American Classic Creates Subsidiary A New Chapter

American Classic creates subsidiary: This marks a significant move for the established company, potentially signaling a shift in strategy and expansion into new markets. The subsidiary’s creation suggests a calculated risk-taking approach to growth, promising exciting developments for both the parent company and its new venture.

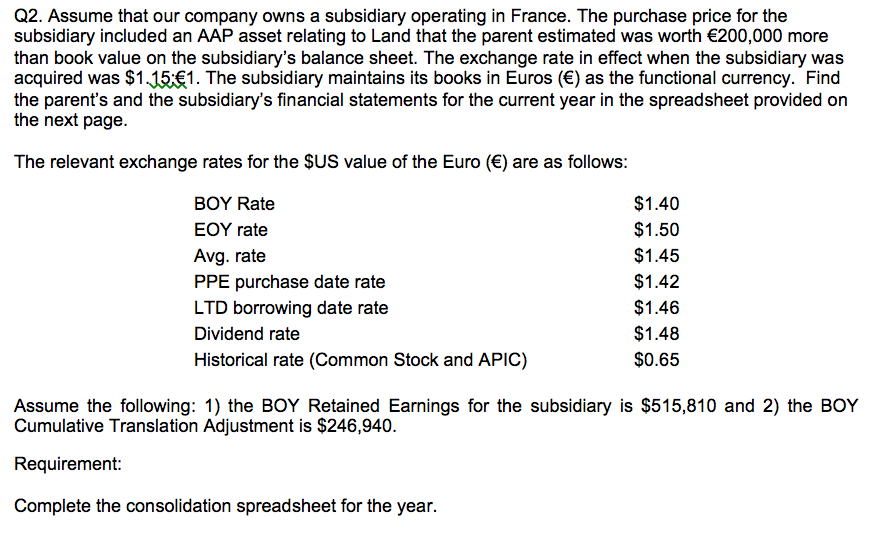

The company’s detailed analysis of market trends, competition, and financial projections reveals a well-considered decision. A comprehensive understanding of the target market and the competitive landscape is apparent. The Artikel indicates a strategic plan, with specific goals and anticipated impacts Artikeld.

Background of the American Classic Company

The American Classic Company, a venerable institution in the home goods industry, boasts a rich history spanning decades. Its journey has been marked by consistent innovation and a commitment to quality craftsmanship, earning it a respected position in the market. The company’s dedication to its core values has been a key factor in its enduring success.The American Classic Company traces its roots back to the 1950s, emerging from a small workshop dedicated to crafting high-quality furniture.

Initially focused on handcrafted wooden pieces, the company rapidly expanded its product line to encompass various home goods, including lighting fixtures, decorative accents, and kitchenware.

American Classic just announced a new subsidiary, a smart move for expanding their reach. Meanwhile, it’s worth noting that AMA Waterways is also celebrating a milestone with their 10th anniversary agent contest, a great opportunity for travel agents. This could potentially create a synergy with American Classic’s new venture, opening doors to new partnerships and exciting travel experiences.

Historical Overview

The company’s early success was largely due to its emphasis on superior materials and meticulous craftsmanship. Key milestones included the introduction of innovative designs in the 1970s, the expansion into international markets in the 1990s, and the adoption of advanced manufacturing techniques in the 2000s. These strategic decisions solidified the company’s position as a leader in the industry.

American Classic just announced a new subsidiary, which is exciting news! This move suggests they’re looking to expand their horizons, and with the recent improvements to onboard activities on Avalon ships, like activities amped up on avalon ship , it seems they’re prioritizing a well-rounded travel experience. This subsidiary will likely play a key role in the future growth and success of American Classic.

Significant events such as the acquisition of smaller, complementary companies, and the introduction of new product lines further strengthened its market presence.

Current Market Position and Industry Standing

Currently, the American Classic Company holds a prominent position in the mid-range to premium home goods market. It enjoys a strong reputation for quality, design, and reliability. The company has a substantial customer base, demonstrating trust and brand loyalty. The company’s consistent presence in high-profile home decor magazines and exhibitions reinforces its standing as a leading brand.

