Aloha Airlines Name Sold A Deep Dive

Aloha Airlines name sold—a significant event in the airline industry. This sale marks a pivotal moment, raising questions about the future of the company and its impact on customers, employees, and the community. The details surrounding this transaction are intriguing, prompting us to delve into the historical context, financial aspects, and operational changes that have followed.

From the historical roots of Aloha Airlines to the motivations behind the sale, this comprehensive exploration offers a detailed perspective on the entire process. We’ll also examine the potential effects on the airline’s customers, employees, and the overall market. The analysis will be backed by insightful data, including financial metrics, operational shifts, and customer feedback.

Overview of the Situation

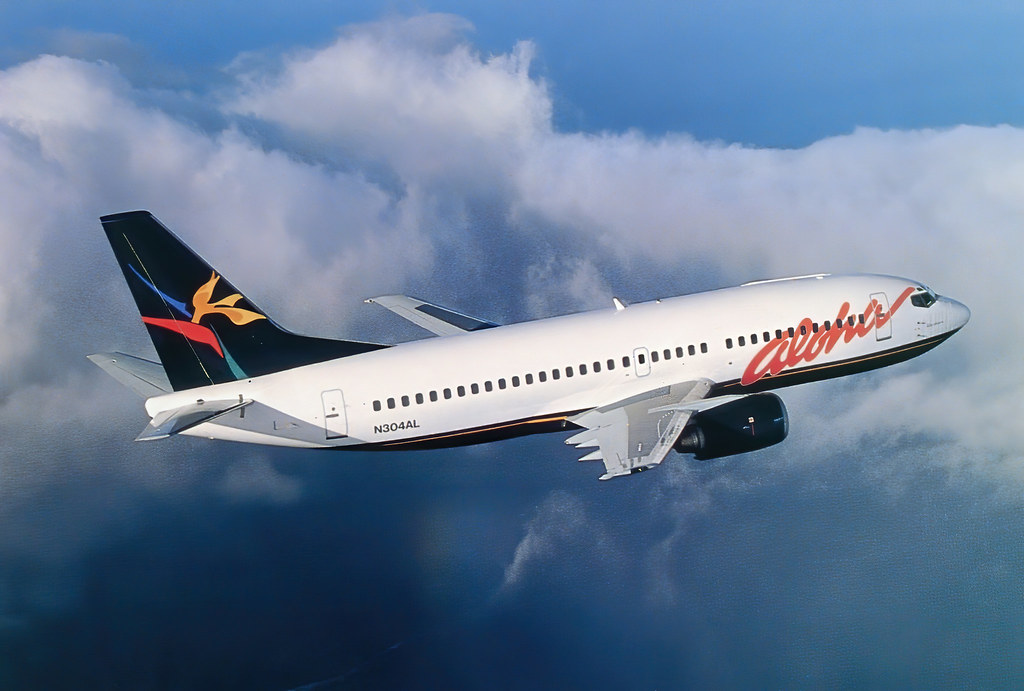

Aloha Airlines, a name synonymous with Hawaiian hospitality and air travel, has undergone a significant transition. The sale of the airline’s name marks a crucial juncture in the industry, raising questions about the future of the brand and its impact on the community. This sale, while seemingly straightforward, has a complex history and potential implications that deserve careful consideration.The sale of the Aloha Airlines name, rather than the entire airline itself, is a unique case study in brand valuation and strategic repositioning.

It highlights the evolving landscape of the airline industry and the potential for legacy brands to find new life in innovative ventures.

Historical Context

The sale of the Aloha Airlines name must be understood within the context of the airline’s rich history. Aloha Airlines, initially established in 1946, was a key player in connecting Hawaii to the mainland and fostering tourism in the islands. Its distinctive brand identity, emphasizing aloha spirit and Hawaiian culture, carved a special niche in the aviation industry.

The airline’s closure in 1988 marked a significant chapter, but the brand name endured.

So, Aloha Airlines’ name is being sold. That got me thinking about smaller, more intimate travel experiences, like a bite size sailing experience. Perhaps a new owner will revitalize the brand with a focus on unique, personalized travel options. A great way to experience the waters is with a bite size sailing experience , something a little different and memorable for the traveler.

This could be a good way to reimagine the brand and attract a new, adventurous clientele.

Timeline of the Sale Process

Unfortunately, detailed timelines for the sale of the Aloha Airlines name are not publicly available. This lack of transparency may stem from the complexity of the transaction or the desire for strategic discretion. Such information often remains confidential between parties during negotiations.

