Carnival Bids Again for NCL A Deep Dive

Carnival again bids for NCL, reigniting speculation about a potential merger in the cruise industry. This bold move promises significant shifts in the competitive landscape, raising questions about financial implications, regulatory hurdles, and the long-term strategic vision for both companies. What could this mean for consumers, employees, and the future of cruising?

This article delves into the complexities of this potential merger, exploring the historical context, potential benefits and drawbacks, and the various factors influencing this crucial decision. We’ll analyze market trends, financial projections, and regulatory considerations to provide a comprehensive understanding of this major development in the cruise industry.

Background Information

Carnival’s pursuit of Norwegian Cruise Line (NCL) has a rich history, marked by periods of intense interest and ultimately, a lack of success. This complex dance between two major players in the cruise industry reflects the intricacies of mergers and acquisitions in a highly competitive market. Understanding past bids and the prevailing market dynamics is crucial to contextualizing Carnival’s current intentions.Previous attempts to acquire NCL reveal a pattern of strategic maneuvering, driven by a desire to consolidate market share and potentially leverage synergies.

Carnival’s motivations are multifaceted, ranging from enhancing its fleet size and geographical reach to optimizing operational efficiencies. However, these efforts have often been thwarted by factors such as regulatory hurdles, financial considerations, and the inherent challenges of integrating two distinct corporate cultures.

Carnival’s Past Bids for NCL

Carnival has historically pursued NCL with varying degrees of intensity. While precise details of previous bids remain largely confidential, public reports suggest attempts were made in specific years and were ultimately unsuccessful. The nature of these past bids remains somewhat obscure, but they were likely influenced by market conditions, including financial performance of both companies and the broader economic climate.

Key Factors Influencing Previous Bids

Several factors likely played a crucial role in shaping Carnival’s past approaches to acquiring NCL. These included the competitive landscape in the cruise industry, NCL’s financial performance, and the potential for operational synergies. Each of these elements contributed to a complex calculation involving market analysis, financial modeling, and regulatory considerations. For example, strong competitor activity in the cruise market could have influenced Carnival’s strategy by making a bid less attractive.

Current Context Surrounding Carnival’s Potential Bid

The current market conditions for Carnival and NCL differ significantly from past scenarios. Carnival’s current position in the market and NCL’s independent performance will be crucial in determining whether the acquisition is feasible. Economic downturns and recovery periods, along with industry-specific trends, play a major role in these kinds of decisions.

NCL’s Current Financial Performance and Market Position

Norwegian Cruise Line’s current financial performance is a significant factor. Key performance indicators such as revenue, profitability, and market share provide valuable insight into the company’s health and attractiveness to potential buyers. A strong performance could make NCL an attractive acquisition target, while a less favorable position might dissuade Carnival from pursuing a bid. Recent earnings reports and market share analysis would provide concrete details on NCL’s position.

Competitive Landscape in the Cruise Industry

The cruise industry is highly competitive, with multiple established players vying for market share. This competition impacts the pricing strategies, vessel offerings, and overall profitability of cruise lines. The presence of large, established competitors could potentially hinder Carnival’s acquisition efforts, requiring a thorough evaluation of competitive advantages and potential weaknesses.

Potential Benefits and Drawbacks

The proposed merger between Carnival and NCL is a significant event in the cruise industry, potentially reshaping the competitive landscape. Analyzing the potential benefits and drawbacks is crucial for understanding the implications for both companies and the wider market. The strategic implications, ranging from operational efficiencies to pricing strategies, are numerous and require careful consideration.This analysis will delve into the potential upsides and downsides, examining the impact on cruise pricing, fleet strengths and weaknesses, and the challenges of integrating two large companies.

This examination aims to provide a comprehensive understanding of the merger’s potential effects on the cruise industry as a whole.

Potential Benefits for Carnival and NCL

The merger presents several opportunities for both companies. Increased market share and economies of scale are significant potential benefits. Combining Carnival’s extensive brand recognition and vast customer base with NCL’s diverse fleet and newer vessels could create a formidable force in the global cruise market. Synergies in purchasing, marketing, and operations could lead to substantial cost savings, allowing for potentially lower prices for consumers.

