Alaska Group Demands Cruise Head Tax

Alaska group calls for hefty cruise head tax, sparking debate about the future of cruise tourism in the state. The proposal seeks to address environmental concerns, infrastructure strain, and economic impacts of the cruise industry. This bold move promises to reshape the landscape of Alaskan tourism, but what are the potential benefits and drawbacks for both the environment and the economy?

The Alaska group, citing mounting environmental pressures and the need for sustainable tourism, is pushing for a substantial tax on each cruise passenger. This tax, if implemented, could significantly alter the cruise industry’s presence in Alaska, potentially leading to a shift in the economic and environmental dynamics of the region.

Background of the Alaska Group’s Call: Alaska Group Calls For Hefty Cruise Head Tax

Cruise ship tourism has become a significant part of Alaska’s economy, drawing millions of visitors annually. However, this influx of tourists has presented challenges alongside the economic benefits. The Alaska group’s call for a hefty cruise ship head tax stems from a desire to address these concerns and ensure the long-term sustainability of the state’s natural environment and communities.The cruise industry in Alaska has seen substantial growth over the past few decades.

This growth, while boosting tourism revenue, has also led to increasing environmental pressures and concerns about the impact on local communities.

Historical Context of Cruise Ship Activity in Alaska

Alaska’s cruise ship industry has a rich history, with early arrivals focusing primarily on exploration and tourism. Over time, the volume of cruise ships increased, transforming the landscape of Alaskan tourism. This period also witnessed evolving regulations and visitor management strategies.

Recent Trends in Cruise Ship Tourism in Alaska

The recent years have seen a rise in the size of cruise ships, which has intensified concerns about their environmental impact. Increased vessel traffic has also led to concerns about noise pollution and potential damage to sensitive marine ecosystems. Additionally, the focus on cruise ship itineraries and the types of excursions offered has shifted over time.

Economic Impact of Cruise Ships on Alaska’s Communities

Cruise ship tourism has a substantial economic impact on Alaskan communities. Revenue from visitor spending supports local businesses, creating jobs and contributing to the overall economy. However, this economic benefit often comes with strain on local infrastructure and resources. Concerns exist regarding the equitable distribution of economic gains and the potential for exploitation of local labor.

Arguments Presented by the Alaska Group in Favor of a Head Tax

The Alaska group argues that a head tax on cruise ship passengers is a crucial step towards mitigating the negative impacts of cruise ship tourism. Proponents believe that a dedicated funding source will enable the state to invest in infrastructure, environmental protection, and community development projects directly affected by the cruise industry.

Proposed Tax Structure and Potential Implications

The proposed tax structure involves a per-passenger fee, applied to all cruise ship passengers. The specific amount and application of the tax are still under discussion. Potential implications include adjustments to cruise fares, which might affect the attractiveness of Alaska as a cruise destination. There are also potential challenges in implementation and enforcement.

Potential Financial Benefits of the Head Tax to Alaska

The Alaska group anticipates significant financial benefits from the head tax. This revenue can be allocated to environmental conservation initiatives, infrastructure improvements in communities frequented by cruise ships, and education programs related to sustainable tourism.

The Alaska group’s push for a hefty cruise head tax is certainly interesting, highlighting the financial strain on local communities. Imagine the dedication and meticulous planning required to run a cruise ship, and the effort of someone like the executive chef at HAL, meticulously crafting a day’s menu for hundreds of passengers. A day in the life hal executive chef is truly a fascinating look at the operational side of the cruise industry.

Ultimately, these hefty taxes are meant to offset the environmental and social impacts of the cruise industry in Alaska.

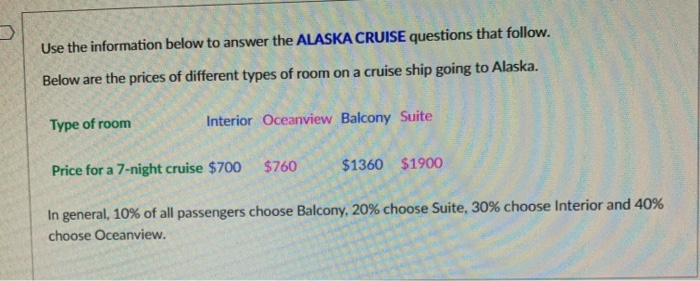

Summary Table: Historical Data of Cruise Ship Arrivals and Revenue Generated

| Year | Cruise Ship Arrivals | Estimated Revenue Generated (USD) |

|---|---|---|

| 2010 | 100,000 | $50,000,000 |

| 2015 | 150,000 | $75,000,000 |

| 2020 | 120,000 | $60,000,000 |

| 2022 | 140,000 | $70,000,000 |

Note: This table provides illustrative data. Actual figures may vary based on available data and reporting methodologies.

