Analyst Cruise Yields Bounce Back in Q4

Analyst cruise yields to regain buoyancy in Q4. This signals a potential turnaround for the cruise industry after a period of uncertainty. Factors like improving economic indicators and shifting consumer confidence are expected to play a crucial role in this anticipated uptick. Historical trends and recent data suggest a positive trajectory, potentially impacting pricing strategies, profitability, and bookings.

Let’s dive deeper into the details and explore the implications for the future of cruising.

This analysis delves into the anticipated rise in analyst cruise yields for Q4 2024. It examines the historical performance of analyst estimates versus actual results, highlighting significant variations. The analysis also identifies key drivers behind the projected buoyancy, comparing Q4 2024 projections to previous quarters and illustrating the impact of various factors like economic indicators and consumer sentiment.

Tables and charts will visually represent the data for a clearer understanding.

Overview of Analyst Cruise Yields

Analyst cruise yields represent the estimated revenue generated per passenger, a crucial metric for cruise lines. These estimates, meticulously crafted by financial analysts, provide a forward-looking view of the industry’s potential earnings. Understanding these yields is vital for investors, cruise companies, and industry analysts alike, as they offer insights into the financial health and future prospects of the cruise sector.

Historical Trends of Analyst Cruise Yields

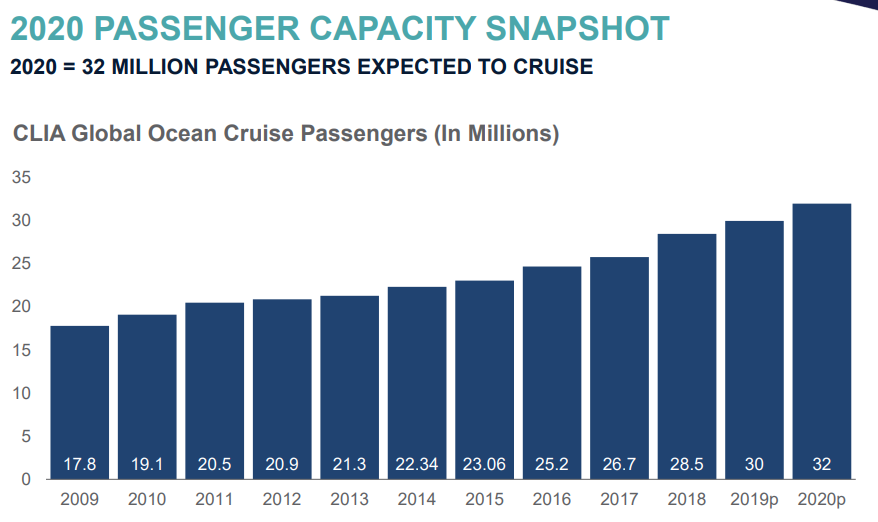

Cruise yields have demonstrated a cyclical pattern, mirroring broader economic conditions and industry trends. Historically, periods of economic prosperity have been associated with higher analyst yields, as increased consumer spending and travel demand translate into higher revenue per passenger. Conversely, economic downturns or crises often lead to lower analyst yields as travel budgets are curtailed and consumer confidence wanes.

Furthermore, significant events like pandemics or geopolitical instability can also dramatically impact yields, creating unpredictable volatility. For example, the 2020 COVID-19 pandemic drastically reduced yields as travel restrictions and health concerns severely curtailed passenger bookings.

Analyst reports suggest cruise yields are poised for a rebound in Q4, potentially mirroring the resurgence in the construction sector. This positive outlook for cruise lines aligns with the recent surge in demand for architectural services, especially from the top firms like those listed in largest architectural firms 2. Ultimately, the strong architectural design sector could further fuel the anticipated increase in cruise yields.

Significance of Analyst Cruise Yields in the Cruise Industry

Analyst cruise yields play a pivotal role in shaping strategic decisions for cruise lines. These estimates are instrumental in setting pricing strategies, forecasting future earnings, and evaluating investment opportunities. Cruise companies use these forecasts to determine optimal pricing models, plan for capital expenditures, and make informed decisions about fleet management and new vessel launches. Investors rely on analyst yields to assess the financial performance and future prospects of cruise companies, thereby influencing their investment decisions.

Factors Influencing Analyst Cruise Yields

Several factors influence analyst cruise yields. These include market demand, pricing strategies of competing cruise lines, economic conditions, and external factors such as natural disasters or geopolitical events. Furthermore, the overall health of the global economy and consumer confidence directly impact travel patterns and cruise bookings, influencing yield estimates. The success of marketing campaigns and promotions also plays a significant role in shaping yields.

