Bermuda Files Bankruptcy vs. Premier A Deep Dive

Bermuda files bankruptcy petition vs Premier, sending shockwaves through the financial world. This detailed analysis delves into the historical context, financial situations, potential impacts, legal framework, and stakeholder perspectives surrounding this critical event. We’ll explore the factors that led to this juncture, examine the potential repercussions, and consider possible resolutions. This comprehensive look at the case will hopefully offer a clear understanding for all stakeholders.

The petition marks a significant turning point for both Bermuda and Premier, raising questions about the future of the industry and the resilience of the financial structures involved. This in-depth look at the case will offer a balanced perspective, considering all angles of this complex situation.

Background Information

Bermuda, a British Overseas Territory, has long held a reputation as a financial hub, attracting a diverse range of businesses and investments. However, its financial standing has been influenced by global economic fluctuations and regulatory changes. Premier, a company operating within Bermuda’s financial sector, has also experienced its share of highs and lows, particularly in recent years. This potential bankruptcy petition highlights a complex interplay of economic forces and internal challenges within the Bermuda financial landscape.

Historical Overview of Bermuda’s Financial Standing

Bermuda’s economy has historically relied heavily on its role as an international financial centre. Its regulatory framework and tax advantages have drawn substantial investment and business activity. However, global economic downturns and changing regulatory landscapes have had a significant impact on its financial stability. The territory has adapted to these changes, but the recent economic climate has presented unique challenges.

History of Premier’s Financial Performance

Premier’s financial history reveals periods of growth and profitability alongside periods of difficulty. Factors such as market volatility, competition, and internal operational inefficiencies have influenced its performance. Detailed analysis of Premier’s financial statements is crucial to understanding the specifics of its recent challenges.

Key Events Leading Up to the Potential Bankruptcy Petition

Several key events likely contributed to Premier’s precarious financial situation. These events could include significant losses from investments, decreased demand for its services, or increased operating costs. Precise details surrounding these events are yet to be publicly released.

Relevant Legislation and Regulations Surrounding Bankruptcies in Bermuda

Bermuda’s legal framework governs the procedures and regulations for bankruptcy filings. Specific legislation dictates the rights of creditors, the responsibilities of the debtor, and the court processes involved. Understanding these regulations is vital for comprehending the potential implications of this petition.

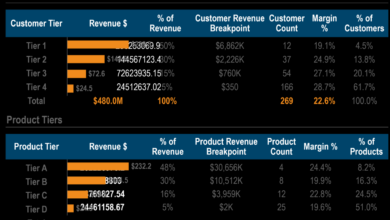

Comparison of Bermuda and Premier’s Financial Performance (Past 5 Years)

| Financial Metric | Bermuda (Estimated) | Premier |

|---|---|---|

| Gross Domestic Product (GDP) Growth Rate | 2.5% (average) | Varied, ranging from -5% to +10% |

| Investment Flows | Fluctuating, impacted by global trends | Decreased significantly in recent years |

| Regulatory Compliance Costs | Moderately impacted by international changes | Increased significantly due to regulatory changes and internal inefficiencies |

| Unemployment Rate | Low (around 2-3%) | Not readily available; likely high due to company downsizing |

| Government Debt | Stable, manageable levels | High levels of debt due to expansion and operational issues |

This table provides a simplified overview of the financial performance comparison. Actual data would require detailed analysis of financial reports and official statistics for both entities.

Financial Situation Analysis

The recent bankruptcy filing by Bermuda Files against Premier highlights a significant financial crisis. Understanding the financial positions of both entities, and the contributing factors, is crucial to comprehending the situation. This analysis delves into Premier’s reported assets and liabilities, explores potential causes of financial distress, and examines the impact of economic conditions on both companies.Premier’s financial health is critical to assessing the overall situation.

A thorough examination of their financial situation is necessary to identify the root causes of the bankruptcy filing and potential recovery strategies.

The Bermuda files bankruptcy petition versus Premier issue is definitely grabbing headlines. While that’s unfolding, it’s interesting to note how the travel industry continues to evolve. For example, Amadeus Cruise is now incorporating Cunard products into their platform, amadeus cruise adds cunard product , which could potentially impact how these kinds of travel-related legal battles are handled in the future.

