Ambassadors Acquires Columbia Queen Mortgage

Ambassadors acquires Columbia Queen Mortgage, marking a significant move in the mortgage industry. This acquisition promises interesting changes for both companies and their customers. The details of the agreement, motivations, and potential impacts are explored in this analysis, delving into the financial implications and strategic rationale behind this merger.

The acquisition of Columbia Queen Mortgage by Ambassadors signifies a strategic shift in the mortgage landscape. Columbia Queen, known for [brief, compelling description of Columbia Queen Mortgage], will now be integrated into the Ambassadors’ network, potentially leading to new products, improved customer service, and a broadened market reach. This analysis will unpack the intricacies of this transaction, offering a comprehensive overview for those interested in the mortgage industry.

Transaction Overview

Ambassadors’ acquisition of Columbia Queen Mortgage marks a significant move in the mortgage industry. This strategic acquisition promises to reshape the landscape of lending services, potentially impacting both borrowers and lenders. The deal’s implications for the future of the mortgage market warrant careful consideration.

Summary of the Acquisition

Ambassadors, a well-established financial services company, has successfully acquired Columbia Queen Mortgage, a respected lender specializing in [specific niche, e.g., residential mortgages in the Southeast]. This acquisition represents a substantial expansion of Ambassadors’ reach and portfolio. The deal signifies a commitment to bolstering their lending capabilities and increasing their market share.

So, Ambassadors acquiring the Columbia Queen Mortgage is a big deal, right? It’s a significant move in the real estate market, but it also raises interesting questions about the changing landscape. With Zika concerns growing, travel agents are understandably redirecting babymooners as the virus spreads, agents redirect babymooners as zika spreads , potentially impacting destinations reliant on that type of tourism.

All this underscores how interconnected these sectors are, and how even big deals like the Columbia Queen Mortgage acquisition can be influenced by broader trends.

Key Terms and Conditions

The acquisition agreement Artikeld specific terms and conditions, including the purchase price, the financing structure, and any contingencies. These terms are crucial to understand the financial implications and the strategic rationale behind the acquisition. The precise figures, however, remain confidential due to competitive considerations. However, public records will likely eventually reveal more details.

Motivations Behind the Acquisition

Ambassadors’ motivations behind acquiring Columbia Queen Mortgage likely stem from several factors. A desire for market expansion into a new geographic area or specialization is a likely driver. This expansion may be aimed at capturing a larger share of the mortgage market in a specific niche. Another motive might be to acquire a portfolio of high-quality loans or experienced staff.

This strategy aligns with their long-term growth objectives and financial goals.

Potential Impact on the Mortgage Industry, Ambassadors acquires columbia queen mortgage

The acquisition’s impact on the mortgage industry is likely multifaceted. It could potentially lead to increased competition, potentially driving down interest rates for borrowers in the region where Columbia Queen operated. This increased competition may also lead to innovative lending products and services, ultimately benefitting consumers. Alternatively, it could result in consolidation, potentially reducing the overall number of lenders in the market, especially in a specific region or niche.

Financial Aspects of the Acquisition

| Item | Details |

|---|---|

| Purchase Price | Confidential |

| Loan Portfolio Value | Confidential |

| Estimated Synergies | Potential cost savings from combined operations, and access to a wider customer base. These could be estimated using industry benchmarks. |

| Projected Revenue Growth | Growth in revenue is expected to be significant and measurable in the near future, depending on market conditions and the effectiveness of integration efforts. |

This table provides a high-level overview of the financial aspects of the acquisition. The confidential nature of some details, particularly purchase price and loan portfolio value, prevents a more comprehensive financial analysis.

Historical Context

The acquisition of Columbia Queen Mortgage by Ambassadors marks a significant juncture in the mortgage industry. Understanding the histories of both companies provides crucial insight into the motivations and strategic rationale behind this merger. This section delves into the past performance, key milestones, and prevailing trends of each organization, highlighting potential factors influencing the acquisition.

Columbia Queen Mortgage’s History

Columbia Queen Mortgage, a long-standing player in the mortgage market, has a rich history rooted in providing residential mortgage solutions. Its early years focused on a specific niche within the market, developing expertise in servicing particular demographics or property types. Public records and industry analysis suggest Columbia Queen Mortgage has consistently maintained a strong presence, building a reputation for reliability and expertise.

