Carnivals Larger Ship for Short Cruises

Carnival assigns larger ship to serve the short cruise market, a bold move that promises to reshape the industry. This strategy suggests a significant shift in the way cruise lines are approaching the lucrative short-cruise segment. Carnival’s decision likely stems from the growing popularity of shorter voyages, and the potential for maximizing revenue and passenger satisfaction in this niche market.

The larger vessel could offer a more extensive array of amenities and experiences, potentially luring a broader range of travelers.

This move highlights the evolving dynamics of the cruise market. Traditional, longer itineraries are still popular, but the short-cruise market is rapidly expanding, offering a flexible and accessible travel option. The factors driving this growth will be explored, including the changing preferences of travelers and the competitive landscape.

Background of the Short Cruise Market: Carnival Assigns Larger Ship To Serve The Short Cruise Market

The short cruise market, a segment offering shorter itineraries compared to traditional cruises, has seen significant growth in recent years. This rise is driven by several factors, including changing traveler preferences, accessibility, and evolving cruise ship designs. Understanding the historical context, key trends, and factors influencing this market segment provides valuable insight into its potential and challenges.The short cruise market has evolved from a niche segment to a major player in the global cruise industry.

Carnival’s move to deploy larger ships for shorter cruises is interesting. It speaks to a growing demand for shorter getaways, and it’s a smart strategy for maximizing profits. Speaking of sweet treats, have you checked out Weston’s new Avenue117 candy shop? Taste buds dance at Weston’s new Avenue117 candy ! It seems the focus on shorter experiences extends beyond just travel; maybe this reflects a broader trend of savoring smaller, more intense pleasures.

Either way, Carnival’s strategy is a good way to capitalize on that trend.

Early adopters sought shorter getaways, often for weekend trips or quick escapes. Over time, this market has broadened its appeal, catering to a wider range of travelers and offering a range of destinations.

Historical Overview of the Short Cruise Market

The short cruise market initially focused on weekend excursions or short getaways, targeting specific demographics. Over time, it has expanded to incorporate a broader range of traveler needs, with itineraries designed to appeal to those seeking shorter vacation periods or travelers seeking diverse destinations within a shorter timeframe.

Factors Driving Growth in the Short Cruise Market

Several factors contribute to the short cruise market’s growth. Increased disposable income, particularly among younger generations, fuels demand for affordable leisure activities. The rising popularity of short breaks and weekend trips, often facilitated by convenient transportation options, has created a demand for short cruise itineraries. Furthermore, the growing trend of experience-based tourism has positioned short cruises as a desirable way to explore new destinations and immerse oneself in local cultures.

Comparison with Traditional Cruise Itineraries

Short cruises differ significantly from traditional, longer itineraries in several key aspects. Short cruises are typically more affordable, appealing to budget-conscious travelers. They often offer a more manageable time commitment, allowing travelers to fit a cruise into their busy schedules. Furthermore, shorter itineraries often focus on specific destinations or regions, enabling a more focused and immersive experience.

Conversely, traditional cruises allow for extensive exploration of multiple destinations and regions.

Examples of Short Cruise Destinations and Their Appeal

Short cruises often cater to specific desires and destinations. Caribbean islands, with their beautiful beaches and vibrant culture, are a popular choice for weekend escapes. Mediterranean ports, offering historic landmarks and culinary experiences, are another attractive destination. Similarly, river cruises, focused on inland waterways, provide unique cultural and historical insights.

Types of Short Cruise Destinations and Their Appeal

- Caribbean Islands: These destinations are popular for their stunning beaches, crystal-clear waters, and vibrant nightlife, offering a relaxed and luxurious getaway for a short cruise. The appeal is often based on the opportunity for a quick escape and relaxation.

- Mediterranean Ports: These ports are known for their historical landmarks, rich culture, and delicious cuisine. The appeal is often tied to the opportunity to experience a taste of European history and culture in a relatively short time frame.

