Fuel Fees Rise at Carnival Impact on Prices

As oil prices climb fuel fees appear at 2 carnival corp lines – As oil prices climb, fuel fees appear at 2 Carnival corp lines, impacting pricing and potentially affecting customer bookings. This rise in fuel costs is forcing Carnival to adjust its strategies, leading to some interesting scenarios for both the company and its passengers. Will the company absorb the increased costs, or will they be passed onto customers? How will this affect different customer segments, from budget travelers to luxury cruisers?

The article delves into the intricate details of this situation, exploring the impact on Carnival’s financial performance, customer pricing, industry trends, potential operational adjustments, and illustrative financial data. We’ll examine how Carnival might respond to the challenges, and how different segments of the customer base might be affected. Understanding the complexities of this issue is crucial for anyone interested in the cruise industry.

Impact on Carnival Corporation

Carnival Corporation, a global cruise line operator, faces significant challenges as oil prices surge. Increased fuel costs directly impact their bottom line, affecting ticket prices, revenue generation, and overall operational strategies. The company’s ability to absorb these rising costs and maintain profitability is crucial for its future success. The pressure is substantial, and the need for adaptable solutions is paramount.Rising oil prices translate into higher fuel costs for Carnival Corporation’s fleet.

This translates directly into increased operational expenses. The company must decide whether to absorb these costs, pass them on to consumers, or implement alternative strategies. These rising costs will inevitably affect their profit margins and their ability to maintain current dividend payments and investment in their operations.

Financial Performance Impact

Carnival Corporation’s financial performance is intricately linked to oil prices. Higher fuel costs reduce profitability. This reduction is not simply a matter of cost increases; it also influences pricing strategies and consumer demand. Fuel accounts for a considerable portion of operational expenses, and any substantial increase directly impacts the company’s overall profitability.

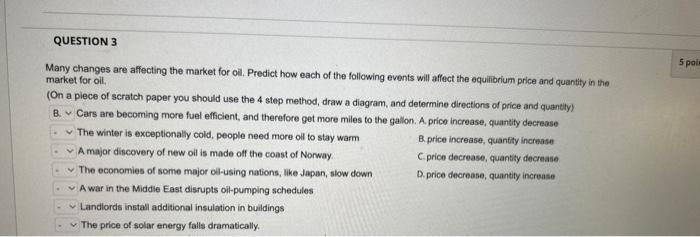

Ticket Pricing and Revenue

Fuel surcharges are a common response to rising fuel prices. Carnival Corporation may adjust ticket prices to reflect the increased costs. However, this strategy carries risks. Higher prices might deter consumers, potentially impacting revenue generation and demand. The company must carefully balance the need to cover fuel costs with the potential for reduced passenger volume.

An example is the airline industry: when fuel costs increase, airlines often implement fuel surcharges to maintain profitability, but these surcharges can influence consumer decisions.

Absorption Capacity and Scenarios

Carnival Corporation’s ability to absorb these rising fuel costs depends on various factors, including the magnitude of the price increase and the company’s existing financial health. Several scenarios are possible: If the increase is modest, the company might absorb the cost without significant adjustments. However, if the price surge is substantial, the company may need to pass on a portion of the increase to consumers through higher ticket prices.

Another scenario involves exploring more efficient operations, such as route optimization, or exploring alternative fuels.

Mitigation Strategies

Carnival Corporation employs various strategies to mitigate the impact of increased fuel fees. These strategies include negotiating favorable fuel contracts, exploring alternative fuels like LNG (liquefied natural gas), and optimizing vessel routes to reduce fuel consumption. These strategies are crucial in maintaining profitability and stability during periods of volatility. The company’s long-term sustainability is intrinsically linked to its ability to adapt to changing market conditions.

Operational Adjustments

Several operational adjustments are possible to address rising fuel costs. These adjustments could include optimizing vessel routes to reduce fuel consumption, exploring the use of more fuel-efficient technologies, and potentially delaying or reducing the deployment of new vessels if the price increases are substantial. Furthermore, exploring alternative fuels or implementing more stringent fuel management programs are other possible actions.

Fuel Fee Implications for Carnival’s Customers

Carnival Corporation, a major player in the cruise industry, is facing rising oil prices, leading to increased fuel surcharges. These surcharges will directly impact the cost of cruises for passengers, potentially altering booking patterns and affecting overall revenue. Understanding the implications of these surcharges is crucial for both Carnival and its customers.Passengers will experience a direct increase in the cost of their cruises due to the fuel surcharges.

This translates to higher prices for tickets, potentially reducing the affordability of travel for some customers. Carnival’s ability to manage these increased costs and maintain profitability will be crucial.