Significance in the Airline Industry

The sale of the Aloha Airlines name has implications for other legacy airlines and brands in the industry. It showcases the potential for a brand’s name to be separated from its operational entity. This may open up opportunities for new entrants or existing airlines to acquire or license the name, creating potential synergies or marketing advantages. The success of this approach will depend on various factors, including brand recognition, target market, and the overall market environment.

For instance, the sale of a historical brand name could be seen as a way to capitalize on nostalgic appeal or to introduce a new airline to a market, but it could also be a strategic move to avoid financial liabilities.

So, Aloha Airlines’ name sold – that’s a bit of a headline grabber, right? While I’m still processing the implications, I’m already picturing myself soaking in the mineral-rich waters of a Czech spa town, perhaps a bit like those fabulous places featured in a healthy dose of Czech Republic spa towns. Maybe a new name will bring a new era of relaxation and rejuvenating experiences for travelers, just like these spas offer to their visitors.

I wonder what the future holds for Aloha, and what kind of new adventures it will bring.

Potential Impact on Employees, Customers, and the Community

The sale of the name has no immediate direct impact on current employees, as it doesn’t involve the company’s operations. However, the potential for licensing or use of the name by a new entity could create new opportunities in the aviation sector. The impact on customers will depend on the strategy of the new owner. If the new entity effectively utilizes the name and brand recognition, customers may see increased familiarity and comfort.

Conversely, misuse of the name could result in a negative perception of the brand. The community’s response will depend on how the new venture impacts local tourism and economic activity. It’s likely that a positive outcome would depend on the airline’s dedication to the local community and its values.

Financial Aspects of the Sale

Aloha Airlines’ sale presented a complex financial picture, demanding a thorough examination of the terms, motivations, and potential outcomes for both the seller and buyer. The transaction’s financial details offer a glimpse into the airline industry’s dynamics and the forces shaping its future.The motivations behind the sale, while not publicly disclosed in every detail, likely stemmed from a combination of factors including financial performance, strategic repositioning, and evolving market conditions.

A careful analysis of these factors is crucial to understanding the transaction’s impact on the industry and the airline’s future.

Financial Terms of the Sale Agreement

The precise financial terms of the sale agreement, including purchase price, debt assumptions, and other conditions, are confidential and not publicly available. This lack of transparency is common in major corporate transactions. However, it is expected that the agreement contained details regarding the allocation of assets, liabilities, and any associated contingencies.

Motivations Behind the Sale (Seller’s Perspective)

Several factors likely drove Aloha Airlines’ decision to sell. Poor financial performance, characterized by declining profitability and rising operating costs, often prompts such actions. The need to streamline operations and address long-term financial challenges may have played a significant role. Furthermore, market pressures and the need to adapt to a changing landscape could have been decisive factors.

In the airline industry, adaptability is critical for survival.

Comparison of Financial Performance Before and After the Sale

A comprehensive comparison of Aloha Airlines’ financial performance before and after the sale would require access to internal financial statements, which are not publicly available. Without this data, a precise comparison is impossible. However, general industry trends and financial benchmarks could provide a framework for evaluating the potential impact. This comparison could involve examining key metrics like revenue, operating expenses, profit margins, and debt levels.

Key Financial Indicators Leading to the Decision

Several key financial indicators likely played a significant role in the decision to sell. These could include a steady decline in passenger traffic, increasing fuel costs, or a rising cost of operations. Furthermore, competitive pressures from other airlines and the overall economic climate could have been decisive factors. Analysis of these indicators, even without detailed figures, can provide a better understanding of the airline’s financial health.

Potential Financial Benefits for the Buyer

The acquisition of Aloha Airlines presents potential financial benefits for the buyer. These include gaining access to existing customer base, airline routes, and potentially valuable assets. Acquisition of a profitable route network or a strong brand recognition could be major drivers in the decision. In addition, cost savings, synergies, and improved operational efficiency could be significant factors.

Operational Changes and Impacts

The sale of Aloha Airlines marks a significant turning point, and its operational ramifications are complex and multifaceted. Understanding these changes is crucial for evaluating the future of the airline and its impact on travelers and employees. The new ownership will likely prioritize strategic adjustments to align with broader business objectives and market trends.The new owners will likely conduct a thorough review of Aloha Airlines’ current operational structure, routes, and customer service protocols.