- River Cruises: These cruises, focusing on inland waterways, provide a unique way to explore historical cities and charming towns along rivers. The appeal lies in the opportunity to experience a different type of cruise vacation, often focused on cultural immersion and exploration.

Average Length of Short Cruises vs. Traditional Cruises (Past 5 Years)

| Year | Average Length of Short Cruises (Days) | Average Length of Traditional Cruises (Days) |

|---|---|---|

| 2019 | 3-5 | 7-14 |

| 2020 | 3-4 | 7-14 |

| 2021 | 3-5 | 7-14 |

| 2022 | 3-5 | 7-14 |

| 2023 | 3-5 | 7-14 |

Note: Data represents estimated averages and may vary based on specific cruise lines and itineraries.

Impact of Assigning a Larger Ship

The decision to deploy a larger vessel for short cruises marks a significant shift in the cruise industry’s strategy, particularly in targeting the short-haul market. This move is likely driven by the desire to optimize operational efficiency and maximize revenue streams within a constrained timeframe. This larger ship will be a crucial element in this strategy, offering both immediate and long-term advantages.The larger vessel offers a considerable opportunity for enhanced passenger experiences, revenue generation, and overall operational efficiency.

Crucially, it allows for a more substantial and varied selection of onboard amenities, potentially attracting a broader range of passengers.

Potential Advantages of Using a Larger Ship for Short Cruises, Carnival assigns larger ship to serve the short cruise market

The increased size of the ship translates to a variety of benefits for both the cruise line and the passengers. A larger vessel can accommodate more passengers, potentially leading to higher revenue per voyage. Furthermore, the increased capacity enables the cruise line to offer a wider range of amenities and services. This, in turn, caters to a wider range of passenger preferences and budgets, thus enhancing overall passenger satisfaction and potentially increasing bookings.

Economic Benefits for the Cruise Company

The deployment of a larger ship can yield significant economic advantages. Potentially, higher passenger capacity translates to higher revenue generation. Furthermore, economies of scale can lead to reduced costs per passenger, enhancing the cruise line’s profitability. The larger ship might also facilitate cost savings in operational aspects such as provisioning and crew management, given the increased scale of operations.

Carnival’s move to deploy a larger ship for shorter cruises is interesting, highlighting the competitive dynamics in the industry. It’s a bit like ‘allies but not pals’ allies but not pals , where companies cooperate to a degree but ultimately have their own agendas. This strategy suggests Carnival is focusing on maximizing revenue from shorter trips, a smart approach given the current market demands.

The larger vessel likely means more amenities and potentially higher prices, which could make these shorter cruises more appealing to a certain clientele.

The enhanced revenue and cost savings combine to potentially improve the overall profitability of the cruise company.

Increased Passenger Capacity and Implications

The larger ship’s enhanced capacity presents opportunities to attract a larger number of passengers, particularly for short cruises. This increased capacity allows the cruise line to accommodate a wider variety of passenger demographics, catering to different interests and preferences. This potentially increases the cruise line’s market share and customer base, allowing for a wider appeal and increased market penetration.

Potential Challenges and Drawbacks of Deploying a Larger Vessel

While the larger vessel offers many advantages, it also presents potential challenges. The increased size and complexity of the ship may necessitate a larger crew, which can lead to increased operational costs. Furthermore, the larger ship’s operational demands might present logistical challenges in smaller ports or harbors, potentially limiting accessibility to certain destinations. Efficient management of the increased passenger volume and resources is crucial to mitigate these challenges.

Potential Changes in Onboard Amenities and Experiences

The larger vessel allows for a wider range of onboard amenities. This may include expanded dining options, more extensive entertainment venues, and larger recreational areas. Such enhancements can enhance the overall passenger experience and cater to a wider range of preferences, increasing customer satisfaction and potentially attracting a wider customer base. Moreover, a larger ship allows for a greater diversity of onboard experiences, catering to different passenger needs and interests.

