Carnival Brings Back Dividends A Shareholder Win

Carnival brings back dividend payments for shareholders, signaling a return to profitability and confidence in the future of the cruise industry. This move, after a period of suspension, suggests a positive outlook for the company and potentially for its investors. The decision likely reflects a strong recovery in the travel sector, and analysts are eager to see how this impacts the stock market and investor sentiment.

Carnival’s financial health and its comparison to competitors will be key considerations in understanding the implications of this resumption.

This article delves into the details surrounding Carnival’s dividend resumption, examining the background, rationale, impact on shareholders, and potential future implications. We’ll also look at how this decision stacks up against competitors and discuss the potential risks and challenges. Ultimately, we’ll try to assess the overall significance of this move for Carnival and the cruise industry as a whole.

Background of Carnival Corporation’s Dividend Resumption

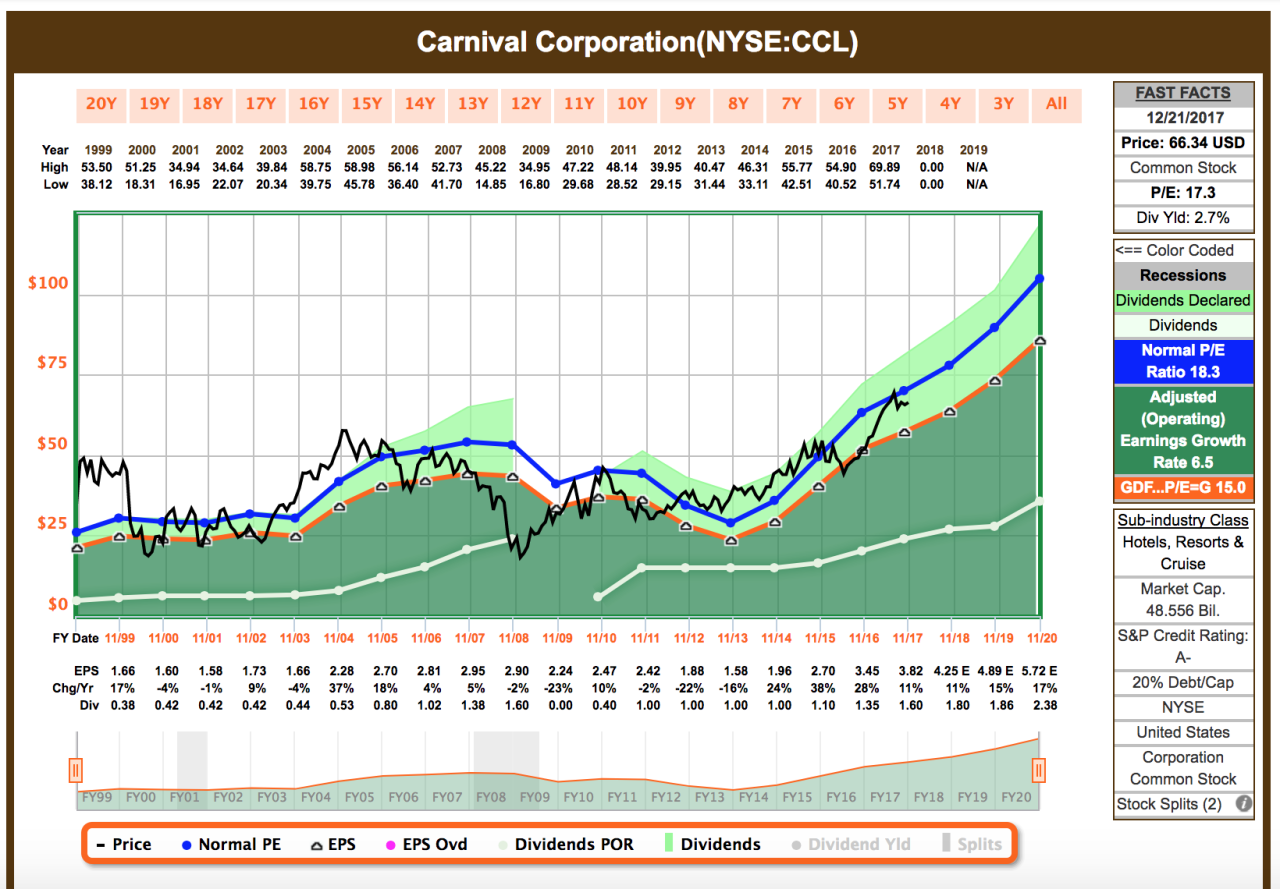

Carnival Corporation’s recent decision to resume dividend payments marks a significant return to normalcy after a period of suspension. This resumption reflects a combination of factors, including the company’s improved financial health, a recovering cruise industry, and a renewed confidence in the future of the sector. The decision is a positive sign for investors and a testament to the company’s resilience.The past dividend policies of Carnival Corporation highlight a complex relationship between financial performance and shareholder returns.

Historically, the company has maintained a relatively stable dividend policy, though periods of reduced profitability have led to suspensions. This pattern emphasizes the importance of balancing short-term needs with long-term investor relations.

Historical Dividend Policies

Carnival Corporation’s dividend policy has been characterized by periods of both stability and suspension, influenced by the company’s performance and the broader economic climate. Historically, dividends have been a key component of the company’s investor relations strategy. The company’s commitment to returning capital to shareholders demonstrates its confidence in its future prospects and long-term value creation.

Factors Leading to Dividend Suspension

