Analyzing Mexico Cruise Passenger Tax

Analysis mexico cruise passenger tax – Analyzing Mexico cruise passenger tax reveals a complex interplay of historical context, current regulations, and economic impact. This in-depth look examines the evolution of taxes on cruise passengers in Mexico, from past rates to current structures, and delves into the economic benefits and potential downsides for the country. We’ll also compare Mexico’s tax policies with other Caribbean destinations, examining the influence of competition and the impact on cruise line choices and passenger behavior.

The analysis explores the economic impact of the tax, considering factors like tax revenue, service costs, and potential effects on cruise itineraries. It also examines potential reforms and improvements to the tax structure, drawing on case studies of similar tax policies in other countries. This comprehensive analysis provides a nuanced perspective on Mexico’s cruise passenger tax.

Historical Context of Passenger Taxes in Mexico

Cruise tourism has significantly impacted Mexico’s economy, and passenger taxes have played a crucial role in managing this influx of visitors. Understanding the historical evolution of these taxes provides insight into how Mexico has adapted its policies to the changing dynamics of the cruise industry. This historical overview will trace the development of tax policies, examining their impact on the cruise sector and the Mexican economy.Early policies regarding cruise passenger taxes were often reactive to the growing popularity of cruise destinations in Mexico.

These early policies aimed to generate revenue for infrastructure development and to address the increasing demand for services associated with cruise tourism.

Evolution of Tax Policies Related to Cruise Tourism

Mexico’s tax policies related to cruise tourism have evolved alongside the industry’s growth. Initially, taxes were relatively simple and focused on generating revenue. As the industry matured, tax policies became more sophisticated, encompassing a broader range of fees and charges. The increasing complexity reflected the growing need to manage the economic and social impact of cruise tourism.

Examples of Past Tax Rates and Changes Over Time

Precise historical tax rates are difficult to obtain in a centralized, readily accessible format. However, changes in policies often reflect broader economic and political trends. For instance, periods of economic instability or infrastructure development initiatives might correlate with changes in the passenger tax structure. While specific historical tax rates are not readily available, it’s evident that these policies have evolved to meet the demands of a growing industry.

Economic Impact of Cruise Tourism in Mexico Throughout History

The economic impact of cruise tourism in Mexico has been substantial, though not uniformly distributed. The industry has created jobs, particularly in hospitality and related services. Revenue from taxes and fees has funded projects like port improvements and infrastructure development in coastal areas. However, concerns about the environmental impact and potential displacement of local communities have also emerged, and the economic impact needs to be considered with these factors in mind.

Role of Government Agencies in Regulating Cruise Passenger Taxes

Various government agencies have played a role in regulating cruise passenger taxes in Mexico. These agencies, often within the Ministry of Tourism or other relevant government bodies, are responsible for establishing and enforcing tax policies. Their role in overseeing the implementation of these policies and adapting them to the evolving needs of the cruise industry has been crucial to managing the economic and social impacts.

Current Tax Structure and Regulations

Cruise tourism is a significant economic driver for many countries, including Mexico. Understanding the tax structure for cruise passengers is crucial for both the industry and travelers. This section delves into the current framework, outlining the different types of taxes, the governing regulations, and potential exemptions.The Mexican government’s tax policies regarding cruise passengers are designed to generate revenue and manage the impact of this sector.

These policies are complex, encompassing various taxes applied at different stages of the cruise experience. Navigating these taxes is essential for both cruise lines and passengers to ensure compliance and a smooth travel experience.

Tax Categories for Cruise Passengers

The tax structure for cruise passengers in Mexico encompasses several categories. These categories, while distinct, often overlap in their application, adding to the complexity of the system. Crucially, the specific taxes and rates can vary depending on factors like the passenger’s nationality and the cruise line’s specific arrangements.

Types of Taxes Imposed

Mexico levies various taxes on cruise passengers, each with its own purpose and application. These taxes are often a combination of federal and local levies.

- Tourism Tax: This tax is a common component of the Mexican tax system and applies to a wide range of tourism activities, including cruise ship passengers. The rate of this tax can vary depending on the municipality or state in which the port of embarkation or disembarkation is located. It typically aims to fund local tourism infrastructure and services.

- Value Added Tax (VAT): Similar to VAT systems in other countries, this tax is imposed on goods and services purchased by cruise passengers. This includes onboard purchases, shore excursions, and other amenities. The VAT rate can vary based on the specific goods or services.

