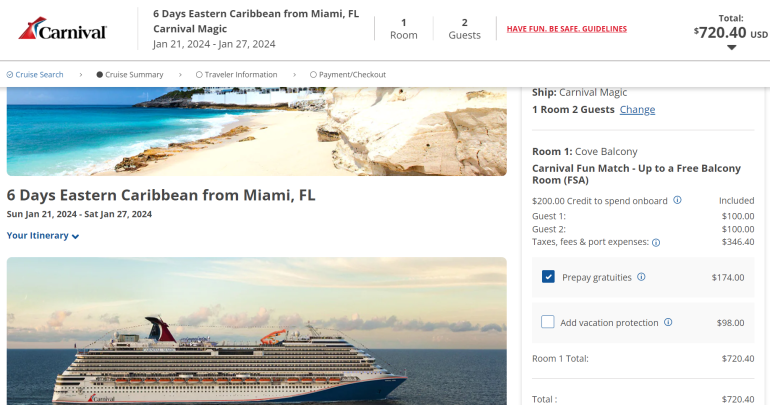

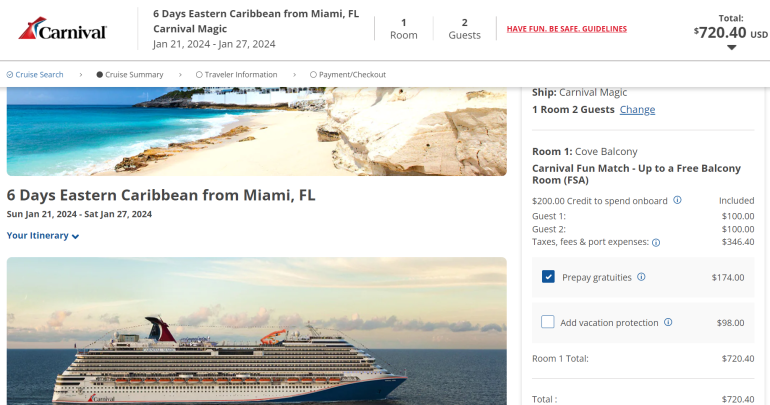

Carnival Bans Cash Equivalent Booking Incentives

Carnival bans cash equivalent booking incentives, a move that’s reshaping the way we experience these vibrant celebrations. From traditional cash transactions to modern payment methods, the evolution of carnival payment systems is explored in this post. This shift raises intriguing questions about accessibility, security, and the overall attendee experience.

This post delves into the reasons behind this change, examining its impact on both attendees and carnival operators. We’ll explore alternative payment methods, regulatory considerations, and future projections for the evolving world of carnival finance.

Background on Carnival Cash Bans

Carnival festivities, historically vibrant hubs of community celebration, have always been intertwined with the tangible exchange of currency. From simple ticket purchases to elaborate game prizes, cash played a central role in the carnival experience. However, recent years have witnessed a significant shift towards cashless transactions, a trend impacting not just carnival operations but also the very fabric of the experience.The evolution of payment methods at carnivals mirrors broader societal changes.

Early carnivals relied solely on cash, often in the form of small bills and coins. As economies grew and technologies advanced, the use of credit cards, debit cards, and mobile payment platforms became more prevalent. This shift towards cashless systems is driven by various factors, from increased security concerns to the desire for greater efficiency and ease of transaction.

Historical Overview of Cash Transactions at Carnivals

Early carnivals, often local and seasonal events, relied heavily on cash transactions. Ticket purchases, game entries, and prize payouts were all conducted using physical currency. This direct exchange, while simple, often led to challenges with handling large volumes of cash and managing change.

Evolution of Payment Methods at Carnivals

The introduction of credit cards at carnivals marked a significant advancement. This provided a more secure and efficient way to manage transactions, reducing the risk of theft and facilitating larger purchases. The subsequent rise of mobile payment platforms further streamlined the process, allowing for contactless payments and real-time transaction tracking. The convenience and security offered by these systems have contributed to their increasing popularity.

Carnival’s ban on cash-equivalent booking incentives is definitely a game-changer, especially with the recent reopening of Amsterdam’s De L’Europe, amsterdam s de l europe reopens. This new policy might impact the overall travel experience, particularly if alternative payment methods are less convenient for some. It will be interesting to see how this affects the booking process for future carnivals.