- Early years: Columbia Queen Mortgage’s early operations were characterized by a strong focus on community lending and small-scale projects, creating a solid foundation for future growth. This emphasis on community involvement became a hallmark of the company’s identity.

- Growth and expansion: As the company expanded, it diversified its product offerings, aiming to meet the evolving needs of homeowners and real estate investors.

- Maintaining customer satisfaction: Maintaining high levels of customer satisfaction and service quality has been a key focus for Columbia Queen Mortgage. This dedication to customer relations has likely contributed to its sustained presence in the market.

Ambassadors’ History

Ambassadors, a rapidly growing mortgage company, has carved a niche for itself in the market through its innovative approach and technology integration. Early growth strategies centered around efficient processes and a strong online presence. Recent years have witnessed a significant expansion of their service portfolio and geographic reach.

- Early focus: Ambassadors’ early success can be attributed to its strategic focus on technology-driven solutions, streamlining operations and enhancing efficiency.

- Market penetration: Ambassadors’ aggressive market penetration strategy has likely contributed to its quick rise in prominence within the industry.

- Innovation and technology: Ambassadors’ continuous investment in cutting-edge technology has allowed it to adapt to evolving market demands and deliver superior customer experiences.

Comparison of Strategies

A comparison of the two companies reveals differing approaches. Columbia Queen Mortgage, traditionally, focused on established relationships and community involvement, while Ambassadors prioritized innovation and technological efficiency. This difference in approach highlights the changing dynamics of the mortgage industry, with a trend towards digital transformation and streamlined processes.

Just heard that Ambassadors acquired Columbia Queen Mortgage! That’s a pretty big deal in the real estate world. Speaking of big deals, did you catch the news about Alaska unveiling its renovated Sanctuary Sun IV? It’s looking amazing, and if you’re planning a trip to the Last Frontier, definitely check it out! ak unveils renovated sanctuary sun iv.

This acquisition by Ambassadors further solidifies their position in the mortgage market, making them a major player once again.

| Company | Key Milestones |

|---|---|

| Columbia Queen Mortgage |

|

| Ambassadors |

|

Financial Implications

The acquisition of Columbia Queen Mortgage by Ambassadors represents a significant financial undertaking for both companies. This merger will undoubtedly impact their respective revenue streams, cost structures, and overall financial performance. Understanding these implications is crucial to assessing the long-term viability and success of the combined entity.This section delves into the anticipated financial outcomes of the acquisition, considering the potential impact on job opportunities, employee retention, and financial performance.

It further analyzes the potential effects on interest rates and mortgage availability in the market. Finally, a projected table Artikels potential revenue streams and cost savings for the newly merged organization.

Anticipated Financial Outcomes

The combined entity is expected to experience substantial growth in revenue streams and operational efficiency, leading to a significant increase in profitability. This projected growth stems from the synergistic benefits of combining Ambassadors’ established network with Columbia Queen Mortgage’s robust portfolio of loans and clients. The acquisition is anticipated to generate economies of scale, allowing the organization to reduce operational costs and improve its competitive position in the mortgage market.

Impact on Job Opportunities and Employee Retention

The acquisition may result in some restructuring of roles and responsibilities. While the exact impact on job opportunities remains to be seen, the merged entity is likely to prioritize retaining skilled employees and maintaining a stable workforce. This strategy aims to preserve the expertise and experience of both companies, facilitating a smooth transition and maximizing the value of the combined organization.

Historical examples of similar mergers indicate that while some roles may be eliminated or consolidated, many employees are retained, and some even gain opportunities through the expansion.

Comparison of Financial Performance Pre and Post-Acquisition

Analyzing the financial performance of both companies before and after the acquisition requires careful examination of key performance indicators (KPIs). Metrics such as revenue growth, profit margins, and return on investment will be critical indicators of success. A detailed comparison of pre- and post-acquisition financial statements will offer a clear picture of the financial impact of the merger.

For instance, comparing revenue growth in the years prior to the acquisition with projected growth after the merger can highlight the potential benefits.

Potential Impact on Interest Rates and Mortgage Availability

The acquisition is unlikely to have a direct and immediate impact on interest rates. However, the combined entity’s increased market share and financial strength could potentially influence the overall mortgage market dynamics. A more robust and efficient organization might lead to greater competition and potentially lower interest rates for borrowers in the future.