With oil prices on the rise, fuel fees are popping up at two Carnival Corp lines. While this might seem like a bummer, it’s a good reminder to plan ahead. Maybe a relaxing escape to some of the fantastic Czech Republic spa towns would be a great alternative? Think about the rejuvenation you could experience at a healthy dose of Czech Republic spa towns , perhaps even while prices are high for flights and petrol.

It’s always a good idea to have some back-up plans, so that’s why you need to factor in some more affordable ways to travel when oil prices climb.

Fuel Surcharge Incorporation Models

Carnival has several options for incorporating fuel surcharges into its pricing structure. A common model is to add a fixed amount per passenger or per cabin, regardless of the length of the cruise. Alternatively, surcharges can be calculated based on the actual fuel costs incurred for the specific cruise itinerary, potentially leading to variations in the surcharge amount for different voyages.

Impact on Customer Reactions

Customers are sensitive to price increases. If surcharges are perceived as excessive or unfairly applied, customer satisfaction and booking behavior could be negatively impacted. Past examples of companies implementing fuel surcharges illustrate varying reactions. Some customers may cancel or postpone bookings, while others may opt for alternative travel options. Customer loyalty could be affected.

Potential Pricing Strategies

Carnival can employ various strategies to mitigate the negative impact of fuel surcharges on customers. One strategy is to communicate transparently about the surcharge calculation methods and how they relate to current fuel costs. This transparency builds trust and reduces customer apprehension. A second strategy is to offer various cruise packages or promotional offers to make cruises more affordable, even with fuel surcharges.

This could involve offering discounted fares or bundling cruises with other services to offset the cost of fuel. Additionally, focusing on routes with lower fuel consumption or optimizing itineraries to reduce fuel costs can be beneficial.

Industry Context and Trends

The cruise industry, a vibrant sector driven by leisure travel, is currently navigating a period of significant change, particularly with the rising cost of fuel. This escalating expense is impacting not only Carnival Corporation but the entire industry, forcing companies to adapt and innovate in their strategies to manage these increased costs. The ripple effect is being felt throughout the supply chain, from ship operators to port authorities, and ultimately, to consumers.The current state of the cruise industry reflects a complex interplay of factors.

While the industry experienced a strong recovery following the pandemic, it is now facing a new set of challenges. Rising fuel costs are a key concern, directly affecting operational expenses and ultimately influencing pricing strategies for consumers. The competitive landscape is also crucial, with cruise lines vying for market share in a dynamic environment. The long-term sustainability of the cruise industry depends on its ability to effectively manage these challenges.

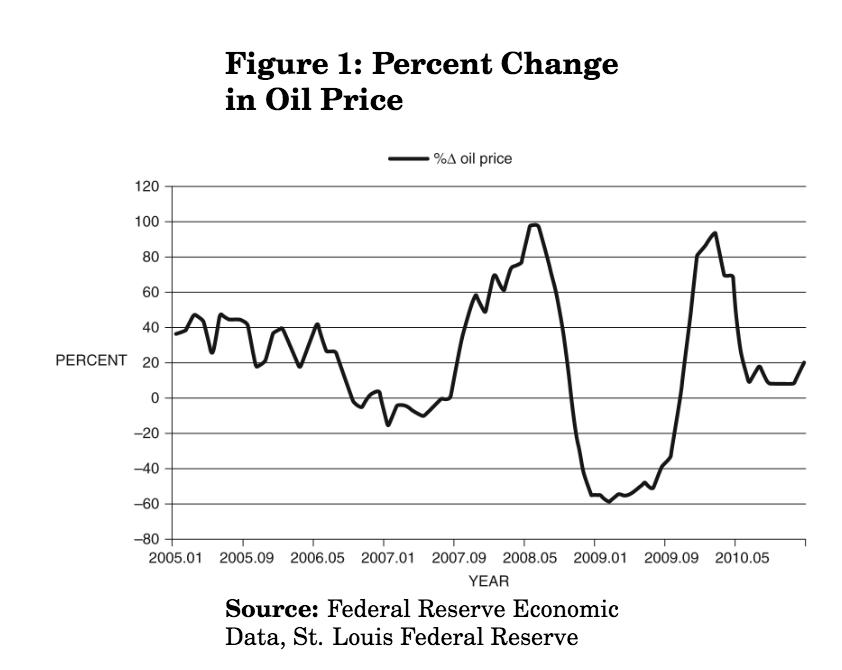

Current State of Fuel Prices and Costs

Fuel prices have seen considerable volatility in recent years. The global energy market is influenced by various factors, including geopolitical events, supply chain disruptions, and fluctuating demand. This volatility directly translates into higher operational costs for cruise lines, as they must purchase fuel for their fleets. The cost of fuel is a significant portion of their operational budget, and any increase can have a substantial impact on profitability.

