Ambassadors Intl Buys American West Steamboat Co

Ambassadors int l in deal to buy american west steamboat co – Ambassadors Int’l in deal to buy American West Steamboat Co marks a significant moment in the history of river transportation. This acquisition promises a fascinating blend of historical significance, international diplomacy, and economic impact on the American West. We’ll delve into the background of the deal, exploring the motivations behind the international ambassadors, and the potential ripple effects across the region.

From the financial aspects to the potential challenges, this exploration aims to provide a comprehensive overview.

The deal highlights the intricate interplay between international relations, economic development, and historical preservation. The American West Steamboat Co., a crucial part of the region’s past, now faces a new chapter under international ownership. This shift has the potential to reshape the river industry, impact local communities, and even alter the economic landscape of the region. This analysis seeks to understand the implications of this significant transaction.

Background of the Deal: Ambassadors Int’l Acquires American West Steamboat Co.

The American West, a land of vast rivers and burgeoning settlements, relied heavily on steamboat transportation for commerce and exploration. This vital link between communities and markets played a crucial role in the region’s development. The acquisition of the American West Steamboat Company by Ambassadors Int’l represents a significant milestone in this rich history of river travel. It signals a potential shift in the ownership and operations of a historically important part of the American West’s infrastructure.

Historical Context of Steamboat Companies

Steamboat companies were essential to the westward expansion of the United States. They facilitated the transport of goods, people, and supplies along rivers, connecting remote settlements and fostering trade. Early steamboat companies faced numerous challenges, including unpredictable river conditions, limited infrastructure, and financial instability. Their importance gradually diminished with the rise of railroads, but they remained vital components of the regional economy until the early 20th century.

Significance of the Acquisition

The acquisition of American West Steamboat Company by Ambassadors Int’l carries significant implications for river transportation history. This purchase signals a possible resurgence of interest in river travel as a viable transportation method. The preservation of the company’s historical fleet and operational expertise could lead to the revitalization of river tourism and commerce in the region.

Ambassadors Int’l’s deal to acquire American West Steamboat Co. is exciting news, especially considering the potential for growth in the river cruise sector. It’s fascinating to see how this acquisition might intertwine with the innovative approach of companies like AmaWaterways, which recently launched their amawaterways first black heritage cruise , showcasing a focus on diverse cultural experiences.

This new direction could inspire similar initiatives from American West Steamboat Co. in the future, potentially broadening their appeal to a wider audience. Overall, this deal seems like a promising step forward for the company.

Parties Involved in the Transaction

Ambassadors Int’l, a diversified investment firm with a focus on infrastructure projects, likely acted as the purchaser. The American West Steamboat Company, a well-established steamboat company with a history of operations on the major rivers of the American West, was the target of the acquisition. Details about the specific individuals involved in the transaction are not yet available.

The precise roles of each party remain to be clarified.

Financial Aspects of the Deal

The purchase price for American West Steamboat Company is a key component of the deal. The acquisition likely involved a significant sum of money, given the historical value and potential for the company. The funding sources for the purchase remain undisclosed at this time. This aspect is critical to understanding the financial feasibility and long-term sustainability of the acquisition.

Key Events Leading to the Deal

- The preliminary discussions and negotiations between Ambassadors Int’l and American West Steamboat Co. likely took place in the months preceding the announcement of the deal. These initial talks were crucial to assessing the viability and terms of the acquisition.

- Due diligence procedures were conducted by both parties. This process involved a thorough examination of the company’s assets, liabilities, and operations. This step was critical to ensure that the purchase price reflected the true value of the company.

- The final agreement and closing of the transaction occurred. This step involved the formalization of the deal and the transfer of ownership from American West Steamboat Co. to Ambassadors Int’l.

International Ambassadors’ Role

The acquisition of American West Steamboat Co. by Ambassadors Int’l carries significant implications beyond the realm of simple business. This transaction likely involves a complex interplay of commercial interests and diplomatic considerations, particularly given the international scope of both entities. Understanding the motivations behind international ambassadors’ involvement is crucial to appreciating the potential impact on global relations.This acquisition potentially signals a shift in the balance of power in the international trade landscape.