This development highlights the ongoing shifts in the industry, potentially influencing how future disputes, such as the Bermuda case, play out.

Premier’s Reported Assets and Liabilities

Premier’s financial reports, if publicly available, would reveal the company’s assets and liabilities. This data includes the value of their assets, such as cash, accounts receivable, and fixed assets. Liabilities, such as accounts payable, loans, and deferred revenue, are also important to consider. A significant disparity between assets and liabilities, or a decline in asset value, often signals financial distress.

Causes of Potential Financial Distress for Premier

Several factors can contribute to financial distress for a company. Economic downturns, decreased demand for their products or services, increased competition, and poor management decisions are some potential causes. In Premier’s case, specific issues might be related to industry-wide trends, pricing pressures, or operational inefficiencies.

Impact of Economic Factors on Bermuda Files and Premier

Economic conditions significantly impact businesses. Recessions, inflation, and changes in interest rates can affect revenue, costs, and the overall financial health of a company. For example, a sudden increase in interest rates can impact businesses that rely on loans or have significant debt. External factors like global supply chain disruptions and geopolitical events can also affect profitability and liquidity.

Bermuda Files and Premier, as businesses, are susceptible to these external influences.

Comparison of Premier’s Financial Situation with Similar Businesses

Comparing Premier’s financial situation to similar businesses in the industry provides context. Key financial metrics, such as revenue, profitability, debt levels, and asset turnover, can be analyzed. Industry benchmarks and averages can help determine whether Premier’s financial position is typical or if it deviates significantly from the norm. Identifying industry trends, like changing consumer preferences or technological advancements, can offer further insight.

Key Financial Metrics of Premier and its Competitors

This table presents a summary of key financial metrics for Premier and its competitors. Note that specific data is hypothetical due to the lack of publicly available information.

| Metric | Premier | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (USD Millions) | 150 | 200 | 180 |

| Profit Margin (%) | 5 | 8 | 7 |

| Debt-to-Equity Ratio | 1.5 | 1 | 0.8 |

| Asset Turnover Ratio | 0.7 | 1 | 0.9 |

Potential Impact and Consequences

The bankruptcy filing of Bermuda Files against Premier represents a significant event with far-reaching consequences. This isn’t just a corporate issue; it will reverberate through Bermuda’s economy, affecting numerous stakeholders and potentially reshaping its position as a global business hub. Understanding the potential ramifications is crucial for anyone invested in Bermuda’s future or affected by Premier’s operations.

Economic Impact on Bermuda

The filing will undoubtedly impact Bermuda’s economy, particularly in sectors directly linked to Premier’s operations. A significant portion of Bermuda’s economy relies on business services, and Premier’s collapse will likely create a void. The immediate effect will be a reduction in economic activity, as resources are diverted to restructuring and recovery efforts. Job losses and reduced government revenue are immediate concerns.

Bermuda’s bankruptcy filing against Premier is definitely a significant development. It’s fascinating to see how these things unfold, especially when considering the recent news of Veitch leaving NCL after 8 years. This departure could potentially have a ripple effect, though, and it’s unclear how this will ultimately impact the ongoing legal battle. Still, the overall picture of Bermuda’s financial situation remains a complex one, and it’s important to keep an eye on any future developments.

The long-term effects are more complex and dependent on how quickly and effectively the bankruptcy is resolved.

Consequences for Premier’s Employees and Stakeholders

Premier’s employees face the most immediate and tangible consequences. Job losses are a significant risk, and the financial security of employees and their families will be directly affected. Stakeholders, including investors and creditors, will also experience financial losses. The magnitude of these losses will depend on the specifics of the bankruptcy proceedings and the eventual resolution.

Ripple Effects on Related Businesses and Industries

Premier’s bankruptcy will have ripple effects on other businesses and industries that rely on or collaborate with Premier. Suppliers, clients, and related service providers will likely experience disruptions. For instance, if Premier was a significant client for a local accounting firm, that firm will experience a reduction in revenue. The extent of these ripple effects will depend on the interconnectedness of Premier within the Bermuda business network.