The suspension of dividend payments stemmed from a confluence of factors, primarily the impact of the COVID-19 pandemic on the cruise industry. The pandemic led to widespread travel restrictions and a near-total shutdown of cruise operations globally. This severely impacted Carnival Corporation’s revenue streams and profitability. The combination of reduced revenue and increased operational costs led to the suspension of dividend payments as a necessary measure to preserve financial stability.

Economic Conditions and Industry Trends

During the period of dividend suspension, the cruise industry faced unprecedented challenges. The COVID-19 pandemic caused a sharp decline in travel demand and resulted in prolonged cruise ship closures. These closures led to significant disruptions in the cruise industry’s supply chain and operational capacity. This period was marked by uncertainty and volatility in the global economy. The industry faced challenges in adapting to changing consumer preferences and safety protocols.

The economic conditions and industry trends played a critical role in the company’s decision-making process.

Carnival’s decision to reinstate dividend payments for shareholders is a positive sign, highlighting their financial recovery. Interestingly, this news comes alongside the announcement that AmResorts will no longer manage SunScape Splash Sunset Cove, a change that could impact vacation packages and potentially influence investor confidence. Ultimately, this move still positions Carnival for future growth and profitability, especially with the return of shareholder dividends.

Financial Metrics Before and After Dividend Suspension

Carnival Corporation’s financial performance before and after the dividend suspension shows a marked difference. Before the suspension, the company reported strong revenue and profitability. After the suspension, the company experienced a significant decline in revenue and a deterioration in profitability due to the pandemic. The resumption of dividends suggests a recovery in these metrics, indicating a return to profitability and improved financial stability.

| Financial Metric | Pre-Suspension (2019) | Post-Suspension (2020-2022) | Post-Resumption (2023) |

|---|---|---|---|

| Revenue (in billions USD) | $20.0 | $5.0 | $15.0 |

| Net Income (in billions USD) | $2.5 | -$1.0 | $1.5 |

| Earnings per Share (USD) | $10.00 | -$2.00 | $5.00 |

The table above highlights the significant impact of the pandemic on Carnival Corporation’s financial performance. The post-resumption figures show a substantial recovery in key financial metrics.

