Calculating Risks Then Going For It A Guide

Calculating risks then going for it is a powerful approach to decision-making, but it’s crucial to understand the process thoroughly. This guide dives deep into the intricacies of evaluating potential risks, quantifying their impact, and ultimately making informed choices that lead to successful outcomes.

From identifying potential hazards to weighing rewards against potential losses, we’ll explore various strategies and examples to illustrate how to effectively calculate risks before taking action. We’ll also discuss the critical factors that influence success and failure, allowing you to make well-informed choices in your personal and professional life.

Defining the Concept

The phrase “calculating risks then going for it” encapsulates a crucial approach to decision-making, especially in situations involving uncertainty and potential rewards. It signifies a calculated risk-taking strategy, emphasizing the importance of thorough analysis before committing to a course of action. This approach is not about recklessness, but rather a measured assessment of potential downsides alongside potential gains.This calculated risk-taking involves a systematic evaluation of possible outcomes, considering both the positive and negative consequences.

It’s a proactive method, not a reactive one, and allows individuals and organizations to make informed choices with a greater chance of success. This calculated approach differs significantly from impulsive actions, which are often driven by emotions or fleeting opportunities without a careful consideration of the potential risks.

Different Interpretations of the Phrase

The phrase can be interpreted in various ways, depending on the context. In a business context, it might involve rigorously analyzing market trends and competitor strategies before launching a new product or service. In a personal context, it could refer to carefully evaluating the pros and cons of a significant life change, such as moving to a new city or changing careers.

The underlying principle remains consistent: a deliberate and informed approach to decision-making, rather than an impulsive one.

Taking calculated risks and then going for it is a key part of any successful venture. Sometimes, that means making tough decisions, like the recent move by Ambassadors to sell off their marine division, ambassadors sells marine division. This strategic shift likely involved a thorough risk assessment, and while it might seem drastic, it could ultimately prove beneficial in the long run.

Ultimately, evaluating the potential rewards and downsides, then acting decisively, is crucial.

Risk Calculation in Different Contexts

The process of calculating risk varies greatly depending on the specific context. In a financial context, risk calculation might involve assessing the volatility of stock prices, evaluating the creditworthiness of borrowers, or analyzing potential losses in investments. In a personal context, it might involve evaluating the health risks associated with certain lifestyle choices or the financial risks of taking out a loan.

In a professional context, it might involve considering the risks of implementing a new technology or strategy, or evaluating the safety of a workplace environment.

Stages of Risk Calculation and Action

The table below Artikels the key stages involved in the process of calculating risks and then acting upon them. Each stage plays a crucial role in the overall decision-making process, contributing to a more informed and successful outcome.

| Stage | Description | Example | Potential Outcomes |

|---|---|---|---|

| Risk Assessment | Identifying potential risks and their likelihood. This involves systematically examining potential threats, weaknesses, and vulnerabilities. | Analyzing market trends, competitor actions, potential legal issues, or environmental factors. | Accurate vs. inaccurate assessment. An accurate assessment provides a solid foundation for the subsequent stages; an inaccurate one can lead to flawed decisions. |

| Risk Quantification | Assigning numerical values to the risks, typically through probability and impact analysis. This allows for a more objective comparison of risks. | Calculating the probability of a project failing, estimating the financial impact of a security breach, or quantifying the potential harm from a product defect. | Overestimation vs. underestimation of risk. Overestimation might lead to unnecessary caution and missed opportunities; underestimation could lead to significant losses. |

| Decision Making | Evaluating the calculated risks against potential rewards. This involves weighing the pros and cons, considering alternatives, and making a strategic choice. | Weighing the potential profits against the potential losses of a business venture, considering alternative investment strategies, or assessing the benefits and drawbacks of a personal decision. | Success vs. failure, profit vs. loss. A well-informed decision increases the likelihood of positive outcomes and reduces the potential for negative ones. |

| Action | Implementing the chosen course of action. This involves developing a plan, executing the strategy, and monitoring the progress. | Executing a business plan, taking a leap of faith in a new venture, or implementing a personal development strategy. | Positive vs. negative consequences. The success of the action hinges on the effectiveness of the preceding stages. |

Illustrative Examples

Embarking on a course of action, after a rigorous risk assessment, requires a careful consideration of potential outcomes. Successes and failures alike provide invaluable lessons, enabling us to refine our approach and improve future decisions. Analyzing both positive and negative consequences offers a comprehensive understanding of the intricacies involved.Successful applications of this approach often involve a meticulous balancing act.

