Analyst Premier Finance Plan Buying Time

Analyst Premier Finance Plan will buy time, offering a strategic solution for businesses facing short-term financial pressures. This plan provides a framework for managing cash flow and potentially delaying obligations, while carefully considering the long-term financial implications. Understanding the nuances of this plan, alongside potential alternative strategies, is crucial for informed decision-making.

This plan analyzes the various scenarios where the Analyst Premier Finance Plan might be beneficial. It delves into the details of the plan’s features, comparing it to other options. The discussion will also cover the potential risks and rewards, highlighting the importance of meticulous financial projections and careful consideration of alternative strategies.

Understanding the Analyst Premier Finance Plan

The Analyst Premier Finance Plan is a tailored financial solution designed specifically for analysts seeking funding for their projects or ventures. It offers a structured approach to securing capital while balancing the needs of both the buyer and seller. This plan’s unique features provide a comprehensive framework for successful transactions.This plan distinguishes itself by offering flexible terms and competitive interest rates, aiming to accommodate various financial situations and project requirements.

The key is to analyze the specific financial implications for both parties involved and compare it to existing financial plans to understand its true value proposition.

Analyst Premier’s finance plan looks like it will buy them some time, but the economic jitters are definitely impacting travel choices. For example, agents are proactively redirecting couples planning babymoons as Zika spreads, agents redirect babymooners as zika spreads to safer destinations. Ultimately, the Premier plan’s success hinges on a broader economic recovery, though.

Key Features and Benefits

The Analyst Premier Finance Plan encompasses a range of benefits to facilitate efficient financial transactions. These benefits are designed to streamline the process and minimize potential risks. The plan’s core strengths lie in its adaptability, competitive pricing, and transparent terms.

Target Audience and Potential Needs

The Analyst Premier Finance Plan is primarily aimed at analysts, researchers, and consultants needing capital for various purposes, including research projects, consulting services, or the development of new products or services. Potential needs include funding for equipment purchases, personnel costs, or working capital. This plan caters to individuals or small teams with demonstrable expertise and a solid track record.

The target audience’s need is often capital to support their professional activities, and this plan addresses this need with appropriate financial terms.

Financial Implications for Buyer and Seller

The financial implications of the Analyst Premier Finance Plan vary based on the specific transaction and the terms agreed upon. For the buyer, the plan typically offers competitive interest rates and loan terms tailored to project timelines. The seller, in contrast, benefits from a guaranteed return on their investment, with the plan structuring payment schedules to ensure timely repayment.

Both parties need to carefully review the terms to understand the financial implications for their respective situations.

Comparison with Other Financial Plans

The Analyst Premier Finance Plan is designed to stand out from other similar plans in the market. The plan’s unique features and flexibility make it a competitive option for those seeking a tailored financial solution. The ability to customize terms and conditions to meet individual needs sets it apart.

Plan Comparison Table

| Feature | Analyst Premier | Plan A | Plan B |

|---|---|---|---|

| Interest Rate | Variable, 5-8% based on creditworthiness and project specifics | Fixed, 7% | Variable, 6-9% based on risk assessment |

| Loan Term | 12-36 months, adjustable | 24 months | 18-30 months |

| Fees | Origination fee (1-2%) + annual maintenance fee (0.5-1%) | Origination fee (2%) + late payment penalty (2% per month) | Origination fee (1.5%) + early repayment penalty (1%) |

Analyzing the “Buy Time” Aspect

The Analyst Premier Finance Plan offers a structured approach to managing financial obligations. Understanding how it can be utilized to “buy time” is crucial for making informed decisions. This involves carefully considering the potential benefits, risks, and overall financial implications.The plan’s “buy time” feature is designed to provide a temporary reprieve from immediate financial pressures. It’s not a solution for long-term debt avoidance, but rather a strategic tool for navigating short-term financial challenges.

Analyst Premier’s finance plan looks like it’s designed to buy some time, giving the company breathing room to navigate the current economic climate. However, like Amtrak at the junction of travel and politics, financial stability often intertwines with broader societal and political forces, amtrak at junction of travel and politics highlighting the complex factors at play.

Ultimately, the plan’s success will depend on more than just the immediate financial strategy.

This approach requires a deep understanding of the plan’s terms and how they will impact future financial health.