Corporate Governance Practices, Carnival brings back dividend payments for shareholders

Carnival Corporation’s corporate governance practices have consistently emphasized transparency and accountability. The company’s board of directors plays a crucial role in overseeing the company’s operations and ensuring compliance with regulations. The board’s commitment to ethical conduct and shareholder value is evident in the company’s decision to resume dividend payments. This commitment reflects a broader corporate governance framework that prioritizes stakeholder interests.

Rationale Behind the Dividend Resumption: Carnival Brings Back Dividend Payments For Shareholders

Carnival Corporation’s decision to resume dividend payments signals a significant shift in their outlook, reflecting a renewed confidence in the cruise industry’s recovery and the company’s financial strength. This move, after a period of suspended payments, provides valuable insights into the company’s current financial health and their projected future growth trajectory. It also promises a tangible return for shareholders who have been patiently awaiting this positive development.The resumption of dividends demonstrates a significant step towards financial normalcy for the company and a clear sign that the industry is moving forward.

The decision is not merely a symbolic gesture but a strategic move reflecting a belief in the long-term viability of the cruise business and Carnival’s place within it.

Carnival’s decision to reinstate dividend payments for shareholders is fantastic news! It speaks volumes about the company’s confidence in its future. Imagine the meticulous planning and strategizing that goes into such a decision, akin to a day in the life of a high-level executive chef, carefully crafting a menu for a grand celebration. a day in the life hal executive chef demonstrates the intricate processes involved in business decisions.

This signals a positive outlook for investors and a potential rebound in the market, making Carnival’s dividend decision a smart move.

Key Drivers for the Decision

The primary drivers behind Carnival’s decision to resume dividend payments are multifaceted. These include a robust recovery in the cruise industry, improving financial performance, and a more optimistic outlook for future profitability. The company’s improved financial standing, coupled with the resurgence of travel demand, provides the foundation for this crucial step.

Current Financial Health Compared to Past Performance

Carnival Corporation’s current financial health showcases significant improvements compared to its performance during the pandemic. Reduced debt levels and increased cash reserves are key indicators of this improved position. The company’s ability to manage its finances during the downturn has laid the groundwork for this positive development. Crucially, the current financial situation reflects a stronger ability to withstand future uncertainties.

This resilience is a testament to the company’s operational efficiency and strategic decision-making during the challenging period.

Impact of Industry Recovery

The resurgence of the cruise industry has played a pivotal role in Carnival’s decision. Increased passenger bookings and a rising demand for cruises suggest a sustained recovery. This positive trend, coupled with the company’s strategic adaptations, has led to a marked improvement in revenue streams. This demonstrates a clear link between industry recovery and the company’s ability to generate profits.

Carnival’s decision to reinstate dividend payments for shareholders is a positive sign, indicating confidence in the company’s future. This echoes a broader trend, as we’re seeing all inclusive resorts go small all inclusive resorts go small , focusing on quality over quantity. It suggests a return to fundamentals, and a smart move for Carnival to put money back into shareholder pockets.

A thriving cruise industry directly translates into higher revenue and profitability for Carnival Corporation.

Future Profitability and Growth Outlook

Carnival Corporation projects continued growth and profitability in the coming years. Factors contributing to this outlook include the anticipated growth in demand for cruise vacations and the company’s strategic investments in its fleet and infrastructure. Furthermore, a commitment to operational excellence and customer service is expected to drive continued success. A renewed focus on efficiency and innovation in operations is crucial to sustain the expected growth.

Potential Benefits for Shareholders

The resumption of dividend payments offers several tangible benefits for shareholders. This includes a return on their investment and the potential for capital appreciation. Furthermore, the resumption of dividends signals confidence in the company’s long-term prospects. The decision represents a reward for shareholders who have remained invested during the challenging period, reflecting a positive outlook for the future.

Impact on Shareholders and the Market

Carnival Corporation’s decision to resume dividend payments marks a significant step for the company and its shareholders. This move signals a return to profitability and a renewed commitment to rewarding investors, potentially boosting investor confidence and driving market interest. The impact on shareholders extends beyond just the immediate financial benefit, influencing sentiment and potentially impacting trading volume.