- Other Local Taxes: Certain municipalities or states might have additional taxes or fees levied on cruise passengers, depending on the specific regulations in place. These can include entry or departure fees at ports or taxes for specific services utilized during the cruise or port stay.

Specific Laws and Regulations

Mexican tax regulations concerning cruise passengers are Artikeld in various federal and local laws. Understanding these legal frameworks is essential for accurate tax calculation and compliance. Information on these laws is often available on the websites of the Mexican tax authorities and relevant government agencies. Regulations are often updated; thus, it’s crucial to consult the most current versions.

Tax Exemptions and Deductions

Certain cruise passengers might be eligible for tax exemptions or deductions. These are often tied to specific circumstances, such as nationality or specific programs. For example, some nationalities might have agreements with Mexico for tax benefits. It is vital for passengers to research potential exemptions and deductions before their cruise. Further research is necessary to determine the eligibility criteria and procedures.

Tax Structure Table

| Tax Category | Rate | Applicable Situations |

|---|---|---|

| Tourism Tax | Variable (e.g., 2-5%) | All cruise passengers; rates depend on the municipality. |

| VAT | Variable (e.g., 16%) | Onboard purchases, shore excursions, and other amenities. |

| Local Taxes | Variable | Depending on specific port regulations and local policies. |

| Exemptions/Deductions | Variable | Specific to passenger nationality, program participation, or other criteria. |

Economic Impact of the Passenger Tax

The Mexican cruise passenger tax, a relatively new addition to the country’s tourism landscape, presents a complex interplay of potential economic benefits and drawbacks. Understanding its impact requires examining both the revenue it generates and its potential effect on the cruise industry’s viability in Mexico. This analysis delves into the economic ramifications of this tax, considering its effect on tourism, revenue generation, and potential adjustments within the cruise sector.The Mexican government likely implemented this tax with the intention of bolstering its national coffers and generating revenue that can be channeled towards infrastructure development and public services within coastal areas.

However, the tax’s effectiveness hinges on its ability to stimulate the economy without simultaneously driving down the attractiveness of Mexico as a cruise destination.

Potential Economic Benefits

The primary aim of the tax is to increase government revenue. This revenue could be used for various projects, from upgrading ports and facilities to funding social programs in coastal communities. The tax could also incentivize the cruise lines to improve the quality of their services and amenities, potentially benefiting passengers and boosting the overall cruise experience. Additionally, the tax could generate funds for supporting tourism-related businesses, indirectly benefiting the local economy.

Potential Negative Impacts on Cruise Tourism

The implementation of a cruise passenger tax could discourage passengers from choosing Mexican ports, potentially impacting the cruise industry’s overall economic contribution to the country. Passengers may opt for destinations without such taxes, especially if the added cost significantly affects their budget or perception of value. Increased prices could also influence cruise lines to adjust their itineraries, potentially reducing the number of calls at Mexican ports, impacting the economic activity of the local communities reliant on cruise tourism.

Comparison of Tax Revenue and Service Costs

A crucial element in assessing the economic impact is the comparison of tax revenue with the cost of services offered to cruise passengers. This requires a thorough examination of the tax rate, the number of passengers, and the services offered. If the tax revenue significantly exceeds the value of the services provided to passengers, it may suggest a potential overcharge.

Conversely, if the revenue barely covers or falls short of the service costs, the tax may need adjustments to ensure its financial viability.

Potential Impact on Cruise Ship Itineraries and Choices

Cruise lines, being profit-driven entities, will likely adapt their itineraries in response to the passenger tax. They might adjust the duration of stops at Mexican ports or even eliminate them altogether if the added cost of the tax is considered too significant. This could impact the economic activity of coastal cities and towns that rely on cruise tourism.

For instance, if the tax makes Mexican ports less attractive than competing destinations, cruise lines might favor alternative ports, leading to a reduction in economic activity for the affected regions.