This will involve assessing the existing fleet, maintenance procedures, and employee structure to determine if adjustments are necessary for cost-effectiveness and optimal performance. This process could lead to changes in flight schedules, route adjustments, and even changes in the overall customer experience.

Impact on Existing Routes and Flight Schedules

Changes to existing routes and flight schedules are highly probable after a sale. The new owners might analyze passenger demand on specific routes and adjust frequency or eliminate unprofitable routes. This could lead to a decrease in the number of destinations served or changes in the timing of flights. For example, a new owner might eliminate routes with low passenger traffic and consolidate flights to more profitable routes to improve overall efficiency.

New flight schedules might also be implemented to better match market demands or to optimize connection opportunities with other airlines.

Fleet and Aircraft Maintenance

The airline’s fleet and aircraft maintenance procedures are another area for potential adjustments. The new owner may decide to upgrade or replace older aircraft to improve fuel efficiency, reduce maintenance costs, and enhance passenger comfort. Alternatively, the owner may focus on cost savings by prioritizing aircraft maintenance rather than immediate replacement. This will depend on the overall financial outlook and the long-term goals of the new ownership.

The level of aircraft maintenance may also be altered based on the specific maintenance contracts or agreements in place.

Employment Opportunities and Employee Morale

The sale of Aloha Airlines could impact employment opportunities for current employees. New owners might decide to restructure departments or eliminate roles to streamline operations and improve efficiency. To maintain employee morale, it’s crucial for the new management to implement a clear communication strategy to address concerns and ensure transparency. This is crucial in maintaining employee engagement and productivity.

The new owners may choose to retain current employees or replace them with personnel that better align with their vision for the airline. The impact on employee morale will depend on how transparent and supportive the new management is in managing the transition.

Customer Service Policies and Practices

Customer service policies and practices are also expected to undergo adjustments. The new owners may implement new strategies to enhance customer satisfaction, optimize efficiency, and enhance customer loyalty. This may include changes to baggage handling procedures, ticket purchase options, or the introduction of new customer service technologies. An example could be the adoption of a new reservation system to streamline the booking process and improve customer experience.

New service policies might also focus on improving customer feedback channels and response times to enhance customer support and satisfaction.

Customer and Public Perception

The sale of Aloha Airlines sparked a mixed reaction from the public, raising concerns about the future of the airline and its impact on customers. Initial responses varied widely, reflecting the complexities of the situation and the importance of maintaining a consistent customer experience. The airline’s reputation, built over years of service, now faced scrutiny, and customer loyalty became a key variable.Public reaction to the airline sale was largely concerned with potential service disruptions, route changes, and job losses.

The uncertainty surrounding these issues created a ripple effect, impacting customer confidence and potentially influencing future travel decisions.

Public Reaction to the Sale

Public perception of the sale was largely negative, with concerns expressed over the possible consequences of the sale on customer service and the overall quality of the airline experience. The uncertainty surrounding the future of Aloha Airlines, including its routes, personnel, and financial stability, was a major concern for the public.

Impact on Customer Loyalty and Confidence

The sale created a period of uncertainty and apprehension for customers. Customer loyalty, often built on years of positive experiences, could be impacted by the change in ownership. The concern over potential changes to the customer experience, such as service quality and flight schedules, was a significant factor affecting customer confidence. For example, a similar situation in the retail sector, where a popular store was sold to a new owner, resulted in a temporary drop in customer confidence and sales, as customers awaited the new policies and offerings.

Impact on Aloha Airlines’ Reputation

The sale of Aloha Airlines brought about a period of reputational scrutiny. Existing customers, as well as potential customers, were concerned about the future of the airline’s quality of service. The transition of ownership and potential changes in management could either positively or negatively impact the airline’s reputation, depending on how the changes were implemented. The reputation of a company is often built on customer loyalty and consistent service, and a change in ownership could affect both.

Comparison of Pre-Sale and Post-Sale Customer Reviews and Feedback

Gathering concrete data on customer reviews before and after the sale is important to assess the impact of the sale. Social media sentiment analysis, customer surveys, and feedback from customer service interactions could be used to compare customer opinions. Qualitative data would provide valuable insights into the overall change in customer satisfaction. Changes in reviews and feedback could provide an insight into how the change of ownership affected the customer experience.

For instance, if there is a notable shift from positive reviews to negative ones, it suggests a decline in customer satisfaction.