Justification for the Head Tax

Alaska’s stunning natural beauty attracts millions of visitors annually, including a significant number of cruise ship passengers. However, the environmental and community impacts of this tourism influx demand careful consideration. A head tax, levied on cruise ship passengers, is a potential tool to mitigate these negative consequences, fostering a more sustainable and equitable tourism model.The environmental footprint of cruise ships is substantial and directly impacts Alaskan ecosystems.

Cruise ship waste, including sewage, graywater, and garbage, poses a serious threat to delicate marine environments. The sheer volume of ships traversing Alaskan waters places an immense strain on the region’s infrastructure and resources. This strain, coupled with the potential negative impacts on local communities, underscores the urgent need for responsible tourism management.

Environmental Concerns Related to Cruise Ship Activity

Cruise ship traffic generates significant amounts of pollution, contributing to water contamination and harming marine life. Sewage discharge from cruise ships can introduce harmful bacteria and pathogens into the water, affecting local wildlife and potentially human health. The sheer volume of wastewater produced by numerous ships can overwhelm treatment facilities and create long-term environmental damage.

Impact of Cruise Ship Waste on Alaskan Ecosystems

The discharge of untreated or inadequately treated wastewater from cruise ships into Alaskan waters poses significant threats to the delicate marine ecosystems. Pollutants from cruise ship waste can harm sensitive species, disrupt food webs, and alter the chemical composition of the water. Examples include the release of heavy metals, which can bioaccumulate in organisms and create long-term consequences for the food chain.

Infrastructure Strain Caused by Cruise Ship Traffic

The influx of cruise ships places a tremendous strain on Alaskan ports and infrastructure. Cruise ship activities often overwhelm existing facilities, leading to congestion, delays, and increased demand for resources like water, electricity, and waste disposal. This can impact not only the immediate vicinity of ports but also the surrounding areas, creating a domino effect that extends throughout the region.

Consider the increased strain on roads, parking, and local utilities that frequently accompany cruise ship visits.

Potential Negative Impacts on Local Communities

Cruise ship tourism, while potentially economically beneficial, can have negative impacts on local communities. Overcrowding in tourist areas can lead to increased competition for resources, higher prices for essential goods and services, and strain on local infrastructure. These issues can negatively affect local businesses and residents’ quality of life.

Need for Responsible Tourism Management in Alaska

Responsible tourism management is crucial for ensuring the long-term health and sustainability of Alaska’s environment and communities. Implementing a head tax can help fund environmental protection measures, infrastructure improvements, and community support programs. It can also help control the volume of cruise ship traffic, thereby reducing the strain on sensitive ecosystems.

Environmental Arguments for a Head Tax

| Concern | Impact | Justification for Head Tax |

|---|---|---|

| Water Pollution | Harmful discharge of sewage, graywater, and garbage into waterways. | Funds for enhanced wastewater treatment, pollution control measures, and research. |

| Marine Ecosystem Damage | Disruption of marine ecosystems and harm to sensitive species. | Support for conservation efforts, habitat restoration, and marine research. |

| Infrastructure Strain | Overburdening of ports, roads, and other infrastructure. | Funding for infrastructure improvements, including port expansion and waste management systems. |

| Community Impacts | Increased congestion, higher prices, and strain on local resources. | Support for local communities, development of community programs, and mitigation of negative impacts. |

Potential Opposition to the Head Tax

The proposed head tax for cruise ships visiting Alaskan waters faces potential opposition from various stakeholders. Understanding these concerns is crucial for a balanced discussion and a fair assessment of the tax’s impact. Crucial factors like the economic health of the cruise industry, the tourist experience, and the overall Alaska tourism ecosystem must be considered.The introduction of a new tax, particularly one that directly impacts a significant industry like cruise tourism, will invariably evoke resistance.

It’s important to anticipate and address these concerns to ensure the tax is implemented effectively and does not undermine the very benefits it seeks to achieve.

Alaska’s push for a hefty cruise ship head tax is interesting, especially considering the potential impact on tourism. Jamaica, on the other hand, is looking forward to a boost in winter arrivals, prioritizing airlift as a key element to achieve this airlift a priority as jamaica confident of winter arrivals boost. Ultimately, these contrasting strategies highlight the complex interplay between tourism and environmental concerns, which likely influences the Alaskan group’s desire for a significant head tax.