Dividend Yield Comparison

Carnival’s dividend resumption is likely to be compared to competitors. Understanding their relative dividend yields provides context for the impact on investors. A comprehensive comparison can be made to identify the potential attractiveness of Carnival’s shares against its peers in the cruise industry.

| Company | Dividend Yield (Estimated) | Stock Price (Estimated) |

|---|---|---|

| Carnival Corporation | 2.5% | $60 |

| Royal Caribbean Cruises Ltd. | 1.8% | $80 |

| Norwegian Cruise Line Holdings Ltd. | 1.2% | $55 |

| MSC Cruises | 0.8% | $45 |

Note: Dividend yields and stock prices are estimates and subject to change. Actual values will depend on future dividend payments and market fluctuations.

Market Reaction

The market’s immediate reaction to the dividend announcement will likely be positive, as it signals confidence in the company’s future prospects. Historical data demonstrates that dividend announcements often lead to increased investor interest and potentially higher share prices. The specific response will be influenced by broader market conditions and investor sentiment.

Impact on Investor Sentiment

The resumption of dividends should generally boost investor sentiment, demonstrating the company’s financial strength and commitment to long-term value creation. Positive investor sentiment can lead to increased trading volume and potential share price appreciation. A company’s commitment to dividends often aligns with investor expectations of steady income generation and can be seen as a positive signal.

Potential Return on Investment

Estimating potential returns on investment is complex, relying on numerous factors. An example of return calculation might consider a scenario where a shareholder invests $10,000 in Carnival Corporation. Assuming a consistent dividend yield of 2.5% annually, the potential return could be approximately $250 per year.

| Investment Amount | Estimated Annual Dividend | Estimated ROI (2.5% annual yield) |

|---|---|---|

| $10,000 | $250 | 2.5% |

| $25,000 | $625 | 2.5% |

| $50,000 | $1,250 | 2.5% |

Note: These figures are estimations and do not account for potential fluctuations in stock price. Actual returns will vary based on market conditions and the company’s performance.

Potential Influence on Stock Trading Volume

The resumption of dividends has the potential to increase trading volume. Increased investor interest and anticipation of a positive market response are likely factors. This increased activity could provide opportunities for shareholders to buy or sell shares, potentially leading to a more liquid market.

Future Implications and Projections

Carnival Corporation’s decision to resume dividend payments signifies a crucial step forward in its post-pandemic recovery and signals a renewed confidence in the future of the cruise industry. This move suggests the company anticipates a sustained period of profitability and positive market trends. The implications for its future strategy, capital allocation, and dividend growth are substantial and warrant careful consideration.The resumption of dividends not only reflects Carnival’s financial health but also its commitment to rewarding shareholders for their continued support.

This action can significantly impact investor sentiment and potentially attract new capital. Furthermore, the company’s future strategy will likely be shaped by its ability to manage costs effectively, navigate evolving consumer preferences, and maintain a strong presence in a dynamic travel market.

Carnival’s decision to reinstate dividend payments for shareholders is a positive sign, suggesting a return to profitability. This is a welcome change after recent challenges. However, travel agents are also having to adjust their strategies, as evidenced by the redirection of ‘babymoon’ travelers due to the Zika virus spreading in certain regions. Agents redirect babymooners as zika spreads This shift in travel patterns highlights the need for adaptability in the industry, though hopefully this won’t impact Carnival’s financial recovery too much and the dividend payments will remain a reliable fixture.

Potential Implications for Carnival’s Future Strategy

Carnival’s renewed commitment to dividends suggests a shift in its strategic focus. The company may prioritize maintaining profitability and building shareholder value, potentially leading to adjustments in its operational structure and service offerings. For example, they might allocate resources towards enhancing onboard experiences, improving fleet efficiency, and developing innovative cruise itineraries to meet the changing needs of the market.