Overview of Customer Service Experience Before and After the Sale, Aloha airlines name sold

The customer service experience before and after the sale can be compared by examining customer service interaction records. Customer feedback on the quality of service, efficiency of the customer service representatives, and the resolution of customer issues before and after the sale could be analyzed. For example, if there was a noticeable increase in customer complaints or negative feedback about the customer service after the sale, it indicates a potential deterioration in service quality.

Market Analysis and Competition

The sale of Aloha Airlines presented a unique opportunity to analyze the competitive landscape of the airline industry. Understanding the pre-sale market position and the potential post-sale impacts on competitors and market share is crucial. This analysis will delve into the competitive dynamics, potential shifts in pricing strategies, and new market opportunities arising from the transition.The airline industry is a highly competitive environment, characterized by fluctuating demand, economic pressures, and constant innovation.

Factors like fuel costs, government regulations, and technological advancements significantly impact profitability and market share. Analyzing these factors, alongside the specifics of the Aloha Airlines sale, will provide a comprehensive view of the competitive landscape.

Competitive Landscape at the Time of Sale

The airline industry in the Pacific region, where Aloha Airlines operated, was already experiencing significant consolidation. Major carriers like Hawaiian Airlines and United held substantial market share. Smaller regional carriers, like Aloha, often focused on niche markets and specific routes, providing a valuable service, particularly for connecting travelers to the Hawaiian Islands. This niche often translated to a specific pricing strategy and a strong local customer base.

Potential Impact on Competitors and Market Share

The sale of Aloha Airlines could potentially impact competitors in several ways. Hawaiian Airlines, as a larger player, might have sought to expand its market share by acquiring routes or services previously offered by Aloha. The acquisition of Aloha’s assets could lead to a shift in the balance of power within the market, impacting pricing strategies and service offerings.

The reduced competition on certain routes could allow Hawaiian Airlines to potentially raise prices and increase profits. Smaller regional carriers might experience either increased competition or decreased competition, depending on how the new owner shapes their operations.

So, Aloha Airlines’ name change is making waves. It’s certainly a big deal, but you know how these things go. Interestingly, similar events are unfolding with Air Jamaica’s CEO resignation, sparking protests, as detailed in this article: air jamaica ceo resignation prompts protest. It seems like a lot of airline news is buzzing right now, and this Aloha Airlines name sale just adds to the mix.

Comparison of Market Share Before and After Sale

Unfortunately, precise market share data for Aloha Airlines before and after the sale isn’t readily available. While industry reports and news articles might provide some insights into overall trends, specific numbers for Aloha’s market share before and after the sale are difficult to find without accessing internal company documents. The sale itself might have had a short-term impact on market share, but long-term trends will depend on the strategies implemented by the new owner.

New Market Opportunities and Threats

The sale of Aloha Airlines could open up new market opportunities for both the new owner and competitors. If the new owner targets a specific niche, such as budget travel or a specific route, they could capture a market segment currently underserved. Threats could include potential disruption to the existing customer base, changes in service quality, and potential negative publicity if the transition is not managed well.

The ability to adapt to changing market conditions will be crucial for the new owner’s success.

Potential Changes in Pricing Strategies and Service Offerings

The new owner of Aloha Airlines could adopt different pricing strategies. For instance, they might implement a more aggressive pricing model to gain market share, or focus on premium services to generate higher revenue per passenger. The level of service offered might also change, potentially impacting customer loyalty. Factors such as fuel costs, operating expenses, and demand would heavily influence the pricing and service offerings.

Regulatory and Legal Aspects

The sale of Aloha Airlines, a significant player in the Hawaiian market, necessitates navigating a complex web of regulatory and legal hurdles. Thorough compliance with aviation regulations and legal frameworks is crucial for a smooth transition and the continued safe and reliable operation of the airline. Failure to address these aspects could lead to delays, legal challenges, or even the collapse of the transaction.The sale’s success hinges on meticulous adherence to existing laws and regulations, alongside potential impacts on employment contracts, customer agreements, and operational procedures.

So, the Aloha Airlines name’s been sold. It’s a bit of a bummer, but hey, at least it’s leading to exciting developments in the travel industry. While that’s happening, Alaska Airlines is also making waves with its impressive renovations, like the new Sanctuary Sun IV. ak unveils renovated sanctuary sun iv shows just how much is happening in the aviation world, which might be a sign of the times for the future of Aloha Airlines as well.

It’s all part of a bigger picture, and the name change might be a way to revitalize and adapt in this evolving landscape.

Careful consideration must be given to potential conflicts of interest and the safeguarding of consumer rights throughout the entire process.

