AK Senate Floats Cruise Pax Tax Impact & Alternatives

AK senate floats cruise pax tax is a proposal to impose a tax on cruise passengers visiting Alaska. This new tax aims to generate revenue for infrastructure improvements and address the economic impact of cruise tourism. However, potential drawbacks such as reduced tourism and increased prices for passengers need careful consideration. The debate is complex and affects various stakeholders, including cruise lines, businesses, and residents.

This article explores the background of the proposed tax, its potential economic impacts, benefits, and drawbacks, public opinion, comparisons to similar taxes, regulatory frameworks, alternative funding solutions, and the possible effects on cruise lines and passenger experiences.

Background on the Proposed Tax

The Alaska Senate’s proposed cruise passenger tax is a recent development in the state’s approach to regulating tourism revenue. This initiative aims to generate funds for various infrastructure and community projects. The potential impact on the cruise industry and its various stakeholders necessitates careful consideration of the proposal’s history, motivations, and potential consequences.

History of the Proposed Tax

The Alaska Senate has been exploring the possibility of a cruise passenger tax for several years. Initial discussions focused on the need to address the growing cruise ship traffic in Alaska’s ports, and the subsequent strain on local infrastructure. Early proposals, and subsequent revisions, have addressed various concerns regarding revenue distribution, potential economic impacts, and the fair treatment of both domestic and international passengers.

The Alaskan Senate’s proposal to tax cruise passengers is raising some eyebrows. While it might seem like a straightforward revenue stream, it could potentially impact the vital role that airlift and cruise ships play in fueling Caribbean growth, as seen in this insightful article: airlift and cruise ships help fuel caribbean growth. Ultimately, this tax could deter visitors and, in turn, hinder the tourism sector that benefits from the influx of cruise ships.

The Alaska Senate’s proposal requires careful consideration of these wider economic implications.

Motivations for Implementing the Tax, Ak senate floats cruise pax tax

Proponents of the tax argue that it is a crucial mechanism to generate funding for much-needed infrastructure improvements. These improvements include better port facilities, improved public transportation, and enhanced community amenities. They believe the tax is a fair and equitable way to distribute the costs associated with accommodating the growing number of cruise passengers visiting the state. The funds generated could be used to address environmental concerns related to cruise ship operations.

Cruise ship operations are frequently cited as a significant source of pollution, and this tax is a potential funding mechanism to offset these environmental concerns.

Types of Cruise Passengers Affected

The proposed tax will likely affect both domestic and international cruise passengers. Domestic passengers, often seeking a vacation experience within the country, will be subject to the tax, as will international passengers, who may view the tax as an additional cost of their Alaskan cruise. The tax structure, if implemented, will determine the precise amount of the tax, with differing rates for domestic and international travelers possible.

Furthermore, different cruise lines and vessel types could be subject to varying tax rates. The tax is intended to provide a means to fund projects related to the cruise industry, and it’s expected that some revenue will be used to address infrastructure issues related to cruise ship operations.

Revenue Generation Projections

Projections for revenue generation from the cruise passenger tax are still being developed and vary widely. Factors like the number of cruise ship visits, the average number of passengers per ship, and the final tax rate will all impact the ultimate revenue figures. The Alaska Department of Revenue will likely provide further details regarding these projections in future reports.

The revenue generated will be dedicated to funding specific infrastructure projects and programs in the state, and will hopefully benefit all residents.

Existing Taxes on Cruise Passengers in Other US States/Regions

Other US states and regions have already implemented cruise passenger taxes. For instance, [Insert specific example of a state/region with a cruise passenger tax here]. The effectiveness and revenue generated from these taxes can provide valuable insights and potential best practices for Alaska’s consideration.

The Alaska Senate’s proposal to tax cruise passengers is sparking debate. While the tax might generate revenue, it could also impact the cruise industry, potentially affecting the overall travel experience. For a more intimate and budget-friendly way to enjoy the waters, consider a bite size sailing experience, like those offered by various smaller operators. a bite size sailing experience might offer a more personal and affordable approach to enjoying the Alaskan waters, while still allowing passengers to experience the beauty of the region.

