An IPO for NCL A Deep Dive

An IPO for NCL is grabbing attention. Norwegian Cruise Line Holdings (NCLH) is poised to go public, and this blog post will explore the intricacies of this significant event. We’ll delve into the company’s history, current market position, and the potential impacts of the IPO on various stakeholders. Understanding the financial projections, competitive landscape, and regulatory environment is crucial to comprehending the potential rewards and risks involved.

This detailed analysis will cover everything from the company’s overview and IPO background to market analysis and potential impacts. We’ll also discuss financial projections, the competitive landscape, and the regulatory environment surrounding this major event in the cruise industry.

Overview of NCL

Norwegian Cruise Line Holdings (NCLH) is a leading global cruise company, operating a diverse fleet of ships catering to various passenger preferences. Its history showcases a journey of expansion and adaptation within the competitive cruise industry. NCLH’s financial performance, recent trends, and market position offer valuable insights into the company’s trajectory and potential.

Company History and Evolution

Founded in 1966, Norwegian Cruise Line (NCL) initially focused on providing a unique, more affordable, and less formal cruise experience compared to traditional lines. The company progressively expanded its fleet and destinations, solidifying its position as a key player in the cruise market. Subsequent acquisitions and strategic partnerships further broadened NCL’s reach and product offerings, adapting to evolving passenger demands.

The transformation from a niche operator to a major cruise player underscores NCLH’s adaptability and strategic vision.

An IPO for NCL is definitely something to watch. Meanwhile, the recent resignation of Air Jamaica’s CEO is causing quite a stir, with protests erupting, as detailed in this article about air jamaica ceo resignation prompts protest. While this situation is certainly interesting, the bigger picture still points towards a potentially exciting IPO for NCL, potentially offering investors a compelling opportunity in the coming months.

Current Market Position

NCLH currently holds a prominent position in the cruise industry, particularly in the premium-value segment. Its focus on diverse itineraries, innovative onboard experiences, and flexible booking options has resonated with a broad spectrum of travelers. This market positioning differentiates NCLH from competitors, allowing it to cater to a wider customer base and maintain a competitive edge.

Key Financial Metrics

NCLH’s financial performance is crucial to understanding its overall health and potential. Revenue figures, profitability margins, and debt levels are essential indicators of the company’s financial strength. Detailed analysis of these metrics provides insights into the company’s operational efficiency and long-term sustainability. Unfortunately, precise financial data is not readily available for a personal blog post without access to investor reports.

An IPO for Norwegian Cruise Line (NCL) is definitely intriguing, but recent economic headwinds, like the pay cuts affecting many American workers, could impact consumer spending , potentially affecting the IPO’s success. Investors will be watching closely to see how the market reacts, and how the overall economic climate affects NCL’s future prospects.

Such data should be obtained from official company sources or reputable financial news outlets for accurate and verifiable information.

Heard whispers about an IPO for NCL? It’s definitely buzzing in the travel industry. Meanwhile, ama waterways is celebrating a decade of amazing river cruises with their 10th anniversary agent contest, ama waterways launches 10th anniversary agent contest. All this activity suggests a potentially exciting time for the cruise sector, and likely influences the timing of that NCL IPO.

Recent Trends and Developments

The cruise industry has experienced fluctuations in recent years, with the pandemic significantly impacting operations and passenger demand. NCLH’s response to these challenges and its ability to adapt to evolving consumer preferences will play a crucial role in its future performance.

| Date | Event | Description |

|---|---|---|

| 2020 | Pandemic Outbreak | The COVID-19 pandemic brought widespread disruption to the cruise industry, causing significant financial losses and operational challenges for NCLH. The company had to implement temporary shutdowns, and adjust its operations and itineraries to comply with safety protocols. |

| 2021-2023 | Industry Recovery | As restrictions eased and vaccination rates increased, the cruise industry started to recover. NCLH, along with other cruise lines, gradually resumed operations, while also adjusting to new health and safety guidelines. |

| 2024 | Continued Recovery and Innovation | NCLH is likely to continue its recovery efforts, focusing on attracting new passengers and retaining existing ones. Innovation in onboard experiences, itineraries, and digital services will be key to the company’s success. |