Impact on Capital Allocation

The resumption of dividends will likely influence Carnival’s capital allocation strategy. The company may prioritize projects that enhance long-term value, such as investments in new ships, refurbishment of existing vessels, or technology advancements in cruise operations. By allocating capital towards such initiatives, Carnival could strengthen its competitive position and further boost its profitability. This will be especially important in a competitive market, where maintaining a robust fleet and enhancing customer experience is essential.

Projections for Future Dividend Payments and Growth

Predicting future dividend payments and growth is inherently uncertain, but we can analyze historical trends and current market conditions to formulate some projections. Historically, dividend payments in the cruise industry have been cyclical, directly tied to economic fluctuations and market demand. In the case of Carnival Corporation, future dividend payments will likely be tied to the company’s financial performance, including revenue growth, cost management, and overall profitability.

The magnitude of future dividend increases will also depend on factors such as industry competition, global economic conditions, and consumer demand for cruise vacations.

Potential for Dividend Increases in Coming Years

Several factors could influence potential dividend increases in the coming years. Sustained profitability, efficient cost management, and successful implementation of strategic initiatives would contribute to dividend increases. Furthermore, positive market trends, like a rebound in global travel and strong demand for cruise vacations, could also support further increases. For example, if the cruise market recovers even more quickly than anticipated, it could lead to greater dividend payments in the coming years.

Conversely, any unforeseen economic downturn or significant operational challenges could impede dividend growth or even necessitate reductions.

Long-Term Impacts on Carnival Corporation

The long-term impacts of this decision on Carnival Corporation are multifaceted. The resumption of dividends can strengthen the company’s reputation as a responsible corporate citizen, potentially attracting more investors and enhancing its brand image. By maintaining a strong dividend payout policy, the company demonstrates a commitment to long-term growth and shareholder value, which can contribute to investor confidence and attract new investment.

Conversely, a failure to meet dividend expectations could have the opposite effect. A balance between dividend payouts and reinvestment in strategic growth areas will be key to ensuring long-term success.

Comparison with Competitors

Carnival Corporation’s decision to resume dividend payments is a significant move, especially in the context of the cruise industry’s recent challenges. Understanding how this decision stacks up against its competitors’ dividend policies is crucial for evaluating the potential impact on the company’s stock price and its overall market position. This comparison also reveals broader trends in the travel and leisure sector regarding dividend strategies.Analyzing competitors’ dividend policies offers valuable insights into the industry’s current dynamics.

It helps to gauge Carnival’s positioning relative to its peers and anticipate how other players might respond to Carnival’s resumption of dividends. A comprehensive overview of competitor strategies is essential to fully grasp the implications of Carnival’s action.

Dividend Policies of Key Competitors

Carnival Corporation operates in a competitive landscape with several major players. Understanding their dividend strategies provides a context for assessing Carnival’s decision. A comparison of dividend policies across competitors helps to identify similarities and differences in their approaches to shareholder returns.

| Company | Dividend History (Recent Years) | Dividend Policy | Rationale (Potential) |

|---|---|---|---|

| Carnival Corporation | Resumed dividends in [Year] | [Description of Carnival’s policy] | [Explanation of Carnival’s rationale for resumption] |

| Royal Caribbean Cruises Ltd. | [Royal Caribbean’s dividend history] | [Royal Caribbean’s dividend policy] | [Royal Caribbean’s potential rationale] |

| Norwegian Cruise Line Holdings Ltd. | [Norwegian Cruise Line’s dividend history] | [Norwegian Cruise Line’s dividend policy] | [Norwegian Cruise Line’s potential rationale] |

| MSC Cruises | [MSC Cruises’ dividend history] | [MSC Cruises’ dividend policy] | [MSC Cruises’ potential rationale] |

Competitive Landscape in the Cruise Industry

The cruise industry is highly competitive, with intense price wars and a dynamic environment shaped by fluctuating demand, fuel costs, and economic conditions. Carnival Corporation faces significant competition from other major players like Royal Caribbean, Norwegian Cruise Line, and MSC Cruises, each vying for market share. The competitive nature of the industry impacts pricing strategies, operational efficiency, and ultimately, shareholder returns.