Ultimately, the Alaska Senate’s cruise passenger tax will be a key factor in determining the future of cruising in the state.

| Time Period | Proposed Change | Supporting Arguments | Affected Parties |

|---|---|---|---|

| [Insert Date Range] | Initial Proposal | Addressing infrastructure needs, generating funding for community projects. | Domestic and International Cruise Passengers, Alaska State Government |

| [Insert Date Range] | Revision 1 | Addressing concerns about the impact on tourism, and potentially focusing on specific infrastructure projects. | Domestic and International Cruise Passengers, Alaska State Government, Cruise Lines |

| [Insert Date Range] | Current Proposal | Addressing environmental concerns, and seeking to find a balance between tourism revenue and community needs. | Domestic and International Cruise Passengers, Alaska State Government, Cruise Lines, Environmental Organizations |

Economic Impacts of the Tax

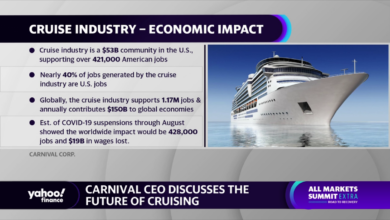

The proposed cruise passenger tax in Alaska presents a complex web of potential economic impacts, affecting not only the cruise industry itself but also the broader Alaskan economy. Understanding these intricate relationships is crucial for a balanced assessment of the tax’s overall effect. The potential benefits must be carefully weighed against the potential losses to ensure a sustainable future for the Alaskan economy.The cruise industry, a significant contributor to Alaska’s tourism sector, is likely to experience direct and indirect economic consequences from the proposed tax.

These impacts will ripple through the Alaskan economy, impacting businesses and employment. Analyzing these effects is paramount to forming a complete picture of the tax’s implications.

Potential Impacts on the Cruise Industry

The cruise industry in Alaska is a multi-billion dollar sector, generating substantial revenue and supporting numerous jobs. A new tax could alter the industry’s financial model, impacting cruise lines’ decision-making regarding routes and pricing. The tax could affect cruise line profitability, potentially influencing the overall economic attractiveness of Alaskan cruises.

Potential Impacts on Businesses Dependent on Cruise Tourism

Numerous Alaskan businesses, including hotels, restaurants, and retail outlets, rely heavily on cruise ship passengers for revenue. A tax increase could directly impact their income streams. For example, if cruise passengers reduce their spending due to the tax, hotels and restaurants could see a decline in business, potentially leading to reduced staffing levels and economic hardship for these businesses.

The cascading effect on the supply chain could be substantial.

Potential Impacts on Alaskan Employment

The Alaskan economy is interwoven with the cruise industry. A decline in cruise tourism could lead to job losses in various sectors. Reduced demand for goods and services could impact employment in areas such as hospitality, transportation, and retail. The potential for job losses across various sectors highlights the need for a comprehensive analysis of the tax’s employment effects.

Examples of Similar Taxes in Other Regions and Their Impact

Examining similar taxes in other regions provides valuable insights into potential outcomes. For example, taxes on cruise passengers in other states have led to varying responses, some showing a reduction in passenger numbers, while others saw minimal impact. Understanding the experiences of other regions can offer a range of scenarios that Alaska might encounter. This is critical for predicting the likely effects on Alaska’s economy.

Projected Economic Benefits vs. Potential Losses

| Category | Description | Projected Value (estimated) |

|---|---|---|

| Projected Economic Benefits | Increased tax revenue for Alaska | $XX million (estimate) |

| Potential for infrastructure improvements | N/A | |

| Potential Economic Losses | Reduction in cruise passenger numbers | $YY million (estimate) |

| Reduced spending by cruise passengers | $ZZ million (estimate) | |

| Potential job losses in related industries | N/A |

Note

“XX”, “YY”, and “ZZ” are placeholders for estimated figures. Actual figures will depend on the specific tax structure and the response of the cruise industry and consumers.*

Potential Benefits and Drawbacks

The proposed cruise passenger tax in the Alaska Senate is a complex issue with potential benefits and drawbacks that impact various sectors of the Alaskan economy and visitor experience. Understanding these multifaceted effects is crucial for informed discussion and policymaking. This analysis will delve into the potential advantages and disadvantages of this new tax.

