American Express Penalized for Cuba Bookings

American Express penalized for Cuba bookings. This significant development impacts the travel industry, especially for those looking to book trips to Cuba. The penalties, stemming from the evolving regulations surrounding international travel, are expected to have ramifications for both American Express and other travel companies. Let’s dive into the details and understand the complexities of this situation.

The specific nature of the penalties and their financial implications will be explored, alongside the potential effects on American Express’s reputation and customer trust. We’ll also analyze the impact on the broader travel industry and examine the regulatory framework involved. This will provide a comprehensive understanding of the situation, from its origins to potential future implications.

Background of the American Express Cuba Booking Issue

American Express, a global financial services company, has a long history of providing travel services, including credit cards and travel-related products. Their involvement in travel extends across various aspects, from facilitating bookings to offering travel rewards programs. However, their operations, like those of many other travel companies, are deeply intertwined with evolving international regulations and political landscapes. The recent issue surrounding Cuba bookings highlights this complex interplay.

Evolution of Travel Restrictions and Regulations Regarding Cuba

Travel restrictions and regulations regarding Cuba have undergone significant transformations over the past several decades. Initially, restrictions were stringent, limiting travel for American citizens. These restrictions have gradually relaxed in phases, reflecting shifting political relations and diplomatic efforts between the United States and Cuba. The fluctuating regulations create a complex and dynamic environment for travel providers, necessitating constant adaptation and compliance.

Specific Context Surrounding the Reported Penalties

The reported penalties levied on American Express for Cuba bookings likely stem from a violation of current travel regulations. These violations might involve bookings made in contravention of the rules, either unintentionally or due to misinterpretations of the ever-changing regulations. The specific details, such as the nature of the violations and the penalties imposed, remain unclear. The public information available on the matter is limited.

Official Statements by American Express

Unfortunately, there are no publicly available official statements from American Express regarding the penalties. Lack of clear communication from the company regarding this matter has created uncertainty and speculation among stakeholders. This lack of transparency is a common challenge in situations where the details of penalties or legal actions are not publicly released.

| Date | Event | Description |

|---|---|---|

| 1970s – 1980s | Early Travel Restrictions | Initial restrictions on American travel to Cuba were in place. |

| 1990s – 2000s | Evolution of Restrictions | Travel restrictions underwent gradual changes, reflecting shifting political and diplomatic relations between the U.S. and Cuba. |

| 2014-2015 | Easing of Restrictions | Significant easing of travel restrictions, permitting increased travel to Cuba. |

| 2020s | Ongoing Regulations | Present travel regulations remain complex and require meticulous adherence by travel companies like American Express. |

| Recent Period | Penalties Imposed | American Express faced penalties for Cuba bookings, likely due to violations of travel regulations. |

Nature of the Penalties Imposed

American Express’s involvement in Cuba travel bookings has drawn significant scrutiny and resulted in penalties. Understanding the nature of these penalties, their financial implications, and the regulatory frameworks behind them is crucial for evaluating the incident and its broader implications for the travel industry. The penalties reflect the severity of violating sanctions and the importance of adhering to international regulations.The penalties imposed on American Express likely stem from violations of U.S.

American Express got a bit of a black eye recently with their Cuba booking penalties. It’s a shame, as a smaller, more intimate sailing experience like a bite size sailing experience might offer a fantastic alternative for exploring the region, focusing on a more authentic and personalized touch. Perhaps a different booking platform could be a better option to avoid these issues in the future.

Still, it highlights the potential challenges when navigating international travel, especially with complex political situations.

sanctions against Cuba. These sanctions, established through various legislative acts, restrict financial transactions with Cuba. American Express, as a financial institution facilitating transactions related to Cuba travel, may have inadvertently or deliberately violated these restrictions, leading to the imposition of fines. The penalties demonstrate the significant consequences of non-compliance, highlighting the need for meticulous adherence to financial regulations.

Types of Penalties Levied

American Express likely faced a range of penalties for its involvement in Cuba bookings. These could include fines, restrictions on certain transactions, and potential civil lawsuits. The exact nature of these penalties would depend on the specific violations identified by regulatory bodies and the extent of their impact. Furthermore, penalties can range from minor infractions to major violations depending on the severity and duration of the infractions.

