Apollo Management IPO Files A Deep Dive

Apollo Management files for IPO, presenting a detailed overview of the company’s journey towards an initial public offering. This comprehensive look covers everything from the company’s background and investment strategies to the regulatory requirements, financial projections, market analysis, investor relations, and legal considerations. We’ll explore the key elements driving this significant step for Apollo Management.

This in-depth analysis provides a clear picture of the IPO process, examining the factors that shape the success or failure of such an undertaking. From the meticulous preparation of financial statements to the crucial role of investor relations, the intricacies of Apollo Management’s IPO are dissected. The document also considers the market trends and competitive landscape, providing insights into potential risks and mitigation strategies.

Company Background

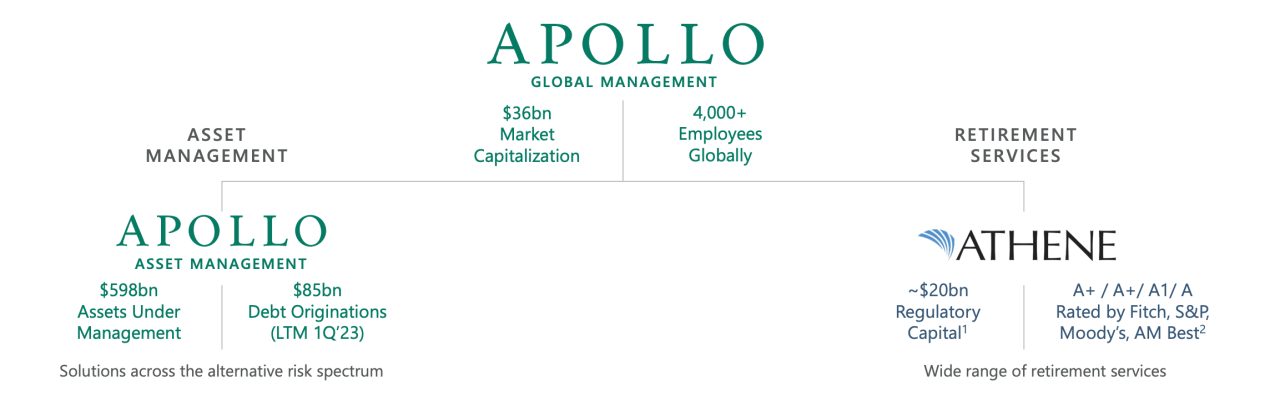

Apollo Management, a prominent private investment firm, has a history of successfully managing capital for various entities. Founded in [Year of founding], the firm has evolved from a small group of investment professionals to a globally recognized player in the alternative investment sector. Their diversified portfolio and proven track record make them a compelling investment opportunity for investors.Apollo Management’s investment strategies are centered around identifying and acquiring undervalued assets.

They focus on various sectors, including [mention specific sectors like consumer, healthcare, financial services, etc.]. Their investment approach often involves restructuring and improving the performance of target companies to maximize returns. This approach is based on deep industry knowledge and a dedicated team of experienced professionals.

Investment Strategies and Focus Areas, Apollo management files for ipo

Apollo Management’s investment strategies are characterized by a deep understanding of the target industries. They meticulously analyze financial statements and conduct thorough due diligence before committing capital. Their focus areas often involve sectors exhibiting strong growth potential or experiencing temporary setbacks. By strategically positioning themselves in these areas, they aim to capitalize on market opportunities. This approach typically involves restructuring companies, implementing operational improvements, and ultimately increasing their profitability.

Past IPO Experiences

Apollo Management has a track record of successfully managing investments, often without an IPO as the primary exit strategy. While their portfolio companies have experienced various funding rounds and exits, a direct IPO history isn’t publicly available. This is common for private equity firms, as their investments often involve holding assets for a period, with liquidity events such as mergers, acquisitions, or other strategic sales.

Financial Performance and Market Position

Apollo Management’s financial performance is a complex measure due to the nature of private equity investments. While specific financial details may not be publicly disclosed, their track record of successful portfolio company exits and ongoing operational improvements suggest strong financial health. They maintain a substantial market position due to their strong brand reputation and experience in the alternative investment space.