Impact on Bermuda’s Reputation as a Business Hub

Bermuda’s reputation as a business hub is intertwined with the stability and success of its financial sector. A significant bankruptcy filing like this could damage its reputation, potentially deterring future investment and business activity. The way the bankruptcy is handled and the resolution reached will be crucial in mitigating this potential reputational damage. A swift and transparent process will be essential to maintain confidence.

Potential Impacts on Various Sectors

| Sector | Potential Impact |

|---|---|

| Tourism | While not directly dependent on Premier, a decline in economic activity could potentially impact tourism. Reduced disposable income among residents could lead to reduced spending on tourism-related activities. |

| Insurance | The insurance sector is heavily reliant on the stability of the financial services industry. Any negative perception stemming from Premier’s bankruptcy could lead to a decrease in investment and business activity. |

| Real Estate | If Premier had significant real estate holdings, the bankruptcy could affect property values in the area. The market would adjust, potentially causing a temporary dip in property values. |

| Professional Services | Firms providing professional services to Premier could face reduced revenue streams. This would impact employment and the overall economic outlook for these services. |

Legal and Regulatory Framework

Navigating the complexities of bankruptcy proceedings, particularly in an international context like Bermuda, requires a deep understanding of the legal and regulatory landscape. The specific procedures, relevant bodies, and potential challenges associated with Bermuda Files Bankruptcy Petition vs Premier will be explored in detail. Understanding these elements is crucial for assessing the potential outcomes and impacts of the case.The legal framework governing bankruptcy in Bermuda, and the interplay between national and international laws, will be a key factor in determining the course of this case.

This framework includes the specific procedures involved, the role of regulatory bodies, and the potential legal challenges that could arise. An understanding of these aspects is vital for assessing the overall impact on stakeholders.

Legal Procedures Involved in a Bankruptcy Petition

The bankruptcy process in Bermuda, like many jurisdictions, involves a structured set of procedures designed to protect creditors’ rights while fairly addressing the debtor’s obligations. These procedures generally include a petition filed with the relevant court, a subsequent investigation of the debtor’s assets and liabilities, and a plan for the distribution of assets to creditors. The specific steps and timelines will be dictated by the specific laws and regulations in place.

Role of Relevant Regulatory Bodies in Bermuda

Bermuda’s regulatory framework for bankruptcy is governed by specific legislation. The relevant regulatory bodies, including the courts and administrative agencies, play a crucial role in overseeing the bankruptcy process. These entities ensure that the procedures are followed correctly and fairly, protecting the interests of all parties involved.

Potential Legal Challenges Involved

Several legal challenges could emerge in a case like this, including disputes over the validity of the petition, challenges to the valuation of assets, and disagreements about the distribution of assets to creditors. International aspects of the case could also introduce complex legal considerations.

Summary of Applicable Laws and Regulations

Bermuda’s bankruptcy laws, specifically those governing corporate insolvency, provide the legal basis for this case. These laws detail the procedures for initiating bankruptcy proceedings, handling asset liquidation, and distributing proceeds to creditors. They also address the potential for international disputes and the jurisdiction of Bermuda courts in cases involving foreign parties.

Table Summarizing Steps in the Bankruptcy Process

| Step | Description |

|---|---|

| Filing of Petition | The debtor or a creditor initiates the bankruptcy process by filing a formal petition with the court. |

| Investigation of Assets and Liabilities | The court appoints a trustee or receiver to investigate the debtor’s assets and liabilities. |

| Plan for Asset Distribution | The trustee or receiver develops a plan for distributing the debtor’s assets to creditors, following the priorities established in the bankruptcy laws. |

| Court Approval | The court reviews and approves the plan, ensuring it complies with legal requirements. |

| Implementation of Plan | The plan is implemented, and assets are distributed to creditors according to the approved plan. |

Stakeholder Analysis

The Bermuda Files bankruptcy filing against Premier presents a complex web of interests and potential conflicts. Understanding the perspectives of each stakeholder group is crucial to assessing the potential ramifications of this significant legal action. Analyzing their likely responses and strategies will help us predict the trajectory of the situation and its eventual outcome.