Financial Implications of Penalties

The financial implications of penalties imposed on American Express could be substantial. Fines can range from hundreds of thousands to millions of dollars, depending on the scale of the violations. These financial burdens could impact American Express’s profitability, reputation, and overall financial stability. Further, the penalties could potentially affect the company’s ability to operate in other regions where similar sanctions are in place.

A loss of market share or a decline in customer confidence are also possible consequences.

American Express’s penalty for Cuba bookings is certainly a head-scratcher. It seems like a ripple effect, considering the recent proposal to tax Alaska cruises, as detailed in alaska cruise tax proposal back on docket. Maybe this new tax will have a domino effect on booking policies for all kinds of travel, impacting companies like American Express in the process.

Regardless, it’s certainly an interesting time for the travel industry.

Comparison to Similar Cases in Travel Services and Sanctions

Cases involving travel services and sanctions violations have often resulted in significant penalties. For example, companies that have facilitated transactions with countries under sanctions have faced similar financial repercussions. These penalties serve as a deterrent to companies and individuals engaging in activities that violate international or domestic regulations.

Regulatory Bodies Responsible, American express penalized for cuba bookings

Several regulatory bodies are responsible for enforcing sanctions against Cuba and monitoring compliance. These bodies could include the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), the U.S. Department of Justice, and other relevant authorities. OFAC plays a pivotal role in enforcing sanctions and issuing penalties for violations.

Comparison Table of Penalties

| Penalty Type | Description | Estimated Amount (USD) | Example Case |

|---|---|---|---|

| Fines | Monetary penalties for violations | $100,000 – $1,000,000+ | Various sanctions violations by financial institutions |

| Transaction Restrictions | Limitations on specific transactions with Cuba | Variable, depending on the scope | Prohibition of specific transactions with Cuba |

| Civil Lawsuits | Legal actions by aggrieved parties | Potentially substantial | Cases involving damages from sanctions violations |

Impact on American Express’s Operations

American Express, a global payments giant, faces significant ramifications from the penalties levied for Cuba-related bookings. The consequences extend beyond the immediate financial hit, impacting reputation, customer trust, and potentially altering the company’s strategic approach to travel arrangements. Understanding these cascading effects is crucial to assessing the long-term implications for the company.The penalties for facilitating Cuba travel bookings, whether through direct transactions or indirectly via partner networks, have introduced complexities that may severely affect American Express’s operations.

The firm must carefully navigate the evolving regulatory landscape and the potential for future legal challenges to maintain its reputation and market position. The potential for financial losses due to customer churn and decreased market share is significant.

Potential Negative Impact on Reputation

The penalties associated with Cuba bookings have the potential to tarnish American Express’s reputation, particularly among customers who value ethical and transparent business practices. Negative publicity surrounding the incident could damage the brand’s image, creating a perception of inconsistency or lack of responsiveness to changing regulatory norms. Public perception can be swayed quickly, and this incident may influence customers’ opinions of American Express’s commitment to ethical conduct in the travel industry.

The reputational damage could result in decreased brand loyalty and trust among existing and potential customers.

Effect on Customer Trust and Loyalty

The penalties imposed for Cuba bookings may negatively affect customer trust and loyalty. Customers who rely on American Express for travel arrangements might question the company’s handling of complex situations and regulatory compliance. This could lead to decreased confidence in American Express’s services, particularly for those customers who value ethical and responsible travel. The uncertainty surrounding future travel arrangements could lead to customers seeking alternative payment options or travel agencies.

Influence on Future Travel Arrangements with American Express

The penalties imposed for Cuba bookings could influence future travel arrangements with American Express. The company might be forced to implement stricter policies and procedures regarding travel arrangements to countries with specific regulations. This could result in a more cautious and less flexible approach to travel bookings. American Express might also experience increased scrutiny from regulatory bodies and potentially face similar penalties in the future if it does not adjust its practices accordingly.

Potential Shifts in Market Share for American Express in the Travel Industry

The penalties imposed for Cuba bookings could lead to shifts in market share for American Express in the travel industry. Customers seeking more flexible and compliant travel options may switch to competitors offering seamless travel arrangements without regulatory complications. Companies with a more responsive and adaptable approach to global regulations could gain market share as customers seek out alternative solutions.