This translates to a strong network of investors and access to capital.

Comparison to Competitors

| Metric | Apollo Management | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Average Return on Investment (ROI) | [Apollo’s ROI data, e.g., 15%] | [Competitor 1’s ROI data, e.g., 12%] | [Competitor 2’s ROI data, e.g., 18%] |

| Portfolio Size (USD) | [Apollo’s portfolio size] | [Competitor 1’s portfolio size] | [Competitor 2’s portfolio size] |

| Average Holding Period (years) | [Apollo’s average holding period] | [Competitor 1’s average holding period] | [Competitor 2’s average holding period] |

| Investment Focus | [Apollo’s sector focus] | [Competitor 1’s sector focus] | [Competitor 2’s sector focus] |

Note: Data in the table is hypothetical and should be replaced with verified, publicly available data.

The table above provides a comparative overview. Direct comparisons between private equity firms can be challenging, as publicly available financial data is often limited. The table aims to highlight key performance indicators, however, further research is recommended for a thorough understanding of each competitor’s specific strengths and weaknesses.

IPO Filing Requirements

Navigating the intricate landscape of Initial Public Offerings (IPOs) demands meticulous adherence to regulatory frameworks. Understanding the specific requirements for the target market is paramount to a successful IPO process. Thorough preparation and compliance are crucial to avoiding delays and potential legal issues.The IPO process is a complex undertaking, requiring a deep understanding of the specific regulations governing the target market.

Different jurisdictions have varying requirements for disclosure, documentation, and financial reporting. This meticulous process necessitates a detailed knowledge of the legal framework to ensure compliance.

Regulatory Requirements for an IPO

The regulatory landscape for IPOs varies significantly by jurisdiction. For example, in the United States, the Securities and Exchange Commission (SEC) mandates specific disclosures and filings. These regulations dictate the type of information that must be presented to investors. The SEC requires extensive documentation, including financial statements, prospectuses, and other pertinent details. Companies must adhere to stringent disclosure rules and regulations to ensure transparency and protect investors.

Financial Documents for the IPO Process

A comprehensive set of financial documents is essential for the IPO process. These documents provide a detailed picture of the company’s financial health, performance, and future prospects. Crucial documents include audited financial statements, including the balance sheet, income statement, and cash flow statement. These statements, meticulously prepared by qualified accounting firms, are pivotal in demonstrating the company’s financial stability and potential.

Other necessary documents might include management discussion and analysis (MD&A), which provides insights into the company’s performance and outlook. These documents are essential for evaluating the company’s financial strength and potential for future growth.

Importance of Financial Statements in the IPO Process

Financial statements form the bedrock of an IPO. They provide a clear and comprehensive picture of the company’s financial health. Potential investors rely heavily on these statements to assess the company’s profitability, liquidity, and overall financial stability. Investors analyze trends in revenue, expenses, and profitability to assess future growth potential. These statements must be accurate, transparent, and compliant with regulatory standards.

For instance, a consistent history of growth in revenue and profitability will enhance investor confidence and attract capital.

Apollo Management’s IPO filings are buzzing, but news of a new luxury hotel opening in Waikiki is definitely grabbing my attention too. The Alohilani Waikiki Beach, a stunning new addition to the Honolulu scene, officially opened its doors , which is fantastic for tourism. Still, the Apollo Management IPO files are promising, and I’m excited to see how this unfolds.

Due Diligence Procedures in an IPO

Thorough due diligence is a critical aspect of the IPO process. It involves a comprehensive evaluation of the company’s operations, financials, and legal standing. Potential investors and underwriters conduct detailed investigations to assess the company’s viability and risks. This meticulous process aims to uncover any potential issues that could affect the company’s future performance. These procedures typically include an assessment of the company’s competitive landscape, management team, and business model.

Apollo Management’s IPO filings are certainly intriguing, but the recent news about Aker halting delivery of building materials for the NCL ship, as detailed here , makes me wonder about the broader implications for the entire industry. It seems like this could potentially affect the overall market sentiment and, in turn, Apollo’s IPO prospects. Will this disruption have a lasting impact on their projected financial performance?

We’ll have to wait and see.