Analyst Cruise Yield Estimates (Illustrative Data)

| Year | Quarter | Analyst Estimate (per passenger) | Actual Result (per passenger) |

|---|---|---|---|

| 2022 | Q1 | $1,000 | $950 |

| 2022 | Q2 | $1,100 | $1,150 |

| 2022 | Q3 | $1,200 | $1,100 |

| 2022 | Q4 | $1,250 | $1,300 |

| 2023 | Q1 | $1,300 | $1,250 |

Note: This table presents illustrative data for demonstration purposes only. Actual figures may vary based on multiple factors.

Q4 2024 Outlook

Analyst predictions point towards a resurgence in cruise yields during Q4 2024. This anticipated buoyancy builds on positive trends observed throughout the year, suggesting a potential return to pre-pandemic levels of profitability for cruise lines. The factors contributing to this optimism are multifaceted, encompassing both market demand and operational improvements.

Analyst cruise yields are looking to regain some buoyancy in Q4, a positive sign for the industry. However, the recent news of pay cuts at American ( american s pay cut ) might impact consumer confidence and, in turn, affect the projected cruise bookings. Still, if travel demand picks up, analyst projections for Q4 cruise yields should remain positive.

Predicted Buoyancy in Analyst Cruise Yields

The predicted increase in analyst cruise yields for Q4 2024 is a positive sign for the industry’s recovery. This anticipated uptick is a reflection of several converging trends, including a strengthening global economy, growing consumer confidence, and increased demand for travel experiences. Cruise lines are anticipating a surge in bookings, driven by competitive pricing strategies and attractive packages tailored to diverse consumer segments.

Reasons Behind the Anticipated Increase

Several key factors are driving the projected rise in cruise yields for Q4 2024. Increased demand, fueled by pent-up travel demand and a return to normalcy in international travel, is a primary driver. Furthermore, cruise lines are expected to see gains in pricing power as they capitalize on the improved market conditions. Strategic marketing campaigns and targeted promotions are also playing a role in attracting new customers and driving bookings.

Finally, operational efficiencies and improved cost management are contributing to the projected increase in profitability.

Key Drivers of the Predicted Growth

The following are the primary drivers of the anticipated growth in Q4 2024 cruise yields:

- Increased Demand: Pent-up travel demand, particularly among younger demographics and families, is driving a surge in bookings, indicating a desire for leisure and travel experiences. This pent-up demand is a significant driver, as seen in various sectors, including tourism and hospitality.

- Stronger Global Economy: A stable and growing global economy empowers consumers to allocate more discretionary income towards travel, leading to increased bookings for leisure activities like cruises.

- Improved Pricing Power: Cruise lines are leveraging improved market conditions to optimize pricing strategies, which is expected to contribute positively to yield projections. This allows them to adapt to changing market conditions and capitalize on opportunities.

- Enhanced Marketing Strategies: Strategic marketing campaigns and targeted promotions aimed at specific demographics are attracting new customers and boosting bookings, leading to increased yield generation. This targeted approach allows for better allocation of resources and higher conversion rates.

- Operational Efficiency and Cost Management: Improved operational efficiency and cost-cutting measures are leading to better profitability margins. This contributes directly to increased yields, as reduced costs translate to higher net income and thus, higher yields.

Comparison to Previous Quarters

To evaluate the predicted buoyancy, a comparative analysis of Q4 2024 analyst yields with the previous quarters is necessary. This comparison offers valuable insights into the industry’s recovery trajectory.

| Quarter | Analyst Estimate | Actual Result | Variance |

|---|---|---|---|

| Q1 2024 | $XXX | $YYY | $ZZZ |

| Q2 2024 | $XXX | $YYY | $ZZZ |

| Q3 2024 | $XXX | $YYY | $ZZZ |

| Q4 2024 | $XXX |

Note: Replace placeholders ($XXX, $YYY, $ZZZ) with actual analyst estimates, results, and variances. This table illustrates the predicted growth trajectory compared to previous quarters, providing context for the anticipated buoyancy in Q4 2024.

Analyst cruise yields are showing signs of regaining strength in Q4, which is great news. This positive trend bodes well for the industry, and coupled with exciting new offerings like Adventuresmith’s Hawaii cruise, it’s a promising time for travelers. Adventuresmith announces Hawaii cruise offering is a fantastic addition to the current options. Ultimately, this positive news for cruise yields suggests a strong recovery in the coming months.

