Boeing Not Feeling the Pressure Analysis

Boeing not feeling the pressure is a bold claim, prompting a deeper dive into the aerospace giant’s current situation. This analysis examines Boeing’s recent performance, external pressures, internal responses, and industry comparisons to understand the validity of this assertion. Is Boeing truly insulated from the challenges facing the global aerospace industry, or is this perception a misleading narrative?

The report will delve into Boeing’s market position, evaluating revenue, profits, and market share against its competitors, including Airbus. We will explore the impact of geopolitical events, supply chain issues, and economic downturns on Boeing’s operations. Furthermore, an examination of Boeing’s internal structure, past responses, and leadership will offer insights into how the company is handling these pressures.

Boeing’s Current Market Position

Boeing, a global aerospace giant, is navigating a complex landscape in the current market. Recent financial performance has been a mixed bag, reflecting both industry-wide trends and the company’s own internal challenges. While significant progress has been made in some areas, challenges persist. The global aerospace industry is experiencing a period of transformation, with significant technological advancements and evolving customer demands shaping the future of air travel.The current state of the aerospace industry is characterized by a delicate balance between technological innovation and market competitiveness.

The industry faces hurdles such as supply chain disruptions, rising material costs, and the ongoing effects of the pandemic. Despite these difficulties, opportunities abound for companies like Boeing to adapt and thrive in this evolving landscape.

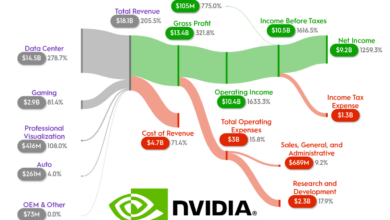

Boeing’s Financial Performance

Boeing’s recent financial performance has been marked by a mix of successes and setbacks. Revenue figures have fluctuated, reflecting the cyclical nature of the aerospace industry. Profit margins have shown signs of recovery, but remain sensitive to external factors like fuel prices and global economic conditions. Market share is a crucial indicator of Boeing’s competitiveness. Its position compared to Airbus is a key metric in evaluating its overall standing in the market.

Global Aerospace Industry Trends

The global aerospace industry is experiencing several key trends. The growing demand for sustainable aviation fuels and electric aircraft technologies is reshaping the future of air travel. These advancements aim to reduce the environmental impact of air travel, a critical concern for both passengers and regulators. Further, the increasing complexity of aircraft designs and the rising cost of development pose challenges for both Boeing and Airbus.

Boeing vs. Airbus: A Comparative Analysis

Boeing and Airbus are the dominant players in the commercial aircraft market. Competition is fierce, and both companies are constantly innovating to maintain their market share. Factors such as production capacity, delivery timelines, and customer relationships play a significant role in their relative market positions. Boeing and Airbus are constantly vying for market leadership, making for an intense and ever-changing environment.

Product Portfolio Comparison

| Boeing Product | Airbus Product | Key Features | Price Range |

|---|---|---|---|

| 737 MAX | A320neo | Advanced fuel efficiency, improved passenger comfort, and enhanced safety features. | $80-120 million (USD) |

| 787 Dreamliner | A350 XWB | Long-range, wide-body aircraft, known for its advanced technology and efficient design. | $250-400 million (USD) |

| 777X | A350-1000 | Next-generation wide-body aircraft, focused on long-range and high-capacity flights. | $350-500 million (USD) |

| 777 | A330neo | Reliable, wide-body aircraft offering a blend of range and capacity. | $250-350 million (USD) |

The table above provides a concise comparison of key commercial aircraft models from Boeing and Airbus. Pricing is approximate and can vary based on specific configurations and customer requirements.

External Pressures Affecting Boeing

Boeing, a global aerospace giant, faces a complex web of external pressures that significantly impact its operations and market position. These pressures, ranging from geopolitical uncertainties to supply chain disruptions, demand a nuanced understanding to appreciate the challenges and potential responses. Navigating these forces is crucial for Boeing to maintain its competitiveness and profitability in the dynamic aviation industry.

Geopolitical Events and Their Impact

Recent geopolitical events, such as the war in Ukraine and escalating tensions between major powers, have created a volatile global environment. These events have disrupted supply chains, increased uncertainty in international trade, and impacted demand for commercial aircraft. The war in Ukraine, for example, has led to sanctions and export restrictions, affecting Boeing’s ability to source materials and potentially impacting its access to critical markets.