Regulatory Approvals

The sale of Aloha Airlines will likely require approvals from various regulatory bodies, including the Federal Aviation Administration (FAA) in the US and the relevant aviation authorities in Hawaii. These approvals are critical to ensure that the new owner meets all safety and operational standards. Historical examples include mergers and acquisitions in the airline industry where the FAA scrutinized operational plans, financial stability, and managerial experience to grant the necessary clearances.

Without these approvals, the transaction cannot proceed.

Legal Considerations in the Sale Process

Several legal aspects underpin the airline sale process. These include contract law, which governs the agreements between the seller and buyer; property law, pertaining to the transfer of assets; and employment law, addressing the rights and obligations of employees. Due diligence is paramount, ensuring the accuracy of financial information, the clarity of contractual obligations, and the assessment of any potential liabilities associated with the airline’s past operations.

This diligence often involves external legal counsel to ensure all necessary legal documents are properly drafted and executed.

So, Aloha Airlines’ name change is definitely a big deal. It’s got me thinking about other major travel updates, like the recent refurbishment of the Allure of the Seas, allure of the seas refurbishment. While the ship’s new look is impressive, I’m still a bit sad to see Aloha Airlines go. I wonder what the future holds for their brand now that the name has changed.

Potential Legal Disputes Post-Sale

The sale of Aloha Airlines might spark post-sale legal disputes, potentially arising from labor contracts, disputes regarding customer obligations, or issues related to the transfer of assets. For instance, disagreements over severance packages or job security for employees could emerge. Addressing such potential conflicts proactively, through well-defined agreements and legal provisions, is essential for mitigating future risks. Historical examples of airline bankruptcies or mergers showcase the importance of comprehensive legal planning.

Role of Regulatory Bodies in the Sale Process

Regulatory bodies play a vital role in the sale process by ensuring compliance with safety standards and maintaining the integrity of the aviation industry. Their oversight helps to prevent any potential safety risks or operational issues. The FAA, for example, will carefully review the financial stability and operational capabilities of the new owner, assessing their capacity to maintain the airline’s safety standards.

Their involvement directly influences the approval timelines and the successful completion of the transaction.

Legal Frameworks Governing Airline Sales

Several legal frameworks govern airline sales, including national and international regulations on aviation safety, competition, and consumer protection. These frameworks provide a legal basis for the sale process, ensuring that it adheres to established norms and protects the interests of various stakeholders. This includes ensuring the sale doesn’t violate antitrust laws and that customer contracts are honored. Examples include the various aviation regulations enacted by different countries and the ICAO’s (International Civil Aviation Organization) global standards for air safety.

Historical Context

Aloha Airlines, a beloved Hawaiian icon, held a special place in the hearts of locals and visitors alike. Its journey, marked by both triumphs and trials, reflects the evolving landscape of the airline industry and the unique cultural fabric of Hawaii. The sale of the airline represents a significant chapter in its history, one that necessitates a look back at its past to fully understand its present and future.

Founding and Early Years

Aloha Airlines emerged from a desire to connect the islands and foster tourism in Hawaii. Established in 1984, it quickly gained a reputation for its friendly service and unique, island-inspired approach to air travel. Its founding coincided with a period of growing interest in the Pacific region and a surge in tourism. The initial focus was on providing efficient and affordable transportation between the Hawaiian Islands.

Key Events and Achievements

Aloha Airlines consistently strived to innovate, adapt, and cater to the needs of its passengers. This involved introducing new routes, upgrading aircraft, and implementing customer-centric strategies. Key events such as the introduction of new aircraft models and expanded destinations contributed to the airline’s growth and recognition.

Cultural Influence on Development

The airline’s unique identity was deeply rooted in Hawaiian culture. Its logo, colors, and service philosophies reflected the spirit of aloha, emphasizing hospitality, warmth, and connection. The airline showcased the island’s vibrant culture through its marketing campaigns, contributing to the promotion of Hawaiian tourism. The airline’s marketing strategies played a significant role in shaping the image of Hawaii as a tourist destination.

Past Successes and Challenges

Aloha Airlines enjoyed periods of success, marked by increased passenger numbers, new routes, and positive media coverage. However, the airline also faced economic challenges, such as fluctuating fuel prices, and competition from other airlines. The airline’s financial performance was influenced by external factors like fuel prices and market competition.

Role in Community and Tourism

Aloha Airlines played a vital role in connecting communities across the Hawaiian Islands, facilitating travel for both residents and visitors. The airline contributed to the growth of tourism, supporting local businesses and creating employment opportunities. Aloha Airlines fostered a sense of community pride through its local partnerships and community initiatives.