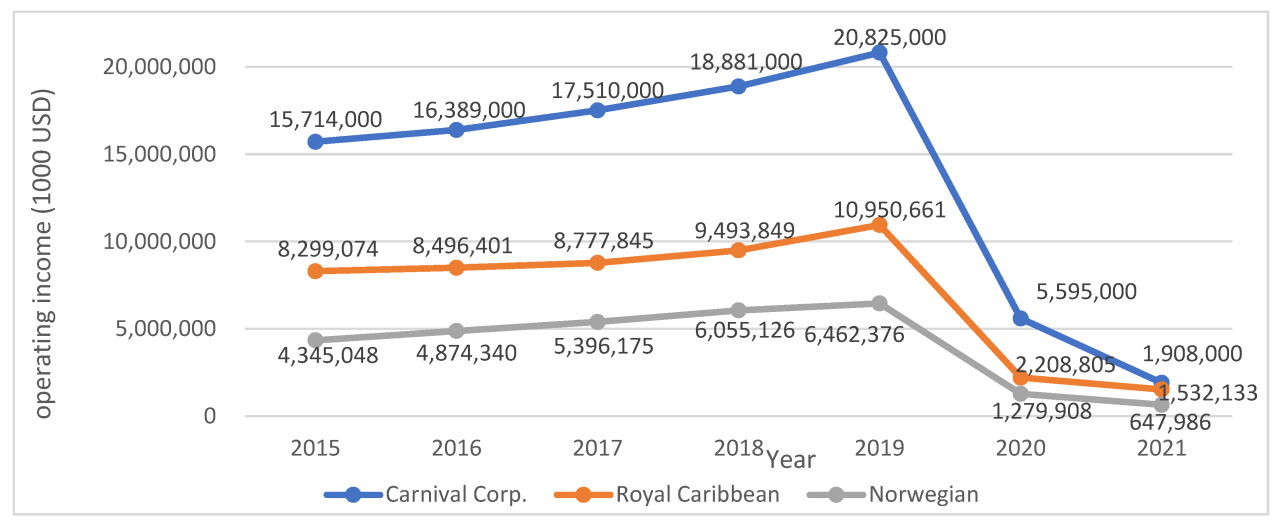

Data to Support Economic Effects

Reliable data on the economic impact of the tax is crucial for evaluating its effectiveness. This would encompass the number of cruise passengers, the average spending per passenger, the amount of tax revenue collected, and the cost of services offered to passengers. Without such data, any projections on the tax’s impact remain speculative. Comparative data from similar taxes in other countries and the impact on tourism in those areas could provide valuable insights.

For example, a comparative study of cruise passenger taxes in the Caribbean, along with data on the number of cruise ship calls and the economic impact on each country, could illuminate how the tax in Mexico will likely affect cruise lines’ choices. Analysis of similar tax implementations in other regions can serve as a benchmark for understanding potential outcomes.

Comparison with Other Destinations

Cruise passenger taxes vary significantly across destinations, influenced by a complex interplay of factors. Understanding these differences is crucial for analyzing Mexico’s tax structure and assessing its competitiveness in the cruise industry. This comparison delves into the tax rates and structures of other Caribbean destinations, highlighting the factors that shape them, and how competition affects these policies.

Analyzing Mexico cruise passenger taxes is fascinating, but sometimes I crave a total escape. A healthy dose of Czech Republic spa towns, like those featured in a healthy dose of czech republic spa towns , offers a perfect antidote. Thinking about the revitalizing mineral waters and thermal springs, it makes me realize how important it is to get away and relax while analyzing those cruise passenger taxes, though.

I’m sure there’s a connection, somehow, between the rejuvenating power of the Czech spas and finding the perfect tax rate.

Caribbean Tax Rate Comparisons

Mexico’s cruise passenger tax, while a source of revenue, sits within a broader regional context. Understanding the tax structures of neighboring Caribbean destinations provides a comparative perspective. Different islands and countries often have distinct approaches to cruise passenger taxes, impacting their attractiveness to cruise lines and passengers alike.

Factors Influencing Tax Rates

Several key factors contribute to the variations in cruise passenger taxes across destinations. These include:

- Economic Dependence on Tourism: Islands heavily reliant on tourism revenue may implement higher taxes to maximize revenue generation from this sector.

- Infrastructure Needs: Destinations needing significant investment in port infrastructure or related facilities might levy higher taxes to fund these developments.

- Political and Regulatory Frameworks: Government policies, tax laws, and regulatory approaches significantly impact the structure and rates of these taxes.

- Competition Among Destinations: The intensity of competition between destinations plays a crucial role in tax policies. A destination that implements overly high taxes may see cruise lines and passengers opt for alternatives, negatively impacting its economic standing.

Impact of Competition

Competition among destinations directly impacts cruise passenger tax policies. Destinations that implement excessively high taxes risk losing market share to competitors offering more attractive packages. The cruise industry is highly competitive; destinations need to carefully balance tax revenue with maintaining competitiveness to attract cruise lines and passengers. This delicate balance often involves negotiation and cooperation to foster a positive environment for the industry.