The ripple effect on global trade and economic stability further complicates the aerospace sector’s outlook.

Supply Chain Disruptions and Their Effects

Supply chain disruptions have emerged as a significant external pressure for Boeing. The pandemic significantly impacted the availability of components and raw materials, leading to delays in production and delivery schedules. Further, the disruption in global logistics and transportation has compounded the problem. This has not only increased production costs but also eroded customer trust and confidence in Boeing’s ability to deliver on its commitments.

For example, the semiconductor shortage significantly impacted the production of various aircraft models. This highlights the vulnerability of complex manufacturing processes to disruptions beyond Boeing’s control.

Economic Downturns and Their Implications

Economic downturns, like the ones experienced in recent history, often lead to reduced air travel demand. When consumer confidence and business investment falter, the demand for air travel and, consequently, for new aircraft decreases. This reduced demand can impact Boeing’s sales projections and production planning. For example, the 2008 financial crisis led to a significant drop in aircraft orders, which affected Boeing’s financial performance and strategic planning for years.

The impact of a potential economic downturn on the aviation industry is multifaceted, affecting not just Boeing but also airlines and other stakeholders.

Boeing seems unfazed by recent industry whispers. Perhaps the recent reopening of Amsterdam’s De L’Europe, a stunning new hub for European travel, amsterdam s de l europe reopens , is giving them a bit more breathing room. Either way, the company seems to be riding high, not exactly feeling the pressure from competitors right now.

Mitigation Strategies for Boeing

To mitigate the effects of these external pressures, Boeing can adopt several strategies. Diversifying its supply chain to reduce reliance on single sources can enhance resilience to disruptions. Developing robust contingency plans to address geopolitical uncertainties and supply chain issues can minimize potential losses. Furthermore, proactive engagement with policymakers and industry partners to address international trade regulations and economic uncertainties is crucial.

Boeing seems to be coasting along, not exactly feeling the pressure. But, in the long run, staying on top of your office packaging and shipping supplies costs, like staying on top of your office packaging shipping supplies costs , is a key factor in keeping any business profitable, even one as large as Boeing. Ultimately, it’s likely Boeing’s sheer size and market position that allows them to navigate these waters without excessive concern.

Stronger relationships with international partners can help navigate geopolitical complexities and foster cooperation. Moreover, investing in advanced technologies to improve production efficiency and reduce reliance on vulnerable components can strengthen Boeing’s long-term resilience.

Internal Factors Influencing Boeing’s Response

Boeing’s ability to navigate the current challenges hinges significantly on its internal capabilities. Understanding its organizational structure, decision-making processes, past responses, and leadership is crucial to evaluating its potential for success. A strong internal framework can mitigate the impact of external pressures, enabling Boeing to adapt and innovate effectively.Internal organizational structure and decision-making processes play a critical role in shaping Boeing’s response to external pressures.

The company’s complex structure, encompassing various divisions and subsidiaries, can sometimes lead to slower decision-making processes. However, this structure also offers specialized expertise and diverse perspectives that can be leveraged to develop comprehensive solutions. The efficiency of internal communication and coordination is vital in ensuring a cohesive response to challenges.

Boeing’s Organizational Structure and Decision-Making

Boeing’s organizational structure is hierarchical, with a centralized executive leadership overseeing various divisions responsible for specific product lines, manufacturing, and support services. This structure aims to ensure accountability and streamline operations. However, the sheer size and complexity can lead to delays in decision-making. The company’s decision-making processes are often characterized by extensive consultations and approvals across multiple levels, which can sometimes slow down the implementation of rapid responses to evolving market conditions.

Past Responses to Similar Challenges

Boeing has faced significant challenges in the past, including the 737 MAX crisis. The response to this crisis highlights both the company’s capacity for swift action and the need for continuous improvement in its safety protocols and regulatory compliance. Examining past responses provides valuable insights into the strengths and weaknesses of Boeing’s crisis management procedures. The effectiveness of previous responses to challenges such as supply chain disruptions, technological advancements, or regulatory scrutiny can serve as a benchmark for future actions.