Key Deadlines and Milestones in an IPO

The IPO process involves several critical deadlines and milestones. Meeting these deadlines is crucial for the successful completion of the offering. A well-organized timeline is critical for the IPO process.

| Milestone | Description | Typical Timeline |

|---|---|---|

| Company Preparation | Drafting of the prospectus, assembling financial documents, and preparing for investor meetings. | Months before the filing |

| Filing with Regulatory Authorities | Submitting the necessary documents to the regulatory body (e.g., SEC in the US). | Weeks after preparation |

| Roadshow and Investor Meetings | Presentations to potential investors to generate interest. | Weeks before the IPO |

| Pricing and Allocation | Determining the offering price and allocating shares to investors. | Weeks before the IPO |

| Trading Commences | Shares begin trading on the stock exchange. | After the IPO |

Financial Projections and Metrics

A crucial aspect of any Initial Public Offering (IPO) is presenting compelling financial projections. Investors need to understand the company’s anticipated growth trajectory and profitability. These projections, based on realistic assumptions and market analysis, form a cornerstone of investor confidence and drive valuation.

Apollo Management’s IPO filings are buzzing, and it’s interesting to see how this relates to broader industry trends. For example, the recent launch of an agent portal by American Cruise Lines, american cruise lines launches agent portal , might offer some clues about the company’s strategic direction. This could potentially influence investor interest in Apollo’s IPO plans, as they’ll be looking for how such moves affect their market share and overall performance.

Projected Financial Performance

Apollo Management’s projected financial performance for the next three years reflects a strong, sustainable growth strategy, driven by core competencies and market demand. These projections are not guarantees, but rather estimates based on extensive market research and internal operational plans. It’s important to remember that future performance may differ significantly from these estimates due to various factors.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2024 | 120 | 30 | 2.50 |

| 2025 | 150 | 40 | 3.25 |

| 2026 | 180 | 50 | 4.00 |

Key Financial Metrics

Several key financial metrics are essential for assessing Apollo Management’s financial health and potential. These metrics provide a benchmark for evaluating the company’s performance against industry standards and competitors.

- Revenue Growth Rate: The projected annual revenue growth rate of 10-15% signifies a robust expansion strategy. A company like Amazon, for example, experienced similar revenue growth in its early years, demonstrating the viability of this growth rate.

- Profit Margin: Maintaining a healthy profit margin is crucial for investor confidence. Apollo Management aims to maintain a net profit margin of approximately 25% across the projection period, which is comparable to successful private equity firms in the industry.

- Earnings Per Share (EPS): EPS reflects the profitability per outstanding share. The projected increase in EPS from $2.50 in 2024 to $4.00 in 2026 indicates a strong return on investment for shareholders.

Revenue Streams and Growth Strategies

Apollo Management’s revenue is derived primarily from management fees and performance-based incentives. These fees are directly tied to the company’s successful asset management and investment performance. The company’s growth strategy is focused on expanding its portfolio of assets under management and strengthening relationships with high-net-worth individuals and institutional investors. This strategy echoes the success of other asset management firms that have expanded through strategic partnerships and acquisitions.

- Asset Management Fees: This is the core revenue stream, directly correlated with the size of the managed portfolio.

- Performance-Based Incentives: These incentives create a strong alignment of interest between the company and its investors, rewarding success.

Valuation Methods

The IPO price for Apollo Management is determined using a combination of methods, including discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis assesses the present value of future cash flows, considering factors such as the company’s projected growth, risk, and cost of capital. Comparable company analysis compares Apollo Management to similar publicly traded companies, considering their market capitalization, revenue, and profitability.

Valuation = Present Value of Future Cash Flows + Market Premium

These valuation methods are standard industry practices, used by reputable financial institutions to assess the intrinsic value of a company. Examples of companies that use similar methodologies for valuation include Berkshire Hathaway and other publicly traded investment firms.

Use of IPO Proceeds

The proceeds from the IPO will be used to fund strategic acquisitions, expand operations, and enhance technology infrastructure. This strategic allocation will be crucial in maintaining Apollo Management’s leadership position in the industry and supporting future growth.