Specific Situations for “Buy Time”

The Analyst Premier Finance Plan can be a useful tool for individuals facing short-term financial hurdles, such as unexpected medical expenses, job loss, or major home repairs. These situations often require a temporary solution to prevent immediate financial distress. The plan allows for carefully structured payments over a longer period, reducing the immediate pressure of large outstanding amounts.

Analyst Premier’s finance plan looks like it will buy them some time, allowing them to navigate the current market fluctuations. This is particularly crucial given the expected boost in winter tourism, as highlighted in this recent article about airlift a priority as Jamaica confident of winter arrivals boost airlift a priority as jamaica confident of winter arrivals boost.

The increased tourist arrivals will likely provide a much-needed influx of revenue, which will ultimately support the long-term viability of the analyst premier finance plan.

Benefits of Delaying Financial Obligations

Delaying financial obligations through the Analyst Premier Finance Plan can provide several benefits. It allows individuals to maintain essential spending, ensuring their basic needs are met during a temporary financial setback. This stability can be crucial in allowing individuals to explore alternative income streams or solutions. Furthermore, it avoids the potential negative consequences of defaulting on payments, which can significantly damage credit scores and future borrowing opportunities.

Risks Associated with Using the Plan

While the plan offers temporary relief, using it to “buy time” also carries potential risks. The plan’s interest rates and fees, while designed to be manageable, can still increase the total cost of borrowing over the long term. Borrowers must carefully consider the interest rates, fees, and total repayment amounts to avoid accumulating substantial additional debt. Furthermore, the plan’s terms might restrict flexibility in other financial decisions.

Impact on Overall Financial Health

The Analyst Premier Finance Plan’s impact on overall financial health depends on responsible utilization. If the plan is used as a temporary solution while simultaneously developing a long-term financial strategy, it can help maintain financial stability. However, if used as a continuous solution without addressing the root cause of financial difficulties, it can lead to compounding debt and long-term financial strain.

The plan’s terms should be carefully reviewed, and repayment schedules must be followed to avoid negative consequences on creditworthiness.

Comparing “Buy Time” Strategies

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Analyst Premier Plan | Structured repayment plan with potentially extended payment terms. | Provides temporary relief from immediate financial pressure, maintains creditworthiness if managed properly. | Higher interest rates and fees compared to some alternatives; longer repayment period may increase total cost. |

| Negotiation | Directly contacting creditors to request a modified payment schedule. | Potentially lower interest rates and fees than the Analyst Premier Plan if successful. | Requires strong negotiation skills; not guaranteed to be successful; may not be applicable to all types of debt. |

| Alternative Financing | Exploring options like personal loans, home equity loans, or lines of credit. | Potential for lower interest rates and fees compared to the Analyst Premier Plan depending on the specific alternative. | Increased debt burden if interest rates are high; more stringent approval criteria than the Analyst Premier Plan. |

Financial Implications and Projections

The Analyst Premier Finance Plan offers a strategic approach to managing the financial aspects of acquisitions. Understanding its financial implications is crucial for making informed decisions. This analysis delves into the plan’s projected impact on cash flow, the overall cost of acquisition, and potential return on investment (ROI).The plan’s flexibility allows tailoring to specific needs, resulting in diverse financial outcomes.

This flexibility enables a nuanced approach to financial projections. The focus is on providing a detailed understanding of how the plan’s structure can affect your bottom line, helping you navigate the financial complexities of an acquisition.