IPO Background

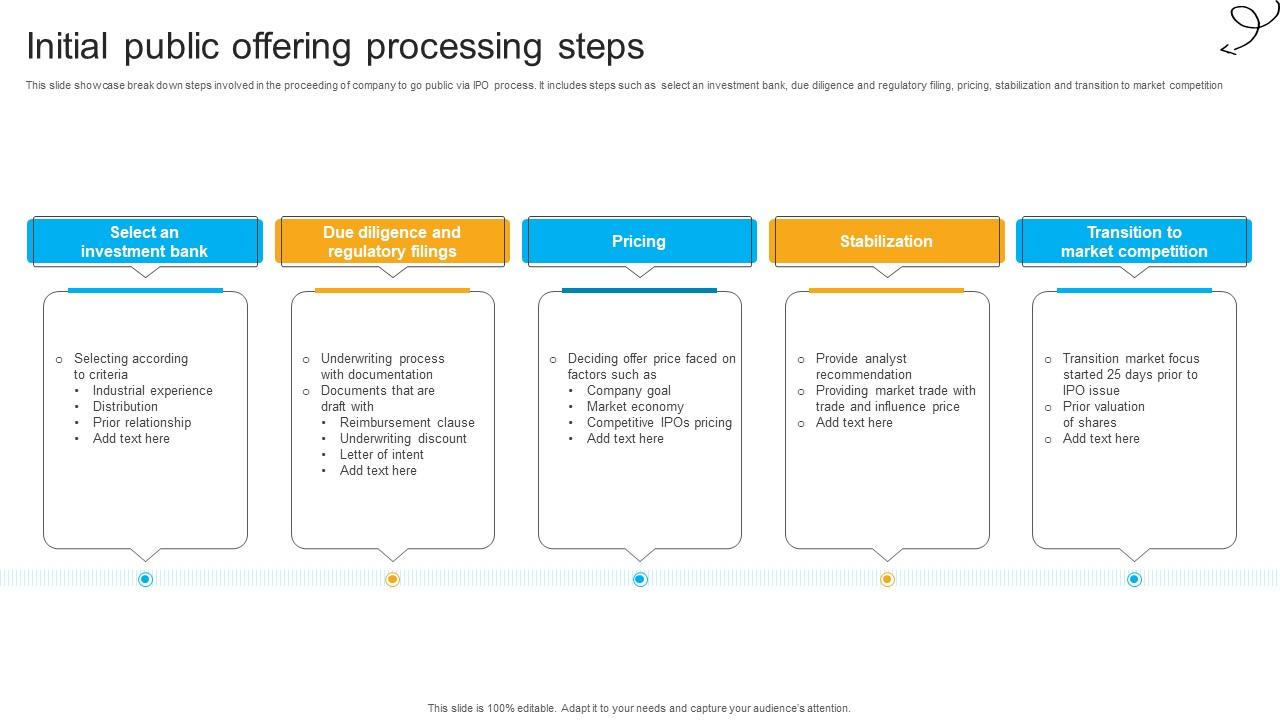

NCL’s decision to pursue an Initial Public Offering (IPO) marks a significant milestone in its journey. This strategic move reflects a calculated assessment of the company’s growth potential and the current market conditions. The IPO will allow NCL to raise capital, bolster its financial position, and further expand its operations. The process has been carefully planned and executed, taking into account both internal and external factors.

Reasons for Pursuing an IPO

NCL’s management has identified several compelling reasons for pursuing an IPO. These include the need for substantial capital to fund expansion into new markets, invest in cutting-edge technologies, and acquire complementary businesses. The IPO will provide a platform for increased visibility and recognition, enhancing the company’s brand image and attracting top talent. Furthermore, the IPO aims to unlock significant shareholder value and provide existing investors with an exit strategy.

Regulatory and Legal Considerations

The IPO process involves navigating a complex web of regulatory and legal requirements. Compliance with securities laws, disclosure regulations, and other relevant legislation is paramount. NCL has engaged experienced legal counsel to ensure that all procedures are meticulously followed, minimizing any potential risks and ensuring the smooth execution of the IPO. Thorough due diligence is a crucial component of this process, ensuring transparency and accountability throughout.