Comparative Table

| Destination | Tax Rate (USD per passenger) | Tax Structure | Economic Impact |

|---|---|---|---|

| Mexico | [Insert average rate] | [Describe Mexico’s structure – e.g., per passenger, per cruise, etc.] | [Summarize Mexico’s economic impact] |

| Bahamas | [Insert average rate] | [Describe Bahamas’ structure] | [Summarize Bahamas’ economic impact] |

| Jamaica | [Insert average rate] | [Describe Jamaica’s structure] | [Summarize Jamaica’s economic impact] |

| Dominican Republic | [Insert average rate] | [Describe Dominican Republic’s structure] | [Summarize Dominican Republic’s economic impact] |

| [Other relevant destination] | [Insert average rate] | [Describe the destination’s structure] | [Summarize the destination’s economic impact] |

Note: Data in the table should be based on reliable sources and represent the most recent available figures. Tax rates are subject to change.

Impact on Cruise Line Choices and Passenger Behavior

Cruise passenger taxes in Mexico, like those in other countries, significantly impact the choices of both cruise lines and passengers. These taxes, while potentially generating revenue for the Mexican government, inevitably influence the overall cruise experience and the decisions made by all parties involved. Understanding these influences is crucial for evaluating the long-term viability of the Mexican cruise industry.The passenger tax in Mexico, as with any tax levied on a service, influences the cruise industry’s operations and ultimately impacts the passenger experience.

This influence manifests in various ways, from the pricing strategies employed by cruise lines to the destinations chosen by passengers. The cruise lines themselves must adjust their business models to accommodate the tax structure, impacting the passenger’s overall cost and travel experience.

Influence on Cruise Line Choices

Cruise lines carefully assess the tax burden in their route planning. They consider the tax rate, its consistency, and potential future changes when selecting destinations. High passenger taxes in a particular region may make that destination less attractive compared to others with more favorable tax structures. This can lead to a shift in cruise line itineraries, with some lines potentially avoiding destinations with high taxes or adjusting their offerings accordingly.

For example, a cruise line might offer fewer itineraries to a Mexican port with a significant tax increase if the cost-benefit analysis suggests that it is no longer economically feasible.

Analysis of Potential Impact on Passenger Behavior and Destinations

Passenger behavior is also significantly affected by passenger taxes. Higher taxes can result in fewer passengers choosing Mexican cruises, potentially impacting the overall economic benefits of the cruise industry in the region. Passengers may opt for destinations with lower taxes, impacting the tourism sector of the destination with high passenger taxes. Conversely, if the tax is perceived as justified and efficiently utilized for local improvements, passenger behavior may be more inclined to support the destination.

For instance, if the tax funds significant infrastructure improvements in the port area, passengers may be more inclined to choose that destination. The influence on destinations, thus, goes beyond the immediate cruise experience to the broader tourism sector.

Impact on Cruise Pricing and Passenger Costs

Passenger taxes directly impact cruise pricing. Cruise lines often absorb some of the tax burden, but they typically pass on a significant portion to the passenger. This increase in the cost of the cruise can deter some potential customers, particularly those on tighter budgets. In competitive markets, this may result in passengers choosing alternative vacation options or potentially fewer cruises overall.

Consequently, the cruise lines need to strategize their pricing models to reflect the tax and remain competitive in the market. For example, a cruise line might offer promotions or discounts to offset the tax increase.

Cruise Line Adjustments to the Tax Structure

Cruise lines adjust to the tax structure in several ways. They may diversify their itineraries to include destinations with lower taxes, potentially shifting the emphasis away from certain regions. They might also look into alternative pricing strategies to compensate for the additional cost. This could involve offering different cruise packages, introducing flexible payment options, or even adjusting the onboard experiences to offset the additional cost.

Analyzing Mexico cruise passenger taxes is interesting, especially now that American cruise lines are making it easier for travel agents to book. With the recent launch of their agent portal, American cruise lines launches agent portal , it’s likely that pricing strategies and passenger volume will shift, potentially impacting those taxes in the near future. We’ll need to see how these changes play out to fully understand the effect on the Mexico cruise market.

Cruise Line Strategies to Manage the Tax in Pricing and Marketing

Cruise lines develop comprehensive strategies to manage the passenger tax within their pricing and marketing campaigns. These strategies often involve careful analysis of the tax’s impact on profitability and the market response. This includes analyzing competitor pricing, evaluating the potential for passenger attrition, and developing marketing campaigns that highlight the value proposition of the cruise despite the tax.