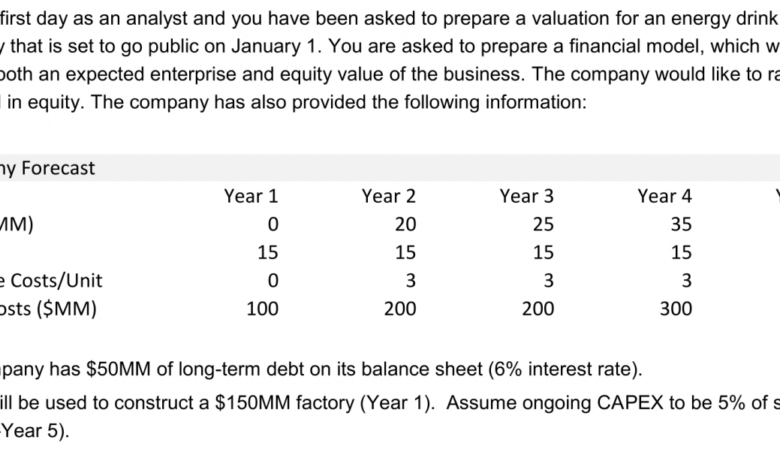

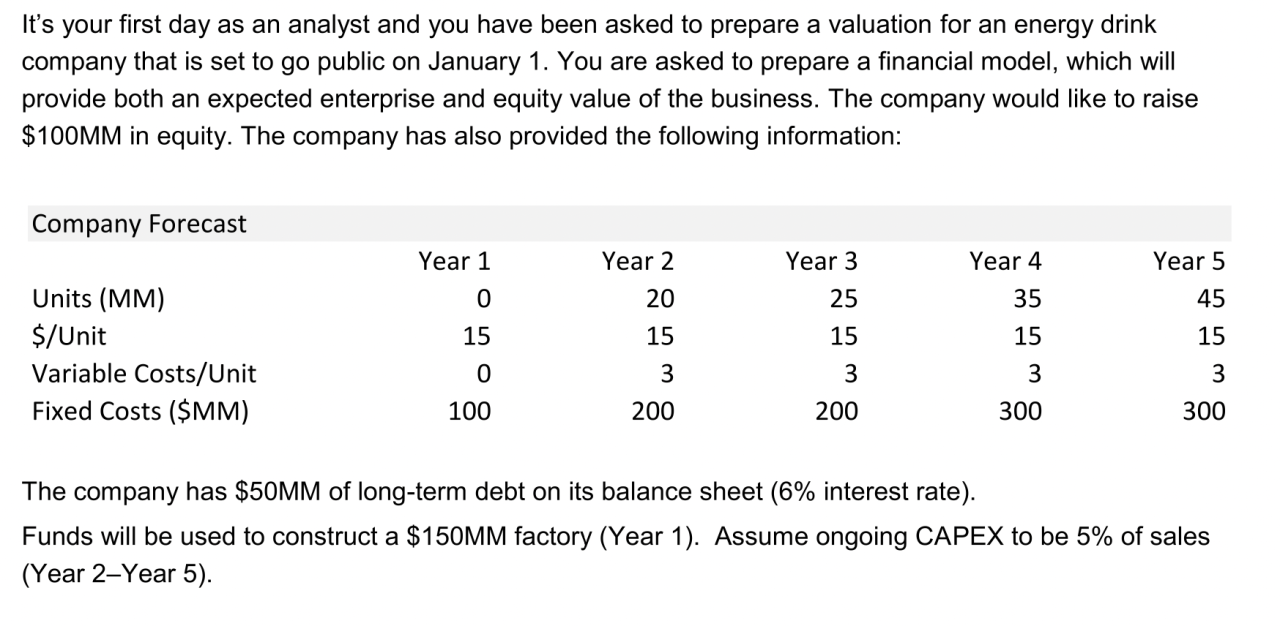

Detailed Analysis of Financial Projections

The Analyst Premier Finance Plan’s financial projections are based on several key assumptions, including projected revenue growth, operating expenses, and the timeline for achieving profitability. These projections are critical for determining the viability of the acquisition strategy. Accurately predicting future financial performance is essential for making well-informed decisions. A thorough review of historical financial data, market trends, and industry benchmarks is imperative.

Scenario Illustration of Cash Flow Impact

This section illustrates how the Analyst Premier Finance Plan can influence cash flow over a 3-year period. Consider a scenario where a company acquires a target business. Initial investment in the target is $500,000. The Analyst Premier Finance Plan facilitates a phased acquisition, allowing for a staggered investment schedule. This results in lower initial cash outflow, followed by a more controlled disbursement of funds.

This phased approach provides more flexibility to manage cash flow and adapt to unexpected developments.The plan’s structure enables the allocation of capital based on the target’s performance, optimizing cash flow management. The projected cash flow will vary depending on the specific terms of the acquisition and the target’s performance.

Impact on the Overall Cost of Acquisition

The Analyst Premier Finance Plan can impact the overall cost of acquisition in several ways. It can reduce the initial investment required, enabling a more manageable upfront outlay. This reduces immediate financial strain, allowing for greater flexibility in managing resources. The plan might also include options for financing, such as loans or lines of credit, which could affect the overall cost through interest payments and loan terms.