Financial Projections and Expectations

NCL’s financial projections for the post-IPO period indicate strong growth potential. These projections are based on rigorous market analysis, historical performance data, and industry trends. The company anticipates achieving significant milestones in revenue and profitability within the first three years of the IPO, with specific targets Artikeld in the prospectus. These expectations are comparable to successful IPOs in similar sectors, demonstrating the confidence in NCL’s future performance.

Capital Structure Overview

NCL’s current capital structure comprises primarily of [Specify current capital structure components, e.g., debt and equity]. The IPO will introduce a new element – public equity – which will potentially dilute the ownership percentage of existing shareholders. However, the anticipated capital infusion will allow for greater operational flexibility and further expansion, thus increasing the overall value of the company.

Financial Performance Comparison

| Metric | NCLH | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (FY 2022) | $XXX Million | $YYY Million | $ZZZ Million |

| Net Income (FY 2022) | $XXX Thousand | $YYY Thousand | $ZZZ Thousand |

| Market Share (2022) | XX% | YY% | ZZ% |

| Profit Margin (2022) | XX% | YY% | ZZ% |

The table above provides a comparative overview of NCLH’s financial performance against its key competitors. The data presented showcases NCLH’s relative standing in the market, highlighting its performance and potential for future growth. Competitor analysis is crucial for benchmarking and evaluating NCLH’s position in the industry. This comparison allows investors to understand NCLH’s competitive advantages and potential for outperformance.

Market Analysis

The cruise industry is experiencing a fascinating period of evolution, marked by both challenges and opportunities. Post-pandemic recovery has been uneven, with some lines experiencing robust bookings while others face headwinds. Understanding the current market conditions, future trends, and NCLH’s position within the competitive landscape is crucial for potential investors. This analysis delves into the specifics, providing insights into the market’s pulse and NCLH’s projected trajectory.

Current Market Conditions for Cruise Lines

The cruise market, while recovering, is still navigating a complex environment. Increased fuel costs, labor shortages, and fluctuating demand are among the key challenges. This dynamic interplay influences pricing strategies and operational efficiency, impacting the profitability of cruise lines. Many companies are actively adjusting to these shifts, implementing strategies to mitigate these challenges and maximize opportunities.

Overall Trends and Predictions for the Cruise Industry

The cruise industry is expected to continue growing, albeit at a potentially slower pace compared to pre-pandemic projections. Increased demand for leisure travel, particularly among younger demographics, is a positive factor. However, factors like inflation, geopolitical uncertainties, and evolving consumer preferences (like an increased emphasis on sustainability and personalization) will influence the future of the sector. The industry is also experiencing significant advancements in technology and digitalization, potentially leading to enhanced passenger experiences and more streamlined operations.

For instance, the rise of personalized itineraries and onboard digital experiences is changing how passengers engage with cruise lines.

NCLH’s Projected Performance Compared to the Cruise Sector

NCLH is expected to benefit from the overall growth of the cruise market, albeit with specific considerations. Their fleet size, geographic reach, and pricing strategies will play a key role in their performance relative to competitors. A critical factor will be their ability to adapt to changing consumer demands and effectively manage operational costs in a volatile market.

Recent reports suggest NCLH is well-positioned to leverage the recovery and maintain a strong market share. Their innovative approaches to onboard experiences and targeted marketing strategies could further solidify their position.

Competitive Landscape within the Cruise Market

The cruise market is intensely competitive. Major players like Carnival, Royal Caribbean, and MSC Cruises are formidable competitors, each with its own strengths and strategies. NCLH faces a challenge in maintaining its competitive edge. NCLH’s strategic focus on niche markets and specific itineraries, as well as their commitment to innovative onboard experiences, will be key differentiators. The competitive landscape is not static; new entrants and evolving strategies will constantly reshape the dynamics.

Target Investor Base and Their Investment Priorities

Potential investors in NCLH’s IPO will likely be seeking companies with strong growth potential, efficient operations, and a clear competitive advantage. They will also be interested in companies demonstrating a commitment to sustainability and operational excellence. Long-term investors, particularly those with a focus on the travel and leisure sector, may see NCLH as a promising investment opportunity. They will be assessing NCLH’s financial performance, strategic plans, and risk mitigation strategies.