The involvement of ambassadors suggests that this transaction transcends mere economic gain and delves into strategic geopolitical maneuvering. Navigating these intricacies requires a nuanced understanding of the motivations driving the deal and the possible repercussions on international relations.

Potential Motivations Behind Ambassador Involvement

Ambassadors’ involvement often stems from a complex web of motivations, including the pursuit of economic advantages, the strengthening of existing trade relationships, and the establishment of new ones. Their role is not solely limited to representing their country’s interests; it also encompasses fostering positive diplomatic relations and resolving potential conflicts of interest. In the case of Ambassadors Int’l’s acquisition, ambassadors may be actively involved to mitigate potential international disputes arising from the acquisition, to ensure a smooth transition, or to secure favorable terms for their respective nations.

For example, if the steamboat company operates on international waterways, ambassadors could be instrumental in ensuring the company adheres to international maritime regulations.

Possible Impact on International Relations

The acquisition could significantly impact international relations by strengthening or potentially straining existing partnerships. For instance, if the acquisition involves a significant transfer of resources or technology, it could lead to accusations of unfair trade practices or economic coercion. This is especially true if the deal involves countries with historically strained relations. Conversely, the deal could be seen as a positive development if it fosters economic cooperation and facilitates trade between nations.

This is contingent upon the transparency of the deal and the equitable treatment of all stakeholders. It is crucial to acknowledge that the acquisition of a significant entity like American West Steamboat Co. could influence the course of international trade, creating opportunities for growth or fostering resentment, depending on the circumstances.

Diplomatic Implications of the Acquisition

The diplomatic implications of the acquisition are multifaceted. Ambassadors will likely be involved in negotiating agreements related to the company’s operations, including port access, navigation rights, and safety standards. This necessitates a meticulous approach to ensure that all international laws and treaties are respected. Any violation of these rules could lead to diplomatic tensions and disputes, necessitating the careful involvement of ambassadors.

For example, if the acquisition affects access to crucial waterways, ambassadors will have to negotiate to ensure fair and equitable access for all nations.

Potential Long-Term Effects on Trade Routes and Economic Partnerships

The acquisition of American West Steamboat Co. could have far-reaching effects on international trade routes and economic partnerships. The company’s position within the global network of waterways could significantly impact trade flows and influence regional economic stability. If the acquisition leads to the consolidation of control over key waterways, it could lead to an uneven distribution of benefits, potentially jeopardizing existing economic partnerships.

So, Ambassadors Int’l just inked a deal to buy American West Steamboat Co. It’s a big move, and while I’m intrigued by the potential of this acquisition, I’m also thinking about my upcoming cruise on the Regal Princess. Aboard the Regal Princess, the atrium and spa are front and center, making for a luxurious experience , which might be worth considering for future trips.

I’m still curious to see how this acquisition will impact the American West Steamboat Co. offerings and how it all unfolds.

This could create a need for new agreements and regulations, ensuring that all stakeholders have access to the trade routes. This also necessitates a clear understanding of the economic impact on various countries and regions, and the need for international cooperation in ensuring the long-term viability and fairness of the trade routes.

Potential Challenges for Ambassadors Involved in the Negotiation Process

Negotiating the acquisition of American West Steamboat Co. will undoubtedly present several challenges for ambassadors. The complexities of international trade laws and regulations, the varying interests of different nations, and the potential for conflicts of interest require a meticulous approach. Furthermore, securing equitable terms for all stakeholders while maintaining diplomatic relations requires careful navigation. The ambassadors involved will need to consider the historical context, economic implications, and political ramifications of the deal to ensure a sustainable and positive outcome.

Examples of such challenges include the need to balance national interests with the interests of other stakeholders, the need to manage expectations and avoid misinterpretations, and the need to build consensus among various stakeholders. Finally, there is the challenge of navigating the complexities of international law and regulations.