The ability to anticipate potential pitfalls, while also acknowledging the possibility of unforeseen opportunities, is paramount.

Successful Instances

A successful example is the development of a new software application. Thorough market research, competitor analysis, and projections of user adoption helped to identify and mitigate potential risks like low user engagement and technological obsolescence. By meticulously analyzing these risks, the developers were able to allocate resources strategically, leading to a successful launch and substantial market penetration. Another example lies in the expansion of a retail chain.

By analyzing local market trends, competitor activities, and potential supply chain disruptions, the company could mitigate risks and optimize expansion strategies. This approach allowed for a controlled expansion, minimizing financial losses and maximizing profits.

Negative Outcomes

Conversely, a lack of proper risk assessment can lead to disastrous consequences. A prime example is the collapse of a startup due to poor market analysis and an underestimation of competition. Ignoring crucial warnings about market saturation and failing to anticipate competitor actions resulted in a swift decline in market share and eventually, the cessation of operations. Similarly, a pharmaceutical company that neglected to consider potential side effects during clinical trials faced significant setbacks, leading to product recalls and reputational damage.

Comparing Approaches to Risk Assessment

Different individuals and entities adopt distinct approaches to risk assessment and subsequent action. The conservative approach prioritizes safety, minimizing potential losses. This approach often involves extensive due diligence, detailed planning, and a cautious approach to implementation. In contrast, the aggressive approach seeks to maximize potential rewards, often accepting greater risks. This approach involves a quicker decision-making process, rapid implementation, and a willingness to embrace change.

These approaches can be further nuanced by considering the specific industry, organizational culture, and individual personalities involved.

Risk Management Approach Comparison

| Approach | Risk Assessment | Decision Making | Action |

|---|---|---|---|

| Conservative | High emphasis on minimizing risk, extensive data collection, and multiple contingency plans. | Favors safety and avoiding losses, meticulous evaluation of all possible scenarios. | Cautious and deliberate, phased implementation with thorough monitoring. |

| Aggressive | Emphasis on potential rewards, acceptance of significant risks, and focus on market opportunities. | Prioritizes potential gains, swift decision-making, and calculated risk-taking. | Quick and decisive, proactive implementation with rapid adaptation to changing circumstances. |

Methods and Procedures

Assessing risk is not a passive exercise; it’s a dynamic process that requires a structured approach. This section delves into the practical methods and procedures for evaluating potential risks and translating them into actionable steps. We’ll explore various techniques for quantifying risk and discuss how to effectively manage the uncertainties inherent in any endeavor.Effective risk management necessitates a clear understanding of the process, from initial identification to the final implementation of mitigation strategies.

By understanding different methodologies, you can choose the approach best suited to your specific context and objectives.

Taking calculated risks and then diving headfirst into a project is a thrilling concept, and it’s a strategy many successful entrepreneurs use. It’s a bit like Richard Branson’s approach to innovation, as seen in his perspective on the APD, bransons view of the apd. He seems to be all about evaluating the potential downsides and then forging ahead, which resonates with a lot of people who want to make a real impact.

Ultimately, that calculated risk-taking mindset is what drives progress and change.