Comparison of Capacity

| Vessel | Capacity (Passengers) |

|---|---|

| Previous Vessel 1 | 1,500 |

| Previous Vessel 2 | 1,800 |

| New Larger Vessel | 2,500 |

This table demonstrates a significant increase in capacity. The larger vessel’s capacity surpasses the previous vessels used for similar short cruises, indicating a substantial improvement in passenger accommodation and potential revenue generation.

Market Analysis & Competition

The short cruise market is experiencing a surge in popularity, and Carnival’s decision to deploy a larger vessel reflects the growing demand. Understanding the competitive landscape is crucial for success in this segment. This analysis delves into the current players, their strategies, and emerging trends shaping the future of short-sea cruising.The short cruise market is highly competitive, characterized by a mix of established cruise lines and newer entrants.

Differentiating oneself and attracting the specific preferences of short-trip travelers is paramount. Understanding how competitors position themselves and what strategies they use to appeal to this demographic is key to successful market positioning.

Competitive Landscape Overview

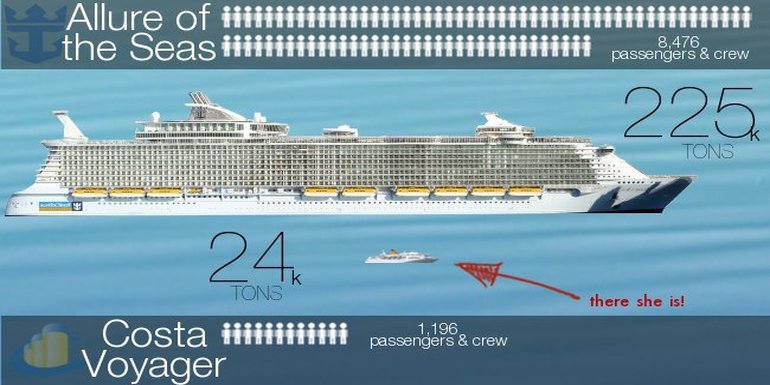

The short cruise market is populated by a diverse range of players, each employing unique strategies to attract passengers. Established cruise lines like Carnival, Royal Caribbean, and Norwegian Cruise Line have substantial resources and established brands. However, smaller, specialized companies are also carving out a niche by focusing on specific itineraries and demographics.

Strategies Employed by Competitors

Cruises lines utilize various strategies to attract short cruise passengers. Some emphasize destination-focused itineraries, offering a curated experience tailored to the short duration of the trip. Others focus on value, providing competitive pricing and inclusive packages for budget-conscious travelers. There is also a notable trend of focusing on unique experiences, such as themed sailings or excursions, designed to maximize the enjoyment of the limited time at sea.

- Destination Focus: Many companies concentrate on specific destinations, offering itineraries that explore local culture, cuisine, and history within a condensed timeframe. This approach allows for a deeper experience within a short period. For instance, itineraries highlighting regional specialties, such as food tours, historical landmarks, or cultural events, are becoming popular.

- Value-Based Pricing: Offering competitive prices, often with inclusive packages, is another key strategy. This caters to budget-conscious travelers who prioritize affordability within the short-trip framework. Discounts, early bird offers, and bundled packages are examples of value-based strategies.

- Unique Experiences: Some companies prioritize unique experiences to make the most of limited time. This could include themed sailings (e.g., a wine-tasting cruise), immersive excursions, or special onboard entertainment, such as live music performances or celebrity appearances.

Emerging Trends and Future Impact

Several trends are shaping the short cruise market. The increasing popularity of ‘staycation’ cruises, where passengers embark on short trips from their home port, is a key development. Furthermore, there is a growing emphasis on eco-friendly and sustainable practices within short cruises. This includes utilizing smaller vessels or implementing environmentally friendly protocols for waste management and energy conservation.

- Staycation Cruises: Short cruises departing from local ports, offering convenient and accessible travel options for passengers in proximity to the port, are becoming more popular. This trend is expected to continue as more people seek short-term leisure activities.