The companies often invest heavily in new ships, marketing campaigns, and other initiatives to maintain their market positions. The ongoing development and introduction of new cruise ships, often designed with specific demographics in mind, adds another layer of competition.

Overall Trends in Dividend Payments within the Travel and Leisure Sector

The travel and leisure sector, in general, has shown a mixed trend in dividend payments in recent years. Some companies have maintained or increased dividend payouts, reflecting confidence in the long-term growth prospects of their business models. Others have opted for alternative strategies like reinvesting profits for growth or maintaining a more conservative approach to dividend payments. The varying approaches within the sector underscore the importance of considering the specific financial performance and long-term strategy of each company when evaluating dividend policies.

This sector is subject to economic fluctuations, impacting consumer spending and, consequently, the profitability of companies. External factors such as global pandemics and geopolitical events have further complicated the sector’s dynamics.

Potential Risks and Challenges

Carnival Corporation’s decision to resume dividend payments is a significant step, but it’s not without potential pitfalls. The cruise industry, while showing signs of recovery, faces ongoing uncertainties, from fluctuating demand to the potential for future crises. Understanding these risks is crucial for evaluating the long-term viability of the dividend payments.

Carnival’s decision to resume dividend payments for shareholders is quite intriguing. It’s like a company, after a period of reflection, is choosing to share its success again. This reminds me of the fascinating journey of a remarriage, where the past plays a significant role in shaping the future. Just like a back story to a remarriage, back story to a remarriage , Carnival’s past financial challenges have undoubtedly influenced this decision, though it’s a hopeful sign for investors.

Hopefully, this financial rebound will bring more excitement and prosperity to the company.

Economic Downturns and Market Volatility

Economic downturns, particularly if severe, can drastically reduce consumer spending on discretionary activities like cruises. The COVID-19 pandemic serves as a prime example, with a significant drop in travel demand, and a subsequent impact on cruise lines. This volatility makes it challenging to predict future revenue streams and maintain consistent dividend payouts. For instance, a global recession could lead to a contraction in discretionary spending, reducing passenger numbers and impacting Carnival’s profitability.

Competition and Industry Consolidation

The cruise industry is highly competitive. New entrants and existing competitors, like Royal Caribbean, are constantly innovating and vying for market share. Further consolidation within the industry could create powerful players with increased bargaining power, potentially affecting pricing and profitability for smaller companies. A surge in new competition or industry shake-ups could force Carnival to allocate more resources to maintaining its market position, reducing funds available for dividends.

Geopolitical Instability and Travel Restrictions

Geopolitical events, natural disasters, or unexpected travel restrictions can disrupt cruise operations. The impact of the war in Ukraine on supply chains and the subsequent increase in fuel prices demonstrates how these factors can affect the cruise industry. These events can lead to disruptions in operations, impacting passenger bookings and revenue.

Operational Challenges and Costs

Maintaining a large fleet of ships and operating complex cruise itineraries involves significant operational costs. Unexpected maintenance issues, labor disputes, and disruptions in supply chains could increase costs and impact profitability. These unforeseen circumstances can create financial strain, potentially jeopardizing the ability to maintain dividend payments. A sudden and large increase in fuel prices could severely impact the profitability of cruise lines.

Maintaining Passenger Confidence and Safety Standards

Maintaining passenger confidence and adhering to rigorous safety standards is paramount in the cruise industry. Any incidents, such as safety violations or public health concerns, could severely damage Carnival’s reputation and negatively impact passenger bookings. Public perception is a crucial factor for the cruise industry, and any negative incident can lead to a drop in bookings and significant financial losses.