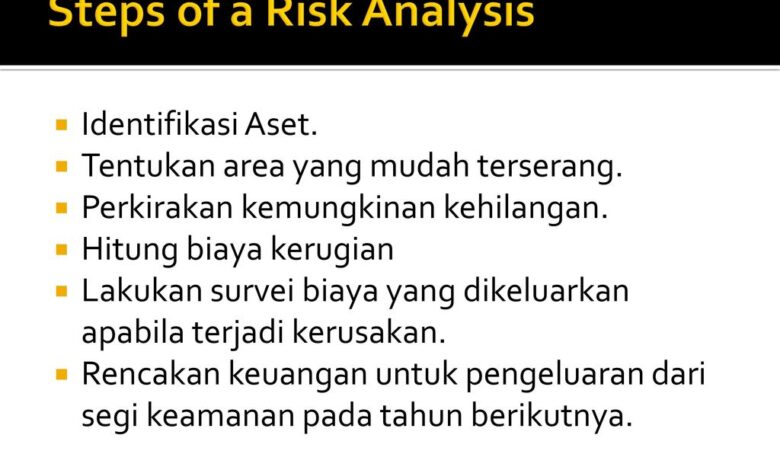

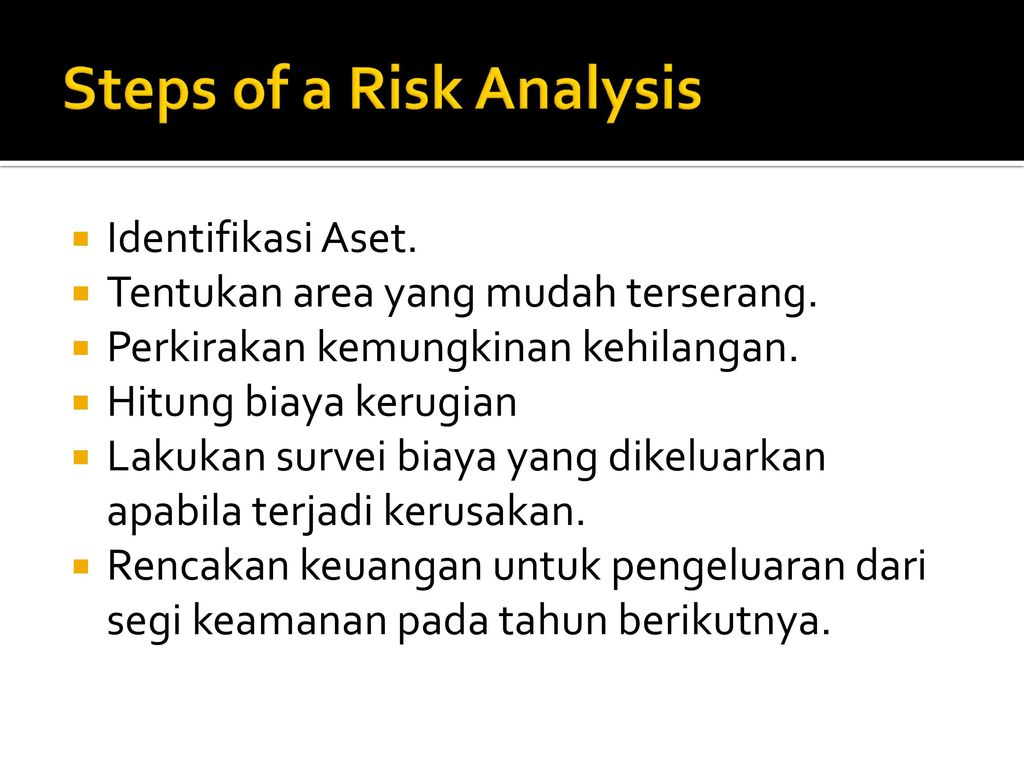

Risk Assessment Process

The risk assessment process is iterative and cyclical. It’s not a one-time event but rather a continuous improvement loop. Identifying potential risks is the first step, followed by evaluating their likelihood and impact. This requires a structured methodology to ensure thoroughness and avoid overlooking critical factors.

Taking a calculated risk and then following through is key, especially when faced with tough financial decisions. For example, considering the recent trends in American pay cuts, as detailed in this insightful article about american s pay cut , understanding the potential downsides is crucial before making any significant changes. Ultimately, careful risk assessment is paramount before taking the leap.

- Identifying Potential Risks: This involves brainstorming and gathering information from various sources. This could include reviewing historical data, conducting interviews with stakeholders, or employing SWOT analysis to uncover both internal and external threats. Techniques such as checklists, questionnaires, and expert judgment can also prove invaluable.

- Analyzing Risk Likelihood and Impact: Quantifying risk involves assigning probabilities to the occurrence of events and estimating the potential consequences. Qualitative methods often use descriptive terms like “high,” “medium,” or “low” to categorize likelihood and impact. Quantitative methods, however, utilize numerical values to provide a more precise assessment. For example, a probability of 0.8 (80%) and a potential impact of $10,000, translated into a quantified risk score.

Taking calculated risks and then forging ahead is a constant balancing act. Sometimes, things don’t go as planned, like with the recent news of Aker halting delivery of building materials for the NCL ship here. This situation highlights how unforeseen circumstances can impact even the most meticulously crafted plans. But, even in these situations, assessing the risks and moving forward remains a crucial aspect of navigating life’s unpredictable journey.

- Evaluating Risk Severity: Combining the likelihood and impact scores produces a risk severity rating. This allows for prioritizing risks based on their potential harm. A risk matrix, for example, graphically displays the combination of likelihood and impact, enabling easy identification of critical risks.

- Developing Mitigation Strategies: This stage focuses on implementing measures to reduce the likelihood or impact of identified risks. Possible mitigation strategies range from implementing preventive controls to developing contingency plans for potential disruptions.