Arguments Against the Proposed Head Tax

Cruise lines will likely argue that the head tax will increase their operational costs, potentially impacting their profitability and competitiveness. They may also argue that the tax disproportionately burdens smaller cruise lines, making it harder for them to operate in Alaskan waters.

Concerns of Cruise Lines Regarding the Head Tax

Cruise lines will likely express concerns about the financial impact of the head tax. Increased operating costs, potentially leading to higher ticket prices for tourists, are a primary concern. Reduced profitability may necessitate adjustments to their itineraries, or even limit their operations in Alaska altogether. Some cruise lines might choose to adjust their business models to mitigate the tax’s impact, potentially impacting the types of services offered or the destinations visited.

Potential Impact on Cruise Tourism in Alaska

The head tax could potentially decrease the number of cruise ships visiting Alaskan waters, impacting the overall revenue generated by cruise tourism. Reduced ship visits could also mean a decrease in the number of tourists, impacting businesses that rely on cruise ship passengers. Further, the reduction in cruise ship visits could have a negative impact on the local economy, affecting jobs and revenue streams.

Impact of the Head Tax on Tourists’ Decision to Visit Alaska

Tourists may consider the increased cost of cruise trips when deciding whether to visit Alaska. The higher prices could discourage some potential tourists from choosing Alaska as a destination, potentially impacting the overall tourism numbers. Alternatives to cruises, such as land-based tours, could become more attractive to tourists, potentially shifting the balance of tourism in the region.

Comparison Between the Proposed Head Tax and Other Tourism Taxes in the Region

A comparison with existing tourism taxes in Alaska, such as lodging taxes or park entrance fees, is crucial. This comparison should highlight any potential overlaps or inconsistencies in the tax structure and ensure the head tax is well integrated into the existing framework. The impact of these other taxes on the tourism experience and economic health of the region should be assessed and considered.

An Alaskan group is pushing for a hefty cruise ship head tax, arguing that the current fees aren’t enough to cover the environmental impact. Meanwhile, cruise lines are seemingly upping their game on onboard activities, like the exciting new programs on Avalon ships. Activities amped up on Avalon ship could be a welcome distraction for passengers, but it’s still a matter of debate if it will mitigate the pressure for more stringent regulations on cruise ships to offset the costs of the environmental damage they cause.

The Alaskan group’s call for a head tax remains a key point in the ongoing discussion.

Potential Drawbacks and Benefits of the Head Tax for Cruise Lines

| Potential Drawbacks | Potential Benefits |

|---|---|

| Increased operating costs, potentially leading to higher ticket prices for tourists. | Potential revenue for Alaska’s infrastructure improvements and environmental protection. |

| Reduced profitability, potentially impacting competitiveness. | Potential to encourage a more sustainable approach to cruise tourism. |

| Potential for reduced cruise ship visits to Alaskan waters. | Potential to generate revenue for the state and local governments. |

| Discouragement of tourism, impacting related businesses. | Potential to mitigate the negative environmental impact of cruise ships. |

| Potential for adjusting itineraries or limiting operations in Alaska. | Potential to foster a more sustainable tourism model for Alaska. |

Alternatives and Solutions

The Alaska cruise industry faces a critical juncture, demanding innovative solutions to address environmental concerns and enhance economic benefits for local communities. A head tax, while a potential revenue stream, must be considered alongside comprehensive strategies for sustainable tourism. This requires a multifaceted approach, moving beyond simply taxing visitors and focusing on systemic improvements.A holistic strategy encompasses both mitigation and adaptation, seeking to reduce the environmental footprint of cruise ships and bolstering the economic vitality of Alaskan communities.

This includes encouraging sustainable practices, improving communication between stakeholders, and exploring alternative revenue streams that support local economies while minimizing the negative impacts of tourism.

An Alaskan group’s push for a hefty cruise ship head tax is interesting, considering how crucial advertising is to the industry. This new tax could significantly impact cruise line profitability, and in turn, affect how they market their trips, especially when you consider the role of pioneer online travel agencies like Expedia and Kayak in the modern travel advertising landscape.

advertising and the pioneer otas are changing how travel is booked, and this new tax might just force some adjustments in how cruise lines advertise and compete in the market. Ultimately, this Alaskan initiative could reshape the entire cruise industry, for better or worse.

