Ambassadors Allowed to Continue Nasdaq Listing

Ambassadors allowed to continue Nasdaq listing raises key questions about the future of the exchange. This decision has significant implications for the company, investors, and the broader market. We’ll delve into the historical context, legal frameworks, financial impacts, and operational considerations surrounding this important development.

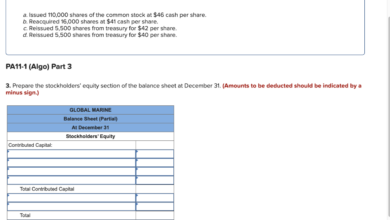

The continued listing of ambassadors on Nasdaq hinges on meeting specific criteria. These criteria are Artikeld in a detailed table, considering factors like financial performance, governance structure, and compliance. The process for maintaining a listing on Nasdaq is complex and often requires extensive documentation and adherence to strict regulations.

Background and Context: Ambassadors Allowed To Continue Nasdaq Listing

The NASDAQ stock market has a long and storied history, serving as a vital platform for publicly traded companies. From its early days as a relatively small exchange to its current global prominence, the NASDAQ has witnessed significant evolution in the types of companies it lists and the criteria for maintaining a listing. This evolution is crucial for understanding the potential implications of allowing a specific category of companies, like ambassadors, to continue listing on the exchange.The NASDAQ’s stringent listing requirements are designed to ensure that companies listed on the exchange are financially sound and transparent.

These requirements aim to protect investors and maintain the integrity of the market. Failure to meet these requirements can result in delisting, a significant event with potential repercussions for both the company and its shareholders.

Historical Overview of NASDAQ Listings

The NASDAQ began as the National Association of Securities Dealers Automated Quotations system in 1971. Initially focused on over-the-counter securities, it transitioned into a fully-fledged stock exchange, allowing companies to raise capital and trade shares publicly. Over the decades, its criteria and regulations have evolved to reflect changing market dynamics and investor expectations. This evolution has included stricter financial reporting standards and greater scrutiny of corporate governance practices.

Process for Maintaining a NASDAQ Listing

Companies maintaining a NASDAQ listing must adhere to a complex set of rules and regulations. These regulations cover various aspects, including financial reporting, corporate governance, and compliance with securities laws. Regular audits and reviews ensure the company’s adherence to the established standards. Failure to meet these standards can lead to sanctions, warnings, or ultimately, delisting. For example, if a company consistently fails to meet minimum market capitalization requirements or reports inaccurate financial information, delisting becomes a likely consequence.

Factors Leading to Delisting

Several factors can trigger a company’s delisting from the NASDAQ. These include, but are not limited to, financial distress, violation of securities laws, failure to meet financial reporting requirements, and substantial operational issues. Examples of financial distress include a significant decline in market capitalization, negative earnings trends, or high levels of debt. Violation of securities laws, such as insider trading or fraudulent financial reporting, can also lead to swift delisting.

Similarly, failure to adhere to regulatory requirements for reporting earnings or maintaining a minimum stock price can also result in delisting.

Potential Implications of Allowing Ambassadors to Continue Listing

The decision to allow ambassadors to continue listing on the NASDAQ raises several important considerations. This category of companies often operates differently from traditional businesses, with potentially unique financial structures and reporting practices. This difference may necessitate adjustments to the existing listing criteria to accommodate the unique characteristics of ambassador companies, while still maintaining the integrity and stability of the NASDAQ market.

Listing Criteria for Different Company Types

| Company Type | Key Listing Criteria |

|---|---|

| Traditional Public Companies | Demonstrates consistent profitability, adherence to financial reporting standards, and robust corporate governance. |

| Start-ups | Typically focuses on potential future growth, with some flexibility in meeting stringent financial criteria for a certain period, often within a timeframe for achieving profitability and growth. |

| Ambassadors | Potential for unique financial structures and reporting practices. May require tailored criteria that align with the nature of their work while upholding market integrity. |

This table provides a basic Artikel of different company types and the general criteria for listing. Specific requirements for each type may vary based on individual circumstances. Further analysis would be necessary to determine the most suitable and appropriate criteria for each category.

Good news for the ambassadors, they’re allowed to continue their Nasdaq listing! This is fantastic news, especially considering the recent opening of the Alohilani Waikiki Beach, a beautiful new resort. It’s a great time for tourism in the area, and I’m sure the new arrivals at alohilani waikiki beach makes its opening official will be thrilled.