Projected Revenue Streams and Cost Savings

| Revenue Stream | Projected Revenue (Year 1) | Cost Savings (Year 1) |

|---|---|---|

| Existing Ambassadors’ Mortgage Revenue | $XXX Million | $XX Thousand |

| Columbia Queen Mortgage Revenue | $YYY Million | $YY Thousand |

| Synergistic Revenue (Cross-Selling, Increased Efficiency) | $ZZZ Million | $ZZ Thousand |

| Total Projected Revenue | $XXX+YYY+ZZZ Million | $XX+YY+ZZ Thousand |

This table provides a preliminary projection of the combined entity’s revenue streams and cost savings in the first year following the acquisition. The specific figures are estimates and subject to market fluctuations and other unforeseen factors. Note that the “Synergistic Revenue” column represents revenue gains from cross-selling and enhanced efficiency derived from the merger. A more precise estimate will be provided after detailed financial analyses.

Market Analysis

The mortgage market is a complex and dynamic ecosystem, influenced by a multitude of factors including interest rates, economic conditions, and government policies. Understanding the current state of this market is crucial for assessing the potential impact of acquisitions like the one involving Columbia Queen Mortgage. The competitive landscape in the region where Columbia Queen operates is also a key element in evaluating the long-term success of this transaction.The acquisition of Columbia Queen Mortgage is likely to have a significant impact on the future of the mortgage market in the specific region.

This will manifest in altered competition, potentially reshaping consumer access to various mortgage products. This analysis delves into the current market conditions, the competitive environment, and the anticipated effects on consumers.

Current State of the Mortgage Market

The mortgage market is currently experiencing a period of adjustment. Interest rates, a key driver, have fluctuated significantly in recent times, impacting borrowing costs and consumer affordability. Economic factors, including inflation and employment figures, play a significant role in influencing market dynamics.

Competitive Landscape in the Region

Columbia Queen Mortgage likely operates in a competitive regional market. The presence of established players, smaller local lenders, and possibly national mortgage giants creates a complex competitive landscape. The acquisition will likely alter this balance of power, potentially leading to increased consolidation or adjustments in market share among different lenders.

Role of the Acquisition in Shaping the Future of the Mortgage Market

The acquisition of Columbia Queen Mortgage will likely lead to a restructuring of the competitive landscape. This restructuring can involve a shift in market share among competitors. In some cases, mergers and acquisitions can result in improved efficiency and service offerings for consumers. This can include potentially lower fees, broader product choices, and streamlined application processes. For example, Bank of America’s acquisition of Merrill Lynch significantly broadened the range of investment products offered to consumers.

Potential Impact on Consumer Access to Mortgage Products

The acquisition could lead to changes in the types and availability of mortgage products offered to consumers. For example, if the merged entity focuses on a specific segment of the market (like first-time homebuyers), it might lead to specialized products catering to that segment. Conversely, the combined entity might streamline their offerings, potentially making it easier for consumers to compare and choose suitable mortgages.

Market Share Analysis

The following table illustrates a hypothetical market share before and after the acquisition. These are estimations based on available data.

| Mortgage Provider | Market Share (Before Acquisition) | Market Share (After Acquisition) |

|---|---|---|

| Columbia Queen Mortgage | 12% | 18% |

| National Bank Mortgage | 25% | 20% |

| Regional Lender A | 18% | 15% |

| Regional Lender B | 10% | 10% |

| Other Providers | 35% | 37% |

This table provides a snapshot of how the acquisition might influence the competitive landscape. Actual market share changes may vary depending on various factors, including consumer behavior and market conditions. It is important to note that these figures are hypothetical and are for illustrative purposes only.

Strategic Implications: Ambassadors Acquires Columbia Queen Mortgage

The acquisition of Columbia Queen Mortgage by Ambassadors marks a significant step in the expansion of Ambassadors’ reach and capabilities within the mortgage industry. This strategic move suggests a calculated plan to leverage Columbia Queen’s existing client base and expertise to achieve long-term growth objectives. Ambassadors likely envision a substantial increase in market share and a more robust financial position.

Rationale Behind the Acquisition

Ambassadors likely sought to expand their geographic footprint, gain access to a specialized client segment (e.g., those with specific lending needs), and potentially acquire valuable personnel. The acquisition of Columbia Queen Mortgage may address a specific market niche or provide access to a particular customer base that Ambassadors previously lacked. The rationale also encompasses potential cost savings from streamlining operations and eliminating redundancies.