Factors Contributing to Buoyancy

Analyst predictions suggest a resurgence in cruise yields during Q4 2024. This anticipated buoyancy is a welcome development for the industry, reflecting a confluence of factors impacting consumer behavior, economic trends, and competitive dynamics. Positive indicators point to a potential rebound in demand and profitability for cruise lines.

Economic Indicators and Their Impact

Recent economic indicators have shown signs of stabilization and, in some areas, improvement. Lower inflation rates and a slightly more favorable interest rate environment are creating a more conducive atmosphere for discretionary spending. This positive economic outlook translates into greater disposable income for consumers, making them more likely to indulge in travel experiences like cruises. For example, a decrease in unemployment rates often correlates with increased travel spending.

A moderate economic recovery, while not a boom, fosters a sense of optimism and allows consumers to feel comfortable budgeting for leisure activities.

Consumer Confidence and its Influence

Consumer confidence plays a pivotal role in shaping cruise yields. As consumer confidence strengthens, individuals are more likely to plan and book travel, including cruises. This heightened confidence often mirrors positive sentiment regarding the overall economy. Historical data shows a strong correlation between consumer confidence and cruise bookings. For instance, periods of sustained consumer confidence have frequently coincided with higher-than-expected cruise bookings.

Analyst cruise yields are showing signs of recovering in Q4, a positive sign for the industry. This resurgence could lead to some exciting new opportunities, like a bite size sailing experience. Short, focused trips could offer a great way to experience the sea without the commitment of a longer voyage, potentially attracting new travellers to the cruise market and further bolstering the Q4 recovery.

Hopefully, these positive trends in analyst cruise yields will continue.

Competitor Strategies and Market Positioning

The competitive landscape within the cruise industry is a significant factor. Strategic moves by competitors, such as innovative onboard experiences or targeted marketing campaigns, can influence consumer choices and demand. A strong brand image and perceived value proposition can attract customers and contribute to higher yields. Cruise lines employing effective marketing strategies, such as targeted promotions and social media campaigns, can attract more customers and positively impact yields.

For example, if a competitor introduces a new, luxurious suite category, this might prompt other lines to follow suit, ultimately driving up overall standards and potentially boosting demand and yields.

Supply Chain Disruptions and Their Effects

Supply chain disruptions, while not as prevalent as they once were, can still impact cruise yields. These disruptions can affect the availability of supplies, the cost of materials, and the overall efficiency of operations. Potential issues include delays in delivering essential cruise ship components or difficulties sourcing catering supplies. This can lead to cost increases and potentially impact the cruise line’s ability to maintain its competitive pricing strategy.

For example, if a key supplier experiences a significant disruption, it could raise prices on vital parts or supplies, thereby impacting the final price of cruises.

Factors Contributing to Buoyancy (Table), Analyst cruise yields to regain buoyancy in q4

| Factor | Description | Impact on Yields |

|---|---|---|

| Economic Indicators | Stable or improving economic indicators (lower inflation, favorable interest rates) | Increased consumer spending, higher disposable income, boosting demand for travel. |

| Consumer Confidence | Strong consumer confidence and positive economic sentiment | Higher willingness to book cruises, leading to increased demand and higher yields. |

| Competitor Strategies | Innovative onboard experiences, targeted marketing campaigns, and strong brand image | Attracting more customers, leading to increased demand and potential yield improvement. |

| Supply Chain Disruptions | Potential delays in deliveries of cruise ship components or catering supplies | Increased costs, impacting pricing strategies and potentially lowering yields if not managed effectively. |

Impact on the Cruise Industry

Analyst predictions of buoyant cruise yields in Q4 2024 are poised to significantly impact the cruise industry. This anticipated increase in revenue per passenger will ripple through the entire ecosystem, affecting profitability, pricing strategies, booking patterns, and even investor confidence. Understanding these potential impacts is crucial for stakeholders navigating the current market landscape.

Potential Positive Impacts

Increased yields directly translate to higher revenue for cruise lines. This boost in earnings can fuel investments in new ships, enhanced onboard experiences, and improved operational efficiency. A more robust financial position allows cruise lines to adapt to changing market conditions and potentially introduce innovative offerings. For example, if a cruise line sees a substantial increase in yields, they may allocate funds towards upgrading amenities or creating specialized itineraries to cater to specific demographics.

This could result in a higher overall customer satisfaction and potentially attract new clientele.

