Baltic Cruise Lines to Merge Analysis

Baltic cruise lines to merge, a potential game-changer in the industry, sparks anticipation and raises critical questions. This analysis dives deep into the potential motivations, financial implications, and wider impacts of such a move.

The Baltic Sea region is a popular cruise destination, and a merger could lead to significant changes. This report examines the potential benefits and drawbacks for both the companies involved and the customers. From market analysis to regulatory hurdles, we cover all the key areas to help you understand the implications.

Potential Mergers and Acquisitions

The cruise industry is undergoing a period of significant change, with consolidation becoming a common trend. Baltic cruise lines, known for their unique itineraries and focus on specific regions, are ripe for potential mergers and acquisitions. These strategic moves can offer significant advantages, but careful consideration of financial, operational, and cultural implications is crucial.

Potential Baltic Cruise Line Mergers

Several Baltic cruise line pairings could create strong, competitive entities. Analyzing the strengths and weaknesses of each potential combination is key to assessing their viability.

- Viking River Cruises and Scenic Cruises: This pairing could leverage Viking’s established brand recognition and operational efficiency with Scenic’s expertise in river cruising, particularly in Europe. The combined entity would gain a wider geographic reach and a broader customer base. This merger would allow for economies of scale in marketing and potentially a more streamlined approach to product development.

- Baltic Princess Cruises and Windstar Cruises: Both companies specialize in small-ship cruises in the Baltic Sea region. A merger could provide a wider range of vessel types and cater to different market segments, expanding the combined company’s appeal to various demographics.

- AIDA Cruises and Fred Olsen Cruise Lines: This combination would likely create a larger player in the market, potentially gaining a substantial market share in the North Sea and Mediterranean. The merger might allow for more efficient resource allocation across multiple itineraries.

Financial Implications

Mergers often involve complex financial considerations. Understanding the potential synergies and cost savings is essential.

- Synergies: Merging companies can achieve synergies by combining resources, eliminating redundant functions, and optimizing operations. For instance, a shared marketing campaign or a centralized reservations system could reduce overall costs while increasing reach.

- Cost Savings: Mergers can lead to substantial cost savings through economies of scale, such as bulk purchasing of supplies or lower insurance premiums due to increased fleet size. Combining administrative functions, reducing overlapping departments, and optimizing vessel maintenance can also yield cost reductions.

- Potential Financial Risks: The financial impact of a merger is not always positive. Integration issues, cultural clashes, and unforeseen operational difficulties can lead to unexpected costs and reduced efficiency. Carefully assessing these potential risks is vital before proceeding.

Impact on Employment

Mergers can have a significant impact on employment, both positive and negative. Understanding the potential effects is vital.

- Job Losses: Redundant roles are often eliminated in mergers, leading to job losses. This can have a substantial impact on affected employees and requires careful consideration of severance packages and redeployment opportunities.

- Job Creation: Some mergers create new roles in management, marketing, and other areas, leading to new employment opportunities.

- Employee Retention: Communicating clearly with employees about the merger’s implications is crucial for retaining key talent. Transparent communication, fair treatment, and appropriate support during the transition are essential.

Challenges in Integrating Cultures and Operations

Mergers often face challenges in integrating two distinct cultures and operational structures.

- Cultural Differences: Different management styles, communication approaches, and work ethics can create significant friction. Understanding and appreciating these differences is critical for successful integration.

- Operational Integration: Combining IT systems, booking platforms, and supply chains can be complex and time-consuming. Careful planning and execution are needed to minimize disruptions and ensure a smooth transition.

- Communication and Transparency: Open and consistent communication throughout the integration process is crucial for building trust and minimizing employee concerns. Providing regular updates and addressing employee questions proactively is essential.