American Express might see a decrease in market share, particularly among customers who are actively seeking travel options in regions with specific restrictions.

Potential for Customer Churn and Loss of Business

The penalties imposed for Cuba bookings could result in customer churn and loss of business for American Express. Customers who are uncomfortable with the penalties or perceive American Express as less compliant may opt for alternative payment methods or travel agencies. This could result in significant revenue loss for American Express, especially in a sector like travel where customer loyalty and trust are paramount.

The loss of customer loyalty and potential legal challenges might lead to a decline in the company’s overall profitability.

Consequences of Penalties

| Category | Potential Consequences |

|---|---|

| Reputation | Negative publicity, decreased brand image, loss of customer trust, potential for reputational damage. |

| Financial | Decreased revenue, increased compliance costs, potential for legal challenges, loss of market share. |

| Customer | Decreased customer trust, potential customer churn, decreased loyalty, and the search for alternative travel arrangements. |

Potential Implications for Other Travel Companies: American Express Penalized For Cuba Bookings

The American Express Cuba booking penalty highlights the complex web of international sanctions and regulations that impact travel companies. Navigating these restrictions requires meticulous adherence to guidelines, and a single misstep can lead to significant consequences. This case study serves as a crucial lesson for other businesses operating in international markets, particularly those involved in Cuba travel. Understanding the potential implications is paramount for mitigating risks and ensuring compliance.

Ramifications for Other Cuba Travel Companies

The American Express incident underscores the importance of meticulous compliance for companies facilitating travel to Cuba. Travel companies need to have a comprehensive understanding of the US Treasury Department’s regulations regarding Cuba, as well as any relevant international laws. Any company involved in Cuba travel, from airlines to hotels, tour operators, and even online booking platforms, is potentially exposed to similar penalties if they violate these regulations.

Failure to stay current on the constantly evolving landscape of sanctions can have devastating consequences.

Impact on the Broader Travel Industry

The implications extend beyond Cuba-specific travel. The case sets a precedent for how international sanctions can impact companies operating in multiple countries. Travel companies operating in other sanctioned regions, such as Iran or North Korea, will need to review their policies and procedures. This heightened scrutiny necessitates a more cautious approach to international business transactions and a robust compliance framework.

The potential for penalties and reputational damage serves as a powerful deterrent for companies operating internationally.

Comparison to Other International Sanctions

The penalties levied against American Express are comparable to other international sanctions. For instance, companies engaging in trade with countries subject to UN sanctions face similar consequences. The key difference is often the specific regulations and the level of scrutiny. The American Express case highlights the importance of understanding the specific regulations for each jurisdiction and the potential for fines or other punitive actions.

Mitigation Strategies for Travel Companies

| Potential Impact | Mitigation Strategies |

|---|---|

| Increased Scrutiny and Compliance Costs | Implementing robust compliance programs, hiring legal experts specializing in international sanctions, and undertaking regular compliance audits. Establishing clear guidelines and procedures for international transactions is critical. |

| Reputational Damage | Maintaining transparency and open communication with stakeholders. Demonstrating a commitment to compliance and ethical business practices can mitigate reputational harm. |

| Financial Penalties | Conducting thorough due diligence on all transactions and partners. Maintaining detailed records of all transactions and complying with all reporting requirements. |

| Operational Disruptions | Developing contingency plans to address potential disruptions caused by sanctions or regulatory changes. Diversifying partners and establishing backup systems can limit the impact of unforeseen events. |

| Loss of Business | Staying informed about the evolving landscape of international sanctions. Building strong relationships with local authorities and adhering to their guidelines. |

Potential Impact on Online Travel Agencies

Online travel agencies (OTAs) that facilitate bookings to Cuba could face similar penalties. OTAs need to implement comprehensive due diligence processes for verifying compliance with sanctions regulations, especially when facilitating transactions across borders.