Potential Benefits of the Tax

This tax, if implemented effectively, could generate substantial revenue for Alaska. This influx of funds can be directed towards vital infrastructure projects that improve the state’s tourism and transportation infrastructure. Examples include upgrades to airports, roads, and ports, leading to a better overall experience for visitors and residents alike. Enhanced infrastructure also fosters economic development, supporting local businesses and creating employment opportunities.

Improved facilities can attract more tourists, further stimulating the economy.

- Funding for Infrastructure Projects: This is a direct benefit, allowing the state to invest in essential improvements to roads, airports, and ports. This will enhance the visitor experience and create a more robust transportation network, facilitating easier travel within the state.

- Economic Development: The tax revenue can be channeled into projects that support local businesses. This could include training programs, grants, and funding for small businesses, stimulating economic activity and job creation. A robust local economy strengthens the state’s overall financial health.

- Improved Visitor Experience: Enhanced infrastructure translates into a better experience for tourists. Modernized facilities, such as upgraded airports and well-maintained roads, make Alaska more attractive as a travel destination.

Potential Drawbacks of the Tax

While the tax has the potential to bring in much-needed revenue, there are also potential drawbacks. A key concern is the possibility of reduced tourism if the tax is perceived as overly burdensome. This could translate to fewer cruise ship passengers choosing Alaska, impacting the economy that relies on tourism. Increased prices for cruise trips and related activities could also deter potential visitors, further hindering the tourism sector.

- Reduced Tourism: If the tax significantly increases the cost of cruising in Alaska, some tourists might choose alternative destinations. This could negatively impact businesses that depend on cruise ship passengers, potentially leading to job losses and economic downturn in areas that heavily rely on tourism.

- Price Increases: The tax may be passed on to consumers through increased prices for cruise tickets, excursions, and other tourist-related activities. This could make Alaska less affordable and less competitive compared to other destinations.

- Impact on the Overall Visitor Experience: While infrastructure improvements aim to enhance the experience, a poorly designed or perceived negative tax could detract from the overall experience. Negative press and perception of Alaska as a destination could lead to reduced visitor numbers.

Comparison of Potential Benefits and Drawbacks

| Benefit | Drawback | Explanation |

|---|---|---|

| Funding for Infrastructure | Reduced Tourism | Increased investment in roads, airports, and ports could enhance the visitor experience. However, a perceived increase in cost could discourage tourists from choosing Alaska as a destination. |

| Economic Development | Price Increases | Funding for local businesses and training programs could stimulate economic activity. However, the tax may be passed on to consumers, potentially making Alaska less affordable for tourists. |

| Improved Visitor Experience | Impact on Visitor Experience | Improved infrastructure and facilities could lead to a more positive visitor experience. However, a poorly designed or perceived negative tax could detract from the overall visitor experience, potentially discouraging future tourists. |

Public Opinion and Stakeholder Perspectives

The proposed passenger tax on cruise ship visitors in the Alaskan Senate raises complex questions about balancing economic benefits with environmental concerns and community well-being. Public opinion on this tax is multifaceted, reflecting diverse interests and perspectives among stakeholders, including cruise lines, residents, and environmental groups. Understanding these perspectives is crucial for shaping a policy that resonates with the needs of all parties involved.

Stakeholder Perspectives on the Proposed Tax

Public opinion regarding the proposed tax is nuanced and varied, encompassing both support and opposition. Different stakeholders have differing priorities and concerns that shape their views on the tax. The cruise industry, local residents, and environmental advocates hold unique perspectives on the financial implications, environmental impact, and overall effects of the tax.

