Analyst Bullish on Cruise Market, Slowing US Economy

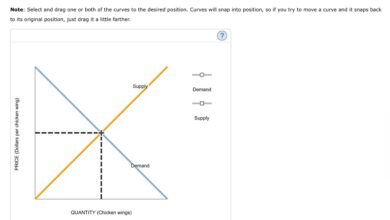

Analyst bullish on cruise market despite slowing u s economy – Analyst bullish on cruise market despite slowing U.S. economy. The cruise industry navigates a tricky economic landscape, with a recent analysis pointing to surprising resilience. While the US economy slows, analysts see opportunities for cruise lines to thrive, highlighting factors like consumer preferences, competitive strategies, and the potential for future growth. This analysis delves into the key economic indicators, the analyst’s reasoning, and the projected future of the cruise market in the face of economic uncertainty.

The current state of the U.S. economy plays a significant role in the cruise market’s performance. Inflation and interest rate fluctuations directly impact consumer spending, influencing their decisions regarding travel and leisure activities like cruises. The historical trends of the cruise market, along with recent performance figures, offer a valuable perspective. This analysis considers various factors, including the analyst’s predictions for the industry’s future and potential strategies, and how the competitive landscape will be impacted.

Market Overview: Analyst Bullish On Cruise Market Despite Slowing U S Economy

The cruise market, despite recent headwinds, remains a resilient sector, with strong potential for future growth. While the U.S. economy is experiencing a slowdown, the cruise industry has shown remarkable adaptability in navigating previous economic downturns. This resilience is due, in part, to the industry’s ability to adjust pricing and itineraries to meet changing consumer demands.Recent economic indicators suggest a softening of the U.S.

economy, with inflation moderating but still a concern. Interest rates remain elevated, potentially impacting consumer spending. However, these factors are not necessarily insurmountable obstacles for the cruise market. The industry’s ability to adapt to changing circumstances is crucial, and early indications show a capacity for the cruise industry to mitigate the impact of these economic shifts.

Current State of the U.S. Economy

The U.S. economy is experiencing a period of deceleration. Key indicators, such as GDP growth and employment numbers, have shown a downward trend in recent quarters. Inflation, while declining, remains a persistent concern. The Federal Reserve’s interest rate hikes, intended to combat inflation, are contributing to higher borrowing costs and potentially dampening consumer spending.

These factors are influencing consumer behavior, including discretionary spending, which can affect travel and leisure activities.

Historical Trends in the Cruise Market

The cruise market has exhibited periods of significant growth and contraction throughout its history. Growth periods have often coincided with economic prosperity and increased disposable income. Recessions, on the other hand, have led to declines in demand, as consumers prioritize essential expenses over discretionary travel. Understanding these historical trends is crucial for analyzing the current market situation and anticipating future developments.

The industry’s ability to weather previous economic downturns is a positive indicator for its potential resilience.

Recent Performance of the Cruise Industry

Recent cruise industry performance has been mixed. While passenger numbers and revenue have shown signs of recovery following the pandemic, they have not yet reached pre-pandemic levels. Financial reports from major cruise lines reveal a path toward profitability, but challenges remain in regaining pre-pandemic market share. Analyzing the financial data and passenger statistics is critical for assessing the industry’s current trajectory.

This includes examining factors such as pricing strategies, route adjustments, and marketing campaigns.

Factors Influencing Consumer Spending Habits

Several factors influence consumer spending habits, particularly in the travel and leisure sector. These include income levels, employment rates, inflation levels, and consumer confidence. A decline in consumer confidence or increased uncertainty about the future can lead to reduced spending on discretionary items like cruises. Understanding these trends allows cruise lines to adjust their strategies and adapt to changing consumer preferences.

This could include offering more affordable options, targeted promotions, and enhanced onboard experiences.

Impact of Inflation and Interest Rates on Consumer Spending for Cruises

Inflation and interest rate changes significantly impact consumer spending for cruises. Higher prices for goods and services reduce discretionary spending, while higher interest rates increase borrowing costs, potentially deterring consumers from taking out loans for cruises. This influence is evident in other sectors, like real estate, where higher interest rates have impacted homebuyers’ decisions. Cruise lines need to consider these factors when determining pricing strategies and marketing campaigns.

Adjustments to pricing and promotions might be necessary to maintain consumer interest in cruise vacations, particularly during periods of economic uncertainty.