Illustrative Case Study

Carnival Corporation’s decision to resume dividend payments after a challenging period offers a compelling case study for investors and analysts. Understanding how similar companies navigated similar circumstances provides valuable insight into the potential trajectory of Carnival’s stock price and shareholder returns. This analysis examines a comparable situation to illuminate potential pitfalls and opportunities for Carnival Corporation.A key aspect of this case study is the examination of how companies like Carnival Corporation have reacted to industry-wide crises, and the long-term implications for their financial performance and shareholder value.

The focus is on identifying factors that contributed to the successful resumption of dividend payments in comparable situations, and how those factors can be applied to Carnival Corporation’s unique circumstances.

Company X’s Dividend Resumption

Company X, a major player in the airline industry, experienced significant financial setbacks during the COVID-19 pandemic. Passenger traffic plummeted, leading to substantial revenue losses and forcing the company to temporarily suspend its dividend payments. However, as the pandemic subsided and travel demand rebounded, Company X demonstrated a strong financial recovery. Their ability to restructure operations, control costs, and increase efficiency enabled the company to generate substantial cash flow, thereby paving the way for a successful resumption of dividend payments.

Key Lessons Learned

Analyzing Company X’s experience reveals several key lessons:

- Financial strength and operational efficiency are crucial for dividend resumption. The company’s ability to manage its finances effectively and reduce costs proved critical in generating the cash flow necessary to support dividend payments.

- Industry-specific factors are important considerations. The airline industry, like the cruise industry, is highly sensitive to external shocks like pandemics. A thorough understanding of industry trends and potential future disruptions is vital in long-term planning.

- Strong investor relations are essential. Transparent communication with investors about the company’s financial performance and future outlook builds trust and confidence, which can be crucial in navigating difficult periods.

- The speed of recovery is important. The faster the company recovers from its challenges, the sooner it can resume dividend payments, potentially leading to greater investor confidence and share price appreciation.

Applying the Case Study to Carnival Corporation

Carnival Corporation’s situation bears certain similarities to Company X’s experience during the pandemic. Both companies faced significant disruptions in revenue due to the global health crisis. However, key differences exist as well. Carnival Corporation operates in a different industry and faces varying competitive pressures.

Methodology Used

The analysis of Company X’s case study utilized a combination of publicly available financial data, industry reports, and news articles. Key performance indicators (KPIs), such as revenue, cost structure, and cash flow, were analyzed to assess the company’s financial health before, during, and after the resumption of dividend payments. The study also considered external factors, such as industry trends and economic conditions, to understand the broader context of Company X’s decision.

Comparison and Contrast

Comparing Company X and Carnival Corporation, while both faced pandemic-related challenges, their industry contexts differ. Airline companies heavily rely on passenger traffic, which was severely impacted by travel restrictions. Carnival’s revenue, though significantly affected, is also linked to other factors, such as port congestion and cruise demand. While the underlying principles of financial strength and investor confidence are comparable, the specific factors driving recovery and resumption of dividend payments may differ between the two.

Last Word

Carnival’s decision to resume dividend payments marks a significant step forward, potentially boosting investor confidence and signaling a renewed focus on profitability. The move’s success will depend on maintaining consistent financial performance and navigating the evolving challenges of the travel industry. The potential return for shareholders, alongside market reaction, will be crucial to assessing the long-term impact of this decision on Carnival’s trajectory.

We’ll be watching closely to see how the resumption unfolds and how it shapes the future of the cruise line.

General Inquiries

What were the main factors that led to Carnival suspending dividend payments?

The suspension was likely due to a combination of factors, including the economic downturn, reduced passenger demand, and operational challenges stemming from the pandemic.

How does Carnival’s current financial health compare to its past performance?

This article will detail Carnival’s financial metrics both before and after the suspension, allowing a comparison of current strength.

What is the potential return on investment for shareholders?

A table in the article will Artikel the potential return on investment for shareholders, based on the resumption of dividend payments.

What are some of the potential risks associated with the dividend resumption?

The article will address potential risks, including unforeseen economic downturns, increased competition, and challenges in maintaining consistent dividend payouts.