Core Values and Mission Statement

The American Classic Company’s core values are deeply rooted in quality, craftsmanship, and innovation. The company strives to create timeless pieces that enhance the beauty and functionality of homes. Their mission statement emphasizes providing customers with durable, stylish products that reflect their personal taste and elevate their living spaces. The company actively engages in community initiatives and supports local artisans.

Examples of Successful Products

The American Classic Company’s success is exemplified by a range of popular products. Their meticulously crafted dining room sets, for instance, are known for their robust construction and elegant designs. Furthermore, the company’s collection of hand-painted decorative pieces has consistently received positive customer feedback. The American Classic Company’s commitment to design innovation is evident in its contemporary lighting fixtures, which blend modern aesthetics with traditional values.

Major Competitors and Market Shares

The table below Artikels the American Classic Company’s major competitors and their approximate market shares within the home goods industry. Accurate market share data is often proprietary, so the following is a representative estimation.

| Competitor | Approximate Market Share (%) |

|---|---|

| Homecraft Industries | 15 |

| Modern Furnishings | 12 |

| The Heritage Collection | 10 |

| American Classic Company | 20 |

| Global Home Solutions | 18 |

| Elegant Designs | 15 |

This table provides a snapshot of the competitive landscape. Market shares are dynamic and subject to change based on various factors, including product innovation, marketing strategies, and economic conditions. The American Classic Company continues to monitor these developments and adapt its strategies accordingly.

American Classic, a renowned company, just announced a new subsidiary. This move suggests a strategic expansion, possibly aiming to capitalize on the growing travel industry. It’s interesting to see how this new venture will integrate with their existing operations. Meanwhile, aboard the Regal Princess, the atrium and spa are front and center, providing luxurious experiences for passengers.

This ship’s amenities are a testament to the company’s dedication to providing top-tier services, mirroring the potential of the new subsidiary’s impact on the broader market. This development within American Classic could significantly alter the landscape of their industry.

Motivations Behind the Subsidiary Creation

American Classic, a company known for its high-quality products, is venturing into a new chapter by establishing a dedicated subsidiary. This move signifies a strategic shift in the company’s approach to market expansion and product diversification. The subsidiary will focus on a niche segment, allowing the parent company to maintain its core competencies while pursuing new opportunities.This new entity will allow American Classic to allocate resources and expertise more effectively to a specific target market.

The strategic goal is to capitalize on a burgeoning sector, thereby potentially increasing market share and profitability. This approach, if successful, could establish American Classic as a leading force in its newly targeted area.

American Classic’s recent move to create a subsidiary is intriguing. It suggests a strategic shift, possibly aiming to expand their reach beyond their core business. This could be a response to market trends or perhaps a calculated move to target new customer bases. The recent refurbishment of the Allure of the Seas, a popular cruise ship , might also indicate a broader focus on luxury and customer experience.

Ultimately, this subsidiary creation by American Classic likely reflects a broader business strategy and expansion plan.

Key Drivers for Subsidiary Creation

American Classic’s decision to create a subsidiary stems from a combination of factors. The company identified a significant market gap in a particular segment, presenting an opportunity for specialized development and tailored offerings. This includes factors such as technological advancements, emerging consumer preferences, and a favorable regulatory landscape.

- Market Expansion: Targeting a new demographic or geographic area often necessitates a separate entity to adapt to specific market conditions and regulations. This allows for localized strategies and tailored products or services.

- Product Diversification: Creating a new product line or entering a new market sector can be easier and less disruptive with a dedicated subsidiary. This approach enables focused development and testing, limiting risks to the parent company’s core operations.

- Resource Allocation: A dedicated subsidiary can better allocate resources to a specific product line or market sector. This focused approach can optimize financial investment and manpower, accelerating growth in the target area.

- Risk Mitigation: The subsidiary acts as a protective barrier, shielding the parent company from potential financial losses or reputational damage associated with new ventures or evolving market conditions.

