, as investors assess the company’s ability to adapt to the evolving market conditions.

Carnival Corp’s recent adjustment to yield projections is interesting, especially considering the historical context of travel. For example, exploring the wartime history at the Hanoi Sofitel Legend Plaza, a fascinating hotel with a rich past, might offer some insight into the complexities of tourism during turbulent times. This historical perspective, found in places like at hanoi sofitel legend a peek at wartime history , could help us understand the current challenges and potential opportunities in the travel industry.

Ultimately, these yield projections will be key to Carnival Corp’s future success, and understanding past events can illuminate their path forward.

Impact on Investor Confidence in the Cruise Industry

The adjustments in yield projections will inevitably influence investor confidence in the broader cruise industry. If the adjustments are perceived negatively, it could trigger a sell-off in other cruise-related stocks, potentially impacting the entire industry’s valuation. Conversely, if the adjustments are seen as a pragmatic response to market dynamics, investor confidence might remain relatively stable, albeit with a degree of caution.

Carnival Corp is adjusting its yield projections, which is definitely interesting. Thinking about how that impacts the entire operation, it got me thinking about a day in the life of a high-profile executive chef, like the one profiled in a day in the life hal executive chef. Their meticulous planning and attention to detail likely mirrors the careful strategy behind these yield adjustments, ultimately affecting the bottom line for the company.

The cruise industry’s reputation for resilience and adaptation will play a crucial role in shaping investor sentiment.

Potential Short-Term and Long-Term Impacts on Investor Sentiment

The impact on investor sentiment will vary based on the perceived validity of the yield adjustments and the overall market conditions.

| Impact | Short-Term | Long-Term |

|---|---|---|

| Positive | Increased scrutiny and potential temporary decrease in stock price. Investors will seek more information and clarification. | Potential long-term stability if the adjustments are seen as a necessary recalibration and the company demonstrates resilience and adaptation. |

| Negative | Sharp drop in stock price, heightened investor anxiety, and possible negative media coverage. | Significant decline in investor confidence in the cruise industry, leading to decreased valuations of cruise-related stocks. |

Influence on Future Valuation of Carnival Corp’s Stock

The adjusted yield projections will undoubtedly influence the future valuation of Carnival Corp’s stock. If the adjustments are perceived as a reliable reflection of the current market conditions and the company’s ability to adapt, the stock valuation might remain stable or even increase. However, if the adjustments are perceived negatively, leading to a sell-off and diminished investor confidence, the stock valuation could significantly decrease.

The long-term impact depends on the company’s response and the industry’s resilience.

Illustrative Scenarios

Carnival Corporation’s yield projections are a critical indicator of its financial health. Understanding how these projections might change, and the resulting impact on the company, is essential for investors and analysts. Illustrative scenarios allow us to explore potential outcomes and prepare for various market conditions.

Potential Scenarios for Adjusted Yield Projections

The adjusted yield projections offer a range of potential outcomes. These scenarios are not definitive predictions, but rather tools to assess the impact of various factors.

| Scenario | Description | Impact on Yield Projections |

|---|---|---|

| Scenario 1: Moderate Decline | Passenger demand remains robust, but slightly below expectations. Inflationary pressures and competitor pricing impact revenue slightly. | Yields decline by 5-7%. |

| Scenario 2: Significant Decline | Economic downturn or unexpected events (e.g., geopolitical instability) significantly impact consumer spending. Demand plummets, and competitor pricing strategies intensify. | Yields decline by 10-15%. |

| Scenario 3: Gradual Recovery | The economic climate stabilizes, and consumer confidence gradually increases. Demand shows signs of improvement, and pricing strategies adapt to the new market dynamics. | Yields recover by 3-5% over the next 6-12 months. |

| Scenario 4: Accelerated Recovery | A surge in consumer spending and positive market sentiment drive a strong increase in passenger demand. Pricing strategies align with increased demand. | Yields increase by 8-12%. |

Impact on Carnival Corp’s Financial Outlook

The adjusted yield projections have direct implications for Carnival Corp’s financial performance. These impacts are multifaceted and depend heavily on the severity and duration of the projection adjustments.

| Scenario | Impact on Revenue | Impact on Profit Margins | Impact on Cash Flow |

|---|---|---|---|

| Scenario 1: Moderate Decline | Reduced revenue by 5-7%. | Profit margins slightly reduced. | Cash flow potentially reduced, but manageable. |

| Scenario 2: Significant Decline | Reduced revenue by 10-15%. | Significant reduction in profit margins. | Cash flow significantly reduced, potentially impacting debt servicing. |

| Scenario 3: Gradual Recovery | Gradual increase in revenue. | Profit margins recover slowly. | Cash flow improves incrementally. |

| Scenario 4: Accelerated Recovery | Significant increase in revenue. | Profit margins significantly improved. | Strong cash flow generation. |

Illustrative Scenario: Downward Adjustment in Yield Projections

A downward adjustment in yield projections signals a potential challenge for Carnival Corp. To illustrate, consider a significant decline (Scenario 2) where yield projections are reduced by 12%. This could lead to reduced revenue and potentially lower profitability.

“Carnival Corp might respond by implementing cost-cutting measures, such as reducing operational expenses or renegotiating contracts. They might also consider strategic partnerships to gain access to new markets or explore innovative ways to increase demand.”

The company might also proactively adjust its pricing strategies to maintain profitability. This could involve offering discounts or promotions to attract passengers. Furthermore, a detailed financial analysis would be conducted to assess the full impact of the reduced yields and the required adjustments to the business strategy.

Last Point

Carnival Corp’s adjustment of yield projections has significant implications for both the company and the broader cruise industry. The decision to adjust projections suggests a proactive response to current market conditions. While the adjustment introduces uncertainty, a careful analysis of the factors behind the change and the potential scenarios Artikeld can help investors and industry observers navigate the evolving landscape.

We’ve explored potential market reactions, financial impacts, and industry-wide ripples, highlighting the multifaceted nature of this adjustment.

User Queries

What is the typical timeframe for yield projections in the cruise industry?

Yield projections are typically created several months in advance and then reviewed and updated regularly based on changing market conditions.

How do competitor actions affect Carnival Corp’s yield projections?

Competitor actions, such as pricing strategies and promotional offers, directly influence demand and pricing dynamics, impacting Carnival Corp’s yield projections.

What are some potential consumer behaviors that might impact yield projections?

Consumer behavior changes, such as shifts in travel preferences or price sensitivity, can dramatically impact demand and consequently, yield projections.

Can you explain how supply chain disruptions impact yield projections for Carnival Corp?

Disruptions in the supply chain, such as port closures or delays in provisioning, can affect operational costs and, subsequently, yield projections.