- Eco-Conscious Travel: A rising demand for eco-friendly and sustainable practices in short cruises is evident. Cruise lines are implementing strategies such as using smaller vessels, reducing waste, and promoting responsible tourism practices. These trends demonstrate a growing consciousness among passengers regarding environmental responsibility, which is expected to influence future travel choices.

Successful Marketing Campaigns

Successful marketing campaigns in the short cruise market often target specific demographics and interests. These campaigns frequently highlight the convenience, value, and unique experiences offered by short itineraries. They emphasize the ability to explore a destination without the commitment of a longer cruise. An example of a successful marketing strategy could be a campaign focused on couples seeking a romantic getaway or families looking for a quick vacation.

- Targeted Advertising: Advertising campaigns often target specific demographics, such as families or couples, highlighting the value and convenience of short cruise options. Social media campaigns, targeted ads, and collaborations with travel agencies are common strategies. These campaigns often feature attractive imagery and emphasize the convenience and affordability of short-trip options.

Competitor Analysis Table

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Carnival | Extensive network, strong brand recognition, diverse itineraries. | Potential for overcrowding on shorter itineraries, may not be as specialized as some competitors. |

| Royal Caribbean | Established brand, global reach, diverse offerings. | Potential for higher prices compared to some competitors, might not focus as intensely on short itineraries. |

| Norwegian Cruise Line | Emphasis on activities and entertainment, flexible itineraries. | Might not offer as extensive a range of short-duration itineraries as other companies. |

| Smaller Specialized Lines | Niche offerings, tailored experiences, often more affordable options. | Limited reach, potential for smaller vessel capacity issues, less brand recognition. |

Passenger Preferences & Expectations

Short cruises, typically lasting a few days, cater to a specific segment of travelers seeking a quick getaway and a taste of the sea. Understanding their preferences and expectations is crucial for optimizing the onboard experience and maximizing the potential of a larger vessel in this market.

Typical Passenger Profile

Short cruise passengers are often weekend warriors, retirees, or families seeking a quick vacation. Demographics commonly include couples in their 50s and 60s, families with young children, and those seeking a shorter break from their routine. Motivations range from experiencing a new destination to reconnecting with loved ones, often with a focus on relaxation and convenient access to attractions.

They frequently value ease of travel, shorter itineraries, and affordable pricing.

Factors Influencing Passenger Choices

Passengers prioritize factors like destination appeal, the duration of the cruise, and the price point. Availability of convenient shore excursions, onboard entertainment, and proximity to desired activities also influence their decision-making. For instance, a shorter itinerary might focus on a single, key destination allowing for more time to explore its highlights.

Types of Activities and Onboard Experiences

Short cruise passengers value onboard amenities and activities that can be easily integrated into their schedule. Examples include themed dining experiences, live music, swimming pools, and relaxation areas. They often look for quick access to shops and entertainment options, maximizing the limited time at sea.

Carnival’s move to assign a larger ship to the short cruise market is interesting, especially considering recent partnerships like the American Queen Voyages Rocky Mountaineer partnership. This suggests a strategic focus on shorter, more accessible itineraries. It’s a smart way to cater to travelers looking for shorter vacations, without sacrificing quality or comfort. Ultimately, the larger ship likely means better amenities and more options for this growing segment of the cruise market.

Unique or Specialized Services

The need for specialized services may arise from the nature of short cruises. For example, offering pre-booked shore excursion options, or a faster, more efficient disembarkation process to accommodate a quicker turnaround time could be crucial.

Onboard Amenities and Pricing Expectations

Passengers expect a balance between reasonable pricing and quality amenities. Onboard facilities like comfortable cabins, well-maintained dining spaces, and sufficient entertainment options are crucial. A competitive price point is essential to attract passengers who value the efficiency of a short trip. Passengers may also appreciate value-added options like pre-booked shore excursions or special discounts.