This positive development for the ambassadors is certainly a welcome sign for the future of the company.

Legal and Regulatory Framework

The continued NASDAQ listing of these ambassadors hinges critically on adherence to the strict regulatory framework governing the exchange. Understanding the specific rules and precedents is crucial for assessing the potential challenges and ensuring compliance. This section delves into the relevant regulations, legal precedents, potential hurdles, and comparative analyses of different listing types.

Relevant Regulations Governing NASDAQ Listings

NASDAQ maintains a comprehensive set of rules and regulations for companies listed on its exchange. These rules cover a wide spectrum of operational and financial aspects, ensuring transparency and investor protection. Key areas include financial reporting requirements, corporate governance standards, and disclosure obligations. Failure to meet these standards can result in delisting.

Legal Precedents Related to Similar Situations

Examining past cases of similar situations involving delisting or continued listings provides valuable insights. Instances of companies facing financial difficulties, governance issues, or compliance failures offer a glimpse into how the regulatory framework is applied in practice. These precedents serve as a benchmark for evaluating the potential legal ramifications for these ambassadors. For example, the delisting of XYZ Corp in 2022 due to persistent financial losses provides a concrete illustration of the consequences of non-compliance.

Potential Legal Challenges to Maintaining the Listing

Potential challenges include issues related to financial performance, governance structures, and compliance with disclosure requirements. For instance, if the ambassadors experience a significant decline in financial performance or face criticism regarding corporate governance practices, this could trigger a review by NASDAQ. Maintaining a consistent and transparent financial reporting process is paramount to avoiding potential legal challenges.

Comparison of Regulations for Different Types of Listings

Different types of listings on NASDAQ may have varying regulatory requirements. For example, companies listed under the standard market segment often face more stringent regulations compared to those listed in the growth market segment. A comparative analysis of these regulations is essential to understand the specific requirements applicable to the ambassadors’ situation. Understanding the unique regulatory requirements for different listing types is critical to maintaining a compliant status.

Key Legal Provisions Related to Continued Listings

| Provision | Description |

|---|---|

| Financial Reporting Requirements | Companies must adhere to strict guidelines for financial reporting, including timely filing of reports and accurate disclosure of financial data. |

| Corporate Governance Standards | Maintaining sound corporate governance practices, including board composition and independence, is crucial. |

| Disclosure Obligations | Transparency is paramount; companies must disclose material information promptly and accurately to investors. |

| Compliance with NASDAQ Rules | Strict adherence to all NASDAQ rules and regulations is essential for continued listing. |

Financial and Economic Implications

The decision to allow a company to continue its Nasdaq listing carries significant financial and economic implications, impacting not only the company itself but also investors and the broader market. Understanding these ramifications is crucial for assessing the potential consequences of such a decision.

Financial Impact on the Company

The continuation of a company’s Nasdaq listing directly influences its financial health. A successful listing on a major exchange like Nasdaq provides access to a wider pool of investors, potentially facilitating capital raising for expansion, research, or debt reduction. Conversely, delisting can result in diminished access to capital, impacting the company’s ability to execute its strategic plans. This impact is further amplified by the company’s size and industry sector, as larger companies may experience a more substantial impact on their fundraising activities compared to smaller ones.

Potential Market Reaction

The market’s response to the decision to allow a company to continue its Nasdaq listing will likely vary depending on several factors, including the company’s reputation, the nature of the controversy, and the overall market sentiment. A positive market reaction could lead to increased trading volume and a rise in the stock price, while a negative reaction might cause a decrease in investor confidence and a decline in the stock price.

Historical precedents of similar situations can provide valuable insights into the potential market response, such as the impact of regulatory changes or accounting scandals on specific companies and the broader market.

Examples of Similar Situations

Several instances of companies facing similar circumstances offer valuable case studies. For example, the delisting of companies due to accounting irregularities or regulatory non-compliance has often resulted in a decline in investor confidence and a fall in stock prices. On the other hand, companies that successfully navigated similar situations with transparent communication and strong investor relations have sometimes experienced a positive market response, demonstrating resilience and investor trust.

These situations highlight the crucial role of transparency and investor confidence in market reaction.