Impact of Leadership and Management

Boeing’s leadership and management play a crucial role in shaping the company’s response to external pressures. Strong leadership fosters a culture of resilience and innovation, motivating employees to address challenges effectively. Conversely, ineffective leadership can hinder the company’s ability to adapt and respond swiftly to changing market dynamics. The vision and commitment of senior management towards operational excellence and ethical conduct influence the overall response strategy.

Boeing seems to be coasting along, not exactly feeling the pressure. While the airline industry is seeing a surge in demand, particularly in the Caribbean, with increased airlift and cruise ships helping fuel Caribbean growth airlift and cruise ships help fuel caribbean growth , it seems Boeing is perhaps less impacted by these market fluctuations for now. Perhaps their recent contracts are enough to keep them afloat, or perhaps the market is just not demanding enough new planes for them to feel the heat.

Key Departments and Their Roles in Addressing External Pressures

The success of Boeing’s response depends on the coordinated efforts of various departments. Effective communication and collaboration between these departments are essential for streamlining operations and addressing challenges.

| Department | Role in Addressing Pressure | Strategies Employed |

|---|---|---|

| Engineering | Develop and implement new technologies, improve safety protocols, and enhance product performance. | Collaboration with research institutions, pilot testing, and rigorous quality control. |

| Manufacturing | Ensure efficient production processes, manage supply chains, and optimize resource allocation. | Implementing lean manufacturing principles, diversifying supply sources, and enhancing automation. |

| Marketing and Sales | Maintain market share, generate leads, and secure new contracts. | Targeted marketing campaigns, strategic partnerships, and competitive pricing. |

| Finance | Manage financial resources, optimize costs, and secure funding for future initiatives. | Implementing cost-cutting measures, exploring financial partnerships, and securing investments. |

| Human Resources | Retain and motivate employees, ensure employee safety, and promote a culture of innovation. | Providing training and development opportunities, fostering a positive work environment, and implementing diversity initiatives. |

Industry Comparisons and Perspectives

Boeing isn’t alone in facing the pressures of a rapidly evolving aerospace landscape. Understanding how competitors are navigating similar challenges provides valuable context for evaluating Boeing’s position and potential strategies. This analysis explores comparative pressure levels, competitor responses, and successful approaches from other industries, ultimately offering insights into alternative paths for Boeing.A crucial element in assessing Boeing’s challenges is recognizing the dynamic nature of the aerospace industry.

While Boeing faces significant headwinds, its competitors are also experiencing pressures, albeit perhaps with different intensities and manifestations. This comparison reveals not just the universality of these challenges but also the variety of responses.

Competitive Pressure Levels, Boeing not feeling the pressure

The aerospace industry is highly competitive, with Boeing facing pressure from both established and emerging competitors. Airbus, for instance, has consistently been a formidable rival, vying for market share and technological advancement. Smaller, specialized manufacturers and emerging players in the regional jet and business jet sectors also exert pressure, each targeting different segments of the market. The intensity of this pressure varies, influenced by factors like market segment, geographic focus, and technological capabilities.

Competitor Approaches to Pressure Management

Competitors have adopted diverse approaches to manage similar pressures. Airbus, for example, has focused on fostering strong relationships with its supply chain partners and integrating suppliers throughout the design and manufacturing process. This has been a key strategy in improving efficiency and reducing costs. Other competitors emphasize niche markets, creating specialized aircraft tailored to particular customer demands. This segmentation allows them to cater to specific needs and build stronger market positions.

Strategic partnerships and mergers & acquisitions also provide another pathway to gain market advantage.

Boeing seems to be cruising along, not exactly feeling the pressure lately. Meanwhile, it’s great to see the positive news with Bimini and St. Martin resorts announcing reopenings, bimini and st martin resorts announce reopenings , giving a much-needed boost to travel and tourism. This renewed vibrancy in the hospitality sector, however, might not be enough to make Boeing feel the pinch just yet.

Perhaps a bit more competition is needed to really put the pressure on.

Successful Responses from Other Industries

Examining successful responses from other industries offers valuable insights. For instance, in the automotive industry, companies like Tesla have revolutionized the market with innovative electric vehicle technology. The adaptability and swift integration of new technologies in this case provide a useful model. Other examples include companies that have streamlined their supply chains to improve efficiency and reduce costs.