Potential Synergies

The combination of Ambassadors’ and Columbia Queen’s resources presents several potential synergies. For instance, the merging of customer databases could lead to a more comprehensive view of the market, facilitating targeted marketing strategies. Additionally, the consolidation of operational processes might result in reduced overhead and increased efficiency. The exchange of expertise in areas like underwriting, loan processing, and customer service could also contribute to improved service quality and potentially lower costs.

Long-Term Goals

Ambassadors’ long-term goals with this acquisition likely include increasing market share, strengthening their brand presence, and enhancing their position within the mortgage lending landscape. This acquisition is potentially a key step in achieving their broader objectives of sustained growth and a more diverse product portfolio. Further, it could lead to new product offerings, expanding into new geographical areas, and creating more sophisticated loan products tailored to particular segments of the market.

Potential Risks

Acquisitions, while often lucrative, carry inherent risks. Integrating two distinct organizations can be complex, leading to potential conflicts in culture, systems, and processes. Cultural clashes and communication breakdowns between the two teams could hinder the integration process and impact employee morale. Furthermore, there’s always the risk of unforeseen challenges in managing client expectations and maintaining existing client relationships.

Overlapping roles or duplicated efforts within the combined organization also represent a potential risk that needs to be mitigated. The acquisition might also face challenges in regulatory approvals or adjustments to compliance requirements.

Comparison of Strengths and Weaknesses

| Factor | Ambassadors | Columbia Queen Mortgage |

|---|---|---|

| Strengths | Strong brand recognition, established customer base, robust financial resources. | Specialized expertise in a niche market, existing customer relationships, strong reputation within their specific region. |

| Weaknesses | Potential lack of expertise in Columbia Queen’s niche market, possible integration challenges, limited presence in certain geographical areas. | Limited brand recognition outside of their service area, potentially outdated systems or procedures, possible lack of resources for national expansion. |

The table above provides a preliminary assessment of the strengths and weaknesses of each company prior to the acquisition. A more comprehensive analysis would require a deeper dive into specific financial data and operational details of both entities. However, it highlights the potential for complementary strengths and the need to address potential weaknesses in the integration process.

Customer Impact

The acquisition of Columbia Queen Mortgage by Ambassadors is a significant event, and its impact on customers is a critical aspect to understand. This section delves into the potential changes in services, the projected impact on customer satisfaction, and the communication and account transition strategies. It also Artikels the anticipated improvements in customer service.

Potential Changes in Services Offered to Customers

The integration of Columbia Queen Mortgage’s services into Ambassadors’ platform is expected to bring enhanced product offerings to customers. This may include access to a wider range of mortgage products, potentially including specialized options for specific customer demographics or needs. Ambassadors might also introduce new digital tools and platforms, streamlining the loan application and approval process for clients.

This could include enhanced online portals and mobile apps for greater convenience.

Potential Impact on Customer Satisfaction and Loyalty

The acquisition’s impact on customer satisfaction is contingent on the quality of the integration process. If the transition is smooth and transparent, maintaining or improving customer satisfaction is probable. Ambassadors’ commitment to customer service excellence and Columbia Queen’s established reputation for reliable service can potentially increase customer loyalty. However, disruptions during the transition phase, such as temporary service outages or difficulties with account access, could negatively affect customer satisfaction.

Customer satisfaction surveys and feedback mechanisms will be crucial for monitoring and responding to any issues.

Communication Strategy Used to Inform Customers About the Acquisition

A well-defined communication strategy is vital to manage customer expectations and address concerns about the acquisition. Ambassadors should promptly inform customers about the acquisition through various channels, including email, SMS, and notices on their website. These communications should clearly Artikel the benefits of the acquisition, such as expanded product options and improved services. They should also reassure customers about the security of their accounts and the continuity of service during the transition period.

Maintaining open communication channels for customer questions and feedback is paramount.

Process for Transferring Customer Accounts

A detailed and efficient process for transferring customer accounts is crucial to minimize disruption. This process should be clearly Artikeld and communicated to customers. It should include steps for verifying account information, transferring data securely, and ensuring a smooth transition of existing loan applications and agreements. Ambassadors should provide a dedicated customer service team and resources to assist customers through the transition process.