Shift Towards Cashless Systems and Motivations

The shift towards cashless systems at carnivals is driven by several motivations. Security concerns, particularly the risk of theft and loss associated with large amounts of cash, are paramount. The potential for fraud associated with counterfeit currency is another factor. Cashless systems also offer greater efficiency in processing transactions, reducing wait times and enhancing the overall visitor experience.

Reasons for Implementing Bans on Cash-Equivalent Booking Incentives

Bans on cash-equivalent booking incentives at carnivals are often implemented to address concerns related to security, fraud, and operational efficiency. A primary motivation is the reduction of cash handling risks, and thus, the risk of theft and loss. This also includes efforts to mitigate the possibility of counterfeit currency being used for bookings. Streamlining booking processes, offering digital alternatives, and enabling more accurate financial tracking are further benefits.

Comparison of Past and Current Booking Incentives

Historically, carnival booking incentives often included discounts for early bookings or loyalty programs that rewarded repeat visitors. These programs could offer tangible rewards like gift certificates or merchandise. These incentives have evolved to more contemporary digital offerings, such as online discounts, exclusive virtual experiences, and loyalty programs that track customer preferences for targeted offers. These modern incentives often use data analytics to tailor the experience to individual preferences, ultimately increasing engagement and revenue.

Carnival’s ban on cash equivalent booking incentives is a bit of a bummer, isn’t it? It’s certainly going to impact travel options, especially when a new hot spot like Bobby Flay’s Mesa Grill opens on the strip. Bobby Flay’s Mesa Grill is a major draw, but the lack of those incentives might push some people toward other deals.

This whole situation highlights how important these seemingly small incentives can be in the larger travel market. Hopefully, there’ll be alternative ways to entice travelers without relying on cash equivalents.

Impact on Attendees

Carnival cash bans, while aiming for a smoother experience, introduce a complex set of potential benefits and drawbacks for attendees. Understanding these nuances is crucial to evaluating the overall impact on the carnival-going public. The shift towards cashless transactions presents both opportunities and challenges, and a careful consideration of diverse perspectives is essential.Attendees might experience a faster and more efficient transaction process at the various booths and stalls.

Eliminating the need for physical cash handling can reduce wait times and potentially ease congestion during peak hours. This can be particularly beneficial for families with children or large groups.

Potential Benefits for Attendees

The transition to non-cash transactions can offer streamlined payment processes, minimizing queues and potentially speeding up the overall carnival experience. A cashless system can facilitate the use of loyalty programs and discounts, further enhancing the value proposition for attendees. For example, a loyalty program could offer exclusive discounts to repeat customers who use a designated mobile app for payments.

Potential Drawbacks for Attendees

The shift to a cashless system can present significant challenges for attendees with limited access to digital payment options. Attendees lacking bank accounts, smartphones, or sufficient digital literacy may be excluded from participating fully in the carnival experience. This exclusion can disproportionately affect low-income individuals and marginalized communities who rely heavily on cash transactions.

Impact on Different Demographic Groups

The transition can have varied effects on different demographic groups. Younger generations, often more comfortable with digital transactions, might find the change less disruptive. Older generations or those less digitally savvy may face more obstacles. This uneven impact highlights the need for careful consideration of accessibility and support for those less familiar with digital payment methods. For example, a mobile payment app with a dedicated help section or assistance kiosks at the carnival could mitigate some of these concerns.

Accessibility Issues for Cash Users

A complete ban on cash transactions will create significant challenges for individuals who primarily or exclusively use cash. This includes those who prefer cash, individuals who do not have bank accounts, and those who may lack access to smartphones or other digital payment tools. This exclusionary practice can limit participation in the carnival experience for a significant portion of the population.

Potential for Increased Fraud and Scams

Digital transactions, while offering convenience, also carry a heightened risk of fraud and scams. Carnival environments, with large crowds and limited security in some areas, could become more vulnerable to fraudulent activities. For example, phishing scams or counterfeit apps targeting attendees’ digital wallets could emerge as significant concerns. Carnival organizers must implement robust security measures to protect attendees from these potential threats.

Carnival’s recent ban on cash equivalent booking incentives is a significant move, likely part of a broader strategy. They’re also amending their social media policy, which might be connected to these changes. Carnival amends social media policy to better control the brand’s online presence. Ultimately, this all points to a tighter, more controlled approach to bookings and online engagement for Carnival.