Access to new markets and customer segments is another potential advantage. NCL’s more modern ships and specialized itineraries could broaden Carnival’s offerings, while Carnival’s established distribution channels could provide NCL with greater market penetration.

Potential Drawbacks for Carnival and NCL

Potential drawbacks are also substantial. Cultural clashes between the two companies’ management styles and workforces could hinder integration and create internal conflicts. Maintaining existing brand identities while forging a unified company identity will be a complex task. The potential for job losses due to redundancies in departments and overlapping roles cannot be ignored. Restructuring departments and processes to optimize efficiency may lead to temporary disruption and dissatisfaction among employees.

Potential Drawbacks for the Wider Cruise Industry

The merger could potentially create a dominant player in the cruise industry, leading to concerns about reduced competition and potential price fixing. This could negatively affect consumer choice and pricing, with potential for increased prices for cruise packages. The effect on smaller cruise lines is a key concern. Smaller competitors might struggle to compete with a combined Carnival-NCL entity, possibly leading to consolidation and decreased diversity in the cruise market.

Impact on Cruise Pricing and Availability

The merger could impact cruise pricing in several ways. If the merger results in significant cost savings, it might lead to lower prices for consumers. However, if the combined entity uses the merger to reduce competition, prices could potentially increase. Availability of certain cruise itineraries and ship types could also change. A reduced number of competing vessels could result in less choice for customers.

Demand-based price adjustments are also a possibility.

Comparison of Carnival and NCL Fleets

Carnival’s fleet is known for its wide range of ships, catering to a broad spectrum of budgets and preferences. NCL, on the other hand, often features newer ships with advanced amenities and more specialized itineraries. This difference in fleet characteristics could influence the combined company’s approach to catering to varied customer demands. The merger might lead to a restructuring of the combined fleet, with some ships potentially being decommissioned or refitted to meet a more unified approach to the cruise market.

Operational Challenges of a Merger

Integrating two large and complex organizations will undoubtedly pose significant operational challenges. Harmonizing reservation systems, booking platforms, and customer service processes will be critical for a smooth transition. Restructuring and training programs will be necessary to ensure that the combined workforce can effectively collaborate and adapt to the new organizational structure. Ensuring consistent quality standards across all ships and destinations will be an ongoing process.

Supply chain management and vendor relations will also need careful consideration. The potential for delays and disruption during the integration period is a reality that needs to be addressed proactively.

Regulatory and Legal Considerations: Carnival Again Bids For Ncl

Carnival Corporation’s bid for NCL requires navigating a complex regulatory and legal landscape. Potential antitrust concerns, specific industry regulations, and procedural hurdles related to merger approval significantly impact the feasibility and timeline of the transaction. Understanding these considerations is crucial for evaluating the overall viability of the merger.The proposed merger between Carnival Corporation and NCL Holdings will undoubtedly be scrutinized by regulatory bodies and potentially challenged in court.

Navigating this process successfully will require meticulous preparation and proactive engagement with relevant authorities. The potential outcomes range from complete approval to complete rejection or a complex set of conditions imposed by the authorities.

Regulatory Hurdles

Regulatory hurdles for a merger of this magnitude are multifaceted. The primary concern is potential anti-competitive effects. Mergers in the cruise industry, like any large-scale consolidation, often raise antitrust concerns due to the potential reduction in competition and subsequent impact on consumer choice and prices. The market share implications of a combined entity must be rigorously analyzed to determine if it substantially reduces competition in key market segments.

Potential Legal Challenges

Several legal challenges could arise during the merger process. These include claims from competitors alleging anti-competitive practices, or complaints from consumer groups alleging potential harm to consumer welfare. Also, existing contracts, agreements, and commitments might need to be addressed or modified to accommodate the merger. Potential challenges could also involve intellectual property rights, trade secrets, or employment disputes.

Carnival’s latest bid for NCL is certainly intriguing, especially considering the recent news about a key executive shift at a rival cruise line. With the recent news that bauer assumes new role at rccl , the cruise industry seems to be undergoing some major restructuring. This new move could significantly impact the competitive landscape, and it’s definitely something to keep an eye on as Carnival continues its pursuit of NCL.