- Monitoring and Review: A crucial aspect of risk management is continuous monitoring and review of the implemented strategies. Regular assessments are essential to adapt to evolving circumstances and ensure that the risk management process remains relevant and effective. Data collected throughout this process informs future adjustments to risk assessment and mitigation.

Quantifying Risk and Actionable Steps

Transforming risk assessments into actionable steps involves translating qualitative judgments into concrete actions. The goal is to quantify the potential loss or gain associated with each risk, enabling a data-driven approach to decision-making.

Taking calculated risks and then going for it is key, especially in the travel industry. Just like assessing the potential upsides and downsides before booking a trip, the recent move by Amadeus to include Cunard products in their cruise offerings ( amadeus cruise adds cunard product ) shows a smart strategic risk assessment. Ultimately, bold decisions like these often lead to the most rewarding outcomes.

- Risk Scoring and Prioritization: Risk scoring involves assigning numerical values to the likelihood and impact of each risk. This numerical representation facilitates comparison and prioritization. For instance, a risk score of 9 (high likelihood and high impact) warrants immediate attention and proactive mitigation strategies. Prioritizing risks based on the calculated score is a key component of efficient resource allocation.

- Defining Mitigation Strategies: Mitigation strategies need to be concrete and measurable. They should Artikel specific actions to reduce the risk’s likelihood or impact. For example, a strategy to reduce the risk of equipment failure might involve implementing regular maintenance schedules and investing in redundant systems. These measures should be documented and include clear performance metrics for tracking success.

- Developing Contingency Plans: Contingency plans provide a framework for responding to unforeseen events or deviations from the anticipated course. These plans Artikel the steps to be taken if a specific risk materializes. For instance, a contingency plan for supply chain disruptions might detail alternative sourcing strategies, emergency inventory levels, and communication protocols.

Comparing Risk Management Methodologies

Different methodologies offer varying approaches to risk assessment and management. Understanding their strengths and weaknesses helps in selecting the most appropriate method for a given context.

| Methodology | Description | Strengths | Weaknesses |

|---|---|---|---|

| Qualitative Approach | Relies on descriptive terms to categorize risks. | Simple, easily understandable, suitable for initial assessments. | Less precise, potentially subjective. |

| Quantitative Approach | Employs numerical values to quantify risk. | Precise, objective, enables data-driven decision-making. | More complex, requires data collection and analysis. |

| SWOT Analysis | Identifies Strengths, Weaknesses, Opportunities, and Threats. | Comprehensive view of internal and external factors. | Not specifically focused on risk assessment. |

Factors Influencing the Outcome

Taking calculated risks and then acting decisively is a powerful approach, but success hinges on a multitude of factors beyond the initial plan. Understanding these influences, both internal and external, is crucial for anticipating potential pitfalls and maximizing the likelihood of a positive outcome. Ignoring these elements can lead to unexpected challenges and ultimately, failure.A well-defined risk assessment, while essential, is just the first step.

A thorough evaluation of the environment in which the approach will be implemented is necessary to gauge its potential for success. This means considering not only the predictable market conditions but also the often-unforeseen external forces that can significantly alter the trajectory of the endeavor. Internal factors, such as the expertise and commitment of the team, also play a pivotal role in determining the final outcome.

External Factors Impacting Success

External factors are forces beyond the control of the individual or organization implementing the approach. Market conditions, competition, and regulatory changes all fall into this category. A shift in consumer preferences, an economic downturn, or a surge in competitor activity can significantly impact profitability and market share. Understanding the potential impact of these external factors is vital for effective risk management.

Internal Factors Influencing Decision-Making, Calculating risks then going for it

Internal factors relate to the resources, capabilities, and processes within the organization. Team expertise, experience, and decision-making processes all contribute to the success or failure of the approach. A team lacking the necessary skills or experience in the chosen area could lead to flawed decisions and implementation problems. Strong leadership, clear communication, and efficient processes are critical for success.

Effective resource allocation and budget management are also key internal factors.