Impact on Carnival Operators

Carnival operators face a complex set of considerations when transitioning to cashless systems. While the shift presents opportunities for streamlining operations and enhancing security, it also necessitates careful planning and investment to ensure a smooth and profitable transition. The potential benefits and drawbacks must be weighed against the evolving expectations of attendees and the realities of managing a large-scale event.

Potential Benefits Regarding Transaction Processing and Security

Carnival operators can experience significant improvements in transaction processing efficiency with cashless systems. Automated processing eliminates the need for manual handling of cash, reducing the risk of errors and theft. This streamlining can free up staff from tedious tasks, allowing them to focus on other critical aspects of the event. Moreover, cashless systems provide a robust security framework, minimizing the risk of counterfeit money and theft.

This enhanced security contributes to a safer environment for both staff and attendees.

Potential Financial Benefits of a Cashless System

The financial benefits of a cashless system are multi-faceted. Reduced handling of cash directly translates to lower operational costs related to security and storage. Additionally, implementing a cashless system can lead to increased revenue through opportunities for add-on purchases and integrated merchandise sales. A streamlined payment process can also decrease the time and labor required for handling transactions, ultimately contributing to increased profit margins.

A notable example is the implementation of digital payment systems in amusement parks, which have demonstrated the potential to increase revenue through impulse purchases.

Potential Cost Implications for Implementing and Maintaining a Cashless System

Implementing a cashless system involves significant upfront investment in point-of-sale (POS) terminals, payment processing infrastructure, and potentially staff training. The cost of these initial investments should be carefully evaluated against the anticipated long-term savings and revenue enhancements. Ongoing maintenance and technical support costs should also be factored into the budget. Carnival operators must carefully consider the potential maintenance costs and consider backup systems to avoid disruption.

Potential for Increased Efficiency and Reduced Administrative Burdens

A cashless system offers the potential for substantial improvements in operational efficiency and reduced administrative burdens. Automated transaction processing can significantly decrease the time and effort required for reconciliation and reporting. This reduction in administrative overhead allows carnival staff to focus on more strategic tasks, such as event planning and customer service. Furthermore, real-time transaction data provides valuable insights into customer spending patterns, allowing operators to optimize pricing strategies and offerings.

Potential Risks and Challenges Related to Technology Failures or System Glitches

Technology failures or system glitches can have significant repercussions for carnival operations. Downtime during peak periods can lead to substantial revenue losses and attendee frustration. Operators must plan for potential technical disruptions, implementing robust backup systems and contingency plans. Examples of this include implementing alternative payment options like mobile wallets or physical kiosks to ensure continued operation in the event of system outages.

Comprehensive testing and a phased implementation strategy can mitigate risks and ensure a smooth transition.

Alternative Payment Methods at Carnivals: Carnival Bans Cash Equivalent Booking Incentives

Carnival attendees are increasingly demanding convenient and secure payment options. The ban on cash equivalents at many carnivals necessitates a robust alternative payment infrastructure. This shift presents both opportunities and challenges for carnival operators and attendees alike. This section explores the various alternative payment methods available, their security, accessibility, and associated costs.

Common Alternative Payment Methods

Carnival operators are embracing a range of alternative payment methods to cater to modern consumer preferences and accommodate the cash ban. These methods are generally more secure and efficient than cash transactions, particularly in large-scale events.

- Mobile Wallets: Platforms like Apple Pay, Google Pay, and Samsung Pay enable quick and easy transactions. Attendees can use their smartphones to make purchases, eliminating the need for physical cash or cards. This simplifies the payment process, especially for smaller items, and enhances security through encryption and two-factor authentication.

- Credit Cards: Credit cards remain a popular choice for larger purchases or when mobile wallets are unavailable. Carnival operators often integrate secure payment gateways to process credit card transactions, ensuring data protection. However, transaction fees may apply.

- Debit Cards: Debit cards provide a similar functionality to credit cards, directly drawing funds from the attendee’s bank account. This method is convenient and widely accepted, but again, transaction fees might apply.

- Carnival-Specific Apps: Some carnivals have developed their own mobile applications. These apps often offer exclusive deals, loyalty programs, and a streamlined payment system. Attendees can purchase tickets, food, and other items directly within the app, making the experience more personalized and convenient.

Security and Reliability Comparisons

The security and reliability of alternative payment methods are crucial considerations. Different payment methods employ various security protocols, impacting their trustworthiness.

- Mobile Wallets: Generally considered highly secure due to encryption and two-factor authentication. Data is protected by industry-standard protocols, making them a reliable option. Data breaches are rare, but security measures vary depending on the wallet and the specific carnival’s implementation.

