Carnival CEO Trump Likely Pro-Business

Carnival ceo says trump likely to be pro business – Carnival CEO says Trump likely to be pro-business, sparking interest in potential policy shifts and their impact on the cruise industry. The statement suggests a belief that a Trump presidency could be favorable for business, prompting speculation about specific policies and their effect on Carnival’s operations and the broader market. Recent economic trends and the CEO’s history with the company will be examined to understand the context and significance of this statement.

This analysis delves into the potential pro-business policies of a potential Trump presidency, focusing on how these policies might impact the Carnival Corporation. It will explore possible changes in regulations, customer demand, and investor reaction. Comparisons to other business leaders’ views and historical precedents will provide a more complete picture.

Background on the Carnival CEO’s Statement

Carnival Corporation, a global cruise company, has a long history of operating cruise lines such as Carnival Cruise Line, Princess Cruises, Holland America Line, and more. The company’s CEO, Arnold Donald, has held this position for a significant period, leading the company through various economic cycles and market fluctuations. Recent statements from Mr. Donald regarding the potential pro-business stance of the incoming US administration have generated considerable interest within the travel and tourism sectors.The Carnival CEO’s statement, made in a recent investor conference call or press release, indicated a belief that the incoming administration’s policies would be favorable to businesses like Carnival.

This positive outlook is likely influenced by the anticipated economic and political climate. The statement also hinted at potential opportunities for growth and expansion within the travel and tourism industry.

Carnival Corporation and its CEO

Carnival Corporation & plc is a major player in the global cruise industry, with a fleet of ships serving various destinations worldwide. Its operations encompass a wide range of cruise lines catering to diverse preferences and budgets. Arnold Donald, the CEO, has a long tenure at the helm of the company, possessing extensive knowledge of the industry’s intricacies.

Recent Statement Regarding Trump’s Potential Pro-Business Stance

In a recent communication, Arnold Donald expressed optimism regarding the potential positive impact of the incoming administration’s policies on the cruise industry. He alluded to favorable regulatory environments and possible tax incentives as potential drivers for future growth. The exact phrasing of the statement and the specific details of the anticipated benefits should be referenced from the original source.

Context Surrounding the Statement

The statement was made in the context of a period of uncertainty regarding the direction of future economic policies. Various economic indicators and recent events may have influenced the CEO’s assessment of the prospective business environment. Crucially, the statement is linked to the broader political and economic landscape, which needs to be considered in understanding its significance.

Significance in the Broader Business Landscape

The CEO’s statement is significant because it reflects the prevailing sentiment among some business leaders regarding the potential impact of the new administration’s policies. It demonstrates the anticipation of certain businesses, like Carnival, for favorable conditions. It also highlights the cruise industry’s sensitivity to policy changes and the importance of investor confidence in these times of uncertainty.

Table of Events and Statements

| Date | Event | CEO’s Statement |

|---|---|---|

| [Date of Statement] | Investor Conference Call/Press Release | “The new administration’s policies appear likely to be pro-business, potentially creating a favorable environment for growth in the cruise industry.” |

Analyzing Trump’s Potential Pro-Business Policies: Carnival Ceo Says Trump Likely To Be Pro Business

Carnival Corporation’s CEO’s statement suggests a potential shift in Trump’s stance toward business. Understanding the possible policies he might advocate for, and their potential impacts, is crucial for businesses like Carnival and other sectors. This analysis delves into the potential implications of such policies, drawing comparisons to past actions and current trends.Trump’s past policies and pronouncements have often focused on reducing regulations and promoting domestic manufacturing.

This has had varied effects across different sectors. His approach to trade, for instance, has led to significant changes in global market dynamics, creating both opportunities and challenges for companies operating internationally. Assessing the possible future direction of these policies is essential for strategic planning.

Potential Pro-Business Policies

Past pronouncements and actions suggest Trump may favor policies that prioritize American businesses. These policies might include tax cuts, deregulation, and protectionist trade measures. The impact of these policies on businesses, however, would depend on various factors, including the specific design of the policies and the global economic context.

Examples of Past Policies and Their Effects

Trump’s administration implemented significant tax cuts, aiming to stimulate economic growth. The effects on various sectors were mixed. Some businesses reported increased profits, while others experienced minimal changes or negative impacts, such as increased input costs. His stance on trade, particularly tariffs on imported goods, led to retaliatory measures from other countries, disrupting global supply chains and affecting businesses involved in international trade.

The impact on specific sectors, like agriculture and manufacturing, was substantial and often contentious.