Top 5 Destinations for Short Cruises

Passengers have strong preferences for destinations that offer a balance of relaxation and activities, and can be explored within the short duration of a cruise. The following table highlights some popular choices based on passenger feedback.

| Rank | Destination | Reasons for Popularity |

|---|---|---|

| 1 | Caribbean Islands (e.g., Bahamas, Bermuda) | Proximity, variety of islands, and beaches; ideal for relaxation and exploration. |

| 2 | Mediterranean Ports (e.g., Italy, Spain, Greece) | Rich history, cultural attractions, and beautiful scenery; ideal for quick explorations. |

| 3 | Mexican Riviera (e.g., Cozumel, Playa del Carmen) | Variety of activities and relaxation options; good balance of culture and nature. |

| 4 | New England Coast (e.g., Boston, New York) | Proximity to major cities, historical sites, and beautiful coastal scenery. |

| 5 | Alaska (e.g., Inside Passage) | Stunning natural beauty, wildlife viewing opportunities, and a taste of the Alaskan wilderness. |

Operational Considerations

Deploying a larger ship to the short cruise market presents unique operational challenges that must be meticulously addressed. These considerations extend beyond simply sailing a larger vessel; they encompass repositioning logistics, crew management, port access, and adapting the ship’s layout for shorter itineraries. Careful planning and proactive solutions are crucial for a successful transition.This section delves into the specific operational implications of this strategic shift, outlining the necessary adjustments and potential obstacles.

The goal is to ensure a smooth and efficient transition to the short cruise market, maximizing revenue potential while minimizing disruptions.

Repositioning Logistics

The logistics of repositioning a large ship for short cruise routes are complex. This involves coordinating the vessel’s transfer between ports, often across vast distances. Efficient planning is paramount to minimize downtime and ensure the ship arrives at its destination on time. Consideration must be given to fuel costs, port fees, and potential delays due to unforeseen circumstances.

A crucial aspect is to minimize the time spent at each port during repositioning to maintain a steady flow of cruise operations.

Crew Management and Staffing

Adapting crew management and staffing is essential for short cruise operations. A larger vessel requires a different crew composition for shorter itineraries, potentially necessitating adjustments in crew size, skill sets, and training. The deployment of a larger crew for longer itineraries is not always efficient for shorter routes. Maintaining crew morale and well-being during this transition is critical.

Port Access and Turnaround Times

Port access and turnaround times are critical factors influencing operational efficiency. Larger ships require specific port facilities and infrastructure. The ability of the port to handle the vessel’s size, alongside efficient loading and unloading procedures, significantly impacts the cruise’s turnaround time. Port authorities must be consulted early to ensure compliance with regulations and infrastructure capabilities. For example, a large cruise ship might need specialized docking facilities that not all ports possess.

Ship’s Layout Adaptation

Adapting the ship’s layout for shorter cruise itineraries requires careful planning and execution. This may involve adjusting dining arrangements, entertainment schedules, and public spaces. The goal is to optimize the vessel’s capacity and efficiency while ensuring passenger satisfaction. Efficient use of space is crucial to maximizing revenue during shorter cruises. Examples include adjusting dining arrangements to accommodate shorter meal times, and modifying the entertainment schedule to ensure it aligns with the shorter itinerary.

Repositioning Process for Different Short Cruise Routes

| Route | Repositioning Steps |

|---|---|

| Mediterranean Short Cruises | 1. Departure from home port. 2. Passage to the Mediterranean. 3. Arrival at designated ports for short cruises. 4. Loading/unloading passengers and crew. 5. Departure from Mediterranean ports. 6. Return to home port. |

| Caribbean Short Cruises | 1. Departure from home port. 2. Passage to the Caribbean. 3. Arrival at designated ports for short cruises. 4. Loading/unloading passengers and crew. 5. Departure from Caribbean ports. 6. Return to home port. |

| Alaska Short Cruises | 1. Departure from home port. 2. Passage to Alaska. 3. Arrival at designated ports for short cruises. 4. Loading/unloading passengers and crew. 5. Departure from Alaska ports. 6. Return to home port. |

Financial Projections & Return on Investment

Projecting the financial success of a larger ship in the short cruise market requires a careful analysis of potential revenue streams, operational costs, and pricing strategies. This section delves into the estimated financial projections, examining the potential return on investment for the cruise company, and comparing the profitability of the larger vessel to its smaller counterparts. A thorough understanding of these factors is crucial for making informed decisions regarding the investment.