Cruise Line Perspectives

Cruise lines, understandably, generally oppose the tax. They contend that such a levy will increase operational costs, potentially leading to reduced profitability and potentially impacting their ability to offer competitive pricing. This, in turn, could result in fewer cruise ships visiting Alaskan ports, thus reducing tourism and the economic benefits it brings to the region. A potential reduction in tourist numbers might affect local businesses and jobs dependent on cruise ship visitors.

Resident Perspectives

Local residents hold a more complex set of views. Some residents might support the tax, seeing it as a way to mitigate the environmental impact of cruise ships, such as pollution and waste. Others might oppose the tax, believing it will negatively impact the local economy, reduce employment opportunities, and diminish the community’s revenue. The tax’s effect on their daily lives and livelihoods is a key concern.

Environmental Group Perspectives

Environmental groups are largely in favor of the tax, viewing it as a necessary measure to curb the environmental damage caused by cruise ships. They often highlight the negative impact of cruise ship emissions on local ecosystems and wildlife. Environmental groups typically support the tax due to its potential to fund measures to mitigate environmental damage, thus promoting sustainable tourism.

Public Opinion Breakdown

The public’s stance on the tax is a mixture of support and opposition. Public opinion, as evidenced in recent news articles and public statements, reveals a significant divide among residents, with arguments ranging from financial impacts to environmental concerns.

“The tax is a necessary evil to help offset the environmental damage caused by cruise ships.”

Representative from an environmental group.

“The tax will negatively impact our local businesses and employment opportunities.”

Local resident.

The Alaska Senate’s proposal to tax cruise passengers is raising some eyebrows. While the specifics are still being debated, it’s likely to impact the cruise industry. Meanwhile, companies like Avalon are upping the ante on onboard activities to keep passengers entertained, like activities amped up on avalon ship which could offer a distraction from the potential tax.

Ultimately, this tax will likely affect cruise lines and the overall Alaskan tourism scene.

Arguments Against the Tax

Opponents of the tax often highlight potential negative economic consequences. They argue that the tax will increase the cost of cruises, potentially deterring tourists and impacting local businesses reliant on cruise ship revenue. The argument often centers on the belief that the tax will negatively affect the region’s tourism industry and the local economy.

Table of Stakeholder Perspectives

| Stakeholder Group | Perspective | Supporting Arguments |

|---|---|---|

| Cruise Lines | Opposed | Increased operational costs, reduced profitability, fewer cruise visits, impacting tourism and jobs. |

| Residents | Mixed | Potential mitigation of environmental impact vs. negative impact on local economy and employment. |

| Environmental Groups | Supportive | Curbing environmental damage caused by cruise ships, funding for environmental protection measures. |

Comparison with Similar Taxes: Ak Senate Floats Cruise Pax Tax

Alaska’s proposed cruise passenger tax presents a fascinating case study in a relatively novel approach to tourism revenue generation. Understanding how this tax stacks up against similar initiatives in other US states and regions provides valuable insights into its potential success or pitfalls. We’ll delve into the specifics of design, implementation, and impact, examining both similarities and crucial differences.

Similarities and Differences in Design

This section Artikels the key similarities and differences in design between Alaska’s proposed tax and comparable levies in other states or regions. The design of a tax significantly influences its implementation and potential impact. Comparing the structure and approach used by different entities can help us assess the proposed Alaska tax’s effectiveness.

- Many states and regions utilize various forms of tourism taxes. These can range from general sales taxes applicable to tourism-related goods and services to dedicated levies on specific activities like lodging, dining, or transportation. Alaska’s proposed tax focuses on cruise passengers, differentiating it from broader-based levies found elsewhere. The specificity of targeting cruise passengers may be a key element in the design’s potential success.

The AK senate’s proposal to tax cruise passengers is certainly interesting, though a bit perplexing. Perhaps a trip to one of the charming Czech Republic spa towns, like those featured in a healthy dose of czech republic spa towns , could offer a more relaxing and rejuvenating way to think about the issue? After all, a little downtime and a change of scenery might just help us all see the whole tax situation in a different light.