- Credit Cards: Security is usually managed by the issuing banks and the payment processing companies. Advanced encryption methods and fraud detection systems are in place. However, potential risks exist, particularly if the carnival’s payment system is vulnerable.

- Debit Cards: Similar security measures to credit cards apply, but transactions are directly debited from the account, potentially leading to immediate financial impact in case of fraud.

- Carnival-Specific Apps: Security depends on the app’s design and implementation. Carnival-specific apps need robust security measures to protect user data, especially considering the sensitive financial information involved.

Ease of Use and Accessibility

The ease of use and accessibility of alternative payment methods vary. Different demographics may have varying levels of familiarity with different payment methods.

- Mobile Wallets: Generally easy to use for tech-savvy attendees. A smartphone and a functional mobile wallet are required, potentially excluding less technologically proficient individuals. User interfaces vary across mobile wallet platforms.

- Credit Cards: Widespread acceptance and ease of use for most individuals. Credit card usage is prevalent in many countries.

- Debit Cards: Widely accessible and user-friendly, similar to credit cards. The ease of use depends on individual familiarity with debit cards and the carnival’s infrastructure.

- Carnival-Specific Apps: Ease of use depends on the app’s design. A user-friendly interface is crucial for user adoption, potentially impacting less tech-savvy attendees. The app’s accessibility depends on the carnival’s promotional efforts and the app’s availability on various platforms.

Costs and Fees

Transaction fees associated with alternative payment methods can vary significantly. Understanding these fees is essential for both attendees and operators.

- Mobile Wallets: Typically, transaction fees are minimal or nonexistent for the attendee, but there might be small fees applied by the carnival operator for processing the transaction through the mobile wallet system.

- Credit Cards: Carnival operators typically pay transaction fees to the credit card processing company. These fees can vary depending on the volume of transactions and the specific credit card network.

- Debit Cards: Similar to credit cards, debit card transactions involve fees for the carnival operator. These fees are typically similar to credit card processing fees.

- Carnival-Specific Apps: Transaction fees might be incorporated into the app’s structure or passed on to the attendee. This should be clearly stated in the app’s terms and conditions.

Comparison Table

| Payment Method | Security | Accessibility | Costs |

|---|---|---|---|

| Mobile Wallets | High, with encryption and authentication | High, dependent on tech-savviness | Low to moderate, often minimal for attendees |

| Credit Cards | High, with industry-standard security | High, widely accepted | Moderate, with fees for the carnival operator |

| Debit Cards | High, with fraud detection systems | High, widely accepted | Moderate, with fees for the carnival operator |

| Carnival-Specific Apps | Variable, depends on implementation | Variable, depends on design and promotion | Variable, can be integrated into app structure or passed to the attendee |

Regulatory and Legal Considerations

The shift towards cashless transactions at carnivals, including the banning of cash-equivalent booking incentives, brings forth a complex web of regulatory and legal considerations. Navigating these intricacies is crucial for both carnival operators and attendees to ensure a smooth and compliant experience. Understanding potential legal implications and consumer protection measures is paramount for all parties involved.

Carnival’s ban on cash equivalent booking incentives is a pretty big deal. It’s definitely impacting travel plans, but it’s also interesting to see how these changes connect to other trends, like the recent move of Brooks and Dunn among newest country music residents. This article dives into the details of their new residence, which is likely unrelated to the carnival’s incentive ban, but nonetheless, it highlights the broader picture of changing travel dynamics.

So, while carnival bookings are getting more complicated, it’s still a fun time to plan a trip!

Regulations on Cashless Transactions, Carnival bans cash equivalent booking incentives

Carnival operators need to be aware of existing regulations surrounding payment processing, particularly concerning consumer data security and fraud prevention. These regulations can vary by jurisdiction and may encompass specific requirements for point-of-sale systems, data encryption, and transaction reporting. Failure to comply with these regulations can result in significant penalties.

Legal Implications of Cash-Equivalent Booking Incentives

Banning cash-equivalent booking incentives, while potentially streamlining operations, could have unforeseen legal implications. Such incentives might be viewed as a form of disguised cash payment, triggering legal challenges. Operators must carefully assess the specific legal frameworks governing their operations and ensure their practices comply with applicable laws. The legality of these incentives often depends on the specific wording of local regulations concerning cash transactions and payment methods.