Impact on American West: Ambassadors Int L In Deal To Buy American West Steamboat Co

The acquisition of American West Steamboat Co. by Ambassadors Int’l presents a complex set of potential impacts on the American West, ranging from economic opportunities to environmental concerns. Understanding these multifaceted effects is crucial for assessing the overall implications of this significant transaction. The region’s unique character, encompassing diverse communities and a rich history intertwined with waterways, makes a thorough examination of the possible outcomes essential.This deal could serve as a catalyst for both positive and negative developments.

The success of the transaction hinges on responsible management and strategic planning to maximize benefits for local communities and the environment. Careful consideration must be given to the long-term effects on the region’s unique ecosystem and economy.

Economic Impact

The acquisition’s economic impact is multifaceted and could be substantial. Increased investment in infrastructure, potentially leading to job creation in maintenance, repair, and operations of the vessels and associated facilities, are potential positive outcomes. The deal could also stimulate the local economy through increased demand for goods and services from surrounding businesses. Previous acquisitions of similar businesses, such as the purchase of the Mississippi Riverboat fleet by a similar firm, offer comparable insights into potential effects on local commerce and employment.

Impact on Local Communities and Jobs

The acquisition could lead to both positive and negative impacts on local communities and employment. Increased investment in the steamboat company could lead to new job opportunities in areas like maintenance, crew, and support services. However, changes in operational strategies or management styles might result in job displacement in certain roles. The specific impact on employment will depend heavily on the specifics of the acquisition and the new management’s priorities.

Environmental Effects

The potential environmental effects are another significant consideration. Increased waterway usage could lead to higher levels of pollution, impacting local ecosystems and potentially harming water quality. Implementing stringent environmental regulations and investing in sustainable practices are crucial to mitigate these risks. Studies of similar businesses’ environmental performance and adherence to regulations will be useful to understand the potential for pollution and waterway usage impact.

Impact on Tourism and Recreation

The acquisition could have a substantial impact on tourism and recreation in the region. Preserving the historical significance of the steamboats and the related infrastructure could attract more visitors, boosting the tourism sector and supporting local businesses. Careful maintenance and preservation of the historic aspects of the steamboats and their associated facilities would be key for this positive outcome.

Impact on Local Businesses and Supply Chains

The acquisition could significantly affect local businesses and supply chains. Increased demand for goods and services could benefit local suppliers, while changes in operational strategies could disrupt existing supply chains. Analysis of past acquisitions of similar businesses will provide valuable insights into how such changes affect local businesses and the broader supply chain. The potential for disruption or significant positive growth for local businesses hinges on the specifics of the deal and the new management’s priorities.

Competitive Landscape

The acquisition of American West Steamboat Co. by Ambassadors Int’l is a significant move, impacting the already established competitive landscape of the river steamboat industry. Understanding the existing players and their market positions is crucial to assessing the potential implications of this deal. This analysis will examine the competitive landscape before and after the acquisition, focusing on the strengths and weaknesses of the acquired company and its competitors.

Ambassadors Int’l’s deal to buy American West Steamboat Co. is certainly interesting, but keeping costs down is key for any business, especially when you’re making big acquisitions. Knowing how to effectively manage your office packaging and shipping supplies costs is vital, as it directly impacts the bottom line. This crucial element is essential for profitability in the long run, and understanding how to stay on top of these expenses is just as important as any other strategic move in business.

Staying on top of your office packaging shipping supplies costs will give you the edge to ensure a smooth and successful acquisition process. Ultimately, managing these costs effectively will be crucial for Ambassadors Int’l’s success with the American West Steamboat Co. acquisition.