Still, it’s hard to say how much revenue this tax could actually generate for the state of AK.

- Implementation methodologies can vary widely. Some states employ comprehensive systems for collecting and managing tourism taxes, while others rely on partnerships or collaborations with local businesses. Understanding how these different approaches affect collection rates, compliance, and administrative burdens is vital for assessing the proposed tax’s practicality.

- The legal frameworks and regulatory environments surrounding tourism taxes differ across jurisdictions. The legality and constitutionality of such taxes are crucial to their implementation and long-term sustainability. This underscores the importance of meticulous legal review for the proposed Alaska tax.

Examples of Similar Taxes and Their Impacts

This section will provide concrete examples of existing tourism taxes in other US states and regions, highlighting their revenue generation and economic impacts.

- Hawaii’s Hotel Tax: Hawaii imposes a significant hotel tax on visitors. This tax has been a substantial source of revenue for the state, funding various projects, including infrastructure improvements and tourism-related initiatives. This example demonstrates the potential for dedicated tourism taxes to generate substantial revenue. However, it’s important to note that Hawaii’s unique economic environment and reliance on tourism might not directly translate to Alaska’s situation.

- Florida’s Tourism Taxes: Florida utilizes a combination of taxes on accommodations and attractions to fund state programs. The success of these taxes in Florida is a function of the state’s highly developed tourism sector. This example highlights the necessity of considering the specific economic context when assessing the potential impact of a similar tax in Alaska.

- California’s State Taxes on Tourism: California incorporates various state taxes into its tourism ecosystem. This example illustrates the broader range of revenue-generating mechanisms that exist. The effectiveness of such broad-based taxes compared to Alaska’s targeted approach to cruise passengers remains an open question.

Comparative Analysis Table

This table provides a concise comparison of the proposed Alaska cruise passenger tax with similar taxes in other jurisdictions. The table will consider factors like revenue generation, economic impact, and the design and implementation processes.

| Feature | Proposed Alaska Tax | Hawaii Hotel Tax | Florida Tourism Taxes | California State Tourism Taxes |

|---|---|---|---|---|

| Tax Base | Cruise passengers | Hotels | Accommodation & Attractions | Broad-based State Taxes |

| Revenue Generation (estimated) | [Insert Estimated Figures Here] | [Insert Estimated Figures Here] | [Insert Estimated Figures Here] | [Insert Estimated Figures Here] |

| Economic Impact (estimated) | [Insert Estimated Figures Here] | [Insert Estimated Figures Here] | [Insert Estimated Figures Here] | [Insert Estimated Figures Here] |

| Implementation Challenges | [List potential challenges here] | [List potential challenges here] | [List potential challenges here] | [List potential challenges here] |

Potential Regulatory Frameworks

Implementing a cruise passenger tax requires a robust regulatory framework to ensure equitable collection, transparency, and accountability. This framework must detail the mechanisms for collecting the tax, how the funds will be utilized, and the procedures for resolving disputes. The design of this framework is critical to the success of the tax, impacting both cruise lines and passengers.

Collection Mechanisms

The cruise passenger tax will need a clear and efficient collection mechanism. Crucial to this is establishing a system for collecting the tax from passengers at the point of booking or embarkation. This will likely involve partnerships with cruise lines and online travel agencies (OTAs). The specific method could vary depending on the complexity of the tax structure.

The Alaskan Senate’s proposal to tax cruise passengers is interesting, but it got me thinking about the bigger picture. Considering the potential economic impact on the state, and how that might affect the tourism sector, it’s crucial to also look at how large architectural firms, like those featured in largest architectural firms 2 , might be involved in the development of new cruise infrastructure.

Ultimately, the cruise tax proposal could have a domino effect, influencing the overall development landscape of Alaska.