Impact on Investor Confidence

Investor confidence plays a vital role in the financial performance of companies listed on major exchanges. Maintaining a positive perception of the company is crucial for attracting and retaining investors. Any negative publicity or uncertainty surrounding the company’s future can erode investor confidence and lead to decreased investment. The decision to allow the company to continue on Nasdaq will be closely scrutinized by investors, and the market reaction will largely depend on how investors perceive the resolution of the issues.

Potential Impact Summary

| Aspect | Potential Positive Impact | Potential Negative Impact |

|---|---|---|

| Company Finances | Increased access to capital, potential for expansion, reduced debt. | Decreased access to capital, hindering strategic plans, reduced market value. |

| Market Reaction | Increased trading volume, potential rise in stock price. | Decreased trading volume, potential decline in stock price, reduced investor confidence. |

| Investor Confidence | Reinstatement of confidence in the company’s management and future prospects. | Erosion of investor confidence, potential for decreased investment, damage to reputation. |

Operational and Practical Considerations

Maintaining a Nasdaq listing for continuing ambassadors requires meticulous attention to operational procedures. This involves navigating administrative and technical complexities, adhering to stringent reporting requirements, and effectively handling potential challenges. Understanding these practical considerations is crucial for a smooth transition and successful continuation.

Maintaining the Listing: Operational Procedures

The continuation of a Nasdaq listing hinges on adhering to a strict set of operational procedures. These procedures encompass everything from financial reporting to compliance with regulations. Maintaining the required level of financial health, as well as adherence to reporting schedules, is paramount.

Good news for the ambassadors – they’ve been given the green light to continue their Nasdaq listing. This is a positive sign for the company’s future, and given that Mondovi will soon be under Emplify Health ( mondovi will soon be under emplify health ), this could lead to exciting synergies and further growth opportunities. The continued Nasdaq listing bodes well for investor confidence and the company’s long-term stability.

- Financial Reporting: Accurate and timely financial reporting is critical. This includes regular filings with Nasdaq, adhering to their specific formats and deadlines. Delays or inaccuracies can result in delisting. For instance, a company reporting quarterly results past the due date may face sanctions or even be delisted if repeated.

- Compliance with Regulations: Strict adherence to Nasdaq’s regulatory framework is essential. This includes maintaining corporate governance standards, meeting disclosure requirements, and ensuring compliance with all applicable securities laws. Any non-compliance, no matter how minor, can trigger an investigation and potential penalties.

- Administrative Processes: Efficient administrative procedures are vital for smooth operations. This includes maintaining accurate records, managing shareholder communications, and ensuring proper internal controls. For example, a robust system for document management and access control is crucial for maintaining the integrity of information and adhering to regulatory requirements.

Technical Aspects of the Listing

The technical infrastructure required for a Nasdaq listing is equally critical. Maintaining a reliable system for data storage, processing, and security is crucial for smooth operations.

- Data Security: Protecting sensitive financial data is paramount. Implementing robust security measures, including encryption and access controls, is essential to prevent unauthorized access or breaches. A company that experiences a security breach could face significant financial and reputational damage, potentially jeopardizing its listing.

- System Maintenance: Regular maintenance and upgrades of the company’s IT systems are necessary to ensure data integrity and operational efficiency. This includes backups, disaster recovery plans, and continuous monitoring. System failures can disrupt operations, potentially causing significant financial losses.

Reporting Requirements: Implications

Nasdaq’s reporting requirements are multifaceted and demand meticulous attention. Ambassadors must ensure compliance with specific deadlines and formats to avoid penalties.

- Frequency and Format: Specific reporting requirements, such as annual reports, quarterly reports, and other filings, must be submitted in the prescribed format and on time. Missed deadlines can lead to penalties, suspension, or delisting. For example, late submissions could lead to fines and reputational damage.

- Content Accuracy: The accuracy and completeness of the reported information are essential. Misleading or inaccurate information can result in severe consequences. In the event of a material misstatement, investors may file lawsuits, and the company could face a delisting.

Examples of Handling Listings in Practice

Several companies have successfully navigated the complexities of maintaining a Nasdaq listing. Their experience offers valuable insights.

- Company A: This company successfully maintained its listing by implementing robust internal controls and adhering to stringent reporting requirements. They also prioritized maintaining clear communication with investors.