Role of Antitrust Authorities

Antitrust authorities play a critical role in evaluating mergers like this. Their primary goal is to ensure that competition remains robust in the relevant markets. They examine market shares, competitive dynamics, and potential impacts on consumers. They may conduct extensive investigations and require the merging entities to provide detailed information to support the merger’s justification. Examples include the scrutiny of mergers in other industries, such as telecommunications or airlines, where market concentration was a key concern.

Procedures for Obtaining Necessary Approvals

The procedures for obtaining regulatory approvals vary by jurisdiction. Generally, companies must file detailed merger applications with antitrust authorities, provide evidence of the merger’s benefits and addressing any potential negative consequences, and participate in hearings or discussions. The timeframes for approval can be lengthy, potentially delaying the merger’s completion. Specific procedural requirements should be diligently researched and followed for each applicable jurisdiction.

Legal Precedents and Outcomes

Past mergers in the cruise industry, or related industries, provide some legal precedents. These precedents offer insight into potential outcomes and the factors considered by authorities. Analyzing previous cases, including the specifics of regulatory requirements and enforcement actions, helps anticipate potential challenges and shape the strategy for obtaining approvals. Successful mergers are often characterized by comprehensive due diligence, proactive communication with regulators, and a robust legal strategy to address potential issues.

Financial Implications

A crucial aspect of evaluating any merger is its financial impact. Understanding the projected changes in revenue, expenses, profitability, and investor confidence is paramount. This section delves into the potential financial implications of Carnival’s bid for NCL, examining both the positive and negative aspects to provide a comprehensive view.

Financial Analysis of a Potential Merger

A detailed financial analysis involves projecting future financial performance for both companies, pre- and post-merger. This necessitates a careful consideration of existing financial data, market trends, and potential synergies. Key metrics include revenue projections, cost structures, and profitability estimates. These projections will inform the decision-making process and help determine the potential value creation of the merger.

Projected Financial Implications for Both Companies

Carnival’s financial health and NCL’s financial performance will be fundamentally affected by the merger. This analysis will consider revenue streams, cost structures, and overall profitability. The integration process itself can be complex and will require a thorough evaluation of operational efficiency and resource allocation to maximize benefits.

Potential Cost Savings

Identifying potential cost savings is a crucial component of a merger analysis. These savings could stem from various sources, including operational efficiencies, reduced administrative overhead, and economies of scale in purchasing and distribution. For example, consolidating marketing campaigns or shared IT infrastructure could yield significant cost reductions. A potential synergy is the streamlining of purchasing contracts for supplies and services, leading to bulk discounts and lower costs.

- Reduced administrative costs through shared functions.

- Lower marketing expenses due to a combined marketing strategy.

- Potential savings in operational expenses from improved efficiency in port management and ship maintenance.

- Negotiated bulk discounts for supplies, reducing purchasing costs.

Potential Revenue Enhancements

The merger may lead to significant revenue enhancements by increasing market share and expanding into new customer segments. A broader customer base and expanded geographic reach are crucial factors. Combined resources and marketing efforts can lead to increased brand recognition and attract new clientele.

- Expanding market reach to new demographics and regions.

- Increased brand visibility and recognition due to a combined marketing effort.

- Potential for higher passenger volume through a more diverse cruise offering.

- Improved distribution and booking channels, allowing for enhanced sales and marketing strategies.

Estimated Impact on Investor Confidence

The potential impact on investor confidence will depend on the perceived value creation and the success of the integration strategy. A successful merger, with clearly defined synergies and strong financial projections, will likely increase investor confidence. Conversely, uncertainty about the merger’s success or negative financial implications could lead to investor apprehension.

- Positive investor reaction to projected financial gains.

- Potential negative impact if the merger does not deliver expected results.

- Public perception and investor sentiment will be influenced by the transparency and communication surrounding the merger.