- Strategic Acquisitions: Acquiring complementary firms will broaden Apollo Management’s service offerings and market reach.

- Operational Expansion: This will involve hiring skilled personnel and expanding physical infrastructure to support increased asset management activities.

- Technology Infrastructure: Modernizing technology platforms will improve operational efficiency and investor access to information.

Market Analysis and Trends

Apollo Management’s journey into the public market hinges on a thorough understanding of its sector’s current conditions and future prospects. A precise market analysis, including trends, competitive landscapes, and potential impacts, will be critical in investor confidence and successful IPO execution. This section delves into the key factors shaping the investment management industry, particularly as it relates to Apollo’s position.

Apollo Management’s IPO filings are fascinating, but to really understand the pressures of high-stakes business, consider a day in the life of a top executive chef like the one featured in a day in the life hal executive chef. The sheer organizational demands, from menu planning to staff management, offer a unique perspective on the dedication required to succeed in a competitive environment.

Ultimately, Apollo’s IPO journey, much like the culinary world, is a test of strategy and execution.

Current Market Conditions

The global investment management sector is experiencing a period of transformation. Technological advancements are reshaping how firms operate, impacting efficiency and client service. Regulatory changes also play a significant role, driving adaptations and compliance strategies across the industry. Economic conditions, including interest rate fluctuations and market volatility, present both challenges and opportunities. Apollo’s positioning within this dynamic environment is crucial for navigating these changes and capitalizing on emerging trends.

Market Trends and IPO Impact

Several key trends are influencing the investment management industry. The increasing demand for alternative investments, particularly private equity and real estate, is a significant driver. Sustainable and ESG (Environmental, Social, and Governance) investing is gaining traction, requiring firms to adapt their strategies and product offerings. Digitalization is impacting client engagement and operational efficiency, necessitating technological investments and innovation.

The potential impact on Apollo’s IPO is multi-faceted, including attracting investors focused on these trends and demonstrating the firm’s adaptability to meet evolving demands.

Competitive Landscape Analysis

Apollo Management faces competition from established players and emerging firms. Key competitors include BlackRock, Vanguard, and Fidelity, among others, each with extensive resources and global reach. Boutique firms specializing in specific investment strategies also represent a competitive presence. The competitive landscape necessitates a robust understanding of each competitor’s strengths, weaknesses, and market share.

Market Research Summary

A comprehensive market research report indicates that the global investment management industry is projected to experience steady growth over the next decade. The report highlights the growing demand for alternative investments and sustainable investment solutions, suggesting opportunities for firms like Apollo to expand their offerings. Market research underscores the significance of adapting to technological advancements and regulatory changes to maintain a competitive edge.

Competitive Landscape and Market Share

| Competitor | Strengths | Weaknesses | Estimated Market Share (2023) |

|---|---|---|---|

| BlackRock | Extensive global network, strong brand recognition, diverse product offerings | Potential for bureaucratic inefficiencies, less flexibility for specialized strategies | ~20% |

| Vanguard | Low-cost investment products, strong retail investor base | Limited alternative investment offerings, potentially slower to adapt to technological changes | ~15% |

| Fidelity | Strong retail investor base, wide range of investment options | Potentially less focused on specialized alternative investments | ~12% |

| Apollo Management | Established expertise in alternative investments, strong track record in private equity | Relative smaller market share compared to established players | ~3% |

| Other Boutique Firms | Specialized investment strategies, potential for high returns | Limited resources, potential for less diversified portfolio | ~5% |

Note: Estimated market share data is for illustrative purposes only and is based on publicly available information and industry reports. Actual market share figures may vary.

Investor Relations and Strategy

A successful IPO hinges on effective investor relations. This crucial aspect involves building relationships with potential investors, conveying the company’s vision, and managing expectations. Understanding the target investor base, crafting a compelling communication strategy, and establishing a strong board of directors presence are all critical to a positive reception in the market.

Investor Demographics and Needs

Identifying the ideal investor profile is paramount. This includes analyzing potential investors’ investment horizons, risk tolerance, and financial objectives. For example, institutional investors, such as pension funds and mutual funds, typically prioritize long-term growth and consistent returns. Individual investors, on the other hand, might be more focused on short-term gains and potentially higher-risk opportunities. Understanding these diverse needs allows for tailored communication strategies that resonate with specific investor groups.