- Tax Integration into Booking Systems: Crucial to ensure seamless collection, the tax could be integrated into online booking platforms. This allows cruise lines and OTAs to automatically calculate and collect the tax during the booking process, reducing administrative burden on both parties and minimizing opportunities for tax evasion. The system could be designed with various payment options, ensuring accessibility for all passengers.

- Cruise Line Responsibility: Cruise lines will play a vital role in collecting the tax. They will be responsible for incorporating the tax into their ticketing and invoicing systems. This may involve adding a dedicated line item on passenger tickets or integrating the tax calculation into the overall pricing structure. Clear guidelines and procedures for implementing this will be essential.

- Third-Party Collection Agencies: In certain cases, a third-party collection agency might be necessary. This could be especially true if the tax is collected at the embarkation port, where handling large volumes of transactions efficiently is critical. The role of this agency would be to facilitate the collection and remitting of the tax to the relevant authorities.

Tax Application and Calculation

The tax should be clearly defined and transparent, allowing passengers to understand the amount they are paying. This is crucial to avoid misunderstandings and ensure equitable application.

- Tax Rate Determination: The tax rate will need to be clearly established, possibly varying based on factors like the length of the cruise or the destination. Consideration of factors like the environmental impact of the cruise and the economic benefits to the destination should inform the rate. This could be achieved through a commission or a regulatory body.

- Tax Calculation Methods: The method for calculating the tax should be readily understandable and demonstrably fair. This could involve a per-passenger or per-night rate, or a percentage of the cruise fare. The calculation method should be Artikeld in a clear and accessible manner.

- Exemptions and Reductions: Establishing clear criteria for exemptions and reductions will be important to avoid unnecessary burdens. This could involve exemptions for children or senior citizens, or reductions for short-duration cruises. These exceptions must be clearly defined to ensure fairness and transparency.

Similar Regulatory Models

Several jurisdictions have implemented similar taxes on tourism activities.

| Jurisdiction | Tax Type | Collection Method |

|---|---|---|

| [Example Jurisdiction 1] | [Type of Tax] | [Collection Method Details] |

| [Example Jurisdiction 2] | [Type of Tax] | [Collection Method Details] |

These models can serve as valuable precedents for the implementation of the cruise passenger tax.

Challenges in Implementation

Implementing the tax effectively presents potential challenges.

- International Cooperation: International cooperation will be crucial for ensuring a uniform application of the tax across various jurisdictions. This includes coordinating with other countries that host cruise ports to avoid inconsistencies and ensure fair treatment of cruise lines operating in multiple regions.

- Data Security and Privacy: The collection and processing of passenger data must adhere to stringent data security and privacy regulations. This will be vital for building trust and maintaining compliance with legal requirements. A transparent policy on data usage will be critical.

- Administrative Burden: Ensuring that the administrative burden on cruise lines and other stakeholders is manageable is essential. Streamlined processes and efficient technology will be needed to minimize this burden.

Proposed Tax Collection and Distribution Flowchart

A flowchart detailing the proposed process is needed to visually represent the tax collection and distribution process.

This flowchart will illustrate the steps involved in collecting the tax from passengers, processing the payments, and distributing the collected revenue. A robust audit trail will also be essential.

Alternatives to the Proposed Tax

The proposed cruise passenger tax for Alaska Senate floats, while seemingly straightforward, isn’t the only way to fund necessary improvements to the state’s infrastructure. Exploring alternative funding mechanisms is crucial to ensure the project’s viability and minimize potential negative impacts on various stakeholders. This section examines several potential alternatives, considering their advantages and disadvantages.Alternative funding strategies can offer a broader range of solutions, reducing reliance on a single revenue stream and potentially mitigating the drawbacks of a passenger tax.

Exploring diverse options is essential for a balanced and sustainable approach to funding the improvements.

Alternative Funding Sources

Examining alternative revenue sources is vital for ensuring the project’s success and minimizing the potential burden on specific stakeholders. A diversified approach to funding can reduce reliance on a single revenue source, increasing resilience and adaptability.