For example, they might highlight the quality of the destinations, the onboard amenities, or the value-added services to mitigate the perception of the added cost. A cruise line might offer packages that include shore excursions or other amenities to make the cruise more appealing despite the tax.

Potential for Reform and Improvement

Mexico’s cruise passenger tax, while generating revenue, could be structured more effectively to maximize benefits for both the government and the cruise industry. Potential reforms should consider the current economic climate, passenger behavior, and the overall cruise tourism experience to ensure sustainable growth and positive impacts for all stakeholders. A more nuanced approach to taxation can optimize revenue collection and enhance the country’s appeal as a cruise destination.

Potential Improvements to the Tax Structure

The current structure could be refined to better reflect the economic value different cruise ships and passenger groups bring. For example, a tiered system based on ship size or passenger numbers could incentivize larger vessels that offer more diverse experiences and contribute more to the local economy. Alternatively, differentiated rates based on the length of stay or number of excursions booked by passengers could further encourage spending within Mexican ports.

Strategies for Optimizing Tax Revenue Collection

Implementing advanced technology and streamlined processes could significantly improve tax collection efficiency. For example, electronic invoicing and digital payment systems could reduce administrative burdens and minimize opportunities for fraud. Clearer communication and information for cruise lines and passengers regarding tax obligations can improve compliance. A dedicated team focused on cruise passenger tax collection, equipped with specialized training, could further enhance accuracy and promptness.

Transparent communication regarding how the funds are utilized is also crucial.

Analyzing Mexico cruise passenger taxes is fascinating, especially when considering the broader travel industry trends. For instance, the recent launch of AmaWaterways’ first black heritage cruise, amawaterways first black heritage cruise , highlights a growing focus on inclusive tourism. Ultimately, understanding how these factors intersect will be key to fully interpreting the data on Mexico cruise passenger taxes.

Potential Tax Reforms or Adjustments

Considering the current economic climate and tourism trends, adjusting the tax structure to reflect fluctuating passenger volumes or market conditions could be beneficial. This could involve periodic reviews and adjustments to tax rates based on real-time data and forecasts. Such flexibility could maintain the revenue stream while adapting to potential downturns in the cruise industry or external economic factors.

Furthermore, tax incentives for cruise lines that invest in sustainable practices, such as reducing emissions or promoting eco-tourism, could encourage environmentally conscious operations.

Detailed Plan for Potential Reform of the Passenger Tax, Analysis mexico cruise passenger tax

A comprehensive reform plan should involve multiple phases. Initial steps could focus on implementing digital platforms for tax collection and communication. Following that, a tiered tax structure based on vessel size and passenger capacity could be introduced, while maintaining a robust system for monitoring and auditing compliance. The second phase would include adjustments to the tax rate based on market conditions, with the implementation of data-driven decision-making models.

Analyzing Mexico’s cruise passenger tax is interesting, especially considering the recent focus on boosting tourism. Jamaica, for example, is prioritizing airlift to capitalize on expected winter arrivals, as detailed in this article: airlift a priority as jamaica confident of winter arrivals boost. This suggests a larger trend in prioritizing efficient transportation to drive tourism, which could have implications for Mexico’s cruise tax strategy as well.

Continuous monitoring and evaluation are essential throughout the reform process to ensure its effectiveness and adaptation to evolving circumstances.

Long-Term Effects of the Proposed Reforms

These reforms could foster a more sustainable and resilient cruise tourism sector in Mexico. A transparent and efficient tax system would increase investor confidence and attract larger, more advanced cruise lines, leading to increased passenger volume and economic activity. A positive reputation as a predictable and reliable cruise destination could draw more international tourists, contributing to broader economic growth.

Implementing a clear and understandable tax system could improve passenger satisfaction and encourage repeat visits.

Case Studies of Similar Tax Structures

Cruise ship passenger taxes are a global phenomenon, and Mexico’s policy is part of a larger international conversation. Examining similar tax structures in other countries provides valuable insights into the successes and failures of such policies. Understanding the nuances of these implementations, from successful collection strategies to the impact on tourism, helps to evaluate the potential outcomes of Mexico’s current approach.

Examples of Similar Tax Structures

Different countries have implemented various forms of taxes on cruise ship passengers. These taxes can vary significantly in their application, from a flat fee per passenger to a percentage-based levy on the cruise line’s revenue. Some countries might also incorporate factors like the length of the cruise or the port of embarkation. This diversity in approaches highlights the complex interplay of economic and political considerations in designing these taxes.