Comprehensive List of Influencing Factors

| Category | Factor | Impact |

|---|---|---|

| External | Market conditions (e.g., economic downturn, consumer trends) | Positive or negative influence on profitability and demand. A downturn can decrease revenue while new trends can open up new markets. |

| External | Competition (e.g., new entrants, aggressive pricing) | Impact on market share and revenue. Aggressive competitors can cut into market share and profits. |

| External | Regulatory environment (e.g., new laws, regulations) | Can create new obstacles or opportunities. New regulations can either hinder or enable certain actions. |

| Internal | Team expertise (e.g., skills, experience, knowledge) | Directly impacts decision accuracy and the effectiveness of implementation. A team with relevant expertise will be more likely to make sound decisions. |

| Internal | Resource allocation (e.g., budget, personnel) | Impacts project scope, timeline, and feasibility. Insufficient resources can lead to delays or failure to achieve goals. |

| Internal | Decision-making processes (e.g., communication, consensus) | Impacts the speed and quality of decisions. Effective processes ensure that decisions are well-informed and promptly executed. |

| Internal | Leadership style (e.g., empowering, directive) | Impacts team morale, motivation, and the overall work environment. An empowering style can foster innovation and improve performance. |

Variations and Considerations

Embarking on a calculated risk requires adaptability. The framework for assessing and mitigating risks, while robust, must be tailored to specific circumstances. Different contexts, potential pitfalls, and cultural nuances necessitate variations in approach. This section explores these considerations, ensuring a more comprehensive understanding of the risk-taking process.Understanding the diverse applications of risk assessment is crucial. The same principles can be applied in various contexts, from personal finance decisions to complex corporate strategies.

The key is to identify the specific variables and parameters relevant to each scenario and adjust the assessment accordingly.

Variations in Application

This approach can be modified to suit various contexts. For instance, a venture capitalist evaluating a new startup will focus on different risk factors compared to an individual investing in a mutual fund. In the startup context, factors like market viability, team competence, and technological innovation are paramount. Conversely, in the mutual fund scenario, market trends, historical performance, and diversification strategies are more critical.

This highlights the necessity of context-specific adjustments to the risk assessment model.

Potential Pitfalls and Drawbacks

Rigorous risk assessment, while beneficial, is not without its limitations. Over-reliance on quantitative data might neglect qualitative aspects, such as unforeseen circumstances or unexpected market shifts. Subjectivity in assessing probabilities can also introduce bias into the decision-making process. Furthermore, the model might struggle to account for highly unpredictable events or those with low probability but high impact.

Situations Requiring Alternative Approaches

Certain situations demand a different approach to risk assessment. For example, in crisis management, a rapid, decisive response is often more critical than a detailed risk analysis. Similarly, when faced with extreme uncertainty or unknown unknowns, a more exploratory or experimental approach might be preferable. This approach prioritizes flexibility and adaptability, focusing on learning and adaptation over rigid calculations.

Influence of Cultural Differences

Cultural factors significantly impact risk tolerance. Some cultures prioritize long-term stability and security, leading to a lower risk tolerance. In contrast, others emphasize innovation and entrepreneurship, potentially resulting in a higher risk tolerance. These differences are rooted in historical, social, and economic contexts and significantly affect individual and collective decision-making regarding risk. For instance, a society valuing stability might be more cautious about investing in new technologies compared to one that values innovation.

Acknowledging these cultural nuances is vital for accurate risk assessment, especially in international business dealings.

Final Review

In conclusion, calculating risks before acting isn’t just about avoiding losses; it’s about maximizing potential gains. By understanding the process of risk assessment, quantification, and decision-making, you can confidently navigate uncertainty and increase your chances of achieving desired outcomes. Remember, successful risk management is an ongoing process that requires careful consideration of internal and external factors. This guide provides a framework to help you develop your own tailored approach to risk management.

Top FAQs: Calculating Risks Then Going For It

What are some common pitfalls when calculating risks?

Oversimplifying complex situations, neglecting external factors, and relying too heavily on gut feelings instead of data-driven analysis are common pitfalls. Furthermore, emotional biases can significantly skew risk assessments. It’s crucial to be aware of these pitfalls and develop a systematic approach to mitigate their impact.

How can I quantify risk in a non-financial context?

In personal or social situations, quantify risk by assessing the probability of a negative outcome and its potential severity. For example, the likelihood of missing a deadline and the consequences of doing so.

What are some alternative approaches to risk management beyond calculating risks then going for it?

Risk avoidance, risk transfer (e.g., insurance), and risk reduction are alternative approaches. Choosing the right approach depends on the specific situation and the desired level of control.

How can I adapt this approach for different types of projects or decisions?

The fundamental principles of risk assessment and decision-making remain consistent. However, the specific methods and considerations will vary based on the context of the project or decision. A detailed assessment of the situation and thorough research are crucial to adjusting the approach appropriately.