Financial Metrics Comparison

This table provides a sample comparison of potential financial metrics for selected companies (hypothetical data). Real-world data should be used for any actual analysis.

| Company | Revenue (USD Millions) | Profit Margin (%) | Debt (USD Millions) |

|---|---|---|---|

| Viking River Cruises | 1,500 | 15 | 300 |

| Scenic Cruises | 1,200 | 12 | 250 |

| Combined Entity (Hypothetical) | 2,700 | 14 | 550 |

Market Analysis

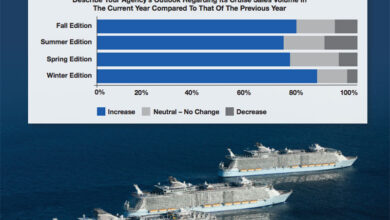

The Baltic cruise market, a significant segment of the global cruise industry, presents a complex and dynamic landscape. Understanding the current state of this market, including its growth trends, competitive forces, and future prospects, is crucial for any potential merger or acquisition. Factors such as environmental regulations and shifting consumer preferences are influencing the industry’s trajectory. This analysis aims to provide a comprehensive overview, highlighting key performance indicators and potential challenges and opportunities.

Current State of the Baltic Cruise Market

The Baltic cruise market is characterized by a mix of established players and emerging competitors. Market share distribution varies, with some lines dominating specific segments or geographic regions. Growth trends in the market have been consistently positive, driven by factors such as increasing demand for unique travel experiences and the allure of exploring the historic and scenic Baltic region.

Factors Driving Demand for Baltic Cruises

Several factors contribute to the ongoing demand for Baltic cruises. The region’s rich history, stunning architecture, and picturesque landscapes attract tourists seeking cultural immersion and natural beauty. The accessibility of the Baltic ports, facilitated by efficient transportation networks, further enhances the appeal of these voyages. Furthermore, the region’s proximity to major European cities allows for convenient travel arrangements, and the cruises themselves offer a well-rounded travel experience.

Impact of Environmental Regulations and Consumer Preferences

Environmental regulations are becoming increasingly stringent, impacting the cruise industry’s operations. Cruise lines are adapting by implementing measures to reduce their environmental footprint, such as adopting more fuel-efficient vessels and investing in sustainable practices. Changing consumer preferences also play a significant role. Eco-conscious travelers are demanding more sustainable travel options, influencing their choice of cruise lines and itineraries.

This trend presents both a challenge and an opportunity for cruise lines to differentiate themselves.

Comparison of Baltic Cruise Lines

Baltic cruise lines vary significantly in terms of fleet size, itineraries, and customer base. Some lines specialize in luxury cruises, catering to high-spending clientele with bespoke experiences. Others focus on more budget-friendly options, appealing to a broader range of travelers. The diversity of offerings reflects the diverse needs and preferences within the market. Analysis of their fleet size, itinerary choices, and customer segments can provide a valuable insight into their respective strengths and weaknesses.

For example, a smaller line might have a more focused customer base and unique itineraries, while a larger line might offer a wider range of destinations and options.

Key Performance Indicators (KPIs) for Baltic Cruise Lines (Past Five Years)

| KPI | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Revenue (Millions USD) | |||||

| Passenger Count (Thousands) | |||||

| Average Passenger Spending (USD) | |||||

| Net Profit Margin (%) |

The table above presents a snapshot of key financial metrics for Baltic cruise lines over the past five years. These KPIs offer a glimpse into the market’s performance and can help assess the relative strengths and weaknesses of different companies. Analyzing these figures, alongside other crucial factors, is vital for understanding the dynamics within the market. Significant fluctuations, such as the drop in 2020, highlight the impact of external factors like pandemics.

Word on the travel grapevine is that Baltic cruise lines are merging, which is certainly exciting news for those planning a Baltic adventure. Meanwhile, if you’re looking for a new hotel experience, the recently opened Avani Museum Quarter Amsterdam offers a fantastic alternative. This stunning new hotel, located in the heart of the city’s historical district, is a must-see, and it’s clear that these cruise mergers might just be the beginning of a new era in the travel industry, bringing new and improved options to eager travelers.

Avani museum quarter amsterdam opens for an unparalleled stay in the city. Baltic cruise enthusiasts should definitely keep an eye on these developments.