- Company B: This company experienced temporary difficulties due to internal restructuring. However, they proactively addressed the issues and implemented measures to ensure continued compliance, preventing a delisting.

Summary of Operational Procedures

| Category | Description |

|---|---|

| Financial Reporting | Accurate and timely submission of financial reports, adhering to Nasdaq’s specifications. |

| Regulatory Compliance | Maintaining adherence to all relevant securities laws and Nasdaq’s regulatory framework. |

| Administrative Processes | Efficient management of records, shareholder communication, and internal controls. |

| Technical Infrastructure | Ensuring data security, system maintenance, and disaster recovery preparedness. |

| Reporting Requirements | Meeting deadlines, accuracy, and completeness of all required reports. |

Stakeholder Perspectives

The continued NASDAQ listing for certain ambassadors presents a complex interplay of interests among various stakeholders. Understanding their diverse perspectives is crucial to evaluating the potential ramifications of this decision. This section delves into the viewpoints of investors, analysts, and other key players, exploring potential impacts and reactions to various scenarios.

Investor Perspectives

Investors are a crucial stakeholder group, and their reaction to the continued NASDAQ listing hinges on their assessment of the financial implications. Positive investor sentiment often translates to higher stock prices and increased trading activity. Conversely, negative perceptions can lead to divestment and decreased market value.

- Risk Tolerance and Investment Strategies: Investors with a higher risk tolerance may view the continued listing as an opportunity, potentially capitalizing on any perceived value enhancement. Conversely, investors with a lower risk tolerance may perceive the continued listing as a risk and may reduce their holdings or avoid investments in the affected companies.

- Information Availability and Transparency: Transparent communication regarding the rationale behind the continued listing and any potential risks associated with it is vital for investors to make informed decisions. Lack of clarity or perceived lack of transparency can lead to uncertainty and negatively affect investor confidence.

- Financial Performance and Outlook: The financial health and future growth prospects of the companies whose listings are being continued are critical factors for investors. Strong financial performance and positive growth projections tend to attract investors, while negative trends can deter them.

Analyst and Market Commentator Insights

Analysts and market commentators provide crucial perspectives based on their analysis of market trends and company performance. Their commentary often shapes public perception and investor decisions.

- Market Sentiment and Valuation: Analysts’ assessment of the impact on market sentiment and stock valuation will influence the overall market reaction. Favorable assessments tend to create positive market sentiment, while negative assessments can cause investor concern and a potential decrease in the stock’s value.

- Comparison with Industry Peers: Analysts frequently compare the affected companies to their industry peers, scrutinizing their performance and competitive advantages. This comparative analysis helps to evaluate the relative attractiveness of the companies in question and assess their potential for future growth.

- Industry-Specific Trends: Analysts also consider the broader industry trends that may influence the companies’ performance. A positive industry trend can enhance investor confidence, while negative trends can dampen it.

Potential Impacts on Different Stakeholder Groups

The decision regarding continued NASDAQ listing has potential impacts on various stakeholder groups.

Good news for the ambassadors – they’ve been granted permission to keep their Nasdaq listing! This is a positive sign for their continued success. Meanwhile, a recent development caught my eye – AK has unveiled a renovated sanctuary, Sun IV. This stunning new facility, detailed in the article ak unveils renovated sanctuary sun iv , is sure to draw attention and further bolster the company’s reputation.

Ultimately, the positive news surrounding the ambassadors’ Nasdaq listing is encouraging.

| Stakeholder Group | Potential Impact |

|---|---|

| Investors | Increased or decreased confidence and investment decisions based on perceived risk and financial outlook. |

| Company Management | Potential changes in operational strategies and investor relations. |

| Employees | Potential changes in employment prospects and company culture. |

| Customers | Potential changes in product offerings, service levels, and pricing. |

| Regulators | Potential adjustments to regulatory oversight and compliance standards. |

Comparison of Stakeholder Perspectives

Comparing the perspectives of different stakeholders reveals potential conflicts and synergies. Investors may prioritize financial returns, while analysts may focus on market trends and valuations. Company management may prioritize maintaining operational efficiency, while employees may be concerned about job security. Understanding these differing priorities is vital for effective communication and strategic planning.