Comparison of Pre- and Post-Merger Financial Forecasts

| Category | Pre-Merger | Post-Merger |

|---|---|---|

| Revenue | $XX Billion | $YY Billion (estimated) |

| Expenses | $ZZ Billion | $WW Billion (estimated) |

| Profit | $AA Billion | $BB Billion (estimated) |

| Stock Price | $CC per share | $DD per share (estimated) |

Note: XX, YY, ZZ, WW, AA, BB, CC, and DD represent placeholder values that need to be replaced with actual data based on specific projections.

Strategic Implications

Carnival’s potential bid for NCL represents a significant strategic move, aiming to consolidate market share and potentially reshape the cruise industry landscape. This consolidation could lead to economies of scale, improved operational efficiency, and a more formidable competitor in the global cruise market. The strategic rationale behind the potential acquisition is multifaceted, focusing on long-term growth and profitability within a dynamic industry.

Strategic Rationale Behind Carnival’s Potential Bid

Carnival’s rationale for pursuing a merger with NCL is rooted in several key objectives. These include achieving substantial market share expansion, optimizing operational efficiency through combined resources, and enhancing its global presence by leveraging NCL’s existing assets and customer base. This strategic move seeks to enhance profitability by leveraging combined purchasing power and minimizing operational redundancies.

Carnival’s renewed bid for NCL is interesting, given the broader context of travel and politics. Just as Amtrak navigates the complex intersection of public transportation and political agendas, as explored in this insightful piece on amtrak at junction of travel and politics , this latest bid for NCL seems to be influenced by similar forces. Ultimately, the future of carnival’s presence in NCL hinges on more than just economic factors.

Long-Term Implications for the Cruise Industry

A merger between Carnival and NCL would likely have profound long-term implications for the cruise industry. A significant consolidation of power could lead to reduced competition, potentially impacting pricing strategies and innovation. However, a more efficient and cost-effective industry structure could benefit consumers through lower prices and enhanced offerings. It could also result in a more streamlined and sophisticated cruise experience.

Past examples of mergers in similar industries demonstrate the potential for both positive and negative outcomes, depending on the execution and regulatory environment.

Carnival’s renewed bid for NCL is interesting, given the current trend of all-inclusive resorts going smaller and more boutique. This shift in the travel industry seems to be impacting how cruise lines are positioning themselves. Perhaps Carnival is adjusting its strategy to better compete with the new all-inclusive resorts and maintain their competitive edge in the market. The focus on smaller, upscale options might be key for their next phase of bids for NCL.

all inclusive resorts go small It will be fascinating to see how this all plays out.

Strategic Plan to Implement a Potential Merger, Carnival again bids for ncl

A successful implementation of a merger between Carnival and NCL requires a comprehensive strategic plan encompassing several critical stages. This plan should address integration strategies, including the consolidation of operations, customer service protocols, and marketing campaigns. A detailed integration strategy, focusing on the harmonization of operations and the efficient utilization of combined resources, is crucial. The process must address potential employee concerns, ensuring smooth transitions and minimizing disruptions.

Potential Synergies Between the Two Companies

The potential synergies between Carnival and NCL are numerous. The combined fleet size and range of destinations could create a more comprehensive global presence, offering diverse cruise itineraries. The combined customer base could result in increased revenue streams and potentially lower marketing costs through shared resources. This synergy could also result in the creation of a more robust brand image, potentially strengthening the combined company’s appeal to consumers.

Effects on Cruise Itineraries and Routes

The merger’s effects on cruise itineraries and routes could be substantial. The combination of Carnival and NCL’s existing routes could result in expanded itineraries, covering a wider range of destinations and potentially offering new, combined routes. The strategic focus on efficient route planning and operational optimization is critical. It is important to analyze the potential impact on existing customer preferences and demands.

Analyzing market demand for new routes and optimizing resource allocation to maximize efficiency are key considerations.

Public Perception and Reactions

Carnival’s bid for NCL presents a fascinating case study in public perception. The potential merger will undoubtedly generate a range of reactions, from enthusiastic support to staunch opposition. Understanding these potential reactions is crucial for Carnival’s strategic planning, allowing them to anticipate and address concerns proactively. The success of the merger hinges on effectively managing public sentiment and fostering a positive image.Potential public reactions to the merger will vary significantly.