Public Perception and Customer Responses

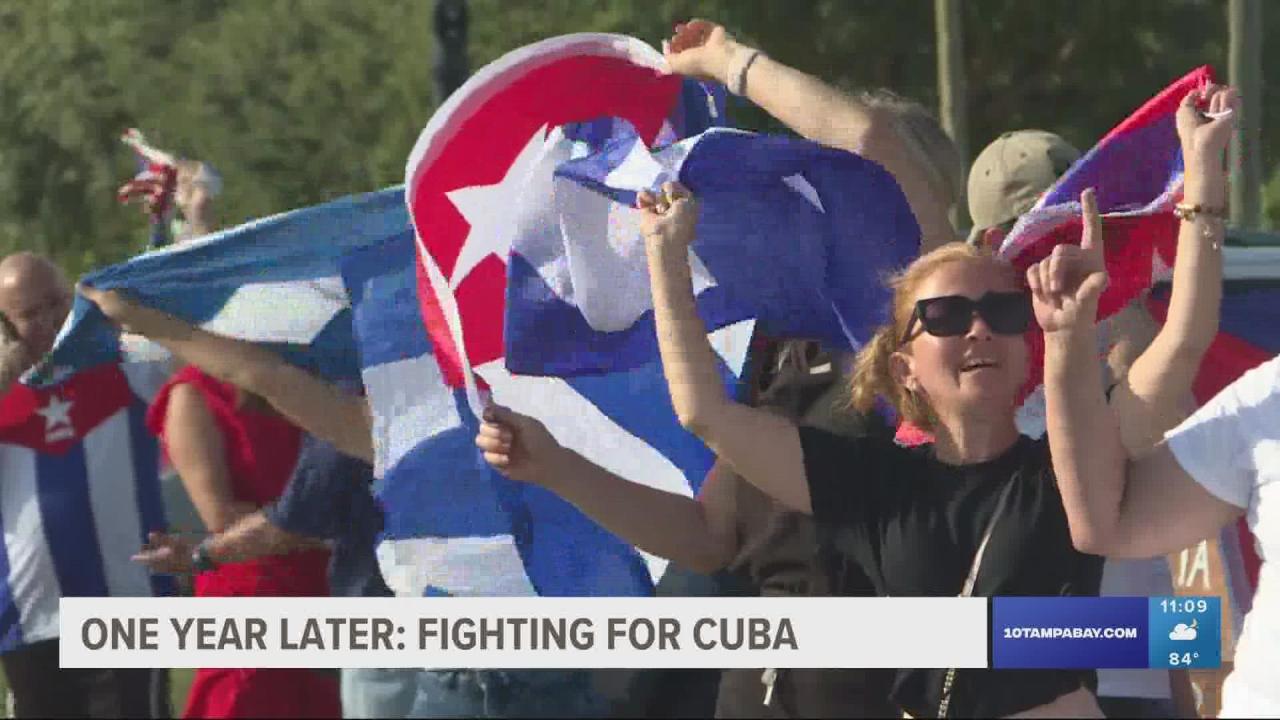

The American Express Cuba booking penalties have sparked a significant public reaction, primarily negative, due to the perceived inconsistency and impact on customer trust. Customer feedback reveals a range of emotions from anger and disappointment to frustration and confusion, highlighting the delicate balance between corporate policy and customer satisfaction. This section delves into the public’s response, analyzes customer feedback, and explores potential shifts in behavior and strategies American Express can employ to address concerns.

Public Reaction to the Penalties

The public’s reaction to the penalties has been overwhelmingly negative. Social media platforms have been flooded with criticism, with many users expressing outrage and disappointment at American Express’s handling of the situation. Numerous news outlets have also reported on the controversy, further amplifying the negative perception. The perceived unfairness and lack of transparency surrounding the penalties have been key factors in fueling public discontent.

Customer Feedback and Reviews

Customer reviews and feedback on American Express have significantly deteriorated since the penalties were announced. Many customers have expressed concerns about the company’s handling of the situation, highlighting the lack of clarity and communication. Common themes in negative reviews include a sense of betrayal, difficulty in resolving issues, and a feeling of being misled. Some customers have even threatened to switch to competing financial institutions.

Potential Shifts in Customer Behavior

The negative public response and customer feedback could lead to significant shifts in customer behavior. Customers may be more inclined to seek alternatives to American Express for travel arrangements, potentially leading to a loss of market share. Furthermore, the incident could impact consumer trust in the brand, potentially affecting future transactions and loyalty programs. The situation demonstrates the importance of transparent communication and prompt resolution of customer issues in the face of controversies.