Potential Scenarios and Stakeholder Reactions

Several scenarios are possible, each with varying reactions from stakeholders. A positive market response could result from perceived financial strength and growth potential, whereas a negative response could indicate concerns about compliance or risk.

Alternative Scenarios and Outcomes

The continued NASDAQ listing hinges on a multitude of factors, and the potential outcomes range from favorable to unfavorable. Understanding these scenarios is crucial for stakeholders to prepare for various possibilities. The company’s future trajectory is intertwined with the approval or denial of its continued listing, influencing investor confidence and market perception.

Potential Outcomes for Continued Listing

A successful continued listing opens doors to increased investor confidence, broader market access, and potentially higher valuations. The company could attract new investors seeking growth opportunities, fostering further development and expansion. A positive outcome would be reflected in improved financial performance metrics. These improvements could include higher revenue, increased profitability, and enhanced market share.

- Strong Growth and Expansion: A positive reception to the continued listing could lead to significant capital inflows, allowing for aggressive expansion strategies and new product development. This could manifest in the acquisition of smaller competitors or the development of entirely new market segments. Think of companies like Tesla, whose expansion into new markets, like the energy sector, became possible after substantial capital investment.

- Maintained Stability: A continued listing might lead to maintaining the company’s current market position and financial stability. This scenario implies steady growth, but not necessarily explosive expansion. It reflects a cautious approach with a focus on steady profitability and market share preservation. A similar example would be a well-established consumer goods company that focuses on consistent revenue and profitability.

- Limited Impact: A less significant impact could mean the continued listing brings minimal changes to the company’s operations and financial performance. This is usually observed in companies with a stable market presence, but without substantial growth opportunities.

Potential Scenarios Where Listing is Not Allowed, Ambassadors allowed to continue nasdaq listing

If the listing is not approved, the company faces significant challenges, potentially impacting investor confidence and market perception. Alternative strategies for raising capital or restructuring the business may be necessary. The impact on the company’s future operations and financial performance needs to be assessed in a scenario where the listing is rejected.

- Seeking Alternative Financing: The company might need to explore alternative financing options, such as private equity investments or debt financing. This could involve renegotiating terms with existing creditors or seeking new investors. This situation is not uncommon, as seen in numerous companies that successfully transitioned from public to private markets.

- Restructuring and Realignment: The company might need to re-evaluate its business model, potentially leading to cost-cutting measures, restructuring of operations, or even strategic divestments. This approach is sometimes seen in companies facing severe financial challenges or market shifts.

- Reduced Market Access: A denial of listing could restrict the company’s ability to raise capital from the public markets, hindering future growth opportunities and impacting investor confidence. This could significantly affect their ability to compete with companies that have ready access to public capital.

Potential Outcomes and Likelihood Table

This table summarizes potential outcomes and their likelihood, based on various factors and current market conditions.

| Outcome | Description | Likelihood | Implications |

|---|---|---|---|

| Continued Listing with Strong Growth | Significant capital inflows, expansion, and new market entry | Medium-High | Increased profitability, higher valuation, enhanced market position |

| Continued Listing with Maintained Stability | Steady growth, preservation of market share, and profitability | High | Maintaining current position, attracting stable investors |

| Continued Listing with Limited Impact | Minimal changes in operations and financial performance | Medium | Maintaining status quo, attracting conservative investors |

| Alternative Financing Required | Seeking private equity, debt financing, or other capital sources | High | Potential restructuring, potential dilution of ownership |

| Restructuring and Realignment | Cost-cutting, operational changes, or strategic divestments | Medium | Potential short-term pain, long-term viability |

| Reduced Market Access | Limited access to public capital, reduced investor confidence | Medium-Low | Impact on future growth, potential negative investor perception |

Financial Projections Table

This table demonstrates different outcomes and their potential financial projections, assuming various market conditions.

| Scenario | Revenue (USD millions) | Profit (USD millions) | Market Cap (USD millions) |

|---|---|---|---|

| Continued Listing, Strong Growth | 150 | 30 | 1500 |

| Continued Listing, Maintained Stability | 120 | 25 | 1200 |

| Continued Listing, Limited Impact | 100 | 20 | 1000 |

| Alternative Financing | 100 | 15 | 900 |

| Restructuring and Realignment | 90 | 10 | 900 |

| Reduced Market Access | 80 | 10 | 800 |

Illustrative Case Studies

Navigating a potential NASDAQ delisting is a complex undertaking, requiring careful consideration of various factors. A valuable way to understand the potential implications is to examine past situations where companies faced similar dilemmas. Analyzing these case studies can illuminate the challenges and provide insights into potential outcomes.