Analyst’s Perspective

The cruise industry, despite recent headwinds from a slowing U.S. economy, presents a compelling investment opportunity. Analysts remain bullish, citing underlying demand and innovative strategies within the sector as key drivers for future growth. This outlook, however, is not without nuance, requiring careful consideration of the current economic climate.The analyst’s optimism stems from a deep understanding of the cruise market’s resilience and adaptability.

They anticipate the industry’s ability to navigate the current economic slowdown, driven by factors like pent-up demand, and strategic adjustments by cruise lines.

Analysts are surprisingly optimistic about the cruise market, even with the US economy slowing down. While the future of travel is certainly complex, it’s interesting to consider how Amtrak, at the junction of travel and politics, amtrak at junction of travel and politics , is navigating these waters. Perhaps the cruise market’s resilience stems from similar factors – a desire for escape and experience, even during economic uncertainty.

Reasoning Behind Bullish Outlook

The analyst’s bullish outlook hinges on several key factors. Firstly, a significant portion of the population still desires travel experiences, and cruise vacations remain a popular choice. Secondly, cruise lines are increasingly implementing strategies to attract a broader customer base and diversify their offerings. This includes offering more affordable options, targeting specific demographics, and expanding itineraries. Finally, the industry is adapting to changing consumer preferences, introducing innovative onboard experiences and amenities.

Comparison with Economic Conditions

While a slowing U.S. economy can potentially impact discretionary spending, the cruise industry is positioned to withstand these pressures. Historically, cruise demand has demonstrated resilience during economic downturns, as travel remains a prioritized expense for many. The analyst believes that cruise lines’ ability to adjust pricing and offer attractive packages can mitigate potential negative impacts from economic headwinds. Further, cruise lines have the opportunity to capitalize on the increased interest in value-based travel options.

Potential Strategies and Predictions

The analyst anticipates several strategic adjustments by cruise lines. These adjustments include targeted marketing campaigns to specific demographic segments, implementing flexible pricing models, and creating more curated experiences to appeal to diverse consumer preferences. Moreover, investments in sustainable practices and digital platforms are anticipated to drive long-term growth. The predicted growth is likely to be gradual and not exponential.

However, the analyst expects continued growth, particularly in the long term, driven by the evolving demand and adaptability of the cruise industry.

Data and Metrics Supporting Bullish Stance

Crucial data supporting the bullish outlook includes strong booking trends for the upcoming season. Data from major cruise lines, along with third-party booking platforms, shows sustained interest in cruise vacations, particularly in specific market segments. Furthermore, industry reports on passenger demographics and preferences demonstrate a shift towards a more diverse customer base, signifying the potential for sustained growth.

Finally, the increasing adoption of digital technologies by cruise lines, leading to greater efficiency and personalized customer experiences, reinforces the analyst’s belief in the industry’s long-term viability.

Concerns Regarding the Slowing U.S. Economy

The analyst acknowledges the potential impact of a slowing U.S. economy on cruise bookings. A potential decrease in discretionary spending could lead to a moderate decline in demand, requiring cruise lines to adopt more strategic pricing and marketing strategies. The analyst anticipates that cruise lines will likely focus on promotional offers and value-driven packages to stimulate bookings during the slowdown.

This strategy is similar to what airlines often do during economic downturns, adjusting prices and promotions to maintain demand.

Economic Factors

The cruise industry, while seemingly immune to economic downturns, is deeply intertwined with the broader economic landscape. Understanding the key economic indicators and their potential impact is crucial for evaluating the long-term health of the cruise market. A nuanced understanding of how past economic slowdowns affected the industry provides valuable context for predicting future performance.Economic fluctuations significantly influence cruise passenger demand.

Factors like consumer confidence, unemployment rates, and disposable income directly impact the willingness and ability of potential passengers to book cruises. Understanding these correlations helps predict how economic headwinds might affect the industry’s profitability and growth trajectory.

Key Economic Indicators Relevant to the Cruise Market

Several economic indicators are closely watched by the cruise industry. These include gross domestic product (GDP) growth, inflation rates, unemployment figures, and consumer confidence indices. These metrics provide insight into the overall economic health of a region and, consequently, the purchasing power of potential cruise passengers. For instance, a robust GDP growth rate often correlates with higher disposable incomes, leading to increased demand for luxury goods and services, including cruises.

Analysts are surprisingly optimistic about the cruise market, even with the US economy slowing down. Perhaps the shift towards more budget-friendly travel options, like all inclusive resorts go small , is influencing this positive outlook. Cruise lines might be adapting to the changing landscape, offering competitive packages and value-added services to maintain their appeal, even with a potential downturn in the overall economy.