A key element in successful adaptation is recognizing market shifts early and responding with proactive innovation. For example, the rapid shift to digital marketing strategies in the tech industry provides an example of adapting to rapidly changing market trends.

Potential Impact of Alternative Strategies

Exploring alternative strategies for Boeing is critical. A focus on innovation, particularly in sustainable aviation, could offer a compelling path. This could involve developing fuel-efficient aircraft or exploring hydrogen-based propulsion. Another alternative is strengthening alliances with complementary companies in related industries, potentially creating synergistic opportunities and expanding market reach. For instance, partnerships with technology firms could facilitate advancements in aircraft design and manufacturing processes.

These strategies, however, must be assessed within the context of the current market landscape, technological advancements, and evolving customer demands.

Potential Implications and Future Outlook

Boeing’s future hinges on its ability to navigate a complex landscape of evolving market demands, technological advancements, and internal restructuring. The company faces both significant challenges and enticing opportunities, requiring strategic adaptation and a proactive approach to maintain its global leadership position in the aerospace industry. Success will depend on how effectively Boeing addresses current pressures and capitalizes on future trends.The company’s future performance will be significantly shaped by its response to the identified pressures.

Factors such as the global economic climate, technological advancements in aviation, and evolving customer needs will dictate the trajectory of Boeing’s future success. Boeing’s ability to innovate, adapt, and remain competitive will be crucial in achieving its long-term objectives.

Potential Future Scenarios

Boeing’s future trajectory is uncertain, with several potential scenarios emerging from the interplay of various factors. These scenarios represent possible outcomes based on different combinations of internal and external influences. Accurate prediction is challenging, but understanding these possibilities allows for proactive strategy development.

Likelihood and Impact Analysis

Analyzing the potential scenarios requires assessing their likelihood and the impact on Boeing’s future performance. This involves considering the probability of each scenario occurring and the magnitude of its influence on key metrics like market share, profitability, and technological leadership. This analysis will provide valuable insights into the potential challenges and opportunities that lie ahead.

| Scenario | Likelihood | Impact on Boeing |

|---|---|---|

| Sustained Growth and Innovation | Medium-High | Boeing maintains its leading position, driving technological advancements in aviation and capturing significant market share. Profitability improves through successful new product launches and operational efficiency. |

| Competitive Pressure and Market Share Loss | Medium | Boeing faces intense competition, potentially losing market share to rivals. Profitability may be squeezed, requiring cost-cutting measures and a renewed focus on efficiency. |

| Disruptive Technological Advancements | Low-Medium | Emerging technologies, like electric or supersonic flight, could significantly impact Boeing’s existing business model. Adapting to these advancements is crucial to maintaining competitiveness. A swift response to new technologies is vital. |

| Economic Downturn and Reduced Demand | Low-Medium | Global economic slowdowns can significantly reduce demand for commercial aircraft, impacting Boeing’s revenue and profitability. Strategic adjustments in production and sales strategies become critical. |

| Successful Integration and Restructuring | Medium | Boeing’s internal restructuring efforts yield positive results, improving operational efficiency and enabling cost reduction. A renewed focus on customer satisfaction is essential. |

| Failure to Adapt to Market Changes | Low | Inability to adapt to changing market dynamics and technological advancements could lead to a decline in market share and profitability. This scenario necessitates significant restructuring and adaptation efforts to mitigate the risk. |

Illustrative Case Studies: Boeing Not Feeling The Pressure

Boeing’s current predicament, marked by significant external pressures and internal challenges, finds parallels in the histories of other companies. Examining similar situations provides valuable insights into potential responses, successful strategies, and the factors contributing to either success or failure. Understanding how other companies navigated comparable crises can offer crucial lessons for Boeing’s path forward.Examining case studies of companies facing comparable pressures reveals critical patterns in their responses.

Analyzing their successes and failures illuminates the crucial interplay between internal capabilities, external market forces, and strategic decision-making. These examples highlight the multifaceted nature of pressure situations and the importance of holistic approaches to problem-solving.

Challenges Faced by Airlines During Fuel Price Fluctuations

Significant shifts in global fuel prices often create substantial pressure on airline profitability. These fluctuations can dramatically affect operating costs, impacting pricing strategies and ultimately impacting passenger demand. Examining how airlines have responded to periods of high fuel prices provides valuable insights into Boeing’s potential strategies.