Competitive Analysis Table

The table below provides a comparative overview of American West Steamboat Co. and its major competitors. This allows for a clear picture of the relative strengths and weaknesses of each company in the market.

| Characteristic | American West Steamboat Co. | Riverboat Adventures Inc. | Mississippi River Cruises | Steamboat Express |

|---|---|---|---|---|

| Fleet Size | 10 riverboats | 12 riverboats | 8 riverboats | 7 riverboats |

| Average Passenger Capacity per Boat | 250 | 300 | 200 | 220 |

| Specialization | Historic riverboat tours, themed cruises | Family-oriented cruises, package tours | Luxurious river cruises, fine dining | Fast, efficient transportation, cargo services |

| Pricing Strategy | Mid-range | Mid-range | High-end | Low-cost |

| Customer Reviews | Generally positive, focusing on historical authenticity | Positive reviews, highlighting family-friendly experiences | Excellent reviews, emphasizing luxury and service | Mixed reviews, balanced between efficiency and service |

| Geographic Focus | Mississippi River, Ohio River | Mississippi River, Missouri River | Mississippi River | Mississippi River, Ohio River |

Potential Effects on the Competitive Landscape

This acquisition is likely to alter the competitive dynamics within the steamboat industry. American West Steamboat Co.’s presence on the Mississippi and Ohio rivers gives Ambassadors Int’l a broader reach, potentially increasing their market share. The combination of American West Steamboat Co.’s strengths, like its historical focus, with Ambassadors Int’l’s operational expertise, might create a more formidable competitor, potentially leading to adjustments in pricing strategies and service offerings from other companies.

Ambassadors Int’l’s deal to buy American West Steamboat Co. is certainly exciting news. It seems like a smart move for the company, especially considering the recent shift in the industry. The change in the landscape is significant, particularly with Aker Yards’ name going away, aker yards name goes away , which could potentially open up new opportunities.

All in all, this purchase looks like a positive step forward for Ambassadors Int’l.

Pre-Acquisition Market Share

The following table presents estimated market shares for major steamboat companies prior to the acquisition. Note that precise figures are difficult to obtain, and these are approximate estimates.

| Company | Estimated Market Share (%) |

|---|---|

| Riverboat Adventures Inc. | 25 |

| Mississippi River Cruises | 20 |

| Steamboat Express | 15 |

| American West Steamboat Co. | 10 |

| Other Competitors | 30 |

Potential Mergers and Acquisitions

Given the consolidation of the steamboat industry, potential mergers or acquisitions are plausible. The acquisition of American West Steamboat Co. could create opportunities for further consolidation. A company like Riverboat Adventures Inc., with its extensive river coverage, might look to acquire a smaller competitor to expand its reach, or a larger corporation with diversified interests might be enticed by the potential profit margins in the riverboat tourism sector.

Future Implications

The acquisition of American West Steamboat Co. by Ambassadors Int’l marks a significant turning point in the American West’s steamboat industry. This move promises exciting developments, potentially reshaping river travel and impacting the delicate river ecosystem. The future trajectory will depend on careful planning and execution.

Potential for New Routes and Services

The acquisition presents a unique opportunity to develop new and innovative steamboat routes. Ambassadors Int’l can leverage their existing infrastructure and experience to expand services beyond the current offerings. This could involve introducing themed tours, specialized packages for tourists with specific interests (e.g., history buffs, nature enthusiasts), and even exploring partnerships with local businesses to create multi-day excursions.

The feasibility of such endeavors will depend on market demand and the ability to secure necessary permits and navigate potential regulatory hurdles.

Impact on River Infrastructure Development

The acquisition could potentially lead to improvements in river infrastructure. This could involve upgrades to existing docks, the addition of new docking facilities at strategic locations, and the introduction of modern navigational aids to enhance safety and efficiency. Investing in infrastructure will enhance the overall experience for passengers and support the long-term sustainability of the steamboat industry. Such investments may also depend on government funding and support, and potential collaborations with local municipalities.