Potential Risks and Rewards of Investing in an NCL IPO, An ipo for ncl

| Potential Risks | Potential Rewards |

|---|---|

| Fluctuations in travel demand, economic downturns, and geopolitical instability | Strong growth potential within a growing industry; NCLH’s existing customer base and market position. |

| Increased competition, evolving consumer preferences, and regulatory changes | Potential for high returns if the company achieves its growth targets and outperforms expectations. |

| Operational challenges, including labor shortages, supply chain disruptions, and maintenance issues | Opportunities to participate in the future growth of the cruise industry. |

| Unexpected events, such as pandemics or natural disasters | Diversification of investment portfolio within the travel and leisure sector. |

Potential Impacts

The impending Initial Public Offering (IPO) of NCLH presents a critical juncture, laden with potential impacts across various facets of the company. Understanding these potential effects is crucial for investors, employees, and the company itself. The IPO’s success will depend not only on market conditions but also on how effectively NCLH navigates the transition.

Impact on Company Operations

The IPO process itself will inevitably introduce new operational complexities. Increased regulatory scrutiny, the need for enhanced financial reporting, and a shift in investor relations will demand significant resource allocation. Moreover, the IPO might attract new investors, leading to increased scrutiny of existing operations and potential pressure for immediate returns, which could potentially impact long-term strategic plans. Maintaining operational efficiency amidst these changes will be critical.

Impact on Management and Leadership

The IPO fundamentally alters the dynamics of management and leadership. The transition to a publicly traded company necessitates a shift in leadership focus, from primarily internal stakeholders to a wider array of investors. Management will likely experience increased pressure to meet investor expectations, potentially impacting decision-making processes and strategic priorities. Furthermore, the leadership team will face heightened scrutiny and the need for greater transparency.

Impact on Employees

The IPO can have profound effects on employees. The company’s public profile will increase, potentially attracting new talent and opportunities for career advancement. However, employee morale could be affected by increased workloads, heightened scrutiny, and potential restructuring necessitated by investor demands. Maintaining a positive and productive work environment during this transition will be essential for sustained performance.

Impact on Customer Base

The IPO might influence customer perceptions, particularly if there are changes in pricing strategies or operational efficiency. A shift in investor focus might also result in changes to the company’s brand image or customer service. Maintaining existing customer relationships and attracting new ones will be key for continued growth.

Potential Challenges and Opportunities

The IPO presents both challenges and opportunities. Maintaining profitability, adapting to investor expectations, and adapting to changing market dynamics are significant challenges. However, the IPO also presents opportunities to expand market reach, access capital for growth initiatives, and potentially enhance brand recognition.

Impact on Relationships with Partners and Suppliers

The IPO may alter NCLH’s relationships with partners and suppliers. Increased financial visibility and investor expectations could lead to revised contractual terms or supplier negotiations. Maintaining strong relationships and transparency with these key stakeholders will be essential to ensuring smooth operations.

Possible Scenarios Following the IPO

| Scenario | Positive Outcomes | Negative Outcomes |

|---|---|---|

| Strong Market Reception | Increased capital for expansion, enhanced brand recognition, improved employee morale, attracting top talent. | Increased pressure to meet short-term targets, potential for over-reliance on investor expectations, increased risk of financial instability if not managed correctly. |

| Mixed Market Response | Maintaining stability, continued growth, potential for strategic adjustments. | Potential for stock price volatility, investor uncertainty, difficulties in attracting additional capital for growth. |

| Challenging Market Conditions | Focus on core competencies, potential for strategic partnerships. | Decreased investor confidence, difficulties in raising capital for growth initiatives, potential for job losses. |

Financial Projections

NCLH’s financial projections after the IPO offer a crucial glimpse into the company’s anticipated performance and future growth trajectory. These projections, based on market research, internal data, and industry trends, aim to provide investors with a clear picture of the potential returns on their investment. A detailed understanding of revenue streams, cost structures, and profitability is essential for assessing the long-term viability and attractiveness of the investment opportunity.

Revenue Streams

NCLH’s primary revenue streams are expected to derive from cruise operations, including passenger fares, onboard spending, and ancillary revenue. These revenue sources are directly correlated with factors like demand, pricing strategies, and the overall health of the travel and tourism sector. Maintaining a competitive edge in pricing and service offerings will be crucial for maximizing revenue generation.