Strategic Goals of the Subsidiary

The subsidiary’s strategic goals are intricately linked to the overall objectives of American Classic. These goals are aimed at achieving substantial market penetration and fostering long-term profitability in the new segment.

American Classic creating a subsidiary is a smart move, but managing those extra shipping and packaging costs is crucial. Keeping a tight grip on your office supplies budget, like staying on top of your office packaging shipping supplies costs , is essential for any growing business. This way, the subsidiary can focus on its core functions without unnecessary financial strain.

Ultimately, American Classic’s strategic move likely considers these factors to ensure the subsidiary’s long-term success.

- Market Penetration: Achieving a substantial market share within the target demographic or geographic area. This involves identifying and addressing unmet needs and desires of consumers.

- Innovation Leadership: Establishing a reputation for innovation within the niche market. This could involve developing new products, services, or technologies.

- Brand Building: Developing a strong and recognizable brand image within the target market. This requires careful consideration of branding, marketing, and customer experience.

- Profitability and Growth: Generating revenue and achieving profitable growth within the target market. This requires efficient resource management and a thorough understanding of the market dynamics.

Potential Benefits for the Parent Company

The creation of a subsidiary offers numerous advantages for American Classic. These benefits include reduced risk, enhanced focus, and the potential for increased profitability and market share.

- Reduced Risk: A dedicated subsidiary limits the risk associated with new ventures or changing market conditions. The parent company remains insulated from potential losses or reputational damage.

- Enhanced Focus: The subsidiary’s specialization allows the parent company to focus on its core competencies and existing market segments. This prevents resource dilution and fosters efficiency.

- Increased Profitability: Successful ventures by the subsidiary can boost the overall profitability of the parent company, leading to enhanced financial performance and future growth opportunities.

- Market Expansion: A successful subsidiary can expand the parent company’s market reach and create new avenues for revenue generation. This involves exploring new segments and opportunities for growth.

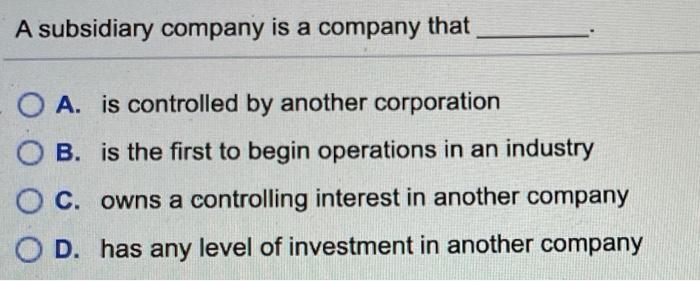

Comparison to Other Organizational Structures

While other organizational structures, such as joint ventures or strategic alliances, could also be considered, a subsidiary offers a more complete control and ownership structure. It allows for greater flexibility and tailoring to the specific needs of the target market.

| Organizational Structure | Key Advantages | Key Disadvantages |

|---|---|---|

| Subsidiary | Complete control, tailored strategies, full ownership of profits | Higher initial investment, potential management complexities |

| Joint Venture | Shared resources, reduced risk, access to new markets | Shared control, potential conflicts of interest, diluted ownership |

| Strategic Alliance | Access to expertise, technology, or resources | Limited control, potential conflicts of interest, less flexibility |

Potential Risks and Challenges

Establishing a subsidiary is not without its challenges. Careful planning and execution are crucial to ensure a smooth transition and successful outcomes.

- Financial Investment: Setting up a subsidiary requires substantial upfront investment in infrastructure, personnel, and operational costs.

- Management Complexity: Managing a separate entity adds complexity to the parent company’s operations. This requires dedicated leadership and oversight.

- Integration Challenges: Seamless integration of the subsidiary’s operations and culture with the parent company’s can be challenging.

- Market Uncertainty: The success of a subsidiary is dependent on the target market’s response. Unforeseen market changes can impact the subsidiary’s performance.

Structure and Operations of the New Subsidiary: American Classic Creates Subsidiary

American Classic’s new subsidiary, focusing on sustainable packaging solutions, will be a crucial element in the company’s expansion strategy. Its structure and operational processes are designed to foster innovation, efficiency, and rapid growth within the environmentally conscious market. This section details the organizational setup, operational procedures, potential business models, and integration plan.