Competitive Landscape and Fuel Fee Strategies

The competitive landscape in the cruise industry is intense. Several cruise lines, both large and small, are actively vying for market share. The impact of rising fuel costs is prompting various responses among competitors. Some are proactively adjusting their pricing models, incorporating fuel surcharges into ticket costs, while others are exploring alternative strategies. These strategies may include implementing energy-efficient technologies on their ships or optimizing their itineraries to reduce fuel consumption.

With oil prices on the rise, fuel fees are popping up at two Carnival Corp lines. It’s a bummer, but hey, at least there’s good news in the cruise world too! Alaska is making waves with its newly renovated Sanctuary Sun IV, a fantastic upgrade for travelers. While that’s great, it doesn’t change the fact that those fuel surcharges at Carnival are definitely something to keep an eye on when booking your next cruise.

ak unveils renovated sanctuary sun iv seems like a worthy investment for those looking to upgrade their cruise experience, but still, watch out for those rising fuel fees!

Comparison of Fuel Cost Management Strategies

Different cruise companies adopt varying approaches to managing fuel costs. Some focus on long-term contracts to secure stable fuel prices, while others prefer to adjust their pricing strategies in response to fluctuations in the market. A crucial aspect is the size of the fleet. Larger cruise lines, like Carnival Corporation, often have more negotiating power and can potentially secure better fuel deals compared to smaller operators.

Further, technological advancements and investment in alternative fuel sources or more fuel-efficient engines are emerging strategies to mitigate the impact of fuel cost increases.

Industry Insights into Future Fuel Prices

Forecasting future fuel prices is challenging, as numerous factors can influence the market. Geopolitical instability, economic downturns, and technological advancements can all significantly impact fuel costs. However, historical data and expert opinions suggest that fuel prices will likely remain volatile in the foreseeable future. The unpredictability of the market necessitates that cruise lines develop strategies to adapt to fluctuations in fuel prices.

For example, the current war in Ukraine has significantly affected the global energy market, driving up fuel costs. This demonstrates the need for cruise lines to have contingency plans in place.

Potential Long-Term Effects on Profitability and Growth

The rising fuel costs have the potential to negatively impact the cruise industry’s profitability and growth. Higher operational costs may lead to increased ticket prices, potentially deterring some customers. The industry must consider the potential long-term consequences of these rising costs. Furthermore, the demand for cruises may decrease as the price of tickets increases, impacting revenue streams.

The need for cruise lines to explore and implement sustainable practices to reduce fuel consumption and reliance on fossil fuels will become more critical in the long term.

Potential Operational Adjustments

Carnival Corporation, facing rising oil prices, must adapt its operations to mitigate fuel costs without sacrificing passenger experience. This necessitates a multifaceted approach encompassing route optimization, engine performance enhancements, and potential exploration of alternative fuels. Understanding these adjustments is crucial for Carnival to maintain profitability and competitiveness in the evolving maritime industry.Higher fuel costs necessitate a proactive approach to operational efficiency.

As oil prices climb, fuel fees are appearing at two Carnival Corp lines. This isn’t surprising, given the complex relationship between companies and their suppliers. It’s a classic case of “allies but not pals” allies but not pals , where cooperation is necessary for profitability, but individual interests remain paramount. Ultimately, the rising fuel costs will likely impact consumers, adding to the already existing price pressures.

Carnival must explore various avenues to reduce fuel consumption, impacting both short-term expenses and long-term sustainability. This involves meticulous analysis of current routes, ship maintenance schedules, and even the potential adoption of alternative fuel sources. The potential for operational adjustments extends to multiple facets of Carnival’s operations, offering a complex interplay between cost savings and operational impact.

Route Optimization Strategies

Route optimization is a key strategy to minimize fuel consumption. Carnival can re-evaluate current itineraries, focusing on routes that reduce travel distance and take advantage of favorable currents and wind patterns. This may involve shifting departure and arrival ports, altering cruise durations, or adjusting the sequence of destinations.

- Adjusting cruise duration:

- Alternative port choices:

- Embarkation and Disembarkation Locations:

By adjusting cruise duration, Carnival can optimize fuel efficiency. Shorter itineraries might be more economical, reducing the overall fuel expenditure while maintaining passenger satisfaction.

Utilizing alternative ports with shorter travel distances between destinations can result in significant fuel savings. Analyzing the distances and potential impact on passenger experience is critical for a successful implementation.