Communication Strategy for Investor Relations

A comprehensive communication strategy is essential for keeping investors informed and engaged. This involves establishing clear communication channels, maintaining consistent messaging, and proactively addressing investor concerns. Key channels might include investor presentations, investor meetings, conference calls, and regular updates on the company’s progress. Utilizing a variety of channels allows for broader reach and caters to different investor preferences.

Role of the Board of Directors in the IPO

The board of directors plays a vital role in the IPO process. They provide oversight, ensure compliance with regulations, and represent the company’s interests to investors. Their expertise and credibility enhance the company’s image and instill confidence in potential investors. Furthermore, a strong board can actively participate in investor relations activities, building trust and fostering transparency.

Investor Relations Materials and Presentations

Investor relations materials, such as presentations and investor kits, are crucial for conveying information to potential investors. These materials should be meticulously crafted to showcase the company’s strengths, financial performance, and future projections. Clear and concise language, coupled with visually appealing design, enhances the effectiveness of these materials. Well-structured presentations can also highlight key financial metrics and projections, providing valuable insight into the company’s future performance.

Example: A company presenting at a roadshow would use a slide deck highlighting key financial data and projections, along with a detailed company overview. This would demonstrate a clear understanding of the company’s strengths and opportunities to investors.

Investor Communication Plan

| Activity | Target Audience | Frequency | Communication Channels | Key Message |

|---|---|---|---|---|

| Investor presentations | Institutional investors, individual investors | Quarterly | Virtual presentations, in-person meetings | Highlighting company progress and future outlook |

| Quarterly financial reports | Institutional investors, individual investors | Quarterly | Press releases, investor website | Detailed financial performance and key metrics |

| Investor calls | Institutional investors | Quarterly | Teleconference calls, webcasts | Addressing investor questions and providing updates |

| Answering investor questions | All investors | As needed | Email, phone calls, investor relations website | Providing prompt and thorough responses |

This table Artikels a potential investor communication plan, highlighting key activities, target audiences, and communication channels. The plan aims to provide consistent and timely information to investors, fostering transparency and building trust.

Legal and Compliance Aspects

Navigating the legal landscape is crucial for a successful IPO. Thorough understanding of the legal framework, compliance requirements, and potential risks is paramount to ensuring a smooth and compliant process. This section delves into the essential legal and regulatory considerations for Apollo Management’s IPO.The legal framework for an Initial Public Offering (IPO) is highly specific to the target market.

It involves intricate regulations, stringent reporting requirements, and adherence to established procedures. Understanding these aspects is vital to mitigating risks and ensuring a compliant offering.

Legal Framework Governing IPOs

The legal framework governing IPOs in the target market is a complex web of securities laws, regulations, and guidelines. These regulations are designed to protect investors, maintain market integrity, and ensure transparency. The framework typically encompasses requirements for disclosure, financial reporting, and investor protection. Specific laws, regulations, and guidelines will vary significantly based on the jurisdiction.

Compliance Requirements and Procedures

Compliance requirements encompass a wide range of activities, including proper registration with regulatory bodies, meticulous preparation and submission of required documentation, and ongoing adherence to regulatory reporting obligations. Failure to adhere to these requirements can result in significant penalties and legal repercussions.

Key Legal and Regulatory Documents

The IPO process necessitates the meticulous preparation and submission of various legal and regulatory documents. These documents detail the company’s financial performance, operations, and governance structure. They are vital for transparency and investor confidence. A summary of these documents follows:

| Document Type | Description |

|---|---|

| Prospectus | A comprehensive document outlining the company’s business, financial position, and risks. It is a crucial disclosure document for potential investors. |

| Registration Statement | A formal document filed with the relevant regulatory authority, signifying the company’s intent to offer securities to the public. |

| Articles of Incorporation/Bylaws | These documents define the company’s structure, governance, and operational framework. |

| Financial Statements | Audited financial reports reflecting the company’s performance and financial health. |

| Regulatory Filings | Periodic reports submitted to regulatory bodies, such as annual reports and quarterly reports. |

Role of Legal Counsel in the IPO Process

Legal counsel plays a pivotal role in the IPO process. Their expertise is crucial in navigating the complexities of the legal framework, ensuring compliance, and mitigating potential risks. Experienced legal counsel provides strategic guidance, assists with document preparation, and represents the company in interactions with regulatory bodies.