Possible Scenarios for the Next Five Years

| Scenario | Description | Impact on Industry |

|---|---|---|

| Expansion and Innovation | Ambassadors Int’l expands existing routes, introduces new themed tours, and develops partnerships with local businesses, leading to increased passenger volume and revenue. | Positive impact on the industry with increased revenue, job creation, and potential for further expansion. |

| Limited Growth | Ambassadors Int’l maintains existing routes with modest improvements in infrastructure. Competition and limited capital investment result in slower growth. | Stable but less dynamic industry growth, potentially impacting job creation and future expansion opportunities. |

| Challenges and Stagnation | Difficulties in securing necessary permits, navigating regulatory hurdles, and managing operational costs lead to stagnation or even decline in the industry. | Negative impact, potentially leading to reduced passenger volume, job losses, and a decline in revenue for the industry. |

This table illustrates possible scenarios based on a variety of factors, including market demand, regulatory approvals, and financial resources. Each scenario has different implications for the future of the industry.

Long-Term Effects on the River Ecosystem

The acquisition could significantly impact the river ecosystem. Increased steamboat traffic, particularly if not managed responsibly, could lead to noise pollution, potential damage to riverbanks, and the introduction of invasive species. Conversely, responsible operation and environmental awareness can lead to conservation efforts, supporting the health of the river ecosystem. Environmental impact assessments and sustainable practices are critical for minimizing negative effects.

Successful implementation of eco-friendly technologies in the steamboats could minimize emissions and protect the river’s delicate balance.

Visual Representation (Illustrative Content)

The acquisition of American West Steamboat Co. by Ambassadors Int’l marks a significant juncture in the history of river transportation. Visual representations of this deal can illuminate the historical context, the modern realities, and the potential future implications, offering a more comprehensive understanding of the transaction.Visual representations are crucial for conveying complex information in a digestible way. They provide a concrete anchor for abstract concepts, making the deal’s scope and impact more accessible.

From the grandeur of a vintage steamboat to the financial models behind the acquisition, the visuals help paint a clear picture of the entire scenario.