Some customers may view the merger as a positive development, anticipating increased service offerings, lower prices, and enhanced fleet choices. Conversely, other customers, particularly those loyal to one of the brands, may express reservations or opposition, potentially due to concerns about service quality, brand identity dilution, or job security. This diverse range of reactions highlights the need for a nuanced approach to public relations.

Potential Impact on Customer Loyalty and Preferences

Public perception of the merger will significantly influence customer loyalty. Customers loyal to either Carnival or NCL may exhibit hesitancy, and this hesitation may extend to those who haven’t developed strong brand preferences. Maintaining the distinct identities of both brands while streamlining operations is key to mitigating potential customer loss. A proactive and transparent communication strategy that emphasizes the benefits of the merger for customers is critical.

Carnival again is vying for a spot on Norwegian Cruise Line (NCL), and while that’s exciting, it’s interesting to see how other luxury destinations are evolving. For instance, the Amanyara resort in the Turks and Caicos is undergoing some fantastic renovations, amanyara turks and caicos renovations , which could give us a peek into what a future Carnival cruise experience might look like.

Ultimately, the big question remains: how will Carnival’s bid for NCL impact the cruise market?

Examples from other industries, such as the airline mergers, demonstrate the complexity of managing customer loyalty in such situations.

Potential Media Coverage and Public Opinion

Media coverage will play a critical role in shaping public opinion. Positive coverage highlighting the benefits of the merger, such as increased capacity and lower prices, will help build public support. Conversely, negative coverage, potentially focusing on concerns regarding job losses or service degradation, will hinder the merger’s acceptance. The media will likely scrutinize the merger’s financial implications, regulatory hurdles, and potential impact on customer experience.

Past mergers in the cruise industry have experienced varying levels of media attention, demonstrating the importance of anticipating and addressing potential negative narratives.

Examples of Past Mergers in the Cruise Industry and the Public Response

Previous mergers in the cruise industry offer valuable insights into public reactions. Some mergers have been met with relatively muted responses, while others have sparked considerable controversy. Examining these cases, including their specific contexts, is essential to understanding potential public reactions. Understanding the past reactions and their underlying causes allows for informed mitigation strategies. A thorough analysis of these historical precedents can provide insights into the specific factors that contribute to public opinion, such as the perceived impact on pricing, service quality, and job security.

Potential Impact on Customer Service and Satisfaction

The merger’s potential impact on customer service and satisfaction is a crucial aspect to consider. Maintaining the high standards of service expected by customers of both brands is paramount. A seamless integration of service protocols, staff training, and customer service channels will be essential to avoid disruptions and maintain high satisfaction levels. The merger’s success relies heavily on preserving the quality of service that customers have come to expect from both brands.

Implementing measures to address potential service disruptions and maintain a positive customer experience should be a priority.

Market Analysis

The cruise industry is a dynamic and competitive market, with ongoing shifts in consumer preferences and strategic maneuvers by key players. Understanding the current market trends, key players, and market size is crucial for evaluating the potential of Carnival’s bid for NCL. This analysis delves into the current state of the cruise market, focusing on Carnival and NCL’s positions within it.The cruise industry is experiencing a period of both growth and adaptation.

Factors like changing travel habits, the rise of alternative leisure options, and the ongoing impact of global events influence the market landscape. This analysis examines these influences to provide a comprehensive picture of the market.

Current Market Trends

The cruise market is characterized by fluctuating demand, influenced by factors like economic conditions, travel advisories, and competitor offerings. Demand often spikes during peak seasons, while economic downturns or geopolitical instability can cause dips. The industry is also responding to evolving consumer preferences, with an increasing emphasis on personalized experiences, sustainability initiatives, and diverse itineraries. These factors underscore the importance of adapting to changing trends to maintain market share.