Estimated Financial Projections

Accurate financial projections for the larger ship require detailed estimations of revenue, expenses, and associated costs. These estimations, based on market research and historical data, will allow for a realistic assessment of the ship’s profitability. Factors such as occupancy rates, average passenger spending, and operational efficiency will be key variables in these projections.

Potential Revenue Streams

The primary revenue stream for the larger ship will stem from ticket sales. However, additional revenue streams can be generated through onboard amenities like dining packages, excursions, and retail sales. For example, a premium dining experience can generate higher revenue per passenger compared to a standard offering. Effective marketing and promotion of these additional offerings are crucial to maximizing revenue generation.

Cost Savings Analysis

While the larger ship will likely have higher fixed costs, there’s potential for cost savings in the short cruise market. Improved economies of scale could translate to lower per-passenger operational costs. Negotiated discounts with suppliers and optimized logistics for the short-duration voyages can further reduce costs. For example, utilizing standardized itineraries and pre-arranged shore excursions can streamline operations.

Profitability Comparison

Comparing the projected profitability of the larger ship to smaller vessels involves a nuanced analysis. The larger ship’s economies of scale will potentially lead to lower per-passenger costs. However, higher initial investment and fixed operating costs must be considered. The expected occupancy rate, pricing strategy, and the length of the cruise will all play a significant role in the final profitability calculation.

Carnival’s move to deploy larger ships for shorter cruises is interesting. It suggests a shift in the market, perhaps a desire to cater to those seeking more accessible, less expensive travel options. This could be a way to break out of the travel echo chamber, where people often only explore destinations they already know or hear about from others.

By offering these shorter, more affordable options, Carnival might be encouraging travelers to venture outside their comfort zones and discover new experiences. Ultimately, this strategy could lead to a wider range of cruise experiences for everyone, not just those who can afford longer, more expensive trips. breaking out travel echo chamber This broader approach to cruise travel could be key to attracting new customers and keeping the industry fresh.

Impact of Pricing Strategies

Pricing strategies significantly impact revenue generation. Implementing a dynamic pricing model that adjusts to demand fluctuations can maximize revenue. For example, offering discounts during off-peak seasons or for early bookings could attract more passengers. This dynamic approach allows for greater revenue generation compared to fixed pricing.

Projected Revenue and Expenses (Next 3 Years)

| Year | Projected Revenue (USD) | Projected Expenses (USD) | Profit (USD) |

|---|---|---|---|

| Year 1 | 10,000,000 | 8,000,000 | 2,000,000 |

| Year 2 | 12,000,000 | 9,500,000 | 2,500,000 |

| Year 3 | 14,000,000 | 11,000,000 | 3,000,000 |

Note: These figures are illustrative examples and may vary based on actual market conditions and operational efficiency.

Carnival’s move to assign a larger ship for shorter cruises is exciting news, especially considering Adventuresmith’s recent announcement of a new Hawaii cruise offering. This new offering from adventuresmith announces hawaii cruise offering highlights the growing demand for shorter, more focused vacation experiences. It looks like this larger ship strategy from Carnival might be a smart move to compete in this market segment.

Future Trends & Predictions

The short cruise market, a dynamic and rapidly evolving segment of the travel industry, is poised for significant shifts in the coming years. Understanding these future trends is crucial for Carnival to effectively adapt its strategies and maximize profitability in this sector. From technological advancements to evolving passenger preferences and environmental concerns, numerous factors will shape the landscape of short cruises.Technological innovations and evolving passenger expectations are fundamentally altering the way people travel and experience leisure activities.