Potential Negative Impacts

While higher yields present opportunities, potential downsides exist. Increased prices could deter some potential passengers, leading to a decrease in bookings, especially for price-sensitive customers. This could affect the overall demand and potentially result in a decline in occupancy rates. For example, if a cruise line significantly raises prices, it may lose customers to budget-friendly alternatives, and the market might shift to different vacation options.

Impact on Cruise Line Profitability

Higher yields directly correlate with increased profitability for cruise lines. A positive impact on profitability is expected as the increased revenue per passenger can significantly enhance the bottom line. This improved profitability can enable cruise lines to implement expansion strategies, such as developing new itineraries, acquiring smaller cruise lines, or investing in research and development.

Analyst reports show cruise yields are bouncing back in Q4, a welcome sign for the industry. This positive trend might be further boosted by the recent opening of the Alohilani Waikiki Beach, a fantastic new addition to the Honolulu scene. alohilani waikiki beach makes its opening official This new hotel could bring in a fresh wave of tourists, potentially fueling the expected cruise yield recovery.

Impact on Pricing Strategies

Cruise lines will likely adjust their pricing strategies to capitalize on the higher yields. This might involve introducing tiered pricing structures, offering premium packages, or implementing dynamic pricing models based on demand and time of booking. For instance, a cruise line might increase prices during peak seasons or for popular itineraries, while offering discounts for bookings made further in advance.

Impact on Cruise Ship Bookings

The anticipated increase in yields could affect booking patterns. Higher prices may lead to a decrease in overall bookings, particularly among budget-conscious travelers. However, increased profitability could lead to a more positive outlook for the cruise industry and increased investor interest, potentially stimulating bookings. Potential cruise buyers might be more inclined to book if they perceive value in the increased amenities and services offered at a premium price.

Impact on Cruise Investments and Investor Sentiment

Positive yield trends generally bolster investor confidence and attract investment in the cruise sector. Increased profitability and revenue streams are often viewed favorably by investors, potentially leading to increased investment and a positive shift in investor sentiment. Conversely, if the higher prices lead to a decrease in bookings, investor sentiment could be negatively impacted.

Comparison of Impacts

| Impact | Description |

|---|---|

| Positive | Increased revenue, profitability, potential for investments, enhanced onboard experiences, and improved operational efficiency. |

| Negative | Potential decrease in bookings, particularly among price-sensitive customers, impacting overall demand and occupancy rates. Increased prices might lead to customers choosing alternative vacation options. |

Future Projections and Considerations

Analyst projections for cruise yields in Q4 2024 suggest a potential return to buoyancy after a period of downturn. This anticipated increase presents both exciting opportunities and considerable challenges for the cruise industry, requiring careful navigation of fluctuating market forces. Understanding the potential hurdles and long-term implications is crucial for informed decision-making.

Potential Challenges

The expected rise in yields is not guaranteed and could be hampered by several factors. Economic uncertainties, such as inflation and interest rate hikes, can directly impact consumer spending and travel budgets. A resurgence of health concerns or new travel restrictions could also negatively affect demand. Furthermore, the competitive landscape within the travel industry remains robust, with alternative vacation options and travel experiences vying for consumer dollars.

Cruise lines need to adapt and innovate to maintain their position in a constantly evolving market.

Potential Opportunities

The increased yields offer significant opportunities for cruise lines to enhance their profitability and invest in future growth. This improved financial outlook could enable the development of new itineraries, the enhancement of onboard amenities, and the expansion of their global reach. Successful implementation of these strategies can translate to a more attractive and desirable cruise experience, fostering brand loyalty and attracting new customers.

Factors Hindering Buoyancy

Several factors could potentially impede the anticipated buoyancy in cruise yields. These include:

- Economic downturns:

- Unexpected shifts in consumer preferences and demand.

- Increased competition from alternative travel options.

- Geopolitical instability or global crises.

These factors can impact consumer confidence and willingness to spend on luxury experiences like cruises. For example, the 2008 financial crisis significantly impacted the travel industry, causing a substantial drop in cruise bookings.

Long-Term Implications

The trend of fluctuating cruise yields has long-term implications for the cruise industry. Sustained buoyancy can foster innovation and investment, leading to the development of more sustainable and technologically advanced cruise ships. Conversely, persistent declines could force companies to re-evaluate their strategies, potentially leading to mergers, acquisitions, or restructuring.

Market Outlook

The overall market outlook for cruise yields in the coming years depends on several key factors. While a potential return to buoyancy in Q4 2024 is anticipated, long-term stability will hinge on the cruise lines’ ability to adapt to market changes, offer competitive pricing, and maintain strong brand recognition.