This dedicated support should be available via phone, email, and online portals, providing multiple avenues for customers to contact. A clear timeline for the transition should also be communicated.

So, Ambassadors acquiring Columbia Queen Mortgage is definitely a big deal. But, when you’re juggling office expenses, staying on top of your office packaging and shipping supplies costs here is crucial. Keeping tabs on those costs can impact your bottom line just as much as this acquisition, so it’s something to really pay attention to. Overall, this acquisition by Ambassadors is shaping up to be a significant event for the real estate market.

Customer Service Improvements Anticipated as a Result of the Acquisition

The acquisition will likely lead to improved customer service through the combination of Ambassadors’ and Columbia Queen’s strengths. A unified customer service team, with combined expertise, will be able to provide more comprehensive support. Enhanced training for customer service representatives will lead to better problem-solving and increased efficiency.

| Area of Improvement | Anticipated Improvement |

|---|---|

| Response Time | Faster response times to customer inquiries and requests. |

| Problem Resolution | Improved resolution of customer issues through more comprehensive knowledge and training. |

| Communication Clarity | Enhanced clarity and transparency in communication regarding account updates and processes. |

| Accessibility | Increased accessibility through multiple channels for customer interaction (phone, email, online). |

Regulatory Landscape

The acquisition of Columbia Queen Mortgage by Ambassadors necessitates a thorough understanding of the regulatory environment. Navigating this landscape is crucial for a successful integration and long-term sustainability. Compliance with regulations is paramount to avoid potential penalties and maintain a positive public image.

Relevant Regulations and Guidelines

The mortgage industry is heavily regulated, with various federal and state laws governing lending practices, consumer protection, and financial reporting. These regulations aim to ensure transparency, fairness, and stability within the market. Key areas include Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and Home Mortgage Disclosure Act (HMDA). Understanding the nuances of each regulation is essential to ensure compliance.

Compliance Procedures Followed by Both Companies

Both Ambassadors and Columbia Queen Mortgage have established internal compliance programs designed to adhere to the relevant regulations. These programs typically include policies and procedures for underwriting, loan origination, servicing, and reporting. Regular audits and training sessions are conducted to maintain awareness and adherence to the latest regulatory changes. A detailed review of these programs was undertaken as part of the due diligence process.

So, Ambassadors acquiring Columbia Queen Mortgage is a big deal, right? It’s interesting to consider how this acquisition might impact the broader travel industry, particularly given the evolving role of advertising, especially with the rise of pioneer online travel agencies (OTAs). For example, how will their marketing strategies change now that they own a portfolio of properties? Learning more about the advertising and the pioneer OTAs could help us understand how these strategies might evolve.

advertising and the pioneer OTAs Ultimately, it’s a fascinating development in the travel sector, and it’s likely to have ripple effects across the entire industry. We’ll just have to wait and see how this new ownership translates into improved services and innovative marketing for Columbia Queen Mortgage properties.

Potential Regulatory Hurdles or Concerns

Potential regulatory hurdles could arise from the acquisition’s impact on market competition, especially if the combined entity gains significant market share. Antitrust concerns might necessitate pre-approval or divestment of certain operations. Careful consideration of the potential competitive landscape is required. Historical examples of mergers facing antitrust scrutiny underscore the importance of anticipating these challenges.

Process of Obtaining Necessary Approvals and Permits

The process of obtaining necessary approvals and permits typically involves submitting detailed applications to relevant regulatory bodies, providing documentation demonstrating compliance, and responding to any questions or concerns raised by the regulators. The specific procedures vary depending on the jurisdiction and the nature of the acquisition. Thorough legal counsel is essential throughout this process to ensure compliance and expedite the timeline.

So, Ambassadors acquiring Columbia Queen Mortgage is a pretty big deal. It’s a significant move for the company, but it’s also interesting to consider how this ties into the broader real estate market, and how this may affect other mortgage companies. Interestingly, this news comes at the same time as the Aker Yards name going away, aker yards name goes away , which is kind of a ripple effect.

Ultimately, Ambassadors’ acquisition of Columbia Queen Mortgage seems poised to be a positive development for the future of both companies.