- Increased State Lottery Revenue: A more substantial lottery investment could be allocated to fund infrastructure improvements. The pros include potentially boosting state coffers with a relatively low administrative burden. However, there’s the risk of decreasing ticket sales due to increased taxes or competition with other forms of entertainment. The impact on stakeholders would depend on the lottery’s structure; a higher percentage of winnings directed towards infrastructure might not be popular with lottery players.

- Enhanced Tourism Promotion Fees: A targeted fee on cruise line tourism promotion and marketing could generate substantial revenue. This would have a direct correlation to increased tourism and is a well-established revenue stream for other states. The drawback lies in potential resistance from cruise lines, potentially affecting their marketing strategies and impacting future bookings. The fee’s impact on tourists could be negligible if factored into ticket prices, leading to a revenue shift rather than a new tax burden.

- Increased Corporate Tax Revenue: Focusing on corporate tax revenues generated by businesses operating in or benefiting from the cruise industry could provide a significant source of funding. The positive aspect is that it directly targets entities profiting from the improved infrastructure. However, increased taxes could potentially deter businesses from operating in the region or lead to reduced investment in the state.

This could indirectly impact employment and overall economic activity.

- Federal Grants and Funding: Exploring opportunities for federal grants or funding tied to infrastructure improvements in tourism-related sectors could provide substantial financial support. This option presents the benefit of receiving additional funding with minimal direct burden on state residents. However, grant applications are highly competitive, requiring meticulous planning and demonstrating strong justification for the project. This alternative would significantly reduce the burden on local taxpayers.

- Public-Private Partnerships (PPPs): A PPP model could leverage private sector investment in exchange for future revenue streams. The advantage is that private sector entities often bring expertise and capital. However, there’s the potential for inequitable revenue distribution or lack of transparency in the agreement terms. This model may influence the long-term cost of maintaining the infrastructure.

Comparative Analysis of Funding Alternatives

A comparison of these alternatives highlights the trade-offs involved in choosing a funding strategy. The ideal approach would involve a combination of methods, leveraging the strengths of each while mitigating their potential drawbacks.

| Funding Source | Pros | Cons | Impact on Stakeholders |

|---|---|---|---|

| Increased State Lottery Revenue | Potentially low administrative burden | Risk of reduced ticket sales | Lottery players may be negatively impacted if taxes are increased. |

| Enhanced Tourism Promotion Fees | Direct correlation with increased tourism | Potential resistance from cruise lines | Tourists might see increased prices if fees are factored into ticket costs. |

| Increased Corporate Tax Revenue | Directly targets entities profiting from the industry | Could deter businesses from operating in the region | Businesses may reduce investment, impacting employment. |

| Federal Grants and Funding | Minimal direct burden on state residents | Highly competitive applications | No direct tax burden, but the project’s success is tied to securing grants. |

| Public-Private Partnerships (PPPs) | Leverages private sector expertise and capital | Potential for inequitable revenue distribution or lack of transparency | Potential long-term costs of maintaining infrastructure. |

Potential Impact on Cruise Lines and Passenger Experience

The proposed Alaska Senate floats cruise passenger tax introduces a new variable into the complex equation of the cruise industry. Understanding its potential ramifications on cruise lines, pricing strategies, and the passenger experience is crucial for anticipating the future of Alaskan cruises. This analysis delves into the potential ripple effects of this tax on various facets of the cruise industry.The tax’s impact will be felt not only by cruise lines but also by passengers, potentially affecting their choices of destinations and itineraries.

The tax’s influence on pricing models and passenger volume will shape the cruise experience and the types of cruises offered in the region.

Pricing Strategies of Cruise Lines

Cruise lines will likely adjust their pricing models to absorb or pass on the tax burden. Different pricing models will respond differently. Some lines might opt for a across-the-board price increase, while others might introduce new tiers or packages.

- Variable Pricing Models: Lines with flexible pricing structures, adjusting prices based on demand and availability, might incorporate the tax into their algorithms, leading to dynamic price changes for different cabins and packages. This could lead to more fluctuating prices for passengers.