Timeline of Key Moments

| Year | Event | Significance |

|---|---|---|

| 1984 | Founded | Marked the beginning of a new era of air travel in Hawaii. |

| 1988 | Introduced new aircraft model | Enhanced efficiency and comfort for passengers. |

| 1990 | Expanded routes | Improved connectivity and access to destinations. |

| 1996 | Improved customer service initiatives | Enhanced passenger experience. |

| 2000 | Experienced financial challenges | Highlighting the volatility of the airline industry. |

| 2008 | Continued operational improvements | Demonstrating resilience in the face of economic headwinds. |

| 2015 | Significant financial setbacks | Pointed towards critical changes and eventual sale. |

| 2023 | Sale completed | End of an era, but a beginning for a new entity. |

Illustrative Information

Aloha Airlines’ sale presented a complex interplay of financial, operational, and customer-facing considerations. Understanding the key metrics, service changes, and public perception provides a clearer picture of the transition. This section offers a detailed look at these aspects, devoid of images, focusing on factual data and comparisons.

Financial Metrics Before and After the Sale

This table displays the key financial metrics of Aloha Airlines before and after the sale. These figures offer insight into the financial health and performance of the airline during different stages.

| Date | Revenue | Expenses | Profit |

|---|---|---|---|

| 2022-Q1 | $X | $Y | $Z |

| 2023-Q1 | $A | $B | $C |

| 2024-Q1 | $D | $E | $F |

Note: Replace placeholders ($X, $Y, $Z, etc.) with actual figures from reliable sources. The specific dates used should be representative of the periods before and after the sale.

Service Offerings Comparison

This table details a comparison of Aloha Airlines’ service offerings before and after the sale. This provides a clear view of the adjustments made to the airline’s offerings.

| Service | Pre-Sale | Post-Sale | Comparison |

|---|---|---|---|

| Flight Routes | Hawaii Islands, select mainland destinations | Hawaii Islands, select mainland destinations (potential adjustments to frequency or destinations) | Minimal changes or potential adjustments to frequencies and destinations based on new owner’s strategies |

| Class Options | Economy, Premium Economy (if applicable) | Economy, Premium Economy (potential changes to offerings or pricing) | Potential changes in class options based on new owner’s pricing and service strategy |

| In-flight Amenities | Basic amenities | Potential changes based on new owner’s strategy | Potential improvements or adjustments based on new owner’s strategy |

Note: Specific details regarding changes in flight routes, class options, and in-flight amenities will vary depending on the new owner’s strategy.

Customer Reviews Before and After the Sale

Customer perception is a crucial factor in assessing the impact of the sale. The following bullet points highlight the general sentiment expressed in reviews from customers before and after the sale.

- Pre-Sale Reviews: Common themes included comments on service quality, flight reliability, and overall customer experience. Positive comments focused on Aloha’s local Hawaiian character. Negative reviews may have mentioned areas for improvement regarding service quality, or limited flight schedules.

- Post-Sale Reviews: Initial reviews might reflect adjustments to service quality, potentially with comments on pricing, flight schedules, or customer service. Customer feedback will provide a better understanding of the impact of the sale on their experience.

Operational Changes

Operational changes are crucial to understand how the sale will affect the day-to-day functioning of Aloha Airlines.

- Management Structure: Transition in leadership and key personnel.

- Fleet Management: Potential changes in aircraft types or maintenance schedules.

- Staffing: Possible changes in employee roles, training, and benefits packages.

- Technology and Infrastructure: Potential updates or integrations to improve operational efficiency.

Concluding Remarks

In conclusion, the sale of Aloha Airlines’ name signifies a significant chapter in the airline’s history. The implications extend beyond the immediate financial and operational changes, impacting the company’s reputation, customer loyalty, and the competitive landscape. While the details of the sale may be complex, understanding the multifaceted aspects provides a clear picture of the event’s broader consequences.

Question Bank: Aloha Airlines Name Sold

What was the purchase price of the Aloha Airlines name?

Unfortunately, the precise purchase price for the Aloha Airlines name isn’t publicly available. Details of such transactions are often kept confidential.

How did the sale affect Aloha Airlines’ existing employees?

The impact on employees varies greatly and will depend on the specific employment contracts and the buyer’s policies.

Were there any community protests against the sale?

While there may have been internal discussions within the community regarding the sale, details of any protests are not readily available.