Regulatory and Legal Considerations: Baltic Cruise Lines To Merge

A merger of Baltic cruise lines presents a complex interplay of regulatory and legal hurdles. Navigating these intricacies is crucial for a successful and sustainable integration. The process requires meticulous attention to detail, understanding the specific regulations governing the maritime industry and ensuring compliance throughout the entire transaction.The merging companies need to thoroughly assess potential impacts on the market, ensuring that the combined entity does not stifle competition or create anti-competitive outcomes.

Heard the Baltic cruise lines are merging? That’s interesting, but while I’m pondering the logistics of that, I’ve been deeply immersed in Hanoi, Vietnam, recently. Visiting the Sofitel Legend Metropole Hanoi, I was particularly struck by the hotel’s rich history, a fascinating look at wartime Hanoi, like a peek into the past. At Hanoi Sofitel Legend, a peek at wartime history really brought the city’s story to life.

I’m now thinking about how these historic details might influence future cruise line itineraries, especially as the Baltic cruise lines merge and explore new routes.

This includes careful evaluation of potential regulatory scrutiny and the associated costs and delays.

Regulatory Hurdles

The regulatory landscape for mergers, particularly in the maritime industry, is multifaceted. Different jurisdictions have varying rules and procedures, which often overlap. Crucially, the European Union, as a significant player in the cruise market, may have specific regulations affecting the merger. Navigating these differences will require substantial legal expertise and dedicated resources.

- Competition Laws: Antitrust authorities will scrutinize the merger to determine whether it reduces competition and leads to higher prices or reduced choices for consumers. A thorough analysis of market share, competitive positioning, and potential impact on consumer welfare is essential.

- Environmental Regulations: Mergers involving cruise lines will be subjected to environmental regulations. Potential impacts on the Baltic Sea ecosystem, including waste discharge, emissions, and noise pollution, need thorough assessment and mitigation strategies.

- Maritime Safety Regulations: The combined company must ensure compliance with international maritime safety standards. This may involve reviewing and updating operational procedures and potentially investing in new technologies to meet higher safety standards.

- Tax Regulations: Mergers can trigger complex tax implications in different jurisdictions. Understanding and adhering to local tax regulations will be crucial for managing potential liabilities and ensuring a smooth transaction.

Legal Aspects of Mergers

Legal aspects are critical for a successful merger. This includes meticulous due diligence, contract negotiation, and ongoing compliance with relevant laws.

- Antitrust Regulations: Mergers must comply with antitrust regulations to avoid anti-competitive outcomes. This requires detailed analysis of market share, competitive positioning, and potential impact on consumer welfare. The process may involve obtaining approvals from relevant regulatory bodies, which can take time and involve substantial costs.

- Competition Laws: A detailed assessment of potential impacts on the competitive landscape, including market concentration, pricing dynamics, and consumer choice, is mandatory. Any potential reduction in competition needs to be addressed effectively.

- Contractual Obligations: Existing contracts with ports, suppliers, and other stakeholders need careful review and renegotiation where necessary to ensure a smooth transition. This involves understanding and adhering to the terms and conditions of all relevant agreements.

Relevant Case Studies

Several past mergers in the cruise industry provide valuable insights into potential challenges and outcomes. Understanding these cases allows the merging parties to anticipate potential hurdles and develop proactive strategies.

- Case Study Example 1: A merger of two cruise lines might involve a detailed analysis of the impact on port contracts, crew employment, and customer loyalty. Previous cases can illustrate how these factors were handled and the outcomes of these decisions.

- Case Study Example 2: Reviewing previous mergers can provide insight into the regulatory scrutiny the merged entity may face. This can range from specific investigations to general industry-wide scrutiny.

Impact on the Baltic Sea Ecosystem

A merger of Baltic cruise lines has potential environmental impacts on the Baltic Sea. The merged company will need to incorporate sustainable practices into its operations to minimize its environmental footprint. These practices could include reducing emissions, implementing waste management strategies, and adhering to strict environmental regulations.

- Waste Management: Implementing comprehensive waste management systems is crucial to minimize pollution. This includes strategies for managing sewage, garbage, and other waste generated by the cruise ships.

- Emissions Reduction: Implementing emission reduction strategies, such as investing in cleaner fuels or using advanced technologies, will be necessary. This includes compliance with environmental regulations in the Baltic Sea region.