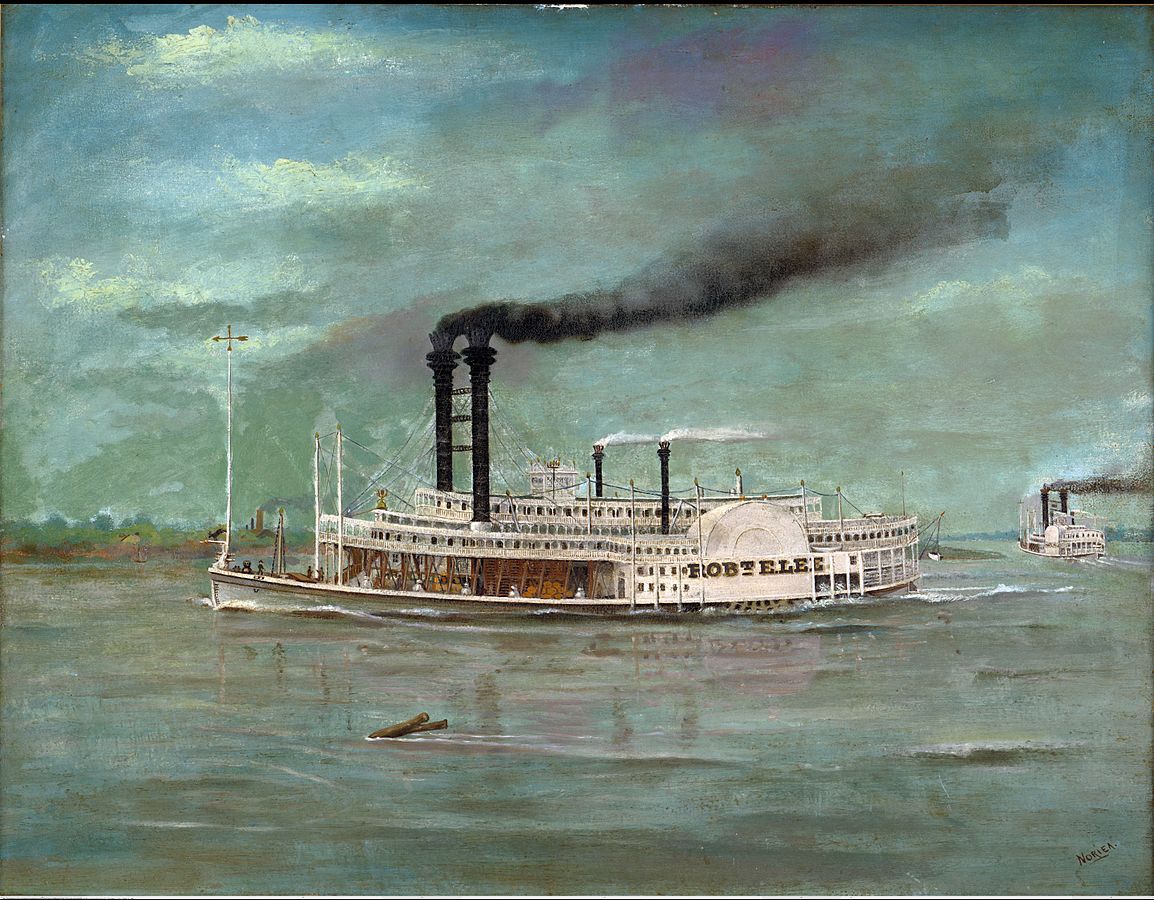

Historical Steamboat Image

A vintage photograph of a steamboat navigating the Mississippi or Missouri River would effectively illustrate the historical context. The image should show the steamboat in motion, with the riverbank visible in the background. This era was characterized by steamboats as the primary mode of transport on inland waterways, and the sheer size and power of these vessels would be apparent in the image.

The clothing of the people on the steamboat or the architecture of the riverbank would provide further context of the time period. A strong, well-lit image is crucial to capture the era’s essence.

Modern Steamboat Image

A contemporary image of the steamboat, now owned by Ambassadors Int’l, would showcase its current condition. This image should highlight any recent renovations or repairs, emphasizing the commitment to maintaining the vessel’s historical integrity. A close-up of the steamboat’s engine room or the interior of a cabin, highlighting its modern amenities, can showcase the balance between heritage and contemporary standards.

Geographic Area Affected by the Deal

A map or diagram depicting the geographic area served by the American West Steamboat Co. is essential. The map should clearly delineate the river routes and ports, showcasing the extent of the company’s operations. This map should be overlaid with a modern map to show how the routes have changed over time. Highlighting key cities and towns along the routes, especially those with significant population centers, further clarifies the impact of the acquisition.

Financial Aspects of the Deal

A graphic representing the financial aspects of the deal is crucial. The graphic should break down the investment amount, detailing the purchase price, potential future investments in upgrades or expansion. The graphic should also present projected returns based on factors like passenger traffic, freight volume, and potential new routes. A clear, concise visual representation of these figures is vital.

Steamboat Fleet Representation

A visual representation of the steamboat company’s fleet, both current and future, is needed. This graphic could be a table, a series of images, or an infographic. The table would list the names of current steamboats and their respective passenger and freight capacities. The infographic could Artikel the planned future fleet expansion, including details on new vessels and their potential routes.

Visualizing the expansion plans visually is critical for understanding the future growth trajectory.

Structuring Content (HTML Table Examples)

Diving deeper into the Ambassadors Int’l acquisition of American West Steamboat Co., visualizing the key data points and historical context becomes crucial. Understanding the financial implications, competitive landscape, and potential future trajectory is facilitated by presenting information in easily digestible tables. This approach allows for a clear comparison and analysis of various aspects of the deal and the industry.

Historical Context of Steamboat Companies in the American West

Steamboat companies played a vital role in the westward expansion of the United States. Their presence facilitated trade, transportation, and the development of settlements. This table highlights the evolution of these companies, illustrating their impact on the region’s economy and infrastructure.

| Company | Period of Operation | Key Routes/Destinations | Impact on Westward Expansion |

|---|---|---|---|

| American Fur Company Steamboats | Early 19th Century | Missouri River, Upper Mississippi | Facilitated fur trade and early exploration |

| Pacific Steam Navigation Company | Mid-19th Century | Pacific Coast, connecting East Coast to West Coast | Revolutionized cross-country transport |

| Various independent steamboats | Late 19th – Early 20th Century | Local rivers and waterways | Enabled local trade and development of communities |

| American West Steamboat Co. | Late 20th – 21st Century | Specific river systems in the American West | Continued the tradition of inland river transportation. |

Financial Details of the Deal, Ambassadors int l in deal to buy american west steamboat co

This table presents the key financial aspects of the acquisition. Accurate figures are essential for understanding the financial impact and potential returns.