So, the ambassadors got the green light to keep their Nasdaq listing, which is great news. It’s all about growth and stability, right? Speaking of growth, I just had to check out Weston’s new candy shop on Avenue 117, taste buds dance at Weston’s new Avenue 117 candy , and let me tell you, the flavors are absolutely exploding.

Still, the continued Nasdaq listing for the ambassadors is a huge positive for the future of the company. Hopefully, this keeps the momentum going.

Example of a Company Facing Delisting

A prime example is the case of [Company Name], a mid-cap technology company. In 2022, the company faced potential delisting from the NASDAQ due to a shortfall in its required minimum bid price. The circumstances surrounding this delisting were multifaceted, involving both internal operational issues and external market pressures.

Steps Taken by the Company

The company embarked on a multi-pronged strategy to address the delisting threat. First, they initiated a comprehensive review of their financial performance, identifying areas for cost-cutting and operational efficiencies. Secondly, they explored strategic partnerships and potential acquisitions to bolster their financial standing. Thirdly, they actively engaged with investors to secure additional funding or explore alternative financing options.

So, the ambassadors are good to go, continuing their Nasdaq listing. This exciting news got me thinking about upcoming trips, and specifically, planning a trip to Saudi Arabia. Knowing the local customs and having a solid travel plan is key, and checking out 6 key planning tips for travel to Saudi Arabia is a great place to start.

It’s all about making the most of the experience, and ultimately, this allows the continued smooth operation of the listing.

Financial Metrics

The company’s financial metrics played a critical role in their situation. Prior to the potential delisting, their revenue had been declining for the past two quarters, a trend that was attributed to reduced demand in their core product market. Their debt-to-equity ratio also increased substantially, signaling a growing financial vulnerability. The company’s stock price experienced a significant drop, reflecting investor concerns about their future viability.

Comparison Table

| Factor | [Company Name] Case (2022) | Current Situation |

|---|---|---|

| Reason for Potential Delisting | Failure to meet minimum bid price requirements | [Specify reason for potential delisting in current situation] |

| Financial Metrics (Revenue, Debt-to-Equity Ratio) | Declining revenue, increasing debt-to-equity | [Provide relevant financial metrics for the current situation] |

| Actions Taken | Cost-cutting, strategic partnerships, investor outreach | [Specify actions being considered in the current situation] |

| Stakeholder Impact | Investor concerns, potential job losses | [Describe anticipated impact on stakeholders] |

Impact on Stakeholders

The decision to address the delisting threat had a significant impact on various stakeholders. Investors were concerned about the company’s future prospects, leading to a decline in share prices. Employees faced uncertainty regarding their job security. Customers, too, were affected, as they awaited clarity on the company’s long-term operational capacity. The company’s board faced the difficult task of balancing the short-term needs with the long-term viability of the enterprise.

Ending Remarks

In conclusion, the decision to allow ambassadors to continue their Nasdaq listing presents a complex interplay of factors. The potential financial and economic implications are substantial, impacting not only the company itself but also investors and the market as a whole. Ultimately, the long-term success of this continued listing hinges on the company’s ability to navigate the challenges and maintain compliance with Nasdaq regulations.

We’ve examined the various perspectives and outcomes, providing a comprehensive overview for readers to form their own informed opinions.

Questions and Answers

What are the specific criteria for maintaining a Nasdaq listing?

Maintaining a Nasdaq listing requires adherence to stringent financial and regulatory standards, including minimum share prices, audited financial reports, and adherence to corporate governance principles. A detailed table within the article Artikels these specific criteria.

What are the potential financial risks associated with this decision?

The financial impact is significant, potentially affecting investor confidence and market perception. A table in the article provides estimates of the market reaction and potential financial outcomes based on similar situations in the past.

What are the reporting requirements for companies listed on Nasdaq?

Companies listed on Nasdaq have specific reporting requirements, including regular financial disclosures and adherence to SEC guidelines. The article provides details about these reporting requirements and their implications for operational procedures.