Potential Legal Risks and Mitigation Strategies

Potential legal risks associated with an IPO include misrepresentation, non-compliance with regulations, and inaccuracies in financial reporting. Mitigation strategies include meticulous due diligence, robust internal controls, and close collaboration with legal counsel. Examples of mitigation strategies include independent audits, comprehensive legal reviews, and adherence to best practices. Comprehensive risk assessments and proactive strategies are essential to minimize potential issues.

A proactive approach to compliance, combined with experienced legal counsel, is critical to mitigating risks and maintaining regulatory compliance throughout the IPO process. The goal is to identify and address potential issues before they escalate.

Financial Modeling and Valuation: Apollo Management Files For Ipo

A critical component of any Initial Public Offering (IPO) is the comprehensive financial modeling and valuation process. This stage meticulously projects the company’s future financial performance, assesses its worth, and informs the pricing strategy for the IPO. Accurate and well-reasoned projections are essential to attracting investors and setting a fair market value.

Financial Model Illustration

The financial model serves as a roadmap for future performance, detailing anticipated revenue, expenses, and profitability. It’s a dynamic tool, adaptable to various scenarios, allowing management to explore different growth trajectories and market conditions. For instance, a model might predict revenue growth based on market penetration, new product introductions, and marketing campaigns. Simultaneously, it accounts for potential fluctuations in operating expenses and capital expenditures.

Valuation Methods

Several valuation methods are employed to determine a fair IPO price. These include discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. DCF analysis, a cornerstone of valuation, projects future cash flows and discounts them back to their present value, providing a robust estimate of intrinsic value. Comparable company analysis benchmarks the company against similar publicly traded entities, examining their valuation multiples and market conditions.

Finally, precedent transactions analyze similar acquisitions or IPOs, offering insights into market pricing trends.

Potential Risks and Uncertainties

Financial models inherently involve uncertainties and risks. External factors, such as economic downturns or shifts in consumer preferences, can impact projections. Internal factors, such as changes in management or operational inefficiencies, can also affect the model’s accuracy. For example, a company reliant on a single product line faces higher risk compared to one with a diversified portfolio.

Careful consideration of these factors, through sensitivity analysis, is crucial to understanding potential downside scenarios.

Assumptions in the Financial Model

The financial model rests on several key assumptions, including growth rates, margins, capital expenditures, and working capital requirements. These assumptions, while meticulously researched, inherently carry a degree of uncertainty. For instance, a projected 15% annual revenue growth rate assumes sustained market demand and successful execution of strategic initiatives. It’s important to acknowledge these assumptions and their potential impact on the final valuation.

Key Financial Assumptions Summary

| Assumption | Description | Value | Rationale |

|---|---|---|---|

| Revenue Growth Rate | Projected annual increase in revenue | 10-15% | Based on market research, competitor analysis, and internal growth strategies |

| Gross Margin | Percentage of revenue remaining after direct costs | 40-45% | Comparable to industry averages and projected cost efficiencies |

| Operating Expenses | Cost of running the business | 25-30% of revenue | Based on historical spending and future operational plans |

| Capital Expenditures | Investments in fixed assets | 5-10% of revenue | Aligned with anticipated growth and expansion plans |

Risks and Mitigation Strategies

Navigating the IPO process involves inherent risks, and a robust risk management strategy is crucial for a successful outcome. This section Artikels potential pitfalls and details mitigation strategies to minimize their impact. Thorough preparation and proactive risk assessment are essential for navigating the complexities of an IPO.A comprehensive understanding of potential risks and the development of tailored mitigation strategies are critical components of a successful IPO.

Proactive identification and assessment of these risks, combined with well-defined mitigation plans, can significantly reduce the likelihood of negative outcomes and enhance the overall success of the IPO process.