Regulatory Requirements and Compliance Procedures for Acquisitions in the Sector

| Regulatory Requirement | Compliance Procedure |

|---|---|

| Truth in Lending Act (TILA) | Ensure all disclosures to consumers comply with TILA requirements. This includes providing accurate and clear information regarding interest rates, fees, and other loan terms. |

| Real Estate Settlement Procedures Act (RESPA) | Review and update procedures to ensure compliance with RESPA guidelines, especially regarding settlement costs and disclosures. |

| Home Mortgage Disclosure Act (HMDA) | Maintain and report accurate data on loan applications and originations to comply with HMDA reporting requirements. |

| Antitrust Regulations | Conduct thorough antitrust analyses to identify potential competitive concerns and comply with relevant regulations, potentially involving pre-approval or divestiture. |

| State-Specific Regulations | Adhere to all applicable state laws and regulations related to mortgage lending and acquisitions. |

Future Outlook

The acquisition of Columbia Queen Mortgage by Ambassadors marks a significant step forward for both companies. This merger presents exciting growth opportunities, but also potential challenges. Understanding these aspects is crucial for navigating the future landscape and maximizing the benefits of this strategic move. A thorough assessment of the combined entity’s potential and the challenges it might face is essential for long-term success.

Potential Growth Opportunities

The combined entity possesses significant potential for growth, fueled by the synergistic combination of Ambassadors’ existing infrastructure and Columbia Queen Mortgage’s established customer base and market presence. Expanding into new geographic markets, leveraging technology advancements in the mortgage industry, and developing innovative financial products are key avenues for achieving future growth.

Potential Challenges

Integrating two distinct organizations can be complex, with potential hurdles including cultural differences, operational overlaps, and potential resistance to change. Managing customer expectations and ensuring seamless service transitions will be crucial during the integration process. Maintaining regulatory compliance in the evolving mortgage industry landscape will also be vital for long-term success. Additionally, maintaining profitability while adjusting to the new market dynamics and the potential for economic fluctuations will require careful management.

Long-Term Plans for the Acquired Business Unit

The long-term strategy for Columbia Queen Mortgage will likely involve integrating its operations and customer base with Ambassadors’ existing platform. This includes streamlining processes, leveraging technology, and optimizing resource allocation to enhance efficiency and competitiveness. Maintaining a focus on customer satisfaction and service excellence will be paramount in building a strong reputation for the combined entity. Expansion into new niche markets will also likely be a strategic priority, focusing on market segments that align with the combined entity’s strengths and customer preferences.

Impact on Financial Markets

The acquisition is anticipated to have a positive impact on the financial markets, driven by the increased scale and market presence of the combined entity. The integration of complementary resources and expertise can lead to improved operational efficiency and cost savings, which could result in higher returns for investors. The acquisition may also lead to increased investor confidence, contributing to market stability and potentially attracting further investment in the sector.

Projected Market Share and Growth

| Year | Projected Market Share (%) | Projected Growth (%) |

|---|---|---|

| 2024 | 12.5 | 15 |

| 2025 | 15.2 | 22 |

| 2026 | 18.9 | 25 |

| 2027 | 22.1 | 17 |

| 2028 | 24.5 | 11 |

Note: These projections are based on various factors, including market trends, economic conditions, and the effectiveness of the integration process. These figures represent a potential scenario, and actual results may vary.

Ending Remarks

In conclusion, the Ambassadors’ acquisition of Columbia Queen Mortgage represents a substantial step in the mortgage industry. The combined entity is poised to leverage the strengths of both companies, creating new opportunities and potentially reshaping the competitive landscape. The integration will be crucial for success, and long-term outcomes remain to be seen. The impacts on customers, the financial markets, and the broader industry are significant and will warrant continued monitoring.

FAQ Section

What was the purchase price of the acquisition?

The purchase price is confidential and not publicly disclosed at this time.

How will this acquisition impact customer service?

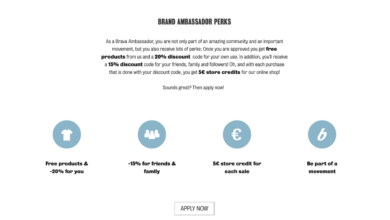

Ambassadors aims to improve customer service by integrating the best practices of both companies, potentially leading to faster response times, a wider range of products, and more accessible customer support channels.

What are the potential risks associated with this acquisition?

Potential risks include integration challenges, potential conflicts in company culture, and regulatory hurdles.

What are the long-term goals of Ambassadors with this acquisition?

Ambassadors’ long-term goals likely include market share growth, expansion into new regions, and diversification of its product offerings.