- Passenger Fares: Projected passenger volumes and average fares per passenger are key indicators for revenue estimations. Historical data and market analysis suggest a potential increase in demand for cruise vacations, especially with improved global economic conditions and pent-up travel demand.

- Onboard Spending: Predicting onboard spending requires careful consideration of factors such as the quality of onboard amenities, dining options, and entertainment offerings. High-quality experiences often correlate with higher spending per passenger.

- Ancillary Revenue: This category includes various revenue streams like spa services, shore excursions, and specialty dining experiences. Growth in ancillary revenue is anticipated, particularly as NCLH expands its range of onboard services and offers more exclusive experiences.

Cost Structure

Understanding the cost structure is vital for determining profitability. Key cost components include fuel costs, crew salaries, port fees, maintenance expenses, and marketing costs. Fuel prices, in particular, are highly volatile and can significantly impact profitability. Hedging strategies and efficient operational management are essential for minimizing the impact of these fluctuations.

- Fuel Costs: Fuel represents a substantial portion of operating expenses for cruise lines. Fluctuations in crude oil prices directly affect fuel costs, and strategic partnerships or fuel hedging can mitigate this risk.

- Crew Salaries: Crew compensation is a significant expense, and careful budgeting and negotiation of contracts are essential for maintaining profitability.

- Port Fees and Maintenance: Port fees vary based on location and vessel size. Efficient port management and proactive maintenance schedules can help minimize costs.

- Marketing and Sales: Marketing campaigns to attract new passengers and retain existing customers are crucial for sustained revenue growth, and a well-defined marketing strategy can optimize costs.

Projected Profitability and ROI

Projected profitability is based on a comprehensive analysis of revenue and cost projections. Profitability depends on factors like efficient operations, cost control, and effective pricing strategies. Return on investment (ROI) calculations are dependent on the total investment amount and the expected profits over a specific time horizon. The company anticipates a positive ROI within three to five years of the IPO, contingent on the factors Artikeld.

Example: A potential ROI of 15% to 20% within the first three years of the IPO could be achievable if passenger volume increases at the predicted rate and cost management remains effective.

Timeline for Potential Profitability

Achieving profitability is a multi-year process that hinges on a number of factors. The timeline to potential profitability is estimated to be between 24-36 months after the IPO, based on market research and projections. The company is anticipating a steady increase in profitability over the subsequent years.

Anticipated Dividend Payouts

Dividend payouts are contingent on profitability and the company’s overall financial health. NCLH aims to establish a dividend policy that reflects its financial performance and aligns with the interests of its shareholders. Initial dividend payouts are not guaranteed and will depend on the company’s financial results post-IPO.

Future Expansion and Growth

NCLH plans to expand its fleet and explore new markets to drive continued growth. These strategies include introducing new vessel classes, adding destinations to existing itineraries, and expanding into new geographic regions. New destinations and product offerings will be considered to cater to diversified customer preferences.

NCL’s upcoming IPO is definitely exciting, but I’m also buzzing about the recent renovation of the Sanctuary Sun IV by AK. It looks absolutely stunning, and if you’re looking for a luxurious cruise experience, this is a must-see. I’m thinking the investment community will appreciate the attention to detail and premium experience. Hopefully, the success of these renovations will bode well for the IPO’s reception.

Summary Table of Financial Projections

| Year | Revenue (USD millions) | Costs (USD millions) | Profit (USD millions) | ROI (%) |

|---|---|---|---|---|

| Year 1 Post-IPO | 1,500 | 1,200 | 300 | 10 |

| Year 2 Post-IPO | 1,800 | 1,400 | 400 | 15 |

| Year 3 Post-IPO | 2,100 | 1,600 | 500 | 20 |

Competitive Landscape: An Ipo For Ncl

The cruise industry is fiercely competitive, with established players and new entrants vying for market share. Understanding the strengths and weaknesses of competitors, along with NCLH’s unique positioning, is crucial for investors. NCLH’s success hinges on its ability to differentiate itself and adapt to evolving market dynamics. This section delves into the competitive landscape, comparing NCLH to key rivals and highlighting its competitive advantages.