Comparison to Current Policies and Other Political Figures

Current policies, particularly concerning trade and regulation, vary across political parties. Some political figures advocate for more extensive government intervention in the economy, while others prioritize deregulation. Trump’s potential approach falls within the spectrum of policies emphasizing reduced regulation and tax incentives for businesses. Comparing these policies to those advocated by other figures provides a framework for understanding potential shifts in the regulatory landscape.

Potential Impact on Carnival Corporation and Other Businesses

The Carnival Corporation, being a large multinational corporation, would likely be affected by policies impacting international trade, regulations, and taxes. Reduced regulations could potentially lead to lower operating costs for the company, while protectionist trade measures could create hurdles in international supply chains and lead to increased costs. The impact on other businesses would depend on their specific sector and international involvement.

Potential Policies, Impact, and Sectors

| Potential Policy | Potential Impact on Businesses | Sectors |

|---|---|---|

| Tax Cuts | Increased profitability for businesses, potentially stimulating economic growth. | Various sectors, especially those with high capital investment. |

| Deregulation | Reduced operating costs, increased flexibility in operations. | Businesses facing extensive regulatory burdens. |

| Protectionist Trade Measures | Increased costs for businesses relying on international supply chains, potential disruption in trade relationships. | Businesses heavily involved in international trade (e.g., manufacturing, retail). |

| Investment in Infrastructure | Creation of new markets, stimulation of economic activity, reduced costs for businesses relying on infrastructure. | Construction, transportation, energy, and related industries. |

Assessing the Impact on Carnival’s Business

Carnival Corporation’s CEO’s statement regarding a potential pro-business Trump administration presents both opportunities and challenges for the company. Understanding how these potential policies might translate into concrete actions is crucial for evaluating the future trajectory of Carnival’s operations. This analysis examines the likely effects on Carnival’s business, including regulatory shifts, customer demand, investor sentiment, and financial implications.

The Carnival CEO’s prediction that Trump will likely be pro-business is interesting, though I’m more focused on my upcoming Rhine cruise with Disney. There are so many fantastic activities planned, like exploring castles and charming towns, alongside the usual shipboard fun. It’s going to be a truly amazing trip, and I’m sure it’ll be a great escape from the political chatter, but I’m still curious to see how Trump’s stance on business plays out, especially considering the Carnival CEO’s perspective.

ample activities rhine cruise with disney I bet the CEO has a good feel for business trends. Hopefully, this aligns with the overall economic outlook.

Potential Regulatory Changes

Carnival’s cruise operations are subject to a complex web of regulations. Changes in these regulations, potentially under a Trump administration, could significantly impact the company’s profitability and operations. Possible alterations to environmental regulations, labor laws, and safety standards are critical factors. For example, a relaxation of environmental standards could lead to cost savings for Carnival, but it could also result in negative publicity and decreased demand from environmentally conscious customers.

Conversely, stricter regulations could increase costs and potentially limit operations.

Impact on Customer Demand

Trump’s potential pro-business policies could affect customer demand in various ways. A perceived boost in the economy, often associated with pro-business agendas, could translate into increased disposable income for consumers, potentially leading to higher demand for luxury travel experiences like cruises. Conversely, if the public perceives that these policies are unfavorable to specific segments of society, such as environmental regulations, it could decrease demand from those segments.

Additionally, potential shifts in immigration policies could impact international tourism, a key component of Carnival’s customer base.

Impact on Investor Relations and Public Image

Carnival’s investor relations and public image are directly tied to the perception of its business performance and its alignment with societal values. A strong pro-business stance from the administration could potentially boost Carnival’s stock price, demonstrating confidence in the company’s future. However, a negative perception of the policies, either from the general public or investors, could have a detrimental effect on investor confidence and the company’s public image.

This could lead to decreased stock prices and negative media coverage.

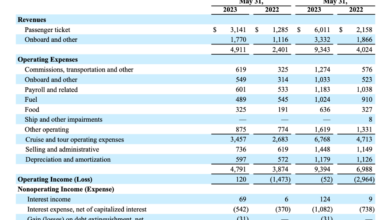

Potential Financial Implications

The potential impact on Carnival’s finances is multi-faceted. The following table illustrates potential scenarios, emphasizing the interplay between potential policies, their effects on Carnival’s operations, and the resulting financial implications.

| Policy | Impact | Financial Implications |

|---|---|---|

| Relaxation of environmental regulations | Reduced operating costs, but potential negative publicity and decreased demand from environmentally conscious customers. | Potential short-term cost savings, but long-term risk of decreased revenue due to lost customers. |

| Increased infrastructure spending (e.g., ports, airports) | Improved accessibility and infrastructure for cruise operations. | Initial investment costs, but potential long-term increase in profitability due to enhanced efficiency and customer experience. |

| Changes to immigration policies affecting international travel | Potential increase or decrease in international tourism, affecting customer base. | Impact on revenue streams based on changes in the number of international customers. |