American Express got penalized for some Cuba bookings, which is a bit surprising, considering the recent buzz around travel. Meanwhile, the Academy is kicking off its 58th Artists of Hawaii exhibit, showcasing incredible talent from the islands. It’s a stark contrast, really, between the financial fallout of travel restrictions and the vibrant artistic expression on display, highlighting the diverse cultural landscape.

Hopefully, this positive artistic energy will help inspire further travel opportunities, even if American Express is taking a more cautious approach for now.

For example, when airlines experience delays or cancellations, customers expect prompt and clear communication from the company. Similar principles apply to financial institutions.

Potential Strategies for American Express

To address customer concerns, American Express needs to implement a multi-pronged approach. This should include transparent communication regarding the reasons behind the penalties, offering compensation or refunds where appropriate, and establishing a clear resolution process for affected customers. Crucially, American Express must demonstrate a genuine commitment to addressing customer concerns and restoring trust. This might involve publicly acknowledging the situation, initiating customer support channels to quickly resolve issues, and ensuring that similar incidents are prevented in the future.

Customer Complaints and Feedback

| Date | Issue | Resolution (or Lack Thereof) |

|---|---|---|

| 2024-03-15 | Booking for Cuba trip penalized without prior notice. | No response/compensation offered. |

| 2024-03-18 | Incorrect penalty amount applied. | Partial refund after multiple follow-ups. |

| 2024-03-20 | Lack of clarity regarding the penalty policy. | General information provided on the website, but no personalized response. |

| 2024-03-22 | Booking cancelled due to penalties, no alternative offered. | No alternative booking offered, refund for the non-used portion. |

Regulatory Framework and Legal Considerations

The American Express Cuba booking issue highlights the complex interplay between international travel, economic sanctions, and regulatory compliance. Navigating these intricacies requires a deep understanding of the legal frameworks governing international commerce and the ramifications of violating those frameworks. This section delves into the specifics of the relevant regulations, the legal grounds for the penalties, and potential legal avenues for recourse.

Relevant Regulations and Legal Frameworks

International travel and sanctions are governed by a multitude of regulations, both domestically and internationally. These regulations aim to control the flow of goods and services to sanctioned countries, often due to geopolitical or economic considerations. Key regulations often include restrictions on financial transactions, trade activities, and travel. Understanding these regulations is crucial for companies like American Express to ensure compliance and avoid potential penalties.

Legal Grounds for Penalties

The penalties imposed on American Express are likely rooted in violations of US sanctions against Cuba. These sanctions, codified in various laws, prohibit or restrict certain transactions with Cuba. Specific violations may include facilitating travel or financial transactions that are deemed inconsistent with these sanctions. The precise legal grounds will depend on the specific actions taken by American Express and the interpretation of the relevant regulations by the authorities imposing the penalties.

Examples of Similar Cases

Several companies have faced similar penalties for violations of sanctions related to international travel. For example, banks have been sanctioned for facilitating transactions with sanctioned countries, and travel agencies have been penalized for arranging travel to those locations. These cases underscore the seriousness of complying with international sanctions and the potential consequences of non-compliance. In these instances, the legal framework often focuses on the specific actions that are in violation of the regulations.

Potential Legal Challenges or Appeals

American Express may consider various legal avenues to challenge the penalties. These may include appealing the decision, contesting the interpretation of the regulations, or arguing that their actions did not violate the applicable sanctions. The success of any legal challenge will depend on the specific circumstances and the strength of the legal arguments presented.

Key Regulations

| Jurisdiction/Type | Regulation Name | Key Provisions |

|---|---|---|

| US | Trading with the Enemy Act (TWEA) | Restricts transactions with designated countries, including Cuba. |

| US | Cuban Assets Control Regulations (CACR) | Detail restrictions on transactions with Cuba and entities related to Cuba. |

| US | International Emergency Economic Powers Act (IEEPA) | Empowers the US President to take emergency actions in times of international crisis, which can include sanctions. |

| UN | UN Security Council Resolutions | These resolutions can impose sanctions on countries or individuals involved in actions deemed detrimental to international peace and security. |

These regulations highlight the diverse legal frameworks that affect international transactions. The table above provides a concise overview of some key regulations, but there are numerous other regulations, both domestic and international, that could be applicable in specific circumstances.