Impact of Economic Recessions or Slowdowns on the Cruise Industry

Economic recessions or slowdowns typically lead to reduced consumer spending. This translates to lower demand for discretionary travel, including cruises. During economic downturns, individuals may prioritize essential expenses over leisure activities. The cruise industry often experiences a significant decline in bookings during periods of economic uncertainty, impacting revenue and profitability. For example, the 2008 financial crisis resulted in a substantial drop in cruise passenger numbers as consumers cut back on discretionary spending.

Correlation Between Unemployment Rates and Cruise Passenger Demand

There is a strong negative correlation between unemployment rates and cruise passenger demand. As unemployment rises, disposable income decreases, leading to a reduced capacity for leisure spending. Cruise passengers are often those with relatively higher incomes, and a rise in unemployment generally impacts this segment disproportionately. This effect is particularly pronounced during periods of prolonged economic downturn, where the impact on demand can be significant.

Cruise Industry Performance During Previous Economic Downturns

The cruise industry’s performance during previous economic downturns offers valuable insights. During the 2008 financial crisis, cruise lines experienced a significant decline in passenger numbers, but the industry rebounded relatively quickly. Subsequent economic slowdowns, while causing short-term disruptions, generally showed resilience in the industry. Crucially, the cruise industry demonstrated the ability to adjust to changing economic conditions and, in some cases, even capitalize on niche markets during these downturns.

Potential Impact of Consumer Confidence Levels on Cruise Bookings

Consumer confidence plays a pivotal role in shaping cruise bookings. High consumer confidence levels generally correlate with increased demand for discretionary travel. Conversely, low consumer confidence can lead to a decline in bookings as consumers prioritize saving over spending. Cruise lines often use marketing strategies to bolster consumer confidence during periods of economic uncertainty, emphasizing value and affordability to encourage bookings.

Competitive Landscape

The cruise industry, while facing potential headwinds from a slowing US economy, remains a dynamic and competitive market. Major players are adapting their strategies to maintain profitability and attract consumers. Understanding the competitive landscape, pricing models, and emerging trends is crucial for navigating this evolving market.

Major Cruise Line Strategies

Cruises lines are actively adjusting their offerings to adapt to economic fluctuations. Some are focusing on more affordable itineraries and onboard experiences, while others are maintaining a premium positioning. This strategic diversification reflects a recognition of the diverse consumer base within the cruise market.

Pricing Strategies and Consumer Impact

Pricing strategies vary significantly across cruise lines. Some emphasize all-inclusive packages to appeal to budget-conscious travelers, while others offer a wider range of onboard options with flexible pricing, catering to a range of price sensitivities. This variation in pricing can significantly influence consumer choices.

Key Competitors and Market Share

The cruise industry is dominated by a few major players. Royal Caribbean Group, Carnival Corporation, and Norwegian Cruise Line Holdings hold significant market share. Smaller, independent lines also contribute to the overall competitive landscape, particularly in niche markets.

Table: Major Cruise Line Market Share (Estimated)

| Cruise Line | Estimated Market Share (%) |

|---|---|

| Royal Caribbean Group | 35-40 |

| Carnival Corporation | 30-35 |

| Norwegian Cruise Line Holdings | 15-20 |

| Other Lines | 10-15 |

Note

* Market share estimations are approximate and may vary depending on the specific time period and the metrics used.

Analysts are surprisingly optimistic about the cruise market, even with the US economy cooling down. It seems the travel sector is holding strong, and that bodes well for exciting new offerings like Adventuresmith’s Hawaii cruise package. This new cruise, adventuresmith announces hawaii cruise offering , is a great option for those looking for a relaxing getaway in beautiful Hawaiian waters.

The analyst predictions for the market remain positive, and I’m excited to see what the future holds for cruise vacations.

Emerging Trends and Innovations

The cruise industry is constantly innovating to enhance the passenger experience and cater to evolving demands. New ship designs, advanced onboard technology, and the incorporation of unique experiences are aimed at retaining customer loyalty and attracting new passengers.

Examples of Innovations

- Enhanced onboard entertainment: Interactive gaming experiences, virtual reality attractions, and expanded live music and theatre offerings are being implemented across many lines. These add-ons enhance the cruise experience beyond traditional activities.

- Sustainability initiatives: Many cruise lines are integrating sustainable practices into their operations, including waste management improvements, reduced emissions, and partnerships with environmental organizations. This trend appeals to environmentally conscious consumers.