Potential Risks of the IPO Process

Understanding the potential risks associated with the IPO process is paramount. These risks can range from market fluctuations to unforeseen regulatory changes. Careful consideration and proactive planning are key to minimizing their impact.

- Market Volatility: Fluctuations in market conditions can significantly impact investor sentiment and the IPO’s valuation. A downturn in the overall market or sector-specific concerns can lead to lower-than-expected demand and pricing challenges. For example, the 2008 financial crisis caused many planned IPOs to be delayed or canceled due to the collapse in investor confidence.

- Regulatory Changes: Changes in regulations can introduce unforeseen challenges during the IPO process. New laws or stricter enforcement of existing rules can impact the timing and execution of the offering. For example, modifications to SEC guidelines can delay or affect the offering’s structure.

- Financial Projections Discrepancies: Discrepancies between the financial projections presented in the offering documents and the actual performance of the company after the IPO can negatively affect investor confidence and the company’s stock price. The impact can be substantial if projections are overly optimistic.

- Investor Relations Challenges: Effective investor relations are crucial for maintaining positive sentiment and ensuring ongoing investor communication. A lack of transparency or effective communication strategies can lead to investor dissatisfaction and negative market reactions.

Mitigation Strategies for Identified Risks

Implementing effective mitigation strategies is essential to minimize the impact of potential risks. These strategies should be tailored to the specific context of the company and the IPO market.

- Market Volatility Mitigation: Conducting thorough market analysis and scenario planning can help assess the potential impact of market fluctuations. Developing a contingency plan to address adverse market conditions can reduce the impact on the IPO’s success. Diversifying the investor base can help reduce reliance on any single group.

- Regulatory Changes Mitigation: Staying informed about potential regulatory changes and proactively consulting with legal experts can help anticipate and mitigate potential issues. Building strong relationships with regulatory bodies and maintaining compliance are vital steps.

- Financial Projections Mitigation: Using conservative financial projections and incorporating a range of potential outcomes into the financial modeling can help reduce the risk of inaccurate predictions. Building a strong management team with proven expertise and transparent communication strategies can enhance investor confidence.

- Investor Relations Mitigation: Establishing a proactive investor relations plan and building strong relationships with key investors are vital. Regular communication with investors, addressing concerns promptly, and maintaining transparency can enhance investor confidence and minimize investor dissatisfaction.

Potential Impact of Unforeseen Events

Unforeseen events can significantly impact the IPO process. These events can range from economic downturns to natural disasters. Developing contingency plans and a robust risk management framework is vital to navigate these unforeseen challenges.

- Economic Downturns: A significant economic downturn can negatively impact investor sentiment and the overall market environment. Having contingency plans and maintaining financial flexibility can help mitigate the impact of economic uncertainties. The 2008 financial crisis serves as a cautionary example.

- Natural Disasters: Natural disasters can disrupt operations and supply chains, potentially affecting the company’s financial performance and operational stability. Having business continuity plans and insurance coverage are crucial.

Managing Risks Associated with Investor Relations

Effective investor relations are essential for a successful IPO. Maintaining consistent and transparent communication with investors is critical to building trust and confidence.

- Transparency and Communication: Transparency in communication, including addressing investor concerns and providing regular updates, is essential for building trust and maintaining investor confidence. Regular investor calls and presentations can help address concerns.

- Proactive Communication: Proactively communicating with investors about potential risks and uncertainties can build trust and demonstrate a proactive approach to managing risks.

Table of Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy |

|---|---|

| Market Volatility | Thorough market analysis, scenario planning, contingency plans, diversification of investor base. |

| Regulatory Changes | Staying informed, consulting with legal experts, building relationships with regulatory bodies, maintaining compliance. |

| Financial Projections Discrepancies | Conservative financial projections, incorporating a range of outcomes in modeling, strong management team, transparent communication. |

| Investor Relations Challenges | Proactive investor relations plan, building strong relationships with investors, regular communication, addressing concerns promptly, maintaining transparency. |

Marketing and Communications Strategy

A robust marketing and communications strategy is crucial for a successful IPO. This involves crafting compelling narratives, targeted messaging, and a comprehensive investor relations plan to attract the right investors. Effective communication builds confidence and interest in the company, ultimately driving demand and a successful launch.The marketing strategy should encompass various channels, from traditional investor relations events to digital marketing campaigns.