Case Studies of Successful Tax Policies

Certain destinations have effectively implemented cruise passenger taxes, with positive outcomes for their economies. One example involves a European country that implemented a tax based on the length of stay and the number of passengers. The revenue generated was directly channeled into infrastructure projects within the port city, which improved the overall tourist experience and bolstered the local economy.

The increased revenue spurred development and created jobs, directly impacting the quality of life for residents. This success highlights the importance of clear allocation of funds and measurable improvements in local infrastructure.

Case Studies of Unsuccessful Tax Policies

Conversely, some implementations have yielded less desirable results. One instance involves a Caribbean island that imposed a high tax rate on cruise passengers. This measure, while generating revenue, significantly impacted cruise line choices. Cruise lines responded by altering their itineraries, potentially diverting revenue to other destinations with more favorable tax structures. This underscores the importance of balancing revenue generation with the need to attract and retain cruise lines.

Best Practices in Collecting and Managing Cruise Passenger Taxes

Effective management of cruise passenger taxes requires a multifaceted approach. Transparent regulations and easily accessible information are key elements. Clear communication about the tax structure and its intended use to the public fosters public trust and understanding. Furthermore, efficient collection mechanisms, coupled with robust accounting procedures, are crucial for ensuring accurate and timely revenue collection.

Successful Implementations and Strategies

Successful implementations often involve clear communication, transparency, and effective collection strategies. One successful case involved a South American country that communicated the tax clearly and transparently, detailing how the funds would be allocated for infrastructure development. This approach built public trust and helped to secure the cooperation of both cruise lines and passengers.

Analyzing Mexico cruise passenger taxes is fascinating, but let’s be honest, it’s not exactly the most exciting topic. However, it’s interesting to see how these taxes might factor into travel agent incentives, like in the case of AMA Waterways’s 10th anniversary agent contest. Perhaps a successful analysis of these taxes could lead to some creative incentive programs for travel agents, boosting the cruise industry in Mexico.

Comparison of Successful and Unsuccessful Policies

| Feature | Successful Policies | Unsuccessful Policies |

|---|---|---|

| Tax Rate | Moderate, aligned with local economic conditions and competitive rates in the region. | Excessively high, creating a significant barrier for cruise lines and potentially diverting traffic to more affordable destinations. |

| Transparency | Explicit details on tax application and allocation of funds. | Vague or unclear regulations, potentially leading to distrust and negative perceptions. |

| Communication | Clear and proactive communication to stakeholders, including cruise lines and the public. | Limited or ineffective communication channels, leading to confusion and misunderstandings. |

| Collection Mechanism | Streamlined processes for collecting and managing taxes, with easily accessible procedures. | Complex and cumbersome procedures, leading to delays and inefficiencies. |

| Allocation of Funds | Transparent and demonstrably beneficial projects focused on infrastructure improvements, community development, or environmental protection. | Funds allocated inconsistently or for non-transparent purposes, leading to public dissatisfaction. |

Last Word

In conclusion, analyzing Mexico’s cruise passenger tax highlights a multifaceted issue with significant economic implications. The tax’s historical evolution, current structure, and potential for reform are crucial to understanding its overall impact. From the economic benefits to potential negative impacts, this analysis provides a comprehensive overview of the complexities surrounding cruise passenger taxation in Mexico. Further research and discussion are essential for crafting effective and equitable policies.

FAQ Summary: Analysis Mexico Cruise Passenger Tax

What are some common cruise passenger tax exemptions in Mexico?

Specific exemptions vary, but some potential examples include exemptions for certain age groups, or those with specific medical conditions. It’s important to check the specific regulations for current exemptions.

How does Mexico’s cruise passenger tax compare to other Caribbean destinations?

A detailed table comparing tax rates and structures in Mexico and other Caribbean destinations is included in the analysis. This will highlight the differences and similarities in tax policies across the region.

What is the potential impact of the tax on cruise ship itineraries?

The analysis discusses how the tax could influence cruise ship itineraries by affecting pricing, route choices, and potentially shifting cruise ship destinations. This is a key element to consider when examining the economic effects.

What are some potential improvements to Mexico’s cruise passenger tax structure?

The analysis suggests potential improvements, including strategies for optimizing tax revenue collection and ensuring fairness and transparency in the tax system. Specific proposals will be Artikeld in the analysis.