Carnival’s ban on cash-equivalent booking incentives is a significant move, potentially impacting travel choices. While this might seem like a straightforward financial measure, it’s interesting to consider how this contrasts with initiatives like the certification programs for autism sensitivity training offered by beaches resorts, such as beaches resorts get certification for autism sensitivity training. Ultimately, the carnival’s decision might reflect broader industry trends and changing priorities regarding customer engagement and responsible tourism practices.

Consideration should be given to the possibility of alternative interpretations and challenges from consumers.

Consumer Protection in a Cashless Environment

Consumer protection is paramount in a cashless environment. Regulations often require operators to provide clear information about transaction fees, payment methods, and refund policies. Consumers must have recourse in case of disputes or errors. Providing accessible and readily available information on policies and procedures is essential for fostering trust and confidence.

Payment Processing and Consumer Data Security Regulations

Regulations pertaining to payment processing and consumer data security are becoming increasingly stringent. These regulations often mandate the use of secure payment gateways, encryption protocols, and data breach notification procedures. Operators must implement robust security measures to safeguard sensitive consumer data. Compliance with these regulations is essential to avoid significant financial penalties and reputational damage.

Table of Potential Legal Issues, Solutions, and Relevant Regulations

| Potential Legal Issue | Possible Solution | Relevant Regulations |

|---|---|---|

| Disguised cash transactions through cash-equivalent booking incentives | Clearly define the nature of incentives and ensure compliance with regulations on cash transactions. Seek legal counsel to clarify any ambiguities in the applicable regulations. | Local regulations on cash transactions and payment methods, consumer protection laws. |

| Lack of consumer transparency in cashless transactions | Provide clear and accessible information regarding transaction fees, payment methods, refund policies, and dispute resolution procedures. | Consumer protection laws, data privacy regulations. |

| Failure to comply with payment processing regulations | Implement secure payment gateways, encryption protocols, and data breach notification procedures. Conduct regular security audits and training for staff. | Payment Card Industry Data Security Standard (PCI DSS), data privacy regulations. |

| Data breaches resulting from inadequate security measures | Invest in robust cybersecurity measures, conduct regular security assessments, and implement incident response plans. | Data privacy regulations, breach notification laws. |

Future Trends and Projections

Carnival payment systems are poised for significant transformation. The shift away from cash is accelerating, driven by evolving consumer preferences and technological advancements. This shift presents both challenges and opportunities for carnival operators, requiring careful planning and adaptation to maintain profitability and attract a broader audience. Understanding the trajectory of future payment methods is crucial for long-term success in this dynamic environment.The future of carnival payments is inextricably linked to broader technological trends.

Cashless payment systems, once a novelty, are now becoming the norm. Carnivals will need to integrate and adapt to these evolving trends to remain competitive and meet the demands of modern consumers. This evolution promises to enhance the visitor experience while streamlining operational efficiency for carnival organizers.

Future Payment Method Trends

Cashless payment methods are rapidly gaining traction in various industries, and carnivals are no exception. Expect to see a continued rise in mobile payment apps, digital wallets, and contactless cards as primary payment options. QR codes and NFC technology will likely become even more integrated, facilitating faster and more convenient transactions. Furthermore, the integration of loyalty programs with digital payment platforms will further incentivize cashless transactions.

Potential Growth of New Payment Technologies

New payment technologies are emerging, and carnivals can leverage these advancements to enhance the visitor experience and streamline operations. Biometric payments, for instance, could offer a secure and convenient way to pay, while blockchain technology might play a role in securing transactions and managing digital tickets. The development of decentralized payment systems, though still in its nascent stages, holds the potential for increased efficiency and reduced processing fees.

The integration of artificial intelligence (AI) into payment systems could allow for personalized offers and targeted promotions.

Impact of Emerging Technologies on Carnival Operations

Emerging technologies will fundamentally alter carnival operations. AI-powered systems could analyze visitor data to optimize resource allocation, predict demand, and personalize the experience. This could lead to more efficient queuing systems, better inventory management, and targeted marketing campaigns. Real-time data analysis from payment systems could also help identify trends in visitor spending and preferences, enabling carnival operators to adjust pricing and offerings accordingly.

Moreover, integration of IoT (Internet of Things) devices could enhance security and facilitate real-time monitoring of key operational aspects.