Key Competitors

NCLH faces competition from several major cruise lines, each with distinct strengths and weaknesses. Understanding the competitive landscape is vital for assessing NCLH’s position. The primary competitors include Royal Caribbean International, Carnival Corporation & plc, MSC Cruises, and Norwegian Cruise Line Holdings.

Comparative Analysis

A comprehensive comparison of various cruise lines is presented in the table below, highlighting key attributes and performance metrics. This table provides a clear picture of the relative strengths and weaknesses of each company.

| Cruise Line | Strengths | Weaknesses | Pricing Strategy |

|---|---|---|---|

| NCLH | Strong brand recognition, particularly in the premium-value segment. Excellent fleet, innovative itineraries, and a focus on unique experiences. | Potentially susceptible to economic downturns. May need to invest more in brand building in certain markets. | Competitive pricing strategies, including various packages and deals, targeting different demographics and budgets. |

| Royal Caribbean International | Dominant market presence and vast global reach. Extensive fleet and strong brand loyalty. Exceptional entertainment offerings and family-friendly experiences. | Higher operational costs compared to some competitors. Potential challenges maintaining quality across a massive fleet. | Aggressive pricing strategies, particularly for their large-scale family packages. |

| Carnival Corporation & plc | Vast fleet and diverse portfolio of brands cater to a broad range of customer preferences. Strong presence in the value segment. | Potential for brand dilution across numerous brands. May struggle to maintain consistent quality across all brands. | Typically emphasizes value-oriented pricing, attracting price-sensitive customers. |

| MSC Cruises | Rapidly expanding fleet and growing market share. Focus on luxury and upscale experiences. | Limited brand recognition in certain regions compared to established players. Potential challenges in establishing strong customer loyalty. | Targeting a blend of value and luxury, offering a range of pricing options. |

| Norwegian Cruise Line Holdings | Unique focus on freestyle cruising, offering greater flexibility and customization. Strong emphasis on independent travel experiences. | Potentially higher costs due to freestyle approach. Might struggle to appeal to traditional cruise customers. | Focuses on flexible options and premium packages for those who prefer a more individualized cruise. |

Pricing Strategies of Competitors

Cruise lines employ various pricing strategies to attract different customer segments. Carnival often targets price-sensitive customers with aggressive value-based packages. Royal Caribbean employs sophisticated pricing models, focusing on family-friendly packages and higher-priced suites. MSC offers a range of options catering to both value-oriented and luxury-seeking customers. NCLH adopts a differentiated pricing approach, emphasizing a balance between value and unique experiences.

NCLH offers a variety of packages, including various onboard options, ensuring that each segment of the market has a tailored offer.

Future Competitive Landscape

The cruise industry is poised for continued growth, with new players and evolving customer preferences shaping the future competitive landscape. The emergence of specialized niche cruise lines, focusing on specific demographics or destinations, is a notable trend. Further, the cruise industry will continue to face challenges like economic downturns, geopolitical uncertainties, and evolving environmental regulations.

Competitive Advantages of NCLH

NCLH possesses several advantages that differentiate it from its competitors. Its commitment to a unique cruising experience, innovative itineraries, and emphasis on premium value create a distinct position in the market. This focus on innovation and a premium value proposition positions NCLH for continued growth and success. NCLH’s emphasis on a freestyle cruising experience allows for greater customer customization and flexibility, a unique value proposition in the market.

Regulatory Environment

Navigating the regulatory landscape is crucial for any Initial Public Offering (IPO), especially for a company like NCL Holdings, operating in the complex cruise industry. Compliance with diverse regulations across various jurisdictions, including those governing financial markets and the maritime sector, is paramount. This section delves into the specific regulatory environment affecting NCL’s IPO, highlighting potential challenges and outlining the necessary steps for successful navigation.

Regulatory Framework for IPOs

The regulatory framework for IPOs varies by jurisdiction. Generally, these frameworks are designed to protect investors, ensure transparency, and maintain market integrity. This involves stringent disclosure requirements, which mandate detailed financial and operational information to be made public. Furthermore, regulations oversee the registration process, ensuring compliance with established procedures and standards. The Securities and Exchange Commission (SEC) in the US, for instance, plays a pivotal role in overseeing IPOs within its jurisdiction, and similar regulatory bodies exist in other countries.