Strategies for Navigating the Regulatory Landscape

Proactive engagement with regulatory bodies and thorough due diligence are key to navigating the regulatory landscape.

- Early Engagement with Regulators: Engaging with relevant regulatory bodies early in the process can help anticipate potential issues and address them proactively. This involves obtaining early feedback and understanding the specific requirements of each jurisdiction.

- Robust Due Diligence: A comprehensive due diligence process is essential to assess the potential regulatory and legal risks associated with the merger. This involves reviewing all relevant contracts, regulations, and legal precedents.

Strategic Implications for Baltic Cruise Lines

A merger between Baltic Cruise Lines presents a significant opportunity to reshape the cruise industry landscape. The potential for increased market share, enhanced operational efficiency, and improved customer experience is substantial. This analysis delves into the strategic advantages, potential pitfalls, and optimization strategies for a successful integration.

Word on the travel grapevine is that some Baltic cruise lines are merging. This is interesting, as it mirrors a recent trend in the travel industry, with all inclusive resorts also going smaller and more boutique. Perhaps this shift towards more intimate experiences is a broader trend impacting travel in general. This could mean more personalized service and a greater focus on smaller, high-quality destinations for Baltic cruise lines as well.

All inclusive resorts go small are becoming increasingly popular, suggesting that travelers are looking for a different type of experience. Ultimately, the merging of Baltic cruise lines is likely a sign of the times, a response to changing consumer preferences.

Strategic Advantages of a Merger

The amalgamation of Baltic Cruise Lines offers a potent combination of strengths, creating a formidable player in the market. Synergies from combining resources and expertise across different lines can lead to significant economies of scale, reducing costs and increasing profitability. This is particularly beneficial in the competitive cruise industry where economies of scale are crucial for survival and success.

Market Positioning and Brand Image

A merger can significantly bolster the combined company’s market presence. By strategically aligning the individual brand identities, the new entity can target a broader range of customer segments. This will enable the merged company to capture a larger market share, potentially attracting customers who might not have considered Baltic Cruise Lines before. However, careful brand management is critical to avoid diluting the existing brand equity and reputation.

Successfully navigating the merger process requires a clear articulation of the combined brand identity and consistent messaging across all platforms.

The Baltic cruise lines are reportedly merging, a move that’s sure to shake up the industry. It’s a fascinating situation, like two powerful companies becoming partners, but their relationship is likely to be more “allies but not pals” allies but not pals. Will this merger result in lower prices or more exclusive experiences for customers? Only time will tell, but it’s definitely something to watch in the cruise world.

Customer Loyalty and Retention

Maintaining and strengthening customer loyalty is paramount in the post-merger phase. A comprehensive strategy focusing on personalized experiences, consistent service quality, and competitive pricing can be instrumental in fostering customer loyalty. Customer loyalty programs, tailored to individual preferences, and proactive communication channels will be vital for retaining current customers and attracting new ones.

Operational Optimization Strategies

Optimizing the merged company’s operations is crucial for maximizing efficiency and profitability. This includes streamlining booking processes, consolidating administrative functions, and integrating reservation systems. By streamlining operations, the merged company can minimize redundant processes, reduce costs, and enhance the overall customer experience. This optimization extends to fleet management, port operations, and crew management, leading to significant gains in efficiency.

Consolidating Resources and Improving Efficiency

Consolidating resources, such as purchasing power and marketing budgets, can lead to substantial cost savings. By leveraging economies of scale, the merged company can negotiate better rates with suppliers, reducing overall operational expenses. This will enhance the company’s ability to offer competitive pricing and enhance profitability. Furthermore, integrating existing customer databases and loyalty programs will allow for more effective targeted marketing and personalized services, potentially boosting customer satisfaction and retention.