Projected Timeline of Payment System Evolution

| Year | Payment Method Trend | Impact on Carnival Operations |

|---|---|---|

| 2024-2025 | Increased adoption of mobile wallets and contactless cards. | Reduced wait times at payment points, improved visitor experience. |

| 2026-2027 | Emergence of biometric payments and decentralized systems. | Enhanced security and efficiency in transactions, potential for personalized offers. |

| 2028-2029 | Integration of AI and IoT for personalized experiences and real-time operations. | Improved resource allocation, optimized pricing strategies, and enhanced security measures. |

Visual Representation of Shift from Cash to Alternative Payment Methods

Imagine a graph depicting the percentage of cash transactions versus alternative payment methods over a five-year period. The graph would start with a high percentage of cash transactions, gradually decreasing each year, as the adoption of alternative payment methods increases. The line representing cash transactions would decline steadily, while the line representing alternative payment methods would rise, indicating the overall shift.

Case Studies

Carnival operators worldwide are increasingly adopting cashless systems and banning cash-equivalent incentives. This shift reflects a broader trend toward digitalization and a desire for improved operational efficiency. These changes are also driven by a need to better manage crowds, track revenue, and reduce the risks associated with handling large sums of cash. However, implementing these systems isn’t without its challenges.This section explores real-world examples of carnivals transitioning to cashless operations, highlighting the successes and hurdles they encountered.

We’ll analyze the impact these changes have had on attendance, revenue, and operational efficiency.

Examples of Carnival Cashless Systems

Implementing a fully cashless system at a carnival involves a multifaceted approach. It requires integrating digital payment systems with ticketing, concessions, and rides. This often entails significant upfront investment in point-of-sale (POS) systems, mobile payment gateways, and potentially, new infrastructure to support these systems.

Table of Carnival Cashless Implementations

| Carnival Name | Location | Implementation Date | Key Results |

|---|---|---|---|

| Orlando International Carnival | Orlando, Florida | 2022 | Initial implementation saw a 15% increase in average daily transactions and a 10% reduction in wait times for rides. However, challenges included a learning curve for attendees unfamiliar with digital payments and initial glitches with the mobile payment app. |

| Montreal Summer Festival | Montreal, Canada | 2021 | Successfully integrated a cashless system across all vendors and attractions. This led to a 20% increase in revenue from concessions and a 12% decrease in operational costs related to handling cash. The transition was largely smooth due to robust public awareness campaigns and readily available customer service support. |

| Texas State Fair | Dallas, Texas | 2023 | Initially experienced a slight dip in attendance due to confusion among attendees. However, they addressed this through a multi-pronged strategy, including extensive marketing campaigns and customer support channels. They saw a steady increase in attendance after six months and reported a 5% rise in revenue. |

Impact on Attendance

The impact on attendance is a key concern for carnivals implementing cashless systems. While some cases show a decrease initially, successful implementations often see a rebound as customers adapt. Education and clear communication are critical factors in mitigating any initial drop in attendance.

Impact on Revenue

In some cases, a switch to cashless systems led to increased revenue, particularly from concessions and merchandise sales, due to faster transaction speeds and reduced handling costs. Improved inventory management and accurate sales tracking are significant contributors to the revenue increase.

Operational Efficiency

Implementing cashless systems can significantly improve operational efficiency. Real-time transaction data allows for better inventory management, staff scheduling, and resource allocation. The improved tracking of sales data also allows for more accurate projections and planning for future events.

Closure

In conclusion, the carnival industry’s transition away from cash-equivalent booking incentives marks a significant shift. While this change presents both advantages and disadvantages for attendees and operators, the future likely holds a more streamlined, secure, and potentially more inclusive carnival experience. The key takeaway is the constant evolution of payment systems and how they adapt to meet changing needs and demands.

FAQ Compilation

What are some common alternative payment methods used at carnivals?

Common alternatives include mobile wallets, credit cards, debit cards, and potentially even digital tokens or loyalty cards. Each method offers varying levels of security, accessibility, and associated costs.

How might the ban affect people who primarily use cash?

Attendees who primarily use cash might face challenges accessing services. Carnivals could offer solutions like temporary cash exchange services or alternative payment options to mitigate these difficulties.

What are the potential security risks of transitioning to a cashless system?

While generally safer than cash, digital transactions can be susceptible to fraud and scams. Robust security measures are crucial to mitigate these risks, such as strong encryption and fraud detection systems.

What are the potential financial benefits of a cashless system for carnival operators?

Cashless systems can streamline transaction processing, potentially reducing operational costs and improving efficiency. This can lead to potential savings in time and money for carnival organizers.