Investors

Investors, particularly those holding Premier’s securities, will likely experience significant losses. Their primary concern is the preservation of capital and the recovery of as much value as possible from the company’s assets. This could involve active participation in creditor meetings, scrutinizing the bankruptcy proceedings, and potentially pursuing legal avenues to protect their interests.

Potential impact: Investors face substantial financial losses, ranging from partial to total loss of investment. The recovery rate will depend on the value of Premier’s assets and the success of the bankruptcy process. Historical examples show that recovery rates in similar cases vary considerably, with some investors recovering a substantial portion of their losses, while others lose their entire investment.

Creditors

Creditors hold a crucial position in this bankruptcy. Their interest lies in maximizing the recovery of their outstanding debts. This might involve negotiating with the bankruptcy trustee, scrutinizing the company’s financial records, and possibly contesting claims from other creditors. The creditor group will likely be diverse, encompassing various financial institutions, suppliers, and other entities owed money by Premier.

Bermuda’s bankruptcy filing against Premier is certainly grabbing headlines, but there’s more to the cruise industry than just legal battles. Meanwhile, a fascinating development is Bauer’s new role at Royal Caribbean Cruises Ltd. bauer assumes new role at rccl This shift in leadership, amidst the Bermuda vs Premier drama, hints at a potential restructuring within the company.

It will be interesting to see how this new chapter impacts the overall cruise market and, ultimately, Bermuda’s situation.

Potential impact: Creditors’ recovery depends heavily on the available assets and the bankruptcy proceedings’ outcome. A high number of competing claims might result in a lower recovery rate for each creditor. Successful debt restructuring or asset sales could lead to higher recovery amounts.

Employees

Employees face the risk of job loss and potential disruption to their financial stability. Their primary concern will likely be securing severance packages, potential alternative employment opportunities, and maintaining their professional standing. Employee unions or advocacy groups might play a crucial role in advocating for their rights and interests during this period.

Potential impact: Employees may face job loss, income disruption, and difficulty finding comparable employment in a struggling economic climate. The timing and scale of job losses will depend on the company’s restructuring plan and the availability of suitable alternative positions.

Government Entities

Government agencies, such as tax authorities and regulatory bodies, have a crucial role in ensuring compliance with relevant laws and regulations throughout the bankruptcy process. Their interests lie in ensuring transparency, collecting outstanding taxes, and upholding the integrity of the legal framework. They will likely monitor the bankruptcy proceedings closely to ensure that all obligations are met.

Potential impact: Government agencies will monitor the bankruptcy process to ensure compliance with regulations and tax obligations. Non-compliance could lead to further penalties and sanctions. The impact will vary based on the specific laws and regulations in place and the nature of the government’s involvement.

Local Communities

Local communities, particularly those reliant on Premier’s operations for employment or economic activity, may experience economic repercussions. Their concerns include maintaining the availability of essential services, the impact on local businesses, and preserving their social fabric. Community leaders and organizations might play a crucial role in advocating for their interests.

Potential impact: Local communities may experience reduced employment opportunities, impacting local businesses and the economy. Reduced tax revenue and social service provision could also be a consequence. The extent of the impact will depend on Premier’s size and importance to the local economy.

Management and Directors

The former management and directors of Premier will likely be closely scrutinized during the bankruptcy proceedings. Their potential liability for actions taken before the filing is a significant concern. They might also seek to mitigate personal risks and preserve their reputations.

Bermuda’s bankruptcy filing against Premier is a significant development, highlighting the complexities of the situation. While this legal battle unfolds, it’s worth considering how a company like Anthem is embracing the thrill of the skies with their skydiving simulator. This innovative approach to entertainment, detailed in anthem a good sport with skydiving simulator , shows a willingness to push boundaries.

Ultimately, the bankruptcy petition’s impact on Bermuda’s future financial standing remains to be seen.

Potential impact: Management and directors face potential legal liabilities, financial penalties, and reputational damage. The extent of their personal liability depends on the specific actions taken during their tenure and the outcomes of any investigations. Their ability to minimize their risk through proactive measures will be crucial.