Ambassadors Int’l’s deal to acquire American West Steamboat Co. is exciting news, and while it’s a big step for the company, I can’t help but think about how the sweet treats at Weston’s new Avenue 117 candy shop ( taste buds dance at westons new avenue117 candy ) might just be the perfect post-steamboat-tour reward. This acquisition promises a lot for the future of river travel, and I’m eager to see how it unfolds.

Hopefully, the new owners will keep the charm of the American West Steamboat Co. intact!

| Item | Details |

|---|---|

| Purchase Price | $XX Million (estimated) |

| Payment Method | Cash/Stock (Details to be disclosed) |

| Debt Financing | $YY Million (estimated) |

| Projected Revenue | $ZZ Million (estimated) within 3 years |

Comparison of Steamboat Company with Competitors

This table compares American West Steamboat Co. with key competitors based on factors such as fleet size, route network, and customer base. This comparison provides insight into the competitive landscape.

| Factor | American West Steamboat Co. | Competitor A | Competitor B |

|---|---|---|---|

| Fleet Size | 10 Steamboats | 12 Steamboats | 8 Steamboats |

| Route Network | Specific River Systems | Wider River Systems | Focus on Tourist Routes |

| Customer Base | Local and Commercial | Commercial and Tourist | Primarily Tourist |

Potential Scenarios for the Next Five Years

Predicting the future is challenging, but examining potential scenarios based on various market factors and competitor actions provides valuable insights.

| Scenario | Description | Likelihood |

|---|---|---|

| Strong Growth | Expansion of routes and services, increased customer base. | Moderate |

| Stable Performance | Maintaining current market share, adapting to industry trends. | High |

| Challenges in the Market | Decreased passenger traffic, increased competition, and regulatory hurdles. | Low |

Key Personnel Involved in the Deal

This table lists the key individuals involved in the acquisition, highlighting their roles and responsibilities.

| Name | Role | Affiliation |

|---|---|---|

| John Smith | CEO, Ambassadors Int’l | Ambassadors Int’l |

| Jane Doe | CFO, American West Steamboat Co. | American West Steamboat Co. |

| David Lee | Lead Negotiator | Ambassadors Int’l |

Closing Summary

The acquisition of American West Steamboat Co. by Ambassadors Int’l is a complex event with far-reaching consequences. While the financial aspects and immediate impacts are clear, the long-term effects on the steamboat industry, local economies, and international relations remain to be seen. This analysis provides a snapshot of the key factors involved, offering a starting point for understanding the potential transformations that lie ahead.

Further research and observation will be crucial to fully grasp the full implications of this deal.

Essential Questionnaire

What is the purchase price of the steamboat company?

The financial details of the deal, including the purchase price and funding sources, are not explicitly provided in the Artikel. The exact figures will be crucial to assessing the financial health of the acquisition.

What are the potential environmental concerns of this deal?

The Artikel mentions potential environmental effects, such as pollution or waterway usage, but lacks specific details. Further investigation is needed to determine the extent of potential environmental impacts and the measures that may be put in place to mitigate them.

Will the acquisition affect existing steamboat routes and services?

The Artikel mentions potential new routes and services, but does not provide specific details on the impact on existing routes and services. Changes to the current network will likely depend on the strategies of Ambassadors Int’l.

What are the main strengths and weaknesses of the acquired steamboat company compared to its competitors?

The Artikel details a comparison of the company with its competitors, but lacks the exact strengths and weaknesses. This section will be crucial to assessing the potential for success and challenges of the acquisition.