- Personalized onboard experiences: Cruise lines are exploring ways to customize itineraries and onboard experiences based on passenger preferences. This may include personalized dining recommendations or curated excursions based on pre-voyage surveys or onboard profiling.

Consumer Behavior

Cruise vacations, often perceived as a luxury, are surprisingly resilient to economic downturns. While a slowing economy might temper spending, the allure of a break and the appeal of value-oriented options can keep cruise bookings afloat. Understanding consumer motivations and how cruise lines are adapting their strategies is key to navigating this economic landscape.

Consumer Segment Analysis

Consumers’ choices regarding cruise vacations are diverse and influenced by various factors, including budget, travel preferences, and family needs. Understanding these diverse segments is crucial for crafting effective marketing campaigns.

| Consumer Segment | Predicted Behavior | Motivations | Potential Impact on Cruise Bookings |

|---|---|---|---|

| Budget-Conscious Families | Seek value-priced cruises with onboard activities and amenities | Desire affordable family experiences without sacrificing quality | Positive, as cruise lines offering deals and package options will see higher bookings. |

| Luxury Travelers | Prioritize exclusive experiences and premium services | Value bespoke attention, high-quality accommodations, and fine dining | Potentially stable, but cruise lines need to focus on maintaining exclusivity and exceptional service |

| Couples Seeking Relaxation | Favor itineraries with less crowded ports and a focus on relaxation | Prioritize serene environments and opportunities for romance and connection | Positive, as cruises with smaller ships and dedicated itineraries for couples will see increased demand |

| Adventure-Seeking Individuals | Look for unique itineraries with destinations beyond the mainstream | Driven by a desire for new experiences, exploration, and adventure | Positive, but demand will be dependent on itineraries and unique offerings. |

Impact of a Slowing Economy

A slowing U.S. economy will likely impact consumer spending on discretionary items like cruise vacations. Consumers may become more price-sensitive and prioritize value. Travelers might choose shorter, more affordable cruises, opting for fewer destinations or simpler itineraries. This necessitates strategic adaptation by cruise lines.

Adapting Marketing Strategies

Cruise lines are actively responding to economic uncertainty by emphasizing value pricing. This includes offering discounted fares, bundled packages, and onboard credit. Promotions tailored to specific consumer segments, like family discounts or early-booking incentives, are also becoming more prevalent.

“Cruise lines are shifting their marketing efforts to emphasize value-driven offerings and targeted promotions rather than focusing solely on premium packages.”

Analysts are surprisingly optimistic about the cruise market, even with the US economy slowing down. It’s interesting to consider how this resilience contrasts with the recent disruptions faced by airlines and cruise lines due to severe weather, like the impact of Hurricane Sandy, which forced numerous alterations in travel plans. airlines cruise lines alter plans due to sandy highlights the challenges in the travel industry.

Perhaps the cruise market’s strength stems from the unique appeal of these vacations, making them a relatively recession-proof option for travelers.

Alternative Travel Options

Alternative travel options, such as budget airlines, budget hotels, and road trips, will compete for travelers’ dollars. Cruise lines must highlight the unique advantages of cruise vacations, such as all-inclusive packages, convenience, and entertainment options, to retain their appeal. This competition will influence the cruise market, so strategies to differentiate themselves will be essential.

Value Pricing and Loyalty Programs

Value pricing and robust loyalty programs are crucial for attracting and retaining customers during economic downturns. By offering tiered pricing options and rewards for repeat bookings, cruise lines can incentivize customer loyalty and encourage repeat business.

Analysts are surprisingly optimistic about the cruise market, even with the US economy slowing down. It’s a fascinating contrast, considering the broader economic trends. This resilience, perhaps, mirrors the dedication and innovation of recent graduates honored at a transformational leadership ceremony, dozens of graduates honored at transformational leadership ceremony. These bright minds might just be the key to future success in the cruise industry, ensuring it navigates these economic headwinds effectively.

“Loyalty programs and value-driven pricing are critical to attracting and retaining customers in a challenging economic environment.”

Future Outlook

Despite the current economic slowdown, the cruise market presents intriguing opportunities for sustained growth. The inherent resilience of leisure travel, coupled with the industry’s adaptability and proactive strategies, suggests a promising future, even in a challenging economic climate. This section explores potential scenarios, growth trajectories, and the impact of emerging trends on the cruise industry’s future.