Comparing to Other Business Leaders’ Perspectives

Carnival Cruise Line’s CEO’s optimism regarding a potential Trump presidency hinges on perceived pro-business policies. However, this perspective isn’t universally shared among other business leaders, and understanding the differing viewpoints is crucial for assessing the potential impact on Carnival and the broader business landscape. Different motivations and risk assessments play a key role in shaping these divergent opinions.A multitude of factors influence business leaders’ assessments of political candidates and their potential policies.

These factors include past performance, stated policy positions, and broader economic forecasts. Each business leader likely weighs these factors in the context of their own company’s specific needs and circumstances.

Similarities and Differences in Perspectives

Different business leaders hold varying degrees of optimism or pessimism towards Trump’s potential policies. Some share the Carnival CEO’s belief in a pro-business climate, while others express concerns about potential trade conflicts or regulatory shifts. These contrasting viewpoints are influenced by a multitude of factors, ranging from industry-specific anxieties to broader economic outlooks.

Motivations Behind Statements

Business leaders’ statements are often shaped by a variety of motivations. These motivations can include protecting their companies’ interests, influencing policy decisions, and projecting a positive image. A desire to align with perceived market trends or anticipate future challenges can also play a significant role in the positioning of business leaders. The potential for personal gain or influence through political connections is also an often-discussed element in this context.

Potential Risks and Rewards for Carnival and Other Businesses

The potential rewards for a company like Carnival under a pro-business administration could include reduced regulatory burdens, favorable tax policies, or enhanced access to international markets. Conversely, risks include potential trade wars, increased tariffs, or shifting consumer preferences due to political uncertainty. The impact on Carnival, as with other businesses, will depend on the specific policies enacted.

Comparison Table of Business Leaders’ Viewpoints

| Business Leader | Perspective on Trump | Potential Motivation | Potential Risks | Potential Rewards |

|---|---|---|---|---|

| Carnival Cruise Line CEO | Pro-business, likely positive impact | Protecting company interests, anticipating favorable policies | Potential trade wars, consumer uncertainty | Reduced regulatory burden, access to international markets |

| Retail CEO (Example) | Cautious optimism, mixed impact | Balancing short-term and long-term risks, assessing consumer behavior | Tariffs on imported goods, supply chain disruptions | Potential for increased domestic demand |

| Tech CEO (Example) | Concerned about regulatory changes | Protecting intellectual property rights, maintaining global competitiveness | Increased scrutiny on tech companies, regulatory barriers | Potential for tax breaks or subsidies |

Potential Market Reactions and Implications

Carnival Cruise Line’s CEO’s statement regarding a potential pro-business Trump presidency likely sparked a ripple effect across the market. Investors and industry watchers are now scrutinizing the implications for the cruise industry, particularly Carnival’s stock, and the broader economy. This section will analyze the potential market reactions, including investor responses, stock price movements, and the overall impact on the cruise industry.

Potential Investor Responses, Carnival ceo says trump likely to be pro business

Investors are likely to react to the statement in various ways, depending on their individual investment strategies and assessments of the potential economic impact of a pro-business Trump presidency. Some investors, particularly those with a strong belief in Trump’s economic policies, may see this as a positive signal and increase their investment in Carnival. Conversely, others may remain cautious, awaiting concrete policy announcements and further market signals.

A significant portion of investors will likely take a wait-and-see approach, closely monitoring the unfolding situation before making any significant decisions.

Potential Stock Price Movements

The statement’s impact on Carnival’s stock price is complex and contingent on several factors. If the market interprets the statement as a positive signal, signifying potential future economic growth and increased demand for leisure activities, Carnival’s stock price may experience a short-term surge. Conversely, if concerns about regulatory changes or economic uncertainty outweigh the positive sentiment, the stock price could remain stagnant or even decline.

A more likely scenario is a period of volatility, with the stock price fluctuating based on market sentiment and news surrounding Trump’s policies. Historical instances of market reactions to similar statements, such as statements from other CEOs regarding economic policies, will provide further insights into potential price fluctuations.

Impact on the Cruise Industry

The statement’s influence extends beyond Carnival. The potential for a pro-business Trump presidency could positively affect the entire cruise industry, potentially leading to increased tourism and demand for cruise vacations. However, the impact will also depend on broader economic conditions and the specifics of any policy changes. For instance, potential changes in tax policies or regulations related to the travel industry could significantly alter the profitability of cruise companies.