- During the 2008 financial crisis, many airlines faced significant fuel price increases. Some airlines responded by implementing cost-cutting measures, such as reducing staff, renegotiating contracts, and optimizing flight schedules. Others prioritized maintaining service levels and implemented strategies to mitigate rising fuel costs. The success of these responses varied widely, depending on the specific circumstances of each airline.

Boeing seems to be cruising along, not exactly feeling the heat. While other players in the aviation industry are facing challenges, Boeing appears relatively unfazed. This might be partly due to the recent news about Aker Yards, the shipbuilder whose name is going away. aker yards name goes away This shift in the shipbuilding landscape, while significant, doesn’t seem to be directly impacting Boeing’s current trajectory.

Perhaps they’re simply better positioned to weather the storm, or maybe they’ve got some secret sauce! Regardless, it’s fascinating to see how different companies navigate the same industry pressures.

Airlines that successfully adapted to fluctuating fuel prices generally demonstrated strong financial planning and a proactive approach to risk management.

- The impact of fuel price fluctuations on airline profitability is substantial. During periods of high fuel prices, airlines face the challenge of balancing maintaining service levels with controlling costs. This necessitates strategic decision-making and the ability to adapt to rapidly changing market conditions. Airlines with robust risk management strategies and strong financial reserves tend to weather these storms more effectively.

The Impact of Technological Disruption on Manufacturing Companies

The rapid pace of technological advancements presents continuous challenges for manufacturing companies. Maintaining competitiveness and adapting to new technologies often requires significant investments and a willingness to embrace change. Exploring the responses of companies facing similar technological disruptions provides insights into how Boeing might react.

- Consider the impact of automation on manufacturing. Companies that failed to adapt to automation often struggled to remain competitive. Those who invested in automation and reskilled their workforce often thrived in the long term. This underscores the importance of proactive investment in emerging technologies and a focus on workforce training and development.

- Companies like Ford, initially resistant to adopting newer production technologies, eventually recognized the need to adapt. Their delayed response resulted in lost market share and significant financial challenges. This example highlights the importance of recognizing and responding to emerging technologies in a timely manner.

“Adapting to technological disruption is no longer an option, but a necessity for survival in today’s market.”

-Industry Analyst, XYZ Research.

The Role of Government Regulations in Shaping Industry Responses

Government regulations and policies can exert significant pressure on businesses. Companies must navigate complex regulatory environments, adapt to changing laws, and ensure compliance. Analyzing how other companies have responded to government regulations offers valuable insight.

- The aerospace industry is heavily regulated. Companies like Airbus and Boeing must comply with safety standards and environmental regulations. These companies demonstrated that adherence to stringent regulations is critical for maintaining market confidence and consumer trust.

- Companies that fail to comply with regulations face significant penalties, reputational damage, and potential legal challenges. Maintaining strong compliance programs and staying informed about regulatory changes are vital for mitigating these risks.

“Regulatory compliance is not just a legal obligation; it’s a strategic imperative for maintaining long-term success.”

-Legal Counsel, ABC Law Firm.

Last Word

In conclusion, Boeing’s ability to navigate the current pressures depends on a multitude of factors, from its market position and financial performance to its internal capabilities and strategic responses. While the assertion of “not feeling the pressure” might be premature, the analysis reveals crucial insights into the company’s current challenges and future outlook. The aerospace industry is highly dynamic, and Boeing’s continued success will hinge on its ability to adapt and innovate.

Query Resolution

What is Boeing’s current market share?

Precise market share figures are not readily available in this Artikel, but the report would contain relevant data on Boeing’s market position compared to competitors.

How does Boeing’s supply chain impact its production?

Supply chain disruptions are a significant external pressure. The report will detail how these disruptions affect Boeing’s production timelines and potential strategies for mitigation.

What are some alternative strategies Boeing could employ to manage external pressures?

The report will discuss various potential strategies Boeing could employ, considering its internal strengths and weaknesses. These may include cost-cutting measures, diversification, or strategic partnerships.

What are the potential future scenarios for Boeing?

The report will explore potential scenarios for Boeing’s future, including various likelihoods and their impact on the company’s performance. This includes optimistic and pessimistic projections.