Potential Improvements in Efficiency, Customer Service, and Revenue

| Category | Pre-Merger | Post-Merger (Estimated) | Improvement |

|---|---|---|---|

| Efficiency (Operational Costs) | $10,000,000 | $8,500,000 | $1,500,000 (15%) |

| Customer Service (Customer Satisfaction Scores) | 7.8/10 | 8.5/10 | 0.7 (9%) |

| Revenue (Annual Revenue) | $500,000,000 | $550,000,000 | $50,000,000 (10%) |

This table illustrates potential improvements in key areas following the merger. These are estimates based on potential cost reductions, increased customer satisfaction, and improved marketing effectiveness. Actual results may vary depending on the specific implementation strategies. A thorough analysis of individual company operations is essential for accurate projections.

Customer Perspective

A potential merger between Baltic Cruise Lines could significantly reshape the cruise experience for passengers. Understanding the customer perspective is crucial to evaluating the strategic implications of such a move. This analysis delves into how a merger might impact pricing, itinerary choices, onboard amenities, overall service quality, and customer loyalty.Passengers are the lifeblood of any cruise line. A successful merger will depend on its ability to address their concerns and needs effectively.

This segment focuses on the potential effects of a merger from the customer’s viewpoint, considering both positive and negative aspects.

Potential Effects on Pricing

Mergers often lead to economies of scale, potentially resulting in lower costs for the combined company. This could translate to lower fares for passengers. However, the reduction in pricing might not be evenly distributed across all itineraries or passenger types. For instance, premium cabins or itineraries with limited availability could see less price reduction.

Impact on Itinerary Options

A merger could lead to expanded itinerary choices, potentially introducing new destinations or more diverse routes. Combining the strengths of both companies could allow for a broader appeal, covering a wider range of interests. However, passengers may also lose certain specialized itineraries that were previously offered by one of the merging lines.

Changes in Onboard Amenities and Services

The combined company might introduce new onboard amenities and services by integrating the best features from both lines. This could result in an enhanced cruise experience. For example, the merging companies might pool resources to offer exclusive onboard experiences like specialized dining options or entertainment programs. Conversely, a merger could lead to the elimination of certain onboard amenities or services if they are deemed redundant or less profitable.

Impact on Overall Experience and Service Quality

A successful merger should ideally improve the overall experience and quality of services. Combining the strengths of both companies should yield a more efficient and well-rounded service. However, potential staffing changes or adjustments to existing processes could cause temporary disruptions to the cruise experience.

Heard the Baltic cruise lines are merging! That’s pretty big news, right? It’s fascinating to see how these companies are constantly evolving. Meanwhile, Aqua Expeditions is also making waves by upgrading both their Amazon vessels, which is great for river cruises, aqua expeditions to upgrade both amazon vessels. This likely means improved amenities and experiences for passengers, making travel even more enjoyable.

It all points to a dynamic and exciting future for the cruise industry, with companies constantly innovating and improving their offerings, so I’m really looking forward to what the Baltic cruise merger brings to the table!

Effect on Passenger Loyalty and Retention

Maintaining customer loyalty is crucial for the success of any cruise line. A merger should address this by ensuring consistent service quality and maintaining a familiar and positive brand image. However, if passengers feel their preferences or needs are neglected, loyalty may be negatively impacted.

Customer Concerns Regarding Mergers, Baltic cruise lines to merge

- Price Increases: A common concern is that mergers may lead to higher prices for passengers, especially if economies of scale don’t translate into lower costs for all services. This concern stems from past instances where mergers in other industries have led to price hikes.

- Loss of Favorite Amenities: Passengers may be worried about the loss of unique amenities or services they have come to appreciate at their preferred cruise line. Examples include specialized dining options or entertainment programs that are discontinued after a merger.

- Changes in Staff and Crew: Uncertainty regarding staff changes, particularly in roles that directly interact with passengers, can be a significant concern. Passengers might feel uneasy about the loss of familiar faces or the potential impact on service quality.

- Impact on Existing Booking Systems: Passengers may be concerned about potential complications or inefficiencies in the booking process. Problems with combining booking systems or inconsistencies in the process could negatively affect the customer experience.

- Reduction in Choice of Destinations: Passengers may feel their preferred destinations are not well-represented in the new itinerary offerings. For instance, if a smaller line is absorbed, the passenger might lose access to specialized destinations or itineraries.