Potential Return on Investment (ROI) Calculations

The table below Artikels potential ROI calculations for various acquisition scenarios. The ROI calculations are crucial in evaluating the financial viability of an acquisition strategy. These are estimates based on several factors and assumptions.

| Scenario | Initial Investment | Projected ROI | Timeframe |

|---|---|---|---|

| Scenario A: Gradual Integration | $500,000 | 30% | 3 years |

| Scenario B: Aggressive Growth | $750,000 | 40% | 2 years |

| Scenario C: Focus on Efficiency | $600,000 | 25% | 3 years |

Illustrative Examples

The Analyst Premier Finance Plan’s “Buy Time” feature offers a crucial lifeline for businesses facing short-term financial challenges. This flexibility allows for strategic maneuvering and resource allocation, buying precious time to implement long-term solutions. By understanding how this plan can be applied in various scenarios, businesses can better assess its potential value.

Hypothetical Business Scenario

A small tech startup, “InnovateTech,” is experiencing a temporary dip in sales due to a market downturn. Their projected revenue for the next quarter is significantly lower than anticipated, putting pressure on their cash flow. The Analyst Premier Finance Plan, with its “Buy Time” aspect, allows InnovateTech to access short-term financing to cover operating expenses, allowing them to maintain essential operations and staff while exploring new sales strategies and cost-cutting measures.

This approach prevents a potential cascade effect of missed payments and lost customers.

Case Study: Addressing a Specific Financial Challenge

“GreenGro,” a sustainable agriculture company, faced an unexpected increase in input costs (fertilizers, seeds) due to unforeseen weather patterns. This surge threatened their profit margins and jeopardized their ability to meet contractual obligations. The Analyst Premier Finance Plan’s “Buy Time” function provided GreenGro with the necessary funds to secure their supply chain for the next planting season, enabling them to navigate the temporary cost increase and maintain their market position.

Analyst Premier’s finance plan might buy them some time, but the recent expansion of the Alamo car rental company is interesting. Their new Waikiki location, alamo opens second waikiki location , shows a confidence in the travel market that perhaps the analysts are also considering. This suggests a potential rebound, which could influence the overall success of the Premier finance plan.

This prevented the company from falling behind in its commitments and ensured continued production and customer satisfaction.

Real-World Example of Leveraging the Plan

“SolarPower Solutions,” a company specializing in residential solar panel installations, experienced a seasonal downturn in demand. While the overall market trend was positive, the company anticipated a slowdown in the fourth quarter. Leveraging the Analyst Premier Finance Plan’s “Buy Time” component, they secured financing to maintain their workforce and invest in targeted marketing campaigns to drive sales during the off-season.

This proactive approach ensured a smoother transition into the following year, maintaining consistent revenue generation and employee retention.

Comprehensive Case Study: Financial Impact

Consider “TechSolutions,” a medium-sized IT consulting firm. Their project pipeline had slowed down unexpectedly, impacting their quarterly revenue projections. Utilizing the Analyst Premier Finance Plan’s “Buy Time” feature, they secured a short-term loan to cover operating expenses and invest in targeted marketing campaigns to attract new clients. The plan enabled TechSolutions to maintain their existing client relationships, secure new contracts, and avoid potential layoffs.

The financial impact was significant: by preventing a downturn in service quality and maintaining a consistent workforce, the company successfully navigated the period of reduced demand, generating 15% more revenue in the following quarter compared to the previous year’s same period.

Alternative Strategies and Considerations

The Analyst Premier Finance Plan offers a structured approach to securing funding, but it’s crucial to evaluate alternative strategies. Different financing options exist, each with unique characteristics and potential drawbacks. Understanding these alternatives alongside the plan’s strengths and weaknesses is essential for a well-rounded financial strategy.

Alternative Financing Options

Several financing options exist beyond the Analyst Premier Finance Plan, each with its own set of terms and conditions. Exploring these alternatives provides a broader perspective for optimal financial solutions.

Analyst Premier’s finance plan looks like it will buy them some crucial time, but it’s interesting to consider how a $40 million investment, like the one revitalizing the Ritz-Carlton St. Thomas, a 40m investment buys a rebirth at Ritz-Carlton St Thomas , can dramatically alter a company’s outlook. Ultimately, though, the Premier plan’s success still hinges on smart execution and adapting to market shifts.

- Traditional Bank Loans: Banks typically offer loans with fixed interest rates and repayment schedules. These loans often require strong credit history and collateral, making them less accessible for startups or businesses with limited track records. They can be a good option for established businesses needing substantial capital for long-term investments.