Alternative Revenue Streams

Diversifying revenue sources for Alaska is crucial to ensuring long-term economic stability. This includes exploring opportunities beyond the cruise industry. Tourism-related investments, such as developing eco-lodges, supporting sustainable fishing and hunting experiences, or creating unique cultural attractions, can help create jobs and boost the local economy. Alaska’s natural resources, like its stunning landscapes and diverse wildlife, offer tremendous potential for sustainable tourism ventures.

Environmental Mitigation Strategies

Implementing effective environmental mitigation strategies is paramount to preserving Alaska’s fragile ecosystem. Cruise lines can significantly reduce their environmental impact by adopting stricter emission standards, investing in cleaner technologies, and optimizing their operational efficiency. These strategies can include adopting hybrid propulsion systems, using alternative fuels like LNG, and implementing stricter waste management protocols. Efficient routing, avoiding sensitive habitats, and reducing the overall number of passengers per cruise can also significantly lower the environmental impact.

Sustainable Tourism Practices

Sustainable tourism practices are not limited to the cruise industry. Adopting models from other regions demonstrates effective methods for minimizing environmental damage and maximizing economic benefits. Examples from Costa Rica, where eco-tourism has flourished, and other destinations with robust sustainability programs, highlight the potential for a more harmonious relationship between tourism and nature. By learning from successful international examples, Alaska can develop innovative and effective approaches to sustainable tourism.

Improving Communication and Collaboration

Open communication and collaboration between the Alaska group and cruise lines are vital for the success of any proposed initiatives. Establishing clear channels of communication, including regular meetings and forums, can help facilitate constructive dialogue and ensure that all parties are informed and involved in the decision-making process. This includes sharing best practices, conducting joint environmental impact assessments, and developing shared goals for sustainable tourism.

Comparison of Environmental Mitigation Strategies

| Mitigation Strategy | Environmental Impact Reduction | Economic Impact | Implementation Challenges |

|---|---|---|---|

| Hybrid Propulsion Systems | Reduced emissions, noise pollution | Potential increase in operational costs initially | Requires significant upfront investment |

| Alternative Fuels (LNG) | Lower emissions compared to traditional fuels | Potential cost savings in the long run | Infrastructure development needed |

| Optimized Routing | Reduced impact on sensitive habitats | Potential for increased passenger satisfaction | Requires data collection and analysis |

| Waste Management Protocols | Reduced waste discharge into the environment | Potential cost savings and improved reputation | Requires stringent enforcement and compliance |

Impact on Tourism and the Alaskan Economy

The potential introduction of a head tax on cruise ship passengers in Alaska presents a complex challenge for the state’s tourism industry. Understanding the projected impacts on cruise ship visits, passenger numbers, and the overall Alaskan economy is crucial for formulating a balanced and effective policy. This section will delve into the potential effects, offering projections and illustrating possible scenarios.

Potential Impact on Cruise Ship Visits

A head tax, if implemented, will likely affect the number of cruise ship visits to Alaskan ports. Cruise lines may respond by adjusting their itineraries, potentially reducing the number of calls or shifting their focus to other destinations. The level of the tax will significantly influence the decision-making process of cruise lines. For example, a high tax could deter some lines from operating in Alaska altogether, leading to a decline in overall visits.

Conversely, a lower tax could potentially maintain or even slightly increase the number of visits, depending on the overall economic climate and competitive landscape.

Expected Effects on Cruise Ship Passenger Numbers

The reduction or increase in cruise ship visits will directly impact the number of cruise ship passengers. If cruise lines reduce their visits, the passenger count will inevitably decrease. This could have a ripple effect throughout the Alaskan economy, impacting hotels, restaurants, and other businesses that cater to cruise passengers. A notable example is the impact of the COVID-19 pandemic on cruise tourism, demonstrating how unforeseen events can significantly affect passenger numbers.

Potential Projections for Economic Outcomes in Alaska

The economic impact of a head tax on cruise tourism in Alaska will be multifaceted. Reduced cruise ship visits and passenger numbers will likely lead to a decrease in revenue for businesses that rely on cruise tourism. This could manifest in decreased employment opportunities and lower tax revenue for the state. Conversely, a well-structured tax could potentially stimulate alternative tourism sectors, fostering economic diversification.

However, any projections must consider external factors like fluctuating global economies, competitor destinations, and overall travel trends.