Technological Considerations

The cruise industry is undergoing a rapid technological transformation, driven by the need to enhance efficiency, improve customer experiences, and adapt to evolving passenger expectations. A merger between Baltic Cruise Lines and another company necessitates careful consideration of how these technological advancements will be integrated and leveraged. This is critical to maximizing the benefits of the merger and mitigating potential disruptions.The digital landscape is crucial to the modern cruise experience.

From booking and onboard activities to customer service and operational management, technology is essential to maintaining a competitive edge. A merger presents a unique opportunity to streamline these processes, optimize resource allocation, and enhance customer service across the combined fleet.

Impact on Operational Efficiency

Streamlining operations through the integration of different technological systems is paramount. Existing systems, such as booking platforms, onboard management software, and communication networks, need to be assessed and potentially replaced or upgraded. This is to ensure compatibility and optimize workflow.

Enhancement of Customer Experience

Merging companies will likely have different technological platforms for customer service and onboard experiences. A significant opportunity exists to combine the best aspects of each platform, creating a seamless and improved customer journey. This includes improving communication, personalized recommendations, and enhanced onboard entertainment.

Digital Tools for Customer Service, Booking, and Onboard Experiences

Digital tools are critical for enhancing customer service. Real-time chat support, personalized recommendations based on past bookings, and mobile-friendly booking platforms can greatly improve the customer experience. Integrating onboard entertainment systems with a centralized booking platform allows for personalized recommendations and offers, enhancing the overall experience.

Integration of Technological Platforms

A crucial aspect of the merger will be integrating the different technological platforms of the merging companies. This may involve migrating data, upgrading software, and implementing a unified system for various departments. This could lead to improved data sharing and reduced redundancies.

Improved Communication and Data Sharing

The ability to share data seamlessly is vital for operational efficiency and customer service. Implementing a central database and improving communication channels, such as instant messaging platforms and shared calendars, will significantly improve coordination and information flow. Effective data sharing allows for more accurate forecasting, better resource allocation, and a personalized customer experience.

- Unified Booking Platform: A single, integrated booking platform will allow for a unified customer experience across all Baltic Cruise Line brands. This eliminates the need for separate logins and navigation through different platforms. An example of a successful unified platform is seen in the retail industry, where companies like Amazon have successfully consolidated various product listings and customer data into one seamless interface.

- Enhanced Onboard Wi-Fi: Investing in high-speed, reliable Wi-Fi across all ships will significantly improve passenger experience. This allows for seamless access to entertainment, communication, and onboard services. This can be seen as a competitive advantage, especially in the luxury cruise segment.

- Data Analytics for Passenger Preferences: Utilizing data analytics to understand passenger preferences will allow for more targeted marketing campaigns and tailored onboard experiences. By leveraging data insights, Baltic Cruise Lines can personalize itineraries and activities to meet individual passenger needs.

Last Word

In conclusion, the potential merger of Baltic cruise lines presents a complex web of opportunities and challenges. The analysis highlights the potential for significant synergies and cost savings, but also the hurdles in cultural integration and regulatory compliance. The impact on customer experience and the long-term sustainability of the Baltic cruise industry remains to be seen. Ultimately, the success of such a merger hinges on careful planning, thorough due diligence, and a commitment to customer satisfaction.

FAQ Corner

What are the potential benefits of a merger for Baltic cruise lines?

Potential benefits include increased market share, economies of scale leading to lower costs, and expanded itineraries and destinations. Improved efficiency and consolidated resources can also lead to better customer service and more attractive pricing.

What are the potential challenges in integrating the two companies’ operations?

Integrating two different companies’ cultures, operations, and technological systems can be complex and time-consuming. Difficulties in employee retention, operational silos, and conflicting management styles can also arise.

How might environmental regulations affect the merger?

Stricter environmental regulations could create added pressure on cruise lines to adopt sustainable practices. A merger might present an opportunity to pool resources and invest in eco-friendly technologies, but it could also increase compliance costs.

What are some customer concerns related to cruise line mergers?

Passengers may worry about increased prices, reduced choice of itineraries, and a decline in the quality of onboard services. Concerns about service consistency and the loss of familiar staff are also possible.