Shifting embarkation and disembarkation locations can optimize routes, considering distances and passenger preferences. Strategically selected ports can reduce fuel consumption.

Ship Maintenance and Operational Procedures

Maintaining optimal ship performance is vital for fuel efficiency. Carnival can implement measures to improve engine performance, optimize onboard systems, and reduce unnecessary energy consumption.

- Engine Optimization:

- Hull Cleaning and Coating:

- Improved Navigation and Voyage Planning:

Regular engine maintenance and performance checks are crucial. Implementing advanced diagnostics and predictive maintenance can identify potential issues before they lead to significant fuel consumption.

A clean hull reduces friction, leading to increased fuel efficiency. Implementing regular hull cleaning and application of specialized coatings can contribute to fuel savings.

Implementing advanced navigation systems and precise voyage planning can help ships utilize optimal routes and avoid unnecessary detours, further reducing fuel consumption.

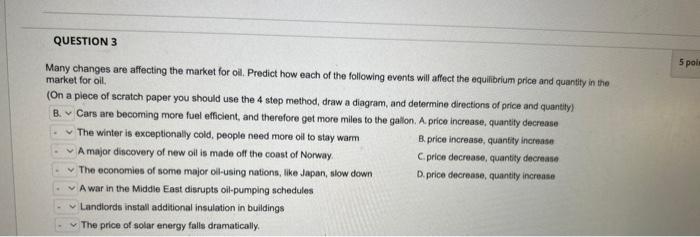

Potential Operational Adjustments Table, As oil prices climb fuel fees appear at 2 carnival corp lines

| Adjustment Category | Description | Estimated Cost Savings | Potential Impact on Operations |

|---|---|---|---|

| Optimized Engine Performance | Implementing advanced diagnostics, optimizing engine parameters, and utilizing predictive maintenance | 10-15% | Increased efficiency, reduced downtime, improved reliability |

| Alternative Fuel Exploration | Exploring and testing alternative fuel sources like LNG or biofuels | High initial cost | Potential long-term cost savings, reduced reliance on traditional fuels |

| Route Optimization | Re-evaluating itineraries, optimizing travel routes, and adjusting embarkation/disembarkation ports | 5-10% | Reduced fuel consumption, improved efficiency, and potential enhancement of passenger experience. |

| Hull Optimization | Regular hull cleaning, application of specialized coatings to reduce friction and drag | 2-5% | Reduced fuel consumption, improved vessel performance, and increased longevity |

Illustrative Financial Data: As Oil Prices Climb Fuel Fees Appear At 2 Carnival Corp Lines

Carnival Corporation’s financial health is intricately tied to the fluctuating costs of fuel. As oil prices rise, the company faces increased expenses for operating its vast fleet of cruise ships. Understanding the potential impact of these price increases is crucial for evaluating the company’s profitability and future outlook. This section presents illustrative financial data to showcase the potential effects of rising fuel costs on Carnival Corporation’s bottom line.

Potential Impact on Profit Margins

The table below illustrates how varying fuel costs can affect Carnival’s profit margins, a key indicator of its financial performance. Profit margins represent the percentage of revenue remaining after deducting expenses, including fuel costs. Lower profit margins often signal a struggle to maintain profitability, particularly when revenue growth isn’t sufficient to offset increased operational costs.

With oil prices on the rise, fuel fees are popping up at two Carnival Corp lines. It got me thinking about a more budget-friendly getaway, like a a bite size sailing experience. Maybe a shorter cruise or a smaller boat could be a way to avoid the hefty fuel surcharges. But then again, it’s still likely to impact the overall cost of a vacation like this.

The rising oil prices are impacting more than just cruise lines.

| Time Period | Revenue (USD Millions) | Fuel Costs (USD Millions) | Profit Margin (%) |

|---|---|---|---|

| 2023 Q1 | 100 | 15 | 80 |

| 2023 Q2 | 120 | 20 | 75 |

| 2023 Q3 | 150 | 25 | 85 |

This simplified example demonstrates the direct relationship between fuel costs and profit margins. A 5% increase in fuel costs (from $15M to $20M) in Q2 resulted in a 5% decrease in profit margin. This data highlights the sensitivity of Carnival’s profitability to fuel price fluctuations.

With oil prices on the rise, fuel surcharges are popping up at two Carnival Corp lines. This isn’t exactly surprising, given the current market conditions. Interestingly, American Cruise Lines, a competitor, recently launched a new agent portal, providing a streamlined booking process for travel agents. This development might indicate a broader industry shift, though it’s still too early to tell.