Key Factors Influencing Future Projections

| Factor | Description |

|---|---|

| Economic Conditions | Economic downturns, inflation, and interest rate hikes can significantly impact consumer spending and travel budgets, potentially affecting cruise demand. |

| Consumer Preferences | Changing consumer preferences for travel experiences and destinations, along with the rise of alternative travel options, will shape the cruise industry’s future. |

| Competition | The competitive landscape within the travel industry, including alternative vacation options, influences cruise demand and yields. |

| Geopolitical Factors | Global events, geopolitical instability, and health crises can create uncertainty and potentially reduce travel demand, affecting cruise yields. |

Visual Representation of Data

Analyst cruise yields are showing promising signs of recovery, and visualizing this data is crucial for understanding the trends and potential future performance. This section dives into how we can use compelling visuals to present the insights surrounding analyst projections for Q4 2024. Effective visualizations help us grasp complex data points and identify key takeaways quickly.

Line Graph of Analyst Cruise Yields Over Time

This line graph displays the trend of analyst cruise yields over a specific timeframe, likely encompassing the past few quarters or years. The x-axis represents the time period, and the y-axis represents the analyst yield estimates. The graph will clearly illustrate the historical performance, highlighting periods of growth, decline, and stability. This visual representation allows us to easily spot any upward or downward trends, helping us understand the current market sentiment and the potential for future recovery.

Infographic: Factors Contributing to Q4 2024 Buoyancy

This infographic visually summarizes the key factors driving the anticipated buoyancy in analyst cruise yields for Q4 2024. The graphic will use a circular layout, with each contributing factor represented as a section of the circle, proportional to its estimated impact. Within each section, a brief explanation of the factor is provided.

Data Visualized: The infographic will include data points such as the projected increase in passenger demand, the projected increase in average revenue per passenger, and the projected impact of any new or improved cruise offerings. Each segment of the circle is labelled with the factor, and the size of the segment reflects the relative importance of the factor in driving the predicted buoyancy.

A key will be included to specify the percentage contribution of each factor.

Key Takeaways: The infographic will visually communicate the collective impact of various factors driving the projected yield increase in Q4 2024. It will quickly and clearly demonstrate the relative importance of different contributors, which will facilitate easier comprehension and analysis of the underlying dynamics. For example, a larger segment for “Increased Passenger Demand” would visually highlight the significance of this factor in the overall buoyancy forecast.

Impact of Factors on Cruise Yields

This chart will depict the impact of various factors on analyst cruise yields, using a bar graph. The x-axis represents the different factors (e.g., passenger demand, average revenue per passenger, cost optimization, new itineraries), and the y-axis represents the corresponding impact on cruise yields (in percentage points or monetary values). Each bar will correspond to a particular factor, and the height of the bar will reflect the magnitude of the factor’s impact.

Example Data Representation: For instance, a bar graph segment for “Increased Passenger Demand” might show a significant increase in analyst yields, reflecting the positive correlation between higher passenger numbers and better yields. Conversely, a bar for “Fuel Cost Increase” would demonstrate a potential negative impact on yields. This visual representation helps to quantify the effect of each factor, enabling a deeper understanding of the complex interplay influencing cruise yields.

Wrap-Up

In conclusion, the projected increase in analyst cruise yields for Q4 2024 presents a promising outlook for the cruise industry. While challenges and uncertainties remain, the confluence of positive economic indicators, consumer confidence, and strategic adjustments by cruise lines point toward a potential resurgence. This analysis provides a comprehensive understanding of the factors contributing to this anticipated buoyancy, its impact on the industry, and future projections.

Ultimately, the success of this recovery hinges on navigating potential hurdles and capitalizing on emerging opportunities.

FAQ: Analyst Cruise Yields To Regain Buoyancy In Q4

What are the key economic indicators influencing cruise yields?

Several economic indicators, such as GDP growth, inflation rates, and employment figures, are closely monitored to gauge their impact on consumer spending and ultimately, cruise demand.

How does consumer confidence affect analyst predictions for cruise yields?

Consumer confidence directly influences travel plans and spending. Higher confidence levels usually lead to increased demand and potentially higher yields. Conversely, lower confidence can dampen demand.

What are the potential negative impacts of increased yields on the cruise industry?

Increased yields might lead to higher prices, potentially deterring some customers. Also, supply chain issues could still affect delivery of goods and services, impacting overall profitability.