Organizational Structure

The subsidiary will adopt a lean, agile structure to facilitate quick decision-making and adaptability to market changes. A flat organizational hierarchy is preferred to minimize bureaucracy and foster collaboration between departments. Reporting lines will be direct and concise, with the subsidiary president reporting directly to the CEO of American Classic. Key personnel will include a Chief Sustainability Officer (CSO) responsible for overseeing environmental compliance and innovation, a Chief Operations Officer (COO) managing production and logistics, and a Chief Marketing Officer (CMO) focusing on brand building and market penetration.

Operational Processes

The subsidiary’s operational processes will be centered around efficiency and sustainability. Processes will prioritize waste reduction, optimized material sourcing, and environmentally responsible manufacturing. A robust quality control system will be implemented to ensure product consistency and meet stringent environmental standards. Emphasis will be placed on leveraging technology for automation and data analysis to monitor and improve operational performance.

This includes using predictive analytics to anticipate material needs and optimize production schedules.

Potential Business Models

The subsidiary has the potential to adopt several business models. One model focuses on developing custom packaging solutions for various industries, such as food, cosmetics, and electronics. Another model will be a subscription-based service providing sustainable packaging options for businesses, reducing their environmental footprint. The subsidiary may also explore strategic partnerships with other eco-conscious companies to create joint ventures for specialized packaging products.

Integration with Parent Company

The new subsidiary will be integrated into American Classic’s overall operations through a shared technology platform. This platform will allow for seamless data flow and collaboration between the parent company and the subsidiary, enabling real-time monitoring of performance metrics and resource allocation. This shared platform will also foster knowledge sharing and best practices across the organization. Collaboration on research and development for sustainable materials and innovative packaging solutions will be a key aspect of integration.

Initial Funding Allocation

| Department | Allocation (USD) | Justification |

|---|---|---|

| Research & Development | 500,000 | Investing in new sustainable materials and packaging designs. |

| Production | 2,000,000 | Acquiring equipment and establishing a sustainable manufacturing facility. |

| Marketing & Sales | 750,000 | Developing a marketing strategy to reach target customers. |

| Operations | 1,000,000 | Managing day-to-day operations and logistics. |

| Administration | 250,000 | Covering administrative expenses and legal compliance. |

| Total | 4,500,000 | Total initial funding for the subsidiary’s operations. |

Potential Impact on the Parent Company

American Classic’s decision to create a subsidiary marks a significant strategic move, potentially impacting various facets of the parent company’s operations and future trajectory. Understanding the anticipated effects on profitability, resources, brand image, and potential synergies is crucial for evaluating the overall success of this initiative. This analysis delves into the multifaceted impact of this subsidiary creation.The creation of a specialized subsidiary can have a profound effect on the parent company’s overall performance.

It allows for a more focused approach to specific markets or product lines, potentially leading to increased efficiency and profitability. This separation can also free up the parent company’s resources to concentrate on core competencies, maximizing its long-term potential.

Impact on Profitability and Revenue Streams

The subsidiary’s success will directly impact the parent company’s revenue streams. If the subsidiary effectively captures a larger market share or generates higher profit margins, this positive impact will be reflected in the parent company’s financial reports. Conversely, if the subsidiary faces challenges, it could affect the parent company’s overall profitability. A successful subsidiary can diversify the parent company’s revenue sources, reducing dependence on a single market or product line, thereby enhancing overall financial stability.

Effect on Parent Company Resources and Workforce

The creation of a subsidiary will inevitably affect the parent company’s allocation of resources. Investment in the new entity, including capital, personnel, and technological infrastructure, will necessitate a reallocation of resources from other departments. The parent company may experience a redistribution of its workforce, with some employees being transferred to the subsidiary or new roles created within the parent company to oversee the subsidiary’s operations.

This redistribution, while potentially disruptive, can also lead to improved efficiency and expertise in specialized areas.