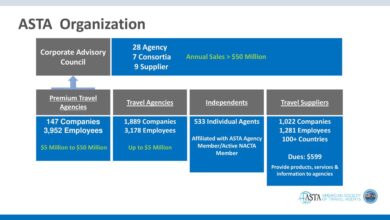

Key Market Players and Strategies

Several major players shape the cruise industry landscape. Carnival Cruise Line, Royal Caribbean International, and Norwegian Cruise Line Holdings (NCLH) are among the largest operators, each employing distinct strategies. Carnival, for instance, often emphasizes affordability and diverse itineraries, while Royal Caribbean focuses on family-friendly experiences and innovative onboard entertainment. NCLH has a reputation for offering a variety of ship types, catering to various preferences, and a strategy of continuous fleet upgrades.

Market Size and Growth Potential

The global cruise market is a substantial industry. The market size is substantial, encompassing diverse ship types, itineraries, and customer segments. The industry’s growth potential hinges on factors such as the continued appeal of cruise vacations, the development of new cruise destinations, and the effectiveness of marketing campaigns. Predictions for future growth vary, influenced by market conditions and industry developments.

Comparison of Carnival and NCL Market Shares

Precise market share data for Carnival and NCL is not readily available in a single, publicly accessible source. However, publicly available information indicates that both Carnival and NCL are major players in the cruise market. Carnival is known for its vast global network and extensive fleet, while NCL offers a variety of options, including smaller ships and unique itineraries.

A comparison requires analyzing various metrics beyond raw numbers.

Competitive Positioning of Carnival and NCL

Note: Exact market share figures are not readily available and require aggregation from multiple sources. Estimates are based on industry analysis and publicly available information.

Potential Impacts on Employees

The proposed merger between Carnival and NCL presents a complex set of potential impacts on the employees of both companies. Understanding these impacts is crucial for assessing the overall viability and success of the transaction, as employee well-being and retention play a significant role in the smooth transition and long-term performance of the combined entity. This section will explore the potential effects on employment, organizational structure, training, compensation, and benefits.The merging of two large cruise lines will inevitably lead to some level of restructuring and adjustments in the workforce.

These changes may result in both job losses and opportunities for growth and advancement, depending on the specific circumstances and the strategic decisions made during the integration process.

Potential Job Losses or Gains

The merger’s impact on employment will depend on the duplication of roles and responsibilities across the two companies. A thorough analysis of overlapping functions and potential synergies is necessary to identify areas where efficiency gains can be achieved through consolidation or restructuring. For example, if one company has redundant positions in sales or marketing, there may be opportunities for consolidation and job cuts.

Conversely, the combined company may find opportunities to expand into new markets or services, creating new roles and employment opportunities. Examples of mergers in other industries demonstrate both job loss and creation, as companies often seek to optimize their resources and processes.

Potential Changes in Organizational Structure and Roles

The integration of two distinct organizational structures will likely result in changes to the reporting lines, departmental hierarchies, and overall organizational design. The combined company may adopt a unified structure, integrating existing teams or creating new ones to better leverage the combined expertise and resources. For instance, combining sales and marketing teams from both companies could lead to more streamlined processes and improved customer outreach.

Similarly, consolidating IT, finance, or human resources functions may be undertaken to achieve economies of scale. The potential changes may require adjustments in job descriptions and responsibilities for employees in affected departments.

Potential Training Needs for Employees

The merger will likely necessitate training programs to ensure a smooth transition and to equip employees with the skills and knowledge necessary to effectively operate within the new organizational structure. Training programs should focus on the integration of processes, systems, and technologies. For example, employees may need training on new software platforms or procedures for customer service or operations.

Employees will need to be familiarized with the combined company’s policies, procedures, and culture. Effective training programs can help employees adapt to the changes and enhance their overall performance. This is crucial to minimize disruption and maximize employee engagement.

Potential Impact on Employee Compensation and Benefits

The merger’s impact on employee compensation and benefits will vary depending on factors like the specific roles, experience levels, and geographic locations of the employees. Companies often strive to maintain competitive compensation and benefits packages to retain valuable employees. The new company may adopt a unified compensation and benefits structure, aligning it with industry standards and the overall compensation strategies of the organization.