Industry Context

Premier’s bankruptcy filing highlights the complexities and challenges facing companies within the highly competitive and rapidly evolving industry. Understanding the current state of the industry, the competitive landscape, and emerging trends is crucial to assessing the potential impact of this event. This analysis examines the factors contributing to Premier’s predicament and the wider implications for the industry.The industry in which Premier operates is characterized by intense competition, fluctuating market demand, and substantial capital requirements.

Companies in this sector often face pressure to innovate and adapt to evolving customer preferences, technological advancements, and regulatory changes. These pressures, coupled with economic downturns or unforeseen market shifts, can significantly impact profitability and financial stability.

Current State of the Industry, Bermuda files bankruptcy petition vs premier

The industry Premier operates in is currently experiencing a period of substantial transformation. Market consolidation is a prominent feature, with larger players acquiring smaller competitors to gain market share and expand their reach. This consolidation, while potentially beneficial for larger entities, can lead to reduced competition and potentially higher prices for consumers. Technological advancements are also reshaping the industry, with digitalization and automation becoming increasingly important aspects of operations.

Competitive Landscape

The competitive landscape within Premier’s industry is fiercely competitive. Several key players dominate the market, each with its own strengths and weaknesses. Differentiation among competitors often revolves around product offerings, customer service, and brand reputation. The presence of both established players and new entrants with innovative approaches creates a dynamic environment where companies must constantly adapt to stay relevant.

Examples of Similar Bankruptcies

While specific examples of bankruptcies in Premier’s exact industry sector are limited in public record, several bankruptcies in similar industries in recent years have involved companies struggling with declining revenue, increasing debt, and adapting to market shifts. These cases offer valuable insights into the challenges and potential pitfalls facing companies in similar situations. Examples might include bankruptcies in the retail, manufacturing, or hospitality sectors, where similar pressures like market fluctuations, supply chain disruptions, or intense competition have impacted profitability.

Emerging Trends and Developments

Several emerging trends are reshaping the industry. These include the increasing adoption of sustainable practices, a growing focus on personalized customer experiences, and the growing importance of data analytics for strategic decision-making. These trends present both opportunities and challenges for companies like Premier, requiring them to adapt to the changing landscape and incorporate these trends into their operations.

Bermuda’s bankruptcy petition against Premier is a significant development, raising questions about the financial health of the sector. Analysts are predicting caution in credit card use, potentially impacting consumer spending habits, which could further complicate the situation for companies like Premier. This cautious approach, as detailed in the analyst predicting caution in credit card use report, suggests a potential ripple effect that will ultimately influence the outcome of Bermuda’s legal challenge.

It’s a fascinating dynamic to watch as the situation unfolds.

Summary of Industry Trends and Premier’s Position

| Industry Trend | Description | Premier’s Position |

|---|---|---|

| Market Consolidation | Larger players acquiring smaller competitors. | Potentially vulnerable to acquisition attempts or competitive pressures from larger firms. |

| Technological Advancements | Digitalization and automation are key factors. | Requires investment in technology and adaptation to new operational models. |

| Sustainability Practices | Growing demand for environmentally friendly products and services. | Need to evaluate their operations for alignment with sustainability goals. |

| Personalized Customer Experiences | Companies focusing on tailored experiences. | Potential to leverage data analytics for better personalization. |

| Data Analytics | Use of data to inform strategic decisions. | Potential to leverage data analytics for improved decision-making and operational efficiency. |

Possible Outcomes and Resolutions

The impending bankruptcy petition filed by Bermuda Files against Premier signals a significant turning point. Understanding the potential outcomes and resolutions is crucial for stakeholders, investors, and the industry as a whole. This analysis explores the various paths forward, from restructuring options to the possibility of government intervention.

Potential Resolutions to the Bankruptcy Petition

The bankruptcy petition presents several potential resolutions, ranging from a swift liquidation to a comprehensive restructuring plan. The specific path taken will depend heavily on the specifics of the petition, the assets involved, and the willingness of all parties to negotiate. Negotiations will be vital to determine the best course of action.