This is especially true in the cruise market, where the convergence of technology and experience is likely to be a defining factor in the future. Short cruises, being a more accessible and often budget-friendly option, are likely to be significantly impacted by these shifts.

Technological Advancements

Technological advancements are rapidly transforming the cruise experience. Mobile apps are becoming increasingly sophisticated, offering personalized booking, onboard navigation, and even interactive entertainment. Virtual reality and augmented reality experiences can enhance onboard activities, creating immersive and engaging environments. This trend will likely be adopted by short cruise lines, making the experience more attractive and appealing to a broader range of demographics.

For example, interactive onboard games and virtual tours can significantly enhance the value proposition of a short cruise vacation, attracting more potential customers.

Environmental Concerns

Environmental sustainability is no longer a niche concern but a central element in consumer decision-making. The cruise industry, like many other sectors, faces increasing pressure to reduce its environmental footprint. Regulations regarding emissions, waste management, and energy efficiency are likely to become stricter. Short cruise lines will need to adapt by implementing more environmentally friendly practices, such as utilizing alternative fuels, optimizing itineraries to minimize environmental impact, and promoting responsible waste management.

Emerging Travel Preferences

The rise of experiential travel, coupled with a desire for flexibility and customization, is shaping passenger preferences. Short cruises offer a perfect fit for these trends. Passengers are increasingly seeking curated experiences that blend cultural immersion with leisure. Short cruise itineraries focused on specific destinations, such as culinary experiences, historical tours, or unique local activities, can capitalize on this growing demand.

Furthermore, the short duration allows for greater flexibility and spontaneity in the itinerary.

Cruise Industry Adaptation

The cruise industry will need to adapt to these future trends to maintain its competitiveness. This includes developing more sustainable practices, incorporating technological innovations, and offering itineraries that cater to emerging travel preferences. Carnival, as a major player in the short cruise market, needs to proactively embrace these changes and leverage its resources to create unique and appealing experiences.

Growth/Decline Forecast

| Year | Growth/Decline Prediction | Rationale |

|---|---|---|

| 2024 | Moderate Growth | Increased demand for shorter, more flexible trips, and technological enhancements. |

| 2025 | Strong Growth | Continued consumer preference for experiential travel and environmental awareness driving demand for sustainable and unique itineraries. |

| 2026 | Moderate Growth | Potential for increased competition in the market and fluctuations in global economic conditions. |

| 2027 | Strong Growth | Expansion of digital platforms and technological innovations creating more personalized experiences, attracting a wider range of passengers. |

| 2028 | Moderate Growth | Potential impact of unforeseen external factors (e.g., geopolitical events, natural disasters). |

End of Discussion

In conclusion, Carnival’s decision to deploy a larger ship for short cruises represents a strategic response to the evolving demands of the market. The potential advantages, such as increased passenger capacity and revenue generation, are substantial, but the challenges, including operational adjustments and competition, need careful consideration. The long-term success of this venture hinges on understanding passenger preferences, optimizing operational efficiency, and successfully navigating the competitive landscape.

Question Bank

What are the typical demographics of short-cruise passengers?

Short cruise passengers often include families, couples, and individuals seeking a quick getaway. Motivations range from a desire for a quick break to exploring nearby destinations without committing to an extended vacation.

How will this larger ship impact pricing?

Pricing strategies will likely be adjusted to reflect the larger vessel’s capacity and amenities. Potential options could include a range of pricing tiers, offering flexibility for different budgets.

What are the main operational challenges of repositioning a large ship for short trips?

Challenges include port access, turnaround times, crew management, and adapting the ship’s layout for shorter itineraries. Careful planning and efficient logistics will be crucial.

How does this strategy compare to competitors’ approaches to the short-cruise market?

Competitors are likely employing various strategies to attract passengers, including targeted marketing campaigns, unique onboard experiences, and competitive pricing. Carnival’s approach will need to differentiate itself to succeed.