Back to the Carnival issue, the fuel surcharges are likely to impact the cost of cruises, potentially affecting the overall booking demand for those lines.

Revenue Loss Projections

Rising fuel costs can lead to reduced revenue, especially if the company doesn’t fully pass on the increased fuel costs to consumers through higher ticket prices. The following illustrates potential revenue loss scenarios.

Revenue loss projections are highly dependent on factors such as consumer demand elasticity, pricing strategies, and competitive pressures in the cruise market. These scenarios should be viewed as illustrative examples, not precise predictions.

- Scenario 1: No Price Adjustment: If Carnival doesn’t increase ticket prices to offset higher fuel costs, revenue will likely decline. In this case, the reduced profit margin in Q2 (75%) from Q1 (80%) may be even more pronounced if the company fails to adjust prices accordingly.

- Scenario 2: Partial Price Adjustment: If Carnival increases ticket prices by a portion of the fuel cost increase, revenue loss may be mitigated, but the profit margin might still be affected. The degree of revenue loss or gain in this scenario depends on the magnitude of the price adjustment and the consumer’s responsiveness to price changes.

Customer Segmentation and Impact

Carnival Corporation’s recent announcement regarding fuel surcharges highlights a crucial aspect of the cruise industry: the varying impact on different customer segments. Understanding how these price adjustments affect different traveler types is key to adapting marketing strategies and maintaining customer loyalty. Budget travelers, with their tight budgets, will face a significantly different experience than luxury travelers, who are often more resilient to price increases.

Impact on Different Customer Segments

Fuel surcharges, while necessary for the industry, can significantly alter the dynamics of the market. Analyzing the impact on different customer segments allows for a more nuanced understanding of potential responses and how to adjust business strategies. A crucial factor is the varying price sensitivity of different customer groups.

| Customer Segment | Impact on Pricing | Potential Response |

|---|---|---|

| Budget Travelers | Significant Increase | Potential decrease in bookings, seeking alternative travel options. They are often more price-sensitive, meaning any substantial increase in the cost of the cruise will likely result in a significant decrease in bookings. |

| Luxury Travelers | Moderate Increase | Less price sensitive, potentially absorbing the increase. These travelers are often less concerned about the precise amount of a fuel surcharge, and are more likely to continue with bookings, despite the rise in price. This is because luxury travelers often have a higher disposable income. |

Strategies for Attracting Different Customer Segments

Addressing the varying impacts of fuel surcharges necessitates tailored marketing strategies for different customer segments. Effective approaches will cater to the needs and preferences of both budget-conscious and luxury-seeking travelers.

- Budget Travelers: Highlight value-added services, such as onboard amenities and discounts, to mitigate the impact of price increases. Partnerships with budget airlines or offering discounted packages can be effective. Consider focusing on shorter cruises, as this will potentially minimize the impact of the fuel surcharges.

- Luxury Travelers: Emphasize exclusive experiences and exceptional service to reinforce the value proposition of the cruise, even with the surcharge. Highlight unique amenities, personalized services, and high-quality onboard experiences. Communicate the cost-effectiveness of the cruise experience in the long run.

Conclusion

In conclusion, rising oil prices are presenting a significant challenge for Carnival Corporation, forcing them to make difficult choices regarding pricing, operations, and customer relations. The company’s ability to navigate these challenges will be critical to their continued success in the face of volatile fuel markets. The impact on customers, particularly budget travelers, is also a key consideration, highlighting the delicate balance between profitability and customer satisfaction.

The cruise industry’s future profitability and growth hinge on how companies like Carnival respond to this emerging trend.

User Queries

What are the potential operational adjustments Carnival might make?

Carnival might explore optimizing engine performance, exploring alternative fuels, and optimizing routes to minimize fuel consumption. Ship maintenance and operational procedures could also be adjusted to increase efficiency. The table in the article details these potential adjustments, categorized by cost-effectiveness and impact.

How will rising fuel costs impact budget travelers?

Budget travelers will likely experience a significant increase in ticket prices due to fuel surcharges. This could lead to a decrease in bookings, requiring Carnival to implement strategies to attract and retain this segment.

What is the current state of the cruise industry regarding fuel prices?

The article provides a broad overview of the current state of the cruise industry, highlighting trends in fuel prices and costs. It also discusses the competitive landscape and how other cruise lines are addressing rising fuel fees.

What are the different pricing models for incorporating fuel surcharges?

The article discusses different models for incorporating fuel surcharges into ticket pricing. Factors like different customer segments, and the overall financial performance of the company are considered when choosing the most appropriate pricing model.