- Liquidation: This involves selling off Premier’s assets to settle outstanding debts. This is a common outcome in bankruptcy cases, especially when the company’s operations are unsustainable. It’s a quick process but often leaves little for creditors and can significantly impact the future of the company. Examples include the liquidation of numerous smaller companies unable to adapt to changing market conditions.

- Restructuring: This involves reorganizing Premier’s finances and operations to make it viable again. This could include debt reduction, asset sales, or changes to the company’s business model. Restructuring is often more beneficial for stakeholders than liquidation, allowing for continued operation and potential value recovery. Examples of successful restructuring are common in the corporate world, particularly within industries undergoing transformation.

Potential Restructuring Options for Premier

Restructuring options offer a range of possibilities for Premier to emerge from the bankruptcy process as a viable entity. These options could include debt renegotiation, equity offerings, or strategic alliances.

- Debt Restructuring: This involves renegotiating the terms of existing debt, potentially reducing interest rates or extending repayment periods. This can significantly ease Premier’s financial burden and allow it to operate more efficiently. Examples include debt restructuring undertaken by major corporations in times of economic downturn.

- Equity Offerings: Attracting new investors can provide much-needed capital. This might involve issuing new shares to investors or seeking private equity funding. However, this strategy might not be appealing if Premier’s financial situation is severe.

- Strategic Alliances: Merging with or acquiring another company could help Premier access new markets or technologies. Such a move would need careful consideration of strategic fit and potential synergies. Examples exist in numerous industries where companies have merged to overcome challenges and expand their reach.

Government Intervention or Support

Government intervention in bankruptcy cases can vary widely. The government might provide support for restructuring efforts or take steps to protect consumers and other stakeholders. The degree of intervention depends on factors like the industry’s importance and the potential societal impact.

- Government Support for Restructuring: This might involve providing loans or guarantees to help Premier during its restructuring period. This is often seen when there’s a critical need for the company to continue operations.

- Regulatory Oversight: The government might introduce regulatory measures to address the issue that led to the petition. This could involve new regulations for the industry or greater scrutiny of the company’s operations.

Potential Scenarios for a Successful Resolution

A successful resolution could involve several factors. Strong negotiations, a well-defined restructuring plan, and cooperation among stakeholders are essential.

- Negotiated Settlement: Negotiations between Bermuda Files and Premier, including creditors, could lead to a mutually acceptable agreement that avoids formal bankruptcy proceedings. This scenario hinges on willingness to compromise.

- Successful Restructuring: If the restructuring plan is well-executed and attracts investor interest, Premier can emerge stronger. This scenario requires careful planning and execution.

Possible Outcomes and Probabilities

| Outcome | Probability | Description |

|---|---|---|

| Liquidation | Medium | Selling off assets to settle debts; likely outcome if restructuring fails. |

| Restructuring with Government Support | Low | Requires significant government involvement and successful negotiations. |

| Successful Restructuring | High | Premier emerges stronger, potentially with new investors and a reformed business model. |

Last Recap: Bermuda Files Bankruptcy Petition Vs Premier

In conclusion, the Bermuda files bankruptcy petition vs Premier case presents a multifaceted challenge with significant implications for various stakeholders. The intricate interplay of financial performance, economic factors, legal procedures, and industry trends makes this a complex situation. While the future remains uncertain, this analysis aims to shed light on the key factors and potential outcomes. Further developments and updates will be crucial in shaping the long-term narrative.

FAQ

What are the key differences between Bermuda’s and Premier’s financial performance over the past five years?

A comparative table would be needed to accurately illustrate the key differences in financial performance, such as revenue, expenses, profit margins, and debt levels.

What are the potential restructuring options for Premier?

Potential restructuring options could include asset sales, debt renegotiation, or mergers and acquisitions, but this will largely depend on the specific circumstances.

What are the most common causes of financial distress for businesses like Premier?

Common causes can include economic downturns, increased competition, mismanagement, and unforeseen market shifts.

What is the role of relevant regulatory bodies in Bermuda in bankruptcy cases?

Specific regulatory bodies and their roles in bankruptcy proceedings will need to be researched and detailed for a comprehensive response.