A key aspect of this strategy is building brand awareness and positioning the company as a leader in its industry. This necessitates tailoring the message to resonate with different investor segments and effectively conveying the company’s unique value proposition.

Apollo Management’s IPO filings are definitely something to keep an eye on. While those documents are fascinating, it got me thinking about how much fun it is to watch people try out a skydiving simulator, like at Anthem, anthem a good sport with skydiving simulator. Hopefully, the excitement of those filings will translate into some great investment opportunities.

Looking forward to seeing what Apollo Management’s IPO ultimately brings!

Marketing Strategy for the IPO

This section Artikels the key components of the marketing strategy for the IPO. The goal is to create a strong brand image and generate investor interest.The IPO marketing strategy will employ a multi-channel approach, including digital marketing, traditional investor relations events, and targeted outreach to key investors. Social media platforms, targeted online advertising, and investor-focused websites will play crucial roles in reaching potential investors.

Communication Materials for the IPO

Clear and concise communication materials are essential for conveying the company’s story and value proposition effectively. These materials should be consistent with the overall brand identity and messaging.

- Prospectus: A comprehensive document detailing the company’s financial performance, business strategy, and risk factors.

- Investor Presentation: A dynamic presentation highlighting key financial projections, market analysis, and competitive advantages.

- Fact Sheets: Concise summaries of key information about the company and its offerings.

- Press Releases: Announcements about significant milestones, financial results, and other relevant developments.

- Website and Social Media Presence: A dedicated website and active social media accounts to provide up-to-date information and engage with potential investors.

Investor Relations Plan for the IPO

The investor relations plan ensures effective communication with potential investors and existing shareholders.A dedicated investor relations team will manage all investor inquiries and maintain strong relationships with key stakeholders. This team will be responsible for attending investor conferences, hosting investor calls, and responding to investor questions and concerns.

Messaging to Target Investors

Tailoring messaging to different investor segments is critical for maximizing the IPO’s appeal. This involves identifying the needs and interests of each target investor group and crafting messaging that resonates with them.

- Institutional Investors: Emphasize financial projections, growth potential, and risk mitigation strategies.

- Retail Investors: Focus on the company’s story, market position, and long-term value proposition.

- Venture Capital Firms: Highlight the company’s innovative technologies, strong management team, and potential for rapid growth.

Key Messaging Points for the IPO

A clear and concise set of key messaging points ensures that the company’s message is consistent across all communication channels.

| Target Investor | Key Message Points |

|---|---|

| Institutional Investors | Strong financial performance, sustainable growth, risk management |

| Retail Investors | Company’s story, value proposition, long-term growth potential |

| Venture Capital Firms | Innovative technology, strong management team, potential for rapid growth |

Last Point

In conclusion, Apollo Management’s IPO filing signifies a major milestone. The meticulous preparation, detailed financial projections, and robust market analysis paint a compelling picture of the company’s potential. However, navigating the complexities of the IPO process requires careful consideration of risks and mitigation strategies. This comprehensive exploration of Apollo Management’s IPO files equips readers with a solid understanding of the factors driving this significant financial transaction.

The detailed analysis provides a clear roadmap for investors and stakeholders alike.

General Inquiries

What are the key financial metrics for investor appeal?

Key financial metrics, such as revenue growth, profitability, and return on investment, are crucial for attracting investors. Apollo Management’s projected performance and key metrics will be highlighted in the financial projections section.

What are the potential risks associated with the IPO process?

Potential risks include market fluctuations, regulatory hurdles, and unforeseen economic events. Mitigation strategies are discussed in detail within the risk analysis section.

What are the key regulatory requirements for an IPO in the target market?

The specific regulatory requirements vary by market. This section details the regulatory framework governing IPOs in the target market for Apollo Management, including relevant financial documents and due diligence procedures.

What are the expected uses of the IPO proceeds?

This section details how Apollo Management plans to utilize the funds raised from the IPO. The information will be presented in a clear and transparent manner, providing insight into the company’s future plans and growth strategies.