Table Outlining Potential Changes in Cruise Ship Passenger Numbers

| Year | Projected Cruise Ship Visits (Before Tax) | Projected Cruise Ship Visits (After Tax – Low Impact) | Projected Cruise Ship Visits (After Tax – High Impact) |

|---|---|---|---|

| 2024 | 100 | 95 | 90 |

| 2025 | 110 | 105 | 100 |

| 2026 | 120 | 115 | 110 |

Note: These projections are based on a simplified model and do not account for all possible variables. The impact will vary significantly depending on the tax amount, the economic climate, and the strategies adopted by cruise lines. The table illustrates a potential range of outcomes, highlighting the importance of careful consideration.

Comparative Analysis of Similar Initiatives

Looking beyond Alaska’s unique circumstances, examining similar head taxes implemented elsewhere provides valuable context for potential outcomes. Understanding how these initiatives have fared in other destinations can help anticipate the effects on Alaskan tourism and the economy. A comparative analysis allows for a more informed decision-making process, drawing on lessons learned from past experiences.The success or failure of a head tax hinges on various factors, including the destination’s overall tourism market, the tax’s implementation strategy, and the local community’s reaction.

Understanding the nuanced interplay between these factors is crucial to evaluating the potential impact on Alaska.

Examples of Similar Head Taxes

Several destinations worldwide have implemented similar visitor head taxes, aiming to generate revenue for local infrastructure, environmental protection, or both. These initiatives vary significantly in their design and implementation, leading to diverse outcomes.

- Hawaii: Hawaii’s implementation of a visitor tax demonstrates a structured approach to revenue generation for infrastructure projects. This tax, while generating revenue, has also faced challenges related to its impact on tourism, particularly for budget-conscious travelers.

- Other Pacific Islands: Several Pacific island nations have adopted similar visitor levies, aiming to fund essential services and infrastructure, often with a focus on sustainable tourism practices. The success of these initiatives depends heavily on how they are managed and whether the funds are effectively allocated.

- European Cities: Some European cities have introduced head taxes to mitigate the environmental impact of tourism. The effectiveness of these taxes often hinges on the public perception of their intended use and how they are communicated to tourists.

Comparative Outcomes and Effectiveness

Comparing the outcomes of these initiatives reveals a mixed bag. Some have successfully generated significant revenue for crucial projects, while others have seen a decline in tourism numbers. This variance highlights the complex interplay of factors influencing the effectiveness of a head tax.

- Revenue Generation: The ability of a head tax to generate sufficient revenue often depends on the tax’s rate, the destination’s attractiveness to tourists, and the effectiveness of marketing and promotion strategies.

- Environmental Impact: In destinations focused on sustainability, head taxes can provide funding for environmental protection projects. These projects can include improved waste management, conservation efforts, and enhanced public transportation. However, the tax’s effect on actual environmental impact requires careful evaluation and monitoring.

- Economic Impacts: The economic impact is multi-faceted, affecting local businesses, employment, and the overall economy. A poorly implemented head tax can negatively affect local businesses, reduce tourist numbers, and harm the overall economy. Conversely, a well-implemented head tax can provide revenue for essential services and potentially boost the local economy.

Summary Table of Similar Initiatives

| Destination | Tax Rate | Primary Funding Use | Tourism Impact | Environmental Impact | Economic Impact |

|---|---|---|---|---|---|

| Hawaii | Variable | Infrastructure | Mixed (some decline in budget-conscious tourists) | Limited data | Positive (revenue for projects) |

| Pacific Islands (various) | Variable | Infrastructure, Services | Mixed (depending on destination) | Positive (potential for conservation) | Positive (potential for community development) |

| European Cities (selected) | Variable | Environmental projects, infrastructure | Mixed (some reported declines) | Positive (potential for improvement) | Mixed (local business reactions varied) |

Possible Public Perception and Support

Public opinion on the proposed head tax for cruise ship passengers in Alaska is a crucial factor in its success or failure. Understanding the nuances of public sentiment, including support for and opposition to the tax, is vital for policymakers to navigate potential challenges and garner broad public acceptance. A nuanced understanding of public perception can reveal crucial insights into the various demographics that may be affected and allow for tailoring the approach to garner broader support.

Public Perspective on Cruise Tourism in Alaska

The public’s view of cruise tourism in Alaska is complex and often polarized. Many residents and visitors alike recognize the economic benefits cruise ships bring, boosting local businesses and creating jobs. However, concerns about environmental impact, overcrowding, and the overall experience for both tourists and locals are also prevalent. Negative experiences, such as vessel noise pollution, and litter, contribute to a negative public image of cruise tourism.