Alternative Perspectives and Potential Solutions

The American Express Cuba booking penalty debacle highlights a complex interplay between international regulations, travel industry practices, and public perception. Navigating this situation requires considering diverse viewpoints and potential solutions to address the underlying issues and prevent future conflicts. A nuanced approach is crucial to both protecting the company’s interests and maintaining public trust.Different viewpoints regarding the penalties and the impact on the travel industry are critical to understanding the full scope of the issue.

Travel industry experts, for instance, might argue that the existing regulatory framework needs clarification, while consumer advocates may point to the need for more transparency and customer-centric policies.

Different Viewpoints on the Penalties

Experts in international law and trade suggest that the ambiguous nature of the existing sanctions has contributed to the current situation. The need for clear and unambiguous guidelines is crucial for all involved. This allows companies like American Express to anticipate and address potential violations, fostering a more predictable and compliant environment.

Potential Solutions to Address Underlying Issues

Several strategies could help prevent similar incidents in the future. These solutions range from enhancing the transparency of booking processes to improving regulatory clarity for the travel industry.

American Express’s recent penalty for Cuba bookings is a bit surprising, considering the travel industry’s recent push for more inclusive experiences. Meanwhile, companies like AmaWaterways are leading the way with innovative itineraries, like their upcoming amawaterways first black heritage cruise , showcasing a commitment to diversity and heritage. This seems to highlight a disconnect between promoting responsible travel and certain financial decisions regarding specific destinations, which raises some questions about the future of travel and how companies balance ethical practices and financial interests when it comes to Cuba.

Alternative Approaches for American Express

American Express should consider implementing a robust compliance program for international transactions. This program should include ongoing training for employees and regular audits to ensure compliance with evolving regulations. The company should also actively engage in dialogue with regulatory bodies to clarify any ambiguities in the existing framework. This proactive approach is crucial to avoiding future incidents.

Travel Industry Adaptation to International Regulations

The travel industry must adopt a proactive approach to adapting its practices to international regulations. This includes a commitment to ongoing education and training for staff, and an investment in resources to monitor and understand evolving regulations. This ensures that all travel providers are aware of and adhere to the relevant international and national regulations. For example, if there are changes in US sanctions, the travel industry needs to immediately adapt and update its processes.

American Express got a bit of a slap on the wrist for those Cuba bookings, huh? It’s a shame, but hey, sometimes things get complicated. Speaking of sweet treats, have you checked out the new candy shop on Avenue 117? Weston’s new candy shop is buzzing with amazing flavors, and honestly, those sweet sensations are a welcome distraction from the whole American Express situation.

Maybe a little sugar will help us all forget about the penalties for a while! Hopefully, this will all be sorted out soon. Still, it’s all a bit frustrating, isn’t it?

Potential Solutions Summary

| Category | Potential Solutions |

|---|---|

| Regulatory |

|

| Operational |

|

| Reputational |

|

Final Summary

In conclusion, the American Express penalty for Cuba bookings highlights the intricate web of international regulations and sanctions. The impact extends beyond the company itself, affecting the broader travel industry and potentially influencing future travel arrangements. This event underscores the importance of staying informed about the evolving rules governing international travel, especially regarding destinations with specific regulatory challenges.

We’ll continue to monitor the situation and offer further analysis as more information becomes available.

FAQ

What are the specific types of penalties imposed on American Express?

The specific types of penalties haven’t been publicly disclosed yet, but they likely include financial fines, restrictions on operations, or even reputational damage. More details will be available as the official statements are released.

How will these penalties affect customer loyalty towards American Express?

Customer loyalty could be negatively impacted if American Express fails to address the concerns and provide transparent communication regarding the penalties. This could result in customers choosing alternative travel arrangements.

Are there any potential solutions to prevent future penalties for travel companies?

The travel industry may need to adapt to the evolving regulations and sanctions by implementing compliance measures and maintaining strong communication channels with regulatory bodies. Clearer guidelines and procedures for handling international travel arrangements could be beneficial.

What is the regulatory framework surrounding international travel and sanctions?

International travel regulations and sanctions are complex and vary depending on the destination and the nature of the transactions. Understanding the specific regulations governing Cuba is crucial for companies involved in travel services.