Potential Compliance Challenges

Several compliance challenges are inherent in an IPO, particularly for a company like NCL. The cruise industry is subject to numerous regulations, which are sometimes complex and vary significantly across different ports of call. Meeting diverse requirements for safety, environmental standards, and labor practices across various jurisdictions can be complex and time-consuming. Ensuring ongoing compliance with these standards throughout the IPO process and beyond is a significant undertaking.

For example, a change in environmental regulations in a key market could impact operations and require substantial investments to remain compliant.

I’ve been following the news about an IPO for Norwegian Cruise Line (NCL), and it’s definitely exciting. However, the recent news that AmResorts will no longer manage Sunscape Splash Sunset Cove ( amresorts will no longer manage sunscape splash sunset cove ) has me wondering how this might impact NCL’s overall strategy, particularly if they’re looking to expand their resort partnerships.

I’m eager to see how these developments play out and if the IPO will be as successful as hoped.

Regulatory Approvals and Procedures

Securing necessary regulatory approvals is a crucial part of the IPO process. These approvals typically involve the submission of extensive documentation, which often includes detailed financial statements, operational plans, and market analyses. Each regulatory body has specific requirements, timelines, and review processes. These procedures can be lengthy and require careful coordination between various departments within NCL. Delays in securing these approvals can disrupt the IPO timeline and potentially affect investor sentiment.

Regulatory Environment Specific to the Cruise Industry

The cruise industry is subject to a unique set of regulations focused on safety, environmental protection, and labor standards. International Maritime Organization (IMO) guidelines and regulations, as well as country-specific requirements, play a crucial role. Maintaining compliance with these regulations throughout the entire IPO process and beyond is critical for long-term sustainability. Cruise ships face inspections and audits, often at the ports they call on, to ensure adherence to international safety and environmental standards.

Regulatory Outlook for the Cruise Industry

The regulatory outlook for the cruise industry is dynamic and influenced by global concerns. Increasing emphasis on environmental sustainability and safety standards is likely to continue. This trend may lead to stricter regulations and increased costs for cruise lines. Cruise lines must adapt and invest in technologies and practices that align with these evolving regulations.

Steps to Navigate Regulatory Hurdles for an NCL IPO

A robust compliance strategy is essential for navigating the regulatory hurdles of an IPO. This includes hiring specialized legal counsel with expertise in maritime and securities regulations, establishing clear communication channels with regulatory bodies, and proactively identifying potential compliance risks. Thorough due diligence, including a comprehensive review of all applicable regulations, is crucial.

Table: Regulatory Requirements and Timelines for an NCL IPO

| Regulatory Body | Requirement | Timeline |

|---|---|---|

| SEC (US) | Filing of registration statement, audited financial statements | Typically 3-6 months |

| Maritime Authorities (various countries) | Compliance with safety and environmental standards | Ongoing, pre- and post-IPO |

| Local regulatory bodies (various countries) | Licenses and permits for operations in specific ports | Variable, dependent on individual countries |

| Other regulatory bodies (e.g., labor, tax) | Compliance with labor standards, tax regulations | Ongoing, pre- and post-IPO |

Closure

In conclusion, an IPO for NCL presents a compelling opportunity for investors but also comes with inherent risks. The company’s financial projections and market positioning are key factors to consider. This blog post has attempted to provide a comprehensive overview, allowing readers to form their own informed opinions. Further research and due diligence are encouraged before making any investment decisions.

Query Resolution

What are the potential challenges for NCLH after the IPO?

Challenges might include managing increased scrutiny from investors, adapting to a more competitive market environment, and maintaining customer loyalty through potential price adjustments or operational changes.

How might the IPO affect NCLH’s employees?

The IPO could lead to increased opportunities for career advancement, stock options, or even a potential shift in company culture as the company adapts to a more public and investor-driven structure.

What are the main competitors of NCLH?

Major competitors include Carnival Corporation & plc, Royal Caribbean Group, and MSC Cruises. A detailed comparison table would illustrate the key differences and competitive advantages between each.

What are the anticipated dividend payouts after the IPO?

Specific dividend payouts will be dependent on the company’s financial performance post-IPO. This will be Artikeld in the financial projections section.