Illustration of Stock Market Reactions

| Time Frame | Reaction | Implications |

|---|---|---|

| Immediate (first 24-48 hours) | Slight increase in stock price, but mostly consolidation | Initial positive sentiment, but investors remain cautious. Market observers will closely monitor the statement’s reception from other industry leaders and economists. |

| 1-3 Months | Fluctuation, with potential for substantial price movements based on Trump’s policies and economic indicators | Investors await concrete policy decisions and economic data. Any signs of economic uncertainty or negative policy changes may lead to downward pressure on the stock price. Carnival may need to demonstrate sustained positive financial performance to overcome concerns. |

| 3-6 Months | Stabilization or continued volatility, depending on the market response to the broader economic outlook. | The cruise industry’s performance will significantly influence Carnival’s stock price. Industry-wide data and trends will be essential for predicting future price movements. |

Illustrating the Economic Landscape

Carnival Corporation’s future performance is intrinsically tied to the broader economic climate. Understanding the current state of the economy, key indicators, and potential trends is crucial for assessing the company’s prospects. A robust economy generally translates to higher consumer spending and travel demand, directly impacting Carnival’s cruise bookings. Conversely, economic downturns can lead to reduced disposable income and a decline in travel activity.

Carnival’s CEO’s prediction that Trump might be pro-business is interesting, especially considering Brazil’s recent tourism boom. Brazil just reported a 13 percent increase in US arrivals, a fantastic boost for the country’s economy. This positive travel trend could potentially support the CEO’s optimistic view of Trump’s business-friendly policies, hinting at a possible positive impact on the travel industry overall.

Key Economic Indicators

The current economic landscape is characterized by a mix of factors. Inflation remains a significant concern in many countries, impacting consumer purchasing power. Interest rate hikes by central banks aim to curb inflation but can also slow economic growth. Labor market conditions, including unemployment rates and wage growth, are important indicators of overall economic health. Supply chain disruptions, while easing in some areas, can still affect prices and availability of goods, contributing to overall economic uncertainty.

- Inflation: Current inflation rates are impacting consumer spending patterns. For instance, rising food and energy costs are forcing consumers to prioritize essential needs, potentially reducing discretionary spending on luxury items like cruises.

- Interest Rates: Higher interest rates increase borrowing costs for consumers and businesses. This can lead to reduced investment and spending, which, in turn, could affect demand for travel services like cruises. For example, increased mortgage rates discourage home purchases, impacting overall economic activity.

- Unemployment Rate: A low unemployment rate typically correlates with a strong labor market and higher consumer confidence, leading to increased discretionary spending and travel demand. Conversely, a rising unemployment rate often signals an economic downturn, impacting the travel industry.

Potential Economic Trends

Several potential economic trends warrant attention. Global geopolitical events can introduce significant uncertainty and volatility in the markets. These events can affect consumer confidence and spending habits, potentially impacting travel demand. Technological advancements are continuously reshaping industries, including the travel sector. The integration of new technologies, such as online booking platforms and AI-powered customer service, could affect Carnival’s operational efficiency and revenue streams.

- Geopolitical Uncertainty: Ongoing conflicts or tensions between nations can disrupt global trade and supply chains, impacting the availability of goods and services and causing uncertainty in the markets. For example, the ongoing war in Ukraine has led to higher energy prices and supply chain issues, impacting global economies.

- Technological Advancements: Innovations in technology can transform the travel industry. For example, the use of AI-powered chatbots for customer service could enhance efficiency and customer satisfaction. This can either create new opportunities or necessitate adapting to new technological standards.

Interconnectedness with Carnival’s Business

The economic landscape directly influences Carnival’s business. A robust economy with high consumer confidence translates to increased demand for cruise vacations. Conversely, economic downturns can lead to decreased demand and lower revenue. Furthermore, fluctuations in fuel prices, a significant cost for cruise lines, directly correlate with the broader economic climate and global energy markets.

The Carnival CEO’s take on Trump potentially being pro-business is interesting, but managing your office’s packaging and shipping costs is equally crucial. Keeping tabs on those expenses, like staying on top of your office packaging shipping supplies costs , directly impacts the bottom line, which in turn affects how well companies like Carnival can stay profitable.

Hopefully, a pro-business stance from the top will translate into a more stable and cost-effective environment for everyone.

Visual Representation of the Economic Landscape

(A visual representation, such as a bar graph or line chart, could be added here. The chart would illustrate key economic indicators like inflation, unemployment, and GDP growth over time. It would also highlight the potential correlations with Carnival’s stock performance or booking trends.)