- Fixed Pricing Models: Cruise lines with fixed pricing models might maintain their published fares but potentially reduce onboard offerings to offset the tax.

This could result in passengers feeling they are getting less for their money.

- Package Deals and Bundling: To mitigate the impact of the tax, cruise lines might emphasize package deals that bundle excursions and amenities to offset the tax burden.

Impact on Passenger Experience

The tax could potentially affect the overall cruise experience for passengers. Changes in pricing and cruise offerings could influence their choices.

- Reduced Amenities: To counter the tax, cruise lines might reduce onboard amenities to offset the additional costs, potentially impacting the quality of the overall experience for passengers.

- Shift in Destination Choices: Passengers might be more selective about the destinations they choose, favoring locations with more competitive pricing or without similar taxes.

- Modified Itineraries: Cruise lines might adjust itineraries to minimize costs, potentially altering the scope of the cruise experience.

Influence on Destination Choice

The tax could impact the popularity of Alaskan cruises, potentially pushing passengers toward other destinations. The relative attractiveness of Alaskan cruises, considering the tax, will be a significant factor in passenger choice.

- Shift to Alternative Destinations: Passengers might opt for cruises in other regions, especially those without similar taxes or with comparable prices, potentially impacting the cruise volume in Alaska.

- Competitive Pricing: Passengers might choose alternative destinations if Alaskan cruises become comparatively more expensive, driven by the tax.

Potential Shift in Passenger Volume

The tax could influence passenger volume on Alaskan cruises. Predicting the precise shift is challenging, but trends in similar situations can offer insight.

- Data Analysis: Analyzing past cruise bookings and trends in response to similar taxes will help estimate the potential decrease in cruise passenger volume in Alaska.

- Market Research: Market research will be important in understanding the extent of passenger response to the tax.

Effect on Types of Cruises Offered

The tax might influence the types of cruises offered in the region. Cruises targeting different demographics or price points might experience adjustments.

- Targeted Cruises: Cruises designed to cater to budget-conscious travelers or specific demographics might see a decrease in offerings.

- Reduced Luxuries: Luxury cruise options might experience a reduction in features and amenities to counter the added cost of the tax.

Cruise Line Pricing Model Response to Tax

| Cruise Line Pricing Model | Potential Response to Tax |

|---|---|

| Variable Pricing | Dynamic adjustment of prices based on tax and demand. |

| Fixed Pricing | Potential reduction in onboard amenities or service offerings. |

| Package Deals | Emphasis on package deals to offset tax burden. |

Final Conclusion

The AK senate floats cruise pax tax proposal sparks a crucial discussion about balancing economic benefits with potential drawbacks for the Alaskan economy and the cruise industry. While the tax aims to improve infrastructure and generate revenue, the potential for reduced tourism and increased prices demands careful consideration. Alternatives to the tax and public opinion will be key factors in shaping the future of cruise tourism in Alaska.

This complex issue requires careful evaluation of all potential impacts on various stakeholders to ensure a sustainable solution.

Key Questions Answered

What are the potential revenue projections for the tax?

The Artikel details potential revenue projections, but the exact figures aren’t available without further analysis. The proposed tax’s impact on revenue will depend on factors such as the tax rate, the number of cruise passengers, and potential impacts on the cruise industry.

What are some alternative funding sources for infrastructure improvements?

The Artikel suggests exploring alternative funding sources like state bonds, increased funding from the federal government, or other state-based funding models. A detailed comparison of pros and cons of different funding strategies is included.

How will the tax impact cruise line pricing strategies?

The tax could affect cruise lines’ pricing strategies, potentially leading to higher ticket prices for passengers. The impact depends on how the cruise lines absorb the additional cost and the competitiveness of Alaskan cruise destinations compared to other destinations.

How might the tax influence the choice of destination for cruise passengers?

The tax could influence the choice of destination, possibly leading to a decrease in cruise passenger volume to Alaska. The Artikel includes a discussion of how the tax compares to similar taxes in other regions.