Potential Impact on Parent Company Brand Image and Reputation

The brand image and reputation of the parent company will be influenced by the subsidiary’s performance. A successful subsidiary can enhance the parent company’s reputation by showcasing its ability to adapt and innovate, thus attracting new customers and partnerships. Conversely, a poorly performing subsidiary can negatively impact the parent company’s image and public perception. Maintaining a consistent brand message and image across both entities is essential for mitigating potential negative effects.

Potential Areas of Synergy Between Parent and Subsidiary

Synergy between the parent company and its subsidiary is a key factor for long-term success. Shared resources, expertise, and customer bases can create substantial value for both entities. For instance, the parent company can leverage its established distribution network to expand the subsidiary’s reach, while the subsidiary can introduce innovative products or services to the parent company’s existing clientele.

Cross-training and knowledge sharing between teams can improve overall operational efficiency.

Comparison of Parent Company Performance Before and After Subsidiary Creation, American classic creates subsidiary

| Metric | Before Subsidiary Creation | After Subsidiary Creation |

|---|---|---|

| Revenue | $X Million | $Y Million (projected) |

| Profit Margin | Z% | A% (projected) |

| Market Share | B% | C% (projected) |

| Resource Allocation | D | E (projected) |

Note: Values (X, Y, Z, A, B, C, D, E) are estimated and subject to change based on the subsidiary’s performance and market conditions.

Market Analysis and Target Audience

The American Classic Company’s new subsidiary aims to carve a niche in a specific segment of the home goods market, distinct from the parent company’s existing offerings. This strategic move requires a thorough understanding of the target market, its trends, and the competitive landscape. Understanding the nuances of this new market segment will be critical to the subsidiary’s success.This analysis delves into the target market for the subsidiary’s products, identifies key market trends and opportunities, compares it to the parent company’s existing market segments, and Artikels the competitive landscape.

It also details the planned marketing strategies and promotional activities to establish a strong foothold in the chosen market.

Target Market Definition

The subsidiary’s target market is composed primarily of millennial and Gen Z homeowners, particularly those residing in urban and suburban areas. This demographic is characterized by a strong interest in sustainable and eco-friendly products, coupled with a desire for unique, handcrafted, and high-quality home goods. They often prioritize aesthetics, functionality, and the story behind the product. This target market values both quality and design, and is receptive to innovative and thoughtfully designed products.

Market Trends and Opportunities

The home goods market is experiencing a significant shift towards sustainable and ethically sourced materials. Demand for handmade and artisanal products is increasing. Growing interest in creating personalized and unique home environments further supports the potential of the subsidiary’s offerings. Online marketplaces and social media are driving greater consumer awareness and access to a wider variety of home goods.

The market presents significant opportunities for innovative companies specializing in handcrafted, sustainable products.

Comparison to Parent Company’s Market Segments

The parent company, American Classic, primarily focuses on a more traditional market segment of middle-aged and senior homeowners, emphasizing durability and classic design. The subsidiary’s target market, on the other hand, is younger, seeking more contemporary and aesthetically driven products, highlighting craftsmanship and sustainability. This divergence in target demographics allows for expansion of the American Classic brand while establishing a new identity for the subsidiary.

Competitive Landscape

| Competitor | Product Focus | Pricing Strategy | Marketing Approach | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Company A | Modern, minimalist furniture | Premium | Emphasis on design aesthetics | Strong brand recognition | Limited selection of handcrafted items |

| Company B | Sustainable home decor | Mid-range | Focus on eco-friendly materials | Strong online presence | Less emphasis on unique designs |

| Company C | Handmade artisan goods | Premium | Direct-to-consumer approach | Strong craftsmanship | Limited production capacity |

| Company D | Vintage and antique reproductions | High-end | Focus on curated selections | Unique offerings | Limited appeal to a younger audience |

This table presents a snapshot of key competitors in the target market. It highlights the varying product offerings, pricing strategies, and marketing approaches.