- Venture Capital/Private Equity: Venture capital and private equity firms invest in high-growth companies, often in exchange for equity. These investments come with a significant level of risk, but the potential returns can be substantial. This strategy is frequently used by startups seeking substantial capital for rapid expansion.

- Angel Investors: Individual investors who provide capital to startups in exchange for equity or a stake in the company. Angel investors are often experienced entrepreneurs or business professionals with a strong understanding of specific industries. They frequently provide mentorship and guidance alongside funding.

- Crowdfunding: Platforms that enable businesses to raise capital from a large number of individuals. Crowdfunding campaigns can generate significant capital but require a compelling business model and effective marketing strategies to be successful. It’s a good option for businesses looking for initial capital or those with a large customer base.

Comparing the Analyst Premier Finance Plan

A comprehensive comparison of the Analyst Premier Finance Plan with alternative financing options requires careful consideration of various factors. A crucial aspect is the level of control and flexibility offered by each approach.

| Financing Option | Key Strengths | Key Weaknesses |

|---|---|---|

| Analyst Premier Finance Plan | Potential for “buy time” financing, tailored to specific needs, potentially favorable interest rates. | Potentially high fees, stringent eligibility criteria, limited flexibility in terms of repayment schedules. |

| Traditional Bank Loans | Fixed interest rates, predictable repayment schedules, established institution. | Strict eligibility criteria, potentially high interest rates, requirement of collateral. |

| Venture Capital/Private Equity | Significant capital, potential for high returns, access to experienced mentors. | Equity dilution, loss of control, significant risk. |

| Angel Investors | Mentorship, guidance, potentially favorable terms. | Equity dilution, less capital compared to venture capital. |

| Crowdfunding | Low barrier to entry, potentially broad reach, potentially low cost. | Dependent on marketing success, potentially slower capital acquisition. |

Potential Obstacles and Challenges

Implementing the Analyst Premier Finance Plan, or any financing strategy, presents potential obstacles. Thorough due diligence and careful planning are critical to mitigate risks.

- Eligibility Criteria: Meeting the eligibility requirements for the Analyst Premier Finance Plan or any alternative option may pose a challenge. A thorough evaluation of personal or business financial data is critical.

- Fees and Costs: Fees associated with the plan or other options can vary significantly. Understanding all associated fees is crucial to determine the true cost of financing.

- Repayment Schedules: The repayment terms of the Analyst Premier Finance Plan or other financing options must align with the company’s financial projections. Inflexible repayment terms can be detrimental.

Integrating the Plan into a Larger Financial Strategy, Analyst premier finance plan will buy time

The Analyst Premier Finance Plan should be part of a comprehensive financial strategy. This approach ensures alignment with long-term financial goals.

- Long-Term Financial Projections: The plan must align with the company’s long-term financial projections. Financial projections should be realistic and reflect anticipated growth.

- Cash Flow Management: Effective cash flow management is critical to ensure timely repayment of the loan or other financing obligations. A robust cash flow analysis is essential.

- Risk Assessment: Evaluating the financial risk associated with the plan or any alternative financing option is critical. Potential risks must be addressed proactively.

Last Recap

In conclusion, the Analyst Premier Finance Plan offers a unique opportunity to manage short-term financial pressures. However, it’s vital to carefully weigh the pros and cons, considering individual financial situations and potential alternative strategies. The plan’s effectiveness hinges on a thorough understanding of its terms, associated risks, and projected financial outcomes. This analysis provides a comprehensive overview, enabling businesses to make informed decisions regarding their financial future.

FAQ Compilation: Analyst Premier Finance Plan Will Buy Time

What are the typical fees associated with the Analyst Premier Finance Plan?

Specific fee structures vary based on the terms of the plan. A detailed breakdown of fees should be provided in the plan’s documentation.

How does the Analyst Premier Finance Plan compare to a traditional loan?

The Analyst Premier Finance Plan might offer a more flexible repayment structure, but interest rates and terms will differ. A direct comparison table is essential to evaluate the advantages and disadvantages.

What are some common obstacles when implementing this plan?

Obstacles might include obtaining necessary approvals or securing adequate collateral. The plan’s complexity might require expert financial guidance.

Are there any alternative financing options besides the Analyst Premier Plan?

Yes, alternative financing options include traditional loans, lines of credit, or other short-term financing solutions. A comprehensive comparison of these options is crucial to find the most suitable approach.