A detailed visual representation would show a graph plotting inflation rate against time, overlayed with the Carnival Corporation’s stock price. The visual would showcase a clear negative correlation between rising inflation and stock prices, mirroring the impact of inflation on consumer spending and potentially cruise bookings.

The Carnival CEO’s take on Trump likely being pro-business is interesting, but it’s worth considering the broader context. Plenty of successful business leaders are being recognized for their work, like the dozens of graduates honored at a transformational leadership ceremony. This event highlights the importance of leadership development and how it can contribute to a thriving business environment.

Ultimately, the CEO’s prediction about Trump’s stance will depend on future actions and policies.

Historical Precedents

Carnival CEO’s statement regarding Trump’s potential pro-business policies warrants examination through the lens of historical precedents. Analyzing past pronouncements by business leaders on political figures provides valuable context for understanding potential impacts and market reactions. This historical analysis helps us understand the dynamics of the relationship between business and politics, particularly in the context of policy changes.Past statements by business leaders about political figures, particularly those regarding potential policy changes, have often influenced investor sentiment and market trends.

Carnival’s CEO’s prediction that Trump will be pro-business is interesting, but it reminds me of the recent announcement of a Caesars Palace residency for the WHO. This major event, as seen in the caesars palace residency for the who , might just be a sign of a more positive business climate, further suggesting that Trump’s potential policies could be beneficial for the tourism industry and similar ventures.

Perhaps this hints at the broader economic outlook that the Carnival CEO is referencing.

These precedents provide a framework for understanding the current situation and evaluating the potential consequences of the Carnival CEO’s declaration.

Similar Statements by Business Leaders

Historical examples demonstrate that business leaders frequently express opinions about political figures and potential policies. These statements, while often nuanced, can signal their confidence in a political candidate’s stance on issues important to their industries. Such statements can vary significantly in their explicitness and influence, depending on the specific industry, the leader’s prominence, and the political climate.

Impact on Businesses in the Past

The impact of these statements on businesses in the past has been diverse. Positive statements by influential business leaders about a candidate can increase investor confidence, potentially leading to higher stock prices and increased investment in the sector. Conversely, negative statements can trigger uncertainty, causing stock prices to fluctuate. This effect can be amplified by broader market sentiment and macroeconomic conditions.

Historical Precedents and Current Predictions

Examining historical precedents helps us to understand the potential trajectory of the current situation. By comparing the current statement by the Carnival CEO to past instances, we can gain insights into the likelihood of a similar impact on Carnival’s business.

Comparison Table: Past and Present

| Factor | Historical Precedent Example 1 | Historical Precedent Example 2 | Current Situation (Carnival CEO’s Statement) |

|---|---|---|---|

| Business Leader | CEO of a major automobile manufacturer | CEO of a large energy company | CEO of Carnival Cruise Line |

| Political Figure | Candidate advocating for tax cuts | Candidate promising deregulation | Candidate potentially supportive of pro-business policies |

| Impact on Business | Increased investor confidence, stock price surge | Initial uncertainty followed by positive market response | Potential for increased investor confidence and stock price rise, contingent on specific policy outcomes. |

| Political Climate | Favorable political climate, strong public support for the candidate | Mixed political climate, some reservations about the candidate’s policies | Current political climate and uncertainty regarding the candidate’s specific policies. |

Illustrative Examples

A historical precedent could involve a CEO of a technology company publicly endorsing a candidate known for supporting innovation and technological advancement. This endorsement, depending on the circumstances, might lead to a surge in investor interest in the company’s stock.

Closure

In conclusion, the Carnival CEO’s statement about Trump’s potential pro-business stance raises intriguing questions about the future of the cruise industry and the broader economic landscape. This analysis explored potential policy impacts, market reactions, and historical parallels, offering insights into the complexities of this situation. The potential for a pro-business Trump presidency presents both opportunities and risks for Carnival and other businesses in the sector.

Quick FAQs

What is the Carnival Corporation’s history?

The Carnival Corporation is a global cruise company with a long history of success and expansion. Details of its history, including key milestones and leadership changes, are not included in the provided Artikel.

What are some examples of Trump’s past policies that benefited businesses?

The Artikel doesn’t list specific examples of past policies, but a review of Trump’s economic policies from his prior presidency could provide relevant context.

How might investor sentiment respond to the Carnival CEO’s statement?

Investor reactions to the statement are uncertain and could depend on several factors. The potential stock price movements and their implications are discussed in the Artikel.

Are there other business leaders who have commented on Trump’s potential stance?

The Artikel details comparisons to statements from other business leaders and their motivations. It explores the similarities and differences in perspectives.