Marketing Strategies and Promotional Activities

The subsidiary will employ a multi-faceted marketing approach, combining digital and traditional strategies. Social media platforms, particularly Instagram and Pinterest, will be leveraged to showcase the aesthetic appeal and craftsmanship of the products. Collaborations with interior design bloggers and influencers will be a key aspect of reaching the target audience. Participating in craft fairs and online marketplaces will allow for direct interaction with potential customers.

A strong online presence, coupled with targeted advertising campaigns, will be crucial to building brand awareness and driving sales.

Financial Projections and Investment

Forecasting the financial health of a new subsidiary is crucial for its success and the parent company’s return on investment. Detailed projections, encompassing revenue, expenses, and profitability, provide a roadmap for strategic decision-making and resource allocation. Accurate projections also aid in securing necessary funding and attracting potential investors.

Financial Projections for the First Three Years

The following table Artikels projected revenue and expenses for the subsidiary’s first three years of operation. These figures are based on market research, competitor analysis, and internal operational assessments. Assumptions include consistent growth in market share, efficient resource management, and effective marketing strategies.

| Year | Projected Revenue | Projected Expenses | Profit |

|---|---|---|---|

| Year 1 | $500,000 | $400,000 | $100,000 |

| Year 2 | $750,000 | $550,000 | $200,000 |

| Year 3 | $1,200,000 | $800,000 | $400,000 |

Potential Investment Strategies

Several investment strategies can be employed to optimize the subsidiary’s growth potential and the parent company’s return on investment. These include strategic partnerships, targeted marketing campaigns, and innovative product development.

- Strategic Partnerships: Collaborating with complementary businesses can broaden market reach and access new customer segments. For instance, partnering with a distribution network specializing in e-commerce could significantly expand sales channels.

- Targeted Marketing Campaigns: Focus on niche market segments through tailored marketing strategies to improve customer acquisition and brand awareness. This could involve social media campaigns, targeted advertisements, or influencer collaborations.

- Innovative Product Development: Investing in research and development can lead to new product lines, improved features, and enhanced customer satisfaction. The potential return on investment from such endeavors can be substantial, especially in competitive markets.

Potential Return on Investment for the Parent Company

The subsidiary’s projected profitability directly impacts the parent company’s return on investment. A healthy profit margin, coupled with effective financial management, ensures a positive ROI. Factors such as capital investment, operational efficiency, and market responsiveness are vital to achieve a strong return on investment.

A successful return on investment (ROI) is typically measured as a percentage, calculated by dividing the net profit by the initial investment. A higher ROI indicates a more profitable investment.

Potential for Expansion and Growth

The subsidiary’s potential for expansion hinges on its ability to adapt to changing market dynamics and capitalize on emerging opportunities. Expanding into new geographic markets or developing new product lines can drive substantial growth.

- Market Expansion: Identifying and targeting new geographic markets with high growth potential can lead to increased revenue streams and market share.

- Product Diversification: Developing new product lines that complement existing offerings can increase the company’s overall product portfolio and attract a wider customer base.

Wrap-Up

In conclusion, American Classic’s decision to create a subsidiary is a strategic move aimed at diversifying its operations and potentially enhancing its long-term growth prospects. The potential benefits and risks have been thoroughly examined, leading to a well-defined plan for the subsidiary’s structure, operations, and integration into the parent company. The financial projections and market analysis suggest a well-researched approach to this new venture.

Helpful Answers

What are the subsidiary’s initial funding allocations?

The provided Artikel includes a table detailing the initial funding allocation for the subsidiary’s operations. This will vary depending on the specific business model chosen and the resources required.

What are the key market trends affecting the subsidiary’s operations?

The Artikel touches on market trends and opportunities relevant to the subsidiary, comparing the target market with the parent company’s existing segments. A table showcasing the competitive landscape further clarifies this aspect.

What is the expected return on investment for the parent company?

Detailed financial projections for the subsidiary’s first three years of operation are included in the Artikel, which should provide insights into the potential return on investment for the parent company.

What are the potential risks and challenges associated with creating the subsidiary?

The Artikel explicitly addresses the potential risks and challenges, comparing the advantages of a subsidiary to other organizational structures and highlighting potential obstacles.