There may be instances where adjustments to compensation packages are necessary to ensure equity and competitiveness, potentially leading to some employees being affected in one way or another. A fair and transparent approach to compensation adjustments is vital to maintain employee morale and trust.

Visual Representation

Visualizing a potential merger between Carnival and NCL is crucial for understanding the implications and potential outcomes. These visualizations can help stakeholders, investors, and the public grasp the complexities of the proposed transaction in a clear and concise manner. This section will present several visual representations, including infographics, timelines, and diagrams, to illustrate the potential merger.

Infographic: Potential Market Share Shifts

A comprehensive infographic would effectively communicate the projected market share changes after the merger. This visualization would use a clear color-coded system to represent the current market share of Carnival and NCL, contrasting it with the anticipated market share distribution following the union. It would visually illustrate how the combined entity would likely position itself against competitors. For instance, a segment of the pie chart could depict the combined market share of Carnival and NCL exceeding the current share of a major competitor.

Timeline: Steps Involved in a Potential Merger

A timeline highlighting the key stages of the merger process would provide a clear understanding of the anticipated duration and procedural aspects. The timeline would break down the process into distinct phases, including due diligence, regulatory approvals, shareholder votes, and the eventual integration of operations. This would help clarify the time frame involved and the anticipated milestones. For example, a realistic timeline might estimate the regulatory approval phase taking approximately 6-12 months, depending on the complexity of the case.

Carnival again bids for NCL’s attention, and with the recent reopening of Amsterdam’s De L’Europe, Amsterdam’s De L’Europe reopens , it’s got me thinking about the vibrant energy of European celebrations. The impressive reopening of the venue further highlights the enthusiasm for cultural experiences. With the possibility of Carnival returning to NCL, it seems like a fantastic time to plan a trip.

Phases of a Merger Process

The merger process typically involves distinct phases. A diagram illustrating these phases could be presented using a flowchart or a series of interconnected boxes. Each phase would be labeled, such as “Due Diligence,” “Negotiations,” “Regulatory Approvals,” “Shareholder Votes,” “Integration Planning,” and “Post-Merger Integration.” This would showcase the steps involved in detail. Each phase could be further subdivided into smaller, more specific tasks to demonstrate the level of complexity involved.

Diagram: Strategic Positioning Before and After Merger

A diagram depicting the strategic positioning of Carnival and NCL before and after the merger would be valuable. This could be a side-by-side comparison using visual representations, such as maps or organizational charts. This diagram could showcase the geographic reach of each company before and after the merger, emphasizing the expanded market presence. For example, the diagram could illustrate how the combined entity now has a presence in key markets previously underserved by either Carnival or NCL.

Graphic: Potential Market Share Shifts After Merger

A graphic illustrating the potential market share shifts would clearly display the predicted outcome. This could be presented as a dynamic graph showcasing the market share percentage for Carnival, NCL, and major competitors before and after the merger. The graphic could use different colors to highlight the companies and use arrows to illustrate the predicted changes in market share.

For example, the graphic could display a significant increase in market share for the combined entity compared to competitors like Royal Caribbean.

Wrap-Up

Carnival’s renewed bid for NCL presents a fascinating case study in corporate strategy. While the potential benefits of a combined entity are significant, substantial challenges and regulatory hurdles remain. The impact on pricing, customer service, and the overall competitive landscape of the cruise industry is undeniable. The ultimate success of this merger hinges on careful planning, effective execution, and a deep understanding of the complexities involved.

Further analysis will reveal the long-term implications of this strategic move.

Query Resolution

What is Carnival’s historical track record with mergers and acquisitions?

Carnival has a history of strategic acquisitions in the past, but this is a notable attempt at a larger scale merger with a different competitor.

What are the potential cost savings from a merger?

Potential cost savings could arise from economies of scale in areas like purchasing, marketing, and administrative functions.

What are the concerns regarding potential job losses?

A merger could result in some job losses due to overlapping roles and potential streamlining of operations. However, new roles and opportunities could also emerge.

How might this merger affect cruise pricing for consumers?

The merger could potentially lead to either price increases or decreases depending on the operational efficiencies and market positioning post-merger.