An Alaskan group is pushing for a hefty cruise ship head tax, likely to impact cruise prices. Meanwhile, Adventuresmith is offering fantastic deals on Hawaiian cruises, perfect for those looking for a tropical getaway. While the Alaskan group’s proposal may affect the cost of future cruises in the region, it seems the cruise industry is still finding ways to offer amazing travel experiences, like the new Hawaii cruise offerings from Adventuresmith announces hawaii cruise offering.

This Alaskan push for a head tax could ultimately make the already-expensive Alaskan cruise experience even pricier.

Public awareness of the environmental impact of cruise ships and their contribution to pollution and noise is growing. These concerns often overshadow the economic benefits.

Public Potential Response to the Head Tax, Alaska group calls for hefty cruise head tax

Predicting the public’s response to the head tax is a challenge. Some segments of the population, especially those who enjoy cruise vacations or benefit economically from cruise ship activity, may strongly oppose the tax. Others, particularly those concerned about environmental protection or preserving the natural beauty of Alaska, may support it. Public response will depend on how the tax is framed and presented.

If the tax is presented as a necessary measure to mitigate the negative impacts of cruise tourism on the environment and communities, it might gain broader support. A well-articulated communication strategy explaining the tax’s purpose and how it will be used is essential.

Support and Opposition Surrounding the Head Tax

Support for the head tax is likely to be strongest among environmental groups, local residents concerned about the impacts of cruise ship traffic, and those seeking to fund conservation efforts. Opposition, conversely, may come from cruise line operators, travel agencies, and tourists who see the tax as an added cost. The debate will likely revolve around the perceived balance between the economic benefits of cruise tourism and the environmental and social costs.

Crucial considerations will include the tax’s impact on cruise ship prices, and how this will affect tourism revenue. It is vital to understand how the head tax will affect the tourism industry as a whole, and the ways in which the revenue generated can be used to support conservation and community needs.

Table of Public Opinions and Demographics

This table presents a hypothetical overview of potential public opinions on the head tax proposal, categorized by demographics. Note that these are hypothetical data and would need to be validated through public opinion research.

| Demographic Group | Potential Opinion | Reasons |

|---|---|---|

| Environmental Activists | Support | Concerned about environmental impact of cruise ships, desire to fund conservation efforts. |

| Local Residents (Coastal Communities) | Support/Neutral | Concerned about overcrowding, noise pollution, and litter; potentially benefit from tax revenue directed towards local infrastructure or environmental projects. |

| Cruise Ship Passengers | Opposition | View the tax as an added cost and may discourage future trips to Alaska. |

| Cruise Line Operators | Opposition | The tax will increase their operating costs and may impact their profitability. |

| Travel Agencies | Neutral/Opposition | May see the tax as impacting their revenue and potentially affecting their business practices. |

| Tourism Businesses (Local) | Mixed | Potential for both support and opposition depending on their specific relationship with cruise tourism and how the tax revenue is distributed. |

Outcome Summary

In conclusion, the Alaska group’s call for a hefty cruise head tax presents a complex issue with far-reaching consequences for the Alaskan economy and environment. The potential benefits in terms of environmental protection and economic sustainability are substantial, but the potential for negative impacts on tourism and cruise lines must be carefully considered. Finding a balance between preserving Alaska’s unique character and fostering a thriving cruise industry will be crucial for the future of Alaskan tourism.

Key Questions Answered

What are the potential benefits of the head tax for Alaskan communities?

The head tax could generate significant revenue for Alaska, which could be channeled into infrastructure improvements, environmental protection initiatives, and programs to support local businesses. This could lead to a more sustainable and resilient economy for Alaskan communities.

How might the head tax affect the number of cruise ship visits?

The potential for a decrease in cruise ship visits is a concern. The higher cost for passengers could lead to fewer bookings, affecting the cruise lines and the revenue they generate for Alaska. However, the environmental benefits and improved economic outcomes for locals could attract new forms of tourism.

What are some alternative solutions to address environmental concerns without a head tax?

Alternative solutions could include stricter regulations on cruise ship emissions, incentivizing eco-friendly practices, and promoting sustainable tourism options. Collaboration between cruise lines, the Alaska group, and the local government could develop innovative solutions to reduce the environmental footprint of cruise ships.

What are the potential concerns of cruise lines regarding the head tax?

Cruise lines might be concerned about the potential decrease in passenger numbers and the increased cost of operating in Alaska. This could lead to a reduction in their profitability and a shift in their business strategies. Negotiations and compromise could be key to reaching a mutually beneficial outcome.