Potential Scenarios and Their Influences

Understanding the possible futures is crucial for informed decision-making. Different economic and consumer behaviors will shape the cruise market’s trajectory.

| Timeframe | Potential Scenarios | Factors influencing the scenario | Impact on the Cruise Market |

|---|---|---|---|

| 2024-2025 | Moderate Growth with Cautious Optimism | Gradual recovery of consumer confidence, increased disposable income, and targeted marketing campaigns. | Continued growth, but at a slower pace than pre-pandemic. Focus on value-based pricing and targeted promotions. |

| 2026-2028 | Steady Growth with Price Sensitivity | Sustained economic recovery, but with inflationary pressures and increased price sensitivity among consumers. | Cruises will need to adapt pricing strategies and product offerings to meet consumer demands for value. Potential for new cruise product lines. |

| 2029-2031 | Strong Growth fueled by Innovation | Strong economic recovery, technological advancements in cruise ship design, and increased environmental awareness. | Innovation will drive growth through features like personalized experiences, more sustainable practices, and enhanced on-board amenities. |

Cruise Market Growth Trajectory (2024-2028)

Predicting precise growth rates in a dynamic environment like the cruise market is inherently complex. The following table presents a possible growth trajectory considering a slowing economy.

| Year | Estimated Passenger Count (Millions) | Growth Rate (YoY) | Key Growth Drivers |

|---|---|---|---|

| 2024 | 25 | 5% | Recovery from pandemic, focused marketing |

| 2025 | 26.5 | 6% | Improved consumer confidence, value-based pricing |

| 2026 | 28.2 | 6% | Sustained economic recovery, new product lines |

| 2027 | 29.8 | 5.5% | Inflationary pressures, targeted promotions |

| 2028 | 31.2 | 4.5% | Innovation in cruise ship design, increased environmental awareness |

Impact of New Technologies and Regulations

Emerging technologies and stricter regulations will significantly impact the cruise industry.The integration of digital platforms for booking and on-board experiences is likely to improve efficiency and enhance the passenger experience. Autonomous ship technology, while still in development, could lead to increased safety and reduced labor costs in the future. Environmental regulations, such as stricter emission standards, will force the industry to invest in more sustainable technologies, potentially affecting the design and operation of cruise ships.

Factors Influencing Analyst Predictions, Analyst bullish on cruise market despite slowing u s economy

Several factors could cause the analyst’s predictions to change or evolve. These include:* Unexpected economic downturns: A sudden and significant economic downturn could drastically alter consumer behavior and spending patterns, impacting cruise demand.

Changes in consumer preferences

Shifting consumer preferences regarding travel choices, experiences, and environmental sustainability will significantly influence cruise market trends.

New competitors

The emergence of new competitors, or a resurgence of existing ones, could impact market share and pricing strategies.

Geopolitical events

Unforeseen geopolitical events could disrupt global travel patterns and affect cruise bookings.

Technological advancements

Rapid advancements in technologies could either positively or negatively impact cruise operations and customer experience.

Key Takeaways

The cruise industry, while facing headwinds from a slowing economy, displays resilience and adaptability. Strategic adjustments in pricing, product offerings, and marketing strategies will be vital to navigate the evolving market. Continued innovation and alignment with environmental concerns will be key to sustained growth. However, unexpected economic shifts and unforeseen changes in consumer preferences remain potential factors that could alter future projections.

Final Thoughts

In conclusion, despite a slowing U.S. economy, the cruise market appears to hold potential for continued growth. Analysts are optimistic about the industry’s ability to adapt to the economic conditions and maintain its market share. Crucial factors include consumer behavior, pricing strategies, and innovative approaches within the competitive landscape. This analysis highlights the resilience of the cruise industry, offering valuable insights into the future of the market.

Quick FAQs

What are the key economic indicators affecting the cruise market?

Key economic indicators include inflation rates, interest rates, unemployment rates, and consumer confidence levels. These factors directly impact consumer spending and travel decisions.

How might alternative travel options affect cruise passenger demand?

The rise of other travel options, like budget airlines and domestic road trips, could potentially divert some passengers from cruise vacations. Cruise lines must adapt their strategies to maintain competitiveness.

What are the potential concerns of analysts regarding the slowing US economy?

Analysts might be concerned about the potential impact of a recession or economic slowdown on consumer spending and confidence, impacting cruise bookings. They also likely consider the potential for reduced demand for luxury or discretionary items like cruises.

What are the pricing strategies of different cruise lines, and how do they impact consumer choices?

Cruise lines employ various pricing strategies, including value pricing, loyalty programs, and promotions. These strategies aim to attract customers and maintain market share during periods of economic uncertainty.